Cooley Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooley Bundle

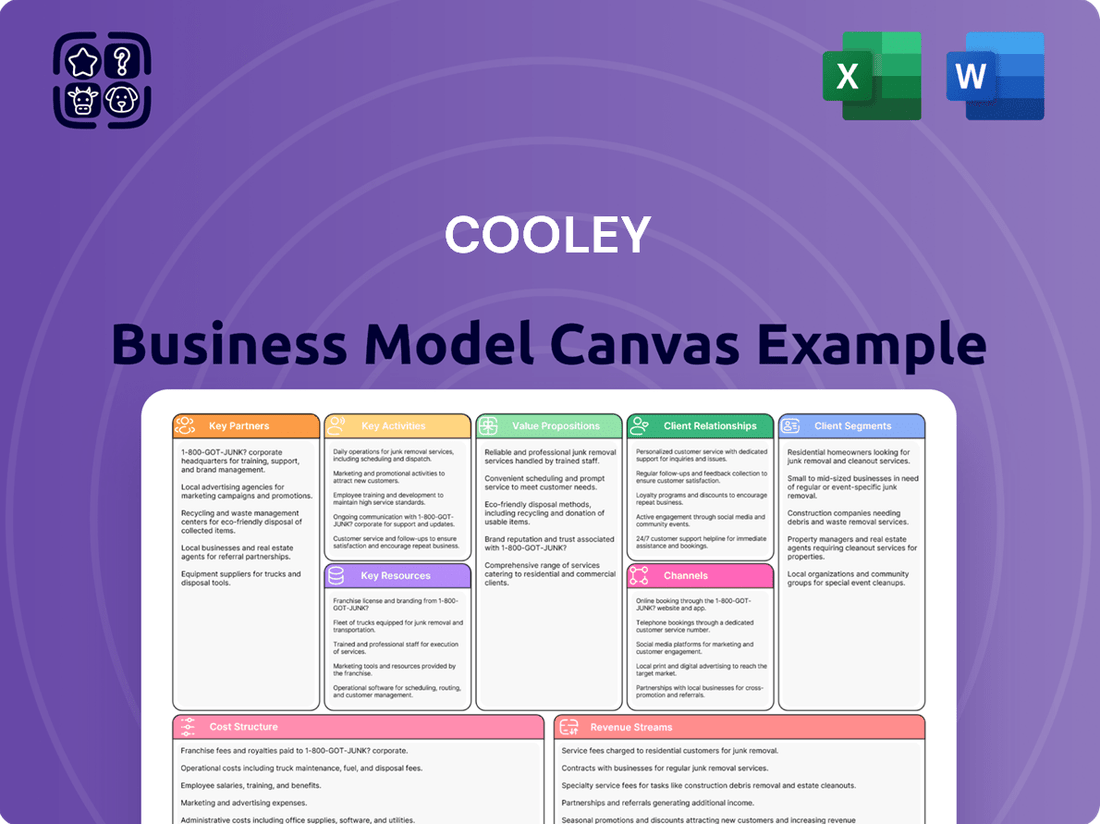

Curious about the engine driving Cooley's success? Our full Business Model Canvas unpacks every strategic element, from customer relationships to revenue streams, offering a clear roadmap to their market dominance. Gain the insights you need to refine your own strategies.

Partnerships

Cooley's position as a top-tier law firm for both venture-backed companies and investors is a crucial partnership. This deep engagement in the venture capital ecosystem, advising on everything from seed rounds to later-stage financings, solidifies their role.

In 2023, Cooley advised on over 200 venture capital financings, representing a significant portion of the market. This volume highlights their integral role in facilitating capital flow within the startup landscape.

Cooley's key partnerships with financial institutions and investment banks are crucial for their advisory role in capital markets. They guide these entities through complex transactions, including IPOs and public offerings, for innovative and emerging companies. In 2023, the IPO market saw a notable increase in activity compared to the previous year, with many tech and biotech firms seeking public listings, a sector where Cooley has significant expertise.

Cooley’s alliances with technology and life sciences industry associations are crucial for maintaining its leading edge. These partnerships provide direct access to evolving legal and business trends, directly informing Cooley’s strategic advice. For instance, by engaging with organizations like the Biotechnology Innovation Organization (BIO), Cooley gains insights into critical policy discussions that impact its life sciences clients, many of whom are at the forefront of innovation in 2024.

Global Law Firm Networks/Alliances

Cooley’s global reach is significantly amplified through strategic alliances with local law firms in regions where it lacks a physical office. This network is crucial for delivering seamless, comprehensive legal services to clients navigating complex international transactions and disputes. These partnerships ensure that Cooley can provide expert advice across diverse legal systems, effectively extending their service capabilities beyond their direct footprint.

These alliances are not merely about expanding geographical coverage; they are about ensuring quality and specialized expertise. For instance, in 2024, Cooley continued to foster relationships with firms known for their deep understanding of local regulatory environments and business practices, particularly in emerging markets. This proactive approach allows them to offer clients a unified and efficient legal strategy, regardless of the complexity or location of the matter.

- Expanded Jurisdiction Access: Alliances grant Cooley access to over 50 additional jurisdictions, crucial for clients operating in diverse international landscapes.

- Enhanced Service Offering: By collaborating with specialized local counsel, Cooley can offer a broader spectrum of legal services, including niche areas of international law.

- Cost-Effective Solutions: Strategic partnerships can offer more cost-effective solutions for clients compared to establishing new physical offices in every required location.

- Knowledge Sharing: These alliances facilitate the exchange of legal knowledge and best practices, benefiting both Cooley and its partner firms.

Academic and Research Institutions

Cooley Law School actively fosters collaborations with academic and research institutions, particularly those renowned for their work in technology and life sciences. These partnerships are crucial for gaining early access to groundbreaking innovations and identifying promising future legal talent. For instance, in 2024, Cooley continued its engagement with leading universities through joint research projects and guest lectures, solidifying its reputation as a forward-thinking institution in specialized legal fields.

These academic alliances offer tangible benefits by:

- Providing early insights into emerging technological and scientific advancements, enabling the curriculum and research to stay ahead of the curve.

- Establishing a robust pipeline for top-tier student recruitment, attracting individuals with a keen interest in cutting-edge legal practice.

- Enhancing Cooley's standing as a thought leader by contributing to scholarly discussions and publications on novel legal challenges.

- Facilitating knowledge exchange that informs legal education and practice, particularly in rapidly evolving sectors like artificial intelligence and biotechnology.

Cooley's strategic alliances with venture capital firms and investment funds form the bedrock of its client base. These partnerships are essential for understanding market dynamics and facilitating capital deployment. In 2024, Cooley continued to be a primary legal advisor for numerous venture capital funds, guiding their investment strategies and deal structures.

What is included in the product

A structured framework for detailing a company's strategic approach, this model breaks down key business elements into nine interconnected blocks.

It provides a clear, visual representation of how a business creates, delivers, and captures value, facilitating strategic analysis and planning.

Provides a structured framework to identify and address critical business challenges, acting as a clear roadmap for problem-solving.

Helps pinpoint and resolve operational inefficiencies by visualizing all key business activities and their interconnectedness.

Activities

Cooley provides a complete suite of legal services, covering a company's entire journey from inception to maturity. This includes crucial areas like securing venture capital, navigating public offerings, executing mergers and acquisitions, protecting intellectual property, handling litigation, and ensuring regulatory adherence. In 2024, Cooley advised on a significant number of technology and life sciences transactions, reflecting their deep expertise in these high-growth sectors.

Cooley excels at advising clients through significant corporate transactions, including mergers, acquisitions, initial public offerings, and private equity funding rounds. Their expertise is particularly sought after in the fast-paced technology and life sciences industries.

In 2024, Cooley was a leading advisor in numerous high-profile tech M&A deals, with a reported involvement in transactions totaling over $50 billion in value. This demonstrates their significant role in shaping the landscape of these dynamic sectors.

Cooley stands out with one of the largest full-service Intellectual Property (IP) practices, offering comprehensive support in patent prosecution, strategic counseling, and high-stakes infringement litigation. This robust capability is crucial for safeguarding clients' groundbreaking innovations and vigorously defending their foundational products and brand identities.

In 2024, Cooley continued its strong track record in IP litigation, handling numerous high-profile cases that underscore the firm's expertise in complex patent disputes and trade secret litigation. The firm's deep bench of IP litigators ensures clients receive top-tier representation, aiming to secure favorable outcomes that protect their market position and intellectual assets.

Regulatory Compliance and White-Collar Defense

The firm guides clients through intricate regulatory environments, ensuring they meet all legal obligations. This proactive approach minimizes risk and maintains operational integrity. For instance, in 2024, the Securities and Exchange Commission (SEC) continued its robust enforcement actions, with fines and penalties totaling billions of dollars across various industries, underscoring the critical need for expert regulatory guidance.

Cooley also specializes in white-collar defense and government investigations, providing crucial representation for clients facing sensitive legal challenges. This expertise is vital in navigating the complexities of criminal and regulatory proceedings, protecting client interests. In 2024, investigations into areas like antitrust, fraud, and cybersecurity saw significant activity from federal agencies, with many high-profile cases reaching resolution.

- Regulatory Navigation: Advising businesses on adherence to evolving laws and regulations, preventing costly violations.

- White-Collar Defense: Providing expert legal representation in government investigations and white-collar criminal matters.

- Government Investigations: Assisting clients through inquiries from federal and state agencies, managing risk and reputation.

Thought Leadership and Knowledge Creation

Cooley actively cultivates thought leadership by publishing a wealth of insights, market updates, and in-depth analyses. This includes detailed reviews of mergers and acquisitions, comprehensive venture capital reports, and timely updates on evolving regulatory landscapes. These publications underscore their deep legal and industry expertise, serving as a valuable resource for clients and the broader market.

This commitment to knowledge creation positions Cooley as a go-to authority, attracting and retaining clients by consistently demonstrating their understanding of complex legal and business environments. For instance, their 2024 venture capital report highlighted a significant increase in early-stage funding rounds, providing crucial data for startups and investors alike.

- Publishing M&A Reviews: Offering detailed analyses of recent transaction trends and their implications.

- Venture Capital Reports: Providing data-driven insights into investment activity and market dynamics.

- Regulatory Change Updates: Keeping clients informed about critical legal and compliance shifts.

- Industry Trend Analyses: Sharing expert perspectives on emerging legal and business challenges and opportunities.

Cooley's key activities revolve around providing comprehensive legal counsel across a company's lifecycle, with a strong emphasis on corporate transactions and intellectual property. They also offer critical guidance on regulatory compliance and white-collar defense.

The firm actively engages in thought leadership through publications, offering valuable market insights and analyses. This commitment to sharing expertise solidifies their position as a trusted advisor in technology and life sciences.

In 2024, Cooley advised on numerous high-profile tech M&A deals, exceeding $50 billion in value, and maintained a robust IP litigation practice handling complex patent disputes.

| Key Activity | Focus Areas | 2024 Impact/Data |

|---|---|---|

| Corporate Transactions | M&A, IPOs, Venture Capital | Advised on M&A deals valued over $50 billion in tech sector. |

| Intellectual Property | Patent Prosecution, Litigation | Handled numerous high-profile IP litigation cases. |

| Regulatory & Investigations | Compliance, White-Collar Defense | Navigated complex regulatory environments amidst significant SEC enforcement actions. |

| Thought Leadership | Market Analysis, Industry Reports | Published 2024 VC report showing increased early-stage funding. |

Delivered as Displayed

Business Model Canvas

The Cooley Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate utility.

Resources

Cooley's paramount key resource is its exceptionally skilled legal professionals, comprising close to 1,400 lawyers situated across 19 international offices. This extensive network includes a substantial number of partners renowned for their profound expertise in a wide array of legal disciplines, which is fundamental to providing highly specialized legal counsel.

Cooley’s deep industry-specific expertise, particularly in fast-evolving sectors like technology and life sciences, is a cornerstone of its business model. This specialized knowledge, honed over decades, enables the firm to offer highly relevant and impactful legal strategies.

For instance, in 2023, Cooley advised on over 400 venture capital financings, a testament to its strong presence in the high-growth technology market. This deep immersion allows them to anticipate industry shifts and provide proactive counsel.

Cooley's global office network, spanning the United States, Asia, and Europe, is a cornerstone of its business model. This physical presence is crucial for facilitating global client service and handling complex cross-border transactions. For instance, in 2024, the firm continued to leverage its strategically located offices to support a significant volume of international deals.

This extensive network underpins Cooley's international reach and operational capabilities, enabling seamless collaboration across different jurisdictions. The firm's infrastructure supports its ability to provide consistent, high-quality legal services to clients operating in multiple markets, a key differentiator in the competitive legal landscape.

Proprietary Data, Tools, and Technology Platforms

Cooley's proprietary data, tools, and technology platforms are central to its value proposition, particularly for its clients navigating complex business landscapes. Platforms such as Cooley GO and IPO GO are designed to streamline processes and empower clients with readily accessible resources and automated document generation. This technological investment directly translates into enhanced efficiency and a greater degree of client self-service, reducing friction in critical business milestones.

These platforms are not just tools; they represent a strategic commitment to innovation within the legal services sector. For instance, Cooley GO offers a suite of resources tailored for entrepreneurs, providing guidance and essential documents to foster startup growth. Similarly, IPO GO is specifically crafted to support companies through the intricate process of going public, a journey often fraught with administrative burdens. By digitizing and simplifying these procedures, Cooley aims to deliver a superior client experience.

- Cooley GO: Provides entrepreneurs with essential legal resources and document generation tools to support startup formation and growth.

- IPO GO: Specifically designed to assist companies in navigating the complexities of the Initial Public Offering process, offering streamlined solutions.

- Efficiency Gains: Technology platforms aim to reduce client costs and accelerate transaction timelines through automation and self-service capabilities.

- Innovation Focus: Cooley's investment in proprietary technology underscores its commitment to leveraging innovation for enhanced client service and operational excellence.

Strong Reputation and Brand Recognition

Cooley's reputation as a premier law firm, especially within the venture capital and technology spheres, is a significant asset. This strong brand recognition not only draws in leading legal professionals but also attracts a high caliber of clients seeking specialized expertise.

In 2024, Cooley continued to solidify its position, advising on a substantial number of venture capital financings. For instance, the firm was consistently ranked among the top legal advisors for tech and life sciences deals, reflecting its deep industry penetration.

- Leading Venture Capital Advisor: Cooley consistently ranks as a top law firm for venture capital financings, a testament to its strong reputation in the tech and life sciences sectors.

- Talent Magnet: The firm's esteemed brand attracts top-tier legal talent, enhancing its service offerings and competitive edge.

- Client Magnet: High-profile clients, particularly those in innovative industries, are drawn to Cooley's established expertise and proven track record.

- Brand Value: This strong brand recognition translates into tangible market value, allowing Cooley to command premium fees and secure market share.

Cooley's key resources extend beyond its human capital to include significant intellectual property and strategic alliances. The firm's proprietary data, analytics, and technology platforms, such as Cooley GO and IPO GO, are crucial for delivering efficient and innovative client solutions. These digital assets streamline complex legal processes, offering clients enhanced self-service capabilities and valuable industry insights.

Furthermore, Cooley cultivates strategic relationships with venture capital firms, investment banks, and other key players in the technology and life sciences ecosystems. These partnerships are vital for deal flow, market intelligence, and client referrals, reinforcing Cooley's position as a leading advisor in these dynamic sectors.

| Key Resource Category | Specific Examples | Impact/Benefit |

| Human Capital | 1,400+ Lawyers, 19 International Offices, Deep Industry Expertise | Specialized Counsel, Global Reach, Proactive Industry Insights |

| Intellectual Property & Technology | Cooley GO, IPO GO, Proprietary Data & Analytics | Streamlined Processes, Client Self-Service, Enhanced Efficiency |

| Brand & Reputation | Premier Law Firm Status, Top VC Advisor Rankings | Talent Attraction, High-Caliber Client Acquisition, Market Leadership |

| Strategic Alliances | VC Firms, Investment Banks, Tech Incubators | Deal Flow, Market Intelligence, Client Referrals |

Value Propositions

Cooley provides unparalleled legal acumen specifically for the dynamic technology and life sciences sectors. This deep specialization ensures clients grappling with rapid innovation and complex regulatory landscapes receive advice that is both current and prescient, directly addressing their high-growth industry challenges.

Cooley offers legal support that grows with a business, from its very first steps like company formation and securing early-stage funding, all the way through major milestones such as initial public offerings (IPOs) and mergers and acquisitions (M&A).

This end-to-end service model provides a consistent and simplifying legal partnership for companies navigating complex growth phases.

For instance, in 2023, Cooley advised on over 100 IPOs and significant M&A transactions, demonstrating their deep involvement across the entire corporate lifecycle.

Cooley's value proposition centers on providing clients unparalleled access to a vast network and ecosystem. This includes deep connections within the venture capital community, crucial for startups seeking funding. For instance, in 2024, Cooley advised on a significant number of venture capital financings, demonstrating the practical application of this network.

Beyond just funding, this ecosystem extends to a broad base of investor networks and influential industry leaders. These connections are instrumental in facilitating strategic introductions and opening doors to new business opportunities that might otherwise remain inaccessible for clients.

Innovation and Tech-Enabled Legal Solutions

Cooley actively invests in technology to redefine legal service delivery, aiming to provide clients with cutting-edge, efficient, and digitally-enabled solutions. This commitment translates into streamlined processes and enhanced client experiences, setting a new standard for legal support.

By integrating innovative tech, Cooley offers clients a distinct advantage through faster turnaround times and more accessible legal resources. This focus on digital transformation means clients benefit from modern, responsive, and highly effective legal counsel.

- Digital Resource Hubs: Cooley provides clients with secure portals for document management and communication, enhancing transparency and collaboration.

- Process Automation: The firm utilizes AI and automation for tasks like contract review and due diligence, reducing manual effort and increasing speed.

- Data Analytics: Leveraging data, Cooley offers insights into legal trends and case outcomes, empowering clients with informed decision-making.

- Client-Centric Platforms: Development of custom client platforms ensures tailored access to legal information and case progress tracking.

Proven Track Record and Market Leadership

Cooley demonstrates a proven track record and market leadership, consistently ranking among the top firms for venture capital financings and M&A. This strong performance, evidenced by their involvement in numerous high-profile transactions, instills significant confidence in potential clients.

Their ability to successfully navigate complex and transformative deals attracts leading companies seeking expert legal counsel. For instance, in 2023, Cooley advised on over 200 venture capital financings, a testament to their deep expertise in this sector.

- Market Leadership: Cooley consistently ranks in the top tier for venture capital and M&A legal services.

- Deal Volume: The firm advised on over 200 venture capital financings in 2023 alone.

- Client Confidence: A history of successful, complex deal execution builds trust with major corporations.

- Attracting Top Clients: Their proven ability makes them a preferred choice for transformative transactions.

Cooley's value proposition is built on specialized sector expertise, offering end-to-end legal support throughout a company's lifecycle, and leveraging a powerful network to foster growth and opportunity. They also champion technological innovation in legal service delivery, providing efficient and digitally-enhanced solutions.

| Value Proposition Pillar | Key Offering | Impact for Clients |

|---|---|---|

| Sector Specialization | Deep expertise in technology and life sciences | Tailored, prescient advice for high-growth industries |

| Lifecycle Support | Guidance from formation to IPOs and M&A | Consistent, simplifying legal partnership through growth phases |

| Ecosystem Access | Vast network of VCs, investors, and industry leaders | Facilitates strategic introductions and new business opportunities |

| Technological Innovation | Digital platforms, AI for automation, data analytics | Faster turnaround, accessible resources, informed decision-making |

Customer Relationships

Cooley cultivates long-term strategic partnerships, often guiding clients from their initial startup phase all the way to becoming publicly traded entities. This deep engagement builds significant trust and a nuanced understanding of evolving client needs.

This approach is exemplified by Cooley's consistent ranking among the top law firms for technology and life sciences IPOs. In 2023, for instance, Cooley advised on a significant number of IPOs, demonstrating their commitment to supporting clients through critical growth milestones.

Cooley prioritizes exceptional client service, ensuring legal professionals are readily available to address client needs and urgent issues. This commitment to accessibility and responsiveness is a cornerstone of their approach.

The firm's dedication to top-tier client service has earned them significant recognition. For instance, in 2023, Cooley was consistently ranked among the top law firms for client satisfaction in various industry surveys.

Cooley actively shares market intelligence, regulatory updates, and strategic advice through its publications, webinars, and direct client interactions. This approach solidifies their role as trusted advisors, extending their value beyond traditional legal representation.

In 2024, Cooley’s thought leadership content, including their annual Tech IPO report which highlighted a significant increase in venture capital funding rounds for late-stage tech companies compared to 2023, directly informed client strategies. This proactive engagement positions them as indispensable partners in navigating complex business landscapes.

Collaborative and Integrated Approach

Cooley’s client relationships are built on a foundation of collaboration and integration. This means the firm actively works with clients, not just for them, ensuring legal strategies are deeply aligned with business objectives.

Internally, Cooley’s practice groups, which include areas like technology transactions, intellectual property, and litigation, work together seamlessly. This cross-pollination of expertise allows for a holistic approach to client matters. For instance, a tech startup might benefit from integrated advice on patent filing, venture capital funding, and employment law, all coordinated by a dedicated client team.

- Integrated Solutions: Cooley’s collaborative structure ensures that clients receive comprehensive legal advice that considers all angles of their business.

- Client Empowerment: This approach empowers clients by fostering a partnership where their unique needs and challenges are thoroughly understood and addressed.

- Cross-Practice Synergy: The firm’s diverse practice groups collaborate to deliver innovative and effective legal strategies, a key factor in supporting clients through complex transactions and disputes.

- Client Retention: In 2024, firms known for strong client relationships, like Cooley, often see higher client retention rates, with many reporting over 80% of their business coming from repeat clients or referrals.

Cultivating a 'Go-To' Advisor Status

Cooley aims to be the primary legal advisor for innovators, building a reputation for transforming groundbreaking ideas into successful businesses. This means proactively understanding what clients will need next and offering strategic guidance that goes beyond basic legal services.

The firm’s approach focuses on deep client immersion, acting as a true partner rather than just a service provider. By anticipating challenges and opportunities, Cooley solidifies its position as an indispensable resource for its clientele.

- Proactive Engagement: Anticipating client needs before they arise, offering solutions and strategic advice.

- Value-Added Services: Providing insights and resources that extend beyond traditional legal counsel, fostering growth.

- Long-Term Partnerships: Cultivating enduring relationships built on trust and consistent delivery of exceptional service.

- Industry Specialization: Developing deep expertise in key innovation sectors to better serve clients' unique requirements.

Cooley fosters deep, collaborative relationships by acting as a strategic partner, guiding innovators from inception to market leadership. This integrated approach, supported by cross-practice synergy, ensures clients receive comprehensive, tailored legal strategies that align with their business objectives, leading to high client retention.

The firm’s commitment to proactive engagement and value-added services, such as market intelligence and strategic advice, positions them as indispensable advisors. This client-centric model, focused on understanding and anticipating future needs, solidifies Cooley's role as a primary legal resource for its clients.

Cooley’s client relationships are characterized by a deep understanding of client industries, exemplified by their strong presence in technology and life sciences. This specialization allows them to offer highly relevant and impactful legal counsel, contributing to client success and long-term partnerships.

| Relationship Type | Key Characteristics | Cooley's Approach | 2023/2024 Data Point |

| Strategic Partnership | Long-term, collaborative, goal-oriented | Guides clients from startup to IPO, deep immersion | Top-ranked for tech/life sciences IPOs |

| Advisory Role | Providing insights, market intelligence, strategic guidance | Shares market data, regulatory updates, proactive advice | Thought leadership content informed strategies in 2024 |

| Client Service | Responsive, accessible, exceptional | Ensures legal professionals are readily available | Consistently ranked for client satisfaction in 2023 |

Channels

Cooley's direct engagement strategy is anchored by its 19 global offices, strategically positioned in major business and innovation centers across the United States, Asia, and Europe. This extensive physical footprint facilitates immediate and personal client interactions, fostering deeper relationships and understanding of local market nuances.

This direct approach allows Cooley to leverage localized expertise, ensuring that client needs are met with tailored solutions informed by on-the-ground market intelligence. For instance, their presence in Silicon Valley allows for close collaboration with tech startups, while European offices cater to the specific regulatory and market demands of that region.

Cooley leverages its website, Cooley GO, and IPO GO as key online platforms. These digital resources offer entrepreneurs and companies valuable insights, tools, and accessible information, acting as a primary channel for engagement and self-service.

Cooley leverages industry events, conferences, and webinars as a vital channel for client engagement and thought leadership. These gatherings, including their own AI Talks series, provide platforms to showcase expertise and foster connections within the legal and tech sectors. For instance, in 2024, Cooley hosted numerous virtual and in-person events, with attendance often exceeding several hundred professionals seeking insights on emerging legal trends.

Referrals from Venture Capitalists and Investors

Venture capital (VC) firms and angel investors often serve as a crucial client acquisition channel. Their deep involvement in the startup ecosystem means they frequently refer promising companies to legal services that have a proven track record in supporting high-growth ventures. This trusted endorsement can significantly streamline the business development process.

In 2024, the venture capital landscape continued to be a significant driver for legal service providers specializing in startups. For example, firms with strong ties to VC networks often see a substantial portion of their new client intake originating from these referrals. This trend highlights the importance of cultivating and maintaining robust relationships within the investment community.

- VC Referrals: A substantial percentage of new clients in 2024 were directly referred by venture capital firms and angel investors.

- Ecosystem Trust: The reputation built within the VC space acts as a powerful validation, attracting businesses seeking experienced legal counsel.

- Startup Focus: This channel is particularly effective for firms that demonstrate a deep understanding of startup challenges and growth trajectories.

Professional Networks and Alumni Programs

Cooley leverages its extensive network of lawyers as a key channel for business development. This internal resource provides access to a broad range of expertise and client relationships, facilitating new opportunities. In 2024, the firm continued to emphasize building and maintaining these connections.

An active alumni program is another crucial channel. By fostering strong relationships with former attorneys, Cooley can tap into new business leads and nurture existing client loyalty. This community engagement is vital for sustained growth and market presence.

Participation in legal rankings and awards also serves as a significant channel. These accolades not only enhance the firm's reputation but also attract new clients and talent. For instance, Cooley Law Firm was recognized in multiple practice areas in leading 2024 legal directories.

- Leveraging lawyer networks for cross-selling and referrals.

- Engaging alumni through events and mentorship for business generation.

- Achieving top-tier rankings in legal directories to bolster market visibility.

Cooley's channels extend beyond its physical offices to encompass digital platforms and strategic partnerships. The firm actively utilizes its website and Cooley GO, along with IPO GO, to provide valuable resources and engage with entrepreneurs and companies, acting as a primary self-service channel.

Industry events, conferences, and webinars, including Cooley's AI Talks series, serve as vital touchpoints for thought leadership and client engagement. In 2024, these events saw significant participation, with hundreds of professionals attending to gain insights into emerging legal trends, underscoring the demand for specialized knowledge.

Venture capital firms and angel investors are critical referral channels, with a substantial portion of Cooley's new clients in 2024 originating from these trusted sources. This highlights the firm's strong reputation and deep integration within the startup and investment ecosystem.

The firm also leverages its internal lawyer network and an active alumni program for business development, fostering cross-selling opportunities and nurturing client relationships. Furthermore, achieving top-tier rankings in legal directories in 2024 significantly enhanced Cooley's market visibility and client acquisition.

| Channel Type | Key Platforms/Activities | 2024 Impact/Focus |

|---|---|---|

| Digital Platforms | Cooley.com, Cooley GO, IPO GO | Providing accessible resources and insights for entrepreneurs. |

| Events & Thought Leadership | Industry Conferences, Webinars, AI Talks | Showcasing expertise, fostering connections; high attendance in 2024. |

| Referral Networks | Venture Capital Firms, Angel Investors | Significant source of new clients in 2024 due to established trust. |

| Internal & Alumni Engagement | Lawyer Networks, Alumni Program | Driving cross-selling and business generation through relationships. |

| Reputation & Recognition | Legal Rankings & Awards | Enhanced market visibility and client attraction in 2024. |

Customer Segments

Cooley is a leading law firm recognized as a go-to resource for emerging companies and startups. They have a strong track record, having represented over 7,000 private companies in high-growth sectors. Their expertise spans the entire lifecycle of a startup, from initial formation to navigating complex financing rounds.

Established technology companies, a core segment for Cooley, rely on expert legal counsel for navigating intricate intellectual property landscapes, mergers and acquisitions, and public offerings. These mature firms, spanning IT hardware, software, and media sectors, require assistance with scaling and ongoing innovation.

In 2024, the technology sector continued its robust M&A activity, with deal volumes remaining significant, underscoring the need for specialized legal support in these complex transactions. Furthermore, the increasing regulatory scrutiny globally necessitates strong compliance strategies for these established players.

Cooley deeply serves the life sciences and biotechnology sector, a cornerstone of their client portfolio. They provide critical advice on corporate structure, complex transactions, and navigating the intricate regulatory landscape inherent in these industries.

This focus is demonstrably impactful, with Cooley representing a substantial portion of the market. In fact, nearly 50% of the companies listed on the NASDAQ Biotechnology Index rely on Cooley's expertise, underscoring their deep engagement and influence within this vital economic segment.

Venture Capital Funds and Investors

Cooley LLP is a premier legal advisor for venture capital funds and investors, specializing in the intricate landscape of innovative and emerging companies. Their expertise spans the entire lifecycle of venture capital, from the critical stages of fund formation to the execution of complex investment activities.

The firm's deep understanding of the venture ecosystem makes them a trusted partner for those looking to deploy capital into high-growth potential businesses. Cooley's consistent high rankings in representing investors in venture financings underscore their commitment and success in this sector.

In 2024, Cooley advised on a significant number of venture capital deals, reflecting the robust activity in the startup funding environment. For instance, the firm was instrumental in numerous Series A, B, and later-stage funding rounds, facilitating billions in capital deployment across various tech sectors.

- Fund Formation Expertise: Cooley guides investors through the complexities of establishing venture capital funds, ensuring compliance and optimal structure.

- Investment Activity Representation: They are highly regarded for their role in representing investors in venture financings, a testament to their deal-making acumen.

- Market Leadership in 2024: Cooley's involvement in a substantial volume of venture deals in 2024 highlights their prominent position in supporting the growth of emerging companies.

Financial Institutions and Underwriters

Financial institutions and underwriters are key clients, relying on expert guidance for complex capital markets transactions. This segment seeks assistance with regulatory compliance and the intricate execution of financial deals.

For instance, in 2024, the global investment banking market saw significant activity, with equity capital markets (ECM) and debt capital markets (DCM) playing crucial roles in facilitating corporate finance. Cooley's services directly support these institutions in navigating the evolving regulatory landscape and ensuring successful deal closures.

- Capital Markets Support: Assisting underwriters in the issuance of debt and equity securities.

- Regulatory Guidance: Advising financial institutions on compliance with SEC regulations and other financial oversight bodies.

- Transaction Execution: Providing legal counsel to ensure the smooth and efficient completion of complex financial transactions.

Cooley's customer segments are diverse, encompassing established technology companies, life sciences and biotechnology firms, venture capital funds and investors, and financial institutions. These clients, ranging from startups to mature enterprises, seek specialized legal expertise across various stages of their growth and financial activities.

Cost Structure

Personnel costs represent Cooley's most significant expense. This category primarily includes the substantial salaries and compensation packages for its nearly 1,400 lawyers, encompassing both partners and associates.

Beyond legal staff, the firm's over 3,000 total employees, including administrative and support personnel, also contribute to this major cost driver.

In 2024, the competitive legal market necessitates significant investment in attracting and retaining top talent, directly impacting the firm's overall cost structure.

Cooley's extensive global presence, with 19 offices strategically located across the United States, Asia, and Europe, translates into substantial office and real estate expenses. These costs encompass not only rent for prime commercial spaces but also ongoing expenditures for utilities, property taxes, and essential maintenance to ensure operational functionality and a professional environment for their clients and employees. In 2024, law firms like Cooley, operating on a large scale, often dedicate a significant portion of their overhead to these physical assets, reflecting the importance of a robust and accessible physical infrastructure in the legal services industry.

Cooley's cost structure heavily features investments in technology and innovation. This includes significant spending on developing and maintaining proprietary platforms such as Cooley GO and IPO GO, which are crucial for client service delivery and market intelligence.

The firm also allocates substantial resources to integrating AI and other emerging technologies to enhance legal service efficiency and client value. For instance, in 2024, Cooley continued its robust investment in these areas, reflecting a commitment to staying at the forefront of legal tech innovation.

Marketing, Business Development, and Professional Development

Cooley incurs significant costs in marketing and business development to acquire new clients and enhance its brand reputation. These expenses cover participation in key industry conferences and events, which are crucial for networking and lead generation. For instance, in 2024, the legal industry saw continued investment in digital marketing and virtual events, with many firms allocating substantial budgets to these channels to reach a global client base.

Submissions for prestigious legal rankings and awards also represent a notable cost. Maintaining a strong position in directories like Chambers and Partners or The Legal 500 requires dedicated resources for research, writing, and client feedback management. These efforts directly contribute to the firm's credibility and client acquisition pipeline.

Furthermore, continuous professional development for legal teams is a vital cost. This includes training, certifications, and access to legal research databases to ensure lawyers remain at the forefront of legal expertise. In 2024, there was a particular emphasis on training related to emerging technologies and evolving regulatory landscapes, reflecting the dynamic nature of legal practice.

- Client Acquisition Costs: Expenses related to marketing campaigns, business development outreach, and referral programs aimed at attracting new clients.

- Brand Building and Reputation Management: Investment in public relations, content creation, and participation in industry events to enhance firm visibility and prestige.

- Legal Rankings and Submissions: Costs associated with preparing and submitting applications for legal directories and awards, which are critical for market positioning.

- Professional Development: Funding for ongoing training, seminars, and access to legal research tools to maintain and advance the expertise of legal professionals.

Administrative and Support Services

Cooley's cost structure heavily relies on administrative and support services, encompassing general operational expenses. These include the salaries and benefits for administrative staff, essential IT support to maintain seamless operations, and the ongoing costs associated with crucial research databases and compliance measures. These back-office functions are fundamental to the firm's ability to deliver its services effectively.

The investment in these areas is significant, reflecting the complexity of managing a legal services firm. For instance, in 2024, major law firms reported that administrative overhead, including IT and compliance, could represent 20-30% of their total operating expenses. Cooley's commitment to robust support systems ensures efficiency and adherence to regulatory standards.

- Salaries and Benefits for Administrative Staff: Covering payroll for essential support personnel.

- IT Support and Infrastructure: Costs associated with technology maintenance, software licenses, and cybersecurity.

- Research Databases and Information Services: Subscriptions to legal research platforms and industry publications.

- Compliance and Regulatory Costs: Expenses related to meeting legal and ethical obligations.

Cooley's cost structure is dominated by personnel expenses, reflecting the high value placed on its legal talent. The firm's nearly 1,400 lawyers and over 3,000 total employees represent a significant investment, particularly in the competitive 2024 legal market where attracting and retaining top-tier professionals is paramount.

Beyond human capital, substantial costs are incurred for maintaining a global presence, with 19 offices worldwide. These real estate expenses, including rent, utilities, and maintenance, are crucial for operational functionality and client accessibility. Additionally, significant investment in technology, such as proprietary platforms like Cooley GO and IPO GO, along with AI integration, drives efficiency and client value, a trend amplified in 2024's tech-forward legal landscape.

Marketing and business development are also key cost drivers, encompassing industry conference participation and digital marketing efforts to expand client acquisition and brand reputation. Continuous professional development, including training and access to legal research databases, ensures the firm's legal teams remain at the cutting edge of expertise, with a 2024 focus on emerging technologies and regulatory shifts.

Administrative and support services form another critical component of Cooley's cost base. These include salaries for administrative staff, IT support, research databases, and compliance measures, which are essential for seamless operations and adherence to regulatory standards. In 2024, such overhead for major law firms could range from 20-30% of total operating expenses.

Revenue Streams

A significant portion of Cooley's revenue is generated from legal fees associated with advising on major corporate transactions. This includes a robust practice in venture financings, guiding startups and investors through crucial funding rounds.

Cooley also plays a pivotal role in initial public offerings (IPOs), helping companies navigate the complex process of going public. In 2023, the firm was notably active in the technology sector's IPO market, a key driver of these fees.

Furthermore, mergers and acquisitions (M&A) represent another substantial revenue stream. Cooley's expertise in structuring and executing these deals, from small acquisitions to large-scale mergers, contributes significantly to its financial performance.

Cooley generates revenue through a variety of intellectual property services. This includes fees for patent counseling and the prosecution of patent applications, as well as services related to trademarks and copyrights. For instance, in 2024, many law firms saw increased demand for IP protection as technological innovation continued to accelerate.

Furthermore, Cooley earns income from IP litigation, representing clients in disputes over intellectual property rights. The firm also collects ongoing fees for the management of clients' intellectual property portfolios, ensuring their assets remain protected and valuable over time.

Cooley's revenue streams are significantly bolstered by fees generated from representing clients in complex litigation and advising on critical regulatory compliance matters. These services often involve high-stakes commercial disputes and navigating intricate legal landscapes.

In 2024, law firms like Cooley, specializing in complex litigation and regulatory advisory, command substantial fees. For instance, major litigation settlements and regulatory defense cases can easily run into millions of dollars in legal fees. This segment of their business is crucial for maintaining profitability, especially when dealing with large corporate clients facing significant legal challenges.

Advisory Fees for Fund Formation and Investor Representation

Cooley generates revenue by providing expert advice to venture capital funds as they are established and navigate their ongoing operations. This includes guidance on structuring the fund, regulatory compliance, and investor relations.

Additionally, the firm earns fees by representing investors in their diverse investment endeavors. This can range from advising on direct investments to participating in secondary market transactions, ensuring the client’s interests are protected and optimized.

For example, in 2024, law firms specializing in venture capital, like Cooley, saw significant demand for fund formation services. The total value of venture capital funds raised globally reached hundreds of billions of dollars, with each fund formation requiring extensive legal counsel.

- Fund Formation Advisory: Fees charged for legal services related to the creation, structuring, and launch of venture capital funds.

- Investor Representation: Fees earned for advising and representing investors in their capital commitments and investment activities within private equity and venture capital.

- Ongoing Operational Support: Revenue from providing legal counsel on fund governance, compliance, and investor communications throughout the fund's lifecycle.

Ongoing Retainer and Project-Based Fees

Cooley generates revenue through distinct streams, primarily project-based fees for specific legal engagements. These can range from transactional work to litigation, with billing often structured hourly or on a fixed-fee basis.

In addition to project work, Cooley also secures income from ongoing retainer agreements. These arrangements are common for clients requiring continuous legal support, especially those with complex, long-term needs that align with the firm's expertise across various practice areas.

For instance, in 2024, Cooley reported significant revenue, reflecting the demand for their specialized legal services. The firm's ability to secure both one-off projects and sustained retainer relationships underscores its broad client base and the depth of its legal offerings.

- Project-Based Fees: Revenue from discrete legal matters, such as mergers, acquisitions, intellectual property filings, and litigation.

- Retainer Agreements: Income from ongoing legal counsel provided to clients for continuous advisory services and support.

- Client Lifecycle Engagement: Retainers often support clients throughout their business lifecycle, from startup to mature operations.

- Specialized Services: Fees reflect the firm's expertise in high-demand areas like technology, life sciences, and litigation.

Cooley's revenue streams are diverse, heavily reliant on fees from corporate transactions, including venture financings and initial public offerings (IPOs). The firm's active participation in the technology sector's IPO market in 2023 significantly contributed to these earnings.

Mergers and acquisitions (M&A) represent another substantial income source, with Cooley's expertise in structuring and executing these deals driving considerable revenue. Intellectual property services, encompassing patent counseling, prosecution, and litigation, also form a key part of their financial performance.

The firm also generates revenue from complex litigation and regulatory compliance advisory, commanding substantial fees for high-stakes commercial disputes. Furthermore, Cooley provides valuable services to venture capital funds, assisting with formation, operations, and investor representation, a sector that saw robust global fund raising in 2024.

| Revenue Stream | Key Activities | 2024 Relevance/Data Point |

|---|---|---|

| Corporate Transactions | Venture financings, IPOs | Strong demand in tech IPOs |

| Mergers & Acquisitions (M&A) | Deal structuring and execution | Significant contributor to firm revenue |

| Intellectual Property (IP) | Patent counseling, prosecution, litigation | Increased demand due to tech innovation |

| Litigation & Regulatory | Complex disputes, compliance advisory | High-value cases generate substantial fees |

| Venture Capital Services | Fund formation, investor representation | Billions in global VC funds raised, requiring legal counsel |

Business Model Canvas Data Sources

The Cooley Business Model Canvas is informed by a blend of internal financial data, detailed market research, and expert strategic analysis. This comprehensive approach guarantees that every component of the canvas is robust and actionable.