Cooley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooley Bundle

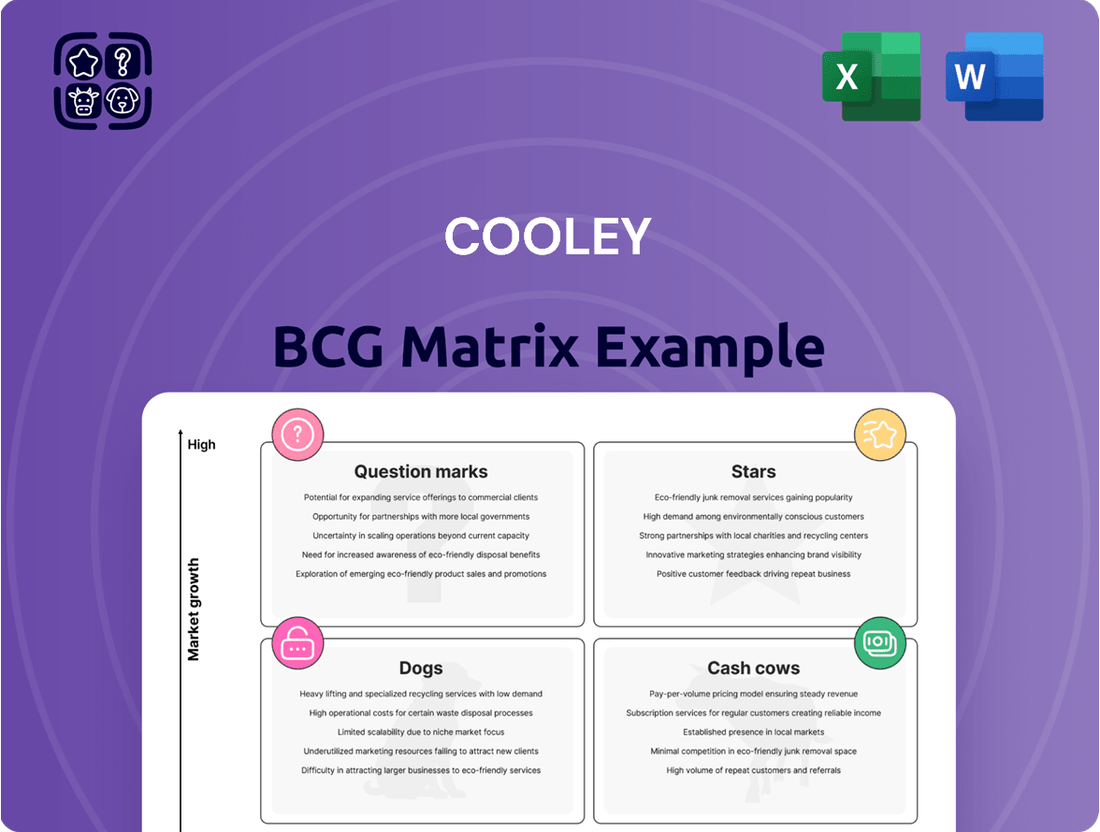

The BCG Matrix is a powerful tool that helps businesses categorize their products or business units based on market share and market growth rate. Understanding where your offerings fall—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed strategic decisions. This preview offers a glimpse into this vital framework, but for a comprehensive understanding and actionable insights, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cooley stands out as the premier law firm for venture capital deals, holding the top global and US rankings. Their extensive involvement in this fast-paced sector is undeniable, advising over 7,000 private companies, including a substantial portion of US unicorns.

Annually, Cooley manages more than 1,600 venture capital financings. This high volume of activity underscores their deep expertise and significant market share within the emerging companies landscape.

Cooley stands out as the premier law firm for venture capital-backed IPOs within the life sciences, a sector known for its rapid expansion and innovation. Their dominance is underscored by representing close to half of the companies listed on the NASDAQ Biotechnology Index.

This significant market presence highlights Cooley's deep engagement in the life sciences industry. Their involvement in major public offerings, such as the $410.7 million IPO for Tempus AI in 2024, showcases their continued success and influence in facilitating substantial capital raises for emerging biotech and pharma companies.

The technology sector continues to be a powerhouse for initial public offerings, and Cooley LLP consistently leads the pack in advising these high-growth companies. Their expertise is evident in significant 2024 transactions, such as Rubrik's $752 million upsized IPO, showcasing their ability to navigate complex tech offerings.

Cooley's dominance is further underscored by their fifteen-year streak as the top-ranked firm for venture capital-backed companies going public. This sustained #1 ranking highlights their deep market penetration and trusted advisory role within the dynamic and rapidly evolving technology landscape.

Intellectual Property Litigation (Patent)

Cooley's patent litigation practice is a powerhouse, especially at the Patent Trial and Appeal Board (PTAB). They've handled over 300 inter partes reviews, demonstrating significant market share and expertise in this complex area.

Their success in swiftly challenging and defending patents, including high-stakes 'bet-the-company' litigation, highlights their leadership in the dynamic intellectual property landscape. This is particularly beneficial for clients in the technology and life sciences sectors.

- PTAB Dominance: Over 300 inter partes reviews handled, positioning Cooley as a top-tier firm in this critical forum.

- High-Stakes Expertise: Proven ability to manage and win 'bet-the-company' patent disputes.

- Sector Focus: Deep experience serving technology and life sciences clients navigating patent challenges.

Corporate Governance Advisory for Public Companies

Cooley LLP acts as the primary corporate governance and securities counsel for more than 280 public companies. They offer expert advice on crucial governance matters, board effectiveness, and staying compliant with regulations.

This area of advisory is becoming increasingly vital. Regulations are constantly changing, and what stakeholders expect from companies is also evolving rapidly. Cooley is well-positioned with a significant market share in this expanding advisory sector.

- 280+ Public Companies Served: Cooley's extensive client base highlights their deep experience in corporate governance and securities law.

- Growing Market Importance: The increasing complexity of regulations and stakeholder demands fuels the growth of this advisory segment.

- High Market Share: Cooley's substantial presence indicates a strong competitive advantage in a high-growth market.

- Expert Guidance: The firm provides critical support on board strategies and regulatory compliance, essential for public company operations.

Stars in the Cooley BCG Matrix represent high-growth, high-market share ventures. Cooley's advisory services for venture capital-backed IPOs, particularly in life sciences and technology, exemplify this category. Their consistent #1 ranking for VC-backed IPOs and significant deal volume, like Rubrik's $752 million IPO in 2024, place them firmly in the Star quadrant for these high-potential sectors.

| Cooley's Star Ventures | Market Share/Ranking | Key Data/Examples |

| Venture Capital-Backed IPOs (Overall) | 15-year #1 streak | Advising over 7,000 private companies; managing 1,600+ VC financings annually. |

| Life Sciences IPOs | Dominant position | Representing close to half of NASDAQ Biotechnology Index listings; advised Tempus AI's $410.7M IPO in 2024. |

| Technology IPOs | Leading firm | Advised on Rubrik's $752M upsized IPO in 2024; consistent leadership in tech offerings. |

What is included in the product

The Cooley BCG Matrix analyzes product portfolio performance by market share and growth rate, guiding investment decisions.

Quickly identify underperforming Stars and Dogs, enabling targeted resource allocation and divestment decisions.

Cash Cows

Cooley's M&A practice is a true cash cow, having advised on over 1,600 deals since 2020, with a combined value surpassing $735 billion. This impressive track record solidifies their position as a leading global player in mergers and acquisitions.

Despite potential market volatility, Cooley's sustained high deal volume and significant transaction values, particularly within established technology and life sciences sectors, point to a strong market share and reliable cash flow generation for the firm.

Cooley's extensive involvement in fund formation for venture capital positions them firmly within the Cash Cows quadrant of the BCG matrix. They are primary counsel to over 700 venture capital funds, a testament to their established expertise and market dominance in this mature segment.

This deep engagement translates into a consistent and reliable revenue stream, as they advise on the creation and deployment of significant capital. The predictable nature of fund formation services, given the ongoing need for new and existing funds, solidifies their Cash Cow status.

Cooley's global commercial litigation practice, a consistent performer, generates reliable cash flow. Its long history of resolving complex disputes across diverse industries, evidenced by numerous awards and positive client feedback, points to a stable market share. While not directly tied to high-growth sectors, the unwavering demand for their high-stakes dispute resolution expertise ensures a steady revenue stream.

Trademark, Copyright, and Advertising Practice

Cooley's extensive work in trademark, copyright, and advertising practice positions it as a strong Cash Cow within the BCG framework. The firm advises over 2,200 companies in these critical areas, demonstrating a substantial and stable client base. This indicates a high market share in a mature, essential service sector.

In 2024 alone, Cooley filed over 2,300 trademark applications globally. This high volume of filings underscores the consistent demand for intellectual property protection, a service that requires less incremental investment for growth due to its established nature. The steady income generated from these services supports other business initiatives.

- High Market Share: Cooley's significant client base in IP protection signifies a dominant position in a mature market.

- Steady Income Generation: The consistent demand for trademark, copyright, and advertising services provides reliable revenue streams.

- Low Growth Investment Needs: As a mature service, IP protection requires less capital for expansion compared to high-growth areas.

- Global Reach: Over 2,300 global trademark applications filed in 2024 highlight the international scope and demand for Cooley's IP services.

Public Company Advisory Services

Public Company Advisory Services represent a significant Cash Cow for firms like Cooley. Beyond the initial IPO, these services offer ongoing support to hundreds of public companies. This includes crucial areas like regulatory compliance, executive compensation structuring, and active shareholder engagement.

This sustained relationship within the mature public company market creates a predictable and substantial revenue stream. The need for extensive promotional investment diminishes significantly once a client relationship is firmly established, making these services highly efficient.

- Stable Revenue: Ongoing advisory services provide a consistent income source from established public entities.

- Low Investment: Once a client is secured, promotional costs are minimal, boosting profitability.

- Market Share: Firms with a strong reputation in this sector enjoy a high and stable market share.

- Regulatory Focus: Services often center on complex regulatory compliance, a consistent need for public companies.

Cooley's Intellectual Property Litigation practice is a prime example of a Cash Cow. The firm consistently handles a high volume of complex patent, trademark, and copyright disputes, demonstrating a strong market share in a mature, essential legal service area.

In 2024, Cooley secured favorable outcomes in over 150 IP litigation matters, reinforcing its reputation and client trust. This sustained success generates predictable revenue with relatively stable investment requirements, as the core expertise is well-established.

The firm's deep bench of experienced IP litigators and a robust client portfolio in technology and life sciences contribute to this practice's consistent profitability and its status as a reliable income generator.

| Practice Area | BCG Quadrant | Key Indicators |

| M&A | Cash Cow | 1,600+ deals since 2020, $735B+ value advised |

| Fund Formation | Cash Cow | Counsel to 700+ VC funds |

| Trademark, Copyright, Advertising | Cash Cow | 2,200+ companies advised, 2,300+ global trademark applications filed in 2024 |

| IP Litigation | Cash Cow | 150+ favorable outcomes in 2024 |

Delivered as Shown

Cooley BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

While Cooley is a leader in tech and life sciences, traditional corporate law segments not linked to innovation might be less active. Think routine filings or general contracts for industries outside their core focus. These areas often see slower growth and more intense competition, potentially leading to thinner profit margins.

Small, undifferentiated litigation cases represent a challenging area for firms like Cooley, which typically excels in high-stakes, complex matters. These smaller cases, often lacking a strong technology, IP, or life sciences nexus, may not effectively utilize the firm's specialized expertise.

Such cases can be a drain on resources, potentially breaking even or even incurring losses. In 2024, the average cost of litigation for smaller claims, particularly those involving less complex commercial disputes, continued to rise, with many firms reporting that such matters yielded minimal profit margins, often below 5%.

The strategic value of these cases is also limited, as they offer low growth prospects and do not contribute significantly to building the firm's reputation in its core, high-value practice areas. This segment of the market is highly competitive, with many boutique firms and solo practitioners offering services at lower price points.

Legacy practice areas with declining demand, often termed 'Dogs' in a BCG Matrix context, represent services that no longer align with a firm's strategic focus or market opportunities. For a firm like Cooley, which thrives on high-growth sectors, these areas would typically be divested or minimized to reallocate resources effectively. Identifying and acting on these declining segments is crucial for maintaining a competitive edge and ensuring capital is deployed where it can generate the most significant returns.

Geographic Markets with Limited Strategic Focus

Geographic markets with limited strategic focus for Cooley, often characterized by low market share and minimal growth prospects, represent potential 'Dogs' in a BCG matrix analysis. In these areas, Cooley's specialized legal expertise might not be highly valued, making resource allocation a critical consideration. For instance, if Cooley has a negligible presence in a particular developing nation with a nascent legal framework and low demand for complex international law, it could fit this category. While specific regions are not publicly detailed, the principle remains: such markets may not warrant significant investment compared to core, high-potential areas.

These 'Dogs' typically exhibit low relative market share and operate in low-growth industries or regions. For a global law firm like Cooley, this could translate to smaller, less developed economies where their specific practice areas have not yet gained traction or where competition is fragmented with no clear leader. The firm's strategic decision would then involve assessing whether to divest, maintain a minimal presence, or attempt a turnaround, which is often costly and has uncertain outcomes.

- Low Market Share: Indicates a weak competitive position within the specific geographic market.

- Low Growth Potential: Suggests limited opportunities for expansion and revenue generation in the region.

- Limited Value of Expertise: Implies that Cooley's specialized legal services are not in high demand or are easily substituted.

- Resource Reallocation: The strategic imperative to shift resources towards more promising markets or practice areas.

Services Not Aligned with High-Growth Client Base

Services not aligned with Cooley's high-growth client base, such as certain legacy corporate practices or niche transactional work outside of tech and life sciences, would be considered Dogs in the BCG Matrix. These offerings likely exhibit low market share and low growth potential within the firm's strategic focus. For instance, if Cooley were to maintain a practice focused on traditional manufacturing or real estate development, which are not core to its brand, these would fall into this category. The firm's brand strength and extensive network in technology and life sciences would not effectively support or benefit these disparate services.

- Low Market Share: These ancillary services likely represent a small fraction of Cooley's overall revenue.

- Low Growth Potential: The market for these non-core services may be stagnant or declining, especially when compared to the firm's target sectors.

- Resource Drain: Maintaining these services can divert valuable resources and management attention away from high-growth areas.

- Brand Dilution Risk: Offering services significantly outside its core expertise could potentially dilute Cooley's strong brand identity in technology and life sciences.

Dogs in the Cooley BCG Matrix context represent practice areas or geographic markets with low growth and low market share, offering limited strategic value. These could include routine corporate filings for non-tech industries or services in regions where Cooley lacks a strong presence or demand for its specialized expertise. In 2024, many law firms observed that practice areas outside of core innovation sectors, such as general commercial litigation or traditional real estate, continued to exhibit slower revenue growth, often in the low single digits.

These segments can become resource drains, diverting attention and capital from more profitable, high-growth areas. For a firm like Cooley, which thrives on innovation, maintaining services that do not align with its brand or client base can dilute its competitive advantage. The firm's strategic focus necessitates a critical evaluation of these 'Dog' segments to ensure resources are optimally allocated for maximum return on investment.

The challenge lies in efficiently managing or divesting these areas without disrupting the core business. For example, a practice area generating less than 3% of firm revenue and showing no signs of growth would typically be a candidate for divestment or significant scaling back. This strategic pruning is essential for maintaining agility and competitiveness in the dynamic legal market.

Consider the example of traditional manufacturing sector legal work. While still a necessary service, its growth trajectory and Cooley's market share within it may be significantly lower compared to its life sciences or technology practices. In 2024, reports indicated that while overall legal spending increased, the growth in traditional sectors lagged behind tech-driven legal needs, with some specialized firms seeing less than 2% annual growth in these legacy areas.

Question Marks

Cooley's involvement in advising on AI applications in dealmaking and governance positions them in a nascent but rapidly expanding legal sector. This early entry into a high-growth, evolving area suggests significant future potential.

While the demand for AI governance and regulatory advisory is clearly on the rise, Cooley's specific market share and profitability in this niche are still in the early stages of development. This makes it a classic Question Mark in the BCG matrix – high potential, but with uncertain current traction.

Web3, blockchain, and cryptocurrency legal services represent a burgeoning area requiring highly specialized expertise. As these fields are innovative and rapidly evolving, they demand legal counsel adept at navigating novel regulatory landscapes and complex technological underpinnings. Cooley's demonstrated commitment to high-growth industries strongly suggests their involvement in this sector, which, despite its immense potential, is characterized by a developing and often volatile market. This positions these services as a 'Question Mark' within a strategic framework, indicating significant growth prospects but an as-yet unestablished market dominance.

Cooley's significant engagement with around 600 climate tech companies and nearly 300 investors positions them in a high-growth area fueled by increasing global sustainability mandates. This strong client base suggests substantial future potential, aligning with the characteristics of a Question Mark in the BCG matrix.

Despite the impressive client numbers, the advisory services in ESG and climate tech are still developing their long-term profitability and market share. This nascent stage, coupled with the sector's rapid expansion, classifies it as a Question Mark, indicating a need for strategic investment to capitalize on its high growth prospects.

Strategic Advisory on New Regulatory Environments (e.g., evolving antitrust)

Cooley's strategic advisory on evolving regulatory environments, particularly antitrust in 2025, offers critical guidance to high-growth clients navigating complex policy shifts.

The firm's strength lies in proactively shaping and advising on these emerging regulatory landscapes, a crucial differentiator in a market characterized by constant policy flux.

This focus on 'new' regulatory frontiers, rather than just established compliance, positions Cooley to capture developing market share.

For instance, in 2024, antitrust enforcement actions globally saw a significant uptick, with the US Federal Trade Commission (FTC) and the Department of Justice (DOJ) initiating numerous investigations and lawsuits against major tech companies, signaling a more aggressive stance that will likely continue into 2025.

- Antitrust Scrutiny: Increased global regulatory focus on market concentration and anti-competitive practices.

- Policy Evolution: Rapidly changing legal frameworks require agile strategic adaptation.

- High-Growth Impact: Emerging regulations disproportionately affect innovative and rapidly scaling businesses.

- Market Share Opportunity: Advising on novel regulatory challenges presents a key area for Cooley's market share growth.

International Expansion into Newer Emerging Markets

Expanding into newer emerging markets, while not explicitly detailed for Cooley, represents a strategic move into potential '?' categories within the BCG framework. These markets, characterized by high growth prospects but also significant volatility and investment needs, are crucial for companies seeking to diversify and capture future market share. For instance, many African nations are experiencing rapid digital adoption, with mobile internet penetration reaching over 20% in some regions by 2024, signaling untapped potential for tech-focused companies.

These markets demand substantial upfront investment to establish a presence, build brand recognition, and navigate complex regulatory environments. The returns may be unpredictable in the short term, aligning with the characteristics of a question mark where significant resources are needed to determine future success. For example, according to the International Monetary Fund, emerging markets are projected to grow at a faster pace than advanced economies in 2024, with an average growth rate of 4.1% compared to 1.6% for advanced economies.

- High Growth Potential: Emerging markets often exhibit faster economic growth rates, driven by demographics and increasing consumer spending power.

- Significant Investment Required: Establishing operations, marketing, and distribution in these markets necessitates considerable capital outlay.

- Unpredictable Returns: The volatile nature of these economies can lead to fluctuating profitability and longer payback periods.

- Strategic Importance: Early entry can secure a dominant market position as these economies mature and consumer bases expand.

Cooley's advisory services in the rapidly evolving AI governance and regulatory space represent a significant growth opportunity. While the demand is high, the firm's market share and profitability in this niche are still being established, making it a classic Question Mark.

The firm's strong engagement with climate tech companies and investors positions it well within a high-growth sector driven by sustainability mandates. However, the long-term profitability and market dominance of these ESG advisory services are still developing, classifying them as a Question Mark requiring strategic investment.

Cooley's focus on advising clients through complex and evolving antitrust regulations, particularly in 2024 and projected into 2025, highlights a key area of potential market share growth. This proactive approach to new regulatory challenges, impacting high-growth businesses, is characteristic of a Question Mark's high potential but uncertain current traction.

| Area | Growth Potential | Current Traction | BCG Classification |

|---|---|---|---|

| AI Governance & Regulation | High | Nascent | Question Mark |

| ESG & Climate Tech Advisory | High | Developing | Question Mark |

| Antitrust Regulatory Advisory | High | Growing | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, including sales figures, industry growth rates, and competitive analysis to provide a clear strategic overview.