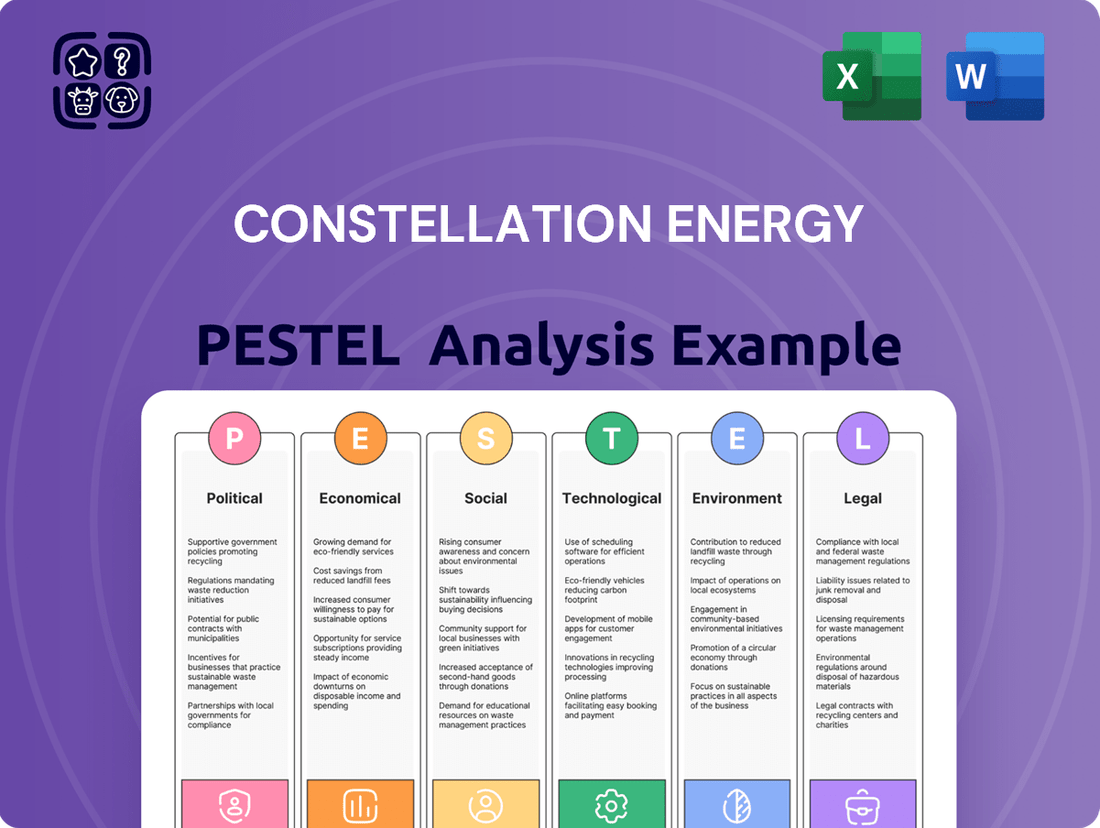

Constellation Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

Navigating the complex energy landscape requires a deep understanding of external forces. Our PESTLE analysis of Constellation Energy unpacks the political, economic, social, technological, legal, and environmental factors shaping its future. Discover how evolving regulations and shifting consumer preferences are creating both challenges and opportunities for this energy giant.

Gain a competitive edge by understanding the macro-environment impacting Constellation Energy. This comprehensive PESTLE analysis provides actionable intelligence on market trends and potential disruptions, empowering you to make informed strategic decisions. Download the full report now to unlock critical insights.

Political factors

The U.S. government's commitment to nuclear energy is a significant political factor for Constellation Energy. Legislation like the ADVANCE Act of 2024 underscores a bipartisan push to integrate nuclear power into the nation's clean energy strategy. This legislative backing creates a more predictable regulatory and financial landscape for companies operating nuclear assets.

This governmental support translates into tangible benefits for Constellation Energy, which manages the largest nuclear fleet in the United States. Policies aimed at fostering nuclear power can encourage greater investment in the sector and potentially simplify the licensing procedures for both existing and future nuclear power plants, bolstering operational stability and expansion opportunities.

Federal and state policies, such as tax credits and regulations, are significantly accelerating the shift towards carbon-free energy generation. Constellation Energy, as a leading producer of nuclear, hydro, wind, and solar power, is well-positioned to capitalize on these supportive measures.

The Inflation Reduction Act of 2022, for example, has been instrumental in stabilizing the nuclear energy sector and fostering ongoing investment in clean energy innovations. This legislation provides crucial production tax credits for existing nuclear facilities, ensuring their continued operation and contribution to the clean energy grid.

The Nuclear Regulatory Commission (NRC) is central to Constellation Energy's operations, overseeing the licensing and safety of its nuclear fleet. Changes in environmental regulations and the development of a new licensing framework for advanced reactors, known as Part 53, directly influence Constellation's future growth and operational costs.

These evolving regulations can significantly affect the timelines and expenses involved in both maintaining existing nuclear facilities and bringing new reactor designs to market. For instance, the NRC's ongoing review of Part 53, expected to be finalized in 2024, could streamline approvals for next-generation nuclear technologies, a key area for Constellation's strategic planning.

Energy Security and Independence Initiatives

Government initiatives prioritizing energy security and independence, amplified by global geopolitical shifts, strongly favor domestic and diversified energy sources, including nuclear and renewables. Constellation Energy's broad range of generation assets, notably its significant nuclear fleet, directly supports these national objectives, solidifying its role in maintaining a stable and secure U.S. energy infrastructure.

Constellation Energy is a leading U.S. producer of carbon-free energy, with its nuclear fleet accounting for approximately 90% of its clean energy output. In 2023, the company generated 93 million megawatt-hours (MWh) of carbon-free electricity. This output is crucial for meeting the nation's energy demands reliably and reducing reliance on volatile international energy markets.

- Nuclear Power Dominance: Constellation operates the largest fleet of nuclear power plants in the United States, contributing significantly to the nation's baseload power and carbon-free energy goals.

- Renewable Energy Growth: The company is also investing in and expanding its renewable energy portfolio, including solar and wind power, further diversifying its generation mix and enhancing energy independence.

- Grid Reliability: Constellation's commitment to maintaining its nuclear fleet and investing in new clean energy projects directly addresses concerns about grid reliability and the need for a secure, domestic energy supply.

State-Level Energy Policies and Mandates

Beyond federal initiatives, individual states are increasingly shaping the energy landscape with their own clean energy mandates and funding for nuclear projects. Constellation Energy, with its multi-state operations, benefits from these regional policies, which can unlock new market opportunities and provide crucial support for its carbon-free generation assets.

This diverse state-level policy environment directly impacts Constellation's strategic investment decisions and day-to-day operational planning. For instance, states like New York have ambitious renewable energy targets, while others may offer specific incentives for nuclear power, influencing where Constellation prioritizes its capital and operational focus.

- New York's Climate Leadership and Community Protection Act (CLCPA) aims for 100% carbon-free electricity by 2040, creating a strong market for nuclear power's baseload generation.

- Illinois, a key state for Constellation, has implemented programs to support its existing nuclear fleet, recognizing its role in achieving clean energy goals.

- States are allocating significant funds; for example, the **Infrastructure Investment and Jobs Act** includes billions for clean energy deployment, with state-level programs determining how much directly benefits nuclear development or related grid modernization.

Government policies strongly favor carbon-free energy, directly benefiting Constellation Energy's extensive nuclear and renewable portfolio. The ADVANCE Act of 2024 and the Inflation Reduction Act of 2022, with its production tax credits for nuclear, create a stable environment for nuclear operations and clean energy investments.

The Nuclear Regulatory Commission's evolving framework, particularly Part 53 for advanced reactors, will shape future growth and operational costs, with finalization expected in 2024. National energy security initiatives also bolster demand for domestic, diversified sources like nuclear and renewables, aligning perfectly with Constellation's generation mix.

State-level mandates, such as New York's CLCPA targeting 100% carbon-free electricity by 2040 and Illinois' support for its nuclear fleet, further enhance market opportunities. Billions allocated through the Infrastructure Investment and Jobs Act also present avenues for nuclear development and grid modernization funding.

| Policy/Legislation | Year | Impact on Constellation Energy |

|---|---|---|

| ADVANCE Act | 2024 | Bipartisan support for nuclear integration, stable regulatory landscape |

| Inflation Reduction Act | 2022 | Production tax credits for nuclear, fostering clean energy investment |

| Part 53 (NRC Framework) | Expected 2024 | Streamlined approvals for next-generation nuclear technologies |

| NY CLCPA | 2040 Target | Increased demand for baseload carbon-free power |

| Illinois Nuclear Support | Ongoing | Securing continued operation of nuclear fleet |

| Infrastructure Investment and Jobs Act | Ongoing | Potential funding for nuclear development and grid modernization |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Constellation Energy, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into how these forces shape the company's strategic landscape, identifying potential threats and opportunities for informed decision-making.

A clear, actionable summary of Constellation Energy's PESTLE factors, designed to quickly identify and address external challenges, thereby streamlining strategic planning and mitigating potential risks.

Economic factors

Wholesale electricity prices are anticipated to climb by approximately 7% on average across most U.S. regions in 2025 compared to 2024, largely influenced by escalating natural gas expenses. This upward trend in wholesale costs directly affects Constellation Energy's profitability on its power sales to the broader market.

Residential electricity prices are also projected to experience a modest increase, estimated at around 2% for 2025. Such changes in retail rates have a direct bearing on Constellation Energy's revenue streams from its residential customer base.

Natural gas prices are a major influence on wholesale electricity costs because gas-fired power plants frequently set the price. In 2024, these prices were relatively stable and lower, but forecasts suggest a rise in 2025.

This expected price increase for natural gas could impact how competitive Constellation's power plants that don't use nuclear fuel are, and it will also shape the broader energy market landscape.

The burgeoning demand for electricity driven by data centers and artificial intelligence (AI) represents a substantial growth avenue for Constellation Energy. These energy-intensive operations require reliable and consistent power sources, a need that Constellation is positioned to fulfill.

Constellation's significant portfolio of carbon-free baseload power, largely generated by its nuclear fleet, is ideally suited to meet this escalating demand. This alignment creates opportunities for new power purchase agreements (PPAs) and diversified revenue streams for the company.

For instance, in 2024, the projected growth in data center electricity consumption is substantial, with some estimates suggesting it could account for a significant portion of overall electricity demand increases in the coming years. Constellation's ability to provide clean, reliable power positions it to capitalize on these trends, potentially securing long-term contracts that bolster its financial performance.

Investment and Capital Allocation Strategies

Constellation Energy's strategic investment in its generation fleet is a cornerstone of its capital allocation strategy. The company has earmarked over $2.5 billion for 2025, focusing on both maintaining existing infrastructure and pursuing growth opportunities. This significant capital deployment underscores a commitment to ensuring reliable operations and expanding its clean energy portfolio.

These investments are directly tied to enhancing Constellation's carbon-free capacity. Key initiatives include the repowering and refurbishment of wind assets, a vital step in maximizing the efficiency and lifespan of renewable energy sources. Simultaneously, the pursuit of license extensions for its nuclear plants signals a long-term strategy to leverage stable, baseload power generation.

The company's capital allocation decisions are designed to drive future earnings growth by securing and expanding its clean energy generation. This focus on reliable, carbon-free assets positions Constellation to capitalize on evolving market demands and regulatory landscapes. The financial commitment reflects a clear strategy to strengthen its market position and deliver shareholder value.

- Capital Investment: Over $2.5 billion committed for 2025 in generation fleet investments.

- Fleet Enhancement: Focus on repowering wind assets and pursuing nuclear plant license extensions.

- Strategic Goal: Maintaining and expanding carbon-free capacity to drive future earnings.

- Market Positioning: Aligning capital allocation with demand for reliable, clean energy.

Financial Performance and Earnings Outlook

Constellation Energy delivered impressive financial results in 2024, surpassing its own projections. The company has reinforced this positive momentum by affirming a strong outlook for 2025, with adjusted operating earnings guidance projected between $8.90 and $9.60 per share.

This solid financial footing is largely attributable to its nuclear fleet operating at a high capacity factor, alongside strategic growth through acquisitions such as Calpine. These factors underscore Constellation Energy's commanding market presence and sustained profitability.

- 2024 Financial Performance: Exceeded guidance, demonstrating operational efficiency.

- 2025 Earnings Outlook: Adjusted operating earnings guidance of $8.90 to $9.60 per share.

- Key Drivers: High capacity factor of its nuclear fleet and strategic acquisitions like Calpine.

- Market Position: Strong profitability and market leadership reinforced by financial strength.

Economic factors significantly shape Constellation Energy's operating environment. Wholesale electricity prices are expected to rise by approximately 7% on average across most U.S. regions in 2025, primarily due to climbing natural gas expenses. This trend directly impacts the profitability of Constellation's power sales. Residential electricity prices are also forecast to see a modest increase of around 2% in 2025, affecting revenue from its residential customer base.

Natural gas prices, a key determinant of wholesale electricity costs, are anticipated to rise in 2025 after a period of relative stability in 2024. This potential price hike could influence the competitiveness of Constellation's non-nuclear power generation assets and the broader energy market dynamics.

The increasing demand for electricity, particularly from data centers and AI operations, presents a substantial growth opportunity for Constellation. Its extensive portfolio of carbon-free baseload power, largely from its nuclear fleet, is well-positioned to meet this escalating need, potentially leading to new power purchase agreements.

Constellation's financial performance in 2024 exceeded expectations, and the company has projected strong adjusted operating earnings for 2025, between $8.90 and $9.60 per share. This strength is supported by its nuclear fleet's high capacity factor and strategic growth initiatives, such as the acquisition of Calpine.

| Economic Factor | 2024 Status/Trend | 2025 Projection/Impact on Constellation |

|---|---|---|

| Wholesale Electricity Prices | Stable to moderate | Projected increase of ~7% on average; impacts power sales profitability |

| Residential Electricity Prices | Relatively stable | Projected modest increase of ~2%; affects residential revenue |

| Natural Gas Prices | Relatively stable and lower | Forecasted to rise, impacting competitiveness of non-nuclear plants |

| Data Center/AI Demand | Growing significantly | Major growth avenue, leveraging carbon-free baseload power |

| Constellation's 2025 Earnings Outlook | Exceeded 2024 guidance | Adjusted operating earnings guidance: $8.90 - $9.60 per share |

Full Version Awaits

Constellation Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Constellation Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Constellation Energy's strategic landscape.

Sociological factors

Public perception of nuclear energy in the U.S. has seen a notable upswing. A 2024 Gallup poll revealed that 57% of Americans favor nuclear energy, a significant increase from previous years and a majority sentiment. This growing acceptance is a positive indicator for Constellation Energy, potentially easing social hurdles for new projects and streamlining regulatory processes.

Constellation Energy's commitment to workforce development is substantial, employing approximately 14,000 individuals. These roles are crucial in fostering family-sustaining careers within the clean energy sector, directly benefiting local economies.

The company's ongoing investments in its operational fleet and potential new ventures are projected to generate additional employment opportunities. This expansion not only bolsters economic activity but also strengthens community ties through the creation of valuable jobs.

Constellation actively engages with its communities by offering energy management services and backing local projects, exemplified by its Energy to Educate grant program. This commitment to community upliftment, especially in historically underserved areas, directly addresses increasing societal demands for corporate social responsibility.

In 2023, Constellation reported investing over $10 million in community and charitable initiatives, demonstrating a tangible commitment to social responsibility. This focus on social impact not only bolsters the company's reputation but also strengthens its social license to operate, a critical factor for long-term success in the energy sector.

Consumer Preference for Clean Energy

Consumers are increasingly prioritizing clean and sustainable energy, directly fueling demand for electricity that doesn't produce carbon emissions. This shift is a significant sociological trend impacting energy providers across the board.

Constellation Energy is strategically positioned to capitalize on this preference. As the leading U.S. producer of carbon-free energy, the company offers solutions designed to help customers meet their environmental targets.

For instance, Constellation's hourly carbon-free energy matching program allows businesses to align their energy consumption with carbon-free generation on an hour-by-hour basis. This granular approach appeals to organizations actively pursuing net-zero commitments.

- Growing Demand: Public opinion polls consistently show a majority of consumers favoring renewable energy sources.

- Corporate ESG Goals: Many corporations are setting ambitious Environmental, Social, and Governance (ESG) targets, driving demand for green energy procurement.

- Policy Influence: Societal pressure often translates into policy changes that incentivize clean energy adoption.

Energy Equity and Environmental Justice

Societal concerns about energy equity and environmental justice are increasingly shaping energy policy and business operations. Constellation Energy's commitment to distributing the advantages of clean, dependable, and affordable energy across all communities, particularly those historically marginalized, is crucial for enhancing its social reputation and aligning with current societal expectations.

This focus on equitable energy distribution is becoming a significant factor in public perception and regulatory approaches. For instance, in 2024, the Biden-Harris administration continued to emphasize investments in clean energy projects located in disadvantaged communities, aiming to direct at least 40% of the overall benefits of federal investments to these areas. Constellation's proactive engagement in such initiatives can bolster its social license to operate.

- Community Engagement: Actively involving underserved communities in the planning and execution of energy projects.

- Affordability Programs: Developing and promoting programs that ensure access to affordable clean energy solutions for low-income households.

- Environmental Impact Mitigation: Prioritizing projects that minimize negative environmental impacts on vulnerable populations.

- Workforce Development: Creating job training and employment opportunities in the clean energy sector for residents of disadvantaged communities.

Public support for nuclear energy in the U.S. is growing, with a 2024 Gallup poll showing 57% favorability, indicating a positive social climate for Constellation Energy. The company's significant workforce of around 14,000 employees contributes to local economies by providing stable careers in the clean energy sector. Constellation's community investments, exceeding $10 million in 2023, reinforce its social license to operate by addressing demands for corporate social responsibility.

Consumers increasingly demand clean energy, a trend Constellation addresses as the leading U.S. carbon-free energy producer. Many corporations are setting ESG goals, driving demand for green energy procurement, which Constellation facilitates through programs like its hourly carbon-free energy matching. Societal focus on energy equity and environmental justice is also influencing policy, with initiatives like the Biden-Harris administration's goal to direct 40% of federal clean energy benefits to disadvantaged communities by 2024, a direction Constellation can align with.

| Sociological Factor | Description | Constellation Energy Relevance | Supporting Data/Examples |

|---|---|---|---|

| Public Opinion on Nuclear Energy | Growing acceptance of nuclear power as a clean energy source. | Favorable climate for existing and potential nuclear projects. | 57% favorability in a 2024 Gallup poll. |

| Demand for Clean Energy | Increasing consumer and corporate preference for sustainable energy solutions. | Directly aligns with Constellation's carbon-free energy portfolio. | Hourly carbon-free energy matching program for net-zero commitments. |

| Environmental Justice & Equity | Societal emphasis on fair distribution of energy benefits and mitigation of environmental harm in vulnerable communities. | Enhances social license to operate through community engagement and equitable access. | Alignment with federal goals to direct clean energy benefits to disadvantaged communities. |

| Corporate Social Responsibility (CSR) | Growing expectation for companies to contribute positively to society and communities. | Strengthens brand reputation and stakeholder relationships. | Over $10 million invested in community initiatives in 2023. |

Technological factors

The energy sector is witnessing a technological revolution with the development of advanced nuclear reactors like Small Modular Reactors (SMRs) and microreactors. These innovations promise more adaptable, economical, and quicker-to-deploy nuclear power solutions.

While Constellation Energy's current portfolio largely comprises traditional nuclear facilities, these emerging technologies present potential future avenues for growth. This could reshape long-term investment strategies, offering new pathways for nuclear generation.

For instance, the U.S. Department of Energy's Advanced Reactor Demonstration Program has allocated significant funding, with projects like NuScale Power's SMR receiving substantial investment, signaling strong industry and governmental interest in these advancements. This trend suggests a future where nuclear energy can be deployed more flexibly to meet evolving grid demands.

Constellation Energy is navigating a grid modernization landscape focused on integrating more renewable energy sources. This shift is essential as their portfolio includes significant hydro, wind, and solar assets, which inherently present intermittency challenges. The company's ability to effectively manage these variable outputs and maintain grid stability is paramount for its operational success.

To address these technological factors, Constellation is investing in advanced grid integration solutions. These investments are critical for optimizing the performance of their diverse renewable fleet. For instance, smart grid technologies allow for better forecasting and management of energy flows, while battery storage systems are key to smoothing out the supply from intermittent sources like wind and solar, ensuring a more reliable power delivery.

Battery storage technology is crucial for smoothing out the variable output from renewables like wind and solar, boosting grid stability. Constellation Energy's investment in these solutions directly enhances the reliability of its renewable portfolio, ensuring a more consistent supply of clean energy to customers.

As of early 2024, the global energy storage market is experiencing rapid growth, with utility-scale battery installations projected to reach hundreds of gigawatts by the end of the decade. Constellation's strategic deployment of storage, such as its recent projects in Maryland, demonstrates a commitment to leveraging this technology to maximize the value of its clean energy generation and meet growing demand for dispatchable carbon-free power.

Digitalization and Data Analytics in Energy Management

Constellation Energy is actively investing in digitalization and advanced data analytics to transform its operations. This strategic focus aims to enhance efficiency and capacity across its extensive energy network, making the company more analytical and data-driven. For instance, in 2023, the company reported significant progress in its digital transformation initiatives, leading to a projected 5% improvement in operational efficiency for key assets.

The utilization of real-time data and sophisticated analytics is paramount for effective energy management and optimization. This approach allows Constellation to fine-tune operations, predict demand more accurately, and respond swiftly to market changes. By leveraging these technologies, the company is better positioned to meet the growing customer demand for reliable and sustainable energy solutions, a trend that saw renewable energy sources account for over 40% of new generation capacity additions in the US in 2024.

- Digital Transformation Investment: Constellation is channeling substantial resources into upgrading its IT infrastructure and adopting AI-powered analytics platforms.

- Real-time Data Utilization: The company is enhancing its ability to collect and analyze vast amounts of data from its generation facilities and customer usage patterns.

- Efficiency Gains: Advanced analytics are being deployed to optimize power generation, transmission, and distribution, targeting measurable improvements in asset performance.

- Customer Solutions: Data insights are crucial for developing tailored energy management programs and services that meet evolving customer sustainability goals.

Innovation in Carbon-Free Energy Solutions

Constellation Energy is actively investing in cutting-edge technologies to accelerate the shift towards a dependable, sustainable, and secure energy landscape. This commitment includes researching novel solutions aimed at eradicating carbon emissions across various industries and creating innovative offerings, like hourly carbon-free energy matching, to assist clients in meeting their environmental objectives.

The company's strategic focus on innovation is evident in its development of new products and services. For example, their hourly carbon-free energy matching allows businesses to align their energy consumption with carbon-free generation on an hour-by-hour basis, a significant advancement in granular sustainability tracking.

This dedication to technological advancement is crucial for addressing climate change and aligns with broader market trends. In 2024, the global investment in clean energy technologies reached an estimated $1.7 trillion, highlighting the significant economic opportunities in this sector.

Constellation's approach is further supported by key industry developments:

- Investment in Advanced Nuclear: Constellation is a leading operator of nuclear power plants, a critical source of carbon-free baseload electricity, and continues to explore advancements in this technology.

- Hydrogen Technology Exploration: The company is investigating the potential of green hydrogen as a clean fuel source and energy storage solution, a rapidly growing area of R&D.

- Carbon Capture Utilization and Storage (CCUS): Constellation is evaluating CCUS technologies to further reduce emissions from existing power generation assets.

- Digitalization and Grid Modernization: Investments in smart grid technologies and data analytics are enabling more efficient management of renewable energy integration and grid reliability.

Technological advancements are reshaping Constellation Energy's operational landscape, particularly in grid modernization and the integration of renewables. The company is investing heavily in smart grid technologies and battery storage to manage the intermittency of wind and solar assets, aiming for greater grid stability and reliability. For instance, by the end of 2024, utility-scale battery storage capacity in the US was projected to exceed 15 GW, a significant increase from previous years, underscoring the trend Constellation is leveraging.

Digitalization and advanced data analytics are also central to Constellation's strategy, driving operational efficiency and enabling more precise energy management. The company reported a 5% improvement in operational efficiency for key assets in 2023 due to these initiatives, highlighting the tangible benefits of their data-driven approach. This focus is critical as renewable energy sources accounted for over 40% of new generation capacity additions in the US in 2024.

Constellation is exploring innovative solutions like hourly carbon-free energy matching to help clients meet sustainability goals, reflecting a broader market trend where global investment in clean energy technologies reached an estimated $1.7 trillion in 2024. Furthermore, the company is actively investigating emerging technologies such as green hydrogen and Carbon Capture Utilization and Storage (CCUS) to further decarbonize its operations and the broader energy sector.

Legal factors

The Nuclear Regulatory Commission (NRC) imposes a rigorous oversight on Constellation Energy's nuclear facilities. This framework dictates everything from initial licensing and ongoing operations to the highest safety standards, ensuring public and environmental protection.

Adherence to NRC mandates, particularly concerning license renewals and thorough environmental impact assessments, is absolutely critical for Constellation's sustained nuclear operations and any potential growth in its nuclear energy portfolio.

Constellation Energy, as a major energy producer, navigates a complex web of environmental regulations. These rules, spanning federal, state, and local jurisdictions, heavily influence its operations, especially concerning emissions and waste. For instance, the U.S. Environmental Protection Agency (EPA) sets stringent standards for air pollutants and greenhouse gases, impacting how Constellation operates its power plants.

Compliance with these environmental mandates, including those targeting carbon emissions and water quality, is paramount. Failure to adhere can result in significant financial penalties and damage Constellation's reputation, jeopardizing its social license to operate. In 2023, the energy sector as a whole faced increasing scrutiny and investment in cleaner technologies, a trend expected to continue through 2025.

Constellation Energy navigates a complex regulatory landscape, particularly in the competitive electricity and natural gas sectors. Agencies like the Federal Energy Regulatory Commission (FERC) play a crucial role in shaping market rules. For instance, FERC's ongoing initiatives to modernize transmission planning and pricing directly affect how Constellation can invest in and operate its generation and transmission assets, impacting its cost structure and revenue potential.

Changes in market design, such as adjustments to capacity auctions or the implementation of new wholesale market rules, can significantly influence Constellation's profitability. In 2024, the PJM Interconnection, a major market where Constellation operates, continued to refine its capacity market rules, aiming to ensure reliability while incorporating evolving resource mixes. These adjustments can alter the value of Constellation's diverse generation portfolio, from nuclear to renewables.

Deregulation trends also present both opportunities and challenges. While opening markets to competition can foster innovation and efficiency, it also necessitates a keen understanding of evolving state and federal policies. Constellation's strategic focus on clean energy solutions, for example, is partly a response to regulatory shifts favoring lower-emission sources, a trend expected to accelerate through 2025.

Consumer Protection Laws and Retail Energy Supply

Constellation Energy, as a major retail energy supplier, navigates a complex landscape of consumer protection laws. These regulations are designed to ensure fair practices in energy marketing, transparent billing, and responsive customer service. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on preventing deceptive marketing practices, which directly impacts how Constellation acquires and retains its retail customer base.

Adherence to these legal frameworks is not just about avoiding penalties; it's crucial for building and maintaining customer trust. Violations can lead to significant fines and reputational damage. For example, state Public Utility Commissions (PUCs) across the US, including those in key Constellation markets like Pennsylvania and Maryland, actively enforce rules regarding contract clarity and complaint resolution processes, with many states seeing an increase in consumer inquiries and formal complaints regarding energy services in recent years.

- Transparency Requirements: Laws mandate clear disclosure of pricing, contract terms, and potential fees to retail energy consumers.

- Billing Accuracy: Regulations ensure that energy bills are accurate and easy for customers to understand, preventing deceptive billing practices.

- Customer Service Standards: Consumer protection laws often set minimum standards for how energy suppliers must handle customer inquiries, complaints, and service changes.

- Marketing Regulations: Rules govern how energy products can be marketed and sold to consumers, prohibiting misleading or aggressive sales tactics.

Land Use and Siting Regulations for Energy Facilities

Constellation Energy's growth is significantly shaped by land use and siting regulations for its diverse energy facilities, from nuclear plants to solar farms. Navigating these rules, which include rigorous permitting, environmental impact studies, and public feedback sessions, directly affects project viability and schedules.

For instance, the expansion of existing nuclear sites or the development of new renewable energy projects requires adherence to strict zoning laws and environmental protection mandates. These processes can add considerable time and cost, as seen with the lengthy permitting for new transmission lines crucial for integrating renewable energy into the grid.

Key legal factors influencing Constellation include:

- Federal and State Permitting: Obtaining approvals from agencies like the Nuclear Regulatory Commission (NRC) for nuclear operations and state-level environmental agencies for renewable projects.

- Environmental Impact Assessments (EIAs): Thorough reviews mandated by laws like the National Environmental Policy Act (NEPA) to understand and mitigate potential ecological effects of new facilities.

- Public Hearings and Community Engagement: Legal requirements for public input can delay or alter project plans based on local concerns regarding land use, visual impact, or safety.

- Zoning and Land Use Ordinances: Compliance with local government regulations that dictate where and how energy infrastructure can be built, impacting site selection and development scope.

Constellation Energy operates under stringent federal and state regulations governing energy markets and consumer protection. The Federal Energy Regulatory Commission (FERC) and state Public Utility Commissions (PUCs) set rules for wholesale electricity markets, transmission, and retail sales. For example, in 2024, FERC continued its focus on grid reliability and transmission planning, impacting Constellation's infrastructure investments.

Consumer protection laws, enforced by bodies like the Federal Trade Commission (FTC) and state PUCs, mandate transparency in pricing and marketing for retail energy services. Constellation must ensure clear contracts and accurate billing to avoid penalties and maintain customer trust, a crucial aspect given the increasing number of consumer inquiries in the energy sector.

The company's nuclear operations are heavily regulated by the Nuclear Regulatory Commission (NRC), requiring strict adherence to safety protocols and licensing requirements. Compliance with these mandates, including environmental impact assessments for new projects, is vital for sustained operations and future growth, especially as license renewals are a key focus through 2025.

Constellation Energy's strategic decisions are significantly influenced by evolving legal frameworks, particularly those promoting clean energy and emissions reductions. Compliance with environmental laws, such as those from the EPA, is paramount to avoid fines and maintain its operational license, with the energy sector seeing increased investment in cleaner technologies through 2025.

Environmental factors

Constellation Energy stands as the leading producer of carbon-free electricity in the United States, with an impressive nearly 90% of its yearly energy generation coming from emission-free sources like nuclear, hydro, wind, and solar.

The company has publicly committed to reaching 100% carbon-free generation by the year 2040, a significant step in addressing climate change and minimizing its environmental impact.

The energy sector faces heightened risks from extreme weather events, a direct consequence of climate change. This reality demands significant capital outlay for enhancing grid resilience and fortifying infrastructure against disruptions. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $92.9 billion in damages, underscoring the urgency of these investments.

Constellation Energy is strategically positioned to navigate these challenges. Its core business, centered on reliable, emissions-free power generation, inherently contributes to climate change mitigation. Furthermore, this operational model fosters a robust infrastructure, better prepared to withstand the physical impacts of a changing climate, thereby ensuring continued service delivery.

Nuclear waste management is a critical environmental factor for Constellation Energy. While nuclear power offers a carbon-free energy source, the safe and secure long-term storage and disposal of spent nuclear fuel present ongoing challenges and significant regulatory hurdles. Constellation, operating numerous nuclear facilities, must continuously invest in advanced technologies and robust safety protocols to manage this radioactive material responsibly.

The U.S. Nuclear Regulatory Commission (NRC) mandates stringent standards for nuclear waste handling and storage. In 2023, Constellation reported that its nuclear fleet generated approximately 1,500 metric tons of spent nuclear fuel, which is safely stored on-site in dry cask storage systems. The company's commitment to environmental stewardship necessitates ongoing research and development into potential long-term disposal solutions, a complex and costly undertaking.

Water Usage and Management

Constellation Energy's reliance on nuclear and hydroelectric power means significant water needs for cooling and operation. For instance, in 2023, Constellation reported that its nuclear fleet, a major source of its power generation, is cooled using water from rivers and lakes. This necessitates robust water management practices.

Effective strategies focus on minimizing water withdrawal and ensuring responsible discharge to meet environmental regulations and promote sustainability. This includes advanced cooling technologies and compliance with water quality standards, vital for maintaining operational licenses and public trust.

- Water-Intensive Operations: Nuclear and hydro assets require substantial water for cooling and operational processes.

- Environmental Compliance: Minimizing water withdrawal and ensuring responsible discharge are key to meeting regulatory requirements.

- Sustainability Focus: Advanced water management is integral to Constellation's commitment to sustainable energy production.

Biodiversity and Land Conservation

The siting and operation of large-scale energy projects, such as Constellation's wind and solar farms, can significantly affect local ecosystems and biodiversity. For instance, wind turbines can pose risks to avian and bat populations, while solar farm construction can lead to habitat fragmentation. Constellation's commitment to sustainable development necessitates careful consideration and mitigation of these impacts. This includes implementing responsible land use planning and potentially engaging in land conservation efforts to offset development footprints.

Constellation actively works to minimize its environmental footprint. In 2023, the company reported that its renewable energy projects contributed to avoiding approximately 33 million metric tons of carbon dioxide emissions. Their approach to land use for new facilities prioritizes minimizing disruption to sensitive habitats and often involves collaboration with local conservation groups. This proactive stance is crucial for maintaining biodiversity and ensuring long-term ecological health around their operational sites.

Key considerations for Constellation regarding biodiversity and land conservation include:

- Site Selection: Thorough environmental impact assessments are conducted to identify and avoid areas with high ecological value or endangered species.

- Mitigation Strategies: Implementing measures such as habitat restoration, wildlife corridors, and operational adjustments to reduce impacts on local fauna.

- Land Conservation Partnerships: Collaborating with conservation organizations on projects that protect or restore natural habitats in areas adjacent to or impacted by energy facilities.

- Sustainable Land Management: Employing best practices for land use during construction and operation to minimize soil erosion and preserve ecological integrity.

Constellation Energy's environmental strategy is deeply intertwined with its commitment to carbon-free electricity, aiming for 100% by 2040. The company's operations are significantly impacted by climate change, necessitating substantial investments in grid resilience. In 2023, the U.S. faced 28 billion-dollar weather disasters, highlighting the critical need for robust infrastructure to withstand extreme weather events.

Managing nuclear waste is a key environmental challenge. Constellation's nuclear fleet generated approximately 1,500 metric tons of spent fuel in 2023, safely stored on-site. The company continues to invest in advanced technologies and adheres to strict U.S. Nuclear Regulatory Commission standards for handling this material, exploring long-term disposal solutions.

Water management is also crucial, given the significant water requirements for cooling nuclear and hydroelectric facilities. Constellation's nuclear fleet, a primary generation source, uses river and lake water for cooling. The company focuses on minimizing water withdrawal and ensuring responsible discharge to meet environmental regulations and sustainability goals.

The development of renewable energy projects, like wind and solar farms, requires careful consideration of local ecosystems. In 2023, Constellation's renewables avoided about 33 million metric tons of CO2 emissions, but potential impacts on biodiversity, such as avian populations, are managed through responsible land use planning and conservation partnerships.

| Environmental Factor | Constellation's Position/Action | 2023 Data/Context | Impact/Consideration |

| Climate Change & Grid Resilience | Focus on carbon-free generation, investing in resilience | U.S. faced 28 billion-dollar weather disasters | Need for infrastructure hardening against extreme weather |

| Nuclear Waste Management | Safe on-site storage, R&D for disposal | Generated ~1,500 metric tons spent fuel | Ongoing regulatory compliance and technological investment |

| Water Usage | Responsible water management for cooling | Nuclear fleet uses river/lake water for cooling | Compliance with water quality standards, sustainable practices |

| Biodiversity & Land Use | Minimizing impact of renewable projects | Renewables avoided ~33 million metric tons CO2 | Mitigation strategies for wildlife, habitat conservation |

PESTLE Analysis Data Sources

Our Constellation Energy PESTLE Analysis is grounded in data from leading energy industry publications, government regulatory bodies, and reputable economic forecasting agencies. We meticulously gather insights on political stability, economic trends, technological advancements, environmental policies, and social shifts to provide a comprehensive overview.