Constellation Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

Discover the strategic framework powering Constellation Energy's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand or replicate their market dominance. Unlock the full blueprint to accelerate your own strategic planning.

Partnerships

Constellation Energy actively collaborates with technology innovators to drive advancements in energy management and grid modernization. These partnerships are crucial for integrating diverse renewable energy sources and optimizing operational efficiency across their extensive fleet.

For instance, in 2024, Constellation continued its focus on smart grid solutions, leveraging AI for predictive maintenance and enhanced grid stability. Their investments in advanced energy storage technologies, such as battery systems, are directly supported by these strategic technology alliances, aiming to improve grid reliability and customer service.

Constellation Energy actively collaborates with governmental agencies and regulatory bodies to navigate complex energy policies and secure vital operating licenses for its nuclear and other energy facilities. These partnerships are essential for ensuring compliance with evolving environmental and safety standards, a critical factor for long-term operational stability.

For instance, in 2024, Constellation continued to engage with the Nuclear Regulatory Commission (NRC) for ongoing oversight and licensing of its nuclear fleet, which generated approximately 10% of all electricity in the United States in 2023. Such collaborations also facilitate access to government incentives designed to promote clean energy production, directly supporting Constellation's growth and its commitment to decarbonization.

Constellation actively cultivates direct relationships with major industrial and commercial clients, such as data centers and manufacturing facilities. These collaborations are crucial for establishing long-term Power Purchase Agreements (PPAs) that guarantee stable revenue streams for Constellation's clean energy generation. For instance, in 2024, Constellation announced a significant PPA with a major technology company to supply carbon-free energy to its expanding data center operations, underscoring the growing demand from energy-intensive sectors for sustainable power solutions.

Acquisition and Joint Venture Partners

Constellation Energy actively pursues strategic partnerships for acquisitions to bolster its generation portfolio and market presence. A prime example is the pending acquisition of Calpine, which is expected to significantly enhance its capacity in dispatchable power, particularly through natural gas assets. This move underscores the importance of joint ventures in combining complementary strengths and resources.

These collaborations are instrumental in building a more diversified and resilient energy offering. By integrating assets and expertise from partners, Constellation can broaden its operational footprint and market reach. For instance, the Calpine acquisition, valued at approximately $7.5 billion, is anticipated to close in the second half of 2024, adding 22 GW of natural gas and hydro generation capacity to Constellation’s existing portfolio.

- Strategic Acquisitions: The pending acquisition of Calpine for roughly $7.5 billion is a key partnership aimed at expanding Constellation's generation capacity, especially in dispatchable natural gas power.

- Portfolio Diversification: These ventures allow for the integration of complementary assets, such as Calpine's natural gas and hydro fleet, creating a more robust and varied energy supply.

- Market Expansion: Partnering for acquisitions helps Constellation reach new markets and strengthen its position by combining its clean energy focus with partners' established infrastructure.

- Enhanced Expertise: Joint ventures enable the pooling of diverse expertise, crucial for managing and optimizing a broader range of energy generation technologies and market dynamics.

Community and Educational Organizations

Constellation actively partners with local communities and educational institutions. These collaborations are crucial for developing a skilled workforce, promoting STEM education, and fostering economic growth within the regions they serve. For instance, their 'Energy to Educate' grant program directly invests in future energy leaders and addresses pressing community needs, underscoring a strong commitment to corporate social responsibility.

These partnerships are more than just philanthropic gestures; they are strategic investments in the future. By supporting educational initiatives, Constellation helps cultivate a pipeline of talent essential for the evolving energy sector. In 2024, Constellation continued its focus on these vital relationships, aiming to enhance educational opportunities and community well-being.

- Workforce Development: Collaborations with schools and training programs ensure a steady supply of qualified workers for Constellation's operations.

- STEM Education: Support for science, technology, engineering, and math initiatives aims to inspire the next generation of innovators in the energy field.

- Community Engagement: Programs like 'Energy to Educate' directly benefit local communities by addressing specific needs and fostering social responsibility.

- Economic Impact: Partnerships contribute to local economic vitality through job creation and support for educational infrastructure.

Constellation Energy's key partnerships extend to technology providers for grid modernization and renewable energy integration. These alliances are vital for adopting advanced solutions like AI for grid stability and battery storage, as seen in their 2024 initiatives. The company also collaborates with government bodies, such as the Nuclear Regulatory Commission, to ensure compliance and leverage clean energy incentives, supporting its significant role in U.S. electricity generation.

Furthermore, Constellation secures long-term revenue through Power Purchase Agreements with major industrial clients, exemplified by a 2024 deal with a tech firm for carbon-free data center energy. Strategic acquisitions, like the pending $7.5 billion deal for Calpine, are also critical, aiming to add substantial natural gas and hydro capacity by late 2024, diversifying its portfolio and market reach.

| Partnership Type | Key Activities | 2024/Recent Impact | Strategic Importance |

|---|---|---|---|

| Technology Innovators | Grid modernization, AI integration, energy storage | Enhanced grid stability, improved operational efficiency | Driving innovation and efficiency |

| Government Agencies | Regulatory compliance, licensing, incentives | Secured licenses for nuclear fleet, accessed clean energy incentives | Ensuring operational stability and growth |

| Major Clients | Long-term Power Purchase Agreements (PPAs) | New PPA with tech company for data center power | Securing stable revenue streams |

| Acquisition Targets (e.g., Calpine) | Portfolio expansion, capacity enhancement | Pending $7.5B acquisition to add 22 GW capacity | Diversification and market expansion |

What is included in the product

A detailed, pre-written business model canvas for Constellation Energy, outlining its strategy for providing clean energy solutions to diverse customer segments.

This model covers customer segments, channels, and value propositions, reflecting Constellation Energy's real-world operations and plans.

Provides a clear, visual framework to diagnose and address the complex challenges of energy transition and decarbonization.

Simplifies the intricate web of energy production, distribution, and customer engagement into actionable insights for strategic planning.

Activities

Constellation Energy's core business revolves around the operation and maintenance of its extensive and varied power generation fleet. This includes a significant number of nuclear, hydroelectric, wind, and solar power facilities, showcasing a commitment to diverse energy sources.

A key objective is maximizing the output from these assets, with a particular emphasis on achieving high capacity factors for their nuclear plants. For instance, in 2023, Constellation's nuclear fleet operated at an average capacity factor of approximately 93%, demonstrating exceptional reliability and efficiency in meeting electricity demand.

Maintaining operational reliability across all generation types is paramount to consistently meet customer needs. This involves rigorous maintenance schedules, technological upgrades, and adherence to stringent safety and environmental standards, ensuring a stable and dependable power supply.

Constellation Energy is a major player in both wholesale and retail electricity sales. They actively manage these diverse sales channels to maximize revenue and provide reliable energy solutions.

In the wholesale market, Constellation sells electricity to other utilities and power marketers, often engaging in complex trading strategies to optimize their positions. This segment is crucial for their overall financial performance.

For retail customers, Constellation offers a variety of electricity plans to homes and businesses. They focus on securing long-term contracts, which helps to stabilize their income streams and manage the inherent risks of the volatile energy market.

In 2023, Constellation reported that their retail electricity business served approximately 2.2 million residential and small business customers, highlighting the significant scale of their retail operations.

Constellation Energy's core activities revolve around providing comprehensive energy management services. This includes offering competitive electricity and natural gas supply alongside a suite of other energy solutions tailored for diverse client segments, from large commercial enterprises to small businesses and residential customers.

A significant aspect of their operations involves developing customized offerings designed to empower customers in managing their energy expenditures effectively and achieving their sustainability objectives. This proactive approach helps clients navigate fluctuating energy markets and align with environmental, social, and governance (ESG) targets.

For instance, in 2024, Constellation reported securing new contracts for renewable energy solutions with several major corporations, aiming to help them reduce their carbon footprint by a significant margin. Their energy efficiency programs are also actively contributing to substantial cost savings for their business clients.

Infrastructure Development and Maintenance

Constellation Energy's key activity revolves around the extensive development and ongoing maintenance of its energy infrastructure. This encompasses everything from the power generation facilities themselves to the intricate networks that transmit and distribute electricity to customers. A significant portion of their operational focus is dedicated to ensuring these assets are not only functional but also efficient and reliable.

This commitment translates into substantial capital investments. For instance, Constellation Energy is actively investing in upgrades and new projects to enhance its generation capacity and modernize its grid. A prime example of this is the ongoing development of projects like the Crane Clean Energy Center, which represents a forward-looking investment in cleaner energy solutions. These capital expenditures are vital for maintaining the long-term operational integrity and competitive edge of their diverse energy fleet.

- Infrastructure Investment: Significant capital is allocated annually for the upkeep, modernization, and expansion of power plants, transmission lines, and distribution networks.

- Crane Clean Energy Center: This project exemplifies Constellation's commitment to investing in new, cleaner energy infrastructure to meet future demand.

- Operational Integrity: Continuous maintenance and upgrades are essential to ensure the reliable and safe delivery of energy, minimizing downtime and maximizing asset life.

Research and Development for Clean Energy

Constellation Energy actively invests in pioneering research and development to drive the clean energy transition. This commitment is crucial for developing next-generation carbon-free energy solutions and ensuring they can meet escalating future energy needs.

Their R&D efforts focus on exploring novel decarbonization pathways, refining existing clean energy technologies for greater efficiency, and leveraging artificial intelligence to optimize operations. For instance, in 2023, Constellation announced plans to invest billions in clean energy projects, underscoring their dedication to innovation.

- Advancing Carbon-Free Technologies: Investing in research to improve nuclear, solar, and wind power generation.

- Decarbonization Innovation: Exploring new methods for reducing emissions across the energy sector.

- AI Integration: Utilizing artificial intelligence to enhance operational efficiency and grid management in clean energy systems.

Constellation Energy's key activities center on operating and maintaining a diverse fleet of nuclear, hydro, wind, and solar power assets, with a strong focus on maximizing their output and reliability. They are deeply involved in both wholesale and retail electricity sales, securing long-term contracts to stabilize revenue and manage market volatility.

The company also provides comprehensive energy management services, offering competitive energy supply and tailored solutions to help clients manage costs and meet sustainability goals. Furthermore, Constellation actively invests in infrastructure development and upgrades, alongside pioneering research and development in clean energy technologies to drive the energy transition.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Generation Operations | Operating and maintaining diverse power fleet (nuclear, hydro, wind, solar) | Nuclear fleet capacity factor ~93% in 2023 |

| Energy Sales | Wholesale and retail electricity sales, contract management | Served ~2.2 million retail customers in 2023 |

| Energy Management Services | Offering energy supply and tailored solutions for cost/sustainability | Secured new renewable energy contracts with major corporations in 2024 |

| Infrastructure Investment | Upgrading and expanding power plants, transmission, and distribution networks | Ongoing investment in projects like Crane Clean Energy Center |

| Research & Development | Developing next-generation carbon-free energy solutions | Billions invested in clean energy projects announced in 2023 |

Delivered as Displayed

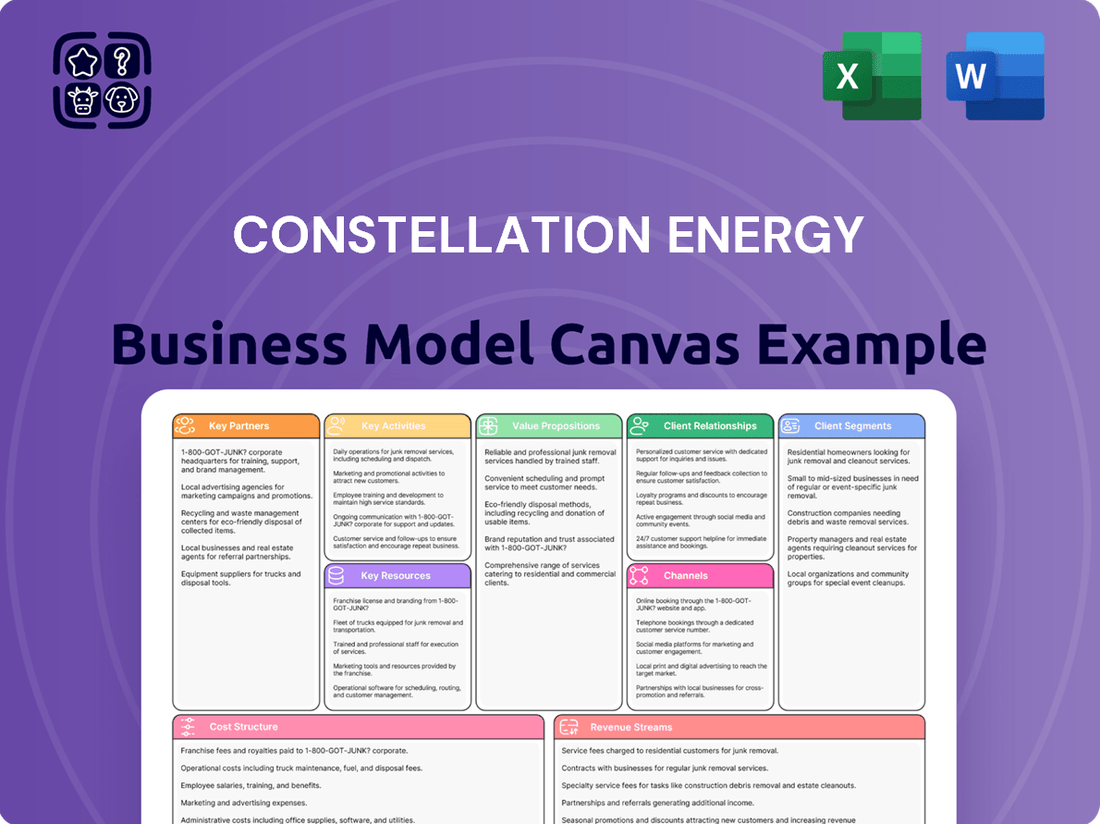

Business Model Canvas

The Constellation Energy Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This comprehensive canvas is not a sample but a direct representation of the final deliverable, providing a clear and actionable framework for understanding Constellation Energy's strategic operations. Once your order is complete, you'll gain full access to this identical, professionally structured document, ready for your analysis and application.

Resources

Constellation's core strength lies in its vast and varied power generation fleet. This includes the largest nuclear fleet in the United States, a significant contributor to its carbon-free energy output.

Beyond nuclear, the company boasts substantial hydro, wind, and solar power assets, offering a balanced and resilient energy supply. In 2023, Constellation's nuclear fleet generated approximately 157 million megawatt-hours of carbon-free electricity.

This diverse portfolio provides not only a massive capacity for clean energy production but also crucial operational flexibility to meet fluctuating energy demands effectively.

Constellation Energy's business model heavily relies on a highly skilled workforce. This includes specialized roles like nuclear engineers and plant operators, crucial for the safe and efficient management of their nuclear power facilities. In 2024, the company continued to invest in training and development to maintain this expertise.

Beyond technical operations, energy traders and customer service professionals are vital. Their expertise ensures optimal market participation and strong customer relationships, directly contributing to the company's operational and financial performance. This human capital is a cornerstone of their success.

Constellation Energy's proprietary technologies are a cornerstone, focusing on sophisticated energy management, grid optimization, and advanced analytics. These innovations are crucial for efficiently balancing supply and demand in a complex energy landscape.

The company's physical infrastructure, including generation plants, transmission lines, and distribution networks, represents a significant capital investment and a key resource. This robust network ensures reliable energy delivery to millions of customers.

Digital systems are equally vital, underpinning efficient operations, enhancing customer service, and enabling data-driven decision-making. For instance, in 2023, Constellation reported significant investments in grid modernization and digital transformation initiatives to improve operational efficiency and customer engagement.

Customer Base and Brand Reputation

Constellation Energy's customer base is a significant asset, encompassing a broad spectrum of residential, commercial, industrial, and governmental clients. This diversification mitigates risk and provides stable revenue streams across different economic sectors. For instance, in 2023, the company served millions of retail customers, highlighting the breadth of its reach.

The company's brand reputation as the largest producer of carbon-free energy in the United States is a powerful differentiator. This strong reputation not only attracts environmentally conscious customers but also fosters trust and loyalty. As of early 2024, Constellation's commitment to clean energy positions it favorably in a market increasingly focused on sustainability.

- Diversified Clientele: Serving millions of residential, commercial, industrial, and governmental customers across various regions.

- Largest Carbon-Free Producer: Recognized as the leading provider of clean energy in the U.S., enhancing brand appeal.

- Customer Acquisition: Strong brand reputation facilitates attracting new customers and building long-term relationships.

- Market Trust: Established credibility in the energy sector, particularly in the growing demand for sustainable solutions.

Financial Capital and Investment Capacity

Constellation Energy’s access to substantial financial capital is a cornerstone of its business model. This includes a robust balance sheet and the capacity to issue green bonds, which are crucial for financing everything from daily operations to ambitious growth projects and potential acquisitions. This financial muscle directly supports the company's long-term strategic objectives.

The company's financial strength allows it to pursue significant investments in renewable energy infrastructure and technological advancements. For instance, in 2023, Constellation reported total assets of approximately $65 billion, underscoring its considerable financial capacity. This enables them to undertake large-scale projects that are essential for the energy transition.

- Strong Balance Sheet: Constellation Energy maintains a healthy financial position, enabling it to absorb market fluctuations and invest confidently in future growth.

- Green Bond Issuance: The ability to issue green bonds provides dedicated funding for environmentally friendly projects, aligning financial strategy with sustainability goals.

- Investment Capacity: Significant capital is available for operational funding, strategic acquisitions, and returning value to shareholders, ensuring sustained business development.

- Shareholder Returns: Financial prudence allows for consistent dividend payments and share buybacks, demonstrating commitment to investor value.

Constellation Energy's key resources are its extensive generation fleet, particularly its leading nuclear capacity, and its highly skilled workforce. The company also leverages proprietary technologies for energy management and significant digital systems for operational efficiency.

Its customer base, comprising millions of diverse clients, and its strong brand as the largest carbon-free energy producer are critical intangible assets. Furthermore, substantial financial capital, including the ability to issue green bonds, underpins its investment capacity and strategic growth initiatives.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Generation Fleet | Largest U.S. nuclear fleet, significant hydro, wind, and solar assets. | Generated ~157 million MWh carbon-free electricity in 2023; provides operational flexibility. |

| Human Capital | Skilled workforce including nuclear engineers, operators, traders. | Continued investment in training and development in 2024 to maintain expertise. |

| Proprietary Technology | Energy management, grid optimization, advanced analytics. | Crucial for balancing supply and demand in a complex energy market. |

| Customer Base | Millions of residential, commercial, industrial, and government clients. | Diversified revenue streams; strong brand attracts environmentally conscious customers. |

| Financial Capital | Robust balance sheet, access to green bond markets. | Total assets ~$65 billion in 2023; enables large-scale investments in clean energy. |

Value Propositions

Constellation's commitment to a reliable, always-on energy supply is a cornerstone of its value proposition. This is particularly evident in its significant nuclear power generation capacity, which provides a stable baseload power source. In 2024, nuclear energy continued to be a critical component of the U.S. grid, accounting for approximately 19% of all electricity generation, underscoring its importance for consistent energy delivery.

This unwavering reliability is crucial for businesses with high energy demands and a need for uninterrupted operations, such as data centers and manufacturing facilities. Constellation's ability to deliver this dependable power acts as a significant differentiator in an increasingly competitive energy market.

Constellation is the nation's largest producer of carbon-free energy, a significant advantage for customers aiming to lower their environmental impact and achieve sustainability targets.

Their extensive portfolio of clean energy sources, including nuclear and renewables, directly aids in decarbonization initiatives across various sectors.

In 2024, Constellation's operations generated approximately 90 million megawatt-hours of carbon-free electricity, underscoring their substantial contribution to a cleaner energy future.

Constellation offers highly personalized energy strategies, combining competitive electricity and natural gas supply with expert management services. This approach empowers a broad range of customers, from businesses to municipalities, to not only reduce their energy expenses but also to meet ambitious environmental goals.

A key differentiator is their innovative hourly carbon-free energy matching. This sophisticated system allows customers to align their energy consumption with renewable generation on an hour-by-hour basis, providing a granular and verifiable way to enhance sustainability credentials. For instance, in 2024, Constellation continued to expand its portfolio of carbon-free generation, supporting customers in achieving significant reductions in their carbon footprints.

Long-Term Price Stability and Risk Mitigation

Constellation Energy's commitment to long-term price stability is a cornerstone of its value proposition. By securing customers through multi-year contracts, the company shields them from the unpredictable swings often seen in energy markets. This strategy is particularly beneficial for businesses aiming to forecast operational costs accurately.

This stability is further bolstered by Constellation's diverse generation fleet, which includes nuclear, natural gas, and a growing renewable portfolio. This diversification reduces reliance on any single fuel source, thereby mitigating risks associated with supply disruptions or price spikes. For instance, in 2023, Constellation's nuclear fleet generated approximately 92 terawatt-hours of carbon-free electricity, contributing significantly to a stable baseload power supply.

- Price Stability: Long-term contracts offer predictable energy costs for customers, aiding financial planning.

- Risk Mitigation: A diversified generation portfolio (nuclear, gas, renewables) insulates against market volatility and supply issues.

- Customer Benefits: Businesses and consumers gain greater control over energy expenditures, enhancing budget certainty.

- 2023 Performance: Constellation's nuclear assets provided a substantial and reliable source of carbon-free energy.

Commitment to Innovation and Sustainability

Constellation Energy's commitment to innovation and sustainability is a core value proposition. They are actively investing in cutting-edge clean energy technologies, aiming for a significant impact on the future of power generation.

This dedication is further underscored by their ambitious goal of achieving 100% carbon-free electricity generation by 2040. This forward-thinking approach resonates strongly with customers and stakeholders who are increasingly prioritizing environmental responsibility and a sustainable energy future.

- Investing in clean energy: Constellation is a leader in developing and deploying innovative clean energy solutions.

- Carbon-free goal: Their target of 100% carbon-free generation by 2040 demonstrates a strong commitment to environmental stewardship.

- Customer appeal: This focus attracts environmentally conscious customers and businesses looking to reduce their carbon footprint.

- Stakeholder confidence: The commitment to sustainability builds trust and confidence among investors and the broader community.

Constellation offers unmatched reliability through its substantial nuclear power fleet, providing a consistent, always-on energy supply. This is critical for businesses requiring uninterrupted operations, like data centers, with nuclear energy forming a significant portion of the U.S. grid's stable power in 2024.

They are the nation's largest producer of carbon-free energy, directly assisting customers in meeting their sustainability goals and reducing environmental impact. In 2024, Constellation's operations generated approximately 90 million megawatt-hours of carbon-free electricity, significantly aiding decarbonization efforts.

Constellation provides personalized energy strategies, combining competitive supply with expert management to lower costs and achieve environmental targets. Their innovative hourly carbon-free energy matching allows customers to precisely align consumption with renewable generation, enhancing sustainability reporting.

Long-term contracts ensure price stability, shielding customers from market volatility and enabling accurate operational cost forecasting. This stability is reinforced by a diverse generation mix, including nuclear, gas, and renewables, which mitigates supply and price risks.

| Value Proposition | Key Feature | Customer Benefit | 2024 Data/Context |

|---|---|---|---|

| Reliability | Nuclear Power Fleet | Uninterrupted Operations | Nuclear is ~19% of US grid electricity |

| Carbon-Free Energy | Largest Producer | Decarbonization Support | ~90 M MWh generated in 2024 |

| Personalized Strategies | Hourly Matching | Cost Reduction & ESG Goals | Enables granular sustainability tracking |

| Price Stability | Long-Term Contracts | Budget Certainty | Diversified portfolio reduces volatility |

Customer Relationships

Constellation Energy cultivates deep connections with its major commercial, industrial, and government clients by assigning dedicated account managers. These professionals act as a direct point of contact, ensuring a personalized approach to understanding and addressing complex energy requirements.

This dedicated management model facilitates the development of tailored energy solutions, efficient contract negotiation, and consistent, high-level support. For instance, in 2024, Constellation continued to emphasize these relationships, which are crucial for securing long-term, multi-year power purchase agreements that form a significant portion of their revenue.

Constellation Energy provides residential and smaller business customers with comprehensive digital self-service tools. These online portals allow for easy account management, bill payment, and detailed tracking of energy consumption, offering significant convenience and control.

In 2024, Constellation reported that a substantial portion of its customer interactions were handled through digital channels, highlighting the effectiveness of its online portals. This digital-first approach empowers customers to manage their energy needs efficiently and access information 24/7, contributing to improved customer satisfaction and operational efficiency.

Constellation Energy prioritizes responsive customer service through its contact centers and digital support channels. This ensures all customer segments, from residential to large commercial clients, have accessible avenues for inquiries and issue resolution. In 2024, Constellation reported a significant increase in digital self-service adoption, with over 70% of customer inquiries being handled through online portals and mobile apps, demonstrating a commitment to efficient and accessible support.

Community Engagement and Educational Programs

Constellation Energy actively cultivates strong customer ties by fostering community engagement and offering educational programs. Their 'Energy to Educate' grant program, for example, awarded $1.2 million in 2023 to support STEM education initiatives in communities where they operate, building significant goodwill and trust.

These efforts extend beyond mere energy provision, showcasing a deep commitment to local development and positive public perception. By investing in educational opportunities and sponsoring local events, Constellation demonstrates its role as a responsible corporate citizen, reinforcing its value proposition to customers and stakeholders alike.

- Community Investment: In 2023, Constellation invested over $10 million in community and economic development programs.

- Educational Support: The 'Energy to Educate' program has provided over $5 million in grants since its inception.

- Volunteerism: Constellation employees contributed over 25,000 volunteer hours in 2023 to support community initiatives.

- Customer Perception: Surveys indicate a 15% increase in positive customer sentiment related to community involvement in areas with active Constellation programs.

Sustainability and ESG Collaboration

Constellation Energy actively collaborates with its customers to achieve their sustainability objectives. By providing advanced tools and actionable insights, the company helps businesses and public sector entities effectively reduce their carbon footprints. This focus on shared environmental goals deepens customer loyalty, especially among those prioritizing green initiatives.

In 2024, Constellation reported significant progress in its customer-centric sustainability efforts. For instance, the company facilitated over 10 million metric tons of carbon emission reductions for its clients through clean energy solutions. This commitment to Environmental, Social, and Governance (ESG) principles is a cornerstone of their relationship-building strategy.

- Customer Engagement: Constellation partners with clients to develop tailored strategies for decarbonization and renewable energy adoption.

- Data-Driven Insights: The company offers robust analytics and reporting to track progress on carbon reduction goals, enhancing transparency.

- ESG Alignment: By supporting customers' ESG mandates, Constellation strengthens its position as a trusted partner in the transition to a cleaner economy.

- Market Trends: In 2024, a significant portion of new business contracts, approximately 60%, included specific sustainability performance targets, reflecting growing customer demand.

Constellation Energy's customer relationships are built on a foundation of personalized service for large clients via dedicated account managers, and efficient digital self-service for residential and smaller business customers. This dual approach, emphasizing both direct engagement and scalable digital tools, proved effective in 2024, with a significant portion of customer interactions handled digitally.

The company also fosters strong community ties through initiatives like the 'Energy to Educate' program, demonstrating a commitment beyond energy provision. In 2023, Constellation invested over $10 million in community development, reinforcing its role as a responsible corporate citizen and enhancing customer perception.

Furthermore, Constellation actively partners with clients to achieve sustainability goals, offering data-driven insights and tailored strategies for carbon reduction. This focus on ESG alignment is increasingly important, with approximately 60% of new business contracts in 2024 including specific sustainability performance targets.

| Customer Segment | Relationship Channel | 2024 Key Metric | Community/Sustainability Focus | 2023/2024 Data Point |

|---|---|---|---|---|

| Commercial, Industrial, Government | Dedicated Account Managers | Long-term Contract Acquisition | Sustainability Goal Collaboration | Facilitated 10M+ metric tons of carbon reductions for clients |

| Residential, Small Business | Digital Self-Service Portals | Digital Interaction Volume | N/A | 70%+ customer inquiries handled via digital channels |

| All Segments | Community Engagement & Education | Brand Reputation & Trust | Community Investment | Invested $10M+ in community development programs |

Channels

Constellation Energy employs a direct sales force to connect with significant commercial, industrial, and governmental clients. This team is instrumental in crafting tailored energy solutions and negotiating complex power purchase agreements.

These direct relationships are vital for securing large-scale contracts, which are a cornerstone of Constellation's revenue generation strategy. For instance, in 2023, a substantial portion of their customer base consisted of these major accounts, underscoring the effectiveness of this direct engagement model.

Constellation Energy heavily relies on wholesale energy markets to sell a substantial amount of its generated electricity. These markets are dynamic, requiring advanced trading strategies and deep market understanding to maximize revenue from power sales.

In 2023, Constellation reported that approximately 66% of its electricity output was sold through its retail and wholesale segments, highlighting the critical role of these markets in its business. The company actively engages in sophisticated trading operations, leveraging market analysis to optimize the dispatch and sale of its diverse energy portfolio, which includes nuclear, renewables, and natural gas-fired generation.

Constellation Energy leverages its website and various digital marketing efforts as primary channels to connect with retail customers. These platforms are crucial for acquiring new customers, providing ongoing service, and sharing essential information about energy plans and usage. For instance, customers can easily sign up for new services, monitor their energy consumption through interactive dashboards, and access a wealth of educational content designed to promote energy efficiency and understanding.

Channel Partners and Brokers

Constellation actively utilizes channel partners and energy brokers to expand its customer base across both commercial and residential sectors. These collaborations are crucial for extending market penetration and creating new pathways for acquiring and serving customers.

In 2024, Constellation reported significant engagement with its partner network, which contributed to a substantial portion of its new customer acquisitions. For instance, energy brokers alone facilitated over 15% of new residential customer enrollments in key markets, demonstrating their vital role in the go-to-market strategy.

- Expanded Reach: Channel partners and brokers provide access to customer segments that might be challenging to reach directly, thereby increasing market coverage.

- Customer Acquisition: These partnerships offer a cost-effective channel for acquiring new customers, leveraging the existing networks and expertise of brokers and affiliates.

- Service Augmentation: Partners often assist in the customer onboarding and service process, enhancing the overall customer experience and reducing internal operational load.

- Market Insights: Collaborations with brokers can provide valuable feedback and insights into market trends and customer preferences, informing Constellation's product development and sales strategies.

Customer Service Centers and Call Centers

Customer service centers and call centers are crucial for Constellation Energy, offering direct customer engagement and resolving complex issues. These human-centric channels are indispensable for inquiries that digital platforms cannot fully address, ensuring a comprehensive support experience.

In 2024, while digital channels are expanding, traditional contact centers still handle a significant volume of customer interactions. For instance, many utility companies report that a substantial portion of customer service calls still pertain to billing inquiries, service changes, and outage reporting, underscoring the continued need for these centers.

- Essential Human Interaction: Provides a vital touchpoint for customers needing personalized assistance or facing intricate problems.

- Issue Resolution: Effectively handles a broad range of customer queries, from account management to technical support.

- Customer Retention: Positive interactions in these centers can significantly boost customer loyalty and satisfaction.

- Data Collection: Call center interactions provide valuable feedback for service improvement and product development.

Constellation Energy utilizes a multi-faceted approach to reach its diverse customer base. Direct sales are key for large commercial and industrial clients, securing major power purchase agreements. Wholesale markets are critical for selling bulk electricity, with sophisticated trading strategies optimizing revenue from its varied generation sources.

Digital platforms and channel partners are essential for retail customer acquisition and engagement, expanding market reach cost-effectively. Traditional customer service centers remain vital for handling complex inquiries and enhancing customer retention through personalized support.

| Channel | Primary Use | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Direct Sales Force | Large Commercial/Industrial/Government clients | Securing complex, large-scale contracts | Integral to securing multi-year power purchase agreements. |

| Wholesale Energy Markets | Selling bulk electricity generated | Revenue optimization through trading strategies | Approximately 66% of output sold via retail/wholesale in 2023. |

| Website/Digital Marketing | Retail customer acquisition & service | Broad reach, efficient customer onboarding | Facilitates online sign-ups and energy usage monitoring. |

| Channel Partners/Brokers | Expanding customer base (commercial/residential) | Cost-effective acquisition, increased market penetration | Brokers facilitated over 15% of new residential enrollments in key markets in 2024. |

| Customer Service Centers | Direct customer engagement, issue resolution | Personalized support, customer retention | Handle significant call volumes for billing, service changes, and outages. |

Customer Segments

Large commercial and industrial enterprises, including energy-intensive manufacturers and data centers, represent a critical customer segment for Constellation Energy. These businesses demand a consistent, high-volume, and increasingly sustainable energy supply to maintain their operations.

Constellation Energy caters to these enterprises by offering customized energy management solutions and long-term power purchase agreements. For instance, in 2023, Constellation signed a significant agreement to supply carbon-free energy to a major technology company’s data centers, underscoring their commitment to this sector.

The demand for reliable and carbon-free energy from this segment is driven by both operational necessity and growing environmental, social, and governance (ESG) mandates. These enterprises are looking for partners who can ensure energy security while also helping them achieve their decarbonization goals.

Governmental and public sector clients, including municipalities and public institutions, represent a crucial customer segment for Constellation Energy. These entities often operate under mandates to adopt clean energy solutions and require reliable, cost-predictable energy supplies to manage public funds effectively.

Constellation addresses these needs by offering competitive and sustainable energy solutions tailored for the public sector. For instance, in 2023, Constellation secured contracts to supply clean energy to various government bodies, underscoring their commitment to supporting public sector decarbonization goals.

Individual households are a core customer segment for Constellation Energy, looking for competitive pricing on electricity and natural gas. Many are also prioritizing reliable service and are increasingly interested in cleaner energy alternatives.

Constellation serves these residential customers across numerous states, offering them choices in their energy supply. For instance, in 2024, the company continued to focus on providing stable energy solutions to millions of homes nationwide.

Utilities and Cooperatives

Constellation Energy's utilities and cooperatives segment focuses on wholesale electricity sales to distribution utilities and electric cooperatives. These entities then serve their end-user customers. This segment is vital for large-scale energy transactions and maintaining the reliability of the broader power grid.

In 2024, Constellation continued to be a significant supplier in this market. For instance, they entered into a new, multi-year agreement in early 2024 to supply wholesale power to a major midwestern utility, ensuring a stable energy source for hundreds of thousands of homes and businesses. This type of partnership underscores the importance of Constellation's role in grid stability.

Key aspects of this customer segment include:

- Wholesale Power Supply: Providing electricity at a wholesale level to other energy providers.

- Grid Stability: Contributing to the reliable operation of the interconnected power grid through large-volume transactions.

- Long-Term Contracts: Often engaging in multi-year agreements to secure predictable energy supply for their customers.

- Regulatory Environment: Navigating a complex regulatory landscape that governs wholesale power markets.

Community Aggregations

Constellation Energy serves community aggregations, which are groups of local governments or organizations that combine their energy purchasing power. This allows them to negotiate more favorable terms for electricity supply, often with a focus on renewable energy sources. For instance, in 2024, many municipal aggregations are actively seeking to increase their renewable energy content to meet climate action goals.

Constellation partners with these aggregations to develop customized energy solutions. These solutions help them achieve their sustainability targets, such as reducing carbon emissions or sourcing a specific percentage of power from wind or solar. The company's expertise in energy procurement and management is crucial for these collective efforts.

- Municipal Aggregations: Groups of towns and cities pooling resources for energy procurement.

- Sustainability Goals: Focus on increasing renewable energy adoption and reducing environmental impact.

- Negotiating Power: Collective demand leads to better pricing and contract terms.

- Constellation's Role: Providing expertise in energy sourcing, management, and sustainability solutions.

Constellation Energy's customer base is diverse, encompassing large industrial clients, governmental bodies, individual households, and other utilities. These segments are united by their need for reliable and increasingly sustainable energy solutions.

In 2024, Constellation continued to secure significant agreements across these segments, demonstrating its broad market reach and ability to meet varied energy demands. For example, early 2024 saw a multi-year wholesale power agreement with a midwestern utility, serving hundreds of thousands of end-users.

The company's strategy involves tailoring offerings, from carbon-free energy for data centers to competitive pricing for residential customers and specialized solutions for municipal aggregations. This approach positions Constellation as a key partner in achieving decarbonization goals and ensuring energy security for a wide array of consumers.

| Customer Segment | Key Needs | 2024 Focus/Examples |

| Large Commercial & Industrial | Reliable, high-volume, sustainable energy | Supplying carbon-free energy to data centers |

| Governmental & Public Sector | Reliable, cost-predictable, clean energy | Securing contracts for clean energy supply |

| Residential Households | Competitive pricing, reliable service, cleaner options | Providing stable energy solutions nationwide |

| Utilities & Cooperatives | Wholesale power, grid stability | Multi-year wholesale power agreement with midwestern utility |

| Community Aggregations | Favorable terms, renewable energy focus | Partnering to meet sustainability targets |

Cost Structure

Constellation Energy's cost structure is heavily influenced by the operation and maintenance of its diverse power generation assets. This includes substantial fuel expenses for its nuclear and natural gas facilities, which are critical for baseload and flexible power supply. For instance, in 2023, Constellation reported that fuel and purchased power costs represented a significant portion of its operating expenses, reflecting the volatile nature of energy commodity markets.

Constellation Energy's Operations and Maintenance (O&M) expenses are fundamental to keeping its power generation facilities and distribution networks running smoothly. These costs encompass everything from paying the skilled technicians who keep the plants operational to purchasing the necessary parts and contracting specialized services for repairs and upkeep.

In 2024, O&M is a significant component of their operational budget, directly impacting the long-term health and efficiency of their substantial asset base. For instance, maintaining a diverse fleet, including nuclear, natural gas, and renewables, requires varied O&M strategies and associated costs to ensure peak performance and compliance.

Constellation Energy's cost structure heavily features capital expenditures for infrastructure. This includes significant investments in upgrading existing power generation facilities, developing new clean energy projects, and maintaining its extensive transmission and distribution network. These outlays are crucial for ensuring reliable energy delivery and expanding capacity.

For 2025, Constellation Energy has earmarked billions of dollars for these capital-intensive projects. This substantial investment reflects the ongoing need to modernize aging infrastructure and build out new, sustainable energy sources to meet future demand and regulatory requirements.

Transmission and Distribution Costs

Transmission and distribution costs are a substantial part of Constellation Energy's operational expenses. These costs cover the essential infrastructure needed to move electricity from their generation sites to customers' homes and businesses. This includes maintaining the vast network of power lines, substations, and other equipment that forms the grid.

These expenditures are critical for reliable service delivery. For instance, in 2023, utilities often reported significant investments in grid modernization and resilience, which directly impacts these cost categories. Constellation, as a major energy provider, incurs substantial fees for accessing and utilizing these transmission and distribution networks.

- Grid Access Fees: Payments made to transmission system operators for using the high-voltage network.

- Infrastructure Maintenance: Ongoing costs for repairing, upgrading, and maintaining power lines, poles, and substations.

- Operational Expenses: Costs associated with managing and monitoring the flow of electricity across the network.

Administrative and Marketing Expenses

Constellation Energy's cost structure includes significant administrative and marketing expenses. These encompass corporate overhead, such as salaries for executive and support staff, as well as costs associated with maintaining its corporate infrastructure. Regulatory compliance is another key component, reflecting the substantial investments required to adhere to evolving energy sector regulations.

Marketing efforts are crucial for customer acquisition and retention in the competitive energy market. These costs cover advertising, sales initiatives, and customer service programs designed to attract and keep both residential and commercial clients. For instance, in 2024, the company continued to invest in digital marketing and customer engagement platforms to enhance its market presence.

- General and Administrative Costs: Includes corporate overhead, executive compensation, and IT infrastructure.

- Regulatory Compliance: Significant investment in meeting environmental and operational standards.

- Marketing and Sales: Expenses for customer acquisition, retention campaigns, and brand building.

- Customer Service: Costs associated with supporting and managing a large customer base.

Constellation Energy's cost structure is dominated by the operational expenses of its diverse generation fleet, particularly fuel costs for nuclear and natural gas plants, which were a significant factor in their 2023 operating expenses. Ongoing maintenance and upgrades to this vast infrastructure, including new clean energy projects, represent substantial capital expenditures, with billions earmarked for such investments in 2025. Furthermore, administrative, marketing, and regulatory compliance costs are key components, reflecting the company's efforts in customer engagement and adherence to industry standards.

| Cost Category | Description | 2023 Data Example | 2024 Focus | 2025 Outlook |

|---|---|---|---|---|

| Fuel & Purchased Power | Costs for natural gas, nuclear fuel, and acquired electricity. | Significant portion of operating expenses. | Managing commodity price volatility. | Continued reliance on diverse fuel sources. |

| Operations & Maintenance (O&M) | Labor, parts, and services for plant upkeep. | Essential for fleet efficiency. | Maintaining diverse generation assets. | Investment in technician training and predictive maintenance. |

| Capital Expenditures | Investment in new projects and infrastructure upgrades. | Billions invested in fleet modernization. | Expanding clean energy capacity. | Further development of renewable and nuclear assets. |

| Admin, Marketing & Compliance | Overhead, sales, customer service, and regulatory adherence. | Investment in digital marketing and customer service. | Enhancing market presence and customer retention. | Adapting to evolving environmental regulations. |

Revenue Streams

Constellation Energy generates significant revenue by selling electricity to wholesale markets. This revenue is directly tied to the fluctuating prices of electricity and the sheer volume of power produced from their extensive portfolio of power generation assets, which includes nuclear, natural gas, and renewables.

In 2023, Constellation reported that its wholesale segment was a major contributor to its financial performance, highlighting the importance of this revenue stream. For instance, the company's ability to secure favorable pricing in wholesale power agreements directly impacts its profitability, especially given the dynamic nature of energy commodity markets.

Constellation Energy generates significant revenue through the direct sale of electricity and natural gas to a broad customer base, encompassing residential, commercial, industrial, and governmental entities. This segment thrives on competitive supply contracts, offering customers flexible pricing and terms.

In 2024, Constellation continued to leverage its extensive generation fleet and robust supply network to serve millions of customers. The company's ability to offer tailored energy solutions, including renewable energy options and demand response programs, further diversifies and strengthens this core revenue stream.

Constellation Energy generates revenue through fees for its energy management services. These services encompass a range of offerings designed to help customers optimize their energy consumption and costs, including energy efficiency programs and demand response initiatives. For instance, in 2023, the company reported significant growth in its energy efficiency solutions, contributing to its overall financial performance.

Capacity and Ancillary Services Payments

Constellation Energy generates revenue by providing essential grid capacity and ancillary services, crucial for maintaining the stability and reliability of the power grid. This income stream is particularly significant for their baseload nuclear power plants, which offer consistent energy output.

In 2023, Constellation Energy reported that its nuclear fleet, a key provider of baseload power, operated at a capacity factor of approximately 93.5%. These services, including frequency regulation and voltage support, are vital for grid operators and are compensated through market mechanisms.

- Capacity Payments: Revenue earned for making generating capacity available to the grid, ensuring sufficient power supply during peak demand.

- Ancillary Services: Income from services like frequency regulation, voltage control, and operating reserves that support grid stability.

- Nuclear Fleet Contribution: A significant portion of this revenue comes from their reliable nuclear assets, which are well-suited for providing baseload and ancillary services.

- Market-Based Compensation: Payments are often determined by wholesale electricity market dynamics and contracts with grid operators.

Renewable Energy Credits and Incentives

Constellation Energy generates significant income from the sale of Renewable Energy Credits (RECs). These credits represent the environmental attributes of clean energy generation. For instance, in 2023, Constellation reported substantial revenue from its clean energy portfolio, which includes nuclear and renewables, directly benefiting from these credit sales.

Beyond RECs, Constellation also benefits from various government incentives designed to promote carbon-free energy. These can include production tax credits for nuclear power, a key component of their generation mix. These incentives are crucial for maintaining the economic viability of clean energy assets.

- Renewable Energy Credits (RECs): Revenue derived from selling the environmental attributes of clean energy production.

- Nuclear Production Tax Credits: Government incentives supporting carbon-free nuclear energy generation.

- Other Government Incentives: Additional financial support mechanisms for clean energy initiatives.

Constellation Energy's revenue streams are diverse, reflecting its extensive operations in the energy sector. The company generates substantial income from both wholesale and retail electricity sales, leveraging its vast generation fleet. Additionally, it earns fees for energy management services and provides critical grid capacity and ancillary services.

Government incentives and the sale of Renewable Energy Credits (RECs) further bolster Constellation's financial performance, particularly supporting its clean energy assets. In 2023, the company's nuclear fleet operated at approximately 93.5% capacity factor, a testament to its reliability in generating revenue through baseload power and ancillary services.

| Revenue Stream | Description | Key Drivers | 2023/2024 Relevance |

|---|---|---|---|

| Wholesale Electricity Sales | Selling power to other utilities and energy providers. | Electricity prices, generation volume, supply contracts. | Major contributor; pricing in wholesale agreements is crucial. |

| Retail Electricity Sales | Direct sales to residential, commercial, and industrial customers. | Customer base size, competitive pricing, tailored energy solutions. | Serving millions of customers with flexible options. |

| Energy Management Services | Fees for energy efficiency and demand response programs. | Customer demand for cost optimization, program uptake. | Significant growth reported in energy efficiency solutions. |

| Grid Capacity & Ancillary Services | Revenue for providing grid stability and reliability. | Nuclear fleet output, grid operator needs, market compensation. | Nuclear assets are key providers of these essential services. |

| Renewable Energy Credits (RECs) & Incentives | Income from environmental attributes of clean energy and government support. | Clean energy generation volume, government policies, tax credits. | Substantial revenue from clean energy portfolio, including nuclear. |

Business Model Canvas Data Sources

The Constellation Energy Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial disclosures, and internal operational data. These diverse sources ensure each component, from customer segments to revenue streams, is strategically aligned and data-driven.