Constellation Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

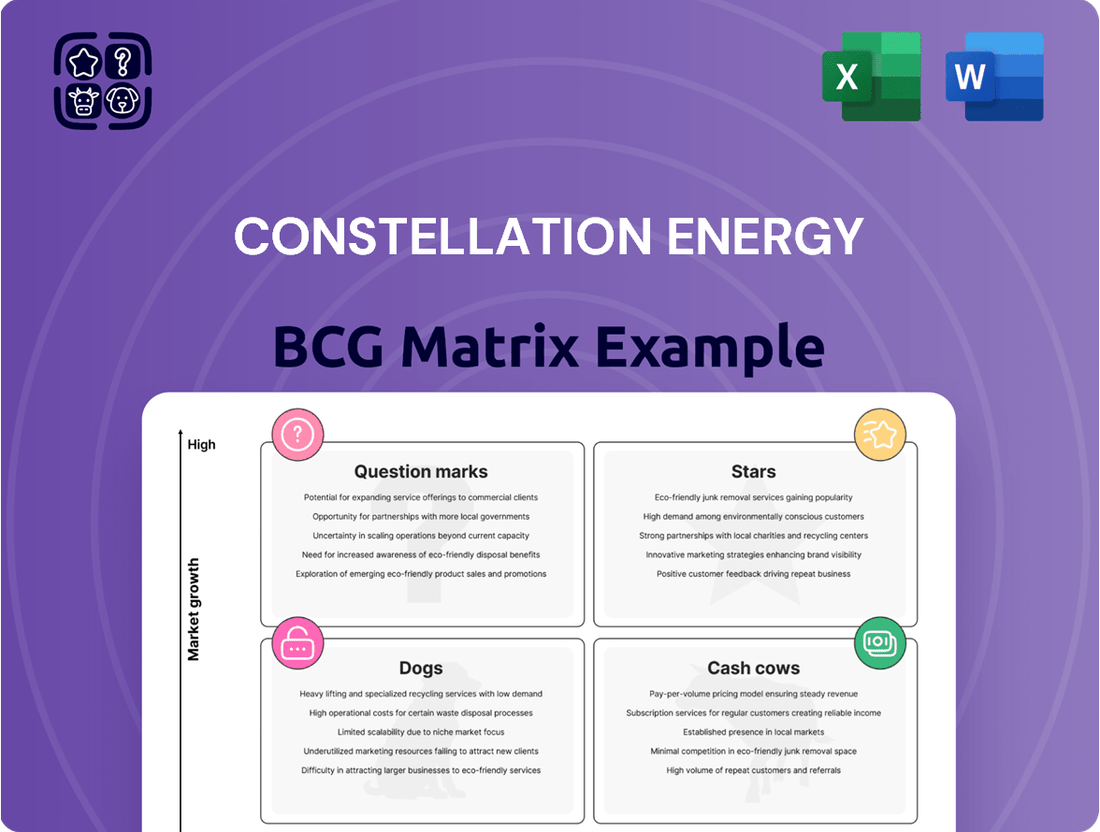

Constellation Energy's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of energy assets. Understand which ventures are poised for growth and which are generating stable returns.

This preview offers a glimpse into the core of Constellation Energy's market strategy. To truly unlock the potential of their diverse business units and make informed investment decisions, you need the complete picture. Purchase the full BCG Matrix report for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights.

Stars

Constellation's nuclear fleet is a significant Star in its portfolio, driven by its high capacity factor and the growing need for consistent, emission-free power. In 2023, Constellation's nuclear fleet operated at an average capacity factor of 93%, a testament to its reliability.

The company is actively pursuing relicensing for key plants, including Clinton and Dresden, ensuring their continued operation. These efforts, coupled with investments in upgrades aimed at increasing output, are projected to add as much as one gigawatt of new clean energy capacity within the next ten years.

Constellation Energy's pending acquisition of Calpine Corporation positions Calpine as a significant Star in its BCG Matrix. This strategic move merges Constellation's established clean energy portfolio with Calpine's extensive dispatchable natural gas generation capacity.

The combined entity is projected to become the nation's foremost competitive retail energy supplier, effectively capitalizing on increasing customer demand for reliable and clean power solutions. This integration is anticipated to significantly bolster Constellation's market presence and competitive edge.

Constellation Energy is making a substantial investment in clean hydrogen, viewing it as a key growth driver. Their MachH2 hub project and the planned LaSalle Clean Energy Center are central to this strategy. These initiatives aim to capitalize on the growing demand for decarbonization solutions.

By utilizing its existing nuclear power generation, Constellation can produce hydrogen with zero carbon emissions. This makes it an attractive option for industries struggling to reduce their environmental impact, such as heavy transport and manufacturing. The company is positioning itself as a leader in this emerging market.

In 2024, Constellation announced a significant expansion of its clean hydrogen efforts, including a potential 400-megawatt electrolysis facility at the LaSalle site, aiming to produce approximately 50 million kilograms of clean hydrogen annually. This move underscores their commitment to scaling up production to meet future demand.

Long-Term Corporate Power Purchase Agreements

Securing substantial long-term power purchase agreements (PPAs) with major corporations is a key indicator of Constellation Energy's strong market position. For instance, agreements with companies like Microsoft for projects such as the Crane Clean Energy Center underscore significant demand for their clean energy offerings.

These long-term contracts are crucial as they provide stable, predictable revenue streams. This stability is vital for financing new clean energy infrastructure and for the overall financial health of the company. It also directly supports corporate sustainability objectives by guaranteeing a supply of clean power.

- Constellation's PPA portfolio supports corporate decarbonization efforts.

- Long-term PPAs provide revenue visibility and reduce project financing risk.

- Major corporations are increasingly seeking clean energy solutions to meet ESG goals.

- The Crane Clean Energy Center exemplifies successful PPA-backed development.

Competitive Retail Energy Supply

Constellation Energy stands out as a dominant force in the competitive retail energy supply sector. They serve a vast customer base, notably including three-quarters of the Fortune 100 companies, highlighting their significant market penetration and trust among major corporations.

Their strength lies in crafting tailored energy solutions, a key factor in their substantial market share within the direct industrial and commercial sales segments. This capability, combined with a rapidly expanding market, firmly places Constellation in the Star quadrant of the BCG Matrix.

- Market Leadership: Constellation Energy is a leading competitive retail energy supplier.

- Customer Reach: They serve three-fourths of Fortune 100 companies.

- Strategic Advantage: Customized energy solutions and strong industrial/commercial market share.

- Market Position: Classified as a Star due to its strong performance in a growing market.

Constellation's nuclear fleet is a significant Star, boasting a 93% capacity factor in 2023 and projected to add 1 GW of clean energy capacity through relicensing and upgrades by 2034.

The pending Calpine acquisition positions it as a Star, merging clean nuclear with dispatchable natural gas, aiming to be the nation's top competitive retail energy supplier.

Clean hydrogen initiatives, like the LaSalle electrolysis facility planned for 2024 with a 400 MW capacity, mark another Star, leveraging nuclear power for zero-emission hydrogen production.

Securing long-term Power Purchase Agreements (PPAs) with major corporations, such as Microsoft, solidifies Constellation's Star status by providing stable revenue and supporting corporate sustainability goals.

Constellation's dominance as a competitive retail energy supplier, serving three-quarters of Fortune 100 companies with tailored solutions, firmly places it in the Star quadrant of the BCG Matrix.

| Business Unit/Initiative | BCG Category | Key Strengths/Drivers | 2023/2024 Data Points |

|---|---|---|---|

| Nuclear Fleet | Star | High capacity factor, emission-free power, relicensing efforts | 93% average capacity factor (2023); Projected 1 GW clean energy addition by 2034 |

| Calpine Acquisition | Star | Complementary generation assets, market leadership potential | Pending acquisition; projected top competitive retail energy supplier |

| Clean Hydrogen | Star | Zero-emission production, growing decarbonization demand | Planned 400 MW electrolysis facility at LaSalle (2024); 50 million kg/year target |

| PPA Portfolio | Star | Long-term revenue stability, corporate ESG alignment | PPAs with Microsoft for Crane Clean Energy Center |

| Competitive Retail Supply | Star | Market penetration, tailored solutions, industrial/commercial share | Serves 75% of Fortune 100 companies |

What is included in the product

This BCG Matrix analysis of Constellation Energy highlights which business units to invest in, hold, or divest based on market share and growth.

The Constellation Energy BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit.

Cash Cows

Constellation's existing nuclear fleet operates as a strong Cash Cow. In Q1 2025, it achieved an impressive 94.1% capacity factor, building on a solid 94.6% in 2024. This consistent, high-level performance means the fleet reliably produces significant amounts of clean electricity.

The nuclear fleet's operational stability and high output translate directly into substantial and dependable cash flows for Constellation. With relatively low ongoing operational growth expenses, these assets are highly efficient at generating profits.

Constellation Energy's wholesale electricity generation and sales represent a significant cash cow, fueled by its robust and diversified power generation fleet. This segment consistently delivers a stable revenue stream, a testament to the essential and mature nature of the electricity market.

In 2024, Constellation's diverse portfolio, including nuclear, hydro, wind, and solar, ensures reliable output, underpinning its strong position in wholesale markets. This reliability translates into predictable cash flows, crucial for funding other business ventures.

Constellation Energy's established energy management services, catering to residential, commercial, industrial, and governmental clients, operate as a mature business segment. This segment is characterized by long-term contracts and consistent, recurring revenue streams, which are vital for generating stable cash flow. For instance, in 2023, Constellation reported that its Energy Services segment generated approximately $2.8 billion in revenue, showcasing the significant contribution of these established offerings to the company's overall financial health.

Competitive Electricity and Natural Gas Supply to Retail Customers

Constellation's retail electricity and natural gas supply business serves as a significant Cash Cow, leveraging its extensive customer base across numerous states to generate consistent revenue. This segment benefits from the essential nature of energy services, providing a stable and predictable cash flow, even within a competitive market landscape. As of the first quarter of 2024, Constellation reported adjusted EBITDA of $1.1 billion, with its retail segment contributing a substantial portion due to this reliable demand.

- Established Market Presence: Constellation's broad penetration in competitive retail energy markets ensures a steady stream of customers for electricity and natural gas.

- Essential Service Demand: The fundamental need for energy provides a resilient revenue base, minimizing volatility and supporting consistent cash generation.

- Stable Cash Flow: This segment's maturity and market position allow for predictable cash inflows, supporting investments in other business areas.

- Competitive Landscape: While competitive, Constellation's scale and operational efficiencies enable it to maintain strong market share and profitability.

Dividend and Shareholder Returns

Constellation Energy's robust cash flow allows for significant shareholder returns, a hallmark of its Cash Cow status. The company demonstrated this commitment by increasing its dividend by 25% in 2024, signaling strong financial health. Furthermore, an anticipated 10% dividend increase is projected for 2025, reinforcing its reliable income stream for investors.

Beyond dividends, Constellation has actively engaged in share repurchases, returning substantial capital to shareholders. Since 2023, the company has repurchased approximately $2 billion in stock. This dual approach of increasing dividends and buying back shares underscores that its mature business segments are generating more cash than required for reinvestment.

- Dividend Growth: 25% increase in 2024, with a 10% increase expected in 2025.

- Share Repurchases: $2 billion executed since 2023.

- Cash Flow Strength: Exceeds investment needs in core, mature business areas.

- Shareholder Value: Consistent and increasing returns demonstrate financial stability.

Constellation's nuclear fleet is a prime example of a Cash Cow, consistently delivering high capacity factors. In 2024, it operated at 94.6%, and Q1 2025 saw this reach 94.1%, showcasing reliable, high-volume electricity generation. This operational excellence translates into substantial and dependable cash flows with relatively low ongoing operational costs, making it a highly efficient profit generator.

The company's wholesale electricity generation and sales, supported by its diverse and robust fleet including nuclear, hydro, wind, and solar, form another significant Cash Cow. This segment provides a stable revenue stream due to the essential nature of electricity. In 2024, this diversified portfolio ensured reliable output, leading to predictable cash flows that fund other business initiatives.

Constellation's retail electricity and natural gas supply business also operates as a strong Cash Cow. With a large customer base, it generates consistent revenue from the essential demand for energy services. This segment's maturity and market position contribute to predictable cash inflows, supporting broader company investments.

| Segment | 2024 Performance Indicator | Cash Flow Characteristic |

| Nuclear Fleet | 94.6% Capacity Factor (2024) | High, stable, and predictable |

| Wholesale Generation & Sales | Diversified Portfolio Reliability | Consistent and dependable |

| Retail Electricity & Gas Supply | Essential Service Demand | Stable and recurring |

What You’re Viewing Is Included

Constellation Energy BCG Matrix

The Constellation Energy BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase, offering a comprehensive strategic overview without any alterations or watermarks. This means the detailed analysis of Constellation Energy's business units, categorized by market share and growth rate, is precisely what you will leverage for your own business planning. You can confidently expect this exact report, ready for immediate application in your strategic discussions and decision-making processes.

Dogs

Underperforming or divested non-core assets within Constellation Energy's portfolio would likely represent older, less efficient power generation units that no longer fit the company's forward-looking strategy focused on carbon-free energy. These might include certain fossil fuel plants or smaller, legacy renewable facilities that are costly to maintain or have limited growth potential. For instance, if Constellation were to divest a coal-fired plant that is no longer economically viable due to environmental regulations or high operating costs, that asset would fall into this category.

Operations in certain highly regulated or historically low-growth regional energy markets represent a potential "Dog" quadrant for Constellation Energy. These markets, often characterized by stringent price controls and limited opportunities for organic expansion, could see Constellation's market share stagnate or even decline, offering minimal avenues for significant profit margin improvement.

For instance, if Constellation Energy has a small presence in a region with an aging infrastructure and a regulatory environment that caps utility rate increases, such as certain parts of the Northeast United States, these operations would likely fall into this category. In 2024, regions with such characteristics might show average annual energy demand growth below 1%, making substantial revenue increases difficult to achieve.

Legacy Energy Solutions with Declining Demand represent older, less efficient, or carbon-intensive energy offerings. These are being phased out due to market shifts toward cleaner energy and technological advancements, resulting in low market share and declining prospects.

Non-Strategic Minor Investments

Non-strategic minor investments, often pilot projects, might fall into the Dogs category if they haven't demonstrated growth or scalability. These initiatives might be consuming capital without a clear trajectory toward profitability or significant market penetration, particularly if they operate within low-growth market segments. For instance, a small investment in a niche renewable energy technology with limited adoption potential could be considered a Dog.

These investments typically exhibit low market share and low market growth. In 2024, companies are increasingly scrutinizing such ventures, aiming to reallocate resources to more promising areas. A key indicator for a Dog is a negative or stagnant return on investment (ROI) over an extended period, failing to meet even modest growth expectations.

- Low Market Share: These investments typically hold a negligible position in their respective markets.

- Low Market Growth: The sectors these investments operate in are not expanding significantly.

- Resource Drain: They consume operational capital and management attention without yielding substantial returns.

- Lack of Strategic Alignment: These ventures often do not contribute to the company's core business objectives or long-term vision.

Inefficient or Outdated Infrastructure

Inefficient or outdated infrastructure within Constellation Energy's portfolio might represent question marks or even dogs, depending on their growth prospects and investment needs. For instance, aging transmission lines in low-demand regions requiring substantial upgrades without clear revenue growth potential could fall into this category. These assets can divert capital that could be better allocated to high-growth areas.

- Asset Depreciation: Older infrastructure often faces higher maintenance costs and lower operational efficiency, impacting profitability.

- Capital Allocation Drain: Investments in maintaining outdated systems may yield low or negative returns, hindering overall growth.

- Regulatory Hurdles: Upgrading or replacing legacy infrastructure can be subject to complex and costly regulatory approvals.

- Market Shifts: Declining demand in served areas can further diminish the value and return potential of older infrastructure assets.

Constellation Energy's "Dogs" are assets or operations with low market share and low growth prospects, often requiring significant capital without clear returns. These might include legacy energy solutions with declining demand or non-strategic minor investments that haven't scaled. For example, a small investment in a niche renewable technology with limited adoption potential in 2024, showing a negative ROI, would be a prime example.

Operations in mature, highly regulated markets with capped price increases also fall into this category. These segments offer minimal avenues for profit improvement, with market share often stagnating. Regions with average annual energy demand growth below 1% in 2024, coupled with stringent price controls, exemplify these challenging markets.

Inefficient or outdated infrastructure, particularly in low-demand areas needing substantial upgrades without clear revenue growth, can also be classified as Dogs. These assets can divert capital from more promising, high-growth ventures, leading to a drain on resources and potentially negative returns.

These underperforming segments consume capital and management attention, hindering overall portfolio growth and failing to align with strategic objectives focused on cleaner energy. Reallocating resources from these Dog assets to more promising areas is a key strategy for improving financial performance.

| Category | Characteristics | Example within Constellation Energy | 2024 Market Context |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Legacy fossil fuel plants with high operating costs | Increasingly stringent environmental regulations impacting profitability |

| Dogs | Low Market Share, Low Market Growth | Minor investments in niche renewable technologies with limited adoption | Stagnant or negative ROI, resource drain |

| Dogs | Low Market Share, Low Market Growth | Operations in highly regulated regional markets with capped price increases | Average annual energy demand growth below 1% |

Question Marks

Constellation Energy's investment in Small Modular Reactors (SMRs) positions them in a potential high-growth sector, albeit with a current low market share. This strategic move aligns with the BCG matrix's 'question mark' category, indicating significant future promise but also considerable uncertainty and the need for substantial investment to gain traction.

The development of SMRs is capital-intensive, requiring ongoing research, development, and navigating complex regulatory frameworks. For instance, NuScale Power, a key player in SMR technology, received its first design certification from the U.S. Nuclear Regulatory Commission in 2023, a critical step but one that highlights the lengthy approval processes still ahead for commercial deployment.

Constellation Energy's commitment to SMRs reflects a forward-looking strategy to diversify its clean energy portfolio and capitalize on evolving nuclear technology. The company is actively exploring SMR deployment opportunities, aiming to leverage these advanced reactors for reliable, carbon-free electricity generation as the energy landscape continues to shift towards sustainability.

Advanced renewable technology pilots, such as next-generation geothermal systems or innovative energy storage chemistries, represent Constellation Energy's potential question marks. These technologies, while offering high future growth prospects, are currently in their infancy with minimal market penetration. For instance, the global geothermal energy market, excluding traditional hydrothermal, is projected to grow significantly, but pilot projects are crucial for validating these advanced concepts.

Aggressive expansion into new geographical markets or highly specialized energy niches where Constellation currently has minimal presence would be considered a Star or Question Mark in the BCG matrix, depending on market growth and Constellation's competitive position. These ventures carry high growth potential but also high risk and require substantial initial investment to gain market share. For instance, entering the burgeoning offshore wind market in Europe, where Constellation has limited existing operations, exemplifies this.

Development of Direct Air Capture or Carbon Sequestration Technologies

Direct air capture (DAC) and other large-scale carbon sequestration technologies represent Constellation Energy's potential future growth areas, but they are currently in the early stages of development. These initiatives, while vital for long-term decarbonization, face significant hurdles in terms of cost and market adoption. For instance, the cost of DAC technology can range from $100 to $600 per ton of CO2 removed, a substantial figure that limits widespread deployment today.

The success of these ventures hinges on achieving critical technological advancements and securing robust policy support. Without breakthroughs that significantly lower operational costs and increase efficiency, these technologies will struggle to compete. Furthermore, government incentives and carbon pricing mechanisms are essential to create a viable market for sequestration services.

- High Cost: DAC technology costs are currently between $100-$600 per ton of CO2 removed, limiting scalability.

- Low Market Share: These technologies have minimal current market penetration due to high costs and nascent development.

- Technological Dependence: Future success relies heavily on innovation to reduce costs and improve capture efficiency.

- Policy Reliance: Supportive government policies and carbon pricing are crucial for market viability and growth.

Innovative Customer-Centric Digital Energy Platforms

Developing and deploying innovative customer-centric digital energy platforms, such as personalized energy management apps or advanced smart grid solutions, positions Constellation Energy within the question mark category of the BCG matrix. These initiatives represent significant investments in early-stage technologies with high growth potential but uncertain market adoption. For instance, the smart home energy management market was projected to reach over $35 billion globally by 2025, indicating a substantial opportunity for platforms that can effectively engage consumers.

These platforms aim to disrupt traditional energy consumption models by offering tailored services and empowering customers with greater control and insight into their energy usage. While the potential for market leadership is high, the substantial upfront investment required for research, development, and customer education can be a barrier. Companies in this space are actively seeking to build user bases and refine their offerings to achieve widespread acceptance, similar to how early streaming services had to overcome initial consumer hesitancy.

Key aspects of these platforms include:

- Personalized Energy Insights: Offering real-time data and actionable recommendations to help customers reduce consumption and costs.

- Smart Grid Integration: Enabling two-way communication between consumers and the grid for demand response programs and improved grid stability.

- Renewable Energy Adoption Support: Facilitating the integration and management of distributed energy resources like solar panels and battery storage.

- Customer Engagement Tools: Gamification, loyalty programs, and community features to drive sustained user interaction and platform stickiness.

Constellation Energy's ventures into cutting-edge technologies like advanced nuclear (SMRs) and direct air capture (DAC) represent classic "question marks" in the BCG matrix. These areas show promise for future growth but currently demand significant investment with uncertain returns and low market share. For example, while SMRs could revolutionize clean energy, their widespread deployment is still years away, with significant capital expenditure required for development and regulatory approval.

These question mark initiatives, such as pilot projects for next-generation geothermal or novel energy storage, are characterized by their high potential but also their nascent stage of development and minimal market penetration. For instance, the global geothermal market, excluding traditional hydrothermal, is expected to see substantial growth, but advanced concepts require extensive validation through these early-stage projects.

Success for these question marks hinges on technological breakthroughs that reduce costs and improve efficiency, alongside supportive government policies and incentives. Without these factors, technologies like DAC, which currently cost between $100-$600 per ton of CO2 removed, will struggle to achieve market viability and scale.

Constellation Energy's investment in digital platforms for energy management also falls into the question mark category, requiring substantial upfront capital for development and customer adoption. The smart home energy management market, projected to exceed $35 billion globally by 2025, highlights the opportunity, but these platforms need to overcome initial consumer hesitancy to achieve widespread acceptance.

| Initiative | BCG Category | Market Growth | Market Share | Investment Need |

| Small Modular Reactors (SMRs) | Question Mark | High | Low | Very High |

| Direct Air Capture (DAC) | Question Mark | High | Very Low | Very High |

| Next-Gen Geothermal Pilots | Question Mark | Medium-High | Very Low | High |

| Digital Energy Platforms | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Constellation Energy BCG Matrix is built on a foundation of comprehensive market data, incorporating financial performance metrics, industry growth forecasts, and competitive landscape analysis.