Constellation Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

Constellation Energy navigates a complex energy landscape where supplier power and the threat of new entrants significantly shape its operations. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Constellation Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of specialized nuclear fuel suppliers is substantial for companies like Constellation Energy. The nuclear fuel supply chain, particularly uranium enrichment and fuel fabrication, is highly concentrated, with only a handful of global providers possessing the necessary expertise and regulatory approvals. This limited supplier base means Constellation Energy has few viable alternatives when sourcing this critical component for its extensive nuclear power generation fleet.

High switching costs further amplify supplier leverage. The stringent safety, security, and regulatory standards in the nuclear industry make it incredibly difficult and time-consuming to change fuel suppliers. This dependency creates a situation where suppliers can command premium pricing and favorable contract terms, impacting Constellation Energy's operational costs and profitability. In 2024, the global uranium market saw continued price volatility, with spot prices fluctuating significantly, underscoring the impact of supply-side dynamics on utilities.

Advanced equipment manufacturers for large-scale power generation, including specialized nuclear reactor components, advanced wind turbines, and high-efficiency solar panels, hold significant bargaining power. These suppliers often possess proprietary technology and incur substantial research and development costs, leading to a limited supplier base. This scarcity allows them to negotiate favorable pricing and delivery terms with companies like Constellation Energy.

Constellation Energy's reliance on highly skilled labor and specialized technical services for its diverse energy fleet, especially nuclear operations, presents a significant factor in supplier bargaining power. The scarcity of professionals with niche expertise, such as nuclear reactor maintenance or advanced grid management, directly translates to increased leverage for these suppliers. This can manifest in higher wages, specialized contract terms, and potentially limited availability, all of which can impact Constellation's operational costs and overall efficiency.

Commodity Input Suppliers (e.g., Natural Gas)

Constellation Energy, despite its focus on carbon-free energy, still relies on natural gas as a commodity for a portion of its generation. The bargaining power of natural gas suppliers is a significant factor impacting Constellation's operational costs in this segment.

Fluctuations in global supply and demand, geopolitical tensions, and the reliability of transportation infrastructure directly influence the price Constellation pays for natural gas. For instance, in early 2024, natural gas prices saw volatility driven by weather patterns and inventory levels, directly impacting the cost structure for non-nuclear power generation.

- Natural Gas Price Volatility: In Q1 2024, Henry Hub natural gas spot prices ranged from approximately $1.80 to $3.00 per MMBtu, showcasing the inherent price swings Constellation must navigate.

- Supply Chain Dependencies: Disruptions in pipeline operations or unexpected increases in demand from industrial sectors can empower suppliers by tightening market availability.

- Geopolitical Influence: Global events impacting energy markets, such as conflicts or production cuts by major exporting nations, can indirectly strengthen the bargaining position of domestic natural gas producers.

Regulatory Compliance and Environmental Technology Vendors

Vendors providing specialized environmental technology and services vital for regulatory compliance exert significant bargaining power. As environmental regulations tighten, Constellation Energy's dependence on these suppliers for technologies like carbon capture or advanced emissions monitoring increases their leverage. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter emissions standards for power plants, potentially increasing demand for specialized abatement technologies.

This reliance is amplified when these technologies are critical for obtaining or maintaining operational permits and for future expansion projects. The cost and availability of these specialized solutions can directly impact Constellation's operational continuity and growth trajectory. The market for these environmental solutions is often concentrated, with a limited number of providers possessing the necessary expertise and patented technologies, further consolidating supplier power.

- Increased Reliance: Evolving environmental regulations, such as those pertaining to greenhouse gas emissions, necessitate specialized technologies that only a few vendors can provide.

- Permitting and Growth Impact: Non-compliance or lack of access to these technologies can halt operations or prevent new developments, giving vendors significant leverage.

- Market Concentration: A limited number of suppliers with proprietary environmental solutions often leads to higher pricing power for these vendors.

- 2024 Regulatory Landscape: Continued emphasis on climate goals and emissions reductions by regulatory bodies globally underscores the critical nature of these vendors' offerings.

The bargaining power of specialized nuclear fuel suppliers remains a critical factor for Constellation Energy. The highly concentrated nature of uranium enrichment and fuel fabrication means few global providers possess the necessary expertise and regulatory approvals, limiting Constellation's alternatives. This concentration, coupled with high switching costs due to stringent safety and security standards, allows these suppliers to command premium pricing and favorable contract terms.

In 2024, the global uranium market experienced significant price volatility, with spot prices fluctuating, directly impacting Constellation's procurement costs. For instance, uranium prices saw considerable swings throughout the year, influenced by supply disruptions and geopolitical events, highlighting the leverage held by these specialized suppliers.

| Supplier Type | Bargaining Power Factor | Impact on Constellation Energy | 2024 Data/Observation |

|---|---|---|---|

| Nuclear Fuel Suppliers (Uranium Enrichment, Fabrication) | High Concentration, Proprietary Technology, High Switching Costs | Premium pricing, favorable contract terms, potential supply chain risks | Uranium spot prices fluctuated significantly in 2024, with some periods seeing increases of over 15% due to supply concerns. |

| Advanced Power Generation Equipment Manufacturers | Proprietary Technology, High R&D Costs, Limited Suppliers | Negotiation leverage on pricing and delivery terms for critical components. | Lead times for specialized components, such as advanced turbine blades, extended in some cases due to high demand and manufacturing backlogs in 2024. |

| Specialized Technical Services (Nuclear Operations) | Scarcity of Niche Expertise, High Demand | Increased labor costs, potential service availability constraints. | Demand for certified nuclear technicians remained high in 2024, leading to competitive compensation packages and potential challenges in securing specialized maintenance crews. |

| Natural Gas Suppliers | Market Volatility, Geopolitical Factors, Infrastructure Reliability | Impact on operational costs for non-nuclear generation segments. | Henry Hub natural gas prices in early 2024 ranged from $1.80 to $3.00 per MMBtu, demonstrating significant price variability. |

| Environmental Technology Vendors | Critical for Compliance, Market Concentration, Proprietary Solutions | Higher costs for regulatory adherence, potential impact on operational continuity and growth. | Increased regulatory scrutiny on emissions in 2024 likely boosted demand for specialized environmental solutions, strengthening vendor positions. |

What is included in the product

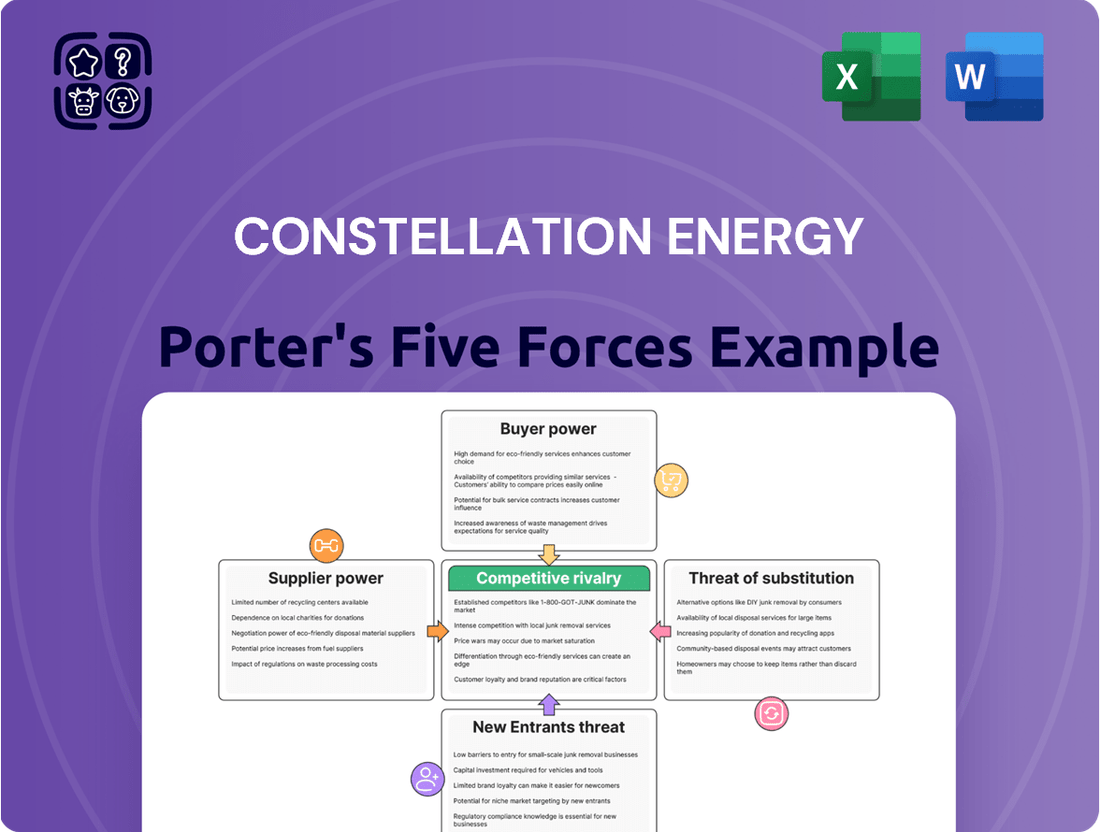

A Constellation Energy Porter's Five Forces analysis reveals how supplier power, buyer bargaining, the threat of new entrants, substitutes, and competitive rivalry shape the company's strategic environment and profitability.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing Constellation Energy to pinpoint and address key strategic challenges.

Customers Bargaining Power

Constellation Energy's large industrial, commercial, and wholesale customers, including other utilities, are significant purchasers of electricity. These entities often buy in massive quantities, which naturally grants them considerable leverage when negotiating terms and pricing.

This substantial buying power allows these customers to press for more favorable rates and customized energy solutions. For instance, if Constellation's pricing isn't perceived as competitive, these large buyers might explore developing their own power generation capabilities, further intensifying the bargaining pressure.

While individual residential and small commercial customers of Constellation Energy possess limited bargaining power on their own, their collective influence, particularly when channeled through regulatory bodies or consumer advocacy groups, can significantly impact pricing structures and service agreements. This aggregated pressure can lead to more favorable terms for a broad base of consumers.

In markets where energy services are deregulated, these customers gain the ability to switch between providers, introducing a degree of competitive pressure on Constellation Energy. However, the effectiveness of this power is often tempered by switching costs, which can discourage frequent changes and maintain a degree of customer inertia.

Governmental and institutional clients, such as municipalities and large corporations, wield significant bargaining power. These entities often engage in competitive bidding for energy supply, allowing them to negotiate favorable pricing and contract terms. For instance, in 2024, many large public sector organizations secured multi-year power purchase agreements with fixed rates, demonstrating their ability to drive down costs.

Availability of Alternative Energy Providers

In states where energy markets are competitive, customers benefit from having numerous energy suppliers available. This abundance of choices significantly amplifies their bargaining power. For Constellation Energy, this means a constant need to present compelling offers, including competitive pricing, dependable service, and unique offerings like carbon-free energy solutions. Customers can readily switch to alternative providers if Constellation's value proposition isn't sufficiently attractive.

The availability of alternative energy providers directly impacts Constellation's pricing strategies and service quality. For instance, in deregulated markets such as Texas, customers can choose from dozens of retail electricity providers, each vying for market share. This intense competition forces suppliers, including Constellation, to innovate and differentiate to retain their customer base. Constellation's commitment to expanding its clean energy portfolio, a key differentiator, is a direct response to this customer demand for sustainable options.

- Customer Choice: In competitive energy markets, customers can select from multiple suppliers, enhancing their leverage.

- Competitive Pressure: Constellation must offer competitive pricing and reliable service to prevent customer attrition.

- Product Differentiation: Offering unique products, like carbon-free energy, is crucial for customer retention.

- Market Dynamics: The ease with which customers can switch providers in deregulated states like Texas underscores the high bargaining power of customers.

Customer's Ability to Self-Generate or Reduce Demand

The increasing affordability and accessibility of distributed generation technologies, like rooftop solar and battery storage, significantly bolster customer bargaining power. This allows customers to produce their own electricity, thereby reducing their dependence on Constellation Energy’s grid supply.

Energy efficiency initiatives and demand response programs further empower consumers by lowering their overall energy consumption. For instance, by 2024, the U.S. Energy Information Administration (EIA) reported a continued upward trend in residential solar adoption, with millions of homes now equipped with solar photovoltaic systems, directly impacting their demand for traditional utility services.

- Distributed Generation Adoption: Rooftop solar installations in the US saw significant growth, with cumulative capacity reaching over 150 GW by early 2024, according to industry reports.

- Energy Efficiency Impact: Federal and state energy efficiency programs have helped reduce overall electricity demand by an estimated 1-2% annually in recent years.

- Demand Response Participation: In 2023, demand response programs across various utility territories enrolled millions of customers, offering incentives to reduce consumption during peak hours.

- Reduced Reliance: As more customers invest in self-generation and efficiency, their willingness and ability to switch providers or reduce consumption from Constellation increases, weakening the company's pricing power.

Constellation Energy faces significant customer bargaining power, especially from large industrial, commercial, and wholesale clients who purchase electricity in massive volumes. These buyers can negotiate favorable pricing and customized solutions, with the potential to develop their own generation if terms are unfavorable. While individual residential customers have less direct power, their collective voice, amplified by advocacy groups, can influence pricing and service agreements.

The increasing adoption of distributed generation, such as rooftop solar, and advancements in energy efficiency further empower consumers. By 2024, millions of U.S. homes were equipped with solar photovoltaic systems, reducing their reliance on traditional utility services. This trend, coupled with demand response programs, directly impacts Constellation's market position.

| Factor | Impact on Constellation Energy | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Large Volume Purchasers | High bargaining power due to scale; can negotiate lower rates. | Industrial and commercial customers account for a substantial portion of electricity demand. |

| Distributed Generation | Weakens demand for grid supply; increases customer self-sufficiency. | US residential solar capacity projected to exceed 160 GW by end of 2024. |

| Energy Efficiency & Demand Response | Reduces overall consumption; offers customers control over usage and costs. | Energy efficiency programs saved an estimated 1.5% of total U.S. electricity consumption in 2023. |

| Market Deregulation & Choice | Intensifies competition; customers can switch providers for better terms. | States like Texas offer dozens of retail electricity providers, driving competitive offers. |

What You See Is What You Get

Constellation Energy Porter's Five Forces Analysis

The document you see here is the complete, professionally written Constellation Energy Porter's Five Forces Analysis, precisely what you will receive immediately after purchase. This in-depth analysis covers all five forces, providing actionable insights into the competitive landscape. You're looking at the actual document, ready for your immediate use, with no placeholders or sample content.

Rivalry Among Competitors

Constellation Energy navigates a highly competitive market characterized by a diverse range of players. This includes established regulated utilities that often have captive customer bases, alongside other independent power producers (IPPs) that compete on price and efficiency across wholesale markets.

The landscape also features a growing number of renewable energy developers, particularly in solar and wind, who are increasingly capturing market share and influencing pricing dynamics. For instance, in 2023, the U.S. saw significant growth in renewable energy capacity additions, with solar and wind leading the charge, intensifying the competitive pressure on traditional generation sources.

The energy generation and distribution sector is inherently capital-intensive, demanding substantial upfront investments in power plants, transmission lines, and advanced technologies. This high barrier to entry means that existing players, like Constellation Energy, must manage significant fixed costs. For instance, building a new nuclear power plant can cost tens of billions of dollars, and even renewable energy projects require millions for wind turbines or solar arrays. This financial commitment naturally fuels intense competition as companies strive to utilize their expensive assets efficiently.

The regulatory landscape significantly fuels competitive rivalry for Constellation Energy. In deregulated or partially deregulated markets, companies vie not just on service and price, but also on their agility in navigating intricate regulations and adapting to shifting market structures. This dynamic environment means that a company's ability to anticipate and respond to regulatory changes directly impacts its competitive standing.

Focus on Decarbonization and ESG Initiatives

Constellation Energy, as the leading producer of carbon-free electricity, faces intense rivalry from other energy companies prioritizing decarbonization and ESG initiatives. This shared focus intensifies competition for lucrative green energy contracts and attracts environmentally aware customers.

The drive towards net-zero emissions is a significant competitive factor, pushing companies to invest heavily in renewable sources like wind, solar, and nuclear power. For instance, in 2023, the U.S. saw significant growth in renewable energy capacity additions, with solar and wind leading the charge, creating a dynamic competitive landscape for Constellation.

- Intensified competition for green energy contracts: Companies are vying for long-term power purchase agreements (PPAs) from corporations and governments committed to sustainability.

- Customer acquisition based on ESG credentials: A company's commitment to environmental, social, and governance principles directly influences customer choice, driving competition for brand loyalty.

- Investment in renewable energy infrastructure: Significant capital is being deployed by competitors to expand their renewable portfolios, directly challenging Constellation's market position.

- Innovation in clean energy technologies: The race to develop and deploy more efficient and cost-effective clean energy solutions fuels a competitive environment for technological leadership.

Innovation in Energy Management and Solutions

Competitive rivalry in the energy sector has significantly expanded beyond traditional power generation. It now encompasses a fierce competition in energy management services, the deployment of smart grid technologies, and the development of highly customized energy solutions tailored to specific customer needs.

Companies are actively innovating to provide advanced services designed to help customers optimize their energy consumption and reduce costs. This has transformed the market into a dynamic battleground where integrated energy offerings are becoming increasingly crucial for differentiation and market share.

- Growing Demand for Energy Efficiency: As of 2024, the global energy efficiency market is projected to reach over $200 billion, driven by rising energy costs and environmental concerns.

- Smart Grid Investment: Investments in smart grid technologies are escalating, with global spending expected to exceed $60 billion annually by 2025, enabling more sophisticated energy management.

- Customer-Centric Solutions: Leading energy providers are focusing on developing personalized energy solutions, including demand response programs and on-site generation, to meet diverse customer requirements.

- Technological Advancements: Innovations in areas like AI-powered energy analytics and IoT-enabled monitoring systems are creating new competitive advantages for firms that can effectively integrate these technologies.

Constellation Energy faces intense rivalry from a broad spectrum of energy providers, including traditional utilities, independent power producers, and a growing number of renewable energy developers.

This competition is amplified by the capital-intensive nature of the industry, with significant investments required for infrastructure, and by a regulatory environment that can shift market dynamics rapidly.

The push for decarbonization further intensifies rivalry as companies compete for green energy contracts and customer loyalty based on ESG credentials, driving innovation in clean energy technologies.

The market is also increasingly defined by competition in energy management services and smart grid technologies, with companies offering integrated, customer-centric solutions.

| Competitor Type | Key Competitive Factor | Example Data Point (2023/2024) |

|---|---|---|

| Regulated Utilities | Captive Customer Base, Grid Reliability | Dominant market share in their service territories. |

| Independent Power Producers (IPPs) | Price, Operational Efficiency | Wholesale electricity prices influenced by supply and demand dynamics. |

| Renewable Energy Developers | Cost of Generation, Environmental Attributes | Solar and wind capacity additions grew significantly in 2023, impacting market prices. |

| Energy Service Companies (ESCOs) | Energy Efficiency Solutions, Smart Grid Integration | Global energy efficiency market projected to exceed $200 billion in 2024. |

SSubstitutes Threaten

The increasing adoption and falling costs of distributed generation (DG) technologies present a substantial threat of substitutes for traditional utility providers like Constellation Energy. Rooftop solar panels, small wind turbines, and battery storage systems are becoming more accessible and affordable, allowing consumers to generate their own electricity.

This trend is particularly impactful for commercial and industrial (C&I) customers who have the scale to invest in DG solutions. For instance, in 2023, the U.S. saw significant growth in distributed solar capacity, with projections indicating continued expansion, enabling these businesses to decrease their dependence on grid power and potentially reduce their overall energy expenditures.

Investments in energy efficiency, like smart thermostats and better insulation, directly substitute for the energy Constellation provides. For instance, in 2024, the U.S. Department of Energy continued to promote programs encouraging residential energy efficiency upgrades, aiming to reduce household energy consumption by up to 20% on average.

As more customers adopt these conservation measures, the demand for traditional electricity supply lessens. This trend is amplified by rising energy prices, which incentivize consumers to seek alternatives, thereby weakening Constellation's market power.

Demand response programs act as a significant substitute for Constellation Energy's traditional generation capacity. By incentivizing customers to curb usage during peak times, these programs effectively reduce the need for Constellation to bring additional, often more expensive, power plants online. For instance, in 2024, many utilities saw increased participation in demand response, helping to stabilize grids during heatwaves and avoid costly peak generation.

Alternative Fuel Sources and Microgrids

The threat of substitutes for Constellation Energy is influenced by the availability and adoption of alternative fuel sources and the growth of microgrids. For certain industrial clients, direct use of fuels like natural gas or biomass can bypass the need for grid electricity, offering enhanced energy autonomy. This is particularly relevant for large consumers looking for cost predictability and control over their energy supply.

The development of private microgrids, often incorporating renewable energy sources and storage, presents another significant substitute. These localized energy systems can provide reliable power, potentially at a competitive cost, reducing reliance on traditional utility providers. For instance, by 2024, the global microgrid market was projected to reach over $40 billion, indicating substantial investment and growth in this substitute area.

- Alternative Fuels: Direct use of natural gas or biomass for industrial processes can replace grid electricity.

- Microgrids: Private microgrids offer localized energy independence and can be a substitute for utility power.

- Market Growth: The microgrid market's projected expansion highlights increasing adoption of these substitute solutions.

- Client Benefits: Energy independence and potential cost savings are key drivers for clients adopting these alternatives.

Technological Advancements in Energy Storage

Technological advancements in energy storage, particularly in battery technology, present a significant threat of substitutes for traditional energy providers like Constellation Energy. These innovations empower customers to store energy from renewable sources or off-peak grid purchases, lessening their reliance on constant, on-demand supply.

For instance, the global battery energy storage system market was valued at approximately $25.5 billion in 2023 and is projected to reach $100.6 billion by 2030, growing at a compound annual growth rate of 21.7%. This rapid expansion signifies a growing capacity for consumers and businesses to manage their own energy needs, thereby reducing demand for services from companies like Constellation.

- Growing Battery Storage Capacity: Advances in lithium-ion and emerging battery chemistries are making energy storage more affordable and efficient.

- Increased Renewable Integration: Homeowners and businesses can now more effectively store solar or wind energy for later use, bypassing the need for grid power.

- Grid Independence: These storage solutions offer a pathway to greater energy independence, potentially reducing the customer base for traditional utility services.

- Cost Reduction Trends: The cost of battery storage has seen a dramatic decline; for example, lithium-ion battery pack prices fell by over 90% between 2010 and 2023.

The threat of substitutes for Constellation Energy is multifaceted, encompassing distributed generation, energy efficiency, and alternative fuel sources. As distributed generation technologies like rooftop solar and battery storage become more accessible and cost-effective, they offer consumers greater energy independence and the ability to reduce reliance on traditional utility providers. For example, the U.S. saw substantial growth in distributed solar capacity in 2023, with continued expansion anticipated.

Energy efficiency measures, such as improved insulation and smart home devices, also act as substitutes by reducing overall energy consumption. Programs promoting these upgrades, like those from the U.S. Department of Energy in 2024, aim to decrease household energy use, directly impacting demand for Constellation's services. Furthermore, industrial clients may opt for direct use of alternative fuels like natural gas or biomass, bypassing the grid altogether for enhanced energy autonomy and cost predictability.

The rise of microgrids, which combine renewable energy sources and storage for localized power, presents another significant substitute. The global microgrid market's projected expansion, potentially exceeding $40 billion by 2024, underscores the growing adoption of these independent energy solutions. Similarly, advancements in battery energy storage systems, with market values reaching approximately $25.5 billion in 2023, enable greater customer control over energy supply and further diminish dependence on traditional utilities.

| Substitute Category | Key Technologies/Strategies | Impact on Constellation Energy | 2023/2024 Data Point |

|---|---|---|---|

| Distributed Generation | Rooftop Solar, Small Wind Turbines, Battery Storage | Reduces demand for grid electricity, increases customer energy independence | Significant growth in U.S. distributed solar capacity in 2023 |

| Energy Efficiency | Smart Thermostats, Improved Insulation, Energy-Saving Appliances | Lowers overall energy consumption, lessening the need for utility-supplied power | DOE programs in 2024 aimed to reduce household energy consumption by up to 20% |

| Alternative Fuels | Natural Gas, Biomass, Propane (for industrial use) | Allows large consumers to bypass grid electricity for direct energy needs | Relevant for industrial clients seeking cost predictability and supply control |

| Microgrids | Localized renewable generation and storage systems | Offers reliable, potentially cost-competitive power, reducing reliance on utilities | Global microgrid market projected to exceed $40 billion by 2024 |

| Energy Storage | Lithium-ion Batteries, Emerging Chemistries | Enables storage of renewable or off-peak energy, reducing demand for constant supply | Global battery storage market valued at ~$25.5 billion in 2023; lithium-ion prices fell >90% (2010-2023) |

Entrants Threaten

The energy generation and distribution sector presents a formidable hurdle for new players due to exceptionally high capital requirements. Building new power plants, whether fossil fuel, renewable, or nuclear, along with the necessary transmission and distribution infrastructure, demands billions of dollars in upfront investment. For instance, a new utility-scale solar farm can cost hundreds of millions, while a modern nuclear power plant can exceed tens of billions.

These immense financial barriers significantly deter potential entrants. Establishing a competitive presence requires not only the construction of generation facilities but also the development of advanced grid technologies and robust distribution networks. This substantial financial commitment effectively limits the number of organizations capable of entering and competing effectively in the market.

New entrants into the energy sector, particularly for a company like Constellation Energy, confront a formidable array of federal, state, and local regulations. These include demanding environmental permits, rigorous licensing procedures, and ongoing operational compliance mandates. For instance, the permitting process for new power generation facilities can extend for several years and involve numerous agencies, significantly increasing upfront costs and project timelines.

Constellation Energy and other established energy providers leverage significant economies of scale in generation, transmission, and customer service. This cost advantage makes it difficult for new entrants to compete effectively without substantial upfront capital investment to match existing infrastructure and operational efficiencies. For instance, in 2023, Constellation Energy reported over $39 billion in revenue, underscoring its massive operational footprint.

Access to Grid and Transmission Infrastructure

Gaining access to the existing electricity grid and transmission infrastructure is a significant hurdle for new entrants in the power generation market. This access is typically managed by incumbent utilities or independent system operators, often leading to substantial costs and complexities for new power producers seeking to connect and sell their energy.

The challenge is amplified by the fact that transmission capacity is finite and often already allocated. For example, in 2024, the backlog of proposed generation projects seeking interconnection in the US reached record levels, with some estimates suggesting over 10,000 GW of capacity waiting for approval, highlighting the bottleneck in grid access.

- High Interconnection Costs: New entrants face significant upfront costs for studies, upgrades, and physical connections to the grid, which can run into millions of dollars per project.

- Long Lead Times: The process of securing grid access and approvals can take years, delaying market entry and increasing project risk.

- Regulatory Hurdles: Navigating the complex regulatory landscape and obtaining necessary permits from various authorities adds another layer of difficulty.

- Limited Transmission Availability: In many regions, existing transmission lines are already operating at or near capacity, making it difficult to add new generation sources without costly expansion projects.

Brand Reputation and Customer Trust

In the energy sector, where consistent and dependable service is critical, Constellation Energy's established brand reputation and deep-rooted customer trust represent a significant barrier to new entrants. Building this level of confidence takes years of demonstrated reliability and customer satisfaction, a substantial hurdle for any newcomer. For instance, in 2023, Constellation Energy reported a customer retention rate of over 95% for its retail electricity customers, underscoring the loyalty it has cultivated.

New companies entering the market would face the arduous task of not only matching Constellation's service quality but also effectively communicating their own reliability to a discerning customer base. This necessitates considerable investment in marketing, infrastructure, and operational excellence to even begin to chip away at the trust already earned by established players. The significant capital expenditure required to build a comparable brand and operational track record deters many potential competitors.

- Brand Loyalty: Established providers like Constellation benefit from long-standing customer relationships, making it difficult for new entrants to attract and retain customers.

- Trust in Reliability: In an industry where service interruptions are costly, customers often favor providers with a proven history of dependable energy delivery.

- High Switching Costs (Perceived or Real): While not always direct financial costs, the effort and perceived risk associated with switching energy providers can deter new customer acquisition.

The threat of new entrants for Constellation Energy is generally low, primarily due to the immense capital required to establish operations in the energy sector. Building new power generation facilities and the associated infrastructure demands billions of dollars, a significant barrier for most potential competitors. For example, constructing a new nuclear power plant can easily cost tens of billions of dollars, a sum that deters many from even considering entry.

Furthermore, the energy industry is heavily regulated, with extensive licensing and permitting processes that can take years and add substantial costs. Compliance with environmental standards and operational regulations adds another layer of complexity. This regulatory environment favors established players with existing compliance frameworks and expertise.

Economies of scale also play a crucial role. Established companies like Constellation benefit from lower per-unit costs due to their large-scale operations in generation, transmission, and customer service. In 2023, Constellation Energy's revenue exceeded $39 billion, illustrating its significant operational scale and cost advantages that new entrants would struggle to match without massive investment.

| Barrier to Entry | Description | Example Data (2023/2024) |

|---|---|---|

| Capital Requirements | Extremely high upfront investment needed for power generation and grid infrastructure. | Nuclear plant construction: $10 billion+; Utility-scale solar: $100 million+ |

| Regulatory Hurdles | Complex and lengthy permitting, licensing, and compliance requirements. | Permitting for new facilities can take several years. |

| Economies of Scale | Established players have cost advantages due to large operational footprints. | Constellation Energy 2023 Revenue: ~$39 billion |

| Grid Access | Difficult and costly to connect to existing transmission infrastructure. | US interconnection backlog exceeded 10,000 GW capacity in 2024. |

| Brand Reputation & Trust | Building customer loyalty and trust in reliability takes considerable time and investment. | Constellation Energy 2023 Customer Retention: >95% |

Porter's Five Forces Analysis Data Sources

Our Constellation Energy Porter's Five Forces analysis is built upon a robust foundation of data, including Constellation Energy's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific reports from reputable sources like the Energy Information Administration (EIA) and market research firms specializing in the utility sector. This multi-faceted approach ensures a comprehensive understanding of the competitive landscape.