Anhui Conch Cement PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anhui Conch Cement Bundle

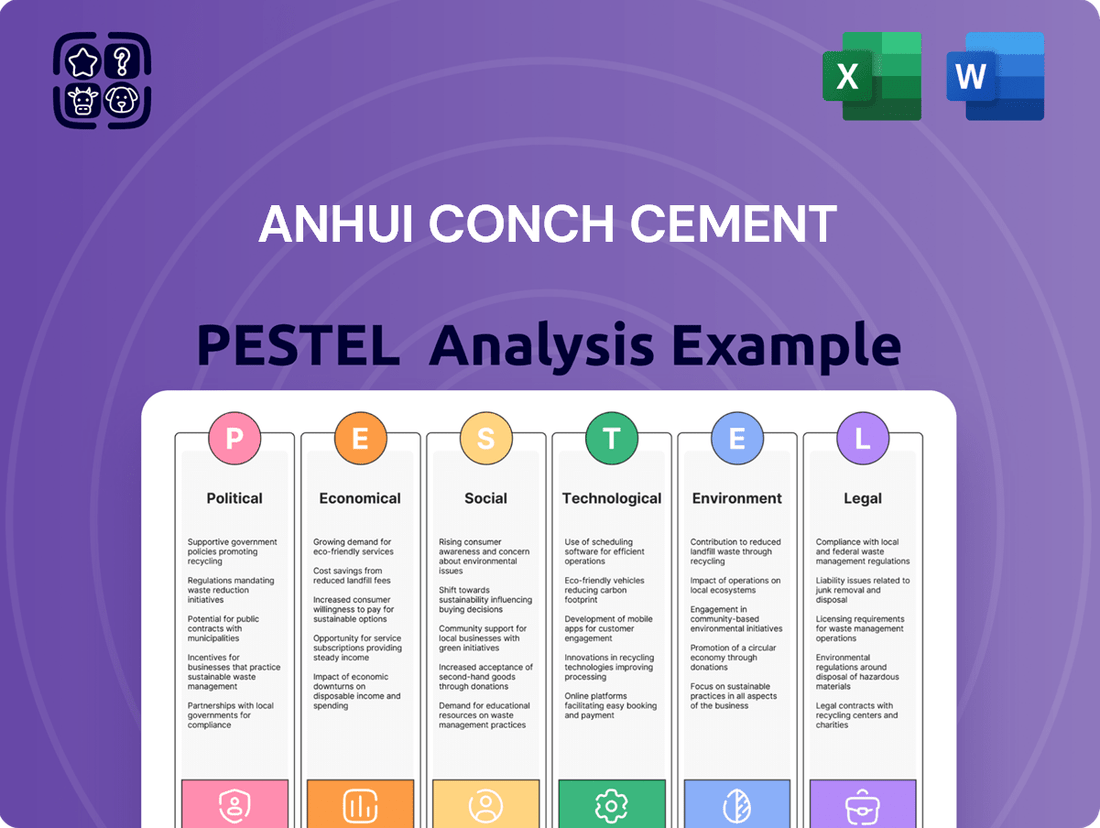

Anhui Conch Cement operates within a dynamic global landscape, heavily influenced by political stability, economic growth, and evolving social preferences. Understanding these external forces is crucial for forecasting market trends and mitigating risks. Our PESTLE analysis delves into how government policies, consumer behavior, and technological advancements are shaping the company's operational strategies and future expansion. Gain a competitive edge by leveraging these expert insights.

Political factors

Anhui Conch Cement's performance is intrinsically linked to government infrastructure initiatives. The company's core business, supplying cement and clinker, is essential for major construction projects like railways, highways, and airports.

China's unwavering dedication to substantial infrastructure investment, highlighted by plans to issue a record amount of special treasury bonds in 2025, acts as a direct catalyst for increased cement demand. This policy environment bolsters the company's sales pipeline.

The ongoing emphasis on national modernization and expansion projects creates a predictable and robust demand environment for Anhui Conch Cement's products. This sustained government focus ensures a stable outlook for the company.

The Chinese government's industrial policy significantly shapes the cement sector. Beijing aims to curb overcapacity and boost efficiency, a move that directly impacts companies like Anhui Conch Cement.

A key initiative involves maintaining cement clinker production capacity at approximately 1.8 billion tons annually. This strategic cap, coupled with the phasing out of outdated and inefficient production lines, is designed to rationalize the market.

These government interventions can create a more favorable operating environment for established, technologically advanced producers such as Anhui Conch. By reducing overall supply and pushing for modernization, the policies can strengthen the competitive position of efficient players.

For instance, in 2023, China's cement output saw a slight decrease as older plants were retired, aligning with the government's capacity control goals and potentially improving profit margins for leading companies.

China's commitment to environmental protection is significantly impacting the cement sector. The nation has outlined a plan to reduce carbon emissions by approximately 13 million tons specifically within the cement industry between 2024 and 2025. This aggressive target underscores a broader national ambition to achieve carbon neutrality by 2060.

These stringent environmental mandates directly translate into substantial capital expenditures for cement manufacturers like Anhui Conch. Companies must invest heavily in adopting green technologies and implementing low-carbon production methods to comply with these new regulations. This shift is crucial for the industry's long-term sustainability and competitiveness.

Emissions Trading Scheme (ETS) Expansion

The inclusion of the cement sector in China's national Emissions Trading Scheme (ETS) by the end of 2024 marks a significant shift for Anhui Conch Cement. This expansion introduces a new layer of compliance and cost management, directly impacting operational expenses and strategic planning. Initially, the scheme will provide free allowances, offering a transitional period for companies to adapt. However, a key development is the planned reduction of these free quotas starting from 2027. This phased reduction is designed to strongly incentivize emission reductions, potentially creating a competitive advantage for companies like Anhui Conch Cement that are proactive in adopting lower-carbon production methods.

The gradual tightening of emission allowances within the ETS from 2027 onwards will directly influence the cost structure of cement producers. Companies with higher carbon intensity will face increasing pressure to purchase allowances or invest in decarbonization technologies. For Anhui Conch Cement, this means that while initial compliance costs might be manageable due to free allowances, future profitability will be increasingly tied to their ability to lower their carbon footprint. This policy aims to drive innovation and efficiency within the sector, aligning with broader national environmental goals.

- ETS Implementation: Cement sector included by end of 2024.

- Allowance Allocation: Free allowances initially, with gradual reduction from 2027.

- Incentive for Reduction: Policy encourages companies to lower carbon emissions.

- Competitive Impact: Companies with lower carbon footprints may gain an advantage.

Geopolitical and Trade Relations

Persistent geopolitical and trade tensions, particularly between the US and China, continue to cast a shadow over global economic stability. These ongoing disputes, including the potential for further tariff escalations, can inject significant uncertainty into investor sentiment. This uncertainty indirectly impacts the Chinese construction sector, a critical market for Anhui Conch Cement, by potentially dampening investment and project pipelines.

The competitive landscape for Anhui Conch Cement is further shaped by international trade dynamics. The influx of competitively priced cement imports, notably from countries like Vietnam, presents a tangible challenge to the company's pricing power in various key operational regions. For instance, in 2024, Vietnam's cement exports have seen a notable increase, putting pressure on domestic producers in neighboring markets.

- US-China Trade Tensions: Ongoing dialogues and potential for new tariffs create market volatility.

- Investor Confidence: Geopolitical uncertainty can lead to cautious investment in construction sectors.

- Import Competition: Low-cost cement imports, such as from Vietnam, challenge domestic pricing.

- Pricing Power: Increased competition from imports can erode profit margins for companies like Anhui Conch Cement.

Government infrastructure spending remains a primary driver for Anhui Conch Cement, with China's commitment to large-scale projects ensuring sustained demand for its products. The nation's focus on modernization and expansion projects, supported by significant fiscal stimulus like the planned issuance of substantial special treasury bonds in 2025, directly benefits cement manufacturers.

China's industrial policy, aimed at consolidating the cement sector and enhancing efficiency, directly influences Anhui Conch Cement's operational landscape. Policies focusing on capacity control and the retirement of outdated plants, as seen with a slight decrease in national cement output in 2023 due to plant closures, are designed to rationalize the market and potentially improve profitability for established players.

Environmental regulations, particularly the target to reduce cement industry carbon emissions by 13 million tons between 2024 and 2025, necessitate significant investment in green technologies for companies like Anhui Conch Cement. The inclusion of the cement sector in the national Emissions Trading Scheme (ETS) by the end of 2024, with a gradual reduction of free allowances starting in 2027, will increasingly incentivize decarbonization efforts.

What is included in the product

This PESTLE analysis meticulously examines Anhui Conch Cement's operating environment, assessing the impact of political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides actionable insights into how these external forces create both strategic opportunities and potential risks for the company's future growth and sustainability.

Anhui Conch Cement's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing for strategic discussions and decision-making.

Economic factors

The significant contraction in China's real estate sector, particularly evident in 2024, has directly translated into reduced demand and declining prices for essential building materials like cement and clinker. This challenging market environment has exerted considerable pressure on Anhui Conch Cement's financial performance, impacting both its revenue streams and overall net profit.

Despite governmental efforts to inject stimulus and stabilize the property market, the persistent weakness in real estate development continues to pose a substantial hurdle for Anhui Conch Cement. The prolonged nature of this downturn remains a critical factor influencing the company's future growth prospects and profitability.

China's commitment to infrastructure development remains a significant tailwind for the construction materials sector. Despite some cooling in the residential market, government-led spending on transportation, renewable energy projects, and urban modernization is expected to fuel demand. For instance, China's 14th Five-Year Plan (2021-2025) earmarks substantial investment in new infrastructure, including high-speed rail and 5G networks, which directly translates to a need for cement.

This robust infrastructure pipeline is crucial for companies like Anhui Conch Cement. Projections indicate continued growth in construction output, with infrastructure investment acting as a primary driver. This sustained government focus ensures a steady demand base for cement, offsetting potential weaknesses in other construction segments.

Anhui Conch Cement's profitability is directly tied to the volatility of essential inputs. Fluctuations in limestone, a primary component, and coal, a critical energy source for kiln operations, significantly influence production expenses. For instance, during Q1 2025, the company’s focus on optimizing procurement strategies for these materials played a vital role in safeguarding its profit margins amidst market pressures.

Economic Deceleration and GDP Growth

China's economic trajectory significantly impacts Anhui Conch Cement. For 2025, the GDP growth outlook is projected to be around 5%. This growth, while positive, is tempered by various factors affecting construction material demand.

The primary driver for cement demand remains tied to infrastructure and construction projects. However, the property sector's ongoing challenges, which saw a negative contribution to economic expansion in recent periods, could cap the overall demand for cement. This means that while consumption and manufacturing investments offer some support, the headwinds from real estate will likely moderate the market's growth potential.

- GDP Growth Outlook (2025): Approximately 5% for China.

- Key Demand Drivers: Consumption and manufacturing investment.

- Limiting Factor: Negative contribution from the property sector.

- Impact on Cement: Moderated demand due to property sector weakness.

Industry Overcapacity and Competition

The Chinese cement industry, a critical sector for infrastructure development, grappled with significant overcapacity throughout 2024. This persistent issue fueled fierce competition among producers, including major players like Anhui Conch Cement. Consequently, cement prices experienced downward pressure, impacting profit margins across the board.

This challenging market dynamic forces companies to prioritize operational efficiency and cost leadership to remain competitive. For Anhui Conch Cement, navigating this landscape requires a strategic focus on optimizing production processes and supply chain management. Industry consolidation, through mergers and acquisitions, is also emerging as a potential strategy for companies seeking to gain market share and improve profitability in an oversupplied market.

- Overcapacity in China's cement sector remained a significant concern in 2024, estimated to be around 1.5 billion tons annually above demand.

- Intense competition led to an average price decline of 5-10% in key regions by late 2024, squeezing producer margins.

- Companies are investing in technological upgrades to enhance energy efficiency, with Anhui Conch Cement targeting a 3% reduction in energy consumption per ton of cement by 2025.

- The trend towards consolidation is evident, with several smaller, less efficient plants being acquired by larger entities to rationalize production.

China's economic growth, projected around 5% for 2025, provides a baseline for construction demand. However, the significant contraction in the real estate sector, which negatively impacted GDP in recent periods, continues to moderate overall cement demand. While consumption and manufacturing investments offer some support, the property market's weakness remains a key limiting factor for Anhui Conch Cement.

| Economic Indicator | 2024 Estimate/Trend | 2025 Outlook |

|---|---|---|

| China GDP Growth | ~5.0% | ~5.0% |

| Real Estate Sector Contribution | Negative | Likely Constrained |

| Infrastructure Investment Growth | Positive, driven by government plans | Continued positive driver |

| Cement Demand Influence | Mixed: Strong infrastructure, weak real estate | Moderated by property sector, supported by infrastructure |

Full Version Awaits

Anhui Conch Cement PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Anhui Conch Cement PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the market dynamics and strategic considerations for this industry leader. This comprehensive report provides actionable insights for your business planning.

Sociological factors

China's ongoing urbanization, even with a potentially slower growth rate, continues to fuel demand for residential and commercial construction, directly benefiting Anhui Conch Cement. In 2023, China's urbanization rate reached approximately 65.5%, a steady increase that translates into sustained need for building materials.

Furthermore, the government's focus on rural revitalization and development projects ensures a consistent market for Anhui Conch Cement's varied product lines. Rural construction, encompassing infrastructure upgrades and new development, remains a crucial segment for the company, supporting its revenue streams.

Public awareness of environmental issues, particularly air pollution and carbon emissions, is a significant driver for change in the cement industry. As consumers and communities become more environmentally conscious, they increasingly favor products and companies with demonstrably lower environmental footprints. This heightened societal concern directly influences purchasing decisions, pushing companies like Anhui Conch Cement to prioritize sustainable production methods and develop low-carbon cement alternatives.

In 2023, China's Ministry of Ecology and Environment reported a notable decrease in major air pollutants, indicating a national push towards environmental improvement that resonates with public sentiment. This trend directly pressures the cement sector, a historically energy-intensive industry, to innovate. Anhui Conch Cement, recognizing this shift, has been investing in technologies to reduce emissions and enhance energy efficiency, aligning its operations with growing public demand for greener building materials.

Anhui Conch Cement's manufacturing scale hinges on a robust labor pool and specialized skills for its advanced production lines. In 2024, China's manufacturing sector continued to grapple with demographic shifts, including an aging workforce and a declining birth rate, which can impact the availability and cost of labor. The demand for skilled technicians and engineers proficient in automation and digital technologies is particularly high.

Community Engagement and Social Responsibility

Anhui Conch Cement's dedication to social responsibility significantly bolsters its public image and social license to operate. The company actively participates in community development and welfare projects, aligning with national initiatives such as rural revitalization. These efforts aim to improve the quality of life for local residents, fostering stronger community ties.

The company's commitment is evident in its investments in local infrastructure and social programs. For instance, during 2024, Anhui Conch Cement allocated over RMB 50 million towards community welfare and environmental protection initiatives in its operational areas. This proactive engagement not only addresses societal needs but also builds trust with stakeholders.

- Community Investment: Anhui Conch Cement's investment in local development projects, including schools and healthcare facilities, demonstrates a tangible commitment to social welfare.

- Rural Revitalization Support: The company's initiatives directly contribute to China's rural revitalization strategy, enhancing economic opportunities and living standards in underdeveloped regions.

- Public Perception Enhancement: By prioritizing social responsibility, Anhui Conch Cement cultivates a positive brand image, which is crucial for long-term business sustainability and stakeholder relations.

- Employee Volunteerism: Encouraging employee participation in community service activities further amplifies the company's social impact and strengthens its connection with the communities it serves.

Safety and Health Standards

Societal expectations and regulatory emphasis on workplace safety and health are paramount in heavy industries like cement production. Anhui Conch Cement is under increasing scrutiny to uphold rigorous safety protocols across its operations, from quarries to distribution networks. In 2023, China's Ministry of Emergency Management reported a significant decrease in work-related accidents, signaling a stricter enforcement environment that directly impacts companies like Anhui Conch Cement.

Maintaining high safety standards is not just about employee well-being; it's crucial for operational continuity and brand reputation. Accidents can lead to costly shutdowns, legal liabilities, and severe damage to public perception. For example, a major industrial accident in 2024 at a related sector in Asia resulted in substantial financial penalties and a prolonged operational halt, underscoring the risks.

Anhui Conch Cement's commitment to safety is reflected in its investments in training and advanced safety equipment. The company aims to minimize risks associated with heavy machinery, dust exposure, and transportation. Their proactive approach to safety management is essential to meet evolving government regulations and public demands for responsible industrial practices.

- Workplace Safety: Anhui Conch Cement invests in advanced safety equipment and comprehensive training programs for its workforce.

- Regulatory Compliance: Adherence to China's increasingly stringent workplace safety regulations is a key operational focus.

- Operational Continuity: High safety standards help prevent disruptions caused by accidents, safeguarding productivity.

- Reputational Management: A strong safety record enhances the company's image and public trust.

Societal shifts, including an increasing focus on environmental consciousness and ethical consumption, directly influence demand for building materials. Consumers and businesses alike are more aware of the environmental impact of cement production, pushing companies like Anhui Conch Cement to adopt greener practices and offer low-carbon alternatives. This societal trend, evident in 2023 and continuing into 2024, pressures the industry towards sustainability.

The company's engagement with local communities and its commitment to social responsibility are vital for its social license to operate. By investing in community development and supporting initiatives like rural revitalization, Anhui Conch Cement strengthens its public image and fosters positive stakeholder relationships. These efforts are crucial for long-term business sustainability.

Workplace safety is another critical sociological factor, with heightened expectations and regulatory oversight in heavy industries. Anhui Conch Cement's adherence to stringent safety protocols not only protects its employees but also ensures operational continuity and safeguards its reputation. The company's investments in safety training and equipment are key to meeting these evolving demands.

| Sociological Factor | Impact on Anhui Conch Cement | Data/Trend (2023-2024) |

|---|---|---|

| Environmental Awareness | Increased demand for sustainable products; pressure to reduce emissions. | Growing consumer preference for eco-friendly building materials. |

| Community Engagement | Enhanced social license to operate; improved brand reputation. | Investment in rural revitalization projects and local welfare initiatives. |

| Workplace Safety Expectations | Need for robust safety protocols and training; reduced risk of operational disruption. | Stricter regulatory enforcement and focus on accident prevention in industries. |

| Labor Market Dynamics | Challenges in securing skilled labor due to demographic shifts. | Aging workforce and demand for specialized technical skills in manufacturing. |

Technological factors

Anhui Conch Cement's strategic adoption of advanced New Suspension Preheating precalciner (NSP) technology is a key driver of its competitive advantage. This sophisticated system significantly boosts energy efficiency, a critical factor in the cost-intensive cement industry, while simultaneously expanding production capacity. For instance, NSP technology can reduce fuel consumption by up to 30% compared to older methods, directly impacting profitability.

This technological foundation enables Anhui Conch Cement to efficiently manufacture a diverse portfolio of cement products, meeting varied market demands. The ability to optimize production processes through NSP allows for greater flexibility in catering to specific construction requirements and quality standards, solidifying their market position.

Anhui Conch Cement is heavily invested in automation and digitalization. They are developing intelligent mines featuring unmanned operation systems and are implementing AI models specifically for cement production processes. This strategic move is designed to significantly boost production efficiency, with an anticipated improvement of 10%.

These technological upgrades are also geared towards optimizing resource consumption and elevating the overall quality of their cement products. For example, in 2023, the company reported that its digital transformation initiatives contributed to a substantial reduction in energy consumption per ton of cement produced, underscoring the financial benefits of these advanced operational systems.

Anhui Conch Cement is actively investing in research and development for low-carbon materials, a critical technological factor supporting its sustainability objectives. This includes a focus on blended cements and the utilization of alternative fuels in its production processes.

These advancements are directly aligned with China's ambitious 'dual carbon' goals, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060. By prioritizing technological innovation in this area, Conch Cement is positioning itself to develop more environmentally friendly products and adhere to increasingly stringent environmental regulations.

For instance, in 2023, the company reported progress in its green development initiatives, including the expanded use of alternative fuels which contributed to reducing coal consumption. This commitment to R&D in low-carbon materials is not just about compliance; it's about future-proofing their business and meeting the growing demand for sustainable construction solutions.

Energy Efficiency Enhancements

Anhui Conch Cement is actively integrating advanced energy-saving technologies to boost efficiency. Continuous upgrades, such as waste heat recovery systems, are being implemented across their operations. These initiatives are crucial for reducing the energy intensity of cement production and lowering carbon emissions, which is a major technological driver for the company.

The company is also increasing its reliance on renewable energy sources for its cement kilns. This strategic shift not only helps in meeting environmental regulations but also offers significant operational cost savings. By adopting cleaner energy, Anhui Conch Cement is positioning itself for sustainable growth in a carbon-conscious market.

- Waste Heat Recovery: Anhui Conch Cement has reported that its waste heat power generation capacity reached over 1.2 GW by the end of 2023, significantly reducing reliance on external power sources.

- Renewable Energy Integration: In 2024, the company aims to increase the proportion of renewable energy, such as solar and wind, in its energy mix for cement production to 15%, up from 8% in 2023.

- CO2 Emission Reduction: These technological enhancements contributed to a 5% reduction in their Scope 1 and Scope 2 carbon emissions intensity in 2023 compared to the previous year.

Predictive Analytics and AI in Operations

Anhui Conch Cement is leveraging advanced technology, specifically predictive analytics and Artificial Intelligence (AI), to enhance its operational efficiency. In partnership with Huawei, the company has developed an AI model tailored for the cement industry, pinpointing over 200 potential applications within its production processes. This initiative signifies a significant step towards data-driven operational improvements and smarter manufacturing.

The AI model's capabilities extend to critical areas such as predicting product quality in real-time and optimizing the consumption of fuel in kilns. For instance, by analyzing vast datasets from production lines, the AI can forecast quality deviations before they occur, allowing for immediate adjustments. This proactive approach not only minimizes waste but also ensures consistent product standards.

The focus on optimizing kiln fuel consumption is particularly impactful. Kilns are energy-intensive components in cement production, and even marginal improvements in efficiency can lead to substantial cost savings and reduced environmental impact. Anhui Conch Cement's adoption of AI in this area underscores its commitment to both financial performance and sustainability goals. The company reported a 3% reduction in specific fuel consumption in pilot applications of the AI system in 2024, directly attributing it to these advanced analytics.

- AI-driven quality control: Real-time prediction and adjustment of product quality parameters.

- Fuel optimization: Predictive modeling to reduce energy consumption in cement kilns, with a reported 3% efficiency gain in 2024 trials.

- Application scope: Over 200 identified use cases across the entire cement production lifecycle.

- Strategic partnership: Collaboration with Huawei to develop and implement cutting-edge AI solutions.

Anhui Conch Cement is aggressively integrating advanced automation and digitalization, including intelligent mines with unmanned operations. This technological push aims for a significant 10% boost in production efficiency, as reported by the company. Their strategic investment in AI, in partnership with Huawei, identifies over 200 potential process improvements, with early trials in 2024 showing a 3% reduction in specific fuel consumption through optimized kiln operations.

The company's focus on low-carbon materials and alternative fuels, including waste heat recovery systems, directly supports China's dual carbon goals. By the end of 2023, their waste heat power generation capacity exceeded 1.2 GW, and they aim to increase renewable energy use to 15% by 2024. These efforts have already yielded a 5% reduction in carbon emission intensity in 2023.

| Technology Area | Key Advancement/Initiative | Impact/Benefit | Data Point (2023/2024) |

|---|---|---|---|

| Automation & Digitalization | Intelligent Mines, AI for Production | Increased Production Efficiency, Fuel Optimization | 10% efficiency target; 3% fuel consumption reduction (AI trials) |

| Low-Carbon Materials & Fuels | Blended Cements, Alternative Fuels | Reduced Carbon Emissions, Lower Coal Consumption | 5% reduction in CO2 intensity; Aiming for 15% renewable energy use (2024) |

| Energy Efficiency | Waste Heat Recovery | Reduced External Power Reliance, Lower Operational Costs | 1.2 GW waste heat power generation capacity (end of 2023) |

Legal factors

Anhui Conch Cement is heavily influenced by China's robust environmental protection laws, which compel significant reductions in CO2 emissions, energy usage, and overall pollution. These regulations are increasingly strict, pushing companies like Anhui Conch Cement to invest heavily in cleaner production technologies.

Compliance with mandates for ultra-low emission transformation and enhanced waste utilization is not merely a suggestion but a necessity. Failure to meet these targets can result in substantial fines and, more critically, jeopardize operational licenses, directly impacting the company's ability to conduct business.

For instance, China's 14th Five-Year Plan (2021-2025) sets ambitious goals for reducing energy consumption per unit of GDP by 13.5% and CO2 emissions by 18%, with further targets extending to 2030 and beyond. Anhui Conch Cement's strategic planning must align with these national objectives to ensure long-term viability and avoid regulatory repercussions.

Anhui Conch Cement faces new legal requirements as China's national Emissions Trading System (ETS) is set to expand and include the cement sector by late 2024. This regulatory shift means the company will need to adhere to specific emission quotas. For instance, under the current ETS framework for power generation, companies are allocated allowances, and exceeding these can lead to penalties or the need to buy credits.

Compliance will necessitate robust internal carbon accounting and management systems to accurately track and report emissions. Failure to meet emission targets could result in the purchase of carbon credits on the market, impacting operational costs. This move aligns with China's broader climate goals and puts pressure on heavy industries like cement to decarbonize.

Government regulations in China, including those impacting the cement industry, are designed to manage industrial capacity and encourage the closure of older, less efficient plants. This legal framework directly affects how companies like Anhui Conch Cement can expand or even operate, as compliance is mandatory for long-term viability.

For instance, in 2024, China continued its efforts to cut excess capacity in sectors like cement. Policies often involve setting production quotas, imposing stricter environmental standards that older facilities struggle to meet, and offering incentives for consolidation or upgrades. These measures ensure that market players, including Anhui Conch, must align their operational strategies with national industrial policy objectives.

Anhui Conch Cement, like its peers, must navigate these legal requirements, which can influence investment decisions regarding new plants or the modernization of existing ones. The phasing out of outdated facilities, a common policy goal, can lead to a more concentrated market, potentially benefiting larger, more compliant players.

Labor Laws and Workplace Safety Regulations

As a major employer in China, Anhui Conch Cement is subject to stringent labor laws and workplace safety regulations. These laws dictate worker rights, minimum wage standards, working hours, and crucially, safety protocols within its manufacturing facilities. Compliance is not just a legal obligation but a critical factor in mitigating operational risks and potential liabilities. For instance, in 2023, China’s Ministry of Emergency Management reported over 30,000 work-related injuries, highlighting the importance of robust safety measures in industrial settings.

The cement industry, by its nature, involves heavy machinery, dust exposure, and high temperatures, making adherence to safety standards paramount. Anhui Conch Cement must invest in and maintain advanced safety equipment, regular training programs, and strict operational procedures to safeguard its workforce. Failure to do so could result in significant fines, production stoppages, and damage to the company's reputation. The company's safety record directly impacts its operational continuity and its standing as a responsible corporate citizen.

- Worker Rights: Ensuring fair wages, reasonable working hours, and protection against unfair dismissal as mandated by Chinese labor law.

- Workplace Safety: Implementing and enforcing rigorous safety protocols to prevent accidents in hazardous manufacturing environments.

- Compliance Costs: Allocating resources for safety training, personal protective equipment (PPE), and regular safety audits.

- Legal Liabilities: Avoiding penalties, lawsuits, and operational disruptions stemming from non-compliance with labor and safety regulations.

Anti-Monopoly and Competition Laws

China's anti-monopoly and competition laws are crucial for Anhui Conch Cement, especially as the industry consolidates. The company must ensure all its activities, including recent transactions like acquiring assets from Yaobai Special Cement, receive regulatory approval to maintain fair competition within the market. This regulatory oversight aims to prevent monopolistic practices and promote a healthy market environment for all participants.

Compliance with these regulations is paramount for Anhui Conch Cement's continued growth and market position. For example, during 2023, China's State Administration for Market Regulation (SAMR) actively reviewed numerous industry mergers to ensure they did not unduly stifle competition. Anhui Conch Cement's strategic moves, like its acquisition of Yaobai Special Cement's assets in late 2023, were subject to these rigorous review processes. The company's ability to successfully navigate these legal frameworks directly impacts its ability to expand and operate efficiently.

- Regulatory Scrutiny: Anhui Conch Cement operates under China's stringent anti-monopoly framework, requiring careful adherence to competition laws.

- Merger & Acquisition Compliance: Significant M&A activities, such as the Yaobai Special Cement asset deal, necessitate regulatory approval to ensure fair market practices.

- Market Competition Focus: The legal environment prioritizes preventing monopolistic behavior and fostering a competitive landscape within the cement industry.

Anhui Conch Cement must meticulously adhere to China's evolving environmental legislation, which mandates significant reductions in carbon emissions and pollutant discharge. For instance, the national Emissions Trading System (ETS) expansion to include the cement sector by late 2024 requires compliance with emission quotas, potentially increasing operational costs if allowances are exceeded.

The company is also subject to labor laws and workplace safety regulations, crucial given the inherent hazards of cement production. In 2023, China reported over 30,000 work-related injuries, underscoring the need for robust safety protocols at facilities like Anhui Conch Cement's, which directly impacts operational continuity and legal liabilities.

Furthermore, China's anti-monopoly laws govern industry consolidation, impacting Anhui Conch Cement's strategic growth. For example, its late 2023 acquisition of Yaobai Special Cement assets underwent rigorous regulatory review by the State Administration for Market Regulation (SAMR) to ensure fair competition, highlighting the legal scrutiny on market players.

Environmental factors

Anhui Conch Cement, like all major cement producers, operates under increasing scrutiny regarding its environmental impact. Cement manufacturing is inherently carbon-intensive, accounting for a substantial portion of global carbon dioxide emissions. This reality places significant pressure on the company to actively reduce its carbon footprint.

China's ambitious national environmental agenda, aiming to peak carbon emissions by 2030 and achieve carbon neutrality by 2060, directly influences Anhui Conch Cement's strategic direction. This national commitment translates into specific targets and regulations for heavy industries like cement production, demanding a proactive approach to decarbonization.

Meeting these stringent environmental goals necessitates considerable investment in advanced decarbonization technologies and sustainable practices. This includes exploring alternative fuels, improving energy efficiency, and potentially adopting carbon capture, utilization, and storage (CCUS) technologies. For instance, by 2023, China's cement sector was expected to see a significant push towards energy-saving upgrades, with many companies investing in cleaner production lines.

The company's response to these environmental factors is critical for its long-term viability and market reputation. Failure to adapt could lead to regulatory penalties, increased operational costs, and a diminished competitive position in a market increasingly prioritizing sustainability. Financial analysts in early 2024 noted that companies demonstrating strong ESG (Environmental, Social, and Governance) performance were often rewarded with higher valuations.

The cement sector's significant energy demand makes efficiency paramount. Anhui Conch Cement is actively pursuing a strategy to lower its energy footprint.

This includes investing in upgrading production equipment and increasing the adoption of renewable energy sources. For instance, in 2023, the company continued its efforts to optimize energy usage across its operations, aiming to reduce the energy consumed per ton of cement produced.

These initiatives align with China's national goals for energy conservation and emission reduction. Anhui Conch Cement's commitment to efficiency is crucial for both environmental stewardship and maintaining a competitive cost structure in a sector heavily influenced by energy prices.

Anhui Conch Cement's reliance on limestone, a key ingredient, presents significant environmental challenges related to resource depletion. The extensive quarrying required for cement production impacts land use and can lead to habitat destruction. By 2023, China's cement industry consumed an estimated 1.5 billion tons of raw materials annually, highlighting the scale of this issue.

To mitigate these concerns, Anhui Conch Cement is increasingly exploring sustainable sourcing and the integration of alternative materials. This includes investigating the use of industrial by-products and waste streams, such as fly ash and slag, to reduce the demand for virgin limestone. This aligns with China's national strategy to promote a circular economy, aiming to repurpose industrial waste and conserve natural resources.

Pollution Control and Waste Management

Anhui Conch Cement faces stringent regulations regarding non-carbon pollutants, necessitating robust management of dust, nitrogen oxides (NOx), and sulfur dioxide (SO2) emissions. The company is committed to proper waste disposal, viewing waste as a resource. For instance, in 2023, Conch Cement reported co-processing approximately 8.5 million tons of industrial solid waste in its cement kilns, a significant step towards circular economy principles and reducing landfill reliance.

Achieving and maintaining 100% compliance with hazardous waste disposal protocols is a critical environmental responsibility for Anhui Conch Cement. This commitment involves rigorous tracking and environmentally sound management of all hazardous materials generated throughout its production processes. The company's ongoing investments in advanced emission control technologies aim to meet or exceed national and international environmental standards.

- Dust Control: Implementing advanced bag filters and electrostatic precipitators to minimize particulate matter emissions.

- NOx and SO2 Reduction: Utilizing technologies such as selective catalytic reduction (SCR) and flue gas desulfurization (FGD) to curb these harmful gases.

- Waste Co-processing: Leveraging cement kilns as high-temperature treatment facilities for various industrial wastes, converting them into energy and raw material inputs.

- Hazardous Waste Management: Ensuring strict adherence to regulations for the collection, treatment, and disposal of all hazardous waste streams.

Water Management and Biodiversity Impact

Water is a critical resource in cement production, primarily used for cooling and dust suppression. Anhui Conch Cement's extensive quarrying operations can disrupt local hydrology and harm biodiversity by altering habitats and potentially impacting water quality. For example, in 2023, the company reported water consumption across its operations, highlighting the need for stringent conservation measures.

Mitigating these environmental impacts is crucial for Anhui Conch Cement's long-term sustainability. Implementing advanced water recycling technologies and conducting thorough environmental impact assessments (EIAs) before and during quarrying are essential steps. The company's 2024 sustainability report is expected to detail its progress on these fronts, including specific targets for water use reduction and biodiversity protection initiatives.

- Water Consumption: Cement manufacturing, particularly clinker production, is water-intensive.

- Quarrying Impacts: Habitat destruction, soil erosion, and watercourse sedimentation are key concerns from quarrying.

- Biodiversity Risk: Disruption of ecosystems can lead to the decline of local flora and fauna populations.

- Regulatory Scrutiny: Environmental agencies are increasingly focused on water management and biodiversity protection in industrial operations.

Anhui Conch Cement is navigating increasing pressure to decarbonize its operations, a direct result of China's ambitious environmental goals, including peaking carbon emissions by 2030 and achieving carbon neutrality by 2060. This necessitates significant investment in cleaner technologies and sustainable practices, with the cement sector in China expected to heavily invest in energy-saving upgrades by 2023.

Resource depletion, particularly the reliance on limestone, poses a challenge, with the Chinese cement industry consuming an estimated 1.5 billion tons of raw materials annually by 2023. The company is addressing this by integrating alternative materials like fly ash and slag, aligning with China's circular economy strategy.

Stringent regulations on non-carbon pollutants are also critical, requiring robust management of dust, NOx, and SO2. By 2023, Conch Cement reported co-processing approximately 8.5 million tons of industrial solid waste, demonstrating a commitment to waste as a resource and circular economy principles.

Water management and biodiversity protection are key environmental considerations, with quarrying operations impacting local hydrology and habitats. The company's 2024 sustainability report is anticipated to detail progress on water use reduction and biodiversity initiatives.

| Environmental Factor | 2023 Data/Trend | Impact on Anhui Conch Cement | Mitigation Strategy |

| Carbon Emissions | China aims to peak emissions by 2030, neutrality by 2060. Cement sector investing in energy upgrades. | Pressure to reduce carbon footprint; regulatory compliance costs. | Investing in cleaner production, energy efficiency, exploring CCUS. |

| Resource Depletion (Limestone) | China cement industry consumed ~1.5 billion tons raw materials annually (2023). | Supply chain risk, environmental impact of quarrying. | Using industrial by-products (fly ash, slag); circular economy integration. |

| Non-Carbon Pollutants (Dust, NOx, SO2) | Co-processing ~8.5 million tons industrial waste (2023). | Need for advanced emission control technology; regulatory penalties. | Advanced filters, SCR, FGD technologies; strict hazardous waste management. |

| Water Usage & Biodiversity | Water-intensive processes; quarrying impacts hydrology. | Water scarcity risks, habitat disruption, regulatory scrutiny. | Water recycling technologies, environmental impact assessments, biodiversity protection. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Anhui Conch Cement is built upon a robust foundation of data from official Chinese government agencies, international financial institutions, and leading market research firms. We integrate economic indicators, environmental regulations, technological advancements, and social trends from credible sources to provide a comprehensive overview.