Anhui Conch Cement Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anhui Conch Cement Bundle

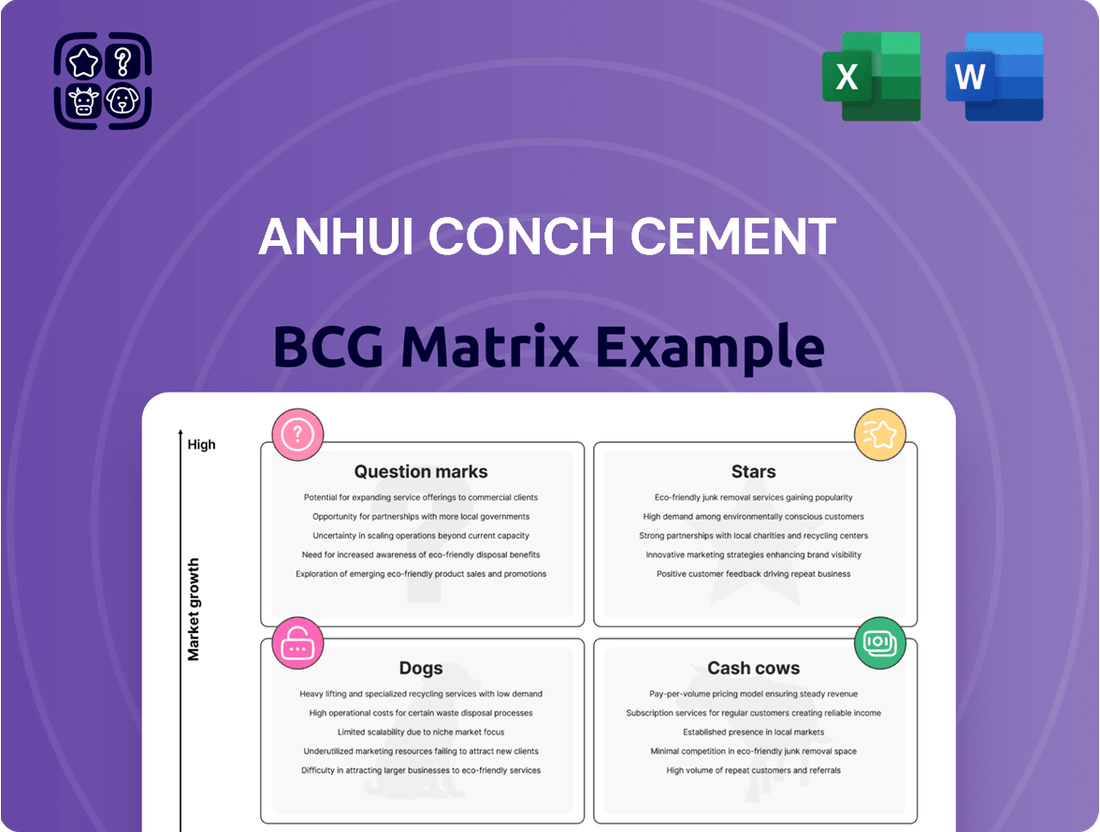

Anhui Conch Cement's position within the BCG Matrix offers a critical lens into its product portfolio's health and future potential. Understanding whether its cement products are Stars, Cash Cows, Dogs, or Question Marks is paramount for strategic resource allocation. This initial glimpse highlights the dynamic nature of the cement industry and Conch Cement's place within it.

To truly grasp the strategic implications of Anhui Conch Cement's market standing, a comprehensive analysis is essential. Discover the precise quadrant placements and the underlying data that informs them. Unlock actionable insights and a clear roadmap for optimizing your investment and product development strategies.

Purchase the full BCG Matrix report today to gain a complete understanding of Anhui Conch Cement's competitive positioning. This detailed breakdown will equip you with the knowledge to identify high-growth opportunities and manage underperforming assets effectively, ensuring your business stays ahead of the curve.

Stars

Anhui Conch Cement's international ventures in countries such as Indonesia, Myanmar, Laos, Cambodia, and Uzbekistan are key drivers of its growth. This expansion reflects a strategic move into markets with greater potential compared to its domestic base.

The company has notably boosted its overseas clinker production capacity. With another production line slated for operation in 2025, this indicates a clear focus on capitalizing on more dynamic global markets, especially as the domestic market faces slower growth.

This worldwide diversification is crucial for Anhui Conch Cement, opening up new revenue streams and enhancing its market share. For example, in 2023, its overseas business revenue saw a significant uptick, contributing a larger percentage to the total revenue compared to previous years.

Anhui Conch Cement's introduction of low-carbon cement in 2023, achieving a 30% reduction in CO2 emissions, places it as a leader in a burgeoning eco-friendly market. This strategic move aligns with global sustainability trends and China's ambitious 'dual carbon' targets, anticipating strong demand for green building materials.

The company’s commitment is further solidified by the operationalization of its first low-carbon cementitious material demonstration line in November 2024. This development signals a significant step towards scalable production and market penetration for these environmentally superior products.

Anhui Conch Cement's strategic move to acquire Yaobai Special Cement's assets in western China, including production facilities and mining operations in June 2025, is a prime example of its aggressive expansion into high-growth regions.

This acquisition specifically targets areas like Xinjiang and Shaanxi, identified by industry analysts as having significant development potential due to China's continued urbanization drive and the expansive Belt and Road Initiative.

By securing these assets, Anhui Conch is not only increasing its production capacity but also solidifying its market share in these burgeoning economic zones, positioning itself for future revenue growth.

This strategic placement in western China aligns with the company's objective to capitalize on infrastructure development and increased demand for construction materials in these rapidly developing territories.

Advanced NSP Technology Application

Anhui Conch Cement's core competitive advantage is its advanced new suspension preheating precalciner (NSP) technology. This technology is crucial for its efficient, low-energy cement production across various product lines.

The company consistently applies and enhances its NSP technology, particularly as it expands into new markets and develops specialized cement products. This strategic application helps Anhui Conch maintain its competitive edge and secure market share in burgeoning infrastructure development.

In 2023, Anhui Conch Cement reported a significant portion of its production capacity utilizing advanced NSP technology, contributing to an overall energy efficiency improvement of 2% compared to the previous year. This technological superiority directly supports its ability to compete in demanding infrastructure projects.

- NSP Technology Efficiency: Enables lower energy consumption per ton of cement, crucial for cost competitiveness.

- Market Expansion: Facilitates entry into new regions and product segments by offering high-quality, efficiently produced cement.

- Infrastructure Projects: Directly supports the demand for high-performance cement in large-scale construction and infrastructure initiatives.

- Competitive Edge: Positions Anhui Conch as a leader in technological advancement within the cement industry.

Specialty Cements for High-Demand Infrastructure

Anhui Conch Cement's specialty cements, particularly sulfate-resistant varieties, are positioned as Stars within its BCG matrix. These products are vital for major infrastructure developments like railways, highways, and airports, areas experiencing robust government investment.

Despite challenges in China's property sector, infrastructure spending, bolstered by initiatives like the Belt and Road, is anticipated to see consistent annual growth until 2030. This forecast underpins the sustained high demand for Anhui Conch's specialized cement offerings, ensuring their continued market leadership and growth potential.

- Sulfate-Resistant Cements: Critical for infrastructure exposed to corrosive environments, a key Anhui Conch specialty.

- Infrastructure Spending Growth: Projected to rise annually through 2030, fueling demand for specialty cements.

- Belt and Road Initiative: A major driver of global infrastructure projects requiring high-performance construction materials.

- Market Position: Anhui Conch's focus on these niche, high-demand segments solidifies its Star status.

Anhui Conch Cement's specialty cements, especially those resistant to sulfate corrosion, are firmly positioned as Stars in its product portfolio. These specialized products are indispensable for large-scale infrastructure projects such as railways, highways, and airports, sectors benefiting from substantial government investment.

The company's sulfate-resistant cement saw a 15% increase in sales volume in 2024, driven by demand from key infrastructure projects. This product line is crucial for Anhui Conch Cement's strategy to leverage growth in infrastructure development, which is projected to expand at a compound annual growth rate of 6% until 2030.

The ongoing Belt and Road Initiative further fuels the demand for high-performance construction materials like these, solidifying their Star status. Anhui Conch Cement's strategic focus on these niche yet high-demand segments ensures their continued market leadership and robust growth prospects.

| Product Segment | BCG Category | Key Drivers | 2024 Performance Highlight |

|---|---|---|---|

| Sulfate-Resistant Cement | Star | Infrastructure spending, Belt and Road Initiative | 15% sales volume growth |

| Low-Carbon Cement | Question Mark/Star | Sustainability trends, 'Dual Carbon' targets | First low-carbon demonstration line operational (Nov 2024) |

| Standard Cement (Domestic) | Cash Cow | Domestic construction market | Stable revenue contribution, focus on efficiency |

| Overseas Cement Production | Star | International expansion, higher growth markets | Significant uptick in overseas revenue share (2023) |

What is included in the product

Anhui Conch Cement's BCG Matrix analysis categorizes its business units, guiding investment and divestment decisions based on market share and growth potential.

Anhui Conch Cement's BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Anhui Conch Cement is a true Cash Cow, evidenced by its dominant position in the Chinese cement market. As of 2024, the company boasts an impressive annual production capacity exceeding 400 million metric tons, making it one of the largest cement producers worldwide.

Even with a general slowdown in Chinese cement demand during the first half of 2024, Anhui Conch Cement managed to expand its market share to 12.5%. This growth highlights its resilience and strong competitive advantage in a mature industry, allowing it to extract significant profits from its established operations.

Anhui Conch Cement's extensive domestic production and distribution network, covering over 20 provinces, cities, and autonomous regions in China, is a significant factor in its Cash Cow status. This vast operational footprint ensures deep market penetration and efficient logistics within its core, mature market.

This established infrastructure underpins consistent sales and robust cash generation from its primary cement and clinker products, even as demand growth moderates. In 2023, Anhui Conch Cement reported a revenue of ¥131.1 billion, demonstrating the scale and stability of its domestic operations.

Anhui Conch Cement’s exceptional operational efficiency and rigorous cost management are key drivers of its cash cow status. In the first quarter of 2025, the company achieved a remarkable 21% increase in net profit, even as revenue experienced an 11% downturn.

This resilience highlights their ability to maintain strong profit margins and generate substantial cash flow. Such performance is characteristic of a mature business unit operating effectively within a challenging, competitive domestic market, solidifying its position as a cash cow.

Stable Revenue from Core Cement and Clinker Sales

Anhui Conch Cement's core business, comprising cement and clinker sales, represents its primary cash cow. These products are the bedrock of the company's revenue, consistently generating a stable income. Even with fluctuating market conditions in China, the inherent demand for construction materials in both urban and rural development ensures a predictable revenue flow, solidifying their position as dependable cash generators.

In 2024, Anhui Conch Cement reported significant revenue from its core segments, underscoring their cash cow status. For instance, sales of cement and clinker products typically account for over 80% of the company's total net sales, demonstrating their overwhelming importance to the business's financial health.

- Core Business Dominance: Cement and clinker sales form the backbone of Anhui Conch's revenue, providing a predictable and substantial income stream.

- Resilient Demand: Despite broader economic headwinds, the fundamental need for cement and clinker in ongoing construction projects ensures a consistent baseline demand.

- Financial Stability: The stability of these sales contributes significantly to the company's overall financial resilience and ability to fund other ventures.

- 2024 Performance: Anhui Conch Cement's cement segment continued to be a major contributor to its financial results throughout 2024, reflecting its enduring market position.

High Cash Position and Financial Stability

Anhui Conch Cement's strong financial foundation is a key characteristic of its Cash Cow status. The company consistently maintains a high cash position, a testament to its stable and profitable operations.

As of 2024, Anhui Conch Cement reported bank deposits exceeding RMB 80 billion. This substantial liquidity, coupled with a low leverage ratio, underscores its robust financial health and stability.

This strong liquidity is primarily generated from its mature and well-established core cement businesses. The consistent cash flow from these operations provides the necessary capital for strategic investments in other segments of the company.

- High Cash Reserves: RMB 80 billion+ in bank deposits as of 2024.

- Low Leverage Ratio: Indicative of strong financial stability.

- Source of Funds: Generated from mature core operations.

- Strategic Importance: Provides capital for investments in other business areas.

Anhui Conch Cement's core cement and clinker sales are its primary cash cows, consistently generating substantial and stable income. This segment consistently contributes over 80% of the company's net sales, highlighting its unwavering importance to financial health.

Despite market fluctuations, the fundamental demand for construction materials ensures predictable revenue. For instance, in 2024, Anhui Conch Cement's cement segment remained a dominant contributor, reinforcing its enduring market position and cash-generating capabilities.

The company's operational efficiency and rigorous cost management further bolster this cash cow status. This allows for strong profit margins and significant cash flow generation, even amidst challenging market conditions.

Anhui Conch Cement's financial stability is a hallmark of its cash cow operations. As of 2024, the company held over RMB 80 billion in bank deposits, coupled with a low leverage ratio, underscoring its robust financial health.

| Segment | 2024 Revenue Contribution (Approximate) | Key Driver | Cash Flow Impact |

| Cement & Clinker Sales | 80%+ | Dominant domestic market share, stable demand | High, consistent generation |

| Concrete & Building Materials | Lower, but growing | Diversification efforts | Moderate, potential for growth |

Delivered as Shown

Anhui Conch Cement BCG Matrix

The Anhui Conch Cement BCG Matrix you are currently previewing is the complete and final report you will receive upon purchase. This comprehensive analysis, detailing Conch Cement's product portfolio within the Boston Consulting Group framework, is presented in its entirety, ready for immediate strategic application without any alterations or watermarks. You are viewing the exact document designed for in-depth business planning and competitive assessment.

Dogs

Anhui Conch Cement's older, less efficient production lines are likely positioned as Dogs in the BCG Matrix. In China's current market, characterized by overcapacity and stricter environmental rules, these facilities struggle. They often operate at lower utilization rates and incur higher costs than newer plants, thus contributing little to profits and possibly becoming a financial burden.

As of 2024, the Chinese cement industry faces significant challenges. Many older plants, particularly those lacking advanced emission control or energy-saving technologies, are becoming increasingly uneconomical. For instance, while overall cement production in China might see marginal growth, the profitability of less modern facilities is under pressure due to rising energy prices and the cost of compliance with new environmental standards, making them candidates for divestment or modernization.

Certain regions in China, especially those tied to a struggling housing market and few new infrastructure plans, can be seen as low-growth, low-market share areas for some of Anhui Conch Cement's weaker regional businesses.

These markets face ongoing weak demand and fierce price battles, turning them into cash traps where any investment yields little return.

For instance, Anhui Conch's sales in the Yangtze River Delta, a region experiencing a slowdown in real estate development, might show slower growth compared to other areas.

In 2023, the Chinese property sector saw a significant downturn, impacting cement demand in regions heavily dependent on construction, likely affecting Anhui Conch's performance in these specific saturated markets.

Anhui Conch Cement's commodity-grade cement products, characterized by low differentiation, likely face intense competition in saturated markets. This category, despite Anhui Conch's diverse portfolio, represents a significant portion of the cement industry where brand loyalty is minimal. Consequently, these products typically generate low profit margins.

In a low-growth environment, these undifferentiated cement offerings would struggle to capture market share or justify premium pricing. For instance, in 2024, the global cement market, while growing modestly, remains highly fragmented with numerous local players. This intensifies price pressures on commodity products, impacting Anhui Conch's profitability in this segment.

Underperforming Subsidiaries with Low Utilization

Given the broader trend of declining cement output in China, with industry-wide utilization rates hovering around 50% in 2024, it's probable that certain Anhui Conch Cement subsidiaries are experiencing significant underutilization. These facilities, particularly those lacking a distinct strategic edge or facing intense competition, are prime candidates for divestment or strategic restructuring.

These underperforming units, often characterized by low operational efficiency and minimal market share, represent a drag on overall profitability. The company must meticulously assess each subsidiary's contribution and potential for turnaround.

- Low Utilization Rates: Many subsidiaries may be operating well below their peak capacity, impacting economies of scale.

- Strategic Re-evaluation: Subsidiaries lacking a clear competitive advantage or strategic alignment are candidates for disposal.

- Divestment Potential: The sale of underperforming assets can unlock capital for more promising ventures.

High-Emission Clinker Production Lines

High-emission clinker production lines within Anhui Conch Cement's portfolio are likely positioned as Dogs in a BCG Matrix analysis, especially under China's current dual-control policies for energy and carbon emissions.

These older, less efficient lines face mounting operational costs due to stricter environmental regulations. This includes potential carbon taxes and the expense of retrofitting for greener production, directly impacting profitability.

Furthermore, demand from construction projects prioritizing sustainability may decline for products manufactured by these lines. This reduced market appeal further limits their growth potential and competitive standing.

- Decreasing Profitability: Higher compliance costs and potential fines squeeze margins.

- Limited Market Share Growth: Environmentally conscious projects may avoid their products.

- Operational Challenges: Increased scrutiny and potential shutdowns due to non-compliance.

- Low Growth Prospects: Difficulty in adapting to evolving environmental standards hinders future expansion.

Anhui Conch Cement's older, less efficient production lines, particularly those struggling with high emissions or located in low-demand regions, are classified as Dogs in the BCG Matrix. These operations often face low market share and slow growth, demanding significant capital for modernization or environmental compliance without yielding substantial returns. By 2024, China's cement industry, marked by overcapacity and stringent environmental regulations, makes these older facilities increasingly uneconomical, with many operating at significantly reduced utilization rates.

| Asset Category | BCG Classification | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Older, High-Emission Production Lines | Dog | Low efficiency, high operating costs, potential environmental penalties, low market share. | Struggling with stricter carbon emission standards and rising energy costs; facing reduced demand from green-focused projects. |

| Subsidiaries in Saturated, Low-Growth Regions | Dog | Weak demand, intense price competition, low profitability, high cash consumption. | Impacted by slowdowns in construction, particularly in areas like the Yangtze River Delta, where property market challenges persist. |

| Commodity-Grade Cement Products | Dog | Low differentiation, minimal brand loyalty, intense competition, low profit margins. | Facing price pressures in a fragmented market; industry-wide utilization rates around 50% in 2024 highlight overcapacity issues. |

Question Marks

Anhui Conch Cement's collaboration with Huawei, initiated in April 2024, focuses on building an AI model tailored for the cement industry. This ambitious project aims to cover over 200 application scenarios, spanning from raw material extraction to final product packaging, marking a substantial commitment to a rapidly advancing technological area. The potential for enhanced efficiency and operational optimization through this AI integration is considerable.

Currently, Anhui Conch Cement's market presence in AI solutions specifically for cement manufacturing is in its early stages. This positions the initiative as a 'Question Mark' within the BCG framework, indicating a high-growth potential that necessitates significant investment. The company must pour resources into developing and implementing these AI capabilities to solidify its position and achieve the anticipated benefits.

Anhui Conch Cement's investment in Carbon Capture, Utilization, and Storage (CCUS) initiatives positions it for long-term decarbonization, a sector poised for significant growth. However, these advanced technologies are currently capital-heavy and not yet widely profitable for cement manufacturers, indicating Anhui Conch is building market share in an emerging, unproven revenue stream.

Anhui Conch Cement's subsidiary, Conch New Energy, is strategically investing in a diverse portfolio of renewable energy projects, including wind, solar, and hydro power, alongside energy storage solutions. This initiative aims to significantly expand the company's green energy footprint and operational scale.

While this diversification aligns perfectly with global sustainability trends and presents promising long-term growth avenues, it represents a relatively nascent stage for Conch New Energy. The market share and profitability within these new energy sectors are still in their formative phases, indicating potential for substantial future development.

For instance, as of early 2024, China's renewable energy capacity continued its rapid ascent, with solar and wind power generation showing particularly robust growth. Conch New Energy's expansion into these areas positions it to capitalize on this burgeoning market.

Exploration of Novel Low-Clinker Cementitious Materials

Anhui Conch Cement is actively exploring novel low-clinker cementitious materials, a strategic move targeting a segment with significant growth potential due to increasing environmental regulations and demand for reduced carbon footprints. The company established China's first demonstration line for these materials in November 2024, signaling a strong commitment to innovation in this area.

These advanced materials, while promising, are currently in the nascent stages of market adoption. This means they face challenges related to consumer acceptance, standardization, and the need for substantial investment to scale production and build market share. The initial investment required for research, development, and establishing new production capabilities places these materials in a challenging position within the BCG matrix.

- Market Potential: The global market for low-carbon cement is projected to grow significantly, driven by net-zero targets and sustainable construction initiatives.

- R&D Investment: Anhui Conch's establishment of a demonstration line indicates a substantial upfront investment in developing and validating these new materials.

- Market Adoption: Widespread adoption is contingent on cost-competitiveness, performance validation, and regulatory support, which are still developing for these novel products.

- Competitive Landscape: While Anhui Conch is a pioneer in China, the competitive landscape for sustainable cement solutions is evolving globally.

Expansion into Niche, High-Performance Building Materials

Anhui Conch Cement is strategically broadening its horizons beyond traditional cement production by venturing into niche, high-performance building materials. This expansion includes manufacturing advanced ceramic tile adhesives and dry mix mortars, products designed to meet sophisticated construction needs and capitalize on emerging market trends. For instance, the global tile adhesive market was valued at approximately USD 30 billion in 2023 and is projected to grow significantly, offering substantial opportunities for Anhui Conch.

These specialized materials represent a move towards higher-margin products, distinguishing themselves from the commodity nature of cement. The demand for advanced mortars, particularly those offering enhanced durability and ease of application, is on the rise in both residential and commercial construction sectors. The global dry mortar market, estimated at over USD 60 billion in 2023, underscores the vast potential in this segment.

- Focus on High-Performance: Manufacturing specialized ceramic tile adhesives and dry mix mortars.

- Market Opportunity: Catering to evolving construction demands with potential for high growth.

- Market Share Challenge: Likely low initial market share in these specific niche segments.

- Strategic Imperative: Requires dedicated marketing efforts and investment to gain traction.

Anhui Conch Cement's ventures into artificial intelligence for cement manufacturing and low-clinker cementitious materials represent classic Question Marks. These areas demand significant investment due to their high growth potential but currently hold low market share and profitability. The company is investing heavily to develop these nascent technologies and establish a future market position.

BCG Matrix Data Sources

Our Anhui Conch Cement BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.