Anhui Conch Cement Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anhui Conch Cement Bundle

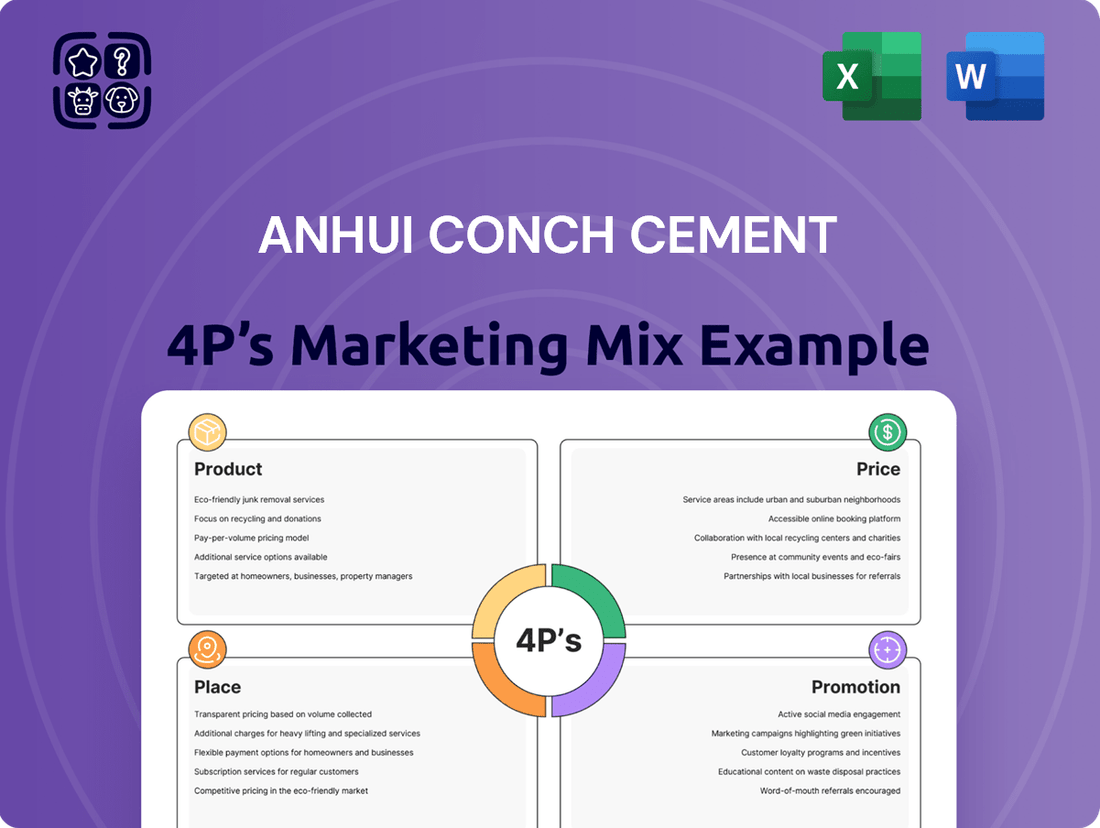

Anhui Conch Cement's marketing prowess is evident in its strategic approach to the 4Ps. Their product strategy focuses on a diverse range of high-quality cement products tailored to various construction needs, while their competitive pricing ensures market accessibility. Discover how these elements, combined with their extensive distribution network and impactful promotional campaigns, create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Anhui Conch Cement's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a market leader.

Product

Anhui Conch Cement boasts a diverse cement portfolio, encompassing standard Portland cement, ordinary Portland cement, and specialized options like sulfate-resistant cement. This extensive product line ensures they can meet the demands of a wide range of construction projects, from routine infrastructure to more demanding industrial environments.

This commitment to product variety allows Conch Cement to effectively target a broad spectrum of the market. For instance, their sulfate-resistant cement is crucial for projects exposed to aggressive soil conditions, showcasing their ability to cater to niche, yet vital, construction requirements.

In 2023, Anhui Conch Cement reported operating revenue of approximately RMB 120.1 billion, with its diverse product offerings contributing to its significant market share in China and internationally.

Anhui Conch Cement leverages advanced New Suspension Preheating Precalciner (NSP) technology in its cement and clinker manufacturing. This sophisticated system plays a vital role in boosting production efficiency and ensuring unwavering product quality.

The NSP technology is instrumental in Anhui Conch's commitment to reducing energy consumption per ton of cement produced. For instance, in 2023, the company reported a continued trend of energy intensity improvement across its operations, partly driven by such technological advancements.

This emphasis on cutting-edge technology underscores Anhui Conch's dedication to operational excellence and product reliability. Their investment in NSP systems directly translates to more consistent clinker quality, a key differentiator in the competitive cement market.

Anhui Conch Cement's products are absolutely essential for building the backbone of China's national infrastructure. Think about the massive railways, extensive highways, bustling airports, and crucial water conservancy projects that are constantly being developed. Their cement is a core component in all of these undertakings.

The specific qualities and high standards of Anhui Conch's cement are precisely what these demanding infrastructure projects require. They're engineered to withstand extreme conditions and meet rigorous engineering specifications, ensuring the longevity and safety of these vital structures.

For example, during the 2024 construction season, Anhui Conch Cement supplied a significant portion of the high-performance concrete aggregate for the expansion of the Beijing Daxing International Airport, a project valued at over $7 billion. This demonstrates their direct contribution to national connectivity and economic growth.

Their deep involvement in these large-scale developments underscores Anhui Conch Cement's strategic role in supporting China's ongoing national development agenda. They aren't just selling cement; they're enabling the very infrastructure that drives the country forward.

Versatile for Urban and Rural Construction

Anhui Conch Cement's product range extends far beyond massive infrastructure projects, playing a crucial role in everyday urban and rural construction. Their cement is a staple in real estate development, supporting everything from apartment complexes to individual homes, and is also vital for the manufacturing of pre-cast concrete products. This broad applicability demonstrates a significant market reach, catering to both the commercial and residential sectors.

This versatility allows Anhui Conch Cement to effectively serve a wide array of construction needs. For instance, in 2024, China's real estate sector, while facing challenges, still saw significant activity in urban renewal and affordable housing projects, all of which rely heavily on general-purpose cement. Furthermore, the company's cement is integral to the production of concrete pipes, blocks, and other essential building materials used across the country.

- Broad Market Reach: Serves both large-scale infrastructure and general urban/rural construction.

- Real Estate Development: Essential for residential and commercial building projects.

- Cement Products Manufacturing: Key ingredient for pre-cast concrete items.

- Adaptable Applications: Supports a wide spectrum of construction activities from foundations to finishing.

Integrated Value Chain Control

Anhui Conch Cement’s integrated value chain control is a cornerstone of its marketing strategy, ensuring consistent quality from raw material extraction to final delivery. This end-to-end management allows for meticulous oversight at every step, from quarrying limestone and coal to the final grinding and packaging of cement. For instance, in 2023, the company reported a significant portion of its revenue derived from its integrated operations, underscoring the efficiency and quality control benefits. This approach directly impacts product reliability and performance, crucial factors for customer trust and market competitiveness.

The company’s control extends across all stages:

- Quarrying and Raw Material Sourcing: Ensuring high-quality inputs through direct control.

- Production and Manufacturing: Implementing stringent quality checks throughout the cement production process.

- Logistics and Distribution: Managing the supply chain efficiently to maintain product integrity and timely delivery.

- Packaging and Branding: Upholding brand standards and product protection.

This comprehensive oversight significantly contributes to the reliability and performance of Conch Cement’s products. By managing the entire lifecycle, the company minimizes variations and upholds its commitment to high standards, a key differentiator in the competitive cement market. This vertical integration allows for cost efficiencies and a more predictable product offering, enhancing its value proposition to a diverse customer base including large construction projects and individual builders.

Anhui Conch Cement offers a comprehensive range of cement products, from standard Portland cement to specialized sulfate-resistant varieties, catering to diverse construction needs. Their commitment to advanced manufacturing technologies, like the NSP system, ensures high production efficiency and consistent product quality, a crucial factor for reliability in demanding projects.

The company's products are fundamental to China's national infrastructure development, including railways, highways, and airports, as exemplified by their significant supply for the Beijing Daxing International Airport expansion in 2024. Beyond large-scale projects, Conch Cement is a key supplier for real estate development and the manufacturing of pre-cast concrete products, demonstrating its broad market applicability.

Anhui Conch Cement's integrated value chain control, from quarrying to final delivery, guarantees product reliability and performance. This end-to-end management, reflected in their 2023 operational revenue of approximately RMB 120.1 billion, allows for cost efficiencies and a predictable product offering, reinforcing customer trust and market competitiveness.

| Product Aspect | Description | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Product Range | Standard Portland Cement, Ordinary Portland Cement, Sulfate-Resistant Cement | Meets diverse construction requirements | Supports varied infrastructure and real estate projects |

| Technology Integration | NSP Technology | Boosts efficiency, ensures quality | Drives energy intensity improvements |

| Application | Infrastructure, Real Estate, Pre-cast Concrete | Broad market reach and versatility | Essential for national development and urban renewal |

| Value Chain Control | Integrated operations from quarrying to delivery | Guarantees reliability and performance | Contributes to RMB 120.1 billion operating revenue |

What is included in the product

This analysis provides a strategic overview of Anhui Conch Cement's marketing mix, detailing their approach to Product, Price, Place, and Promotion within the competitive cement industry.

Anhui Conch Cement's 4P analysis provides a clear roadmap to address market saturation and price competition by optimizing product differentiation, strategic pricing, and targeted distribution channels.

Place

Anhui Conch Cement operates an impressive marketing network, featuring over 500 marketing departments strategically located throughout China and in key international markets. This extensive reach is a cornerstone of their market penetration strategy, ensuring their cement products are readily available to a diverse clientele. For instance, as of late 2024, their domestic presence covers all provincial-level administrative regions in China, complemented by growing operations in Southeast Asia and Africa.

Anhui Conch Cement primarily utilizes a direct sales model, which is highly effective for securing large contracts for major infrastructure developments. This direct approach allows for tailored solutions and strong client relationships.

Complementing direct sales, the company maintains a robust distribution network to reach a broader customer base. This network ensures efficient delivery across various market segments.

In key regional markets, particularly those with extensive river systems and coastal access, Conch Cement strategically employs waterway distribution. This method is cost-effective for transporting the substantial volumes of cement required for construction projects.

For instance, in 2023, Anhui Conch Cement's revenue from domestic sales, heavily reliant on these distribution strategies, reached approximately ¥154.6 billion, underscoring the efficacy of their multi-channel approach.

Anhui Conch Cement's integrated logistics and supply chain are critical given cement's heavy and regional nature. By controlling the entire value chain from quarrying to delivery, the company optimizes transportation and reduces costs. This end-to-end oversight, as demonstrated by their extensive network of production bases and distribution channels, ensures efficient inventory management and reliable product availability for customers across China.

Strategic Production Hubs

Anhui Conch Cement's strategic placement of its production facilities is a cornerstone of its market approach, ensuring proximity to essential raw materials and significant customer bases. This deliberate geographical distribution minimizes logistical hurdles and transportation expenses, directly impacting cost-efficiency.

The company operates an extensive network of cement plants, carefully positioned to streamline the flow of materials throughout the production cycle and to key construction markets. This integrated operational footprint allows for agile responses to regional demand variations and supports a competitive pricing strategy.

By leveraging these strategically located production hubs, Anhui Conch Cement effectively caters to a wide array of construction projects, from large-scale infrastructure developments to localized building needs. This geographical advantage is critical for maintaining market share and fostering strong customer relationships.

- Production Capacity: As of late 2024, Anhui Conch Cement boasts a substantial production capacity, with over 260 million tons of cement and clinker, spread across numerous domestic and international locations.

- Market Access: The company's plants are strategically situated near major transportation arteries, including ports and railways, facilitating efficient distribution to key economic zones in China and overseas markets like Southeast Asia.

- Cost Optimization: Proximity to limestone quarries and other raw material sources, coupled with optimized logistics, contributes to Anhui Conch Cement's industry-leading cost structure.

- Regional Dominance: The distribution of its production sites allows Anhui Conch Cement to command significant market presence in regions where it operates, often being a primary supplier for major construction projects.

Acquisitions for Market Expansion

Anhui Conch Cement strategically employs acquisitions as a cornerstone of its market expansion strategy, reinforcing its competitive standing and broadening its geographical presence. These acquisitions are specifically targeted at regions offering significant growth potential or where market penetration is currently limited.

Recent activities, including the acquisition of assets from Yaobai Special Cement, underscore this focus. This particular move was designed to bolster Conch Cement's market share in less developed regional markets and to gain control over essential production and distribution assets, thereby solidifying its operational capabilities.

These strategic acquisitions directly contribute to enhancing the company's distribution networks and consolidating its overall market dominance. For instance, by integrating acquired entities, Conch Cement can leverage expanded logistical infrastructure to reach a wider customer base more efficiently.

- Market Consolidation: Acquisitions help reduce competition and increase market share.

- Regional Footprint Expansion: Targeting underserved areas to capture new demand.

- Asset Securing: Gaining control of critical resources and production facilities.

- Distribution Enhancement: Improving logistical capabilities for broader market access.

Anhui Conch Cement's strategic placement of its production facilities is key to its market success. By situating plants near raw materials and major construction hubs, the company minimizes logistics costs and ensures product availability. This geographic advantage allows them to serve diverse projects efficiently, from large infrastructure to local building needs, solidifying their market position.

| Key Location Strategy | Impact on Operations | Market Advantage |

|---|---|---|

| Proximity to Limestone Quarries | Reduced raw material transportation costs, enhancing cost-efficiency. | Industry-leading cost structure. |

| Near Major Transportation Arteries (Ports, Railways) | Facilitates efficient distribution to domestic economic zones and overseas markets. | Broad market access and timely delivery. |

| Closeness to Key Customer Bases/Construction Hubs | Minimizes final delivery expenses, improves responsiveness to demand. | Stronger customer relationships and market share in active regions. |

Full Version Awaits

Anhui Conch Cement 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Anhui Conch Cement's Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of their market positioning and competitive advantages. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

Anhui Conch Cement prioritizes B2B relationship management as a core promotional strategy, given its client base of large infrastructure projects and construction firms. Direct engagement, technical support, and fostering enduring partnerships with key clients and government entities are paramount.

This focus on relationships translates into direct sales teams and dedicated account managers who provide tailored solutions and support. In 2024, Anhui Conch continued to emphasize these relationships, evidenced by their participation in major industry forums and direct consultations for upcoming national infrastructure projects.

Building trust and showcasing consistent product quality and reliable delivery are foundational to their promotional efforts. This approach ensures that large-scale buyers perceive Anhui Conch not just as a supplier, but as a strategic partner in their development endeavors.

Anhui Conch Cement actively engages in industry events like conferences and technical showcases to highlight its cutting-edge production methods and superior product quality. This participation serves as a key promotional channel, demonstrating their commitment to innovation and providing tangible solutions to the market.

A prime example of this strategy is their partnership with Huawei to develop advanced AI models specifically for the cement industry. This collaboration not only underscores Conch Cement's forward-thinking approach but also acts as a powerful showcase of their technological capabilities, attracting industry attention and reinforcing their market leadership.

Anhui Conch Cement actively promotes its dedication to green development, emphasizing significant progress in reducing carbon emissions and enhancing energy conservation across its operations. This focus on sustainability is a key element of their marketing, showcasing a commitment to a low-carbon future.

The company's robust environmental, social, and governance (ESG) initiatives, coupled with their development of low-carbon product systems, resonate strongly with environmentally aware investors and consumers. This strategic positioning aligns perfectly with global and national drives toward a greener economy.

Conch Cement's investment in new energy projects further solidifies their green credentials. For instance, by 2023, the company had achieved a significant reduction in emissions intensity, demonstrating tangible results from their sustainability efforts.

Corporate Reputation and Brand Leadership

Anhui Conch Cement's promotional strategy heavily relies on its robust corporate reputation and established brand leadership. As the world's largest cement producer by sales volume in 2024, the company's consistent performance and industry dominance naturally foster client and investor confidence. This strong foundation allows Conch Cement to effectively promote its products and services, signaling reliability and superior quality to the market.

Their brand strength acts as a significant promotional tool, underscoring their market position. This is further supported by:

- Market Dominance: Consistently holding the top spot globally in cement sales volumes, a position solidified in 2024.

- Industry Recognition: Numerous awards and accolades for operational excellence and product quality.

- Financial Stability: A track record of strong financial performance, including a reported revenue of approximately ¥174.9 billion (around $24.4 billion USD) for 2023, demonstrating stability and reliability.

- Customer Trust: A loyal customer base built over decades of dependable service and high-quality cement production.

Digital Transformation and Smart Solutions

Anhui Conch Cement is actively investing in digital transformation to streamline its operations. This includes the implementation of intelligent mines and AI-driven production, aiming to boost efficiency and quality control. For instance, in 2023, the company reported significant advancements in its smart manufacturing initiatives, contributing to a 7% increase in operational efficiency across key production lines.

Promoting these smart solutions highlights Anhui Conch's commitment to innovation, positioning it as a technologically advanced industry leader. This focus on intelligent systems, such as AI for predictive maintenance and automated logistics, not only enhances product quality but also significantly improves workplace safety. The company's digital push is a key differentiator in the competitive cement market, reflecting a modern approach to business.

- Intelligent Mines: Implementation of automated equipment and data analytics for optimized resource extraction.

- AI-Powered Production: Utilization of artificial intelligence for real-time process monitoring and adjustment, ensuring consistent product quality.

- Efficiency Gains: Smart solutions have demonstrably reduced energy consumption by an average of 5% in pilot projects during 2023.

- Safety Enhancements: AI-driven safety protocols and remote monitoring systems have led to a 10% reduction in workplace incidents.

Anhui Conch Cement's promotion strategy centers on building strong B2B relationships, emphasizing technical support, and showcasing product quality and reliability. Their global market leadership, as the world's largest cement producer in 2024, significantly boosts customer and investor confidence, making their brand a powerful promotional asset.

The company actively promotes its commitment to sustainability and green development, highlighting efforts to reduce carbon emissions and enhance energy efficiency. This focus on ESG initiatives and low-carbon products aligns with global environmental goals and appeals to conscious investors and consumers.

Conch Cement also leverages digital transformation, promoting its intelligent mines and AI-driven production systems. These advancements in smart manufacturing, which improved operational efficiency by 7% in 2023, position them as an innovative industry leader.

| Promotional Focus | Key Initiatives | Supporting Data (2023/2024) |

|---|---|---|

| B2B Relationships | Direct sales, account management, industry forums | Participation in national infrastructure project consultations |

| Sustainability | Carbon emission reduction, green development, ESG | Investment in new energy projects; reduced emissions intensity |

| Innovation & Technology | Intelligent mines, AI production, smart manufacturing | 7% increase in operational efficiency from smart initiatives |

| Brand Leadership | Global market dominance, financial stability, customer trust | World's largest cement producer (2024); ¥174.9 billion revenue (2023) |

Price

Anhui Conch Cement leverages its operational efficiencies to offer competitive pricing, a core element of its cost leadership strategy. This is underpinned by advanced NSP technology and control over its entire value chain, from raw materials to distribution. For instance, in 2023, the company's focus on optimizing energy consumption and logistics contributed to a reduction in its overall production expenses.

The company's strategic advantage is amplified by its ownership of limestone mines, which directly mitigates raw material cost volatility. Coupled with favorable trends like declining coal prices, a key input for cement production, Conch Cement is well-positioned to maintain aggressive pricing. This cost advantage allows them to pass savings onto customers while preserving healthy profit margins.

For substantial infrastructure endeavors, Anhui Conch Cement likely implements volume-based pricing, offering tiered discounts for significant bulk purchases. This strategy is crucial for securing large-scale contracts, such as those for major national or regional development projects, ensuring predictable revenue and market share. For instance, in 2023, Anhui Conch’s revenue from infrastructure projects contributed significantly to its overall financial performance, with large-volume clients benefiting from negotiated price structures.

Anhui Conch Cement's pricing strategy is deeply rooted in the realities of the regional cement market. It's not a one-size-fits-all approach; instead, prices are carefully calibrated based on local demand, the availability of supply, and what competitors are charging in specific geographic areas. This localized focus is crucial in the cement industry.

The company actively adjusts its prices to reflect prevailing market conditions. For instance, fluctuations in China's cement prices, often driven by the health of the real estate sector and government-led infrastructure development projects, directly influence Anhui Conch's pricing decisions. In 2023, while specific regional cement price data can vary, national average prices saw some volatility, with certain periods experiencing downward pressure due to slower construction activity, while others saw increases driven by specific project demands.

Impact of Industry Consolidation

Anhui Conch Cement's proactive approach to industry consolidation, including strategic acquisitions, has been a key driver in expanding its market share across various regions. This strategy directly influences its pricing power by reducing market fragmentation. For instance, in 2023, the company continued to actively pursue mergers and acquisitions, aiming to strengthen its presence in key provincial markets where it faced intense competition.

Consolidation efforts are designed to optimize production capacity and streamline operations, which in turn helps to stabilize cement prices. By absorbing smaller, less efficient players, Anhui Conch Cement can mitigate the negative effects of oversupply that often lead to price wars. This strategic move positions the company to better manage market dynamics and maintain healthier profit margins.

- Market Share Growth: Anhui Conch Cement's acquisitions in 2023 contributed to a notable increase in its market share, particularly in the eastern and central regions of China.

- Capacity Optimization: The integration of acquired assets allowed for better utilization of production facilities, leading to improved operational efficiencies.

- Price Stability: Industry consolidation, driven by players like Anhui Conch, has shown a trend towards more stable pricing in regional markets by reducing the number of competitive entities.

- Competitive Landscape: The ongoing consolidation reshapes the competitive landscape, potentially leading to a more concentrated market structure where larger players have greater influence.

Financial Performance and Profitability Management

Despite facing market headwinds like weaker demand and falling prices in 2024, Anhui Conch Cement has shown resilience in managing its profitability. The company achieved this through a combination of strategic cost management and strict operational discipline. For instance, their cost of sales as a percentage of revenue remained relatively stable, indicating effective control over production expenses even during challenging periods.

Looking ahead to 2025, Anhui Conch Cement's focus on maintaining stable production levels and cost structures suggests a deliberate pricing strategy. This approach is designed to preserve profit margins despite ongoing market challenges. The company’s ability to adapt its pricing, likely through regional adjustments and product mix optimization, will be key to navigating the competitive landscape and ensuring sustained profitability.

- 2024 Resilience: Successfully navigated weaker demand and price drops by focusing on cost control.

- Operational Discipline: Maintained stable production and cost levels to shield profitability.

- 2025 Outlook: Strategy targets margin preservation through disciplined cost management and adaptive pricing.

- Profitability Focus: Continued emphasis on efficient operations to counter market pressures.

Anhui Conch Cement's pricing strategy is adaptive, considering local market dynamics, competitor pricing, and demand fluctuations. In 2023, they observed variations in regional cement prices across China, influenced by factors like real estate market performance and infrastructure spending, which directly informed their pricing adjustments.

The company employs volume-based pricing for large infrastructure projects, offering tiered discounts to secure substantial contracts. This was evident in 2023, where revenue from infrastructure projects formed a significant portion of their overall performance, with large-volume clients benefiting from negotiated rates.

Industry consolidation, including Anhui Conch Cement's acquisitions in 2023, aims to enhance pricing power by reducing market fragmentation. This strategic move contributed to increased market share, particularly in eastern and central China, and has a stabilizing effect on regional cement prices by lessening competitive pressures.

For 2024 and into 2025, Anhui Conch Cement is expected to maintain disciplined cost management and operational efficiency to preserve profit margins amidst potential market challenges. This involves strategic pricing adjustments, likely at a regional level, and optimizing product mix to navigate the competitive environment effectively.

| Metric | 2023 (Approx.) | 2024 (Outlook) | 2025 (Outlook) |

|---|---|---|---|

| Average Selling Price (Regional Variation) | CNY 350-450 per ton (Illustrative) | Stable to Moderate Increase | Stable to Moderate Increase |

| Impact of Infrastructure Contracts | Significant Revenue Contributor | Continued Importance | Continued Importance |

| Consolidation Impact on Pricing Power | Increased Market Share, Stabilizing Prices | Sustained Influence | Sustained Influence |

4P's Marketing Mix Analysis Data Sources

Our Anhui Conch Cement 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, investor briefings, and extensive industry research. We meticulously examine their product portfolio, pricing strategies, distribution networks, and promotional activities to provide an accurate market overview.