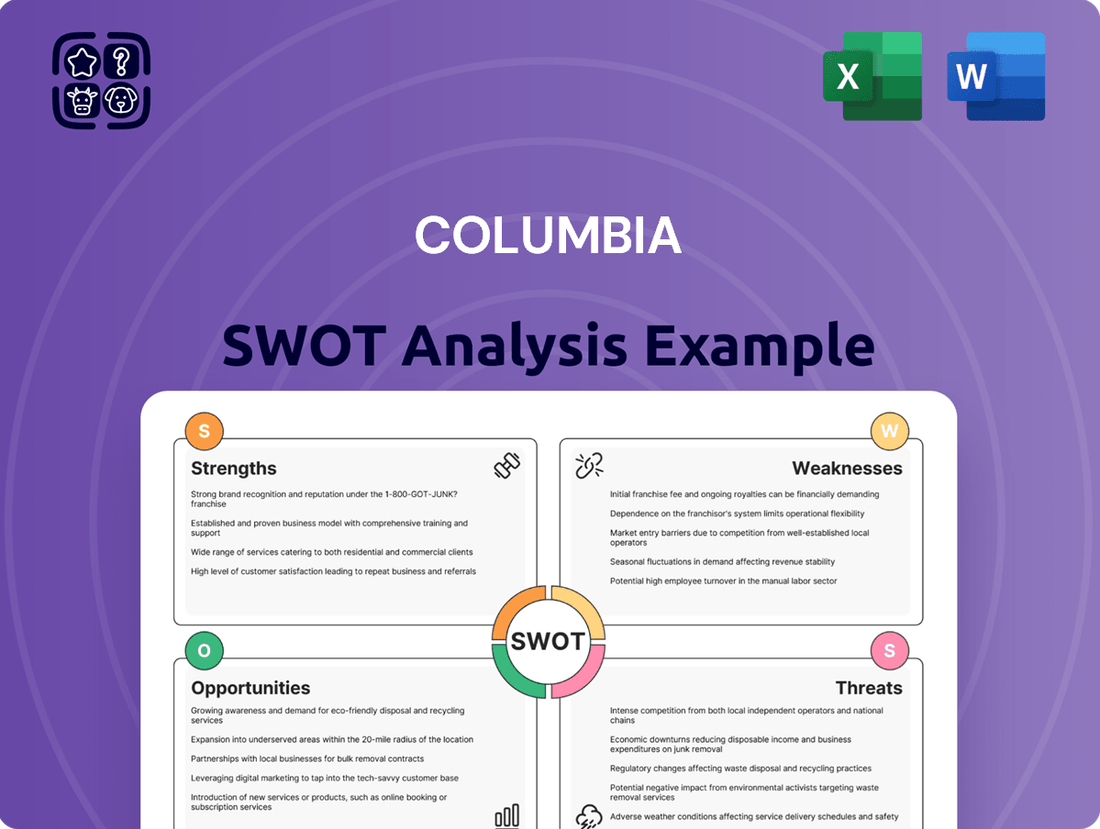

Columbia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

Columbia's strong brand recognition and diverse product offerings are significant strengths, but they also face intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Columbia's market position and future potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Columbia Sportswear Company boasts a robust brand portfolio, featuring established names like Columbia, SOREL, Mountain Hardwear, and prAna. This strategic diversification allows the company to effectively target different niches within the outdoor and lifestyle apparel markets, thereby broadening its customer appeal and mitigating risks associated with over-reliance on a single brand.

The flagship Columbia brand remains a significant growth engine for the company. Complementing this, SOREL offers a distinct footwear focus, while prAna provides a unique lifestyle and yoga-inspired apparel offering, each contributing to Columbia's overall market presence and revenue streams.

Columbia Sportswear boasts an impressive global footprint, with its products available in over 100 countries, underscoring its significant market presence. This extensive distribution network, encompassing wholesale, direct-to-consumer (DTC), and licensing agreements, serves as a powerful engine for sales and brand visibility on a worldwide scale.

International regions, particularly EMEA (Europe, Middle East, and Africa) and LAAP (Latin America and Asia Pacific), have demonstrated robust growth trajectories. For instance, in the first quarter of 2024, Columbia reported a 10% increase in net sales in the EMEA region, reaching $205 million, and a 15% rise in LAAP to $140 million, helping to counterbalance any softness experienced domestically.

Columbia consistently invests heavily in product innovation, a key strength that sets it apart. Recent advancements include Omni-Heat™ Infinity and the new Omni-Heat™ Arctic insulation, showcasing their commitment to developing cutting-edge technologies.

These innovations directly translate into enhanced performance, comfort, and functionality for Columbia's apparel and footwear. This technological edge provides a significant competitive advantage, particularly appealing to discerning outdoor enthusiasts who prioritize quality and advanced features in their gear.

Commitment to Sustainability and Corporate Responsibility

Columbia Sportswear's dedication to sustainability and corporate responsibility is a significant strength. Their 2024 Impact Report details substantial progress, including surpassing 80% of their Planet Water goal and actively reducing energy usage across their operations. These initiatives not only align with growing consumer demand for ethical brands but also bolster Columbia's overall image.

Key aspects of their commitment include:

- Environmental Stewardship: Exceeding 80% of their Planet Water goal demonstrates a tangible impact on water conservation.

- Operational Efficiency: Reductions in energy consumption at their facilities highlight a focus on minimizing their carbon footprint.

- Social Impact: Programs like RISE are in place to promote worker well-being, underscoring a commitment to ethical labor practices.

- Brand Reputation: These efforts resonate with environmentally and socially conscious consumers, enhancing brand loyalty and appeal.

Solid Financial Position and Inventory Management

Columbia Sportswear demonstrates a robust financial standing, notably maintaining substantial cash reserves. As of the first quarter of 2024, the company reported cash and cash equivalents of $565.6 million, with no outstanding debt. This strong liquidity position allows for operational flexibility and strategic investment.

The company has also effectively addressed inventory levels. By the end of Q1 2024, Columbia had reduced its inventory by approximately 15% compared to the previous year, a move that directly supported gross margin expansion. This improved inventory turnover is crucial for profitability and efficient capital allocation.

- Strong Liquidity: $565.6 million in cash and cash equivalents as of Q1 2024, with zero debt.

- Inventory Reduction: Approximately 15% decrease in inventory year-over-year by Q1 2024.

- Margin Improvement: Inventory management efforts have contributed to gross margin expansion.

- Financial Resilience: Solid financial health provides a buffer against market volatility and supports growth initiatives.

Columbia's diverse brand portfolio, including Columbia, SOREL, Mountain Hardwear, and prAna, allows it to capture various market segments. This strategy broadens customer appeal and reduces reliance on any single brand. The flagship Columbia brand continues to be a key driver, supported by SOREL's footwear focus and prAna's lifestyle offerings, all contributing to diversified revenue streams.

Columbia's global reach is a significant asset, with products available in over 100 countries through wholesale, DTC, and licensing. This extensive network fuels sales and brand awareness worldwide. Emerging markets like EMEA and LAAP are showing strong growth; for example, EMEA sales increased by 10% to $205 million in Q1 2024, and LAAP sales rose 15% to $140 million, balancing domestic performance.

Continuous investment in product innovation, such as Omni-Heat™ Infinity and Omni-Heat™ Arctic insulation, provides a competitive edge. These technologies enhance product performance and appeal to consumers seeking advanced gear. Furthermore, Columbia's commitment to sustainability, evidenced by exceeding 80% of its Planet Water goal and reducing energy usage as detailed in its 2024 Impact Report, strengthens its brand image among conscious consumers.

Financially, Columbia maintains a strong position with $565.6 million in cash and cash equivalents and no debt as of Q1 2024. The company also successfully reduced inventory by approximately 15% year-over-year by Q1 2024, which aided gross margin expansion. This financial health provides resilience and supports strategic growth initiatives.

| Strength | Description | Supporting Data (Q1 2024) |

|---|---|---|

| Brand Portfolio | Diversified brands targeting different market niches. | Columbia, SOREL, Mountain Hardwear, prAna. |

| Global Footprint | Extensive distribution in over 100 countries. | EMEA sales +10% ($205M), LAAP sales +15% ($140M). |

| Product Innovation | Investment in advanced technologies for enhanced performance. | Omni-Heat™ Infinity, Omni-Heat™ Arctic insulation. |

| Financial Strength | Strong liquidity and debt-free status. | $565.6M cash, 0 debt. |

| Inventory Management | Effective reduction leading to margin improvement. | ~15% inventory reduction YoY. |

What is included in the product

Analyzes Columbia’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Columbia Sportswear has faced significant headwinds in its core U.S. market, a key weakness impacting its overall performance. Declining net sales in recent quarters, particularly in the latter half of 2023 and early 2024, highlight this domestic struggle. For instance, the company reported a 12% decrease in U.S. wholesale net sales in the fourth quarter of 2023 compared to the previous year.

This downturn in the U.S. is largely driven by a slowdown in consumer spending and reduced wholesale orders from key retail partners. Factors such as unseasonably warm weather during critical selling periods and broader challenges within the outdoor apparel and footwear categories have dampened demand. This domestic softness contrasts sharply with Columbia's more robust performance in international markets, underscoring the U.S. as a primary area needing strategic attention for growth.

While the core Columbia brand demonstrates resilience, a notable weakness lies in the underperformance of its specialty brands. SOREL, for instance, experienced a significant 10% revenue drop in the second quarter of 2025, signaling a challenging period for the footwear segment. Similarly, prAna, the yoga and lifestyle apparel brand, has also reported decreases in sales, indicating a broader issue with these niche offerings.

Columbia Sportswear has highlighted concerns regarding tariffs as a key factor in withdrawing its 2025 financial forecast. The company's projections for the upcoming year are based on an assumption that U.S. tariffs on imported goods will stay at 10%, with the exception of China, where tariffs remain at 30%.

These tariff assumptions directly influence Columbia's cost structure and, consequently, its profitability. The ongoing geopolitical landscape adds another layer of complexity, introducing market volatility that can disrupt supply chains and impact consumer spending patterns.

Increased Selling, General & Administrative (SG&A) Expenses

Columbia Sportswear has seen an increase in its Selling, General & Administrative (SG&A) expenses. This rise is largely attributed to greater spending in direct-to-consumer (DTC) channels and increased demand creation efforts. For instance, in the first quarter of 2024, SG&A expenses were $318.5 million, up from $308.2 million in the same period of 2023, representing an increase in the SG&A as a percentage of net sales.

While these investments are often strategic, aiming to build brand equity and customer relationships, a sustained increase in SG&A as a proportion of net sales poses a challenge. If revenue growth does not outpace these rising costs, it can put pressure on Columbia's overall profitability and operating margins.

- Increased DTC Investment: Higher costs associated with expanding and operating Columbia's direct-to-consumer channels, including e-commerce and owned retail stores.

- Demand Creation Expenses: Greater spending on marketing, advertising, and promotional activities to drive consumer demand for its products.

- Impact on Profitability: Rising SG&A as a percentage of net sales can erode profit margins if not effectively offset by corresponding revenue growth or cost efficiencies elsewhere.

- Q1 2024 SG&A: Reached $318.5 million, an increase from $308.2 million in Q1 2023, highlighting the growing expense base.

Dependence on Wholesale Channel

Columbia's continued reliance on its wholesale channel presents a significant weakness. This was evident in the first and third quarters of 2024, where the company saw declines in this segment due to reduced retailer orders. This dependence leaves Columbia vulnerable to shifts in wholesale demand and inventory challenges faced by its retail partners, potentially hindering overall revenue growth despite direct-to-consumer (DTC) initiatives.

The impact of this wholesale dependence is clear:

- Wholesale Declines: Q1 2024 and Q3 2024 saw lower orders from wholesale partners, directly impacting sales performance.

- Retailer Vulnerability: Fluctuations in retailer demand and their inventory management issues directly affect Columbia's order volumes.

- DTC Growth Lag: While DTC efforts are underway, they haven't fully offset the challenges within the larger wholesale segment.

Columbia's reliance on its wholesale channel remains a notable weakness, as demonstrated by declining net sales in this segment during Q1 2024 and Q3 2024. This dependence makes the company susceptible to shifts in retailer demand and inventory management issues, potentially limiting overall growth despite DTC investments.

The underperformance of its specialty brands, such as SOREL and prAna, also presents a challenge. SOREL, for example, saw a 10% revenue drop in Q2 2025, indicating difficulties in these niche markets that require strategic attention to revitalize sales.

| Brand | Q2 2025 Performance | Impact |

| SOREL | 10% Revenue Drop | Weakness in footwear segment |

| prAna | Sales Decreases | Underperformance in lifestyle apparel |

| Wholesale (Overall) | Declines in Q1 & Q3 2024 | Vulnerability to retailer demand |

Same Document Delivered

Columbia SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you're getting the exact, professional SWOT analysis you expect.

You are previewing the actual analysis document. Buy now to access the full, detailed report, which is identical to this preview.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, providing you with the complete, ready-to-use report.

Opportunities

Columbia Sportswear sees a significant opportunity in expanding its presence in international markets, especially within the EMEA (Europe, Middle East, and Africa) and LAAP (Latin America and Asia Pacific) regions. These areas have shown robust growth, indicating a strong demand for Columbia's products.

Further investment and expansion in these regions, coupled with tailored product assortments and targeted marketing campaigns, can significantly boost Columbia's net sales. This strategy also offers a valuable path to diversify revenue, reducing reliance on the U.S. market, which has faced its own set of challenges. For instance, Columbia's international wholesale net sales saw a notable increase in recent periods, reflecting the potential of these markets.

Columbia's direct-to-consumer (DTC) channels present a significant growth opportunity, especially as wholesale channels face challenges. The company has seen its DTC net sales climb, with a notable contribution from its physical stores.

By continuing to invest in digital infrastructure and improving the online shopping experience, Columbia can further capitalize on this trend. Expanding their brick-and-mortar presence also offers a path to increased profitability and stronger brand oversight.

For instance, Columbia reported a 10% increase in DTC net sales in the first quarter of 2024, driven by strong performance in its owned retail stores. This segment typically offers higher gross margins compared to wholesale.

Columbia's 'ACCELERATE' strategy specifically targets younger, more active consumers through updated marketing and product lines. This initiative aims to revitalize the brand's appeal, potentially boosting sales in the lucrative outdoor and lifestyle segments. For instance, in 2023, the apparel and footwear market for Gen Z and Millennials showed continued growth, with a significant portion spent on performance and athleisure wear, indicating a strong opportunity for Columbia.

Leveraging Sustainability for Market Advantage

Columbia's robust sustainability initiatives, as showcased in their latest Impact Report, tap into a growing consumer demand for environmentally responsible products. This focus on eco-friendly practices and ethical sourcing provides a clear avenue for market differentiation and attracting a key demographic.

By actively promoting their use of recycled materials and transparent supply chains, Columbia can build stronger brand loyalty and capture market share from less sustainable competitors. This aligns with a broader market trend where consumers are increasingly willing to pay a premium for goods that reflect their values.

- Growing Consumer Demand: A significant portion of consumers, particularly younger demographics, actively seek out brands with strong environmental, social, and governance (ESG) credentials.

- Brand Differentiation: Highlighting sustainability efforts can set Columbia apart in a crowded market, creating a unique selling proposition.

- Premium Pricing Potential: Studies indicate consumers are often willing to pay more for sustainably produced goods, potentially boosting profit margins.

- Investor Appeal: Strong ESG performance is increasingly attractive to investors, potentially lowering the cost of capital and increasing valuation.

Innovation in Product Categories and Technology

Columbia's commitment to continuous product innovation, exemplified by advancements like the Omni-Heat™ Arctic insulation, allows for strategic portfolio extensions. This can lead to premiumization, enabling the company to capture new market segments and command higher average selling prices, a key driver for revenue growth.

Exploring and enhancing product categories with cutting-edge materials and designs directly addresses evolving consumer preferences. For instance, Columbia's focus on sustainable materials and technical apparel aligns with growing market demand, potentially boosting sales and brand loyalty.

- Portfolio Expansion: Innovations like Omni-Heat™ enable entry into niche markets and premium product tiers.

- Enhanced Consumer Appeal: New materials and designs cater to trends in outdoor performance and sustainability.

- Increased ASP: Premiumization strategies driven by technological advancements can lift average selling prices.

Columbia's strategic focus on international expansion, particularly in the EMEA and LAAP regions, presents a significant growth avenue. These markets are demonstrating strong consumer appetite for outdoor and activewear, with international wholesale net sales showing positive momentum. This diversification reduces reliance on the U.S. market, enhancing overall financial stability.

The company's direct-to-consumer (DTC) channels, including both online and physical stores, are a key area for increased profitability and brand control. In Q1 2024, DTC net sales grew by 10%, driven by strong retail store performance, which typically yields higher gross margins than wholesale.

Columbia's 'ACCELERATE' strategy targets younger consumers through updated marketing and product lines, aligning with the growing Gen Z and Millennial spending in performance and athleisure wear. This initiative is poised to capture a larger share of this lucrative market segment.

Furthermore, Columbia's commitment to sustainability, highlighted by their use of recycled materials and transparent supply chains, resonates with a growing consumer base prioritizing ESG factors. This focus not only differentiates the brand but also opens opportunities for premium pricing and attracts socially conscious investors.

Product innovation, such as the Omni-Heat™ technology, enables portfolio expansion and premiumization, allowing Columbia to command higher average selling prices and enter new market segments. This continuous development caters to evolving consumer preferences for technical and sustainable apparel.

Threats

The outdoor apparel market is incredibly crowded, with numerous brands competing for consumer attention and dollars. This intense rivalry means Columbia Sportswear constantly faces pressure to innovate and differentiate its products to stand out.

This heightened competition can lead to more unpredictable demand patterns, making inventory management a significant challenge. For instance, a competitor’s aggressive marketing campaign or a new product launch can quickly shift consumer preferences, impacting Columbia's sales forecasts and potentially leading to excess or insufficient stock.

Furthermore, a promotional environment often arises where brands resort to discounts and sales to attract customers. This can erode profit margins for all players, including Columbia, as it becomes harder to maintain premium pricing when competitors are consistently offering lower prices.

Persistent inflation and rising consumer prices in 2024 and early 2025 are likely to dampen discretionary spending on items like Columbia's outdoor apparel. As consumers face increased costs for essentials, they may cut back on non-essential purchases, impacting sales volumes.

A general economic slowdown, potentially exacerbated by geopolitical uncertainties, could further erode consumer confidence. This cautious sentiment might lead individuals to prioritize spending on experiences, such as travel, over durable goods, directly affecting demand for Columbia's product lines.

Global supply chain snags and the specter of rising import tariffs continue to present significant hurdles for Columbia Sportswear. These disruptions can directly translate into higher production expenses and extended lead times for getting products to market.

For instance, in early 2024, many apparel companies, including those in Columbia's sector, reported extended shipping times and increased freight costs due to ongoing geopolitical tensions and port congestion. This directly impacts Columbia's ability to maintain optimal inventory levels, potentially leading to lost sales and reduced customer satisfaction.

The volatility in raw material prices, a common consequence of supply chain instability, also poses a threat. Fluctuations in the cost of textiles, manufacturing components, and transportation can squeeze profit margins if not effectively managed through pricing strategies or hedging.

Changing Weather Patterns and Climate Change

Columbia Sportswear faces a significant threat from changing weather patterns and climate change. Unseasonably warm weather, especially during crucial fall and winter selling seasons, directly impacts demand for cold-weather apparel, a core category for the company. This unpredictability can lead to substantial disruptions in seasonal sales performance.

The increasing volatility of weather systems poses a direct risk to Columbia's revenue streams. For instance, a warmer-than-average winter in key markets could lead to reduced sales of insulated jackets and snow gear. This directly affects inventory management and sales forecasts, making it harder to plan effectively.

- Impact on Seasonal Sales: Warmer winters in North America and Europe can significantly reduce demand for core products like insulated outerwear and ski apparel.

- Inventory Risk: Unpredictable weather patterns increase the risk of holding excess inventory of seasonal items that may not sell as anticipated.

- Supply Chain Disruptions: Extreme weather events, exacerbated by climate change, can also disrupt Columbia's global supply chain, affecting production and delivery timelines.

Brand Homogenization and Difficulty in Differentiation

The outdoor apparel market faces a growing threat of brand homogenization, where competitors increasingly offer similar products. This makes it harder for Columbia to stand out. For instance, in 2024, the global outdoor apparel market saw a significant increase in product overlap, with many brands adopting similar design aesthetics and material innovations, as reported by industry analysts.

This trend creates an opening for smaller, niche brands to attract consumers seeking unique or specialized gear. If Columbia doesn't consistently innovate and clearly communicate its distinct value proposition, it risks losing market share to these agile competitors. In 2025, early reports indicate a rise in consumer preference for brands with strong sustainability narratives or unique heritage stories, areas where differentiation is key.

- Market Saturation: The outdoor industry is crowded, with many brands offering comparable products.

- Innovation Race: Competitors are rapidly adopting new technologies and materials, blurring product lines.

- Consumer Fatigue: Shoppers may become less engaged if brands fail to offer distinct features or brand stories.

Columbia faces intense competition, with rivals frequently launching new products and aggressive marketing campaigns. This can lead to unpredictable demand and pressure on profit margins through increased discounting. Furthermore, persistent inflation in 2024 and early 2025 is expected to reduce consumer discretionary spending on outdoor apparel.

Supply chain disruptions and rising import costs remain significant threats, as seen with extended shipping times and increased freight expenses reported by apparel companies in early 2024. Volatile raw material prices also squeeze profit margins. Changing weather patterns, particularly unseasonably warm winters, directly impact sales of core cold-weather products, creating inventory risks and affecting seasonal revenue.

The market is also threatened by brand homogenization, where similar products make differentiation difficult. This trend, evident in 2024 with increased product overlap, favors niche brands and requires Columbia to continually innovate and clearly articulate its unique value proposition to avoid losing market share in 2025.

| Threat Category | Specific Threat | Impact on Columbia | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Market Saturation and Product Overlap | Reduced differentiation, pressure on pricing, potential market share loss | Industry analysts noted increased product overlap in 2024; consumer preference shifting towards unique brand stories in 2025. |

| Economic Factors | Inflation and Reduced Discretionary Spending | Lower sales volumes for non-essential goods | Persistent inflation in 2024/2025 impacting consumer purchasing power. |

| Supply Chain & Operations | Global Supply Chain Disruptions & Rising Costs | Higher production expenses, extended lead times, inventory management challenges | Extended shipping times and increased freight costs reported in early 2024 due to geopolitical tensions. |

| Environmental Factors | Unpredictable Weather Patterns & Climate Change | Reduced demand for seasonal products, inventory risk, disrupted sales forecasts | Unseasonably warm winters directly impacting sales of insulated outerwear and snow gear. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Columbia's official financial reports, comprehensive market research, and insights from academic and industry experts to ensure a well-rounded and accurate assessment.