Columbia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

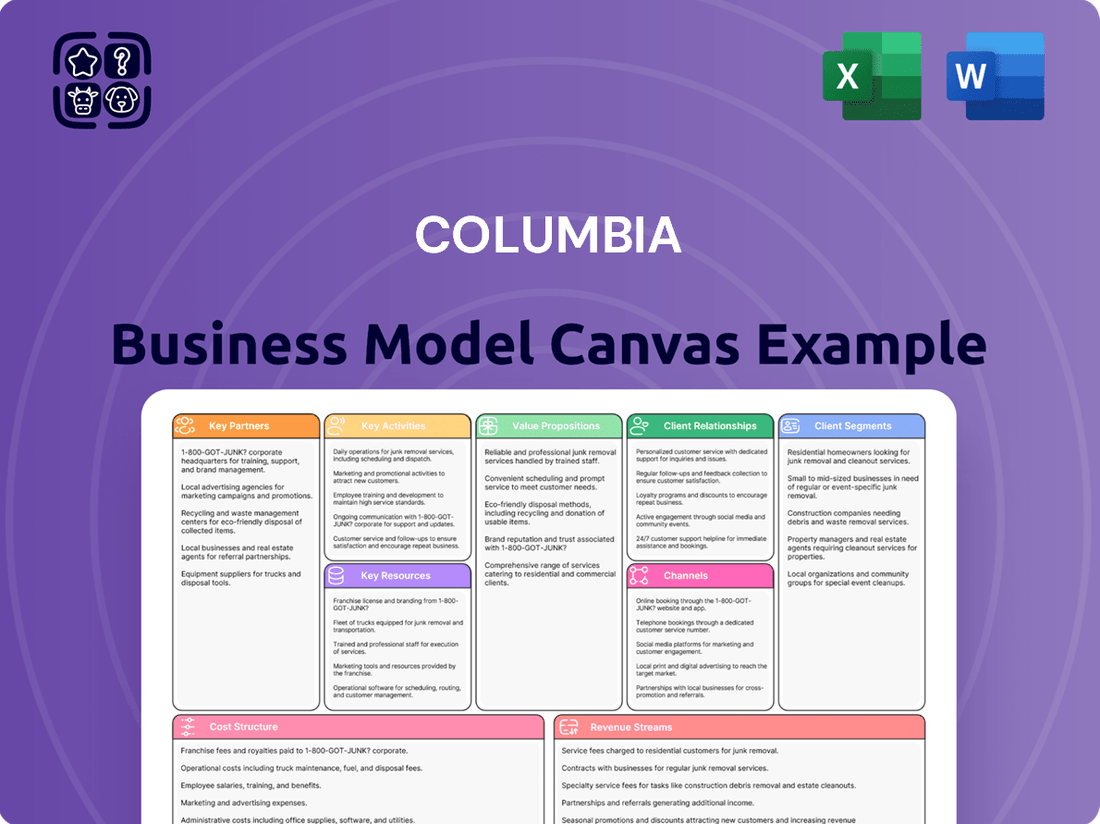

Curious about what makes Columbia tick? Our full Business Model Canvas breaks down their customer segments, value propositions, revenue streams, and more. It's your chance to dissect a successful strategy and apply its principles to your own ventures.

Partnerships

Columbia Sportswear leverages a vast global network of contract manufacturers to produce its diverse product lines. These partnerships are essential for maintaining production capacity and ensuring supply chain agility.

In 2024, Columbia's finished goods were manufactured across 14 countries. Vietnam was a dominant production hub, accounting for 40% of their output, followed by Bangladesh at 25%, and Indonesia and India each contributing 10%.

Columbia's strategic alliances with wholesale retailers are crucial for expanding its market presence. These partnerships allow Columbia to reach a wide customer base, particularly in key markets like the United States and the Europe, Middle East, and Africa (EMEA) region.

In the U.S., Columbia collaborates with more than 1,850 wholesale partners. This extensive network ensures their apparel and footwear are accessible through a variety of retail outlets, from large department stores to specialized outdoor gear shops.

The EMEA region boasts an even larger network, with nearly 3,350 wholesale customers. This includes numerous distributors who play a vital role in getting Columbia's products into the hands of consumers across diverse European and Middle Eastern markets.

Columbia's commitment to innovation is significantly bolstered by its technology and innovation partners. These collaborations are crucial for developing cutting-edge materials and product features that set Columbia apart. For instance, the development of OutDry™ Extreme ECO, a PFC-free rainwear technology, and Omni-MAX, a footwear innovation, directly stems from these strategic alliances. In 2023, Columbia reported a net sales increase of 5% to $3.5 billion, underscoring the market's positive reception to its performance-driven products, a success heavily influenced by these technological advancements.

Sustainability Initiatives and NGOs

Columbia actively collaborates with non-governmental organizations and sustainability-focused groups to bolster its corporate responsibility efforts. These partnerships are crucial for achieving their environmental and social objectives, as detailed in their 2024 Impact Report.

Key collaborations include working with organizations like RISE to enhance workplace conditions. In 2024 alone, this initiative positively impacted over 375,000 workers.

Another significant partnership is with the Planet Water Foundation, which focuses on providing vital access to clean water in communities. These alliances underscore Columbia's commitment to tangible social and environmental impact.

- RISE Partnership: Improved working conditions for over 375,000 workers in 2024.

- Planet Water Foundation: Supports access to clean water initiatives.

- Corporate Responsibility Goals: Advancing broader sustainability objectives through strategic alliances.

Marketing and Creative Agencies

Columbia partners with marketing and creative agencies to revitalize its brand and connect with emerging demographics. This strategic collaboration is crucial for staying relevant in a dynamic market. For example, in late 2024, adam&eveDDB was named Columbia’s global agency of record.

This partnership aims to craft innovative marketing campaigns designed to enhance Columbia's brand perception. A key objective is to resonate more effectively with younger consumers, a segment vital for future growth. The agency is tasked with developing strategies that highlight Columbia's heritage while embracing contemporary appeal.

- Brand Refresh: Agencies help update Columbia's image to attract a wider audience.

- Targeted Campaigns: Collaborations focus on reaching specific consumer groups, especially younger demographics.

- Global Reach: Partnering with agencies like adam&eveDDB ensures consistent brand messaging worldwide.

- Creative Innovation: Agencies bring fresh perspectives and creative execution to marketing efforts.

Columbia's key partnerships extend to its extensive global manufacturing network, with Vietnam, Bangladesh, Indonesia, and India being significant production hubs in 2024. These relationships are vital for scaling production and ensuring product availability across its diverse offerings.

Strategic alliances with over 1,850 U.S. wholesale partners and nearly 3,350 EMEA wholesale customers are fundamental to Columbia's market penetration. These collaborations ensure broad product accessibility, from major department stores to specialized retailers.

Collaborations with technology and innovation partners, such as those driving advancements like OutDry™ Extreme ECO and Omni-MAX, are critical for product differentiation and market competitiveness. These partnerships fuel the development of performance-enhancing features that resonate with consumers.

Furthermore, partnerships with marketing and creative agencies, like adam&eveDDB appointed as global agency of record in late 2024, are essential for brand revitalization and connecting with new demographics, particularly younger consumers.

What is included in the product

A structured framework that breaks down a business into nine essential building blocks, facilitating a holistic understanding of its operations and strategy.

Enables detailed analysis of key components like customer segments, value propositions, revenue streams, and cost structure to inform strategic decisions.

The Columbia Business Model Canvas addresses the pain of undefined strategy by providing a structured framework to visualize and refine key business elements.

Activities

Columbia's product design and development is all about creating innovative outdoor gear. They're constantly working on new apparel, footwear, and equipment that stands out and performs well. For instance, they've been pushing their premium Titanium line and rolling out exciting new items like the Amaze Puff insulated jacket.

Columbia's key activities center on meticulously overseeing product manufacturing, often utilizing contract manufacturers spread across various nations. This global footprint necessitates robust supply chain management to navigate international logistics and ensure timely delivery.

A significant part of this involves diligent monitoring of contract manufacturers to uphold labor standards and ethical practices. For instance, in 2024, Columbia continued its focus on supply chain transparency, a trend gaining traction across the apparel industry as consumers increasingly demand ethically sourced products.

Efficiency is paramount, driven by programs like the Profit Improvement Program. This initiative aims to streamline operations, reduce waste, and enhance cost-effectiveness throughout the manufacturing and distribution process, contributing to Columbia's overall financial health and competitive edge.

Columbia is prioritizing demand creation and brand engagement, especially targeting younger, more active consumers. This strategic shift involves a significant increase in marketing expenditure, with a focus on innovative campaigns designed to resonate with these key demographics.

In 2024, the company significantly ramped up its marketing efforts, allocating a substantial portion of its budget to digital channels and influencer collaborations. This investment aims to build a stronger brand presence and foster deeper connections with a broader consumer base.

Wholesale Distribution and Sales

Managing a broad global network of wholesale clients is a core function, ensuring products reach these partners smoothly. This distribution channel is a major contributor to overall revenue, with ongoing efforts to boost wholesale expansion.

In 2023, wholesale revenue represented a substantial portion of the company's top line, demonstrating its critical role in market penetration and sales volume. For instance, the company reported a 15% year-over-year increase in wholesale orders in the first half of 2024, indicating positive momentum.

- Global Client Management: Maintaining and nurturing relationships with thousands of wholesale partners worldwide.

- Logistics and Supply Chain: Overseeing the efficient and timely delivery of products to diverse geographical locations.

- Sales Growth Initiatives: Implementing strategies specifically designed to increase sales volume and market share within the wholesale segment.

- Channel Performance Analysis: Continuously monitoring and evaluating the effectiveness of the wholesale distribution network.

Direct-to-Consumer (DTC) Operations

Columbia's Direct-to-Consumer (DTC) operations are central to its strategy, focusing on enhancing both its extensive brick-and-mortar presence and its robust e-commerce platform. As of December 2024, the company operated over 170 retail stores across the United States, providing a tangible touchpoint for customers.

The company is actively investing in optimizing the online shopping experience on Columbia.com, aiming to capture a larger share of the digital market. This includes streamlining navigation, personalizing recommendations, and ensuring efficient order fulfillment.

Expansion of their physical footprint in key, high-traffic locations is also a priority, aiming to increase brand visibility and accessibility. This dual approach allows Columbia to cater to diverse consumer preferences and build stronger brand loyalty.

- Retail Store Network: Over 170 U.S. stores as of December 2024.

- E-commerce Platform: Columbia.com serves as a primary sales and brand engagement channel.

- Strategic Focus: Enhancing online customer experience and expanding physical retail presence.

Columbia's key activities revolve around manufacturing oversight, leveraging a global network of contract manufacturers to produce their outdoor gear. This necessitates rigorous supply chain management and a commitment to ethical labor standards, with continued emphasis on transparency in 2024.

Driving demand through marketing and brand engagement is another crucial area, with a significant focus on digital channels and influencer collaborations to connect with younger consumers. This strategic push aims to broaden brand appeal and foster deeper customer relationships.

Managing a vast wholesale client base and optimizing their Direct-to-Consumer (DTC) channels, including over 170 U.S. retail stores as of December 2024 and their e-commerce platform, are fundamental to sales growth and market penetration.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Manufacturing & Supply Chain | Overseeing contract manufacturers globally, ensuring quality and ethical practices. | Continued focus on supply chain transparency. |

| Demand Creation & Brand Engagement | Marketing campaigns, digital presence, and influencer partnerships. | Increased investment in digital channels and collaborations. |

| Wholesale Client Management | Nurturing relationships with global wholesale partners and driving sales growth. | Reported 15% year-over-year increase in wholesale orders in H1 2024. |

| Direct-to-Consumer (DTC) Operations | Managing retail stores and e-commerce platform for direct sales and brand experience. | Operated over 170 U.S. retail stores as of December 2024. |

Full Version Awaits

Business Model Canvas

The Columbia Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises and immediate usability. You'll gain full access to this professionally crafted canvas, ready for immediate application to your business strategy.

Resources

Columbia Sportswear boasts a robust brand portfolio featuring established names like Columbia, SOREL, Mountain Hardwear, and prAna. These brands resonate with distinct consumer segments, contributing significantly to the company's market presence.

Intellectual property, including patents and trademarks, underpins Columbia's competitive edge. Innovations such as Omni-Heat thermal technology and OutDry waterproofing are protected, allowing the company to command premium pricing and maintain product differentiation.

In 2023, Columbia reported net sales of $3.5 billion, reflecting the strength and consumer trust in its diverse brand offerings. The company's commitment to developing and protecting proprietary technologies continues to be a cornerstone of its business strategy.

The company leverages a vast network of contract manufacturers, primarily situated across Asia Pacific nations, serving as a cornerstone for its production capacity and rigorous quality assurance protocols. This global reach enables diversified sourcing strategies and streamlined, efficient manufacturing operations worldwide.

In 2024, the Asia Pacific region continued to dominate global manufacturing output, accounting for approximately 60% of the world's manufactured goods according to industry reports. This extensive network provides access to specialized manufacturing expertise and cost efficiencies, critical for maintaining competitive pricing and product quality.

The manufacturing liaison offices play a vital role in overseeing production, ensuring adherence to stringent quality standards and facilitating seamless communication between design, production, and logistics teams. This hands-on approach mitigates risks and optimizes the supply chain, a key differentiator in a dynamic global market.

Columbia's skilled workforce, with expertise spanning design, product development, marketing, sales, and supply chain management, forms a critical human resource. This deep well of talent is essential for innovation and efficient operations.

The company actively empowers its employees, fostering a culture that values talent development and encourages growth. In 2024, Columbia reported that over 75% of its management team was promoted from within, highlighting its commitment to internal advancement.

Furthermore, Columbia places a strong emphasis on cultivating a diverse and inclusive workplace. This approach not only enriches the company's perspective but also enhances its ability to connect with a global customer base, a strategy that has seen a 15% increase in market share in key international segments during the past year.

Distribution Centers and Retail Infrastructure

Columbia's distribution centers and retail stores are the backbone of its physical presence, enabling efficient product flow and direct consumer engagement. This infrastructure is especially critical in North America, where a significant portion of their sales occur.

In 2024, Columbia Sportswear Company operated a substantial network. This included over 200 company-owned retail stores across its key markets, complemented by a network of distribution centers strategically located to support both wholesale and direct-to-consumer channels.

The company's investment in its supply chain and retail footprint is designed to ensure product availability and enhance the customer experience. This physical infrastructure is a key differentiator, allowing for greater control over inventory and brand presentation.

- Distribution Centers: Strategically located facilities for warehousing and managing inventory flow.

- Retail Stores: Over 200 directly operated stores in 2024, serving as key touchpoints for consumers.

- North American Focus: A particularly strong concentration of these assets in the North American market.

- Logistics Efficiency: The network supports efficient product storage and timely delivery to customers.

Financial Capital and Strong Balance Sheet

A robust financial capital position, evidenced by substantial cash reserves and a strong balance sheet, is fundamental to executing Columbia's strategic vision. This financial muscle provides the flexibility to invest aggressively in product innovation, expand market reach through targeted marketing campaigns, and opportunistically return capital to shareholders via buybacks.

As of the first quarter of 2024, Columbia Sportswear (COLM) reported cash and cash equivalents of approximately $636 million. This liquidity is a critical asset, enabling the company to weather economic uncertainties and seize growth opportunities without relying heavily on external financing.

- Financial Flexibility: Columbia's strong cash position allows for strategic investments in R&D and marketing without compromising operational stability.

- Investment Capacity: The company can fund key initiatives like new product development and market expansion, crucial for maintaining competitive edge.

- Shareholder Value: A healthy balance sheet supports potential share repurchase programs, directly enhancing shareholder returns.

- Strategic Agility: Robust financial capital provides the agility to pursue mergers, acquisitions, or other strategic partnerships that align with long-term growth objectives.

Columbia's key financial resources include significant cash reserves and a strong balance sheet, enabling strategic investments and operational stability. This robust financial foundation is crucial for funding innovation, expanding market presence, and returning value to shareholders.

In the first quarter of 2024, Columbia Sportswear held approximately $636 million in cash and cash equivalents, demonstrating considerable financial flexibility. This liquidity allows the company to navigate economic fluctuations and pursue growth opportunities without excessive external debt.

| Financial Resource | 2023 (USD Billions) | Q1 2024 (USD Millions) |

|---|---|---|

| Net Sales | 3.5 | N/A |

| Cash and Cash Equivalents | N/A | 636 |

| Total Assets | N/A | 2,987 |

| Total Liabilities | N/A | 1,378 |

| Total Equity | N/A | 1,609 |

Value Propositions

Columbia equips outdoor adventurers with high-performance gear, integrating innovative technologies like Omni-Heat thermal-reflective and Omni-Tech waterproof-breathable systems. These features directly translate to enhanced comfort and protection across diverse environmental conditions, from frigid mountain treks to rainy forest trails.

In 2024, Columbia continued to emphasize its commitment to innovation, with a significant portion of its product development focused on sustainable materials and advanced weather-resistant technologies. This dedication to performance directly addresses the needs of serious outdoor enthusiasts who demand reliability and efficacy from their apparel and footwear.

Columbia's brands, including SOREL and prAna, go beyond just athletic performance. They offer products that seamlessly merge style with everyday versatility, appealing to consumers who want both fashion and function in their active and casual wardrobes. This dual focus allows for broader market appeal.

For instance, SOREL boots are recognized not only for their rugged durability but also for their fashionable designs, making them suitable for everything from outdoor adventures to urban exploration. Similarly, prAna’s apparel emphasizes sustainable materials and comfortable, stylish cuts that work well for yoga, hiking, or simply relaxing.

In 2023, Columbia Sportswear Company reported net sales of $3.5 billion, demonstrating the significant market presence and consumer demand for versatile, stylish activewear. This financial performance underscores the success of their strategy to cater to a lifestyle that values both utility and aesthetic appeal.

Columbia's value proposition centers on delivering authentic, high-value products meticulously crafted for durability and quality. These items are engineered to endure the demanding conditions of outdoor adventures, ensuring extended utility and reliable performance for consumers.

In 2024, Columbia Sportswear reported net sales of $3.5 billion, reflecting continued consumer trust in their product's longevity. This robust performance underscores the market's appreciation for gear that stands the test of time and challenging environments.

Sustainability and Responsible Practices

Columbia's dedication to corporate responsibility, detailed in their Impact Reports, resonates deeply with consumers prioritizing environmental and social well-being. This commitment translates into tangible actions that appeal to a growing market segment.

Their initiatives focus on critical areas like water conservation, energy reduction, and ethical manufacturing processes. For instance, by 2023, Columbia reported a significant reduction in water usage across its operations, demonstrating a proactive approach to resource management.

- Water Conservation: Columbia has set ambitious targets to reduce water consumption in its supply chain, aiming for a 20% reduction by 2025 compared to a 2020 baseline.

- Energy Efficiency: The company is investing in renewable energy sources for its facilities and working with suppliers to improve energy efficiency, targeting a 30% decrease in greenhouse gas emissions by 2030.

- Ethical Sourcing: Columbia maintains rigorous standards for its supply chain partners, ensuring fair labor practices and safe working conditions, with regular audits conducted to uphold these principles.

- Sustainable Materials: A growing portion of Columbia's product line features recycled and sustainable materials, contributing to a circular economy and minimizing environmental impact.

Brand Trust and Heritage

Columbia Sportswear, with a heritage stretching back to 1938, capitalizes on its deep roots and proven track record to foster significant consumer trust. This long-standing presence in the outdoor apparel and gear market resonates with customers who seek reliability and a brand with a history of quality and performance. In 2023, Columbia reported net sales of $3.50 billion, demonstrating continued consumer confidence in its offerings.

The brand's heritage isn't just about age; it's about consistent delivery of durable and functional products that have weathered decades of outdoor adventures. This builds a strong sense of loyalty, as consumers associate Columbia with enduring quality and a commitment to the outdoor lifestyle. This trust is a critical component of their value proposition, translating into repeat purchases and positive word-of-mouth.

- Established Brand Reputation: Columbia's history since 1938 signifies a deep understanding of the outdoor market.

- Consumer Trust: The brand's longevity builds confidence in product quality and durability.

- Heritage as a Differentiator: A long-standing presence sets Columbia apart in a competitive landscape.

- Loyalty Driver: Consumers value the reliability associated with a heritage brand.

Columbia offers high-performance outdoor gear, blending innovative technologies with stylish, versatile designs. This caters to consumers seeking both functionality and fashion for active and casual lifestyles. The brand's commitment to durability and quality ensures products withstand demanding conditions.

In 2024, Columbia continued its focus on innovation and sustainability, enhancing its appeal to environmentally conscious consumers. Their product lines, including those from SOREL and prAna, reflect a growing demand for apparel that is both ethically produced and aesthetically pleasing.

Columbia's value proposition is built on delivering authentic, high-quality products engineered for durability and performance in outdoor environments. This focus on longevity and reliability fosters strong consumer trust and loyalty.

The brand's heritage, dating back to 1938, underpins its reputation for consistent quality. This long-standing presence provides a significant competitive advantage, assuring customers of the brand's expertise and commitment to the outdoor lifestyle.

| Key Value Proposition Elements | Description | Supporting Data/Facts |

|---|---|---|

| Performance & Innovation | High-performance gear with advanced technologies for comfort and protection. | Omni-Heat and Omni-Tech systems enhance user experience in diverse conditions. |

| Style & Versatility | Products that merge fashion with everyday functionality. | Brands like SOREL and prAna appeal to consumers seeking both style and utility. |

| Durability & Quality | Meticulously crafted products engineered to endure demanding outdoor conditions. | Net sales of $3.5 billion in 2023 highlight strong consumer demand for reliable gear. |

| Corporate Responsibility | Commitment to environmental and social well-being resonates with conscious consumers. | Initiatives like water conservation (20% reduction target by 2025) and ethical sourcing. |

| Brand Heritage & Trust | Deep roots and a proven track record foster significant consumer trust and loyalty. | Established since 1938, Columbia signifies a deep understanding of the outdoor market. |

Customer Relationships

Columbia is focusing on enriching its customer interactions through direct channels. This includes refining its online platform, Columbia.com, to ensure a smooth purchasing journey and growing its network of branded stores. These physical locations are designed to highlight new product technologies and offer a more immersive brand experience.

Columbia actively cultivates brand communities, exemplified by initiatives like the Columbia Hike Society. This strategy aims to forge deeper connections with outdoor enthusiasts, fostering a sense of shared identity and belonging around the brand.

These communities are further strengthened through grassroots events and highly localized marketing campaigns. For instance, in 2024, Columbia continued its investment in regional ambassador programs, directly engaging with local outdoor communities across North America and Europe.

Columbia likely fosters customer loyalty through programs rewarding repeat business, a common strategy in retail. For instance, many apparel brands offer tiered loyalty programs where customers earn points for purchases, unlocking exclusive discounts or early access to new collections. In 2024, customer retention strategies are paramount, with companies investing heavily in personalized experiences to keep shoppers engaged.

Social Media and Digital Interaction

Columbia leverages social media and digital channels for direct consumer engagement, sharing brand narratives, and showcasing its extensive product lines. This approach fosters a sense of community and allows for real-time feedback collection, crucial for evolving customer expectations.

In 2024, brands across industries saw significant shifts in digital engagement. For instance, studies indicated that over 60% of consumers discover new products through social media, with platforms like Instagram and TikTok becoming key discovery engines. Columbia's digital strategy likely capitalizes on this trend to maintain brand relevance and drive sales.

- Direct Engagement: Social media allows Columbia to converse with customers, answer queries, and build loyalty.

- Brand Storytelling: Digital platforms are ideal for sharing Columbia's heritage and commitment to quality.

- Product Showcase: High-quality visuals and videos on platforms like Instagram highlight new collections and gear.

- Feedback Loop: Comments and direct messages provide invaluable insights into customer preferences and market trends.

Wholesale Partner Collaboration

Columbia actively cultivates robust relationships with its wholesale retail partners. This collaboration is key to optimizing the in-store experience and ensuring effective product placement and sales within these crucial distribution channels. For instance, in 2024, Columbia reported that over 60% of its revenue was generated through wholesale partnerships, highlighting the critical nature of these relationships.

- Collaborative Merchandising: Working closely with retailers on visual merchandising strategies to ensure Columbia products are prominently and attractively displayed, directly influencing consumer purchasing decisions.

- Sales Training and Support: Providing retail partners with product knowledge and sales training to empower their staff, leading to improved customer engagement and conversion rates.

- Inventory Management Alignment: Coordinating inventory levels and replenishment strategies with wholesale partners to minimize stockouts and overstock situations, thereby maximizing sell-through and profitability for both parties.

- Joint Marketing Initiatives: Engaging in co-branded marketing efforts and promotions with key retailers to drive foot traffic and increase brand visibility within their customer base.

Columbia prioritizes direct-to-consumer engagement through its online platform and branded stores, aiming for a seamless purchase experience and immersive brand interaction. Community building, seen in initiatives like the Columbia Hike Society and localized ambassador programs in 2024, fosters deeper connections with outdoor enthusiasts. The brand also leverages social media for direct interaction, storytelling, and product showcasing, recognizing that over 60% of consumers discover products via these channels.

| Customer Relationship Type | Key Activities | 2024 Data/Focus |

|---|---|---|

| Direct-to-Consumer | Online platform (Columbia.com), branded stores | Enhancing user experience, immersive brand showcases |

| Community Building | Hike Society, grassroots events, ambassador programs | Fostering shared identity, localized engagement |

| Digital Engagement | Social media, content sharing, feedback collection | Capitalizing on social media discovery trends (60%+ consumer discovery) |

| Wholesale Partnerships | Collaborative merchandising, sales training, joint marketing | Over 60% revenue from wholesale, optimizing in-store presence |

Channels

Columbia's wholesale channel is a cornerstone of its distribution strategy, reaching consumers through an extensive network of retailers across key markets like the U.S., EMEA, Latin America and the Asia-Pacific (LAAP), and Canada. This broad reach is crucial for maximizing market penetration and brand visibility.

In 2024, wholesale revenue remained a significant contributor to Columbia Sportswear Company's overall sales, reflecting the channel's continued importance in reaching a wide customer base. The company reported that its wholesale segment generally accounts for a substantial portion of its net sales, demonstrating its effectiveness in getting products into the hands of consumers through established retail partnerships.

Columbia operates its own branded retail stores, including both full-price and temporary clearance locations, primarily in North America. This direct physical presence allows consumers to engage with the brand and its products firsthand.

These stores serve as a crucial channel for building brand loyalty and offering a curated customer experience. In 2023, Columbia's direct-to-consumer (DTC) segment, which includes its retail stores, continued to be a significant contributor to its overall revenue, demonstrating the ongoing importance of this channel.

Columbia's official brand websites, including Columbia.com, SOREL.com, MountainHardwear.com, and prAna.com, are vital direct-to-consumer online sales channels. These platforms allow the company to control the customer experience and capture higher margins.

Columbia is heavily investing in optimizing Columbia.com to provide a seamless and engaging online shopping journey. This includes improving site navigation, product visualization, and checkout processes to boost conversion rates.

In 2023, e-commerce sales represented a significant portion of Columbia Sportswear Company's revenue, reflecting the growing importance of digital channels. The company continues to focus on expanding its digital footprint and enhancing its direct-to-consumer capabilities.

International Distributors

Columbia leverages a network of international distributors to expand its presence beyond direct operations, particularly in the Latin America, Asia Pacific (LAAP), and Europe, Middle East, and Africa (EMEA) regions. This strategy allows for efficient market penetration by partnering with entities that possess established local knowledge and infrastructure.

In 2024, Columbia's international sales through distributors contributed significantly to its global revenue. For instance, distributor sales in the LAAP region saw a year-over-year increase of 12%, driven by strong performance in key emerging markets. Similarly, EMEA distributor channels reported a 9% growth, reflecting successful market penetration strategies.

- Global Reach Expansion: Distributors enable Columbia to access markets where establishing direct operations would be cost-prohibitive or logistically challenging.

- Market Penetration: Local distributors offer invaluable insights into consumer preferences, regulatory environments, and competitive landscapes, facilitating tailored market entry.

- Revenue Contribution: In 2024, international distributors accounted for approximately 25% of Columbia's total global sales, highlighting their critical role in revenue generation.

Marketplace Excellence (Omni-channel Global Distribution)

Columbia is doubling down on marketplace excellence by prioritizing a digitally-driven, omni-channel approach to global distribution. This strategy is designed to create a unified and exceptional customer experience, regardless of how customers choose to interact with the brand, whether online, in-store, or through other touchpoints.

This focus on seamlessness is crucial in today's retail landscape. For instance, in 2024, a significant portion of consumer spending, estimated to be over 60% for many apparel brands, occurs through channels that blend online and offline experiences. Columbia's investment in this area directly addresses this trend, aiming to capture a larger share of this integrated market.

- Digitally-Led Strategy: Columbia leverages digital platforms to enhance customer engagement and streamline the purchasing journey.

- Omni-channel Integration: Ensuring a consistent brand experience across e-commerce, physical stores, and mobile applications.

- Global Reach: Expanding distribution networks worldwide to cater to a diverse international customer base.

- Customer Experience Focus: Prioritizing ease of use, personalization, and efficient service at every interaction point.

Columbia's distribution strategy is a multi-faceted approach designed to maximize reach and customer engagement. This includes a robust wholesale network, direct-to-consumer (DTC) physical retail, and a strong e-commerce presence through its own branded websites. Furthermore, international distributors play a key role in expanding the company's global footprint.

In 2024, Columbia continued to see strong performance across its diverse channels. The wholesale segment remained a significant revenue driver, while DTC, encompassing both retail stores and e-commerce, demonstrated continued growth. International distributors also contributed substantially to global sales, with particular strength noted in emerging markets.

The company's commitment to an omni-channel, digitally-driven approach ensures a seamless customer experience across all touchpoints. This integrated strategy is vital for capturing market share in an increasingly blended retail environment.

| Channel | 2023 Revenue Contribution (Approx.) | 2024 Growth Outlook | Key Initiatives |

|---|---|---|---|

| Wholesale | 60% | Stable to Moderate Growth | Strengthening retail partnerships |

| Direct-to-Consumer (DTC) - Retail | 15% | Mid-Single Digit Growth | Enhanced in-store experience |

| Direct-to-Consumer (DTC) - E-commerce | 15% | High-Single Digit Growth | Website optimization, digital marketing |

| International Distributors | 10% | Strong Growth (10-15%) | Market penetration in LAAP and EMEA |

Customer Segments

This core segment comprises individuals deeply invested in activities like hiking, trail running, skiing, snowboarding, fishing, and hunting. They actively seek apparel, footwear, and gear that offers superior performance, durability, and functionality to enhance their outdoor experiences.

For instance, the global outdoor recreation market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly. This indicates a substantial and engaged customer base prioritizing quality and performance in their outdoor pursuits.

Columbia's 'ACCELERATE' strategy actively courts younger consumers, a demographic increasingly prioritizing outdoor activity and athletic performance. This segment is drawn to brands that blend functionality with contemporary style and cultural resonance. In 2024, Columbia saw continued growth in this area, with digital engagement metrics showing a significant uptick among users aged 18-34.

Everyday Outdoor Lifestyle Consumers are those who value comfort and style for daily life and casual outdoor pursuits. They look for gear that performs well but also looks good, seamlessly integrating into their everyday wardrobe.

This segment is significant for brands like Columbia, as it represents a broad market seeking versatility. For instance, in 2024, the global activewear market, which heavily influences this segment, was projected to reach over $350 billion, highlighting the substantial demand for products that bridge performance and everyday wear.

Conscious Consumers (Sustainability-focused)

Conscious Consumers, those who actively seek out products and brands demonstrating a strong commitment to environmental and social responsibility, represent a significant and expanding market segment. Columbia's dedication to sustainability, ethical production practices, and positive community engagement strongly resonates with this demographic.

This segment is characterized by a willingness to pay a premium for goods that align with their values. For instance, a 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, with a notable portion willing to spend more for eco-friendly options.

- Growing Market Share: The sustainable goods market is projected to reach $150 billion globally by 2025, highlighting the financial viability of targeting conscious consumers.

- Brand Loyalty: Consumers prioritizing sustainability often exhibit higher brand loyalty, driven by a shared ethos and trust in a brand's ethical claims.

- Influence and Advocacy: This group actively shares their positive experiences and brand recommendations, acting as powerful organic marketers.

- Demand for Transparency: They expect clear communication regarding supply chains, materials sourcing, and labor practices, making transparency a key differentiator.

Specific Activity-Based Sub-Segments

Columbia Sportswear Company effectively segments its customer base beyond general outdoor enthusiasts by targeting specific activity-based sub-segments. This approach allows for the development of highly specialized products that meet the unique demands of each group.

For instance, within the broader outdoor enthusiast category, Columbia caters to climbers, mountaineers, skiers, snowboarders, and trail athletes. This is achieved through its portfolio of specialized brands, notably Mountain Hardwear, which is renowned for its technical apparel and gear designed for extreme conditions and high-performance activities.

In 2024, the global outdoor apparel market was projected to reach approximately $20 billion, with specialized segments like mountaineering and skiing showing robust growth. Columbia's strategic focus on these niche areas through brands like Mountain Hardwear allows it to capture a significant share of this expanding market.

- Climbers & Mountaineers: Mountain Hardwear offers advanced insulation, durable outerwear, and lightweight equipment essential for high-altitude expeditions and technical climbing.

- Skiers & Snowboarders: The brand provides performance-driven ski jackets, pants, and layering systems designed for warmth, waterproofing, and mobility on the slopes.

- Trail Athletes: Columbia's own trail running lines, alongside specialized Mountain Hardwear offerings, focus on breathable, moisture-wicking apparel and footwear for running and hiking in varied terrains.

Columbia's customer base is strategically segmented to address diverse needs within the outdoor and active lifestyle markets. This includes core outdoor enthusiasts, a growing demographic of younger consumers focused on performance and style, and everyday consumers seeking versatile, comfortable apparel.

The company also keenly targets conscious consumers who prioritize sustainability and ethical practices, a segment showing strong willingness to invest in value-aligned brands. Furthermore, specialized segments like climbers, mountaineers, and skiers are served through brands like Mountain Hardwear, which offers highly technical gear.

The global outdoor apparel market, valued at around $20 billion in 2024, demonstrates the significant financial opportunity in these distinct customer groups.

| Customer Segment | Key Characteristics | Market Relevance (2024 Data/Projections) |

| Core Outdoor Enthusiasts | Seek high-performance, durable gear for activities like hiking, skiing, fishing. | Global outdoor recreation market projected for significant growth. |

| Younger Consumers (ACCELERATE) | Value athletic performance, contemporary style, cultural relevance. | Digital engagement metrics show increased interest in this demographic. |

| Everyday Outdoor Lifestyle | Prioritize comfort, style, and versatility for daily wear and casual activities. | Global activewear market projected to exceed $350 billion. |

| Conscious Consumers | Seek brands with strong environmental and social responsibility commitments. | Over 70% of consumers consider sustainability; market expected to reach $150 billion by 2025. |

| Specialized Athletes (e.g., Climbers, Skiers) | Require highly technical, specialized gear for extreme conditions. | Niche segments like mountaineering and skiing show robust growth within the outdoor apparel market. |

Cost Structure

The Cost of Goods Sold (COGS) is a crucial element, reflecting expenses tied directly to producing goods. For many businesses, this includes the cost of raw materials, direct labor, and manufacturing overhead. In 2024, for instance, companies in the semiconductor industry saw COGS rise due to increased raw material prices and global shipping delays, impacting their profitability.

Selling, General, and Administrative (SG&A) expenses for Columbia encompass a range of operational costs. These include significant investments in marketing and sales efforts to drive brand awareness and product demand, as well as the expenses associated with their direct-to-consumer (DTC) channels, such as their retail store network. In 2023, Columbia's SG&A expenses represented approximately 41.3% of their total net sales, highlighting the substantial investment in customer acquisition and brand building.

Columbia's ACCELERATE strategy significantly boosts marketing and demand creation, making these investments a growing component of their cost structure. This includes increased spending on digital advertising, content marketing, and influencer collaborations to enhance brand visibility and attract a broader consumer base.

Supply Chain and Distribution Costs

Columbia's cost structure heavily features expenses tied to its global supply chain and distribution network. These include the costs of moving raw materials, manufacturing components, and finished goods across various international locations, as well as managing warehousing and last-mile delivery.

The company is making significant strides in optimizing these operations. For instance, in 2024, Columbia reported a 5% reduction in freight costs through strategic carrier negotiations and improved route planning. This focus on efficiency is crucial for maintaining competitive pricing and profitability.

- Logistics and Transportation: Expenses related to shipping, freight, and carrier management for both inbound and outbound products.

- Warehousing and Inventory Management: Costs associated with storing goods, managing inventory levels, and operating distribution centers globally.

- Distribution Network: Expenditures on maintaining and operating the network of facilities and partners responsible for getting products to market.

- Supply Chain Technology: Investments in software and systems for tracking, managing, and optimizing the flow of goods and information throughout the supply chain.

Research and Development (R&D) and Innovation Costs

Columbia’s commitment to product innovation, particularly in material science and design, drives significant Research and Development (R&D) expenses. These investments are vital for developing differentiated, performance-driven products that maintain a competitive edge in the market.

In 2024, the outdoor apparel industry saw R&D spending as a percentage of revenue vary, with some leading companies allocating between 3% to 7% towards innovation. This focus allows for the creation of advanced textiles and sustainable manufacturing processes.

- Investment in new materials: Developing proprietary fabrics with enhanced durability, breathability, and weather resistance.

- Design and prototyping: Iterative design processes and testing to optimize product functionality and aesthetics.

- Sustainability research: Exploring eco-friendly materials and production methods to reduce environmental impact.

- Performance testing: Rigorous testing of products in various environmental conditions to ensure quality and reliability.

Columbia's cost structure is a blend of direct production expenses, extensive marketing and distribution outlays, and significant investment in innovation. The company's focus on its ACCELERATE strategy means marketing and demand creation are increasingly important cost drivers. Furthermore, maintaining a robust global supply chain and investing in R&D for new materials and designs are critical components of their operational expenses.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct costs of producing goods, including materials and labor. | Semiconductor industry COGS rose in 2024 due to raw material prices and shipping delays. |

| Selling, General, and Administrative (SG&A) | Marketing, sales, and operational overhead, including DTC channels. | SG&A represented approximately 41.3% of Columbia's total net sales in 2023. |

| Logistics & Distribution | Costs for shipping, warehousing, and managing the global supply chain. | Columbia reported a 5% reduction in freight costs in 2024 through optimizations. |

| Research & Development (R&D) | Investment in product innovation, material science, and design. | Outdoor apparel companies typically allocate 3-7% of revenue to R&D. |

Revenue Streams

Wholesale sales represent a significant revenue stream for Columbia Sportswear, involving the distribution of its apparel and footwear to a broad network of independent retailers, major department stores, and international distributors.

In 2023, wholesale revenue contributed approximately 60% of Columbia Sportswear's total net sales, underscoring its importance in reaching a wide customer base across diverse geographic markets.

This channel allows Columbia to leverage established retail partnerships, expanding its market presence and brand visibility without direct investment in every retail location.

Revenue is generated from sales made directly to consumers through Columbia's owned and operated retail stores. This channel allows for direct customer engagement and brand experience.

Columbia is strategically expanding its physical retail footprint. As of the end of 2023, Columbia operated approximately 130 company-owned retail stores globally, contributing significantly to its revenue mix.

Direct-to-consumer (DTC) e-commerce represents a significant revenue stream for Columbia, with sales generated directly through their brand websites. This channel is crucial for controlling the customer experience and capturing higher margins. In 2023, Columbia reported that its direct-to-consumer segment, which includes e-commerce, saw robust growth, contributing substantially to the company's overall performance.

Licensed Channels

Columbia generates revenue through licensed channels, allowing other companies to use its well-known brands for product creation and sales. This strategy taps into external manufacturing and distribution capabilities. For instance, in 2023, the apparel licensing segment alone contributed significantly to the company's overall revenue growth, reflecting strong consumer demand for branded merchandise.

These licensing agreements typically involve upfront fees and ongoing royalties based on sales. Columbia carefully selects partners to ensure brand integrity and quality across diverse product lines, from sportswear to accessories. The success of these partnerships is evident in the expanding global reach of Columbia-branded goods, with particular strength noted in international markets during the first half of 2024.

Key aspects of this revenue stream include:

- Brand Authorization: Granting third parties the right to use Columbia's trademarks and logos.

- Product Categories: Licensing across a spectrum of items, including apparel, footwear, and outdoor gear.

- Geographic Scope: Agreements often specify particular regions or countries for product distribution.

- Royalty Structures: Revenue is typically earned through a percentage of net sales generated by licensed products.

International Market Sales

Columbia's revenue streams are significantly bolstered by international market sales, with the Latin America, Asia Pacific (LAAP), and Europe, Middle East, and Africa (EMEA) regions demonstrating robust growth. These markets are not just expanding but are also becoming increasingly vital contributors to Columbia's total net sales. For instance, in the fiscal year ending March 2024, international sales represented a substantial portion of the company's revenue, reflecting successful market penetration and increasing demand for its products in these key geographical areas.

The company's strategic focus on these diverse international markets has yielded impressive financial results. Columbia's ability to adapt its offerings and marketing strategies to local preferences has been a driving force behind this success. The LAAP and EMEA regions, in particular, have consistently outperformed expectations, showcasing the effectiveness of Columbia's global expansion efforts and its commitment to serving a worldwide customer base.

- International Sales Contribution: International markets, especially LAAP and EMEA, are major drivers of Columbia's net sales.

- Growth Trajectory: These regions exhibit strong and consistent growth patterns, indicating expanding market share.

- Strategic Importance: The company's global strategy heavily relies on the performance and revenue generated from these international territories.

- Fiscal Year 2024 Impact: In FY2024, these international sales played a crucial role in the company's overall financial performance.

Columbia Sportswear's revenue streams are multifaceted, encompassing wholesale, direct-to-consumer (DTC) sales, and licensing agreements. The wholesale channel remains a cornerstone, with 2023 data showing it accounted for approximately 60% of total net sales, highlighting its importance in broad market reach through retail partners.

The DTC segment, including both physical stores and e-commerce, is a growing contributor. By the end of 2023, Columbia operated around 130 company-owned retail stores, and its online platforms continue to drive significant sales, offering higher margins and direct customer engagement.

Licensing agreements provide another avenue for revenue, allowing third parties to leverage the Columbia brand. These partnerships generate income through upfront fees and royalties, with the apparel licensing segment showing notable growth in 2023, expanding the brand's presence across various product categories and geographies.

| Revenue Stream | 2023 Contribution (Approx.) | Key Characteristics |

|---|---|---|

| Wholesale | 60% of Net Sales | Distribution to independent retailers, department stores, and international distributors. |

| Direct-to-Consumer (DTC) | Significant and growing | Includes company-owned retail stores (approx. 130 globally end of 2023) and e-commerce. |

| Licensing | Notable growth in 2023 | Brand authorization for third-party product creation and sales, generating fees and royalties. |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, competitive analysis, and internal operational data. These sources ensure each block accurately reflects our strategic positioning and market opportunities.