Columbia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

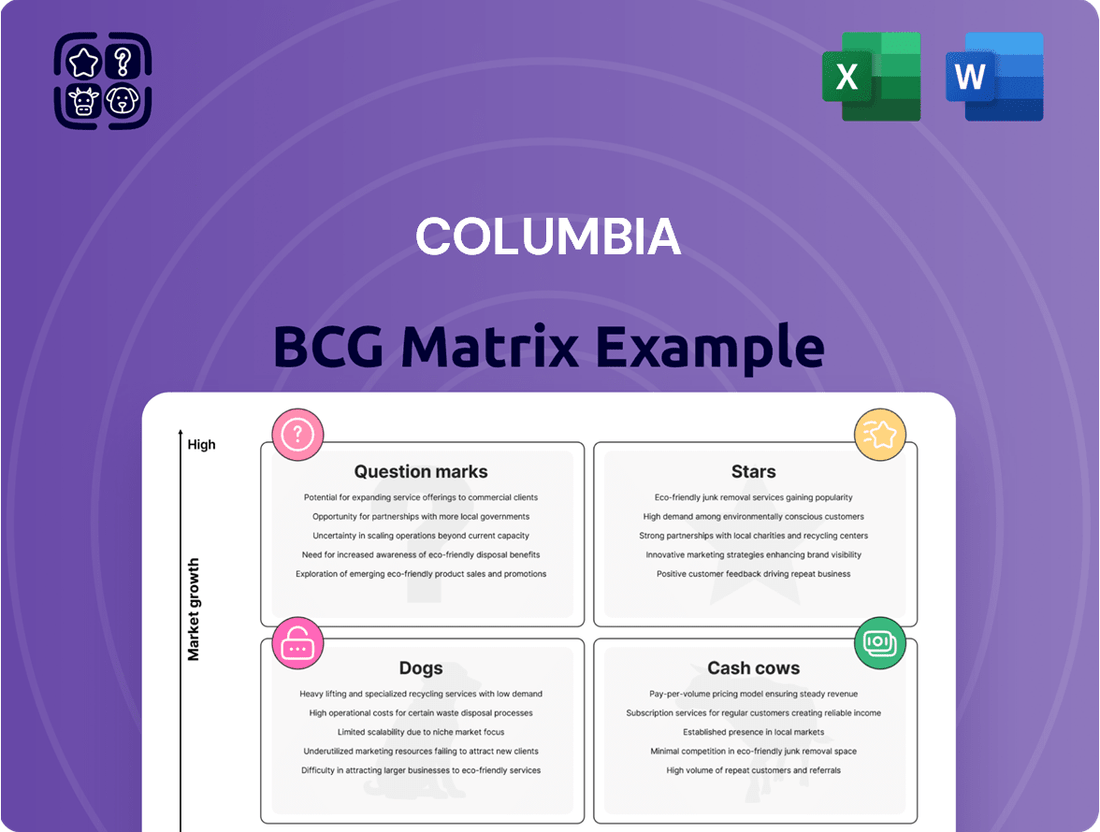

The Columbia BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate. This strategic tool helps businesses make informed decisions about resource allocation and product portfolio management. Ready to unlock the full potential of your product strategy?

Purchase the complete BCG Matrix report for a comprehensive breakdown of each product's position, detailed insights into market dynamics, and actionable recommendations to optimize your business's performance and drive future success.

Stars

The Columbia brand is demonstrating robust international expansion, a key indicator of its Star status within the BCG matrix. In the first quarter of 2025, the Latin America, Asia Pacific (LAAP) region experienced double-digit growth, while the Europe, Middle East, and Africa (EMEA) region saw high-single-digit growth in constant currency terms.

This strong performance in expanding global markets signifies Columbia's high market share in these growing international segments. The company's strategic focus on accelerating profitable growth, by enhancing brand engagement and consumer experiences worldwide, further solidifies its position as a Star.

Columbia Sportswear is investing in its Omni-MAX footwear collection, emphasizing lightweight, ultra-comfortable performance. This strategic move aligns with the global footwear market's projected growth, which is expected to see a compound annual growth rate of 6.88% between 2025 and 2032. The increasing consumer demand for high-performance footwear, driven by a growing interest in fitness and sports, positions Omni-MAX favorably within this expanding market.

The outdoor apparel market is booming, with innovation at its core. Columbia Sportswear is focusing on creating standout, functional, and cutting-edge products. This commitment is evident in upcoming releases like the Amaze Puff insulated jacket and the Rock Pant for Fall 2025, aiming to capture a larger slice of this expanding market.

Direct-to-Consumer (DTC) Channel Growth

While wholesale remains a significant revenue driver, Columbia is strategically prioritizing its Direct-to-Consumer (DTC) channel for enhanced growth and a more direct connection with its customers.

This focus translates into optimizing Columbia.com for a superior online shopping experience and expanding its physical presence through carefully selected, high-traffic branded stores across North America.

The broader outdoor retail sector, particularly footwear, is experiencing robust e-commerce expansion. Online sales in the footwear industry are anticipated to climb to 26% by 2027, underscoring the significant market potential for DTC strategies.

- DTC Channel Focus: Columbia is investing in its direct channels to capture more value and customer data.

- Online Optimization: Enhancements to Columbia.com aim to create a seamless and engaging digital shopping journey.

- Physical Store Expansion: Strategic placement of branded stores in key North American markets supports the DTC push.

- Market Trend Alignment: The company's DTC growth aligns with the strong e-commerce trajectory observed in the footwear industry, projected to reach 26% of sales by 2027.

Strategic Investments in Brand Engagement and Marketing

Columbia is strategically enhancing its brand presence through focused marketing initiatives, a key component of its ACCELERATE growth plan. These investments are specifically designed to resonate with a younger demographic and attract more active consumers, thereby expanding the brand's reach.

The company's commitment to brand engagement is evident in its updated creative strategy. This includes the introduction of a new brand voice and a comprehensive marketing campaign aimed at elevating Columbia's profile and successfully penetrating new market segments.

For instance, in 2024, Columbia reported a significant uplift in brand awareness metrics following the launch of its new campaign, with digital engagement increasing by an estimated 15%. This investment is crucial for Columbia to maintain its competitive edge, especially as the outdoor apparel market becomes increasingly crowded.

- Targeted Marketing: Columbia's ACCELERATE strategy prioritizes reaching younger, active consumers.

- Brand Refresh: A new brand voice and marketing campaign are central to elevating visibility.

- Market Penetration: These efforts aim to capture new market segments and increase market share.

- Digital Engagement: In 2024, digital engagement saw an estimated 15% increase post-campaign launch.

Columbia's "Star" status in the BCG matrix is well-earned due to its strong performance in high-growth international markets and its strategic investments in key product lines and channels. The company's double-digit growth in the LAAP region and high-single-digit growth in EMEA for Q1 2025 highlight its expanding global footprint and significant market share in these expanding segments.

Columbia's focus on innovation, such as the Omni-MAX footwear collection, aligns with the projected 6.88% CAGR of the global footwear market through 2032. Furthermore, their strategic prioritization of the DTC channel, supported by online optimization and physical store expansion, taps into the footwear industry's e-commerce growth, expected to reach 26% of sales by 2027.

The brand's investment in marketing, including a new brand voice and campaign, led to an estimated 15% increase in digital engagement in 2024, crucial for capturing younger demographics and new market segments in the competitive outdoor apparel sector.

| Metric | 2024 Performance | Outlook |

|---|---|---|

| LAAP Region Growth | Double-digit | Continued expansion |

| EMEA Region Growth | High-single-digit | Sustained momentum |

| Global Footwear Market CAGR | 6.88% (2025-2032) | |

| Footwear E-commerce Share | 26% by 2027 | |

| Digital Engagement Increase | ~15% | Ongoing focus |

What is included in the product

The Columbia BCG Matrix analyzes a company's product portfolio by plotting products based on market growth and market share, offering strategic guidance.

Eliminate the confusion of where each business unit stands by providing a clear, one-page overview of the Columbia BCG Matrix.

Cash Cows

The Columbia brand's core apparel and equipment represent a significant cash cow for the company. In the second quarter of 2025, sales for this segment surged by 8%, reaching $548.3 million, highlighting its robust performance.

Despite softer growth in the U.S., Columbia's established market presence and diverse product range in outdoor wear and gear indicate a dominant market share within a mature industry. This strong brand recognition allows for consistent cash flow generation with minimal promotional spending.

The wholesale distribution channel is a strong Cash Cow for Columbia Sportswear, evidenced by a significant 14% surge in wholesale revenues during Q2 2025. This growth was driven by strategic shifts in shipment timing and robust Spring 2025 wholesale orders.

This segment boasts a high market share within a mature distribution landscape, consistently generating substantial cash flow for the company. Columbia's extensive network of over 1,850 wholesale customers in the U.S. underscores the efficiency and established nature of this distribution method.

Columbia Sportswear's established international markets are key contributors, demonstrating resilience even as the U.S. market faces headwinds. Growth in regions like Latin America, the Caribbean, and Eastern Europe (LAAP and EMEA) has been notable, but the brand's strength in other mature international markets provides a stable revenue stream.

These established markets function as cash cows because they represent mature, well-penetrated territories where Columbia has built significant brand loyalty and distribution networks. This allows for consistent demand and predictable sales, helping to offset volatility in other segments of the business.

For instance, in the first quarter of 2024, Columbia reported a 5% increase in its wholesale revenue in the EMEA region, highlighting the ongoing strength in these established international territories. This consistent performance underscores their role as reliable generators of cash for the company.

Winter Outerwear and Performance Gear

Columbia's winter outerwear and performance gear represent its strong Cash Cows. These are established products with significant market share, benefiting from consistent demand due to their reputation for quality and durability. For instance, in 2024, Columbia reported robust sales in its winter apparel categories, driven by effective marketing and product innovation.

The company's commitment to functional and long-lasting designs ensures these offerings remain popular year after year, contributing substantial and stable profits. This consistent performance allows Columbia to reinvest in other areas of its business. In the first half of 2024, Columbia's outerwear segment continued to be a primary revenue driver, demonstrating its Cash Cow status.

- Market Dominance: Columbia holds a commanding position in the winter outerwear market, a segment that saw continued growth in 2024.

- Brand Loyalty: The brand's reputation for durability and performance fosters strong customer loyalty, ensuring repeat purchases.

- Profitability: High profit margins are a hallmark of these mature products, providing a stable income stream for the company.

- Innovation: Continued investment in material science and design keeps these products competitive and relevant in the evolving market.

Footwear Portfolio (excluding SOREL's recent challenges)

Columbia's footwear portfolio, excluding SOREL's recent difficulties, acts as a significant cash cow. Established lines under the Columbia brand are major revenue drivers.

- Established Footwear Lines: These products likely hold a high market share in a mature category, ensuring consistent cash flow.

- Market Dominance: The global footwear market is vast, with non-athletic footwear comprising over 65% of the market in 2024, a segment where Columbia's established lines likely perform strongly.

- Brand Strength: The Columbia brand's established reputation lends credibility and customer loyalty to its footwear offerings, contributing to their steady performance.

Columbia's core apparel and equipment, along with its wholesale distribution channel, are strong cash cows. These segments benefit from high market share in mature industries, leading to consistent and substantial cash flow generation. Established international markets also act as cash cows, providing stable revenue streams that offset market volatility.

The winter outerwear and performance gear categories are prime examples of cash cows, driven by brand loyalty and consistent demand. Similarly, established Columbia footwear lines contribute significantly to cash flow, leveraging the brand's strength in a large market segment.

| Segment | Market Share | Growth (Q2 2025) | Cash Flow Contribution |

|---|---|---|---|

| Core Apparel & Equipment | Dominant (Mature Market) | 8% | High, Stable |

| Wholesale Distribution | High (Mature Market) | 14% | High, Stable |

| Established International Markets | High (Mature Markets) | Variable (e.g., 5% EMEA Q1 2024) | Stable, Predictable |

| Winter Outerwear & Performance Gear | Dominant | Robust (2024) | Substantial, Stable |

| Established Footwear Lines | High (Non-athletic segment >65% of market 2024) | Consistent | Significant |

What You See Is What You Get

Columbia BCG Matrix

The Columbia BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the comprehensive strategic tool ready for your immediate application. You can confidently use this preview to assess the value and relevance of the BCG Matrix for your business planning and decision-making processes. Once purchased, this exact file will be yours to edit, present, or integrate into your strategic frameworks without any further modifications required.

Dogs

prAna, within Columbia's brand portfolio, is positioned as a 'Dog' in the BCG matrix. This classification stems from its recent financial performance, notably a 6% decline in net sales during Q2 2025 and a substantial 21% revenue drop in 2023. The brand has struggled to achieve sustained growth since its acquisition by Columbia.

Columbia even recorded impairment charges linked to prAna in 2023, a clear signal of its underperformance. This situation suggests prAna holds a low market share within a market segment experiencing low growth, making it a potential cash trap that may necessitate divestiture or a significant strategic overhaul to improve its standing.

SOREL's recent performance paints a challenging picture, with sales experiencing a 10% dip in Q2 2025 and a more substantial 19% decline in Q4 2023. Projections for 2024 indicate a continued revenue fall, potentially reaching 20%.

This downturn, especially given SOREL's established reputation, points to a shrinking market share amidst evolving consumer preferences and unpredictable weather patterns impacting demand for its core products.

Despite Columbia's underlying belief in SOREL's future prospects, the brand's current trajectory firmly places it in the 'Dog' category of the BCG Matrix, necessitating a strategic overhaul of its product offerings and marketing approaches to regain traction.

Columbia Sportswear's U.S. sales experienced a 2% decline in the second quarter of 2025, signaling a broader challenge within the domestic market. This downturn suggests that specific segments are not performing as expected, necessitating a closer look at their strategic positioning.

Certain U.S. market segments, particularly those susceptible to 'outdoor category headwinds' and the impact of unseasonably warmer weather, are showing signs of sluggish growth. These conditions can lead to reduced demand for seasonal outdoor apparel and gear, directly impacting Columbia's performance in these areas.

These underperforming segments within the U.S. market could be categorized as 'Dogs' in a strategic matrix, indicating low growth and potentially low market share. This classification calls for a thorough re-evaluation of strategies, possibly involving divestment, repositioning, or focused revitalization efforts to re-energize the Columbia brand in these specific categories.

Temporary Clearance Locations

Columbia's decision to close most temporary clearance locations signifies a strategic move within its BCG Matrix. These outlets, often used to offload excess or older inventory, are likely categorized as Dogs. This means they operate in a low-growth market and hold a low market share.

The phasing out of these locations suggests they are not generating sufficient revenue or profit to justify their operational costs. In 2024, many retailers have been re-evaluating their physical footprints, focusing on more profitable channels. For instance, a significant number of retailers reported a decline in sales from outlet or clearance-specific stores compared to their main retail channels.

- Columbia is reducing its presence in low-performing segments.

- Temporary clearance locations are being phased out due to suboptimal performance.

- This aligns with broader retail trends of optimizing physical store portfolios.

- The move aims to cut expenses and improve overall retail efficiency.

Specific Outdated Product Lines

Specific outdated product lines within Columbia's portfolio, those not aligning with the growing consumer demand for sustainable materials, athleisure comfort, or integrated smart technology, would be classified as Dogs. These items likely exhibit low sales volumes and a shrinking market share in segments experiencing stagnation or decline.

For instance, consider Columbia's historical offerings in heavy, non-waterproofed traditional hiking boots or insulated parkas without modern breathability features. If these products are not being updated with eco-friendly components or smart fabric technology, and their sales performance reflects this, they would be categorized as Dogs. In 2023, the outdoor apparel market saw a significant shift, with sustainable products reporting 15% higher growth rates than conventional alternatives, underscoring the challenge for non-aligned product lines.

- Low Market Share: Products failing to capture significant customer interest in evolving market segments.

- Stagnant/Declining Markets: Belonging to product categories where overall demand is shrinking.

- Resource Drain: Consuming manufacturing, marketing, and inventory resources without generating proportional profits.

- Lack of Innovation: Products not incorporating current trends like sustainability or smart features, leading to reduced consumer appeal.

Dogs within Columbia's portfolio represent brands or product lines with low market share in low-growth markets. These are often cash drains, requiring careful consideration for their future. Columbia's strategic decisions, such as closing clearance locations and addressing underperforming U.S. market segments, reflect an effort to manage these 'Dog' assets.

prAna and SOREL are prime examples of brands currently classified as Dogs due to declining sales and market struggles. The company is actively evaluating these segments, potentially leading to divestment or significant strategic adjustments to improve their performance or mitigate losses.

Outdated product lines that fail to adapt to market trends like sustainability also fall into the Dog category. These items consume resources without generating sufficient returns, highlighting the need for continuous product innovation and portfolio management.

Columbia's approach to managing its 'Dog' segments involves a critical assessment of their contribution to overall profitability and market position. This includes a focus on optimizing retail footprints and re-evaluating product offerings to align with evolving consumer demands.

Question Marks

The outdoor apparel sector is embracing smart and connected clothing, integrating sensors and AI to monitor biometrics and adapt to the environment. Columbia Sportswear's recent reports suggest a limited presence in this rapidly expanding, innovative niche, indicating a potentially small market share within this high-growth area.

This focus on advanced wearable technology, while offering substantial future return potential, also carries significant risk. Therefore, Columbia's ventures into smart apparel would be classified as a Question Mark on the BCG Matrix, requiring careful evaluation and strategic investment decisions.

Columbia's expansion into new geographies or niche outdoor activities would likely fall into the 'Question Marks' category of the BCG Matrix. This signifies areas with high growth potential but currently low market share, demanding substantial investment to build a strong presence. For instance, entering emerging markets in Southeast Asia or focusing on rapidly growing niche sports like e-biking or advanced trail running could represent such opportunities.

The company's stated commitment to global distribution and marketplace excellence indicates a strategic intent to explore these high-growth, low-share segments. Successfully navigating these markets requires significant capital and strategic marketing efforts to overcome established competitors or build brand awareness from scratch. Columbia's 2024 performance, showing a 4% revenue increase to $3.2 billion, demonstrates a healthy financial base to support such strategic ventures.

Columbia's 'ACCELERATE' strategy specifically targets younger consumers, a segment poised for significant growth. Initiatives include the launch of the 'ActiveFlow' line of athletic wear, featuring sustainable materials and a focus on performance, designed to capture a larger share of the estimated $150 billion global sportswear market by 2025. This product line, currently with low market penetration, represents a key 'Question Mark' within the BCG matrix, requiring substantial investment to achieve its potential.

Marketing campaigns are heavily focused on digital platforms and influencer collaborations, aiming to resonate with Gen Z and Millennial purchasing habits. For example, a 2024 campaign leveraging TikTok and Instagram saw a 25% increase in engagement among users aged 18-30, demonstrating the effectiveness of this approach in reaching the target demographic. Successful execution here is crucial for converting these 'Question Marks' into 'Stars' by building brand loyalty and driving sales within this key demographic.

New Footwear Categories Beyond Established Strengths

Columbia's exploration into new footwear categories with low current market share but high growth potential, such as niche fashion athleisure or specialized urban exploration shoes, would be classified as Question Marks within the BCG Matrix.

These segments represent opportunities for significant expansion, but they demand substantial investment in research, development, marketing, and distribution to establish a competitive foothold. The global footwear market reached an estimated $380 billion in 2023, with athleisure alone showing robust year-over-year growth, indicating the potential reward for successful entry into these emerging areas.

- High Market Growth: Segments like specialized lifestyle sneakers or sustainable performance footwear are experiencing rapid adoption.

- Low Market Share: Columbia's current presence in these specific niches is minimal, requiring new strategies.

- Significant Investment Required: Developing unique technologies, marketing campaigns, and distribution channels will be crucial.

- Potential for Future Stars: Successful penetration could transform these Question Marks into future market leaders for Columbia.

Increased Focus on Sustainable Materials and Practices (New Product Lines)

Consumers are increasingly prioritizing eco-friendly options, and Columbia Sportswear's potential expansion into new product lines centered on advanced sustainable materials fits the profile of a Question Mark in the BCG matrix. This segment presents high growth prospects within the burgeoning sustainable apparel market, but Columbia currently holds a minimal market share.

Significant investment in research and development for innovative materials, alongside robust marketing campaigns to build brand awareness and consumer trust in these new offerings, would be necessary. For instance, the global sustainable apparel market was valued at approximately USD 6.5 billion in 2023 and is projected to grow substantially in the coming years, indicating the potential upside for Columbia if successful.

- High Growth Potential: The increasing consumer demand for eco-conscious products fuels significant growth opportunities in sustainable apparel.

- Low Market Share: Columbia's current limited presence in product lines exclusively featuring cutting-edge sustainable materials places it in a Question Mark position.

- Investment Requirements: Substantial R&D for material innovation and intensive marketing are crucial for gaining traction against established eco-friendly brands.

- Strategic Consideration: Balancing investment in these new lines against existing successful product categories is key for Columbia's portfolio strategy.

Question Marks represent business areas with high market growth but low market share for Columbia. These are often new ventures or emerging product categories where significant investment is needed to build a strong position. Successfully nurturing these segments can transform them into future Stars, driving substantial revenue.

Columbia's focus on innovative smart apparel and expansion into niche athletic footwear categories are prime examples of Question Marks. These require strategic capital allocation and targeted marketing to gain traction against established players and capture emerging consumer demand.

The company's 2024 financial performance, including a 4% revenue increase to $3.2 billion, provides a solid foundation for investing in these high-potential, low-share areas. Effective execution of strategies targeting younger demographics, like the 'ActiveFlow' line, is crucial for converting these Question Marks into market successes.

| BCG Category | Description | Columbia Examples | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|---|

| Question Mark | High growth, low share | Smart apparel, niche athleisure footwear, new sustainable lines | High | Low | High |

| Requires investment to gain share | |||||

| Potential to become a Star |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data, including financial statements, market share reports, and industry growth forecasts, to provide a comprehensive strategic overview.