Columbia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Columbia Bundle

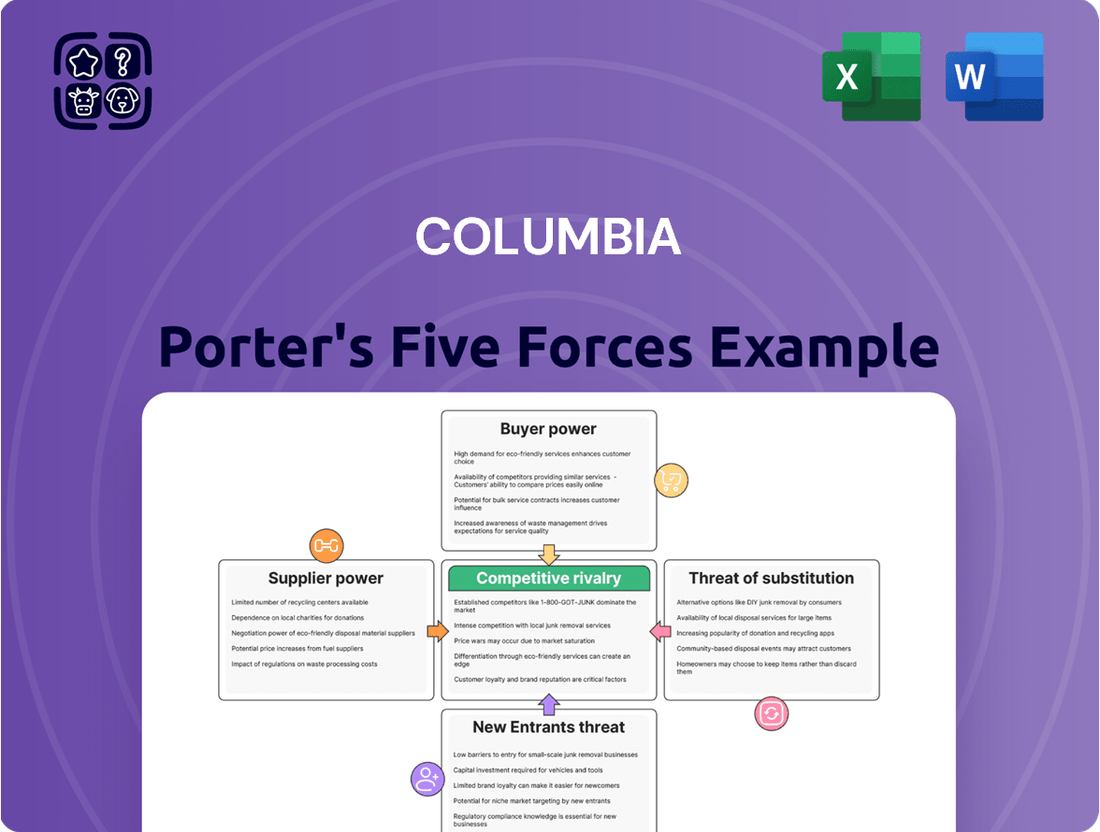

Columbia's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Columbia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Columbia Sportswear's reliance on a concentrated group of specialized fabric manufacturers for its technical apparel significantly influences supplier bargaining power. As of 2024, the global landscape for these high-performance textile producers is quite narrow, with only about 7 to 9 key players worldwide.

This scarcity, coupled with the unique capabilities and proprietary technologies these manufacturers possess, grants them considerable leverage. They can dictate terms, influence pricing, and potentially limit supply, directly impacting Columbia's production costs and material availability.

Columbia Sportswear's reliance on key material suppliers like Gore-Tex for waterproof membranes, Polartec for performance fleece, and Toray Industries for specialized synthetic fabrics significantly influences its bargaining power. This dependence is amplified when alternative materials are limited in availability or performance, thereby strengthening the suppliers' position.

Columbia Sportswear's strategic sourcing locations, primarily in the Asia Pacific region including Vietnam, China, and Indonesia, influence supplier bargaining power. While diversification across these areas helps, a concentration in any single region can still leave Columbia exposed to the leverage of suppliers within that specific market.

Long-Term Supplier Relationships

Columbia Sportswear prioritizes building enduring connections with its manufacturing collaborators, evidenced by an average supplier relationship spanning 12.5 years. This commitment to longevity fosters stability and can mitigate risks associated with supply chain volatility.

These long-term agreements, coupled with a strategy of sourcing critical components from multiple suppliers, enhance Columbia's resilience. This approach not only safeguards against potential disruptions but also provides leverage for negotiating more favorable terms on pricing and quality assurance.

- Supplier Relationship Longevity: Columbia's average supplier relationship is 12.5 years.

- Risk Mitigation: Long-term contracts and multi-sourcing reduce supply chain disruption risks.

- Pricing and Quality Stability: Established relationships can lead to more predictable costs and consistent product quality.

Supplier Compliance and Ethical Practices

Columbia's rigorous supplier compliance and ethical practices, detailed in their 2024 Impact Report, significantly shape supplier bargaining power. By mandating adherence to strict policies against forced labor, child labor, and modern slavery, Columbia narrows its supplier base.

This focus on ethical sourcing, while crucial for brand reputation, can increase the cost of compliance for suppliers. Consequently, suppliers who can meet these stringent standards may find themselves in a stronger negotiating position, as the pool of compliant partners is more limited.

- Supplier Compliance: Columbia's 2024 Impact Report highlights a strong commitment to ethical sourcing, requiring suppliers to adhere to strict policies.

- Ethical Standards: These policies actively combat forced labor, child labor, and modern slavery within the supply chain.

- Impact on Supplier Pool: The stringent requirements can limit the number of eligible suppliers, potentially increasing the bargaining power of those who meet the criteria.

- Cost Implications: Compliance with these ethical standards may lead to increased operational costs for suppliers, influencing their pricing and negotiation leverage.

The bargaining power of suppliers for Columbia Sportswear is influenced by the concentration of specialized fabric manufacturers and the unique capabilities of these providers. With a limited number of high-performance textile producers globally, these suppliers can exert significant leverage over pricing and supply, as seen with key partners like Gore-Tex and Polartec.

Columbia's strategy of fostering long-term relationships, averaging 12.5 years with suppliers, and diversifying its sourcing across regions like Vietnam, China, and Indonesia, helps to mitigate this supplier power. However, the company's commitment to rigorous ethical sourcing, as detailed in its 2024 Impact Report, can narrow the pool of compliant suppliers, potentially strengthening the position of those who meet these stringent standards.

| Factor | Impact on Columbia | Supplier Leverage |

|---|---|---|

| Specialized Fabric Manufacturers | Reliance on few, high-capability producers | High |

| Supplier Relationship Longevity | Average 12.5 years | Moderate (promotes stability) |

| Geographic Diversification | Sourcing from Vietnam, China, Indonesia | Moderate (reduces regional concentration risk) |

| Ethical Sourcing Compliance (2024 Report) | Narrows supplier pool, increases compliance cost | Potentially High (for compliant suppliers) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Columbia's unique position in the education and research sector.

Instantly identify and address competitive threats with a comprehensive, yet easily digestible, overview of each Porter's Five Forces.

Gain clarity on strategic vulnerabilities by visualizing the interconnectedness of competitive pressures, enabling proactive problem-solving.

Customers Bargaining Power

Columbia Sportswear's strategy of utilizing diverse distribution channels, including wholesale, international distributors, direct-to-consumer (DTC) retail, and e-commerce, significantly dampens customer bargaining power. This multi-pronged approach means no single customer group or channel holds excessive sway over Columbia's sales terms.

The increasing consumer interest in outdoor activities and active lifestyles is a significant trend driving demand for outdoor apparel. This growing preference for engaging in nature and pursuing fitness directly translates into a larger overall market for companies like Columbia Sportswear.

This broad market expansion, with projections indicating the global outdoor apparel market could reach $62 billion by 2032, can actually temper the bargaining power of individual customers. When a market is growing and there's a larger pool of consumers eager to buy, it can reduce the leverage any single customer or small group of customers has over pricing and product terms.

Columbia Sportswear's robust brand recognition, encompassing popular names like Columbia, SOREL, Mountain Hardwear, and prAna, significantly mitigates customer bargaining power. This strong brand equity allows Columbia to command premium pricing and fosters a loyal customer base less inclined to switch based on price alone.

Impact of Direct-to-Consumer (DTC) Sales

The rise of direct-to-consumer (DTC) sales, including Columbia's own retail stores and e-commerce, significantly bolsters its position against customer bargaining power. By interacting directly, Columbia gains valuable insights and maintains greater control over pricing and promotions, diminishing reliance on intermediaries who could otherwise dictate terms.

This direct engagement allows Columbia to build stronger customer relationships and gather feedback, which is crucial for product development and marketing. For instance, Columbia's DTC segment has seen robust growth, contributing to a more favorable pricing environment and reducing the leverage that large retail partners might wield.

- DTC Growth: Columbia's DTC net sales have shown consistent upward trends, indicating a successful shift towards direct customer engagement.

- Reduced Intermediary Dependence: By controlling more of the sales channel, Columbia can better manage its brand image and profit margins, lessening the impact of retailer demands.

- Customer Data Advantage: Direct sales provide rich customer data, enabling personalized marketing and product offerings that can increase customer loyalty and reduce price sensitivity.

- Pricing Control: The DTC model allows Columbia to set and maintain its pricing strategy without the pressure from wholesale markups or retailer discounting demands.

Consumer Demand for Sustainability and Ethical Practices

Consumer demand for sustainability and ethical practices is a significant factor influencing the bargaining power of customers. Younger consumers, in particular, are actively seeking brands that reflect their values, which can give them leverage. For instance, Columbia Sportswear's 2024 Impact Report details their commitment to eco-conscious materials and responsible production, directly addressing this growing consumer preference. This alignment can allow Columbia to command premium pricing and solidify customer loyalty, thereby mitigating some of the customers' bargaining power.

- Growing Consumer Consciousness: A significant portion of consumers, especially Millennials and Gen Z, now consider a company's environmental and social impact when making purchasing decisions.

- Brand Differentiation: Columbia's investment in sustainable materials and ethical sourcing, as evidenced by their 2024 reporting, provides a key differentiator in a competitive market.

- Potential for Premium Pricing: Brands demonstrating strong sustainability credentials can often justify higher price points, as consumers are willing to pay more for ethically produced goods.

- Shifting Market Expectations: The increasing prevalence of sustainability reporting and certifications means that ethical practices are becoming less of a niche concern and more of a baseline expectation for many consumers.

Columbia's diverse distribution strategy, spanning wholesale, international partners, and direct-to-consumer (DTC) channels, effectively dilutes customer bargaining power. This broad reach means no single customer segment can exert undue influence over pricing or terms.

The robust growth in the outdoor apparel market, projected to reach $62 billion by 2032, also serves to lessen individual customer leverage. A larger, expanding market with high demand naturally reduces the power any single buyer holds.

Columbia's strong brand portfolio, including Columbia, SOREL, Mountain Hardwear, and prAna, further solidifies its position. This brand equity fosters customer loyalty, making them less susceptible to price-based negotiations.

The company's strategic expansion of its DTC segment, which includes its own retail stores and e-commerce, enhances its control over pricing and customer relationships. This direct engagement allows Columbia to gather valuable data and maintain pricing integrity, thereby diminishing the bargaining power of intermediaries and individual consumers.

Columbia's commitment to sustainability, as highlighted in its 2024 Impact Report, addresses a key consumer driver. By aligning with eco-conscious values, the company can command premium pricing and build loyalty, reducing price sensitivity and thus customer bargaining power.

| Metric | 2023 Data | 2024 Projection/Trend |

|---|---|---|

| Global Outdoor Apparel Market Size | Estimated $55 billion | Projected $62 billion by 2032 |

| Columbia DTC Net Sales Growth | Positive year-over-year | Continued upward trend |

| Consumer Preference for Sustainability | Growing significantly | Increasingly a key purchase driver |

What You See Is What You Get

Columbia Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Columbia provides an in-depth examination of industry competition, supplier and buyer power, threat of new entrants, and the threat of substitute products, offering valuable strategic insights.

Rivalry Among Competitors

The outdoor, active, and lifestyle sectors are incredibly crowded. Think of the sheer number of brands out there, from giants like Nike and Adidas to specialized names like Patagonia and The North Face, plus a growing wave of direct-to-consumer startups. This makes standing out a real challenge.

In 2024, the global sportswear market alone was valued at over $200 billion, highlighting the vastness and the intense battle for market share. This sheer volume of players, each vying for consumer attention and dollars, underscores the high level of rivalry.

Columbia Sportswear operates in a highly competitive landscape, contending with global powerhouses such as Nike and VF Corporation, the latter boasting brands like The North Face and Patagonia. This intense rivalry demands constant innovation and strategic positioning to secure and grow market share.

The presence of these major global players, alongside a multitude of regional and niche competitors, creates significant pressure on pricing and product development. For instance, in 2023, Nike reported net sales of $51.2 billion, demonstrating the scale of investment and marketing power Columbia must counter.

Competitive rivalry in the outdoor apparel and gear market is fierce, largely fueled by relentless product innovation. Brands are in a perpetual race to introduce novel materials, advanced technologies, and updated designs that improve performance, extend durability, and elevate style.

Columbia Sportswear, for instance, actively invests in research and development, launching new product lines each year. This commitment to innovation is crucial for maintaining competitiveness and distinguishing its products in a market where having the latest features is no longer a bonus but a fundamental expectation.

Price Sensitivity and Promotional Activities

The outdoor apparel market often exhibits significant price sensitivity. Consumers frequently anticipate and seek out discounts, which intensifies competitive pricing pressures among brands. This dynamic necessitates that companies like Columbia carefully balance their pricing strategies to remain competitive while also safeguarding profitability and brand equity.

Promotional activities are a common tactic to capture market share in this environment. Brands frequently engage in sales events, loyalty programs, and bundled offers to attract price-conscious shoppers. For instance, in 2024, many major outdoor retailers offered seasonal sales exceeding 30% off on select items, directly impacting the perceived value and price points of products.

- Price Sensitivity: Consumers in the outdoor apparel sector are highly attuned to pricing, often delaying purchases for sales events.

- Promotional Intensity: Brands regularly employ discounts, loyalty programs, and special offers to drive sales and manage inventory.

- Profitability vs. Market Share: Companies must navigate the challenge of offering competitive prices without eroding profit margins or devaluing their brand.

- 2024 Market Trends: Data from 2024 indicated a rise in promotional frequency, with an average of 4 major sale periods per year for leading brands.

Shifting Consumer Preferences and Athleisure Trend

The athleisure trend has significantly blurred the lines between traditional outdoor apparel and everyday casual wear, intensifying competitive rivalry. This shift means Columbia faces increased pressure not only from direct outdoor competitors but also from fashion brands and major sportswear companies that are expanding into performance-oriented clothing. For instance, Nike's continued dominance in athletic wear and Adidas's successful integration of lifestyle and performance elements present formidable challenges.

Columbia's competitive landscape is further complicated by the demand for versatile products that can transition seamlessly from outdoor adventures to daily life. This requires continuous innovation in materials and design to meet consumer expectations for both functionality and style. The market saw considerable growth in the activewear segment, with global sales reaching approximately $350 billion in 2023, indicating a strong consumer preference for this versatile clothing category.

- Athleisure Growth: The global athleisure market is projected to continue its upward trajectory, with estimates suggesting it could reach over $500 billion by 2028, driven by evolving consumer lifestyles.

- Brand Diversification: Traditional fashion retailers like Lululemon have successfully pivoted to offer technically advanced apparel, directly competing with established outdoor brands.

- Sportswear Expansion: Major sportswear giants are increasingly incorporating outdoor-inspired aesthetics and technologies into their product lines, broadening their competitive reach.

- Consumer Demand: Consumers are actively seeking apparel that offers both high performance for outdoor activities and a stylish, comfortable fit for everyday wear, forcing brands to adapt their offerings.

The competitive rivalry within the outdoor and activewear sectors is exceptionally high. This intensity stems from a crowded marketplace featuring global giants, specialized brands, and emerging direct-to-consumer players, all vying for consumer attention and market share. For instance, the global sportswear market was valued at over $200 billion in 2024, underscoring the vastness and the fierce competition for a piece of this lucrative pie.

Columbia Sportswear faces formidable competition from industry titans like Nike, which reported net sales of $51.2 billion in 2023, and VF Corporation, the parent company of brands such as The North Face and Patagonia. This intense rivalry necessitates continuous innovation in materials, technology, and design to remain relevant and capture market share.

Price sensitivity is a significant factor, with consumers often waiting for sales. Brands frequently deploy discounts and promotions, with leading companies averaging four major sale periods annually in 2024. This dynamic forces companies to carefully balance competitive pricing with profitability and brand value, a challenge amplified by the growing athleisure trend that blurs the lines between performance and lifestyle wear.

| Competitor | 2023 Net Sales (Approx.) | Key Brands |

|---|---|---|

| Nike | $51.2 billion | Nike, Jordan |

| VF Corporation | $10.5 billion | The North Face, Vans, Timberland |

| Adidas | $24.5 billion (approx. €21.4 billion) | Adidas, Reebok |

SSubstitutes Threaten

The outdoor apparel market is experiencing a significant threat from the rising popularity of alternative brands, such as The North Face, Patagonia, and Arc'teryx. These competitors offer comparable functional and stylish products, giving consumers a broad spectrum of choices that can divert demand away from Columbia.

For instance, in 2023, The North Face reported strong revenue growth, indicating its continued appeal and market penetration. This increasing consumer preference for these established alternatives means Columbia must constantly innovate and differentiate its offerings to retain its customer base.

The rise of non-specialized and private-label brands presents a significant threat of substitutes in the fashion and sportswear industry. Traditional brands and a growing number of private labels are expanding their product lines to include versatile, performance-oriented apparel, directly competing with specialized offerings.

These diversified brands often benefit from established distribution networks and can price their products more competitively. For instance, in 2023, the global private label apparel market was valued at approximately $200 billion, demonstrating its substantial market presence and ability to offer compelling alternatives to consumers seeking value.

The rise of athleisure wear presents a significant threat of substitutes for traditional outdoor apparel brands like Columbia. Consumers are increasingly prioritizing versatile clothing that can be worn for both athletic pursuits and everyday casual settings. This trend means that general activewear, often produced by a wider range of competitors, can effectively replace specialized outdoor gear for many consumers.

For instance, the global athleisure market was valued at approximately $326 billion in 2023 and is projected to grow substantially. This broad availability of stylish and functional activewear blurs the lines of competition, as consumers may opt for these more broadly appealing items over dedicated outdoor apparel, especially for less extreme activities.

Do-It-Yourself (DIY) and Secondhand Markets

The growing popularity of rental and secondhand markets for outdoor gear presents a significant threat of substitutes. Consumers are increasingly prioritizing sustainability and cost-effectiveness, opting to rent equipment for occasional use or purchase pre-owned items. This trend directly impacts the demand for new products, as seen in the projected growth of the global secondhand apparel market, which was estimated to reach $350 billion by 2027, according to ThredUp's 2024 Resale Report.

Furthermore, a burgeoning DIY culture for minor repairs and modifications empowers consumers to extend the lifespan of their existing gear. This self-sufficiency reduces the perceived need for frequent new purchases. For instance, online tutorials and readily available repair kits for items like tents or backpacks enable users to tackle common issues themselves, further diminishing the urgency to buy replacements.

- Rental Market Growth: The outdoor gear rental market is expanding, offering consumers access to equipment without the commitment of ownership.

- Secondhand Sales Surge: Pre-owned outdoor equipment is gaining traction, driven by environmental consciousness and budget-friendly options.

- DIY Repair Culture: Consumers are increasingly equipped and inclined to repair their gear, reducing the frequency of new purchases.

Innovation in Other Product Categories

Advancements in smart and connected apparel, alongside the growing popularity of general performance wear, present a significant threat of substitutes for specialized outdoor gear. For instance, advancements in materials science mean that everyday athletic wear can now offer impressive moisture-wicking and temperature regulation, features once exclusive to high-end outdoor equipment.

These alternatives can fulfill many of the comfort and protection needs for less extreme outdoor activities, potentially reducing consumer reliance on specialized products. A study in late 2023 indicated that the global athleisure market, which often overlaps with performance wear, was projected to reach over $324 billion by 2028, highlighting the increasing adoption of versatile apparel.

- Smart Apparel Integration: Emerging smart fabrics offering basic health monitoring or climate control could diminish the need for specialized devices or clothing layers.

- Performance Wear Versatility: High-quality, general performance wear is becoming more adept at handling varied weather conditions, blurring the lines with specialized gear.

- Cost-Effectiveness: These broader categories of apparel often come at a lower price point than highly specialized outdoor equipment, making them attractive substitutes for casual users.

The threat of substitutes for Columbia's outdoor apparel is multifaceted, encompassing both direct competitors and broader lifestyle trends. The increasing availability of high-quality, versatile activewear and athleisure, often at more accessible price points, directly challenges specialized outdoor gear for everyday use or less demanding activities. Furthermore, the growing secondhand and rental markets offer consumers more sustainable and budget-friendly alternatives to purchasing new items, impacting Columbia's sales volume and market share.

| Substitute Category | Key Characteristics | Market Data Point (2023/2024) | Impact on Columbia |

|---|---|---|---|

| Athleisure & Performance Wear | Versatile, stylish, comfortable for multiple activities | Global athleisure market valued at ~$326 billion in 2023 | Reduces demand for specialized outdoor gear for casual use |

| Secondhand Market | Cost-effective, sustainable | Global secondhand apparel market projected to reach $350 billion by 2027 (ThredUp 2024 Resale Report) | Decreases new product sales, offers lower-cost alternatives |

| Rental Market | Access without ownership, ideal for occasional use | Growing significantly, though specific aggregate data for outdoor gear rental is still emerging but shows strong consumer interest in access over ownership models. | Limits purchase intent for infrequent users |

| Private Label Brands | Competitive pricing, broad product lines | Global private label apparel market valued at ~$200 billion in 2023 | Offers value-driven alternatives, potentially eroding market share |

Entrants Threaten

The threat of new entrants into the outdoor apparel market is significantly dampened by the immense capital required for product innovation and production. Establishing a brand that can rival established names like Columbia necessitates substantial upfront investment in research and development, sophisticated manufacturing capabilities, and the creation of a robust supply chain. For instance, companies must invest heavily in material science, design, and testing to create high-performance, durable outdoor gear.

Columbia Sportswear's financial disclosures often reflect these high entry barriers. In 2023, the company reported capital expenditures of $129.3 million, a portion of which is allocated to enhancing its manufacturing and distribution networks. Furthermore, ongoing investment in research and development, crucial for staying competitive with new materials and sustainable practices, adds another layer of financial commitment that deters smaller, less-capitalized newcomers.

Columbia's established brand recognition and deep-rooted customer loyalty present a significant barrier to new entrants. For instance, in 2023, Columbia Sportswear's net sales reached $3.45 billion, a testament to its market presence and consumer trust built over decades. Newcomers face the daunting task of not only matching product quality but also investing heavily in marketing and brand building to even approach the loyalty enjoyed by incumbents.

Columbia Sportswear's established global distribution network, spanning wholesale, direct-to-consumer retail, and e-commerce in over 100 countries, presents a significant barrier to new entrants. Replicating this reach and efficiency requires substantial investment and time, making it difficult for newcomers to compete effectively. For instance, in 2023, Columbia reported net sales of $3.46 billion, a testament to the scale and effectiveness of its distribution capabilities.

Access to Specialized Materials and Technologies

The outdoor apparel industry's reliance on specialized performance fabrics and advanced technologies presents a significant barrier to entry. Newcomers often struggle to gain access to these proprietary materials, which are crucial for creating competitive products.

Established companies have cultivated long-standing relationships with a select group of specialized suppliers, giving them preferential access and potentially better pricing. This can make it difficult for new entrants to source comparable materials or achieve the same level of innovation. For instance, companies like Gore-Tex, known for its waterproof and breathable membranes, have exclusive agreements that limit broader availability.

- Proprietary Materials: Access to patented fabrics like Gore-Tex or Polartec is often restricted through exclusive supplier agreements.

- Technological Innovation: Developing comparable performance features, such as advanced moisture-wicking or insulation, requires significant R&D investment, which new entrants may lack.

- Supplier Relationships: Incumbents benefit from established trust and volume commitments with key material manufacturers, securing supply chains.

- Cost of Innovation: The high cost of research and development for new fabric technologies acts as a deterrent for potential new market participants.

Intellectual Property and Regulatory Hurdles

Columbia, like many established brands, vigorously protects its intellectual property, including trademarks, patents, and trade dress. For instance, in 2023, the apparel industry saw numerous legal battles over design infringement, highlighting the importance of unique product development. New companies entering the market must meticulously navigate this existing IP landscape to avoid costly litigation and potential product recalls.

The cost of developing and defending proprietary technology or unique designs can be substantial, acting as a significant barrier. In 2024, companies investing in innovative materials or manufacturing processes often face upfront R&D expenses that can run into millions of dollars. This financial commitment deters many potential new entrants who lack the capital to compete on an innovative footing.

- Intellectual Property Protection: Columbia's extensive portfolio of patents and registered trademarks makes it challenging for new entrants to offer similar products without infringing on existing rights.

- Regulatory Compliance: Navigating the complex web of regulations, from material sourcing to product safety standards, adds another layer of difficulty and expense for new market participants.

- R&D Investment: The substantial investment required for research and development to create unique, non-infringing designs and technologies acts as a significant deterrent to new entrants.

The threat of new entrants into the outdoor apparel market is moderate, primarily due to high capital requirements for innovation, production, and brand building. Columbia's substantial investments, like its $129.3 million in capital expenditures in 2023, and its $3.45 billion in net sales that same year, highlight the scale needed to compete. Newcomers must overcome significant hurdles in accessing proprietary materials and navigating established intellectual property.

| Factor | Impact on New Entrants | Columbia's Position |

|---|---|---|

| Capital Requirements | High (R&D, Manufacturing, Marketing) | Established, significant financial resources |

| Brand Loyalty & Recognition | Challenging to replicate | Strong, built over decades |

| Distribution Networks | Difficult and costly to establish globally | Extensive, operating in over 100 countries |

| Proprietary Materials & Technology | Limited access, high R&D costs | Invests in material science and innovation |

| Intellectual Property | Risk of infringement, costly defense | Vigorously protects its IP |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive dynamics.