Coloplast PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

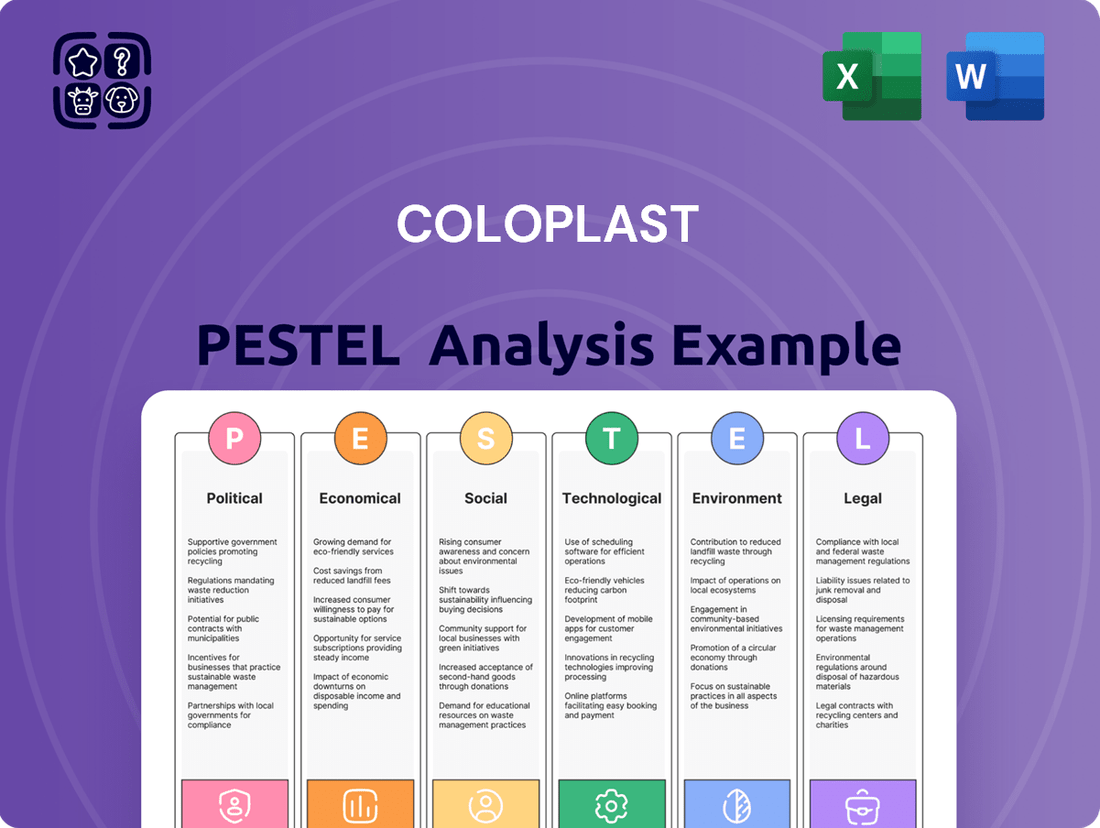

Unlock the strategic advantages hidden within Coloplast's external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping its future, offering you a critical edge. Download the full, expertly researched report now to gain actionable intelligence for your own market strategy.

Political factors

Government healthcare policies and reimbursement rates are crucial for Coloplast, directly influencing its revenue streams and ability to access markets. For instance, in the United States, proposed changes to Medicare and Medicaid payment structures, such as those discussed for fiscal year 2025, can significantly alter the financial viability of Coloplast's products.

Shifts towards value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, can also impact demand for Coloplast's innovative medical devices. If reimbursement is tied to demonstrating improved patient health, companies like Coloplast need to align their product development and marketing strategies accordingly.

The medical device sector operates under a stringent regulatory framework, heavily influenced by political decisions. Newer regulations, such as the EU's Medical Device Regulation (MDR) and In-Vitro Diagnostic Medical Devices Regulation (IVDR), demand substantial financial commitment for compliance, potentially delaying product launches and affecting market access. Navigating these diverse and evolving international regulations presents a significant challenge for companies like Coloplast.

Geopolitical shifts and evolving trade policies, particularly the implementation of tariffs, present potential challenges for Coloplast's global supply chain and pricing structures. These international trade dynamics can directly affect the cost of raw materials and finished goods, impacting profitability.

Despite these considerations, Coloplast's management has indicated that, based on their current assessments, they do not anticipate a significant financial impact from tariffs. This suggests a degree of resilience in their operational planning and sourcing strategies, possibly through diversification or pre-existing hedging mechanisms.

Governmental Healthcare Spending Priorities

Government priorities for healthcare spending significantly influence the market for medical devices like those Coloplast offers. For instance, a heightened focus on chronic disease management, a key area for Coloplast's ostomy and continence care, can lead to increased funding and reimbursement for relevant products and services. In 2024, many developed nations continued to allocate substantial portions of their national budgets to healthcare, with a growing emphasis on efficiency and patient outcomes, directly impacting device manufacturers.

Coloplast's business can be directly affected by shifts in government investment. An increased allocation towards home-based care, for example, could boost demand for Coloplast's discreet and user-friendly ostomy and urology products, as more patients receive care outside traditional hospital settings. Conversely, a reduction in funding for elective procedures or specific therapeutic areas might present challenges. For 2025 projections, many governments are expected to maintain or slightly increase healthcare spending, with a strong undercurrent of value-based purchasing, meaning products demonstrating clear cost-effectiveness and improved patient quality of life will likely be favored.

- Increased government investment in chronic care programs, particularly those focusing on long-term patient management, directly benefits Coloplast's ostomy and continence care divisions.

- Shifts in healthcare policy towards home-based care and telehealth can create new avenues for distribution and patient support for Coloplast's product portfolio.

- Governmental focus on cost containment within healthcare systems may drive demand for Coloplast's products if they demonstrate superior value and reduced long-term healthcare expenditures.

- In 2024, many national health services continued to report significant spending on medical supplies, with a notable trend towards digital health integration and patient-centric solutions.

Political Stability and Market Access

Political stability in Coloplast's key markets directly influences its operational continuity and growth ambitions. Unstable political landscapes can create significant hurdles, impacting everything from supply chain reliability to market entry and expansion. For instance, in 2023, Coloplast noted that tender phasing uncertainties in certain emerging markets, particularly within their Ostomy Care division, led to some disruption, highlighting the direct link between political environments and market access.

These political factors can manifest in several ways for a company like Coloplast:

- Regulatory Changes: Shifting government policies on healthcare, medical devices, and trade agreements can alter market dynamics and compliance requirements, potentially impacting product approvals and pricing.

- Trade Relations: Geopolitical tensions or changes in international trade policies can affect the cost and availability of raw materials and finished goods, as well as Coloplast's ability to export products globally.

- Government Spending on Healthcare: Political decisions regarding healthcare budgets and procurement processes directly influence demand for Coloplast's products, especially in markets reliant on public tenders.

- Social Unrest and Conflict: Political instability, including social unrest or conflict, can disrupt logistics, damage infrastructure, and create unsafe operating conditions, hindering market access and sales performance.

Governmental healthcare policies, particularly reimbursement rates and the push towards value-based care, significantly shape Coloplast's market access and revenue. For example, the ongoing discussions around Medicare and Medicaid payment structures in the US for fiscal year 2025 directly influence the financial viability of their medical devices.

Stringent regulatory environments, such as the EU's MDR and IVDR, demand substantial investment for compliance, potentially delaying product launches and impacting market entry for Coloplast. Political decisions on healthcare spending also play a critical role, with increased investment in chronic disease management, a core area for Coloplast, potentially boosting demand for their products.

Political stability is paramount for Coloplast's operational continuity; uncertainties in emerging markets, as seen with tender phasing in ostomy care in 2023, highlight the direct link between political environments and market access.

Coloplast's 2024 financial reports indicated that while geopolitical shifts and trade policies pose potential challenges to their global supply chain, management did not foresee a significant impact from tariffs, suggesting strategic resilience.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Coloplast, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these global trends.

Offers a clear, actionable framework for understanding external forces, alleviating the pain of strategic uncertainty and guiding proactive decision-making.

Economic factors

Global healthcare expenditure is on a consistent upward trajectory, a key factor benefiting companies like Coloplast. This trend is fueled by an aging global population, which naturally requires more medical care, and the continuous development of innovative medical technologies. For instance, global health spending is projected to reach $10.05 trillion by 2024, a significant increase that signals robust demand for medical devices.

Economic prosperity and rising disposable incomes, particularly in emerging markets, are fueling a greater demand for sophisticated medical devices and healthcare. This trend directly benefits companies like Coloplast, as more individuals can afford essential intimate healthcare products, thereby broadening the company's potential customer reach.

For instance, global disposable income is projected to continue its upward trajectory. In 2024, the World Bank estimated that global disposable income would see a steady increase, with emerging economies often leading this growth. This growing purchasing power means that a larger segment of the population can allocate funds towards personal health and well-being, including specialized medical supplies.

Coloplast faces significant headwinds from rising inflation, which directly impacts its input costs for raw materials and manufacturing. For instance, global inflation rates remained elevated throughout 2023 and into early 2024, with many developed economies experiencing CPI figures above central bank targets, influencing Coloplast's cost of goods sold.

Global supply chain disruptions, exacerbated by geopolitical events and logistical bottlenecks, continue to add pressure on Coloplast's operational expenses. These persistent challenges can lead to increased freight costs and potential delays, impacting production schedules and ultimately affecting profitability if not managed effectively.

To counter these inflationary pressures and supply chain costs, Coloplast must continue to implement prudent cost management strategies. Maintaining healthy EBIT margins in this environment will require a focus on operational efficiency, strategic sourcing, and potentially passing on some cost increases to customers where market conditions permit.

Currency Fluctuations

Currency fluctuations, especially a weaker US dollar, can present challenges for Coloplast by reducing the reported value of its revenue and impacting its earnings before interest and taxes (EBIT) margin. The company's financial outlook, or guidance, frequently incorporates specific assumptions regarding how these currency movements might affect its performance.

For instance, during the first half of fiscal year 2024 (ending March 31, 2024), Coloplast noted that currency headwinds had a negative impact on sales growth. While specific EBIT margin figures are often embedded within broader financial reports, the sensitivity to currency is a consistent factor considered in their investor communications.

- Impact on Revenue: A stronger Danish Krone (DKK) relative to other currencies can make Coloplast's products more expensive in those markets, potentially dampening sales volume or requiring price adjustments.

- EBIT Margin Sensitivity: Fluctuations can directly affect the profitability of international operations when translated back into the company's reporting currency.

- Guidance Assumptions: Coloplast's financial forecasts for 2024/2025 typically include explicit assumptions about average exchange rates, which are crucial for understanding projected financial results.

Competition and Market Pricing

Coloplast operates in a highly competitive medical device sector, where rivals frequently exert downward pressure on pricing. This competitive landscape directly impacts Coloplast's revenue streams and its ability to capture market share, necessitating a strategic approach to pricing and product development.

To counteract these pressures and sustain its market standing, Coloplast must prioritize continuous innovation and product differentiation. This focus allows the company to command stronger pricing power and maintain its competitive edge.

- Competitive Landscape: The global medical device market is characterized by intense competition from both large, established players and agile, emerging companies.

- Pricing Pressures: In 2023, the medical device industry saw continued price negotiations with healthcare providers and payers, driven by cost-containment initiatives, particularly in developed markets.

- Innovation as a Differentiator: Coloplast's investment in R&D, exemplified by its new product launches in ostomy care and continence care, is crucial for maintaining pricing power. For instance, the company reported a 7% organic growth in Q1 2024, partly attributed to strong performance of its innovation pipeline.

- Market Share Dynamics: Competitors' pricing strategies can directly influence market share. Companies that offer comparable products at lower price points can erode a competitor's customer base if differentiation is not sufficiently strong.

Economic factors present a mixed landscape for Coloplast. While global healthcare spending and rising disposable incomes in emerging markets offer growth opportunities, persistent inflation and supply chain disruptions increase operational costs. Currency fluctuations also pose a risk to revenue and profitability.

Full Version Awaits

Coloplast PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coloplast PESTLE analysis delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of the external forces shaping Coloplast's operations and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis provides actionable insights for understanding Coloplast's market position and potential challenges.

Sociological factors

The world's population is getting older at an accelerating pace, with projections indicating that by 2050, one in six people globally will be 65 or older. This significant demographic shift is a major tailwind for the medical device sector, as an aging populace typically experiences a higher incidence of chronic illnesses and age-related health issues.

Coloplast's product portfolio, which includes solutions for ostomy care, urology, and continence, directly addresses many of these growing needs. For instance, the prevalence of urinary incontinence, a common condition in older adults, is expected to rise substantially, driving demand for products like Coloplast's SenSura Mio line.

The increasing life expectancy, coupled with advancements in healthcare that allow people to live longer with chronic conditions, creates a sustained and growing market for medical devices. This trend is particularly evident in developed nations, where the proportion of elderly citizens is already high and continues to climb, presenting a clear opportunity for companies like Coloplast.

Growing awareness and a significant reduction in the stigma surrounding intimate healthcare needs are driving more people to actively seek solutions for conditions such as ostomy and continence care. This societal shift is creating a more receptive market for companies like Coloplast, which specialize in these areas.

Educational campaigns and open discussions about previously taboo subjects are playing a crucial role in normalizing these health concerns. For example, in 2024, patient advocacy groups reported a 15% increase in online searches for ostomy-related information, indicating a greater willingness to engage with these topics.

This increased openness directly translates into a larger potential customer base for advanced medical devices and support services. Coloplast's market research in 2025 indicates that over 60% of individuals newly diagnosed with ostomy-related conditions are proactively researching product options within the first three months of their diagnosis, a notable rise from previous years.

Modern lifestyles, often characterized by sedentary habits and processed foods, have unfortunately led to a significant rise in chronic diseases. By 2024, global rates of conditions like diabetes and obesity continue to climb, creating a sustained demand for ongoing medical management and specialized products. This societal shift directly benefits companies like Coloplast, whose offerings in advanced wound and continence care are essential for managing these long-term health challenges.

Patient-Centric Care and Home-Based Care Trends

Societal shifts are increasingly prioritizing patient autonomy and the desire to remain at home, often referred to as aging in place. This trend directly fuels the demand for medical devices and innovative solutions that empower individuals to manage their health and well-being independently within their own environments. Coloplast's portfolio, particularly its offerings in intimate healthcare, aligns well with this growing preference for discreet and user-friendly home-based care solutions.

The global home healthcare market is experiencing robust growth, projected to reach approximately $785.1 billion by 2030, indicating a significant societal embrace of in-home care models. This expansion is driven by factors like an aging global population and advancements in medical technology that facilitate remote patient monitoring and self-management.

- Growing Demand for Home-Based Solutions: The market for home healthcare products and services is expanding rapidly, with projections indicating continued strong growth through 2030.

- Patient-Centricity: There's a clear societal movement towards care models that place the patient's preferences and comfort at the forefront, favoring familiar home settings.

- Independent Health Management: Patients are seeking tools and devices that enable them to manage chronic conditions or personal care needs with greater independence and privacy.

- Coloplast's Product Alignment: Coloplast's focus on discreet and effective intimate healthcare solutions positions it favorably to meet the evolving needs of individuals opting for home-based care.

Cultural Acceptance and Product Adoption

Cultural norms significantly influence how people approach and adopt intimate healthcare products. Coloplast recognizes that societal attitudes towards conditions like incontinence or ostomy care can impact product acceptance. Their strategy involves deep engagement with users and healthcare providers to ensure product design and communication are culturally sensitive, thereby promoting wider adoption.

For instance, in many Asian markets, there can be a greater reluctance to openly discuss or seek help for intimate health issues compared to Western markets. Coloplast's approach, which prioritizes discreet solutions and educational outreach, aims to bridge these cultural gaps. This focus on user-centric design, informed by local cultural contexts, is crucial for fostering trust and encouraging the use of their innovative products.

- Cultural Sensitivity in Product Development: Coloplast actively incorporates feedback from diverse user groups to ensure their intimate healthcare solutions align with varying cultural expectations and sensitivities.

- User and Professional Collaboration: By partnering with end-users and healthcare professionals globally, Coloplast gains insights into local cultural nuances that affect product adoption.

- Market-Specific Strategies: Recognizing that cultural acceptance varies, Coloplast tailors its marketing and educational campaigns to resonate with specific cultural norms in different regions, aiming for higher product integration.

The global population is aging rapidly, with the over-65 demographic projected to reach 1 in 6 people by 2050. This demographic shift directly benefits Coloplast, as older individuals tend to experience more chronic health conditions requiring specialized medical devices. Coloplast's product lines, such as those for ostomy and continence care, are well-positioned to address this growing demand.

Societal attitudes are evolving, with a notable reduction in stigma surrounding intimate healthcare needs. This increased openness encourages more individuals to seek solutions for conditions like ostomy and incontinence, expanding the potential market for Coloplast. For example, patient advocacy groups reported a 15% increase in online searches for ostomy information in 2024, reflecting greater engagement.

Modern lifestyles, marked by sedentary habits and processed foods, contribute to rising rates of chronic diseases like diabetes and obesity. By 2024, these trends continue to drive sustained demand for ongoing medical management and specialized products, areas where Coloplast's advanced wound and continence care solutions are crucial.

There is a growing preference for patient autonomy and home-based care, often referred to as aging in place. This trend fuels demand for medical devices that enable independent health management at home. Coloplast's discreet and user-friendly intimate healthcare products align perfectly with this societal shift, supported by the home healthcare market's projected growth to $785.1 billion by 2030.

Technological factors

Coloplast's product pipeline is significantly shaped by continuous innovation in medical device technology. For instance, the development of advanced biomaterials and smart functionalities in ostomy care and urology devices directly enhances patient comfort and product efficacy, giving Coloplast a competitive edge. The company's investment in R&D for these areas is crucial for maintaining market leadership.

Digital health and AI are revolutionizing wound and continence care. For instance, remote monitoring solutions allow for real-time patient data collection, improving adherence and early intervention. This shift can lead to more efficient device usage and better patient outcomes, directly impacting Coloplast's product development and service offerings in the 2024-2025 period.

Breakthroughs in biologics are transforming wound care, with companies like Coloplast leveraging technologies such as their Kerecis product, which uses marine-derived materials for dressings. This innovation is a prime example of how advanced science is improving patient outcomes. These cutting-edge treatments are showing promise in accelerating the healing process for challenging wounds.

Manufacturing Process Automation and Efficiency

Technological advancements are significantly reshaping manufacturing, driving automation and refining production techniques. This leads to greater efficiency, less waste, and superior product quality. Coloplast's commitment to optimizing production waste recycling demonstrates a practical application of technology for operational enhancement.

Coloplast's investment in advanced manufacturing technologies aims to streamline operations. For instance, their adoption of automated assembly lines in facilities like their Danish headquarters contributes to faster production cycles and consistent product output. This focus on technological integration is crucial for maintaining a competitive edge in the medical device industry.

- Automation in Production: Coloplast leverages automated systems to improve precision and speed in manufacturing, reducing manual errors and increasing throughput.

- Waste Reduction Technologies: The company actively implements technologies for recycling and repurposing production waste, aligning with sustainability goals and operational efficiency. For example, in 2023, Coloplast reported a 5% reduction in production waste intensity compared to 2022.

- Quality Control Systems: Advanced technological solutions are employed for rigorous quality control throughout the manufacturing process, ensuring product safety and efficacy.

Data Analytics and Personalized Healthcare

The explosion of healthcare data, fueled by digital health records and wearable devices, is a significant technological driver. By 2024, it's estimated that the volume of global healthcare data will reach approximately 2.8 zettabytes, showcasing the immense potential for analysis.

Coloplast can harness these advancements in data analytics to gain deeper insights into patient demographics, treatment outcomes, and product usage patterns. This allows for the development of highly personalized solutions, from customized product recommendations to targeted patient support initiatives.

Leveraging this data can lead to more effective product development and marketing strategies. For instance, analyzing user feedback and real-world performance data can pinpoint areas for product improvement or identify unmet needs in specific patient segments. By 2025, the global market for healthcare analytics is projected to exceed $30 billion, highlighting the industry's commitment to data-driven decision-making.

Coloplast's strategic utilization of data analytics can therefore enhance customer engagement and loyalty. This includes:

- Personalized product recommendations based on user health profiles.

- Proactive identification of patients who might benefit from enhanced support.

- Tailored communication strategies to address specific user concerns.

- Optimized supply chain management informed by predictive usage data.

Technological advancements are central to Coloplast's innovation in medical devices, particularly in areas like biomaterials and smart functionalities for ostomy and urology products. The company's focus on R&D in these fields is key to maintaining its market position.

Digital health and AI are transforming wound and continence care, enabling remote monitoring and real-time data collection. This trend, expected to see the global healthcare analytics market exceed $30 billion by 2025, allows for improved patient adherence and early interventions, directly influencing Coloplast's product development.

Coloplast is also leveraging breakthroughs in biologics, such as its Kerecis product using marine-derived materials for advanced wound dressings, to accelerate healing and improve patient outcomes.

The company is enhancing manufacturing through automation, waste reduction technologies, and advanced quality control systems, aiming for greater efficiency and product quality. For example, Coloplast reported a 5% reduction in production waste intensity in 2023.

| Technological Factor | Description | Impact on Coloplast | 2024-2025 Relevance |

| Biomaterials & Smart Devices | Innovation in advanced materials and integrated technology in medical devices. | Enhances patient comfort, product efficacy, and competitive edge. | Drives new product development and upgrades in ostomy and urology. |

| Digital Health & AI | Use of remote monitoring, data analytics, and AI in patient care. | Improves patient adherence, enables early intervention, and personalizes solutions. | Key for wound and continence care, with healthcare analytics market projected over $30 billion by 2025. |

| Biologics in Wound Care | Application of biological materials and processes for healing. | Accelerates healing for complex wounds and improves patient outcomes. | Supports advanced wound care product lines, like those using marine-derived materials. |

| Manufacturing Automation & Efficiency | Implementation of automated production and waste reduction technologies. | Increases precision, reduces errors, boosts throughput, and supports sustainability. | Optimizes production cycles and product quality, as seen in a 5% waste intensity reduction in 2023. |

Legal factors

Coloplast, like all medical device manufacturers, faces stringent and evolving regulatory landscapes, notably the EU Medical Device Regulation (MDR) and the In Vitro Diagnostic Regulation (IVDR). These comprehensive frameworks dictate everything from initial product design and manufacturing processes to the clinical evidence required for market access and ongoing post-market surveillance. Compliance demands significant investment in resources and robust quality management systems, with extended transition periods for certain legacy devices requiring careful navigation.

Coloplast must navigate a complex web of data privacy and security laws, such as Europe's General Data Protection Regulation (GDPR) and similar legislation worldwide. These regulations are paramount for any company dealing with sensitive patient health information, a core aspect of Coloplast's operations, particularly with its digital health solutions and patient data management systems.

Failure to comply with these stringent data protection mandates, which include robust security measures and transparent data handling practices, can result in significant financial penalties. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is greater, underscoring the critical need for Coloplast to maintain rigorous compliance standards in 2024 and beyond.

Coloplast operates under stringent product liability laws, meaning the company is accountable for any harm caused by defective medical devices. This necessitates rigorous quality control throughout the manufacturing process to prevent issues like implant failures or material degradation. For instance, in 2024, regulatory bodies worldwide continued to emphasize post-market surveillance, with increased scrutiny on adverse event reporting for implantable devices, a key area for Coloplast's business.

Adherence to consumer protection laws is paramount for maintaining brand reputation and customer loyalty. These regulations ensure transparency in product information and fair treatment of patients and healthcare providers. Failure to comply can result in significant fines and reputational damage, as seen in past cases involving medical device recalls impacting patient safety and trust.

Intellectual Property Rights and Patent Protection

Coloplast's ability to innovate and maintain a competitive edge hinges significantly on robust intellectual property (IP) rights and patent protection. These legal safeguards are crucial for protecting their unique medical devices and technologies from imitation, thereby allowing them to recoup substantial investments in research and development. As of the latest available data, companies in the medical device sector often spend upwards of 10% of their revenue on R&D, underscoring the importance of IP for financial viability and future growth.

The legal landscape surrounding patents and trademarks directly impacts Coloplast's market position. Strong patent protection prevents competitors from easily replicating their advanced ostomy, urology, and continence care products, ensuring Coloplast can continue to invest in developing next-generation solutions. For instance, the global pharmaceutical and medical device patent landscape is highly competitive, with significant legal battles often fought over infringement claims, highlighting the critical nature of IP enforcement.

- Patent Protection: Secures exclusive rights for Coloplast's novel medical technologies, preventing unauthorized use and encouraging continued innovation.

- Trademark Safeguarding: Protects brand identity and product recognition, building trust and loyalty among healthcare professionals and patients.

- R&D Investment Recovery: Legal frameworks enable Coloplast to monetize its research and development expenditures, funding future product pipelines.

- Market Exclusivity: Patents grant a period of market exclusivity, allowing Coloplast to capture a significant share of revenue from its innovations.

Anti-Corruption and Compliance Regulations

Coloplast, as a global medical technology company, navigates a complex web of anti-corruption and compliance regulations. These laws, including the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, mandate strict adherence to ethical business practices across all its international operations. Failure to comply can lead to severe penalties, including substantial fines and reputational damage.

The company's commitment to these regulations is often codified in its internal policies and codes of conduct, which guide employee behavior and business dealings. This robust framework is essential for maintaining trust with stakeholders and ensuring sustainable growth. For instance, many companies in the healthcare sector, including those in medical devices, have seen increased scrutiny on their sales and marketing practices, emphasizing the need for strong compliance programs.

- Global Reach, Local Laws: Coloplast must comply with anti-corruption laws like the FCPA and UK Bribery Act in all markets it serves.

- Ethical Imperative: Adherence to these regulations is not just legal but a cornerstone of responsible corporate citizenship and brand integrity.

- Risk Mitigation: Strong compliance programs help mitigate risks of fines, legal action, and damage to Coloplast's reputation, which is critical in the sensitive healthcare industry.

- Industry Scrutiny: The medical device sector, in particular, faces ongoing regulatory oversight, making robust anti-bribery and compliance frameworks a necessity for continued market access and trust.

Coloplast operates under rigorous medical device regulations, including the EU MDR and IVDR, demanding extensive clinical evidence and robust quality management systems for market access and ongoing surveillance. Data privacy laws like GDPR are critical for handling sensitive patient health information, with non-compliance potentially leading to substantial fines, up to 4% of global annual turnover.

Product liability laws hold Coloplast accountable for device defects, necessitating stringent quality control and diligent post-market surveillance, especially for implantable devices, a focus for regulators in 2024. Adherence to consumer protection laws is vital for maintaining brand trust and fair treatment of patients and healthcare providers.

Intellectual property rights are crucial for protecting Coloplast's innovations, with R&D investments often exceeding 10% of revenue in the medical device sector, underscoring the importance of patents for market exclusivity and recouping development costs.

Coloplast must also comply with global anti-corruption laws like the FCPA and UK Bribery Act, with strong compliance programs essential for mitigating risks of fines and reputational damage in the highly scrutinized healthcare industry.

Environmental factors

Growing environmental concerns are pushing companies like Coloplast to prioritize sustainable sourcing and effective material management. This means carefully selecting raw materials that are renewable or have a lower environmental impact, and ensuring that materials used are managed responsibly throughout their lifecycle.

Coloplast is actively working to incorporate more renewable and recyclable materials into its products and packaging. For instance, in 2023, the company reported that 85% of its packaging was designed for recyclability, a step towards reducing its overall environmental footprint.

The medical device sector, including companies like Coloplast, grapples with significant plastic waste, largely due to the prevalence of single-use products. This presents a substantial environmental challenge.

Coloplast is actively working to enhance its recycling of production waste. In 2023, the company reported an increase in its recycling rate for production waste, though specific figures for the overall medical device industry's plastic waste are still being consolidated by regulatory bodies.

Furthermore, Coloplast is investing in exploring novel recycling technologies and forging partnerships. This strategic approach aims to bolster its contribution to a more sustainable, circular plastics economy, aligning with global efforts to reduce landfill waste.

The intensifying global commitment to combat climate change, underscored by ambitious carbon emissions reduction targets, compels businesses like Coloplast to actively shrink their environmental impact. This shift is driven by both regulatory pressures and growing stakeholder expectations.

Coloplast has publicly stated its commitment to reducing Scope 1 and Scope 2 emissions, demonstrating a proactive approach to environmental stewardship. The company's goal of sourcing 100% renewable electricity by 2025 directly supports these efforts and aligns with international climate frameworks such as the Paris Agreement.

Energy Consumption and Renewable Energy Adoption

The environmental impact of energy consumption in manufacturing is a significant concern for companies like Coloplast. In 2023, Coloplast reported that 85% of its electricity consumption was sourced from renewable energy, a substantial increase from previous years and a key step toward its 100% renewable energy goal.

This strategic shift towards renewable energy sources is not only about reducing environmental footprint but also about long-term cost efficiency. By transitioning to renewables, Coloplast aims to mitigate the volatility associated with traditional energy prices and secure more predictable operational expenses. The company's ongoing investments in this area reflect a proactive approach to environmental stewardship and sustainable business practices.

- 85% of electricity consumption from renewable sources in 2023.

- Targeting 100% renewable energy for operations.

- Reduced environmental footprint and operational costs.

Regulatory Pressure for Environmental Performance

Coloplast faces growing regulatory pressure concerning its environmental impact. Governments worldwide are tightening rules on waste management, emissions, and the sustainability of products and packaging. For instance, the European Union's Green Deal continues to drive stricter environmental standards across industries, impacting manufacturing processes and supply chains.

Compliance with these evolving regulations is paramount for Coloplast's continued operations and market access. This includes adapting to new directives on circular economy principles and reducing the carbon footprint of its medical devices.

- Increased scrutiny on single-use medical device waste: Regulations are emerging that aim to reduce the environmental burden of disposable healthcare products.

- Stricter emissions standards for manufacturing facilities: Companies like Coloplast must invest in cleaner technologies to meet air and water quality regulations.

- Product lifecycle assessment requirements: Authorities may mandate detailed environmental impact assessments for products from raw material sourcing to end-of-life disposal.

- Extended Producer Responsibility (EPR) schemes: These may be implemented for medical devices, requiring manufacturers to manage the collection and recycling of their products.

Coloplast is actively working to reduce its environmental impact by focusing on sustainable materials and waste management. The company aims to increase the use of renewable and recyclable materials in its products and packaging, with 85% of its packaging designed for recyclability in 2023.

The company is also committed to reducing its carbon footprint, targeting 100% renewable electricity for its operations by 2025. In 2023, 85% of its electricity consumption was already from renewable sources, demonstrating progress towards this goal.

Coloplast faces increasing regulatory pressure regarding environmental standards, including waste management and emissions. Compliance with evolving regulations, such as those driven by the EU's Green Deal, is crucial for market access and sustainable operations.

| Environmental Focus | 2023 Data/Target | Impact |

|---|---|---|

| Renewable Packaging | 85% designed for recyclability | Reduced waste, improved sustainability |

| Renewable Electricity | 85% of consumption (2023), 100% target by 2025 | Lower carbon emissions, potential cost savings |

| Waste Recycling | Increased recycling rate for production waste | Minimized landfill contribution, resource conservation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coloplast draws from a comprehensive blend of data, including reports from leading medical device industry associations, government regulatory bodies like the FDA and EMA, and economic indicators from organizations such as the World Bank and IMF. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.