Coloplast Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

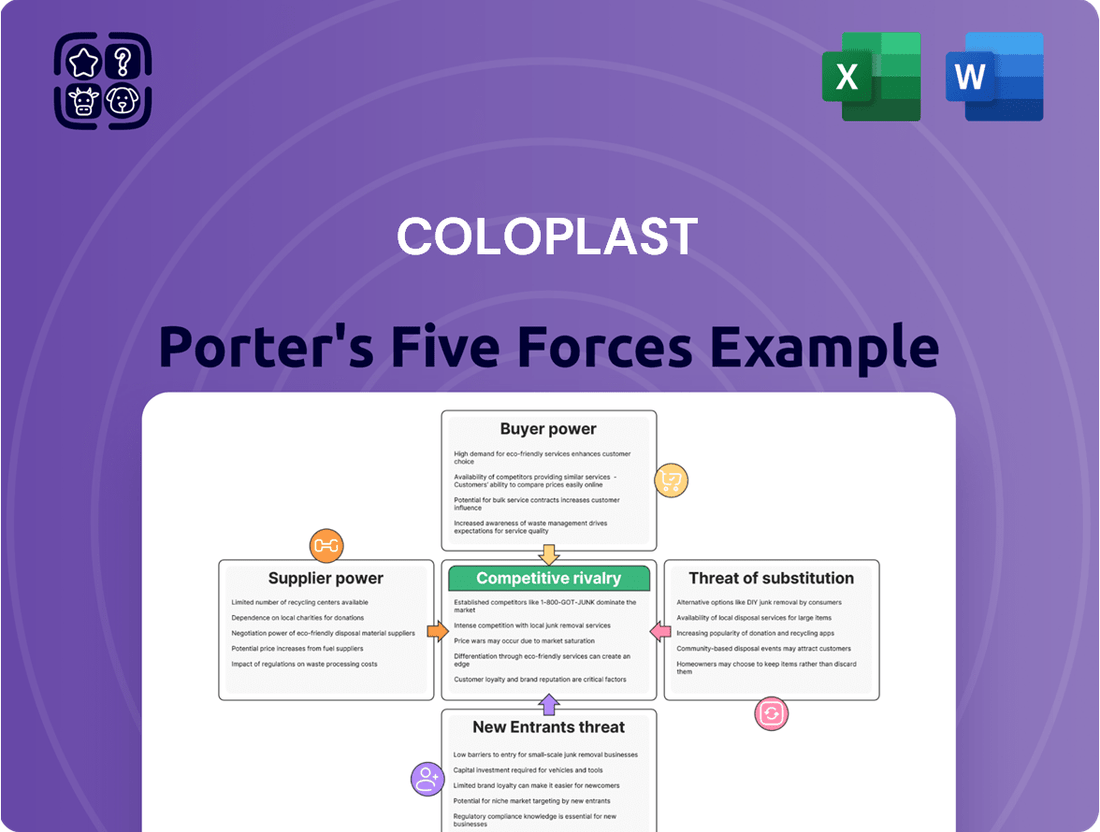

Coloplast operates within a dynamic healthcare landscape shaped by significant buyer power from large hospital networks and intense rivalry among established medical device manufacturers. Understanding these forces is crucial for strategic planning.

The complete Porter's Five Forces Analysis for Coloplast delves deeper into the threat of substitutes, the bargaining power of suppliers, and the potential for new market entrants. Gain actionable insights to navigate Coloplast's competitive environment effectively.

Ready to move beyond the basics? Get a full strategic breakdown of Coloplast’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Coloplast, like many in the medical device sector, often faces a concentrated supplier base for specialized components. This means a few key suppliers might provide essential materials like advanced polymers or specific electronic sensors needed for their ostomy, continence, and wound care products. For example, the market for medical-grade silicone, a crucial material for many of their devices, is dominated by a handful of global manufacturers.

This reliance on a limited number of suppliers can grant them significant bargaining power. If these suppliers face production issues or decide to increase prices, Coloplast could be forced to accept higher costs or face supply disruptions. In 2023, the global medical device market experienced supply chain challenges, with some component prices seeing increases of 5-10% due to raw material shortages and increased logistics costs, directly impacting companies like Coloplast.

Suppliers offering unique or proprietary components with no easy substitutes wield significant bargaining power. For instance, if Coloplast's advanced sensor technology for its Heylo™ digital leakage notification system comes from a single source, that supplier gains considerable leverage. This specialization makes it challenging and costly for Coloplast to switch, impacting its operational flexibility.

Coloplast faces significant bargaining power from its suppliers due to high switching costs. If Coloplast needs to change suppliers, it could incur substantial expenses related to re-tooling its manufacturing processes and re-validating materials to meet stringent medical device regulations. For instance, the complexity inherent in medical device production, which demands rigorous quality control and specialized components, often makes transitioning to a new supplier a lengthy and costly endeavor.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power against Coloplast. If a supplier, particularly one providing specialized components, possesses the capability and strategic intent to move into manufacturing and marketing finished medical devices, they gain leverage. This is especially true if their expertise in a critical technology is difficult for Coloplast to replicate internally or source elsewhere.

For example, a supplier of advanced sensor technology for Coloplast's ostomy care products might consider developing their own line of ostomy bags that utilize this proprietary sensor. Such a move would transform them from a component provider into a direct competitor, forcing Coloplast to reconsider its supply agreements and pricing. While direct examples of this specific scenario for Coloplast are not publicly detailed, the principle remains a key consideration in supply chain risk assessment.

The potential for suppliers to integrate forward is a constant undercurrent in strategic sourcing. Companies like Coloplast must monitor their key suppliers for signs of such ambition, which could include increased investment in R&D for end-user applications or strategic acquisitions of smaller device manufacturers. This threat necessitates strong supplier relationships and potentially diversification of the supplier base for critical components to mitigate the risk.

- Supplier Capability Assessment: Coloplast continuously evaluates suppliers' technological capabilities and their potential to develop end-to-end solutions.

- Market Dynamics Analysis: Monitoring competitor strategies and market trends helps identify suppliers who might be considering forward integration.

- Strategic Sourcing Practices: Diversifying the supplier base for critical components and fostering long-term partnerships can reduce reliance on any single supplier with integration potential.

- Intellectual Property Protection: Safeguarding proprietary technologies and ensuring robust agreements with suppliers are crucial to prevent them from leveraging Coloplast's innovations for their own competitive advantage.

Importance of Coloplast to Suppliers

The bargaining power of suppliers is a key factor in understanding the competitive landscape for companies like Coloplast. This power is significantly influenced by how crucial Coloplast's business is to its suppliers.

If Coloplast accounts for a substantial percentage of a supplier's total sales, that supplier is likely to be more accommodating with pricing and terms to secure Coloplast's continued patronage. For example, if a key component supplier derives 20% of its annual revenue from Coloplast, it has a strong incentive to maintain a good relationship and offer competitive pricing.

Conversely, if Coloplast represents only a minor portion of a supplier's revenue, perhaps less than 1%, the supplier has less motivation to negotiate favorable terms. In such a scenario, the supplier can afford to be less flexible, as losing Coloplast's business would have a minimal impact on its overall financial performance.

- Supplier Dependence: The degree to which a supplier relies on Coloplast for its revenue directly impacts its bargaining power.

- Revenue Contribution: A supplier whose business with Coloplast constitutes a significant portion of its annual income will likely offer better terms to retain that customer.

- Customer Size: For suppliers where Coloplast is a small client, the incentive to concede on price or terms is considerably lower.

Coloplast's suppliers can exert considerable influence due to specialized, high-value components and the significant costs associated with switching. This is amplified when suppliers offer unique technologies or materials that are difficult to source elsewhere, as seen with advanced polymers or specific sensors vital for their medical devices. In 2024, the medical technology sector continued to grapple with supply chain complexities, with some specialized component costs rising by an estimated 7-12% due to ongoing raw material volatility and geopolitical factors impacting logistics.

The bargaining power of Coloplast's suppliers is substantial when they possess unique or proprietary components, making it costly and time-consuming for Coloplast to find alternatives. This leverage is heightened by the stringent regulatory environment for medical devices, which necessitates extensive re-validation processes for any material or component change. For example, transitioning to a new supplier for a critical sensor in their continence care products could involve months of testing and regulatory approvals, significantly increasing switching costs.

Suppliers' potential for forward integration also bolsters their bargaining power. If a supplier develops the capability to produce finished medical devices using their specialized components, they can become a direct competitor. This threat necessitates strong supplier relationships and strategic sourcing to mitigate risks. For instance, a supplier of advanced materials for Coloplast's ostomy bags might explore developing their own branded ostomy pouches, creating a competitive dynamic.

| Factor | Impact on Coloplast | Example Scenario |

|---|---|---|

| Supplier Concentration | High | A few key suppliers for medical-grade silicones or specialized electronic sensors. |

| Switching Costs | High | Costs associated with re-tooling, material re-validation, and regulatory approvals. |

| Proprietary Components | High | Unique sensor technology for digital leakage notification systems from a single source. |

| Supplier Dependence on Coloplast | Variable | Suppliers deriving a significant portion of revenue from Coloplast have less leverage than those for whom Coloplast is a minor client. |

What is included in the product

This analysis dissects the competitive forces impacting Coloplast, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the medical device industry.

Effortlessly identify and address competitive threats with a streamlined, visual representation of each force, making strategic planning more intuitive.

Customers Bargaining Power

Coloplast's end-users, individuals managing intimate healthcare needs, represent a highly fragmented customer base. This fragmentation means that no single patient holds significant sway over pricing or product specifications. Their purchasing power is further diluted as decisions are often guided by healthcare providers, insurance coverage, and the critical need for effective solutions for their specific medical conditions.

While individual patients typically have minimal influence, major healthcare systems, hospitals, and national insurance providers (payers) wield considerable bargaining power. These substantial purchasers can negotiate for reduced prices, customized product specifications, or advantageous contract conditions, leveraging their capacity to direct purchasing decisions for a large patient base. For instance, in 2024, the top 10 hospital systems in the U.S. accounted for a significant portion of healthcare spending, giving them considerable leverage in price negotiations with medical device manufacturers.

Customer price sensitivity is a key factor influencing Coloplast's profitability. For essential medical devices like ostomy bags, where patient well-being is paramount and alternatives might be limited or require significant switching costs, price sensitivity can be relatively lower. However, in markets with strong competition or where reimbursement policies dictate pricing, such as certain surgical equipment or urology products, customers, or more often their insurers and healthcare systems, become highly sensitive to price. This increased sensitivity can put direct pressure on Coloplast's pricing power and overall profit margins.

Availability of Information

The increasing availability of information significantly bolsters the bargaining power of customers in the medical device sector. Patients and healthcare providers can now readily access detailed data on product efficacy, pricing structures, and available alternatives. This transparency, often facilitated by patient advocacy groups and online health platforms, empowers informed decision-making.

For instance, in 2024, the proliferation of online patient forums and comparison websites meant that a significant percentage of patients researching ostomy supplies, a key Coloplast market, could easily compare product features and costs from multiple manufacturers. This accessibility directly translates into a stronger negotiating position for buyers, who can now demand better value or readily switch to competitors offering more attractive terms.

- Informed Choices: Customers can compare product performance, pricing, and competitor offerings with unprecedented ease.

- Leverage for Value: Access to comparative data allows customers to negotiate for better pricing or superior product features.

- Reduced Switching Costs: Greater transparency lowers the perceived risk and effort associated with changing suppliers.

- Market Responsiveness: Companies must be more competitive in their offerings to retain customers in an information-rich environment.

Switching Costs for Customers

For patients relying on medical devices such as ostomy bags or continence care products, the decision to switch can be complex. It often involves not just a physical adjustment to a new product but also psychological considerations and potentially the need for new training or professional guidance. This makes frequent switching less likely.

These switching costs significantly diminish the bargaining power of customers. Even if a slightly cheaper alternative becomes available, patients who are comfortable and satisfied with their current Coloplast product are less inclined to make the change. This loyalty, driven by the hassle and uncertainty of switching, strengthens Coloplast's position.

- High Adjustment Burden: Patients often face physical and psychological hurdles when switching between medical devices.

- Need for Re-training: New products may require learning different application techniques or seeking professional advice.

- Reduced Price Sensitivity: Satisfied customers are less likely to switch for minor price differences due to the effort involved.

- Brand Loyalty: Established comfort and trust in a current solution foster loyalty, limiting customer power.

While individual patients have limited sway, large purchasers like hospital networks and insurance providers in 2024 possess significant bargaining power. Their ability to commit to large volumes allows them to negotiate favorable pricing and contract terms with manufacturers like Coloplast. This concentrated buying power can directly impact Coloplast's revenue streams.

Customer price sensitivity varies. For critical, life-sustaining devices where alternatives are scarce or require significant patient adaptation, sensitivity is lower. However, in competitive segments or where reimbursement policies are strict, such as certain urology products, buyers (or their payers) become highly price-conscious, pressuring Coloplast's margins.

The increasing availability of product information and patient reviews in 2024 empowers customers. This transparency enables easier comparison of efficacy and cost, strengthening their negotiating position and potentially reducing switching costs for patients seeking better value or performance. For example, online platforms in 2024 allowed patients to compare ostomy supplies from various brands, influencing their purchasing decisions.

| Customer Type | Bargaining Power Factor | Impact on Coloplast |

|---|---|---|

| Individual Patients | Low (fragmented, influenced by providers) | Minimal direct price negotiation |

| Healthcare Systems/Payers | High (large volume, concentrated demand) | Significant price negotiation leverage |

| Overall Price Sensitivity | Moderate to High (depends on product criticality and competition) | Direct pressure on pricing and margins |

Same Document Delivered

Coloplast Porter's Five Forces Analysis

This preview showcases the complete Coloplast Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain instant access to this comprehensive analysis, ready for immediate use in your strategic planning.

Rivalry Among Competitors

The medical device sector, especially in niche areas such as ostomy, continence, and wound care, is populated by several significant global companies. Coloplast operates within this competitive landscape, contending with established giants like ConvaTec, Hollister, and B. Braun, among others, across its primary product categories.

The intensity of competition is amplified by the sheer number of these formidable players. For instance, in the global ostomy care market, which was valued at approximately USD 2.5 billion in 2023, Coloplast, ConvaTec, and Hollister are consistently among the top three market share holders, indicating a concentrated yet highly contested space.

The overall growth rate of the intimate healthcare market significantly shapes competitive rivalry. In segments experiencing robust expansion, such as the projected growth in ostomy care, companies can often increase their sales by tapping into new demand rather than directly competing for existing customers. This dynamic generally leads to a less aggressive competitive landscape.

However, the intensity of competition can escalate in mature or slower-growing segments within the intimate healthcare sector. Here, companies are more likely to engage in direct competition for market share, potentially leading to price wars or increased marketing expenditure. For instance, while the ostomy care market is expected to see growth, specific product categories or geographic regions might exhibit slower expansion, intensifying rivalry in those particular niches.

Coloplast actively pursues product differentiation through innovation, exemplified by offerings like the Heylo™ digital leakage notification system and the Luja™ intermittent catheter. This strategy aims to create unique value propositions that set its products apart in the market.

When products offer distinct clinical advantages or demonstrably enhance patient quality of life, it can effectively dampen direct competition based purely on price. For instance, a catheter with superior comfort or reduced infection risk commands a different competitive dynamic than a basic alternative.

However, the intensity of rivalry hinges on the replicability of these innovations. If competitors can swiftly and effectively imitate Coloplast's advancements, the pressure for price-based competition will likely persist, limiting the long-term impact of differentiation on rivalry.

Exit Barriers

High exit barriers can trap companies in a market, even when profits dwindle. Think of specialized machinery or lengthy employee contracts; these make it tough to leave. This often results in too much product on the market and intense price competition, fueling rivalry.

In the medical device sector, where Coloplast operates, these barriers are significant. Companies invest heavily in highly specialized manufacturing plants and navigate complex regulatory approvals. For instance, the cost of retooling or decommissioning a facility designed for specific medical device production can be prohibitive. Furthermore, the need to maintain product support and regulatory compliance for existing devices even after exiting a particular product line adds to the financial burden.

- Specialized Assets: High capital investment in unique manufacturing equipment for products like Coloplast's ostomy or urology devices.

- Regulatory Hurdles: The extensive time and cost associated with obtaining and maintaining regulatory approvals (e.g., FDA, CE Mark) for medical devices.

- Long-Term Contracts: Commitments with healthcare providers or distributors that are difficult and costly to break.

- Employee Severance Costs: Potential high social costs associated with laying off a specialized workforce in a regulated industry.

Strategic Stakes

The strategic stakes in the medical device industry are incredibly high, driving intense rivalry. Companies like Coloplast are deeply invested in maintaining leadership in key product segments, such as ostomy care and urology. This pursuit of market dominance often leads to significant investments in research and development, aggressive marketing campaigns, and strategic acquisitions, even if it means sacrificing immediate profits. For instance, Coloplast's Strive25 strategy explicitly targets sustainable growth leadership, signaling a commitment to long-term competitive positioning.

The drive for market leadership creates a dynamic where rivals are constantly seeking an edge. This can manifest in a fierce race to innovate, with companies pouring substantial resources into developing next-generation products. For example, in 2023, the global medical device market was valued at approximately $600 billion, with significant growth driven by technological advancements. Companies are willing to spend heavily on R&D, understanding that groundbreaking innovations can secure substantial market share and long-term profitability. This high-stakes environment means that a single successful product launch or a well-executed acquisition can dramatically alter the competitive landscape.

- Market Leadership Focus: Coloplast and its competitors vie for leadership in critical areas like ostomy and urology care, where market share translates to significant revenue.

- R&D and Marketing Investments: High strategic stakes necessitate substantial spending on innovation and promotion to gain or maintain a competitive advantage.

- Acquisition Strategies: Companies may pursue acquisitions to quickly expand their product portfolios or enter new markets, reflecting the urgency to bolster competitive standing.

- Long-Term Growth Emphasis: Coloplast's Strive25 strategy underscores a commitment to sustainable growth leadership, indicating a proactive approach to managing competitive pressures.

Coloplast faces intense competition from global players like ConvaTec and Hollister in its core markets, such as ostomy care, which was valued at approximately USD 2.5 billion in 2023. While market growth can sometimes temper rivalry, mature segments within intimate healthcare can trigger aggressive competition, including price wars and increased marketing spend. Coloplast's strategy of product differentiation, exemplified by innovations like the Heylo™ system, aims to mitigate direct price competition, though the effectiveness depends on how quickly competitors can replicate these advancements.

High exit barriers in the medical device sector, including specialized assets and regulatory hurdles, can prolong intense rivalry by keeping companies invested even in less profitable niches. The strategic imperative to achieve market leadership drives substantial R&D and marketing investments, as seen in Coloplast's Strive25 strategy, creating a high-stakes environment where innovation and acquisition are key to maintaining a competitive edge.

| Competitor | Key Product Areas | 2023 Revenue (Approx.) | Market Share (Ostomy Care Estimate) |

|---|---|---|---|

| ConvaTec | Ostomy, Wound Care, Continence & Critical Care | USD 2.3 billion | 15-20% |

| Hollister Incorporated | Ostomy, Continence & Critical Care | USD 1.5 billion | 10-15% |

| B. Braun Melsungen AG | Medical & Pharmaceutical Devices (incl. Ostomy) | USD 8.5 billion (Group) | 5-10% |

SSubstitutes Threaten

The threat of substitutes for Coloplast's products is generally low for many of its core medical device offerings, as direct alternatives that provide the same level of efficacy and patient benefit are often scarce. For instance, in ostomy care, while there are different pouching systems, they are largely variations within the same product category rather than true substitutes that bypass the need for a device altogether. However, in areas like continence care, patients might explore non-device solutions such as lifestyle adjustments or pharmacological treatments, though these often complement rather than replace the need for advanced medical devices for severe conditions. The medical necessity for many of Coloplast's specialized devices in managing chronic conditions limits the immediate threat from substitutes.

If alternative treatments or products offer similar or better results for a lower price, the threat of substitutes for Coloplast's offerings grows. For instance, advancements in wound care dressings not requiring ostomy appliances could reduce demand for Coloplast's ostomy products if they are significantly cheaper and equally effective.

Coloplast counters this by emphasizing its innovative, clinically proven products. By showcasing superior patient outcomes and ease of use, Coloplast aims to demonstrate that its higher price point is justified by the added value, making less effective, cheaper alternatives less appealing to both patients and healthcare providers.

The willingness of patients and healthcare professionals to adopt substitute products is a significant factor. This adoption hinges on how easy the substitutes are to use, how effective they are perceived to be, and the availability of adequate support and educational resources. For instance, if a new ostomy pouching system is difficult to manage or lacks clear instructions, patients may stick with familiar Coloplast products.

Coloplast actively works with healthcare professionals and patients to ensure their product innovations genuinely enhance quality of life. This focus on user experience and demonstrable benefits can create a loyalty that makes switching to a less proven or less user-friendly substitute less attractive. In 2023, Coloplast reported strong growth in its advanced wound care segment, indicating a positive reception for its innovative solutions, which can deter patients from seeking alternatives.

Technological Advancements in Other Fields

Breakthroughs in fields like regenerative medicine or advanced pharmacology present a significant threat of substitutes for Coloplast. For instance, new biomaterials or cell-based therapies could emerge, offering alternative solutions for conditions currently addressed by Coloplast's ostomy or urology products. These advancements might not directly compete today but could fundamentally alter treatment pathways, diminishing demand for existing offerings.

Consider the rapid progress in less invasive surgical techniques. Innovations in robotics or endoscopic procedures could reduce the need for certain ostomy appliances or continence solutions, thereby acting as substitutes. While Coloplast reported 2023 revenue of DKK 29.7 billion, such technological shifts could impact future growth trajectories.

The threat is amplified as these advancements mature. For example, the development of fully implantable or bio-integrated devices for bladder control or bowel management could eventually phase out the need for external appliances. This potential shift underscores the importance of continuous R&D for Coloplast to remain competitive against these evolving substitutes.

- Regenerative Medicine: Potential for new therapies that reduce reliance on ostomy bags or catheters.

- Advanced Pharmacology: Development of drugs that manage conditions currently requiring Coloplast's devices.

- Minimally Invasive Surgery: Techniques that may obviate the need for certain ostomy or urology products.

Regulatory and Reimbursement Landscape

The threat of substitutes for Coloplast's offerings is significantly influenced by the evolving regulatory and reimbursement landscape. Changes in healthcare policies, such as new guidelines for medical device approvals or shifts in coverage for specific procedures, can alter the competitive dynamics. For example, if government bodies streamline approval processes for competing minimally invasive technologies, it could reduce the time-to-market for substitutes, thereby increasing their accessibility and appeal to healthcare providers and patients.

Reimbursement structures play a crucial role in determining the economic viability of alternative treatments. If payers, like Medicare or private insurers, adjust their reimbursement rates to favor less invasive or more cost-effective procedures, it could directly impact the demand for Coloplast's products. For instance, a significant increase in reimbursement for non-surgical interventions for conditions like benign prostatic hyperplasia could draw patients away from surgical solutions that utilize Coloplast's devices. In 2024, healthcare systems globally continue to scrutinize cost-effectiveness, with many governments implementing policies aimed at reducing overall healthcare expenditure, which can indirectly favor lower-cost substitute products or therapies.

- Policy Shifts: Healthcare policy changes can make alternative treatments more attractive by altering approval pathways or safety standards.

- Reimbursement Adjustments: Changes in how procedures are paid for can significantly impact the cost-competitiveness of substitutes.

- Cost-Effectiveness Focus: Global healthcare systems in 2024 are increasingly prioritizing cost-effective solutions, potentially benefiting lower-cost alternatives.

- Procedural Preference: A shift towards less invasive or non-surgical alternatives, driven by reimbursement and policy, can directly threaten demand for interventional products.

The threat of substitutes for Coloplast's medical devices is generally low due to the specialized nature and medical necessity of its core products, particularly in ostomy and continence care. While variations exist within product categories, true substitutes that bypass the need for a device are scarce, and lifestyle changes or less advanced treatments often complement rather than replace them.

However, advancements in regenerative medicine, advanced pharmacology, and less invasive surgical techniques pose a growing threat. These innovations could fundamentally alter treatment pathways, potentially reducing demand for existing external appliances. For example, new biomaterials or cell-based therapies might offer alternative solutions for conditions currently managed by Coloplast's devices.

The evolving regulatory and reimbursement landscape also influences the threat of substitutes. Changes in healthcare policies and payer coverage can favor less invasive or more cost-effective alternatives, impacting the economic viability and accessibility of competing products. In 2024, the global focus on cost-effectiveness in healthcare systems may indirectly benefit lower-cost substitute therapies.

| Threat of Substitutes | Description | Coloplast's Response/Mitigation |

|---|---|---|

| Regenerative Medicine & Advanced Pharmacology | Development of therapies that reduce reliance on ostomy bags or catheters, or drugs that manage conditions currently requiring devices. | Focus on innovation, clinical validation, and demonstrating superior patient outcomes to justify product value. |

| Minimally Invasive Surgery | Techniques that may obviate the need for certain ostomy or urology products. | Continuous R&D to develop advanced, user-friendly products that enhance quality of life, creating customer loyalty. |

| Regulatory & Reimbursement Changes | Policy shifts favoring less invasive or cost-effective procedures, impacting product accessibility and appeal. | Monitoring and adapting to healthcare policy changes, emphasizing cost-effectiveness and patient benefits. |

Entrants Threaten

Entering the medical device sector, particularly for sophisticated products akin to Coloplast's offerings, demands significant financial outlay. This includes substantial investments in research and development, state-of-the-art manufacturing capabilities, and navigating stringent regulatory approvals, creating a formidable barrier for newcomers.

The medical device industry, where Coloplast operates, presents substantial regulatory challenges for potential new entrants. Obtaining approvals from bodies like the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) requires extensive and costly clinical trials, often spanning years. For instance, the average cost to bring a new medical device to market can range from hundreds of thousands to millions of dollars, a significant deterrent for smaller or less capitalized competitors.

Coloplast benefits from deep-seated brand loyalty among healthcare professionals and patients, cultivated through decades of reliable product performance and dedicated support. This trust is a significant barrier for new entrants. For instance, in 2023, Coloplast reported a customer retention rate of 95% across its ostomy care division, a testament to the strength of these relationships.

New competitors face the formidable task of not only matching Coloplast's product quality but also replicating its established network of trust and understanding within the sensitive healthcare sector. Overcoming this entrenched loyalty requires substantial investment in building new relationships and proving exceptional value, a difficult proposition when patient well-being and consistent comfort are non-negotiable.

Proprietary Technology and Patents

Coloplast's significant investment in research and development has resulted in a strong portfolio of proprietary technologies and patents. For instance, their innovative digital leakage notification systems and advanced catheter designs are protected by intellectual property rights. These patents create substantial barriers to entry for potential competitors seeking to offer similar products, as they would need to develop unique technologies or license existing ones, which is often costly and time-consuming.

The company's commitment to innovation is reflected in its consistent R&D spending. In fiscal year 2023, Coloplast reported R&D expenses of DKK 2.1 billion, a notable increase from previous years, underscoring their strategy to maintain a technological edge. This focus on intellectual property protection makes it challenging for new entrants to replicate their product offerings without facing legal hurdles or significant development costs.

- Proprietary Technology: Coloplast holds numerous patents covering its medical devices, including advancements in ostomy care and urology.

- R&D Investment: The company allocated approximately 6.5% of its revenue to R&D in FY2023, aiming to secure future market positions.

- Patent Protection: These patents deter new market entrants by requiring them to invest heavily in developing non-infringing alternatives or face legal challenges.

Access to Distribution Channels

Establishing robust distribution channels to effectively reach hospitals, clinics, and individual patients worldwide presents a significant hurdle for new entrants in the medical device sector. These networks are not only complex to build but also inherently costly, requiring substantial investment in logistics, sales forces, and regulatory compliance.

New companies would face considerable difficulty in gaining access to or replicating the established networks that incumbent players like Coloplast have cultivated over years. This access is absolutely critical for any meaningful market penetration, as it dictates how efficiently products reach their end-users.

Coloplast, for instance, benefits immensely from its existing global distribution network. This established infrastructure provides a competitive advantage, allowing for efficient product delivery and market reach, which new entrants would find challenging and expensive to match. In 2023, Coloplast reported that its sales growth was significantly supported by its strong distribution capabilities across key markets.

- Distribution Channel Complexity: Building global healthcare distribution networks involves intricate logistics, regulatory navigation, and relationship management with healthcare providers.

- Cost of Entry: The financial outlay required to establish or acquire comparable distribution channels can be prohibitive for new entrants.

- Coloplast's Advantage: Coloplast's existing, well-established global distribution network provides a significant barrier to entry by offering immediate market access and efficiency.

The threat of new entrants for Coloplast is generally considered low to moderate. The medical device industry demands substantial capital for research, development, and regulatory compliance, creating high initial barriers. For example, bringing a new medical device to market can cost millions of dollars, a significant hurdle for potential competitors.

Coloplast's strong brand loyalty, built on decades of reliable products and support, further deters new entrants. In 2023, the company reported a 95% customer retention rate in its ostomy care division, demonstrating the difficulty new companies face in winning over established customer bases.

Furthermore, Coloplast's extensive patent portfolio and ongoing investment in R&D, with DKK 2.1 billion spent in FY2023, protect its technological advantages. New entrants must either develop unique, non-infringing technologies or license existing ones, both of which are costly and time-consuming endeavors.

Finally, Coloplast’s well-established global distribution network is a significant barrier. Replicating this complex and costly infrastructure, which facilitated strong sales growth in 2023, requires immense investment and time, making it difficult for new players to achieve comparable market reach and efficiency.

| Barrier Type | Description | Coloplast's Strength | Impact on New Entrants |

| Capital Requirements | High investment needed for R&D, manufacturing, and regulatory approvals. | Well-established infrastructure and funding capacity. | Formidable financial hurdle. |

| Brand Loyalty & Reputation | Trust built over years of product performance and patient support. | High customer retention (95% in ostomy care in 2023). | Difficult to displace established customer relationships. |

| Intellectual Property | Patented technologies in ostomy care and urology. | Significant R&D investment (DKK 2.1 billion in FY2023). | Requires costly development or licensing for competitors. |

| Distribution Channels | Complex global networks for reaching healthcare providers and patients. | Existing, efficient, and expansive global network. | Challenging and expensive to replicate market access. |

Porter's Five Forces Analysis Data Sources

Our Coloplast Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Coloplast's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and data from reputable financial information providers like Bloomberg and S&P Capital IQ.