Coloplast Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

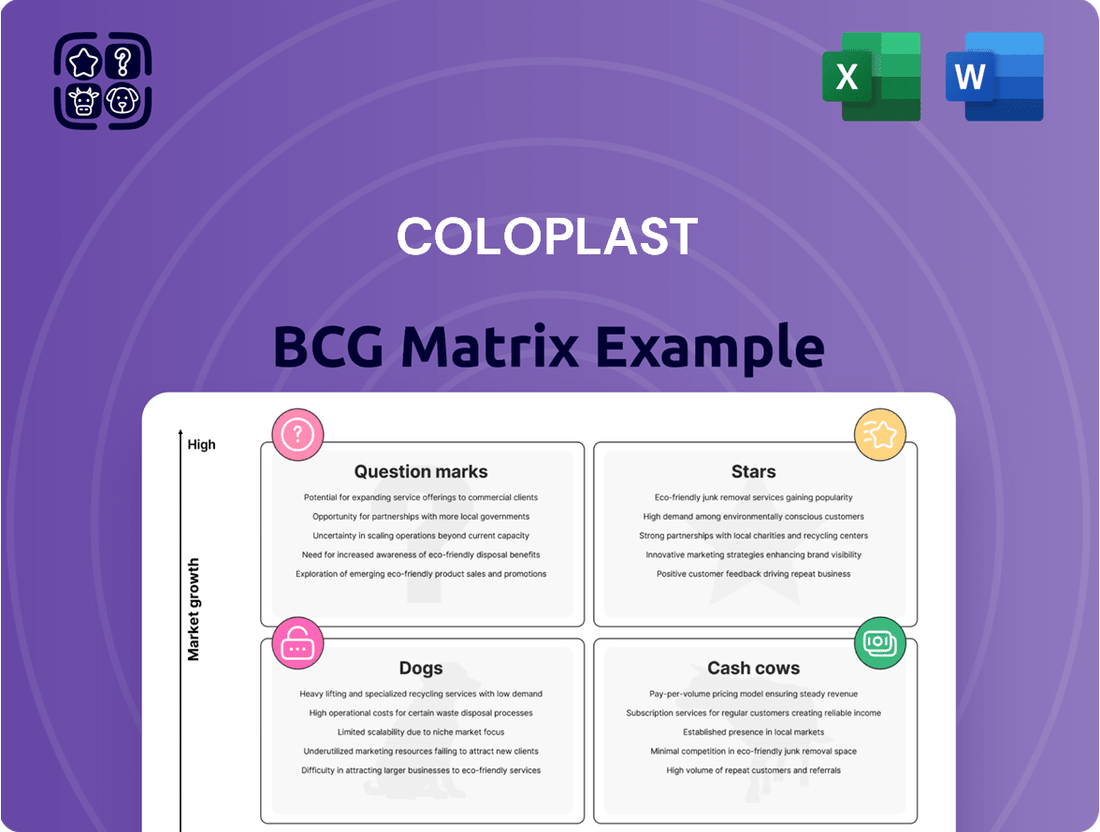

Curious about how a company's product portfolio stacks up? Our BCG Matrix preview offers a glimpse into the strategic positioning of its offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; unlock the full potential of your strategic planning by purchasing the complete BCG Matrix report for actionable insights and a clear roadmap to optimize your investments.

Stars

The Luja catheter, especially designed for women, has been a standout performer for Coloplast, fueling significant growth within its Continence Care division. This innovative product directly tackles the risk factors associated with urinary tract infections (UTIs), a primary concern for many users, making it a key growth engine in a market experiencing substantial compound annual growth.

As a premium incontinence solution, Luja commands a notable global market share. Its success in a rapidly expanding market firmly places it in the Star category of the BCG Matrix, reflecting its strong current performance and promising future potential.

Kerecis, now a part of Coloplast, is a standout performer in the advanced wound care biologics sector. The company has been showing impressive growth, with figures around 30-32% in recent periods. This robust expansion suggests Kerecis is effectively capturing more of the biologics market within advanced wound care.

This strong growth is particularly noteworthy given the overall health of the advanced wound care market, which itself is experiencing solid expansion. Kerecis's ability to outpace this growth indicates a successful strategy for increasing its market share in a dynamic and expanding industry.

Heylo, a groundbreaking digital leakage notification system for ostomy care, launched in 2024, represents a significant innovation in the medical device sector. This system is designed to proactively alert users to potential leaks, thereby enhancing user confidence and quality of life. Its introduction addresses a critical unmet need within the ostomy community.

Coloplast's strategic positioning of Heylo within the BCG matrix likely places it in the "Star" category. This is due to its status as a novel, first-of-its-kind product with substantial market potential. The company's investment in such advanced technology signals a commitment to leading the ostomy care market with innovative solutions.

The market for ostomy supplies is substantial, with estimates suggesting it will reach over $3 billion globally by 2028, growing at a CAGR of approximately 4.5%. Heylo's unique value proposition, coupled with anticipated reimbursement approvals, such as in the UK, positions it to capture a significant share of this growing market. This makes it a key driver of future growth for Coloplast.

Advanced Continence Care Products (beyond Luja)

Coloplast's advanced continence care products, extending beyond their established Luja line, represent a significant growth opportunity. These innovative solutions for bladder and bowel management are well-positioned as Stars within the BCG matrix.

The global continence care market is experiencing robust expansion, projected to reach approximately $28.6 billion by 2027, driven by an aging global population and a rising incidence of chronic conditions like diabetes and neurological disorders. For instance, the prevalence of urinary incontinence alone affects an estimated 200 million people worldwide. Coloplast's commitment to developing cutting-edge technology in this space, such as advanced catheterization systems and improved ostomy appliances, allows them to capture increasing market share within this expanding sector.

- Market Growth: The continence care market is expanding due to demographic shifts and increased disease prevalence.

- Innovation Focus: Coloplast's investment in advanced technological solutions drives product adoption and market penetration.

- Product Portfolio: A broad range of innovative products for bladder and bowel management supports their Star status.

- Financial Performance: While specific 2024 figures for this segment are pending, Coloplast's overall continence care division has shown consistent revenue growth, indicating the strength of these advanced products.

New SenSura Mio Ostomy Products

Coloplast bolstered its SenSura Mio ostomy product line in 2024 with strategic new offerings. This expansion includes the introduction of SenSura Mio in black, addressing aesthetic preferences, and the SenSura Mio Convex Soft featuring a Flex coupling for enhanced flexibility and secure fit. These advancements aim to broaden user choice and deliver superior ostomy care solutions.

The ostomy care market is experiencing consistent growth, driven by factors such as an aging global population and increasing diagnoses of inflammatory bowel diseases. Coloplast's innovation in the SenSura Mio range is well-positioned to capitalize on this trend. For instance, the global ostomy care market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 4-5% through 2030, according to various market research reports from late 2024 and early 2025.

- SenSura Mio in black: Addresses user demand for discretion and aesthetic customization.

- SenSura Mio Convex Soft with Flex coupling: Offers improved adaptability to body contours and enhanced security.

- Market Impact: These launches are expected to strengthen Coloplast's competitive position in the ostomy care segment, potentially increasing market share.

- Growth Potential: The innovations align with market trends favoring user-centric design and improved product performance in the expanding ostomy care sector.

Coloplast's advanced continence care products, including the Luja catheter and other innovative bladder and bowel management solutions, are firmly positioned as Stars in the BCG Matrix. These products benefit from a rapidly expanding global market, projected to reach approximately $28.6 billion by 2027, driven by an aging population and increased chronic disease prevalence.

The Heylo digital leakage notification system, launched in 2024, is another Star. As a novel, first-of-its-kind product in the ostomy care market, which is expected to exceed $3 billion by 2028, Heylo addresses a significant unmet need and is poised for substantial growth.

The SenSura Mio ostomy product line, enhanced in 2024 with new offerings like black variants and the Convex Soft with Flex coupling, also represents a Star. This segment benefits from the ostomy care market's steady growth, valued at around USD 2.5 billion in 2023 and anticipated to grow at a 4-5% CAGR through 2030.

Kerecis, a significant acquisition, is demonstrating exceptional growth in advanced wound care biologics, with recent figures around 30-32%. This performance outpaces the overall advanced wound care market, solidifying its Star status.

| Product/Segment | BCG Category | Key Growth Drivers | Market Size (Approx.) | Projected Growth (CAGR) |

| Luja Catheter (Continence Care) | Star | Aging population, increased chronic conditions, UTI risk reduction | Continence Care Market: $28.6B by 2027 | 4-5% (Continence Care) |

| Heylo (Ostomy Care) | Star | Digital innovation, user confidence, first-of-its-kind | Ostomy Market: >$3B by 2028 | ~4.5% (Ostomy Care) |

| SenSura Mio (Ostomy Care) | Star | User-centric design, aesthetic options, improved functionality | Ostomy Market: ~$2.5B (2023) | ~4-5% (Ostomy Care) |

| Kerecis (Advanced Wound Care) | Star | Biologics innovation, strong market penetration | Advanced Wound Care Market: Growing | 30-32% (Kerecis growth) |

What is included in the product

The Coloplast BCG Matrix analyzes product portfolio performance based on market share and growth, guiding investment decisions.

Clear visualization of product portfolio performance, easing strategic decision-making.

Cash Cows

Coloplast's established ostomy care portfolio, with offerings like the SenSura Mio range, holds a significant share in a mature but expanding market. These products are reliable revenue generators, even when facing temporary market headwinds. For instance, in Q2 2025, the ostomy care segment saw a slight dip influenced by broader economic conditions, yet its underlying strength persists.

These mature products, while not demanding the same marketing push as newer innovations, continue to deliver robust cash flows for Coloplast. The consistent demand in the ostomy care market ensures these established lines remain key contributors to the company's financial stability.

Coloplast's traditional continence care products, while not experiencing rapid growth, represent a stable and reliable revenue stream. These established offerings, which have long served a consistent customer base, are likely classified as cash cows within the company's BCG matrix. Their mature market position means they require minimal investment for expansion, instead focusing on operational efficiency and maintaining their significant share.

Coloplast's Voice and Respiratory Care segment is a solid performer, demonstrating consistent growth within a stable market. This area, encompassing laryngectomy and tracheostomy products, functions as a mature business, reliably generating substantial cash flow for the company.

Mature Advanced Wound Dressings

Within Coloplast's Advanced Wound Care division, products like Biatain Silicone and Biatain Fiber are strong candidates for cash cows. These established wound dressings benefit from significant market penetration and reliable revenue generation, even as newer, high-growth products emerge.

These mature offerings consistently contribute to Coloplast's financial performance. For instance, the global advanced wound care market was valued at approximately USD 10.1 billion in 2023 and is projected to reach USD 15.9 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.7% during this period. While specific figures for Biatain Silicone and Fiber aren't publicly broken out, their longevity in the market suggests a stable, albeit slower, growth trajectory compared to breakthrough innovations.

- Established Market Presence: Biatain Silicone and Biatain Fiber have a long history and strong brand recognition in the advanced wound care sector.

- Consistent Revenue Contributors: These products reliably generate sales, providing a stable income stream for Coloplast.

- Lower Growth, High Share: While not experiencing rapid expansion like newer products, they hold a significant share of their respective market segments.

- Foundation for Innovation: The cash flow generated by these mature products can be reinvested into research and development for future growth drivers.

Brava Range of Supporting Products (Ostomy Care)

The Brava range of supporting products within Coloplast's Ostomy Care division exemplifies a classic cash cow. These accessories, designed to improve the comfort and security of ostomy appliance users, leverage the established and substantial user base of Coloplast's core ostomy pouches.

This strategic positioning allows Brava products to generate stable, recurring revenue streams. While the overall ostomy market might exhibit moderate growth, the Brava line benefits from high market penetration within Coloplast's existing customer base, indicating a mature product with consistent demand.

- Stable Revenue: Brava products, such as barrier creams and adhesive removers, are essential consumables for ostomy patients, ensuring predictable sales.

- High Market Share: Benefiting from Coloplast's strong brand loyalty in ostomy care, Brava enjoys significant adoption among existing users.

- Low Investment Needs: As mature products, Brava items typically require minimal research and development or marketing investment compared to newer offerings.

- Profit Generation: The consistent demand and low operational costs associated with the Brava range contribute significantly to Coloplast's overall profitability.

Coloplast's established ostomy care products, like the SenSura Mio range, are prime examples of cash cows. These items hold a significant share in a mature market, consistently generating reliable revenue. Even with slight market fluctuations, their underlying strength ensures they remain key financial contributors.

These products, while not requiring extensive marketing, continue to deliver robust cash flows. The consistent demand in the ostomy care market solidifies these established lines as vital for Coloplast's financial stability.

Coloplast's traditional continence care products also function as cash cows. Their mature market position and consistent customer base mean they need minimal investment for expansion, focusing instead on efficiency and maintaining their substantial market share.

The Voice and Respiratory Care segment, including laryngectomy and tracheostomy products, reliably generates substantial cash flow. This mature business demonstrates consistent growth within a stable market.

In Advanced Wound Care, products like Biatain Silicone and Biatain Fiber are strong cash cow candidates. They benefit from significant market penetration and reliable revenue generation, contributing steadily even as newer innovations emerge.

The Brava range of ostomy accessories exemplifies a cash cow strategy. These products leverage Coloplast's established ostomy user base, generating stable, recurring revenue streams with high market penetration and low investment needs.

| Product Category | BCG Classification | Key Characteristics | 2024/2025 Performance Indicator |

|---|---|---|---|

| Ostomy Care (e.g., SenSura Mio) | Cash Cow | High market share in a mature market, stable revenue generation. | Continued strong revenue contribution despite moderate market growth. |

| Continence Care (Traditional) | Cash Cow | Established customer base, low investment requirement, consistent sales. | Reliable income stream supporting other business areas. |

| Voice and Respiratory Care | Cash Cow | Consistent growth in a stable market, substantial cash flow. | Maintained profitability and market position. |

| Advanced Wound Care (e.g., Biatain) | Cash Cow | Significant market penetration, predictable sales, mature product lifecycle. | Steady revenue generation, contributing to R&D funding. |

| Ostomy Accessories (e.g., Brava) | Cash Cow | High adoption among existing users, recurring revenue, low operational costs. | Strong profitability due to high customer loyalty and minimal marketing spend. |

What You’re Viewing Is Included

Coloplast BCG Matrix

The preview you are currently viewing is the exact Coloplast BCG Matrix document you will receive upon purchase, ensuring no surprises and immediate usability. This professionally formatted report is ready for strategic application without any watermarks or demo content. Once purchased, you'll gain full access to this analysis-ready file, allowing you to seamlessly integrate it into your business planning or presentations. You can confidently expect the same comprehensive insights and clear visualization that are presented here, delivered instantly after your transaction.

Dogs

Coloplast's divestment of its Skin Care portfolio in December 2024 signals a strategic move away from a segment likely characterized by low growth and limited market share. This action aligns with a broader objective to streamline operations and bolster profitability within its Advanced Wound Care division.

The Skin Care business was likely a cash trap, with its profitability falling considerably short of Coloplast's overall earnings before interest and taxes (EBIT) margin. For instance, if the group EBIT margin was around 25%, the Skin Care segment might have been generating margins closer to 10-15%, making it less attractive for continued investment.

Within Coloplast's Interventional Urology division, certain legacy products are currently positioned as dogs on the BCG Matrix. These are older offerings that, despite the company's overall growth ambitions in the sector, are struggling to gain traction. Their performance is particularly impacted by the voluntary product recall initiated in the Bladder Health and Surgery segments.

These underperforming products are characterized by negative growth trends and a slow, uncertain recovery. This suggests they hold a low market share within a market that itself presents significant challenges. For instance, the recall specifically affected certain bladder management devices, leading to a decline in sales and market presence for those particular items.

Certain regional or niche offerings within Coloplast's portfolio, while potentially serving specific customer needs, might fall into the "dogs" category. These are products with low market share and limited growth potential, often due to intense competition in a particular geographic area or a highly specialized market segment. For instance, a particular wound care dressing with a strong but small presence in a single European country, facing established local competitors, could be an example.

While specific financial data for such niche products is not publicly disclosed by Coloplast, companies of its scale typically manage a portfolio where some items exhibit these characteristics. In 2023, Coloplast reported overall revenue growth of 9% in its Advanced Wound Care segment. However, within this segment, specific regional or niche products might have experienced much lower growth, or even declines, impacting their overall standing in the BCG matrix.

Products with Declining Demand in Specific Geographies

Products facing declining demand in specific geographies can be categorized as dogs within the BCG matrix for those particular regions. For instance, Coloplast's Ostomy Care business in China experienced a slowdown in 2024, partly due to tender delays and a softening consumer demand environment. This situation illustrates how a product can be a dog in a specific market even if the overall business segment performs well globally.

These geographically constrained underperformers can consume valuable resources, such as marketing and sales efforts, without generating substantial returns. In 2024, the Chinese ostomy market faced headwinds, impacting sales volumes for established players. While Coloplast's global ostomy care segment remained a strong performer, these regional challenges highlight the need for careful portfolio management.

- Ostomy Care in China: Weakening consumer demand and tender delays in 2024 impacted sales.

- Resource Drain: Geographically specific underperformance can divert resources from more promising areas.

- Portfolio Management: Identifying and addressing regional "dog" products is crucial for overall business health.

- Market Specificity: A product's success is not uniform; regional economic and regulatory factors play a significant role.

Non-Strategic or Non-Core Product Lines

Non-strategic or non-core product lines within Coloplast, those not directly supporting its primary focus on intimate healthcare, would be classified as Dogs in the BCG Matrix. These are typically products with low market share and low growth potential.

For instance, any legacy product lines that have been overshadowed by newer innovations or have seen declining market interest would fall into this category. Such segments might include certain older wound care products or discontinued lines that no longer fit the company's forward-looking strategy.

The company’s strategic review, potentially highlighted at its September 2025 Capital Markets Day, could identify these underperforming segments for divestment. This aligns with Coloplast’s historical approach, as seen with the divestment of its Skin Care portfolio, aiming to optimize resource allocation and boost overall financial performance.

- Low Market Share: Products failing to capture significant customer adoption.

- Low Growth Potential: Segments operating in stagnant or declining markets.

- Strategic Misalignment: Offerings that do not complement core intimate healthcare solutions.

- Divestment Candidates: Potential for sale or closure to improve profitability.

Products classified as Dogs in Coloplast's BCG Matrix are those with low market share and low growth potential, often representing non-core or legacy offerings. The divestment of its Skin Care portfolio in December 2024 exemplifies a strategic move away from such segments, likely to improve overall profitability and streamline operations.

These underperforming segments, such as certain legacy Interventional Urology products impacted by recalls, are characterized by negative growth and slow recovery. For instance, specific bladder management devices saw sales declines following voluntary product recalls, illustrating the challenges faced by these "dog" products.

Geographically constrained underperformers, like Ostomy Care in China experiencing a slowdown in 2024 due to tender delays and softening demand, also fit this category. These products can consume resources without substantial returns, highlighting the need for careful regional portfolio management.

Coloplast's strategic reviews, potentially detailed at its September 2025 Capital Markets Day, are expected to identify and address these non-strategic lines, similar to the Skin Care divestment, to optimize resource allocation and enhance financial performance.

Question Marks

Coloplast's Bladder Health and Surgery products, situated within the Interventional Urology segment, are currently facing significant headwinds. A voluntary product recall has severely impacted sales, and the expected recovery has been notably sluggish.

The market for these products holds considerable potential, yet the recall has disrupted customer relationships and market penetration. Consequently, Coloplast has revised its full-year growth forecast for this segment to approximately 0%, a stark indicator of the challenges ahead.

To regain its footing, Coloplast must commit substantial investment to rebuild market share and restore customer confidence. Alternatively, if a robust recovery proves unfeasible, the company may need to explore divestment options for this business unit.

Coloplast's Ostomy Care division is targeting emerging markets, recognizing their significant growth potential. These regions often have growing populations and increasing healthcare awareness, creating a fertile ground for expansion. For example, by 2024, many emerging economies are projected to see a notable increase in their middle-class populations, driving demand for advanced medical products.

However, this expansion is classified as a Question Mark due to several hurdles. Navigating complex tender processes, which can be lengthy and subject to political shifts, presents a consistent challenge. Furthermore, a slowdown in key emerging markets, such as China, can impact overall growth projections. In 2024, China's GDP growth, while still substantial, has shown signs of moderation compared to previous years, affecting market penetration strategies.

The opportunity for high growth is undeniable, but Coloplast's current market share in these emerging regions is relatively low. This necessitates substantial investment in sales, marketing, and local infrastructure to build brand awareness and establish distribution networks. The company must strategically manage these uncertainties, akin to navigating a complex maze, to transform these nascent markets into future Stars.

New technologies in their nascent stages, like advanced AI-powered diagnostic tools for medical imaging or biodegradable plastics derived from novel bio-sources, fit the question mark category. These innovations show promise for high future growth but currently hold minimal market share, demanding significant investment in market education and development. For instance, the global market for biodegradable plastics was valued at approximately $47.1 billion in 2023 and is projected to grow substantially, yet specific novel bio-sources are still finding their footing.

Specific Advanced Wound Care Innovations (beyond Kerecis)

While Kerecis is a recognized Star in Coloplast's portfolio, the company is actively nurturing other promising advanced wound care innovations. These products target high-growth niches and demonstrate strong potential but require further development to achieve dominant market share.

Products like Biatain Superabsorber, launched in October 2024, exemplify this strategy. It has shown a positive initial uptake, but ongoing investment in research, clinical validation, and market penetration is crucial for its long-term success and to solidify its position within the competitive advanced wound care landscape.

Coloplast's approach involves identifying and supporting these emerging technologies, much like a Question Mark on the BCG matrix, with the aim of transforming them into future Stars. This requires a strategic allocation of resources to foster innovation and build robust clinical and commercial evidence.

- Biatain Superabsorber: Launched October 2024, targeting high-absorbency needs in wound care.

- Focus on Niche Segments: Innovations aimed at specific, growing areas within advanced wound care.

- Investment Strategy: Continued R&D, clinical trials, and market development to drive growth.

- Potential for Future Stars: Nurturing emerging products to achieve significant market presence.

Digital Health Solutions in Intimate Healthcare

Coloplast's strategic push into digital health, particularly with platforms like Heylo, signals a proactive approach to intimate healthcare. This indicates a potential expansion beyond traditional products into a burgeoning digital ecosystem. In 2024, the digital health market continued its rapid ascent, with investments in health tech reaching significant figures, underscoring the growth potential in this sector.

These emerging digital solutions in intimate healthcare, while perhaps not yet commanding substantial market share, are positioned in a high-growth, transformative market. Coloplast's investment in these areas reflects a recognition of the evolving patient needs and the opportunities presented by technology-driven healthcare delivery. The global digital health market was projected to reach over $600 billion by 2024, demonstrating the significant financial interest and potential for these nascent ventures.

- High Growth Potential: The intimate healthcare sector, augmented by digital solutions, is experiencing rapid expansion, driven by increased patient engagement and demand for personalized care.

- Low Market Share: As these digital platforms are often new or in early development stages, their current market share is typically low, reflecting their nascent status.

- Substantial Investment Required: Proving the value and scaling these digital health initiatives necessitates significant financial and research and development investment to overcome market adoption hurdles and technological challenges.

- Transformative Market: Digital health is fundamentally reshaping healthcare delivery, offering new avenues for patient support, data collection, and treatment adherence in intimate healthcare contexts.

Coloplast's emerging digital health initiatives, such as the Heylo platform, represent a strategic move into a rapidly expanding sector. These ventures are positioned within a market characterized by high growth potential, fueled by evolving patient needs and technological advancements in healthcare delivery.

Despite this promising outlook, these digital solutions currently hold a low market share, reflecting their early stage of development and the inherent challenges in market penetration. Significant investment in research, development, and market adoption is therefore essential to realize their full potential.

The digital health market is a transformative force, projected to exceed $600 billion by 2024, highlighting the substantial opportunities for companies like Coloplast to innovate and lead in intimate healthcare.

Coloplast's Ostomy Care division's expansion into emerging markets is a prime example of a Question Mark. While these regions offer significant growth prospects due to increasing populations and healthcare awareness, challenges such as complex tender processes and economic slowdowns in key markets like China, which saw moderated GDP growth in 2024, pose considerable risks.

The company's current market share in these nascent markets is relatively low, necessitating substantial investment in sales, marketing, and infrastructure to build brand presence and distribution networks. Successfully navigating these uncertainties is key to transforming these markets into future revenue drivers.

Coloplast's focus on new wound care technologies, like the Biatain Superabsorber launched in October 2024, also falls into the Question Mark category. These innovations target high-growth niches but require ongoing investment in research, clinical validation, and market penetration to build significant market share.

| Product/Segment | BCG Category | Market Growth | Market Share | Strategic Implication |

| Bladder Health & Surgery | Question Mark (formerly Star/Cash Cow) | Moderate to High | Declining (due to recall) | Requires significant investment for recovery or potential divestment. |

| Ostomy Care (Emerging Markets) | Question Mark | High | Low | High investment needed for market penetration; risk of market slowdowns. |

| New Wound Care Innovations (e.g., Biatain Superabsorber) | Question Mark | High | Low | Requires continued R&D and market development to become a Star. |

| Digital Health (e.g., Heylo) | Question Mark | Very High | Low | Substantial investment required to scale and establish market leadership in a transformative sector. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of publicly available financial statements, industry-specific market research reports, and proprietary sales data to provide a comprehensive view of product performance and market dynamics.