Coloplast Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coloplast Bundle

Discover how Coloplast masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the medical device market. This analysis delves into their innovative product portfolio, strategic pricing, expansive distribution networks, and impactful promotional campaigns.

Unlock the secrets behind Coloplast's marketing success with a comprehensive 4Ps analysis, offering actionable insights and real-world examples. Elevate your understanding of their market positioning and competitive advantage.

Ready to gain a competitive edge? Access the full, editable Coloplast 4Ps Marketing Mix Analysis now and transform your own marketing strategies.

Product

Coloplast's core business revolves around developing, manufacturing, and marketing essential healthcare solutions in ostomy care, continence care, wound and skin care, and interventional urology. These areas address sensitive, intimate health needs, offering vital support to patients managing chronic conditions.

The company's commitment to these segments is evident in its 2023/2024 financial performance, with reported revenue growth in key areas like Ostomy Care and Wound & Skin Care, demonstrating strong market demand for their specialized products. This focus on improving patient quality of life underpins their strategic marketing efforts.

Innovation is the engine for Coloplast's growth, consistently introducing new solutions that improve lives. In fiscal year 2023, the company reported innovation-driven organic growth of 8%, underscoring its commitment to R&D.

Coloplast's substantial investment in research and development, amounting to approximately 5% of sales, fuels the creation of cutting-edge medical technologies. This focus ensures their products offer clear clinical advantages and better patient experiences.

The company's innovation pipeline extends to digital health solutions, aiming to integrate technology for enhanced patient support and data management. This forward-thinking approach also involves continuous refinement of their established product portfolios.

Coloplast has been actively innovating with recent product launches designed to enhance user experience and expand market reach. The introduction of Heylo™, a pioneering digital leakage notification system for ostomy care, addresses a critical unmet need, potentially reducing anxiety and improving quality of life for users. This digital integration signifies a forward-looking approach to connected health solutions.

Further strengthening its ostomy portfolio, Coloplast has expanded the SenSura® Mio range. New variants, such as black ostomy bags and Convex Soft with Flex coupling, cater to diverse user preferences and anatomical needs. These additions aim to improve discretion and provide a more secure, comfortable fit, driving continued adoption within this segment.

In continence care, the Luja™ intermittent catheter has emerged as a key growth driver. Its user-friendly design and performance characteristics have resonated well with the market, contributing significantly to the company's performance in this vital area. This success underscores Coloplast's commitment to developing advanced solutions for managing bladder conditions.

User-Centric Development

Coloplast's commitment to user-centric development is a cornerstone of its marketing strategy. They actively involve healthcare professionals and end-users throughout the product creation process. This collaborative approach ensures that new innovations directly address the real-world needs and preferences of those who will use them.

This deep understanding allows Coloplast to design products that not only solve specific problems but also genuinely improve the quality of life for patients. For instance, their focus on intuitive design and comfortable materials in ostomy care products reflects direct feedback from users. This dedication to user experience is crucial for building brand loyalty and market leadership.

Coloplast's investment in understanding user needs is reflected in their financial performance. In fiscal year 2023-2024, the company reported a revenue growth of 10%, with innovation and user feedback cited as key drivers. This demonstrates a clear link between their user-centric approach and commercial success.

- Direct User Feedback: Coloplast actively gathers input from patients and clinicians to refine product features and usability.

- Problem-Solving Innovation: Products are developed to address specific challenges faced by users, enhancing daily living.

- Fiscal Year 2024 Impact: User-centric development contributed to a 10% revenue increase, highlighting its commercial importance.

- Market Relevance: This approach ensures products are highly relevant and meet the evolving expectations of the healthcare market.

Portfolio Optimization

Coloplast's product portfolio management is a key element of its marketing strategy, focusing on optimizing offerings to drive growth and profitability. This includes strategic decisions to divest non-core assets, thereby streamlining operations and enhancing focus on core business areas. For instance, the divestment of its Skin Care portfolio in December 2024 exemplifies this approach, allowing for a more concentrated effort within its Advanced Wound Care segment.

This strategic pruning of the product line aims to improve overall financial performance. By shedding less profitable or non-strategic business units, Coloplast can reallocate resources towards areas with higher growth potential and stronger market positions. This focus is crucial for maintaining a competitive edge in the dynamic healthcare market.

The impact of such portfolio adjustments can be significant. For example, the Skin Care divestment is expected to contribute to a more efficient allocation of capital and management attention. This allows the company to better leverage its expertise and innovation capabilities in its priority segments.

- Portfolio Optimization: Coloplast actively manages its product offerings, divesting non-core assets to sharpen strategic focus.

- Divestment Strategy: The sale of the Skin Care portfolio in December 2024 highlights a commitment to simplifying operations and improving profitability.

- Focus Enhancement: This move allows for greater concentration on high-growth areas like Advanced Wound Care, where Coloplast possesses strong capabilities.

- Resource Allocation: By streamlining the portfolio, Coloplast aims to optimize capital deployment and management resources towards its most promising segments.

Coloplast's product strategy centers on delivering innovative, user-centric healthcare solutions across its core segments. The company actively refines its portfolio, exemplified by the expansion of the SenSura® Mio range in ostomy care and the success of the Luja™ intermittent catheter in continence care.

Recent innovations like Heylo™, a digital leakage notification system, underscore Coloplast's commitment to integrating technology for enhanced patient support. This focus on addressing unmet needs and improving quality of life drives product development and market penetration.

The company's strategic approach includes portfolio optimization, such as the divestment of its Skin Care business in December 2024. This allows for increased focus on high-growth areas like Advanced Wound Care, ensuring efficient resource allocation and a stronger market position.

| Product Area | Key Innovations/Developments | Fiscal Year 2023/2024 Impact |

|---|---|---|

| Ostomy Care | SenSura® Mio range expansion (black bags, Convex Soft), Heylo™ digital leakage notification system | Strong market demand, innovation-driven growth |

| Continence Care | Luja™ intermittent catheter | Key growth driver, positive market reception |

| Wound & Skin Care | Focus on Advanced Wound Care post-divestment | Streamlined operations, enhanced focus on high-growth segments |

What is included in the product

This analysis provides a comprehensive examination of Coloplast's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive advantages.

Provides a clear, actionable framework for understanding how Coloplast's 4Ps address customer pain points in ostomy care.

Simplifies complex marketing strategies into a concise overview, highlighting how each P alleviates user challenges.

Place

Coloplast boasts a robust global footprint, with Europe serving as its primary market. In 2023, Europe accounted for a substantial portion of its sales, underscoring its deep roots there. The company is actively pursuing growth in the United States, recognizing its significant market potential.

While Coloplast has a presence in emerging markets, its growth trajectory in these regions can be influenced by external factors. Tender cycles and economic downturns in these areas can impact sales performance, as seen in some Asian and Latin American markets in late 2023 and early 2024.

Coloplast's distribution strategy heavily relies on direct engagement with healthcare professionals. These medical experts, including doctors and nurses, are pivotal in recommending and prescribing Coloplast's advanced medical devices, ensuring products reach the right patients with expert backing.

This direct channel allows Coloplast to provide essential product education and support, fostering strong relationships within the medical community. For instance, in fiscal year 2023, Coloplast reported a 9% organic growth, driven in part by successful direct sales efforts in key markets, reflecting the effectiveness of this professional-focused distribution.

Coloplast is making significant investments in its supply chain and logistics to enhance customer convenience and delivery efficiency. This strategic focus includes expanding its distribution network, exemplified by the establishment of new facilities like a recent distribution center in the US. These efforts are crucial for ensuring timely product availability and supporting Coloplast's global operations.

Optimizing inventory management is a key component of Coloplast's supply chain strategy. By implementing advanced inventory control systems, the company aims to reduce holding costs while maintaining adequate stock levels to meet demand. This meticulous approach to inventory ensures that products are readily accessible to healthcare providers and patients, minimizing potential disruptions.

In 2023, Coloplast reported a revenue of DKK 24.7 billion, with a significant portion of this growth driven by efficient product delivery and customer service, underscoring the importance of their logistics investments. The company's commitment to upgrading its infrastructure is designed to support continued expansion and maintain a competitive edge in the medical device market.

Regulatory Compliance & Market Access

Coloplast's product availability across various global markets hinges on successfully navigating intricate regulatory landscapes and securing essential approvals, such as the CE-mark for medical devices in Europe. This process can be time-consuming and resource-intensive, directly impacting market entry timelines and the speed at which innovations reach patients.

Beyond initial product approval, securing favorable reimbursement policies is paramount for widespread market access and commercial success. For instance, the UK's approval for Coloplast's Heylo product signifies a crucial step in ensuring patients can access and benefit from the innovation through established healthcare funding channels.

- Regulatory Hurdles: Obtaining CE-marking, a key requirement for products sold in the European Economic Area, involves rigorous conformity assessments.

- Reimbursement Landscape: Favorable reimbursement decisions, like the one for Heylo in the UK, directly influence adoption rates and market penetration.

- Geographic Variance: Regulatory and reimbursement requirements differ significantly by country, necessitating tailored market access strategies for each region.

Strategic Manufacturing Locations

Coloplast strategically expands its manufacturing footprint to meet growing global demand and boost efficiency. A new facility in Portugal, slated for operation by 2026, will bolster its production capabilities. This expansion complements existing key sites, such as the one in Costa Rica, ensuring a robust supply chain.

The company's investment in these strategic locations underscores its commitment to operational excellence. For example, Coloplast's 2023 annual report highlighted significant capital expenditures aimed at expanding and modernizing its production facilities. This proactive approach is designed to support the increasing sales volumes anticipated in its key markets.

- Portugal Facility: Expected to be operational by 2026, enhancing European production capacity.

- Costa Rica Operations: A vital hub for manufacturing, serving markets in the Americas.

- Global Network: Coloplast maintains a network of production sites to ensure supply chain resilience and cost-effectiveness.

Coloplast's place strategy focuses on making its products accessible through a well-established global distribution network, directly engaging healthcare professionals. This approach ensures their advanced medical devices reach patients effectively, supported by expert recommendations. The company's commitment to efficient logistics and supply chain optimization, including new US distribution centers, underpins its ability to serve diverse markets and maintain competitive delivery.

Preview the Actual Deliverable

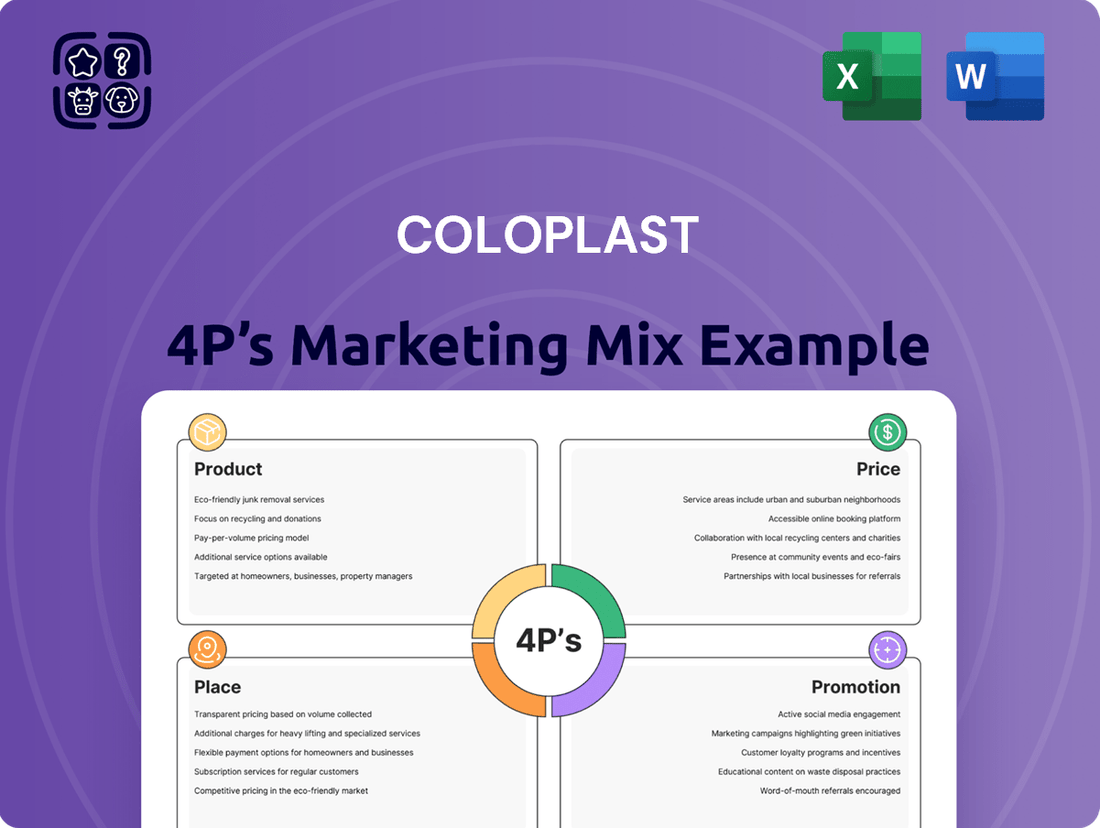

Coloplast 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Coloplast's Product, Price, Place, and Promotion strategies, offering critical insights into their market approach. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Coloplast actively communicates its dedication to innovation, focusing on how new products and technologies directly address unmet patient needs and enhance care delivery. This commitment is evident in their promotion of advancements such as the digital Heylo system, designed to streamline ostomy management, and the Luja catheter, which aims to improve user experience and reduce complications.

Coloplast effectively leverages patient testimonials and user stories as a cornerstone of its promotional strategy. These authentic narratives highlight the tangible improvements in users' quality of life after adopting Coloplast's medical devices.

These powerful stories are frequently showcased in company reports and investor presentations, serving as compelling evidence of product efficacy and patient satisfaction. For instance, in their 2023 annual report, Coloplast emphasized how their ostomy care solutions enabled individuals to regain confidence and engage fully in daily activities.

By sharing these real-life experiences, Coloplast not only builds trust and credibility but also fosters a deeper emotional connection with both patients and healthcare professionals, reinforcing the brand's commitment to improving intimate healthcare for people around the world.

Coloplast's strategic vision and financial reporting are key components of its marketing mix. The company leverages its annual reports, interim financial statements, and investor presentations to clearly articulate its strategic direction, financial performance, and future outlook. For instance, in fiscal year 2023, Coloplast reported a 10% increase in organic growth, reaching DKK 22.7 billion in revenue, demonstrating its commitment to growth and transparency.

These published materials serve as vital communication tools, informing a broad spectrum of stakeholders, including individual investors, financial professionals, and business strategists. They provide insights into Coloplast's ongoing progress, key initiatives, and financial health, enabling informed decision-making across various sectors. The company's consistent reporting allows for a data-driven understanding of its market position and strategic execution.

Public Relations & News Releases

Coloplast actively uses public relations and news releases to communicate key developments. These releases serve to inform investors, healthcare professionals, and the general public about important company milestones, fostering transparency and engagement.

In 2024, Coloplast continued its practice of issuing press releases for significant events. For instance, their Q1 2024 earnings release on February 7, 2024, highlighted a 10% increase in reported revenue to DKK 7.3 billion. This proactive communication strategy is vital for managing market perception and building trust.

- New Product Launches: Announcing innovations like the SenSura Mio Convex Light ostomy pouch, which received positive media coverage in early 2024, driving awareness among healthcare providers.

- Financial Performance: Regular updates on revenue growth, profitability, and strategic investments, such as the DKK 1.5 billion allocated for R&D in fiscal year 2024, demonstrate financial health and future commitment.

- Strategic Partnerships: News regarding collaborations, like the one with a leading European digital health platform announced in late 2023, showcases Coloplast's forward-thinking approach and expansion into new service areas.

Healthcare Professional Engagement

Coloplast actively engages healthcare professionals (HCPs) to ensure they are well-informed about their innovative solutions. This collaboration is crucial for them to confidently recommend and support patients with Coloplast's products. For instance, in fiscal year 2023, Coloplast reported a 10% organic growth in its Advanced Surgery division, partly driven by strong HCP adoption and education initiatives.

Their engagement strategy includes a multi-channel approach, encompassing medical education, scientific exchange, and digital platforms. This ensures continuous dialogue and knowledge sharing. In the first half of fiscal year 2024, Coloplast continued to invest in these HCP interactions, seeing positive feedback on their updated training modules for their latest ostomy care advancements.

Key aspects of Coloplast's healthcare professional engagement include:

- Educational Programs: Providing up-to-date training and information on product efficacy and patient benefits.

- Scientific Exchange: Collaborating with key opinion leaders and researchers to advance clinical understanding.

- Digital Resources: Offering online portals and virtual events for accessible learning and support.

Coloplast's promotional efforts highlight innovation and patient-centric solutions, as seen with the digital Heylo system and Luja catheter. Their use of patient testimonials, like those featured in the 2023 annual report showcasing improved quality of life, builds trust and emotional connection.

The company also emphasizes financial transparency and strategic vision through annual reports and investor presentations. For instance, a 10% organic growth reported in fiscal year 2023 to DKK 22.7 billion revenue underscores their commitment to performance and stakeholder communication.

Public relations and news releases, such as the Q1 2024 earnings release on February 7, 2024, reporting DKK 7.3 billion in revenue, are key to managing market perception. These communications detail new product launches, financial performance, and strategic partnerships, like the digital health platform collaboration announced in late 2023.

Coloplast actively engages healthcare professionals through educational programs, scientific exchange, and digital resources, fostering informed product recommendations. This is supported by their DKK 1.5 billion allocation for R&D in fiscal year 2024, demonstrating a commitment to advancing their product portfolio.

| Key Promotional Activities | Examples/Data Points | Impact/Focus |

| Product Innovation Communication | Digital Heylo system, Luja catheter | Addressing unmet patient needs, enhancing care delivery |

| Patient Testimonials | 2023 Annual Report: Improved quality of life | Building trust, emotional connection, product efficacy |

| Financial & Strategic Updates | FY23 Revenue: DKK 22.7 billion (10% organic growth) | Transparency, stakeholder confidence, market position |

| Public Relations | Q1 2024 Earnings: DKK 7.3 billion revenue | Market perception management, transparency |

| Healthcare Professional Engagement | FY24 R&D Allocation: DKK 1.5 billion | Informed recommendations, clinical understanding, product adoption |

Price

Coloplast employs a value-based pricing strategy, reflecting the specialized nature and perceived value of its advanced medical devices. These products are engineered to address sensitive and complex healthcare needs, such as ostomy care and urology. The company's pricing structure is directly linked to the significant clinical benefits and the tangible improvements in patients' quality of life that its innovations provide.

Securing reimbursement approval across different countries is a significant driver for Coloplast's pricing and product availability. For instance, the positive reimbursement status for Heylo in the United Kingdom directly boosts its market reach and sales figures, demonstrating the tangible impact of these approvals on the company's financial performance.

Coloplast's pricing strategy is carefully calibrated against a backdrop of intense competition in the medical device sector. The company aims to strike a balance, offering products that are both competitively priced to attract a broad customer base and sufficiently profitable to fuel continued innovation and growth. This requires a keen understanding of rival pricing structures and dynamic market demand.

In 2023, Coloplast reported net sales of DKK 27.7 billion, demonstrating its significant market presence. The company's approach to pricing is informed by continuous analysis of competitor price points and the perceived value of its offerings, ensuring its products remain appealing without compromising on financial health.

Profitability Targets & Guidance

Coloplast's profitability targets are a key component of its marketing mix, directly influenced by its pricing strategies and cost control measures. The company provides clear financial guidance to investors, outlining its expected performance.

For the fiscal year 2024/2025, Coloplast has set ambitious goals for its earnings before interest and taxes (EBIT) margin. This metric is a crucial indicator of operational efficiency and pricing power.

- EBIT Margin Target: Coloplast anticipates an EBIT margin before special items to be in the range of 27-28% for FY 2024/2025.

- Pricing Strategy Impact: This target reflects the company's ability to maintain strong pricing power across its product portfolio, even amidst market dynamics.

- Cost Management: Achieving this margin also underscores Coloplast's ongoing commitment to efficient cost management and operational excellence.

Long-Term Pricing Pressures

Coloplast, like many in the medical device sector, anticipates ongoing long-term pricing pressures. The company projects these pressures could amount to approximately 1% annually, impacting its revenue streams.

To navigate this, Coloplast must prioritize continuous innovation in its product offerings and relentlessly pursue operational efficiencies. These strategies are crucial to counteract potential revenue erosion and safeguard its profitability in a competitive market.

- Industry Trend: Medical device companies typically face sustained price reductions.

- Coloplast's Expectation: Anticipates up to a 1% annual impact from pricing pressures.

- Mitigation Strategy: Focus on innovation and operational efficiency to maintain margins.

Coloplast's pricing strategy is fundamentally value-based, reflecting the advanced nature and patient benefits of its medical devices. The company aims for a competitive yet profitable price point, balancing market demand with its financial health and investment in innovation.

For the fiscal year 2024/2025, Coloplast is targeting an EBIT margin of 27-28%, underscoring its pricing power and cost management. However, the company expects ongoing industry-wide pricing pressures, potentially impacting revenue by around 1% annually, which it plans to mitigate through innovation and operational efficiencies.

| Metric | Value | Period |

| Net Sales | DKK 27.7 billion | FY 2023 |

| EBIT Margin Target | 27-28% | FY 2024/2025 |

| Expected Pricing Pressure Impact | ~1% annually | Ongoing |

4P's Marketing Mix Analysis Data Sources

Our Coloplast 4P's Marketing Mix Analysis is meticulously constructed using a blend of proprietary market research, official company disclosures, and extensive industry reports. We leverage data from Coloplast's investor relations, product catalogs, distribution partner networks, and public financial filings to ensure accuracy and relevance.