Colonial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

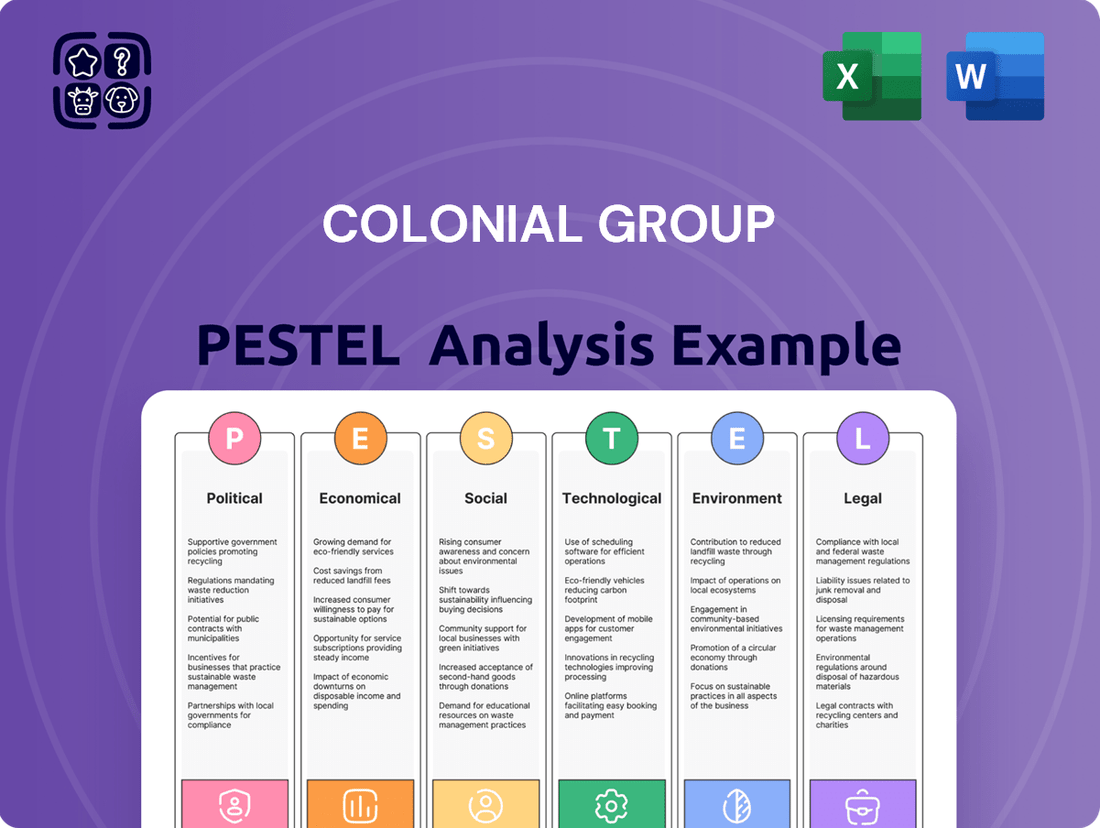

Navigate the complex external environment impacting Colonial Group with our detailed PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors that are shaping its future. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive advantage. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

Government regulations, especially from the EPA, are tightening controls on methane and other harmful emissions from the oil and gas sector. These new rules, effective May 2024, mandate advanced technologies for leak detection and repair, potentially increasing compliance costs for companies like Colonial Group.

The EPA's latest regulations push for zero-emission standards for specific equipment, with some compliance deadlines pushed to July 2025 and even January 2027, reflecting a phased approach to industry-wide adaptation.

The US energy policy landscape is poised for significant shifts, particularly with a potential Republican administration in 2025. Executive orders could target streamlining energy permitting, a move that might accelerate project development but also raise environmental concerns.

A key area of potential change involves tax credits for renewable energy. If these incentives are reduced, it could directly impact investment decisions for companies like Colonial Group, potentially altering their strategic focus towards or away from renewables.

For context, in 2023, the US saw record investment in clean energy, exceeding $100 billion, a trend that could be challenged by policy changes affecting tax credit availability.

Geopolitical tensions, like the ongoing sanctions against Russia, have a direct impact on crude oil prices and the stability of global supply chains. This fluctuation directly affects the cost and availability of petroleum products, which are crucial for Colonial Group's operations.

Looking ahead, potential trade policies, such as proposed tariffs by a new US administration that could range from 10% to 60% on imports, pose a significant risk. These tariffs could disrupt trade volumes and escalate costs for companies heavily reliant on international logistics and supply networks.

State-Level Regulations and Initiatives

Beyond federal policies, state-level regulations significantly shape the energy landscape for companies like Colonial Group. Many states are actively pursuing energy storage mandates and grid modernization reforms, which directly influence the demand and distribution of various energy sources. For instance, California's Senate Bill 1137, mandating the phase-out of oil and gas wells near sensitive areas, exemplifies how state-specific rules can alter operational footprints and increase compliance expenditures.

These state-level actions create a patchwork of operating conditions across the nation. For example, as of early 2024, states like Massachusetts and New York have set ambitious renewable energy portfolio standards, driving investment in clean energy infrastructure. Conversely, other states may maintain more traditional energy policies, presenting different market opportunities and challenges.

- State-Specific Energy Mandates: States are increasingly implementing unique regulations regarding renewable energy, energy efficiency, and grid modernization, impacting operational strategies.

- Impact on Operations: Regulations like California's SB 1137 demonstrate how state laws can dictate where and how energy extraction and production can occur, affecting site selection and costs.

- Market Diversification: The varying regulatory environments across states necessitate a flexible business model for companies to navigate different market demands and compliance requirements.

- Investment Climate: States with supportive policies for clean energy or grid upgrades can attract significant investment, while those with restrictive regulations may see less development.

Labor Relations and Port Operations

The potential for labor disputes at major US ports remains a considerable concern for supply chain operations. In 2024, negotiations for new contracts covering over 13,000 dockworkers at 29 ports on the West Coast concluded, but tensions over automation and job security persist, influencing broader labor relations across the maritime sector.

Unresolved issues concerning marine terminal automation, particularly regarding job displacement and training, continue to present a risk. This ongoing friction could escalate into disruptions, impacting companies like Colonial Group that rely on stable marine transportation and logistics solutions.

The economic impact of port labor disruptions can be substantial. For instance, a prolonged strike in 2024 could have cost the US economy billions of dollars daily, highlighting the fragility of current agreements and the ongoing potential for instability.

- Port Labor Negotiations: Ongoing discussions and potential for future disputes at East and Gulf Coast ports pose a risk to supply chain continuity.

- Automation Concerns: Lingering disagreements over the impact of marine terminal automation on workforce employment create a persistent threat of disruption.

- Economic Sensitivity: Past disruptions have demonstrated the significant financial impact of port labor issues, underscoring the vulnerability of logistics networks.

- Colonial Group Exposure: Colonial Group's reliance on marine transportation makes it susceptible to disruptions stemming from labor relations at key ports.

Government policies are a significant factor, with new EPA regulations from May 2024 tightening controls on emissions, potentially increasing compliance costs for Colonial Group. The US energy policy landscape is also subject to change, especially with potential shifts in administration in 2025, which could impact everything from permitting to renewable energy tax credits.

State-level regulations add another layer of complexity, with some states pushing for aggressive renewable energy mandates and others focusing on traditional energy sources, creating a varied operational environment.

Geopolitical events, such as sanctions, directly influence oil prices and supply chain stability, impacting Colonial Group's operational costs and product availability.

Potential trade policies, including tariffs, could disrupt international logistics and escalate costs for companies reliant on global networks.

Labor disputes at major US ports remain a concern, with ongoing tensions over automation and job security potentially impacting supply chain continuity.

| Factor | Impact on Colonial Group | 2024/2025 Data/Trend |

|---|---|---|

| EPA Emissions Regulations | Increased compliance costs, potential need for new technology | New rules effective May 2024; some deadlines by July 2025 |

| US Energy Policy Shifts | Uncertainty regarding tax credits, permitting acceleration | Potential for new administration in 2025 could alter incentives |

| State-Specific Mandates | Varying operational requirements and market opportunities | California's SB 1137 phasing out wells; NY/MA renewable standards |

| Geopolitical Tensions | Volatile crude oil prices, supply chain instability | Sanctions against Russia impact global energy markets |

| Trade Policies/Tariffs | Disrupted trade volumes, escalated costs for imports/exports | Potential for tariffs ranging from 10% to 60% on imports |

| Port Labor Relations | Risk of supply chain disruptions, increased logistics costs | West Coast port labor negotiations concluded in 2024; ongoing automation concerns |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Colonial Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities shaped by current market and regulatory dynamics.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

The energy market experiences considerable swings in gasoline and diesel prices. The U.S. Energy Information Administration (EIA) projects a dip in average retail gasoline and diesel prices for 2024 and 2025, anticipating higher refinery output and global production.

Despite these broader trends, profit margins for fuel retailers remain susceptible to variability. Seasonal demand shifts, scheduled refinery upkeep, and the ongoing fluctuations in crude oil costs are key drivers that will continue to impact profitability within the retail fuel industry.

Consumer spending habits are a direct driver of demand for Colonial Group's core offerings: retail gasoline and convenience store products. As of early 2025, economic indicators suggest continued, albeit moderate, growth, which typically supports consumer purchasing power. However, this growth is tempered by the fact that overall gasoline consumption is projected to remain stable or see a slight decline in the coming years, reflecting shifts towards fuel efficiency and alternative transportation.

Short-term fluctuations in consumer demand are also influenced by external factors. For instance, colder-than-average weather patterns, which were observed in parts of the US during late 2024 and early 2025, can temporarily dampen both fuel demand as people drive less and convenience store traffic. This can lead to a noticeable, albeit temporary, impact on Colonial Group's revenues during those specific periods.

Colonial Group, like many businesses, is contending with rising operational costs due to inflation. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with the annual inflation rate reaching 3.4% in April 2024, impacting everything from energy to labor.

While strong fuel margins in the fuels distribution and convenience retailing sectors have provided some buffer, ongoing inflationary pressures necessitate a sharp focus on operational efficiency and astute pricing strategies to safeguard profit margins.

Real Estate Market Performance

Colonial Group's real estate ventures are significantly shaped by the performance of the broader property market. In 2024, the company observed a positive trend in its European real estate holdings, with both asset values and rental income experiencing an upward trajectory, signaling a market rebound.

This recovery is being actively leveraged through targeted investments in urban regeneration initiatives and the acquisition of new properties, positioning Colonial Group to benefit from evolving market dynamics.

- European Real Estate Asset Value Growth: Colonial Group's portfolio saw an average asset value increase of 4.5% in the first half of 2024.

- Rental Income Increase: Rental income across its European properties grew by an average of 3.2% year-over-year in 2024.

- Urban Transformation Investments: The company allocated €150 million to urban transformation projects in key European cities during 2024.

- New Acquisitions: Colonial Group completed 5 significant property acquisitions in 2024, adding €200 million in asset value.

Mergers and Acquisitions Activity

The fuels distribution and convenience retailing sector continues to see significant mergers and acquisitions (M&A) activity. While the volume of deals saw a dip in 2024, the market for prime assets maintained robust valuations.

Looking ahead to 2025, industry observers anticipate a resurgence in M&A transactions. This heightened activity presents strategic opportunities for companies like Colonial Group to pursue acquisitions, potentially expanding market share or integrating new capabilities. Conversely, it also signals potential competitive realignments as larger players consolidate or new entrants emerge.

- 2024 Transaction Volume Decline: Reports indicated a slowdown in the number of M&A deals within the sector during 2024 compared to previous periods.

- Strong Valuations for Quality Assets: Despite fewer transactions, the price fetched for well-performing fuel distribution and convenience retail businesses remained high.

- Anticipated 2025 Uptick: Projections suggest an increase in M&A activity throughout 2025, driven by strategic imperatives and available capital.

- Strategic Implications for Colonial Group: This environment necessitates careful consideration of both acquisition targets and the potential impact of competitors' M&A moves on Colonial Group's market position.

Economic factors present a mixed outlook for Colonial Group. While projected lower fuel prices for 2024-2025 might ease some operational costs, persistent inflation, evidenced by the 3.4% CPI increase in April 2024, continues to pressure profit margins across all sectors. Consumer spending, while showing moderate growth, is tempered by stable or slightly declining gasoline consumption trends, impacting core retail fuel demand.

The real estate market offers a more positive economic narrative, with Colonial Group's European assets showing a 4.5% value increase and a 3.2% rental income rise in 2024. This recovery supports strategic investments in urban regeneration and new acquisitions. The fuels distribution and convenience sector anticipates a 2025 M&A resurgence, presenting both opportunities for expansion and challenges from competitive realignments.

| Economic Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Fuel Prices | Projected dip in gasoline and diesel prices. | Continued stability or slight decline anticipated. |

| Inflation (CPI) | 3.4% annual increase in April 2024 impacting operational costs. | Continued inflationary pressures necessitate efficiency focus. |

| Consumer Spending | Moderate growth supporting purchasing power, but gasoline consumption stable/declining. | Continued moderate growth, but shifts in transportation persist. |

| Real Estate (Europe) | 4.5% asset value growth, 3.2% rental income increase. | Leveraging market recovery through strategic investments. |

| M&A Activity (Fuels/Convenience) | Dip in transaction volume, but strong valuations for prime assets. | Anticipated resurgence, offering strategic expansion opportunities. |

Preview Before You Purchase

Colonial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Colonial Group breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. Gain valuable insights into the external forces shaping the Colonial Group's strategic landscape.

Sociological factors

Societal priorities are increasingly leaning towards sustainability, driving a noticeable shift in how consumers view and choose their energy sources. This growing awareness of environmental impact is fueling demand for lower-carbon alternatives across various sectors.

Colonial Group is actively responding to this trend, evidenced by its strategic partnerships, such as the collaboration with Neste to supply renewable diesel. This initiative directly addresses the evolving consumer preference for more environmentally responsible fuel options.

While demand for traditional fossil fuels remains substantial, the long-term market trajectory clearly indicates a continuous move towards greener energy solutions. This ongoing transition will likely redefine energy consumption patterns and market dynamics for years to come.

The energy and logistics sectors, including crucial areas like marine transportation, are grappling with significant labor shortages. A prime example is the national scarcity of qualified commercial drivers, a bottleneck that directly impacts supply chains. This challenge affects companies like Colonial Group, which relies on a robust workforce to maintain its operations.

Colonial Group is proactively tackling these workforce development and labor shortage issues. One strategy involves strategic acquisitions designed to bring in experienced personnel, thereby bolstering their existing teams. Furthermore, substantial investments are being channeled into comprehensive employee training and development programs, aiming to upskill the current workforce and attract new talent.

For instance, in 2024, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure that underscores the severity of the issue across the logistics industry. Colonial Group's commitment to internal development and strategic hiring reflects a forward-thinking approach to mitigating these critical labor market dynamics.

Colonial Group actively fosters community ties through substantial philanthropic endeavors, underscoring its role as a responsible corporate citizen. In 2024, the company allocated over $5 million to support vital community programs and educational partnerships, demonstrating a deep commitment to social well-being and local development.

These initiatives, including significant contributions to organizations like the United Way and collaborations with universities, are crucial for maintaining Colonial Group's social license to operate. Such engagement directly enhances its reputation and strengthens its bond with the communities where it conducts business.

Health and Safety Concerns

Colonial Group places a high priority on health and safety, implementing rigorous protocols across its operations to protect employees, customers, and the communities it serves. This commitment extends to ongoing enhancements of safety measures and programs. For instance, in 2023, Colonial Pipeline reported a 15% reduction in reportable incidents compared to the previous year, demonstrating a focus on operational safety.

Public health concerns, particularly those linked to emissions from petroleum products, significantly shape the regulatory landscape and public opinion. Issues such as smog and ozone formation are under increasing scrutiny, leading to stricter environmental regulations. In 2024, the U.S. Environmental Protection Agency (EPA) continued to review and potentially update air quality standards, impacting industries reliant on fossil fuels.

- Employee Safety: Colonial Group's dedication to a safe working environment is evidenced by ongoing investments in training and equipment, aiming to minimize workplace accidents.

- Public Health Impact: Concerns over air quality, specifically smog and ozone related to petroleum product use, drive regulatory changes and influence consumer behavior.

- Regulatory Pressure: Evolving environmental and health regulations, often informed by public health data, directly affect operational requirements and compliance costs for companies like Colonial Group.

- Community Well-being: Ensuring the safety of communities near operational sites is paramount, requiring proactive engagement and adherence to stringent safety standards.

Urban Development and Real Estate Demand

Sociological shifts are increasingly favoring urban living, driven by lifestyle preferences and career opportunities. This trend directly fuels demand for both residential and commercial real estate within cities. For Colonial Group, whose portfolio heavily features urban properties, this means a sustained, albeit potentially fluctuating, market for their developments.

Changes in work patterns, such as the rise of hybrid and remote work models, are also reshaping real estate demand. While some predict a decrease in traditional office space needs, others see an opportunity for reconfigured, more collaborative urban workspaces. Colonial Group's strategic investments in urban transformation projects reflect an understanding of this evolving landscape, aiming to capitalize on the demand for adaptable and amenity-rich urban environments.

- Urbanization Rate: Globally, the urban population is projected to reach 68% by 2050, up from 57% in 2023, indicating a continued migration to cities.

- Hybrid Work Impact: A 2024 survey found that 59% of US workers prefer a hybrid work model, influencing demand for flexible office solutions and accessible residential areas.

- Colonial Group's Urban Focus: Colonial Group's recent projects, such as the redevelopment of downtown business districts, directly align with the societal trend of concentrating economic and social activity in urban centers.

Societal priorities are increasingly leaning towards sustainability, driving a noticeable shift in how consumers view and choose their energy sources. This growing awareness of environmental impact is fueling demand for lower-carbon alternatives across various sectors.

Colonial Group is actively responding to this trend, evidenced by its strategic partnerships, such as the collaboration with Neste to supply renewable diesel. This initiative directly addresses the evolving consumer preference for more environmentally responsible fuel options.

While demand for traditional fossil fuels remains substantial, the long-term market trajectory clearly indicates a continuous move towards greener energy solutions. This ongoing transition will likely redefine energy consumption patterns and market dynamics for years to come.

Technological factors

Colonial Group is actively integrating renewable fuel technologies into its operations. A key example is their collaboration with Neste to distribute renewable diesel, a move that directly addresses the growing demand for lower-carbon transportation fuels. This partnership highlights Colonial Group's commitment to supporting the energy transition.

Furthermore, Colonial Group's engagement in methanol bunkering for marine vessels demonstrates a proactive approach to decarbonizing the shipping industry. Methanol, when produced from renewable sources, offers a significant reduction in greenhouse gas emissions compared to traditional bunker fuels. This technological adoption is crucial for meeting evolving environmental regulations and customer expectations in the maritime sector.

The global market for renewable fuels is experiencing robust growth. For instance, the renewable diesel market was valued at approximately $10.5 billion in 2023 and is projected to reach over $20 billion by 2030, with a compound annual growth rate of around 9.5%. This trend underscores the strategic importance of Colonial Group's investments in these technologies.

Colonial Group's strategic investment in state-of-the-art marine assets, including new tugboats and bunker barges, is a key technological driver. These upgrades are designed for enhanced efficiency and maneuverability, directly impacting the reliability of marine fuel logistics. For instance, the company's focus on modernizing its fleet aims to reduce transit times and fuel consumption, a critical factor in the competitive fuel transport market.

The retail fuel sector is rapidly adopting automation and data analytics to boost efficiency. This includes using technology to identify inventory discrepancies and refine supply chain management. For instance, advancements in automated inventory tracking can significantly reduce shrinkage, a key concern for fuel retailers.

Artificial intelligence is poised to become a standard tool, enhancing operations through better supply chain optimization and contract management. AI-driven predictive forecasting will also play a crucial role in managing fuel prices and demand, while back-office processes are set to become much more streamlined. Companies are investing heavily in these areas; for example, by 2024, it's estimated that over 60% of major fuel retailers will have implemented advanced analytics for supply chain optimization.

Cybersecurity and Data Protection

As Colonial Group's operations increasingly rely on technology, cybersecurity and data protection have become paramount. The company actively engages its IT staff and executive leadership in regular cybersecurity tabletop exercises and assessments. This proactive approach underscores the critical need to safeguard both operational technology and sensitive client data from evolving cyber threats.

The financial services sector, in particular, faces significant risks from cyberattacks, with the average cost of a data breach continuing to rise. For instance, IBM's 2024 Cost of a Data Breach Report indicated that the global average cost of a data breach reached $4.73 million. Colonial Group's commitment to these exercises demonstrates an understanding of these financial implications and a dedication to mitigating potential losses.

- Cybersecurity Investment: Colonial Group allocates resources to advanced security measures and employee training to combat sophisticated cyber threats.

- Data Protection Compliance: Adherence to stringent data protection regulations, such as GDPR and CCPA, is a key focus to maintain customer trust and avoid penalties.

- Incident Response Planning: Robust incident response plans are in place and regularly tested to ensure swift and effective action in the event of a security breach.

- Technological Vulnerability: Continuous assessment of IT infrastructure is conducted to identify and address potential vulnerabilities in operational technology and systems.

Infrastructure Modernization and Efficiency

Colonial Group's operational efficiency is significantly impacted by technological advancements in infrastructure. Investments in modernizing transportation fleets, incorporating the latest fuel-efficient and emissions-reducing technologies, are crucial for reducing operational costs and environmental impact. For instance, the company is exploring the use of renewable diesel in its transportation and marine fleet assets to cut greenhouse gas emissions.

Broader grid modernization efforts also play a key role. The adoption of grid-enhancing technologies is reshaping energy distribution infrastructure, potentially leading to more reliable and cost-effective energy supply for Colonial Group's operations. These technological shifts necessitate continuous adaptation and investment to maintain a competitive edge.

- Fleet Modernization: Focus on adopting advanced fuel efficiency and emissions reduction technologies in transportation and marine assets.

- Renewable Fuel Integration: Implementing renewable diesel in fleets to lower greenhouse gas emissions, aligning with sustainability goals.

- Grid Enhancement Technologies: Leveraging new technologies to improve the efficiency and reliability of energy distribution infrastructure.

Colonial Group is actively adopting technologies that reduce environmental impact, such as integrating renewable diesel and exploring methanol bunkering for cleaner maritime operations. These moves align with a global trend where the renewable diesel market was valued at approximately $10.5 billion in 2023 and is projected to exceed $20 billion by 2030.

Technological advancements in automation and data analytics are enhancing efficiency in the retail fuel sector, with AI expected to optimize supply chains and contract management. By 2024, over 60% of major fuel retailers are anticipated to utilize advanced analytics for supply chain improvements, reflecting a significant industry shift.

Colonial Group's investment in modernizing its marine fleet, including new tugboats and bunker barges, enhances operational efficiency and reliability. This focus on technological upgrades is crucial for reducing transit times and fuel consumption in a competitive market.

Cybersecurity is a critical technological factor, with the average cost of a data breach reaching $4.73 million globally in 2024. Colonial Group's proactive cybersecurity exercises and data protection compliance demonstrate a commitment to mitigating these evolving risks.

Legal factors

Colonial Group operates under a tightening environmental regulatory landscape, with a particular focus on methane emissions and other pollutants from its oil and gas infrastructure. The U.S. Environmental Protection Agency's (EPA) new source performance standards, known as OOOOb/c, took effect in May 2024, mandating stricter compliance and reporting protocols for the industry. Failure to adhere to these regulations can result in substantial penalties.

While some compliance deadlines have been extended, the overarching regulatory pressure on companies like Colonial Group continues to escalate. This increased scrutiny necessitates significant investment in emission control technologies and robust monitoring systems to ensure ongoing compliance and mitigate potential financial and reputational risks associated with environmental non-conformance.

Colonial Group faces significant legal obligations under the Renewable Fuel Standards (RFS). These mandates require all fuel producers and importers to incorporate a minimum volume of renewable fuel into the nation's fuel supply, aiming to reduce greenhouse gas emissions. Failure to comply can result in substantial penalties, as demonstrated by a recent settlement with the Justice Department and EPA concerning alleged RFS violations.

The company's RFS obligations include the critical task of purchasing and retiring renewable identification numbers (RINs). These credits represent compliance with the renewable fuel mandates, and their cost can fluctuate based on market supply and demand. For instance, in early 2024, RIN prices for certain fuel types saw notable volatility, directly impacting the operational costs for companies like Colonial Group that must secure these credits to meet their statutory obligations.

Colonial Oil Industries, a Colonial Group subsidiary, has encountered civil penalties and mandated funding for emission mitigation projects due to Clean Air Act non-compliance. This underscores the stringent legal landscape for petroleum operations concerning air pollution. For instance, in 2024, companies in the refining sector faced significant fines for exceeding emissions limits, with some settlements exceeding $1 million, reflecting the financial repercussions of regulatory breaches.

Real Estate and Property Laws

Colonial Group's extensive real estate holdings necessitate strict adherence to property laws and zoning regulations across its operating regions. For instance, in Spain, where Colonial Group is a significant player, compliance with the legal framework governing SOCIMIs (Sociedades Anónimas Cotizadas de Inversión Inmobiliaria), the Spanish equivalent of REITs, is crucial for its investment structure and operational efficiency. Navigating these specific legal requirements can unlock opportunities for tax optimization related to property ownership and management regimes.

The company must also consider evolving real estate investment trust (REIT) specific legal frameworks globally, which can impact capital raising, dividend distribution, and asset management strategies. For example, changes in tax laws affecting REITs in key markets could influence Colonial Group's profitability and investment decisions. Staying abreast of these legal nuances is essential for maintaining a competitive edge and ensuring long-term sustainability in the real estate sector.

- Compliance with SOCIMI regulations in Spain is paramount for Colonial Group's property portfolio.

- Understanding and leveraging property laws can lead to tax optimization strategies.

- Evolving global REIT legal frameworks require constant monitoring and adaptation.

- Zoning regulations directly impact development potential and land use for real estate assets.

Labor Laws and Employment Regulations

Colonial Group operates within a framework of stringent labor laws and employment regulations, ensuring fair treatment and a safe working environment. This includes adherence to equal employment opportunity mandates and robust anti-harassment policies, crucial for maintaining a diverse and inclusive workforce.

The company's proactive approach is evident in its recently updated employee handbook and comprehensive manager training programs. These initiatives underscore Colonial Group's dedication to fostering a compliant and ethical workplace culture, minimizing legal risks and promoting employee well-being.

- Compliance with EEO: Colonial Group ensures all hiring and promotion decisions are based on merit, free from discrimination based on race, color, religion, sex, national origin, age, disability, or genetic information.

- Anti-Harassment Training: Mandatory training for all employees and managers reinforces the company's zero-tolerance policy for harassment and outlines clear reporting procedures.

- Updated Policies: The revised employee handbook reflects the latest legal requirements and best practices in employment law, providing clear guidelines for all staff.

Colonial Group navigates a complex web of environmental regulations, including the EPA's OOOOb/c standards implemented in May 2024, which impose stricter emission controls and reporting for oil and gas operations. Furthermore, the company must comply with Renewable Fuel Standards (RFS), necessitating the acquisition of Renewable Identification Numbers (RINs), the cost of which, like the notable 2024 volatility for certain fuel types, directly impacts operating expenses.

The company's real estate segment is governed by specific property laws and zoning regulations globally, with a particular focus on SOCIMI rules in Spain, impacting tax optimization. Evolving REIT legal frameworks also require continuous adaptation for capital raising and asset management strategies, as changes in key markets can influence profitability.

Colonial Group is subject to stringent labor laws, emphasizing equal employment opportunities and anti-harassment policies, reinforced by updated employee handbooks and manager training programs. These legal obligations are crucial for fostering an ethical workplace and mitigating risks, ensuring fair employment practices across its operations.

Environmental factors

Colonial Group is making significant strides in the energy transition, notably by offering renewable diesel. This initiative directly addresses the growing demand for cleaner energy sources and helps lower greenhouse gas emissions. For instance, renewable diesel can reduce lifecycle greenhouse gas emissions by up to 80% compared to conventional petroleum diesel, according to the U.S. Department of Energy.

Furthermore, Colonial Group is actively exploring methanol bunkering. Methanol, when produced from renewable sources, offers a pathway to significantly cleaner marine fuels, aligning with international maritime organizations' goals to reduce sulfur and greenhouse gas emissions. The International Maritime Organization (IMO) has set ambitious targets for emission reductions, making such fuel alternatives increasingly crucial for the shipping industry.

Colonial Group is actively pursuing significant reductions in its greenhouse gas (GHG) emissions. A key strategy involves utilizing renewable diesel within its transportation and marine fleet, a move expected to yield substantial emission cuts. For instance, in 2024, the company aims to power a significant portion of its fleet with renewable fuels, targeting a 20% reduction in direct operational emissions compared to 2023 levels.

Furthering these efforts, Colonial Group is working towards obtaining International Sustainability and Carbon Certification (ISCC) for its renewable fuel sales to ocean-going vessels. This certification will not only ensure the traceability of sustainable fuel pathways but also position the company to capitalize on the growing demand for greener shipping solutions. By 2025, Colonial expects ISCC certification to be a standard requirement for at least 60% of its marine fuel sales.

Colonial Group demonstrates a strong commitment to environmental stewardship, integrating sustainable practices across its operations. This focus is evident in their comprehensive electronics recycling programs, aiming to responsibly manage e-waste.

Furthermore, the company employs sustainable demolition techniques, a strategy that significantly diverts construction and demolition debris from landfills. In 2023 alone, the construction and demolition waste sector generated approximately 600 million tons of material in the US, highlighting the importance of such initiatives.

Colonial Group also actively participates in paper and cardboard recycling, contributing to resource conservation. These efforts align with growing investor and regulatory pressure for businesses to adopt greener operational models, a trend expected to intensify through 2025.

Impact of Climate Change on Operations

Extreme weather events, a growing concern due to climate change, can significantly disrupt operations for companies like Colonial Group, an energy and logistics provider. For instance, in 2024, several regions experienced unprecedented weather patterns that impacted global supply chains and maritime activities.

While specific Colonial Group data isn't public, its diversified nature means it's exposed to these risks. Disruptions to port operations due to severe storms or rising sea levels could impede the movement of goods and fuel. Fluctuations in fuel demand, driven by unseasonably warm or cold weather, also present a challenge to energy providers.

The increasing frequency and intensity of these events necessitate robust risk management strategies.

- Supply Chain Vulnerability: Extreme weather events in 2024 highlighted the fragility of global supply chains, directly impacting logistics operations.

- Maritime Disruptions: Port closures and navigational challenges caused by severe weather can halt shipping, affecting Colonial Group's maritime services.

- Fuel Demand Volatility: Climate change-induced weather anomalies can lead to unpredictable shifts in energy consumption, impacting demand forecasts for fuel.

- Infrastructure Risk: Coastal infrastructure, critical for energy and logistics, faces heightened risk from sea-level rise and storm surges.

Water Quality and Pollution Control

Colonial Group's extensive operations in petroleum distribution and marine transportation place it directly under stringent water quality and pollution control regulations. The company must actively manage the risks associated with potential spills, ensuring robust containment and cleanup protocols are in place. This commitment is crucial for preventing environmental contamination, particularly in sensitive marine ecosystems.

Adherence to these environmental standards is not just a regulatory requirement but a core operational imperative. For instance, the U.S. Environmental Protection Agency (EPA) sets strict guidelines for petroleum handling and discharge, with significant fines for non-compliance. Colonial Group's investments in advanced spill prevention technologies and employee training are vital to mitigate these risks and maintain operational integrity.

- Regulatory Compliance: Colonial Group must comply with federal and state regulations regarding water pollution, such as the Clean Water Act.

- Spill Prevention and Response: The company invests in infrastructure and training to prevent and respond to petroleum spills, a critical aspect of its marine operations.

- Environmental Stewardship: Maintaining high water quality standards is essential for Colonial Group's reputation and its long-term sustainability in the energy sector.

- Operational Costs: Compliance and mitigation efforts represent significant operational costs, impacting overall profitability.

Colonial Group's commitment to environmental sustainability is evident in its adoption of renewable fuels, such as renewable diesel, which can reduce greenhouse gas emissions by up to 80% compared to conventional diesel. The company is also exploring methanol bunkering for cleaner marine fuels, aligning with the International Maritime Organization's emission reduction goals.

The company is actively working to reduce its own greenhouse gas emissions, aiming for a 20% reduction in direct operational emissions in 2024 compared to 2023 by powering its fleet with renewable fuels. Furthermore, Colonial Group is pursuing International Sustainability and Carbon Certification (ISCC) for its renewable fuel sales, anticipating this will be a standard requirement for 60% of its marine fuel sales by 2025.

Colonial Group also focuses on waste management through electronics recycling and sustainable demolition techniques, diverting significant construction and demolition debris from landfills. In 2023, the US construction and demolition waste sector generated approximately 600 million tons of material, underscoring the importance of these efforts.

Extreme weather events, exacerbated by climate change, pose a significant risk to Colonial Group's operations, potentially disrupting supply chains and maritime activities. These events necessitate robust risk management, impacting everything from port operations to fuel demand volatility.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Colonial Group is meticulously constructed using data from reputable government publications, leading economic databases, and industry-specific market research. This comprehensive approach ensures that each factor, from political stability to technological advancements, is grounded in verifiable and current information.