Colonial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the foundational dynamics at play. Purchase the full BCG Matrix report for a comprehensive, data-driven analysis and actionable strategies to optimize your investments and guide your product development.

Stars

Colonial Oil Industries' strategic partnership with Neste, launched in January 2024, to distribute renewable diesel across the Southeast places them squarely in a high-growth sector. This move capitalizes on the surging demand for sustainable fuels, a market projected to expand significantly in the coming years.

By offering a lower-carbon alternative, Colonial Oil is not just meeting current market needs but is also positioning itself as a leader in a rapidly evolving energy landscape. This initiative taps into a strong market potential, driven by environmental regulations and consumer preference for greener options.

Methanol bunkering services at Colonial Group's terminals represent a Stars category in the BCG Matrix. The successful completion of the first methanol bunkering operation at Port of Savannah in February 2024, involving the Stena Provident, underscores Colonial's strategic positioning in this emerging alternative fuel market.

With the global maritime industry actively pursuing decarbonization strategies, methanol is gaining traction as a viable lower-emission fuel. This shift creates a high-growth environment for methanol bunkering, offering Colonial Group significant potential to capture increased market share and revenue.

Colonial Oil Industries' strategic investment in marine transportation assets, including the January 2025 christening of the tug 'Soaring Eagle' and a 30,000 bbl capacity bunker barge, bolsters its U.S. East Coast fuel logistics. This move is crucial for meeting rising demand and overcoming refinery capacity constraints in the region.

Prime Office Real Estate in Key European Cities

Prime office real estate in key European cities like Paris, Madrid, and Barcelona represents a strong performer for Colonial Group. These assets are characterized by high occupancy and significant rental income growth, positioning them as Stars within the BCG Matrix.

Inmobiliaria Colonial, a key entity within the Colonial Group, reported robust performance in its prime office portfolio for the first half of 2025. This segment demonstrates a high market share in a growing sector of the real estate market.

- Rental Income Growth: H1 2025 saw substantial increases in rental income from these prime European office assets.

- High Occupancy Rates: The portfolio maintained very high occupancy levels, underscoring demand for quality office space.

- Market Position: This performance indicates a strong market share in the growing prime office segment across major European hubs.

- Strategic Importance: These assets are crucial for Colonial Group's overall growth and profitability, fitting the Star quadrant of the BCG Matrix.

Urban Regeneration Projects (Real Estate)

Colonial Group's urban regeneration projects, like the 'Alpha X' initiative launched in 2024, represent significant investments in prime real estate. These ventures focus on revitalizing over 110,000 square meters in key European cities, including Paris, Madrid, and Barcelona.

The strategic aim is to capitalize on the current upward trend in the real estate market. These developments are projected to generate an additional €64 million in annual rental income, underscoring their potential as high-growth assets within the BCG matrix.

- Project Alpha X Launch: 2024

- Total Area Regenerated: Over 110,000 sqm

- Key Locations: Paris, Madrid, Barcelona

- Projected Additional Annual Rents: €64 million

Colonial Group's methanol bunkering services and prime European office real estate are positioned as Stars in the BCG Matrix. The successful methanol bunkering operation in February 2024 and the robust performance of its office portfolio in H1 2025, with significant rental income growth and high occupancy, highlight their high-growth, high-market-share status. These segments are critical drivers of Colonial Group's current and future profitability.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Methanol Bunkering | High | High | Star |

| Prime European Offices | High | High | Star |

| Urban Regeneration Projects (Alpha X) | High | High | Star |

What is included in the product

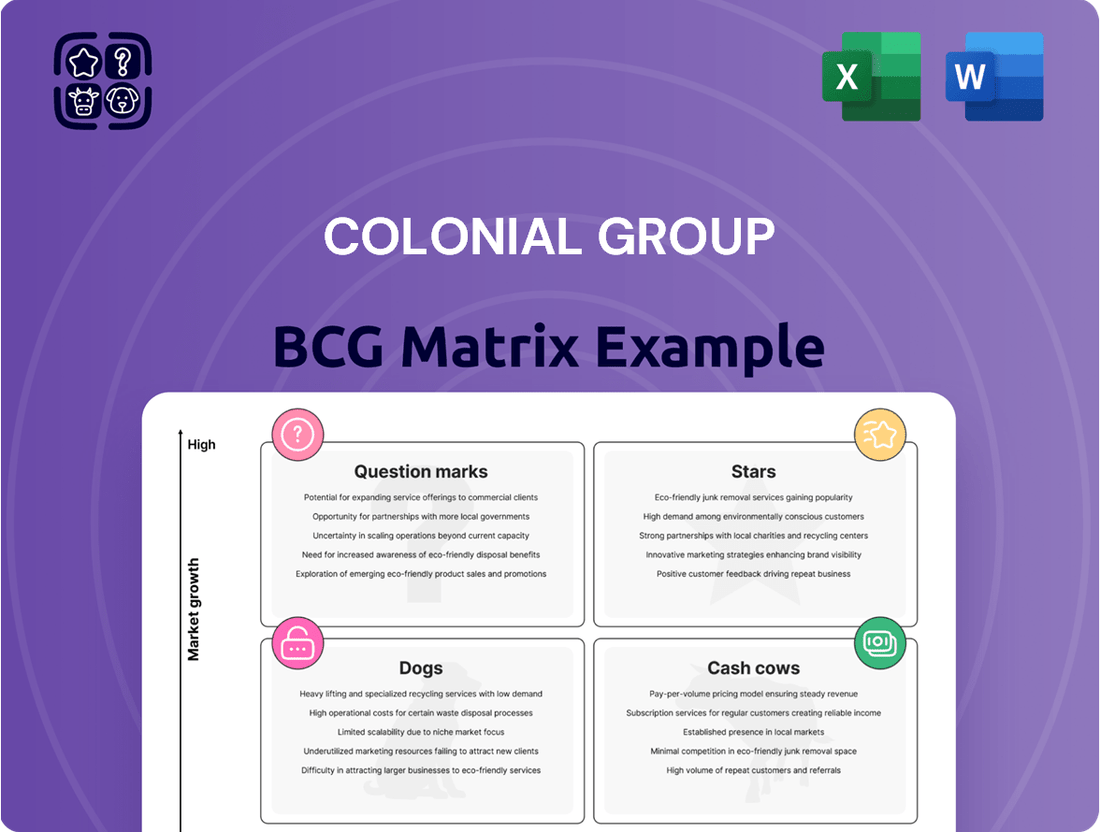

The Colonial Group BCG Matrix offers a strategic overview of a company's product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

Colonial Group's established petroleum product distribution is a classic cash cow. This core business, serving over 5,000 customers across the Southeast, operates in a mature market characterized by stable, ongoing demand.

The segment consistently generates robust cash flow, a direct result of its deep-rooted customer relationships and highly efficient, extensive logistical infrastructure. In 2024, this segment is projected to contribute significantly to Colonial Group's overall profitability, underscoring its role as a reliable income generator.

Before its acquisition by Nouria in February 2025, Colonial Group's Enmarket chain of retail gasoline stations and convenience stores operated as a classic cash cow. This segment consistently generated robust revenue and predictable cash flows, underpinning the company's financial stability.

Enmarket boasted a significant market presence across its operating regions, a testament to its strong brand recognition and customer loyalty. This high market share allowed it to command consistent sales volumes, even in a competitive landscape.

In 2024, the convenience store sector, which Enmarket was a part of, saw continued growth. For instance, the National Association of Convenience Stores (NACS) reported that in 2023, total industry sales reached $876 billion, with inside sales (excluding fuel) accounting for $323 billion, demonstrating the substantial revenue potential within this segment.

Colonial Group's existing liquid product ocean terminals, with their substantial two million barrels of storage capacity, are prime examples of cash cows. These terminals, accessible by marine, rail, and truck, are established assets in a mature industry, generating reliable income from storage fees and handling services. In 2024, the demand for efficient logistics and storage solutions remained robust, supporting consistent revenue streams for these well-positioned facilities.

Tug and Barge Services

Colonial Group's tug and barge services, primarily through Colonial Towing, are a prime example of a cash cow within their portfolio. These operations are fundamental to marine transportation and port logistics, enjoying consistent demand in a well-established market.

The reliable cash flow generated by these services stems from their essential nature in supporting various industries. In 2024, the demand for efficient marine transport remained robust, driven by global trade and port activity.

- Established Operations: Colonial Towing's long-standing presence ensures operational efficiency and strong client relationships.

- Stable Demand: The services cater to a consistent need for moving bulk commodities and cargo, particularly in coastal and inland waterways.

- Mature Market: While growth may be moderate, the mature market provides predictable revenue streams.

- Cash Flow Generation: These services are key contributors to the group's overall financial stability, providing ample cash for reinvestment or other strategic initiatives.

Dry Bulk Terminal Operations

Colonial Group's dry bulk terminal operations function as a classic Cash Cow within the BCG Matrix. These terminals benefit from a well-established market, offering reliable revenue through handling and storage services for diverse commodities.

The consistent demand for dry bulk commodities ensures a steady income stream, mirroring the stability of their liquid product terminals. This segment leverages existing infrastructure and market relationships for predictable performance.

- Consistent Revenue: Dry bulk terminals generate predictable income from storage and handling fees, reflecting mature market demand.

- Established Market: The sector serves a broad range of essential commodities, ensuring ongoing operational activity.

- Capital Efficiency: As a Cash Cow, this operation likely requires minimal new investment, allowing for strong cash generation.

- Commodity Handling: Operations involve key materials like grain, coal, and aggregates, vital to various industries.

Colonial Group's petroleum product distribution, Enmarket, and ocean terminals all exemplify cash cows. These segments operate in mature markets with stable demand, consistently generating strong, predictable cash flows. In 2024, these established businesses continue to be vital contributors to Colonial Group's financial health, requiring minimal new investment while providing substantial returns.

| Business Segment | Market Position | Cash Flow Generation (2024 Projection) | Key Drivers |

|---|---|---|---|

| Petroleum Product Distribution | High Market Share, Southeast | Strong & Stable | 5,000+ Customers, Efficient Logistics |

| Enmarket (Retail Gasoline & Convenience) | Significant Presence | Robust & Predictable | Brand Recognition, Customer Loyalty, Growing Sector (2023 Industry Sales: $876 Billion) |

| Liquid Product Ocean Terminals | Well-Positioned | Reliable | 2 Million Barrels Storage, Marine/Rail/Truck Access, Storage Fees |

Full Transparency, Always

Colonial Group BCG Matrix

The preview you're currently viewing is the complete, unwatermarked Colonial Group BCG Matrix document you will receive immediately after purchase. This is the exact file, ready for immediate download and use, providing you with a professionally formatted strategic analysis tool without any hidden surprises or demo content.

Dogs

Underperforming legacy retail locations, like those previously under the Enmarket umbrella, represent the Dogs in Colonial Group's BCG Matrix. These are typically gas stations and convenience stores that experienced low customer traffic, featured outdated facilities, or simply couldn't keep pace with competitors in crowded areas before their divestiture. In 2024, such locations would likely show minimal revenue growth, perhaps less than 1% annually, and a declining market share, potentially falling below 5% in their respective local markets.

Outdated or inefficient storage infrastructure, such as aging tanks or terminals needing extensive upkeep, can be classified as dogs within the BCG matrix. These assets typically hold a low market share because their inefficiencies limit their competitive edge.

These facilities often reside in low-growth market segments, meaning there's little opportunity for expansion or improvement without substantial capital injection. For instance, many older petroleum storage facilities might face increasing regulatory burdens and declining demand for certain refined products, further solidifying their dog status.

In 2024, Colonial Group divested €201 million worth of non-strategic real estate assets, a move that aligns with its BCG Matrix strategy by shedding underperforming or misaligned holdings. This included significant property disposals in key markets like Madrid.

These divested assets likely represented a low market share and limited growth potential for Colonial Group, fitting the profile of 'Dogs' within the BCG framework. The substantial sum indicates a deliberate effort to streamline the portfolio and focus on more promising ventures.

Segments Heavily Reliant on Declining Fossil Fuel Demands

Within Colonial Group's petroleum distribution, certain niche services might be classified as dogs if they cater to declining fossil fuel demands and hold a small market share. These segments, despite the overall strength of petroleum distribution, struggle to generate substantial returns as the market shifts towards cleaner energy alternatives.

For instance, specialized lubricants for older, less fuel-efficient industrial machinery could be a prime example. If demand for such machinery is rapidly decreasing due to new, more efficient or electric models entering the market, and Colonial Group's share in this specific lubricant niche is minimal, it would fit the dog category.

- Niche Lubricants for Outdated Industrial Equipment: Demand is falling as industries upgrade to newer, more energy-efficient machinery.

- Specialized Fuel Additives for Aging Vehicle Fleets: As older vehicles are retired and replaced, the market for specific additives diminishes.

- Distribution of Certain Refined Products with Limited Future Demand: Products like specific grades of heating oil for regions rapidly transitioning to electric heating.

Legacy IT Systems or Processes

Legacy IT systems and outdated processes within Colonial Group can be classified as Dogs in the BCG Matrix. These internal elements are characterized by their high maintenance costs and their inability to support growth or enhance market share. For instance, a significant portion of IT budgets, potentially exceeding 30% in some organizations, is often allocated to maintaining these aging systems, diverting funds from innovation and strategic initiatives.

These systems, while functional, are inefficient and hinder operational agility. They consume substantial resources for upkeep and troubleshooting, much like a product with low market share and low growth potential. In 2024, many companies reported that over 50% of their IT spending was dedicated to legacy system maintenance, a clear indicator of a Dog classification.

- High Maintenance Costs: Legacy IT systems often require specialized, costly support and consume a disproportionate amount of the IT budget, estimated to be as high as 70-80% of IT spending in some legacy environments.

- Operational Inefficiency: Outdated processes lead to slower workflows, increased error rates, and reduced employee productivity, impacting overall business performance. Studies show that inefficient processes can increase operational costs by up to 20%.

- Lack of Agility: These systems prevent rapid adaptation to market changes or the implementation of new technologies, thereby limiting competitive advantage and growth opportunities.

- Resource Drain: Significant human and financial resources are tied up in managing and supporting these systems, resources that could otherwise be invested in growth-driving activities.

Dogs in Colonial Group's BCG Matrix represent business units or assets with low market share and low growth potential. These are often legacy operations or niche offerings that no longer align with the company's strategic focus or market demands. For instance, in 2024, Colonial Group's divestment of €201 million in non-strategic real estate, including properties in Madrid, exemplifies shedding these 'dog' assets to optimize the portfolio.

These divested assets likely contributed minimally to overall revenue growth, potentially showing less than 1% annual increase, and held a declining market share, perhaps below 5% in their respective sectors. The strategic move to sell these underperforming holdings underscores a commitment to resource reallocation towards more promising ventures within the group's portfolio.

Examples of 'Dogs' could also include specialized fuel additives for aging vehicle fleets, where market demand is shrinking as older vehicles are retired. Similarly, distribution of certain refined products with limited future demand, such as specific grades of heating oil in regions rapidly transitioning to electric heating, would fit this category due to their low market share and declining growth prospects.

| Asset/Business Unit Type | BCG Classification | Market Share (Estimated 2024) | Annual Growth Rate (Estimated 2024) | Strategic Rationale |

|---|---|---|---|---|

| Legacy Retail Locations (e.g., former Enmarket) | Dog | <5% | <1% | Divested due to low traffic and outdated facilities. |

| Outdated Storage Infrastructure | Dog | Low | Low | Inefficiencies limit competitive edge; often in low-growth segments. |

| Niche Lubricants for Outdated Equipment | Dog | Minimal | Declining | Demand decreasing with industry upgrades to newer machinery. |

| Legacy IT Systems | Dog | N/A (Internal) | N/A (Internal) | High maintenance costs, operational inefficiency, lack of agility. |

Question Marks

Colonial Energy's exploration of renewable natural gas and responsibly sourced options, coupled with their ability to purchase carbon credits, places them in emerging, high-potential markets. These ventures, while currently holding a small market share, are poised for significant expansion, necessitating considerable investment to capture future growth.

New digital solutions for energy logistics, such as AI-powered route optimization or blockchain-based supply chain tracking, represent a high-growth segment within the broader technology market. These innovations are crucial for enhancing efficiency and transparency in the complex energy supply chain.

Colonial Group's new digital solutions likely hold a low current market share due to their recent introduction and the inherent challenges of widespread adoption in a traditionally conservative industry. However, their potential is significant.

With strategic investment in development, marketing, and integration, these digital platforms could evolve into Stars within the BCG matrix. For instance, the global energy logistics market is projected to reach over $2.5 trillion by 2028, indicating a substantial opportunity for digital solutions that can capture even a small fraction of this value.

Expanding into new geographic markets for petroleum distribution, where Colonial Oil Industries currently holds a low market share, would place these ventures in the question mark category of the BCG matrix. These markets, while offering potential for future growth, would necessitate substantial upfront investment in marketing and operations to establish a competitive presence.

Pilot Programs for Alternative Energy Infrastructure at Retail Sites

Piloting electric vehicle (EV) charging stations or hydrogen fueling points at select former Colonial Group retail locations would position these initiatives as question marks within the BCG matrix. The global EV charging infrastructure market, for instance, was valued at approximately $20 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $100 billion by 2030. This rapid market expansion presents a substantial opportunity for Colonial Group.

However, Colonial Group's initial market share in this nascent sector would likely be minimal, necessitating considerable capital investment to achieve meaningful scale and compete effectively. For example, establishing a single fast-charging EV station can cost anywhere from $50,000 to $150,000 or more, depending on the technology and site requirements. This high upfront cost, coupled with the need to build brand recognition and customer adoption in a competitive landscape, underscores the question mark status.

- Market Growth Potential: The global market for EV charging infrastructure is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 25% in the coming years.

- High Investment Requirements: Significant capital outlay is required for the installation and maintenance of charging or fueling infrastructure, including grid upgrades and technology advancements.

- Low Initial Market Share: As a new entrant, Colonial Group would face challenges in capturing substantial market share against established players and rapidly evolving technologies.

- Strategic Importance: These pilot programs represent a strategic bet on future energy trends, aiming to secure a foothold in a potentially lucrative, albeit uncertain, market segment.

Strategic Partnerships for Diversification beyond Core Operations

Colonial Group's strategic partnerships for diversification beyond core operations, particularly in nascent industries, would fall into the question mark category of the BCG Matrix. These ventures represent new, unexplored territories with high growth potential but currently low market share for Colonial. For instance, a partnership in the burgeoning green hydrogen sector, where Colonial currently holds minimal market share but anticipates significant future expansion, exemplifies this. Such initiatives demand rigorous evaluation and substantial capital infusion to establish a foothold and capture market share.

These question mark ventures require careful assessment of market viability and competitive landscapes. Consider a hypothetical partnership in advanced battery technology manufacturing. While the market is projected for substantial growth, Colonial's current presence is negligible. For example, the global advanced battery market was valued at approximately $100 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030, presenting a clear high-growth, low-share scenario.

- Nascent Industries: Exploring ventures in sectors like renewable energy storage solutions or sustainable aviation fuel production through joint ventures.

- Low Market Share, High Growth Potential: Targeting markets with significant projected expansion but where Colonial currently has minimal competitive presence.

- Strategic Investment: Allocating capital for research and development, market entry, and scaling operations in these new domains.

- Risk Mitigation: Employing phased investment strategies and rigorous performance monitoring to manage the inherent uncertainties of question mark businesses.

Question Marks represent new ventures or markets where Colonial Group has a low market share but the market itself is growing rapidly. These initiatives require significant investment to develop and capture market potential. Examples include expanding into new geographic regions for petroleum distribution or piloting EV charging stations.

The success of these question marks hinges on strategic capital allocation and market penetration. For instance, the global EV charging infrastructure market was valued at approximately $20 billion in 2023 and is expected to grow substantially, presenting a clear opportunity for Colonial if they can secure a foothold.

Careful evaluation of market viability and competitive landscapes is crucial for these ventures. Partnerships in nascent industries, such as green hydrogen or advanced battery technology, also fall into this category, demanding substantial investment to establish presence.

These ventures are strategically important for future growth, aiming to secure a position in potentially lucrative, albeit uncertain, market segments. The global advanced battery market, for example, was valued at around $100 billion in 2023 and is projected for strong growth.

| Venture Area | Market Growth Potential | Colonial's Current Market Share | Investment Needs | Strategic Consideration |

|---|---|---|---|---|

| EV Charging Infrastructure | High (>$100B by 2030) | Low (Nascent) | High (Infrastructure costs) | Bet on future energy trends |

| New Geographic Petroleum Markets | Moderate to High | Low | High (Market entry costs) | Expand existing business |

| Green Hydrogen Partnerships | Very High (Emerging) | Negligible | Substantial (R&D, scale-up) | Diversification into new energy |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including historical sales figures, competitor analysis, and industry growth projections, to accurately position each business unit.