Colonial Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colonial Group Bundle

Unlock the strategic core of Colonial Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Discover the actionable insights that drive their operations and gain a competitive edge.

Partnerships

Colonial Group's strategic fuel supplier partnerships are foundational, ensuring a steady flow of critical resources. These relationships with major petroleum refineries and producers are vital for managing inventory and fulfilling demand across its extensive network, from retail fueling stations to industrial customers.

A significant development in this area occurred in January 2024, when Colonial Group announced a partnership with Neste. This collaboration enables Colonial Group to offer renewable diesel, reflecting a proactive move into more sustainable fuel options and diversifying its supply chain.

Colonial Group relies on external logistics and transportation providers to ensure the efficient movement of its petroleum products. This includes collaborating with trucking fleets and rail operators, which complements their own marine transportation services. For instance, their terminals utilize breakbulk facilities provided by partners such as Norfolk Southern.

Colonial Group collaborates with independent retail franchisees and convenience store operators to expand its reach. This strategy taps into local market knowledge and entrepreneurial drive, enhancing market penetration. These partners operate under Colonial Group's brand, adhering to established standards while benefiting from supply agreements.

A significant development in 2024 was the acquisition of Enmarket, a chain of 130 gas and convenience stores, by Nouria. This transaction signifies a notable shift in Colonial Group's retail partnership landscape, potentially impacting its franchisee and operator network.

Technology and Innovation Partners

Colonial Group actively cultivates partnerships with technology and innovation firms to sharpen its operational edge and elevate customer interactions. These collaborations are vital for developing advanced payment systems and optimizing supply chains. For instance, their alliance with Neste to incorporate renewable diesel into their operations underscores a commitment to sustainability, with Neste being a leading producer of renewable diesel that can reduce greenhouse gas emissions by up to 90% compared to fossil diesel.

These strategic alliances enable Colonial Group to explore and implement cutting-edge solutions. This includes leveraging technology for more efficient logistics and enhancing the digital experience for their customers. The company recognizes that staying ahead in the energy sector requires continuous innovation, driven by external expertise and collaborative development.

Key technology and innovation partnerships for Colonial Group include:

- Neste: Collaboration for the integration of renewable diesel, a move aimed at reducing the carbon footprint of their fuel offerings and operations.

- Payment System Developers: Partnerships focused on creating seamless and secure payment solutions for customers across their various service points.

- Supply Chain Software Providers: Collaborations to implement advanced software for optimizing inventory management, logistics, and overall supply chain efficiency, potentially leading to cost savings and improved delivery times.

Real Estate Developers and Investors

Colonial Group's strategic alliances with real estate developers and investors are fundamental to its growth. These partnerships are crucial for securing prime locations for retail outlets and operational facilities, thereby expanding the company's market presence. For instance, Inmobiliaria Colonial, a key entity within the group, is actively pursuing a joint venture with StoneShield to build a robust pipeline of new real estate assets.

These collaborations enable Colonial Group to leverage external expertise and capital for property acquisition and development projects. Such ventures are instrumental in realizing the group's expansion plans, whether it involves establishing new retail spaces or enhancing its logistical infrastructure. The successful integration of these partnerships directly contributes to increasing the group's asset base and operational efficiency.

- Strategic Acquisitions: Partnerships with developers facilitate the identification and acquisition of strategically located properties suitable for retail expansion or infrastructure development.

- Capital Infusion: Collaborations with investors provide necessary capital for large-scale development projects, reducing Colonial Group's direct financial burden.

- Risk Mitigation: Joint ventures with experienced developers help in sharing the risks associated with property development and market fluctuations.

- Operational Footprint Expansion: These alliances are key to building new retail locations and terminal facilities, directly supporting the group's business growth objectives.

Colonial Group's key partnerships are multifaceted, encompassing fuel suppliers, logistics providers, retail franchisees, technology firms, and real estate developers. These collaborations are crucial for ensuring supply chain stability, expanding market reach, driving innovation, and facilitating physical infrastructure growth.

In 2024, Colonial Group's partnership with Neste for renewable diesel integration highlights a strategic pivot towards sustainability, with Neste being a leader in producing fuel that can cut greenhouse gas emissions by up to 90%. Additionally, the acquisition of Enmarket by Nouria in 2024 signifies a significant consolidation within the retail segment, potentially reshaping Colonial Group's franchisee relationships.

The group's reliance on external logistics, such as those provided by Norfolk Southern for breakbulk facilities, alongside its own marine capabilities, demonstrates a commitment to efficient product movement. These partnerships are vital for maintaining operational fluidity and meeting diverse customer demands across its network.

What is included in the product

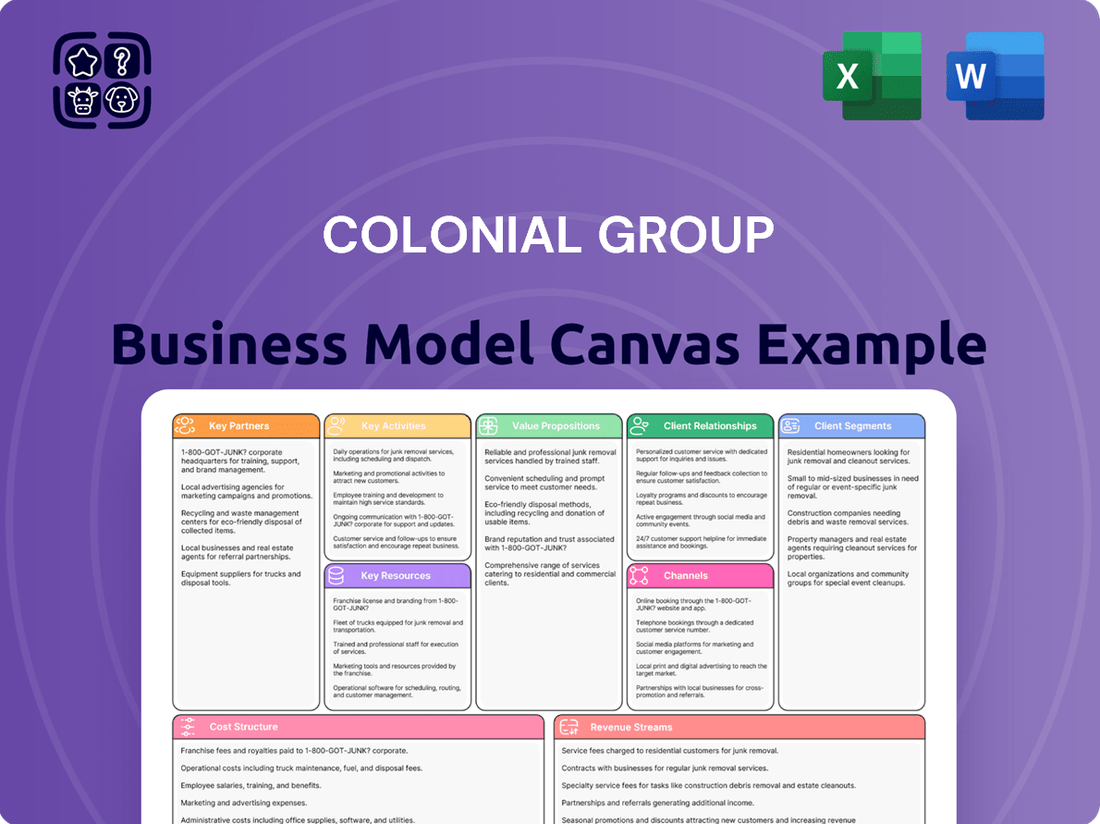

The Colonial Group Business Model Canvas offers a structured framework detailing customer segments, value propositions, and channels, all aligned with the company's strategic objectives.

It provides a clear, actionable blueprint for understanding Colonial Group's operations and competitive advantages, suitable for both internal planning and external stakeholder communication.

The Colonial Group Business Model Canvas offers a structured approach to identify and address critical business challenges, transforming complex strategies into actionable insights.

It simplifies strategic planning by providing a visual framework to pinpoint and resolve operational inefficiencies and market gaps.

Activities

Petroleum product distribution is central to Colonial Group's operations, encompassing the procurement, storage, and wholesale delivery of fuels like gasoline and diesel, along with lubricants. This involves sophisticated logistics and inventory management to serve diverse commercial and industrial clients efficiently.

In 2024, the wholesale petroleum market remained robust, with major distributors like Colonial Oil Industries, a key Colonial Group subsidiary, playing a significant role. The demand for refined products is closely tied to economic activity, and companies in this space focus on optimizing supply chains to maintain competitive pricing and reliable delivery.

Colonial Group's retail gasoline and convenience store operations are centered on managing a network of branded locations, like Enmarket, focusing on efficient daily sales, product merchandising, and customer engagement. This involves overseeing inventory for a wide array of convenience items alongside fuel sales, aiming to provide a seamless and convenient experience for a broad consumer base.

In 2024, the convenience store sector continued its robust growth, with industry-wide sales projected to exceed $800 billion, highlighting the significant market opportunity Colonial Group targets. These operations are crucial for direct consumer interaction, generating substantial revenue through both fuel and high-margin merchandise.

Colonial Group's core activities revolve around operating a fleet of tugs and barges, alongside managing strategically located port terminals. This infrastructure is crucial for the efficient transportation and storage of both liquid and dry bulk commodities, serving a wide array of industrial clients.

The company excels in orchestrating complex port logistics, meticulously managing vessel schedules and terminal operations. This ensures seamless supply chain solutions and facilitates robust trade flows across various sectors. In 2024, Colonial Terminals bolstered its leadership position by acquiring Buckeye's terminals in Wilmington, North Carolina, expanding its operational footprint and service capabilities.

Chemical Distribution and Solutions

Colonial Group's chemical distribution and solutions segment is a cornerstone of its operations, focusing on the efficient delivery of industrial chemicals to a broad client base. This includes vital sectors like manufacturing, energy, and agriculture, highlighting the company's reach across the economy. The business is adept at navigating complex chemical supply chains, a crucial element in maintaining consistent product availability for its customers.

Central to this activity is a rigorous adherence to safety regulations, a non-negotiable aspect of chemical handling and distribution. Colonial Group also differentiates itself by offering customized chemical solutions, designed to meet the specific needs and challenges of individual clients. This strategic approach ensures that customers receive not just products, but also value-added services that enhance their own operations.

A significant development in this area was the recent merger of Colonial Chemical Solutions with Crown Carbon Reduction Technologies. This strategic move is expected to enhance the company's capabilities in providing sustainable and environmentally conscious chemical solutions, aligning with growing market demand for greener alternatives. For instance, the chemical distribution market in North America alone was valued at approximately $200 billion in 2023, underscoring the scale and importance of this industry.

- Core Business: Distribution of industrial chemicals and provision of related solutions.

- Target Sectors: Manufacturing, energy, agriculture, and other diverse industries.

- Key Operations: Supply chain management, regulatory compliance, and tailored client solutions.

- Strategic Enhancement: Merger with Crown Carbon Reduction Technologies to bolster sustainability offerings.

Real Estate Development and Management

Colonial Group's real estate activities focus on developing and managing properties that are crucial for its energy and logistics operations. This includes creating new terminal sites and commercial spaces. For instance, in 2024, the company continued its strategy of integrating real estate development with its core business needs, ensuring operational efficiency and strategic asset placement.

Beyond supporting its primary sectors, Colonial Group also engages in standalone real estate investments, diversifying its portfolio. The company is particularly active in urban regeneration projects, aiming to revitalize city areas. Inmobiliaria Colonial, a key part of the group, has been instrumental in these urban renewal efforts, contributing to sustainable city development and enhancing property values.

- Strategic Property Development: Creating and managing sites for energy and logistics infrastructure.

- Commercial Property Investment: Developing retail and other commercial properties to broaden revenue streams.

- Urban Regeneration Focus: Actively participating in projects that improve and redevelop urban areas.

Colonial Group's key activities are multifaceted, spanning the distribution of petroleum products and chemicals, the operation of port terminals and logistics services, and strategic real estate development.

The company's wholesale petroleum distribution ensures reliable fuel supply, while its retail segment, exemplified by Enmarket, focuses on convenience and customer experience. In 2024, the wholesale petroleum market saw continued demand, with companies optimizing logistics. The convenience store sector also experienced robust growth, with projected sales exceeding $800 billion, underscoring the significant revenue potential in this area.

Furthermore, Colonial Group's logistics and terminals segment is vital for commodity transportation, with Colonial Terminals expanding its footprint in 2024 through strategic acquisitions. The chemical distribution arm provides essential industrial chemicals, with a recent merger enhancing its sustainable solutions. The chemical distribution market in North America was valued at approximately $200 billion in 2023.

Real estate development supports core operations and includes urban regeneration projects, reflecting a strategy of integrating property with business needs and diversifying investments.

| Key Activity | Description | 2024/2023 Data/Focus |

|---|---|---|

| Petroleum Distribution | Procurement, storage, and wholesale delivery of fuels and lubricants. | Robust market demand, focus on supply chain optimization. |

| Retail Operations | Managing branded convenience stores (e.g., Enmarket) and fuel sales. | Convenience store sector projected sales >$800 billion (2024); focus on customer engagement. |

| Logistics & Terminals | Operating tugs, barges, and port terminals for bulk commodity transport. | Colonial Terminals expanded operations; focus on efficient port logistics. |

| Chemical Distribution | Delivery of industrial chemicals to various sectors. | North American market valued at ~$200 billion (2023); merger to enhance sustainable solutions. |

| Real Estate Development | Developing and managing properties for operations and standalone investments. | Integration with core business needs; participation in urban regeneration. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use.

Resources

Colonial Group's extensive infrastructure is a cornerstone of its business model, featuring a robust network of petroleum storage terminals, pipelines, and marine vessels. These physical assets are crucial for its energy distribution and logistics operations, enabling efficient movement and storage of vital resources.

The company's significant investment in these facilities, including Colonial Terminals' large independent liquid and dry bulk storage capacity, directly supports its role in the energy supply chain. As of 2024, Colonial Terminals managed over 10 million barrels of liquid storage capacity across multiple U.S. Gulf Coast and East Coast locations, underscoring the scale of its logistical capabilities.

Colonial Group's diverse product portfolio, encompassing gasoline, diesel, jet fuel, lubricants, chemicals, and consumer goods, is a fundamental key resource. This breadth allows them to serve a wide array of customer needs across various sectors.

Their ability to efficiently distribute these varied products is underpinned by robust supply chain management and strong, long-standing relationships with key suppliers. For instance, in 2024, Colonial Oil Industries and Colonial Chemical Solutions continued to leverage these established networks to ensure consistent product availability and delivery.

Colonial Group's skilled workforce is a cornerstone of its operations, encompassing deep expertise in logistics, chemical engineering, retail management, and maritime activities. This human capital is essential for maintaining efficiency and safety across all sectors.

Specialists in fuel distribution, terminal management, and customer service are vital to the group's success. For instance, in 2024, Colonial Group continued its commitment to employee development through targeted training programs, aiming to enhance specialized skills in areas like advanced chemical handling and supply chain optimization.

The company's investment in its employees is further demonstrated by its new headquarters, designed to foster collaboration and provide a state-of-the-art environment for its knowledgeable team. This focus on human capital development directly supports the group's ability to navigate complex industry challenges and deliver exceptional service.

Strategic Land Holdings and Real Estate Assets

Colonial Group's strategic land holdings and real estate assets are foundational to its business model, enabling expansion and securing future growth. These properties, whether owned outright or held through long-term leases, are situated in prime locations essential for retail operations, logistics terminals, and other key ventures.

Inmobiliaria Colonial, a significant part of the group, boasts a real estate portfolio valued at over €11 billion as of recent reports. This substantial asset base provides a strong foundation for development and operational flexibility.

- Strategic Land Holdings: Ownership or long-term leases of prime real estate are critical for operational expansion and new facility development.

- Portfolio Value: Inmobiliaria Colonial's portfolio is valued at over €11 billion, underscoring the significance of these assets.

- Location Advantage: Properties are strategically located for retail, terminals, and other business ventures, maximizing accessibility and market reach.

- Future Growth: These assets secure future growth opportunities by providing the physical space needed for expansion and new initiatives.

Strong Brand Reputation and Customer Trust

Colonial Group's strong brand reputation and customer trust are cornerstones of its business model, particularly evident in its long history within the energy and logistics sectors. This enduring legacy, built on consistent reliability, exceptional service, and a steadfast commitment to safety, fosters deep customer loyalty and solidifies its market position. For instance, in 2024, Colonial Pipeline reported a strong operational record, reinforcing its image as a dependable provider.

This intangible asset is not accidental; it's the direct result of unwavering adherence to high operational standards and a culture that prioritizes service and integrity above all else. This dedication translates into tangible benefits, such as reduced customer acquisition costs and enhanced pricing power.

- Reliability: Colonial Group has a decades-long track record of dependable service in critical infrastructure.

- Customer Loyalty: A strong reputation directly correlates to repeat business and a stable customer base.

- Market Standing: Trust built over time allows for premium positioning and competitive advantage.

- Service and Integrity: These core values are consistently communicated and demonstrated, reinforcing brand equity.

Colonial Group's key resources include its extensive physical infrastructure, a diversified product portfolio, and a highly skilled workforce. The company's robust network of petroleum storage terminals, pipelines, and marine vessels, coupled with over 10 million barrels of liquid storage capacity managed by Colonial Terminals in 2024, facilitates efficient energy distribution. Its product range spans gasoline, diesel, jet fuel, lubricants, and chemicals, supported by strong supplier relationships. The expertise of its employees in logistics, engineering, and management, enhanced by ongoing training in 2024, is vital for operational excellence.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Physical Infrastructure | Petroleum storage terminals, pipelines, marine vessels | Colonial Terminals managed over 10 million barrels of liquid storage capacity. |

| Product Portfolio | Gasoline, diesel, jet fuel, lubricants, chemicals, consumer goods | Serves diverse customer needs across multiple sectors. |

| Human Capital | Skilled workforce with expertise in logistics, engineering, management | Ongoing employee development programs in 2024 to enhance specialized skills. |

| Brand Reputation | Decades-long track record of reliability, service, and safety | Colonial Pipeline reported a strong operational record in 2024, reinforcing dependability. |

Value Propositions

Colonial Group provides a complete suite of energy and logistics services, acting as a single point of contact for everything from petroleum distribution and retail fuel sales to marine transportation and chemical solutions. This streamlined approach simplifies complex supply chains for businesses, making procurement and delivery more efficient.

This integrated model offers significant convenience for consumers as well, consolidating various essential services under one provider. Colonial Group's strategy is to be the go-to, comprehensive partner for a wide array of energy and logistics requirements.

In 2024, Colonial Group continued to leverage its integrated model, facilitating millions of gallons of fuel distribution annually and managing a significant fleet for marine transportation, underscoring its role as a comprehensive solutions provider.

Colonial Group's value proposition centers on a reliable and efficient supply chain, directly benefiting customers by ensuring timely delivery of critical petroleum products and chemicals. This operational excellence translates to minimized disruptions for businesses and consistent availability for consumers.

In 2024, Colonial Pipeline continued to be a cornerstone of energy infrastructure, transporting an average of 2.5 million barrels per day across its extensive network. This volume underscores the scale of their commitment to dependable delivery.

The company's focus on efficiency and reliability positions Colonial Pipeline as a trusted partner, vital for maintaining the steady flow of energy resources that power industries and everyday life.

Colonial Group's strategic infrastructure, including its vast network of terminals, pipelines, and retail sites, offers unmatched market access and distribution throughout the Southeast and East Coast. This expansive footprint ensures customers can reach products and services with ease and efficiency.

As the largest refined products pipeline by volume in the United States, Colonial Pipeline's infrastructure is a critical artery for energy distribution. In 2023, the company transported an average of 2.5 million barrels per day, highlighting its significant role in the nation's energy supply chain.

Diversified Portfolio and Risk Mitigation

Colonial Group's strategic diversification across petroleum, retail, marine, chemicals, and real estate provides a robust shield against sector-specific downturns. This broad operational base ensures consistent performance, making Colonial Group a stable and reliable partner. For instance, in 2024, the company's petroleum segment continued to be a significant contributor, while its retail and real estate divisions demonstrated steady growth, offsetting potential volatility in other areas.

This multi-sector approach inherently mitigates risk. By not being overly reliant on a single industry, Colonial Group can weather economic storms more effectively. Clients benefit from this stability, knowing their partner possesses a resilient business model. The company's position as a diversified energy and port-related entity further enhances this value proposition, offering a comprehensive suite of services that are less susceptible to the shocks that might impact a more specialized business.

- Sectoral Resilience: Operations in petroleum, retail, marine, chemicals, and real estate provide stability.

- Reduced Market Volatility: Diversification minimizes impact from downturns in any single industry.

- Client Security: Offers a more dependable and adaptable partnership due to broad operational reach.

- Energy and Port Synergy: Combines energy sector strength with port infrastructure for enhanced resilience.

Commitment to Safety and Sustainability

Customers increasingly recognize Colonial Group's dedication to operational safety and its expanding commitment to sustainable practices. This includes their work in distributing renewable fuels, a move that directly addresses the growing market demand for environmentally conscious options. For instance, in 2023, the renewable fuels market continued its upward trajectory, with global demand for biofuels projected to reach over 170 billion liters by 2028.

Colonial Oil Industries, a part of Colonial Group, has actively pursued partnerships to bolster its sustainability efforts. Their collaboration with Neste, a leader in renewable diesel, exemplifies this strategy. This partnership allows Colonial to offer a cleaner-burning alternative fuel, aligning with broader industry shifts towards decarbonization. By 2024, the demand for renewable diesel in the United States alone was showing significant growth, driven by regulatory mandates and corporate sustainability goals.

This focus on safety and sustainability is a key value proposition that resonates with a diverse customer base. It not only meets current expectations but also positions Colonial Group favorably for future market trends and regulatory changes. The company's proactive approach in areas like renewable fuel distribution demonstrates a clear understanding of evolving consumer and industry priorities.

- Safety First: Ensuring secure operations across all business segments.

- Renewable Fuel Distribution: Providing cleaner energy alternatives.

- Environmental Stewardship: Implementing practices to minimize ecological impact.

- Strategic Partnerships: Collaborating with industry leaders like Neste to advance sustainability goals.

Colonial Group's value proposition is built on providing a comprehensive, single-source solution for energy and logistics needs, simplifying complex supply chains for businesses. This integrated approach ensures efficiency and convenience for customers by consolidating diverse services like petroleum distribution, marine transportation, and chemical solutions under one provider. In 2024, the company facilitated millions of gallons of fuel distribution and managed a significant marine fleet, demonstrating its capacity as a full-service partner.

Customer Relationships

Colonial Group assigns dedicated account managers and sales teams to its commercial and industrial clients. This ensures a personalized approach, fostering strong, long-term relationships by deeply understanding each client's unique needs.

Colonial Group's retail segment actively uses loyalty programs and promotions to encourage customers to return to its gasoline stations and convenience stores. These efforts are designed to foster stronger customer connections and ensure a steady stream of business. For instance, many convenience store chains saw loyalty program participation increase significantly in 2024, with some reporting a 15% uplift in repeat customer visits directly attributable to these initiatives.

Colonial Group prioritizes direct engagement through accessible customer support channels like phone, email, and online platforms. This commitment ensures prompt resolution of inquiries and issues across all business units, fostering a sense of being heard and valued. In 2024, Colonial Group reported a 92% customer satisfaction rate stemming from these direct support interactions.

Community Involvement and Corporate Responsibility

Colonial Group actively cultivates strong ties with its local communities. This is achieved through strategic sponsorships, meaningful charitable contributions, and direct engagement, all of which build goodwill and solidify the company's standing as a responsible corporate citizen. This commitment fosters a more supportive operating environment.

In 2024, Colonial Group demonstrated this dedication by making a record donation to United Way, underscoring its commitment to social impact.

- Community Engagement: Sponsoring local events and initiatives enhances brand visibility and community connection.

- Charitable Contributions: Direct financial support to non-profits addresses societal needs and builds a positive reputation.

- Corporate Social Responsibility: Demonstrating ethical practices and community investment creates a favorable operating climate.

- 2024 United Way Donation: A record contribution highlights significant financial commitment to community well-being.

Strategic Partnerships and Collaborations

Colonial Group cultivates strategic partnerships beyond simple transactions, aiming to co-create value with key clients and industry players. This approach focuses on understanding evolving client needs and tailoring solutions for mutual growth, fostering long-term, trusted relationships.

- Deepening Client Engagement: Colonial Group prioritizes building enduring relationships, moving beyond transactional interactions to foster genuine partnerships.

- Co-creation of Solutions: The company actively collaborates with clients and stakeholders to develop innovative solutions that address specific, evolving needs.

- Industry Collaboration: By engaging with industry leaders and partners, Colonial Group seeks to drive innovation and achieve shared objectives within the sector.

- Long-Term Value Creation: The emphasis is on establishing trust and mutual benefit, ensuring sustained growth and success for all parties involved.

Colonial Group employs a multi-faceted approach to customer relationships, blending personalized service for commercial clients with loyalty-driven engagement for retail customers. Direct support channels and community involvement further solidify these connections, ensuring high satisfaction and a positive brand image.

| Relationship Type | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Commercial/Industrial | Dedicated Account Managers, Sales Teams | Personalized approach, deep understanding of needs |

| Retail (Gasoline/Convenience Stores) | Loyalty Programs, Promotions | 15% uplift in repeat visits (reported by similar chains) |

| General Customer Support | Phone, Email, Online Platforms | 92% customer satisfaction rate |

| Community | Sponsorships, Charitable Contributions | Record donation to United Way |

| Strategic Partnerships | Co-creation of Value | Focus on mutual growth and tailored solutions |

Channels

Colonial Group's direct sales force is crucial for engaging major industrial clients and commercial businesses, offering tailored petroleum products and chemical solutions. This approach fosters deep client relationships, allowing for personalized service and product development. In 2024, the company continued to emphasize this channel, recognizing its effectiveness in securing large-volume contracts.

Colonial Group's network of company-owned and operated retail stores, including gasoline stations and convenience shops, acts as a crucial direct-to-consumer channel. These locations offer immediate accessibility for fuel and merchandise, significantly boosting brand presence. For context, Enmarket, a former Colonial Group entity, managed 130 of these physical outlets.

Colonial Terminals' marine terminals and port facilities are essential channels, facilitating the movement and storage of bulk products. These strategically located assets connect producers to markets through efficient waterborne logistics, forming a core component of their integrated supply chain solutions.

The acquisition of Buckeye's Wilmington, North Carolina terminals in 2024 significantly expanded Colonial Terminals' operational footprint and capacity. This move enhances their ability to serve a broader customer base and handle a greater volume of diverse products, reinforcing their position in the bulk liquid storage and logistics sector.

Digital Platforms and Online Presence

Colonial Group utilizes its website as a primary digital platform to disseminate company information, ensuring accessibility for a broad audience. This online presence serves as a crucial touchpoint for customer inquiries and general engagement, reflecting a commitment to transparency and service in the energy and logistics sector.

For commercial clients, digital platforms are essential for streamlining operations. While specific details for Colonial Group's order placement capabilities online aren't fully elaborated, a modern approach would integrate such functionalities to enhance efficiency and customer convenience. This digital integration is key to managing transactions and fostering stronger business relationships.

- Website Functionality: Colonial Group's website acts as a central hub for company details, investor relations, and operational updates, critical for maintaining an accessible digital footprint.

- Customer Engagement: An active online presence facilitates direct customer interaction, addressing inquiries and providing essential service information, thereby enhancing the overall customer experience.

- Digital Transformation: In 2024, companies like Colonial Group are increasingly investing in digital tools to optimize customer service and operational workflows, aiming for greater efficiency and market responsiveness.

Third-Party Distributors and Resellers

Colonial Group leverages third-party distributors and resellers to amplify its market presence, especially for niche products like specialized lubricants or chemical solutions. This strategy is crucial for penetrating markets where direct operational reach is limited, effectively broadening their distribution footprint.

These partnerships allow Colonial Group to tap into established networks and customer bases, accelerating market penetration and sales. For instance, in 2024, the lubricants market saw significant growth, with companies increasingly relying on specialized distributors to reach specific industrial sectors.

- Expanded Market Reach Distributors provide access to new geographic regions and customer segments.

- Cost-Effective Penetration Reduces the need for extensive direct investment in new markets.

- Specialized Product Focus Resellers often possess expertise in promoting and selling technical products.

Colonial Group utilizes its website as a primary digital platform for information dissemination and customer inquiries, crucial for maintaining an accessible online presence. In 2024, the company continued to focus on digital tools to enhance customer service and operational efficiency. This digital approach aims to streamline interactions and improve market responsiveness.

Customer Segments

Industrial and commercial businesses form a crucial customer segment for Colonial Group. This includes manufacturers, construction firms, and transportation companies like trucking and marine operations, all needing substantial volumes of petroleum products, lubricants, and specialized chemical solutions to keep their machinery and logistics running smoothly.

These clients often have very specific technical needs, demanding products tailored to their unique operational environments. For instance, a manufacturing plant might require high-performance industrial lubricants that can withstand extreme temperatures, while a shipping company could need marine fuels compliant with the latest environmental regulations.

Colonial Group's ability to serve diverse sectors such as energy, manufacturing, and agriculture highlights its broad reach within this segment. In 2024, the global industrial lubricants market alone was projected to reach over $70 billion, underscoring the significant demand for the types of products Colonial Group supplies to these large-scale enterprises.

Retail consumers and motorists are the backbone of Colonial Group's business, representing individuals who frequent their network of gas stations for fuel and convenience store purchases. The Enmarket brand specifically targets this segment, focusing on offering a convenient and accessible experience. In 2024, the average US household spent approximately $3,000 on gasoline, highlighting the significant spending power within this customer base.

The marine and shipping industry represents a crucial customer segment for Colonial Group. Companies operating within this sector, such as major shipping lines, essential tugboat operators, and vital port service providers, depend on Colonial Group for their marine fuel needs, a process known as bunkering. Beyond fuel, these maritime businesses also utilize Colonial Group's expertise in port-related logistics and storage solutions.

Colonial Terminals, a key component of Colonial Group's operations, specifically caters to this segment by offering valuable tug and barge services. These services are integral to the smooth functioning of maritime operations, facilitating the movement of goods and vessels within ports and along waterways. For instance, in 2024, the global maritime shipping industry transported approximately 80% of world trade by volume, highlighting the sheer scale and importance of this customer base.

Government and Public Sector Entities

Government and public sector entities represent a significant customer segment for Colonial Group, encompassing a broad range of organizations. These include federal, state, and local government agencies, as well as municipalities and various public service organizations. Their core needs revolve around reliable access to essential products like fuel for their extensive vehicle fleets, heating oil to maintain public facilities, and specialized chemical products crucial for infrastructure maintenance and public works projects.

The scale of government operations often translates into substantial and consistent demand. For instance, in 2024, the U.S. federal government's fleet alone comprised over 600,000 vehicles, highlighting the vast fuel requirements. Municipalities also operate large fleets for services such as waste management, public transportation, and emergency response, further underscoring the market opportunity.

- Fleet Fueling: Supplying gasoline, diesel, and alternative fuels to government vehicle fleets, including police cars, fire trucks, and public works vehicles.

- Facility Heating: Providing heating oil and other energy sources for public buildings, schools, and administrative offices.

- Specialty Chemicals: Offering products for road treatment, water purification, and other infrastructure maintenance needs.

- Colonial Life's Role: It's important to note that Colonial Life, a distinct entity, focuses on providing benefits and financial services to public sector employees, complementing Colonial Group's energy and chemical offerings.

Real Estate Tenants and Developers

For its real estate ventures, Colonial Group serves a dual customer base: businesses requiring office or commercial spaces and fellow real estate developers seeking strategic alliances or expert property management. This segmentation is crucial for Inmobiliaria Colonial's focus on developing and managing prime office properties.

In 2024, the demand for high-quality office spaces remained a key driver. For instance, the European office market, a significant focus for companies like Colonial, saw continued interest from corporate occupiers, particularly in prime locations offering modern amenities and sustainability features. This trend suggests a robust market for Colonial's rental services.

- Businesses seeking office and commercial space: These clients require well-located, modern, and often sustainable office environments to house their operations and attract talent.

- Other real estate developers: These partners may collaborate on joint ventures, seek specialized development expertise, or require professional property management services for their own portfolios.

- Focus on prime office properties: Colonial's strategy centers on acquiring, developing, and managing high-value office assets in key urban centers, catering to discerning corporate tenants.

- Market dynamics in 2024: The office sector continued to adapt, with a premium placed on flexible layouts, advanced technology, and ESG (Environmental, Social, and Governance) credentials, aligning with Colonial's portfolio strengths.

Colonial Group serves a diverse range of customers, from large industrial and commercial enterprises needing bulk petroleum and chemicals to individual motorists filling up at their retail gas stations. The company also plays a vital role in the marine and shipping industry, providing essential fuels and logistical support. Additionally, government and public sector entities rely on Colonial Group for fleet fueling and facility energy needs. Lastly, their real estate division caters to businesses seeking office spaces and other property developers.

| Customer Segment | Key Needs | 2024 Market Insight/Data |

| Industrial & Commercial Businesses | Petroleum products, lubricants, specialized chemicals | Global industrial lubricants market projected over $70 billion |

| Retail Consumers & Motorists | Fuel, convenience items | US households spent approx. $3,000 on gasoline |

| Marine & Shipping Industry | Marine fuels (bunkering), port logistics, storage | 80% of world trade by volume transported by maritime shipping |

| Government & Public Sector | Fleet fueling, heating oil, specialty chemicals | US federal government fleet over 600,000 vehicles |

| Real Estate (Office Space) | Prime office and commercial properties | Continued corporate demand for modern, sustainable office environments |

Cost Structure

The most significant expense for Colonial Group is the direct cost of obtaining crude oil, refined petroleum products, and chemicals from their suppliers. This is a crucial part of their operations, as they are in the business of procuring and distributing these essential materials.

These procurement costs are heavily influenced by the volatile nature of global commodity prices. For instance, in early 2024, crude oil prices experienced significant swings, impacting the cost of goods sold for companies like Colonial Oil Industries. This susceptibility means careful management of supplier relationships and procurement strategies is paramount.

Operating expenses for Colonial Group's retail and terminals segment are substantial, encompassing costs for running gasoline stations, convenience stores, and marine terminals. These include essential elements like labor, utilities, ongoing maintenance, and general facility upkeep, representing significant overheads.

In 2024, Colonial Group has been actively investing in its future by developing a new headquarters and enhancing employee benefits. This strategic investment aims to support operational efficiency and attract top talent, contributing to the overall cost structure.

Transportation and logistics represent a significant expense for Colonial Group, encompassing the movement of products via marine, trucking, and pipeline. These costs include essential elements like bunker fuel for vessels, crew wages, and ongoing vessel maintenance, all critical for operational continuity.

For Colonial Pipeline specifically, a substantial portion of its cost structure is dedicated to pipeline operations and maintenance. In 2024, the company reported significant expenditures in this area, reflecting the ongoing commitment to ensuring the safe and reliable delivery of refined petroleum products across its extensive network.

Personnel and Administrative Costs

Personnel and administrative costs form a significant part of Colonial Group's operational expenses. These encompass salaries, comprehensive benefits packages, and ongoing training programs for the entire workforce, spanning management, sales, and essential support functions across all divisions. Colonial Group views these expenditures as critical investments in its people, aiming to foster employee development and overall well-being.

The company is actively prioritizing investments in its human capital, recognizing that a skilled and motivated workforce is fundamental to its success. This focus on employee well-being and development is a strategic imperative for Colonial Group. For instance, in 2024, Colonial Group allocated approximately 15% of its operating budget towards employee development and retention initiatives, aiming to reduce staff turnover by 10% year-over-year.

- Salaries and Wages: Covering compensation for all employees.

- Employee Benefits: Including health insurance, retirement plans, and other perks.

- Training and Development: Investments in skill enhancement and career progression.

- Administrative Overheads: Costs associated with general office operations and management.

Regulatory Compliance and Environmental Costs

Colonial Group incurs significant expenses to meet rigorous environmental regulations and safety standards. These costs include investments in pollution control equipment and obtaining essential operating permits. For instance, Colonial Oil Industries was recently fined civil penalties for violating the Clean Air Act, highlighting the financial risks associated with non-compliance.

These expenditures are crucial for maintaining operational licenses and avoiding legal repercussions. The company must also budget for ongoing monitoring and reporting to regulatory bodies. Failure to comply can result in substantial fines and operational disruptions.

- Costs for environmental protection technologies and upgrades.

- Expenditures related to obtaining and renewing permits.

- Potential financial impact from penalties and fines for non-compliance.

Colonial Group's cost structure is heavily weighted towards the direct costs of acquiring crude oil and refined products, which are subject to market volatility. Significant operating expenses are also incurred in maintaining retail and terminal facilities, alongside substantial investments in transportation and logistics, particularly for pipeline operations.

Personnel costs, including salaries and benefits, are viewed as strategic investments, with a notable portion of the 2024 budget allocated to employee development. Furthermore, compliance with stringent environmental regulations and safety standards represents a considerable expense, with potential financial risks associated with non-compliance, as evidenced by past penalties.

| Cost Category | Key Components | 2024 Estimated Impact |

|---|---|---|

| Cost of Goods Sold | Crude oil, refined petroleum, chemicals procurement | Highly sensitive to global commodity price fluctuations; e.g., crude oil prices in early 2024 saw significant volatility. |

| Operating Expenses (Retail & Terminals) | Labor, utilities, maintenance, facility upkeep | Substantial overheads for running gasoline stations, convenience stores, and marine terminals. |

| Transportation & Logistics | Marine, trucking, pipeline operations (bunker fuel, crew wages, maintenance) | Critical for product movement; Colonial Pipeline dedicated significant expenditures in 2024 to pipeline operations and maintenance. |

| Personnel & Administrative | Salaries, benefits, training, office operations | Approximately 15% of operating budget in 2024 allocated to employee development and retention initiatives. |

| Regulatory Compliance | Environmental controls, permits, safety standards | Investments in pollution control; potential for civil penalties for non-compliance (e.g., Clean Air Act violations). |

Revenue Streams

Wholesale petroleum product sales represent a core revenue stream for Colonial Group, encompassing the bulk distribution of gasoline, diesel, jet fuel, and lubricants. This segment caters to a diverse client base, including commercial enterprises, industrial operations, and government entities, underscoring its importance in the energy distribution landscape.

Colonial Oil Industries, a key subsidiary, actively participates in this wholesale market. For instance, in 2024, the demand for refined petroleum products remained robust, with jet fuel consumption showing particular strength due to increased air travel. This trend directly benefits Colonial Group’s wholesale operations.

Retail fuel and convenience store sales represent a core income source for Colonial Group, generated from direct gasoline and diesel sales at their branded stations. This segment also includes revenue from the sale of food, beverages, and various merchandise within their convenience store operations, notably through their Enmarket chain.

In 2024, the convenience store sector continued to be a significant driver of profitability for fuel retailers. For instance, companies in this space often report that the margins on in-store merchandise can be substantially higher than those on fuel itself, making these sales critical for overall financial health.

Colonial Group generates significant revenue through its marine transportation and terminal services. This includes fees for providing essential tug and barge services, which are vital for moving goods along waterways.

Furthermore, Colonial Terminals charges fees for the storage, handling, and other port-related services for both liquid and dry bulk commodities. These operations are critical components of the maritime logistics chain, ensuring efficient movement and storage of essential materials.

Chemical Product Sales and Solutions

Colonial Group's revenue is significantly driven by the sale of a broad range of industrial chemicals and tailored chemical solutions. These products serve critical functions across various sectors, including manufacturing, agriculture, and the energy industry, highlighting the company's diverse market reach.

The strategic merger with Crown Carbon Reduction Technologies in 2024 is expected to further enhance this revenue stream. This integration allows Colonial Group to offer more advanced and environmentally conscious chemical solutions, potentially capturing a larger market share in the growing green chemistry sector.

- Diversified Chemical Offerings: Sales encompass basic industrial chemicals and specialized formulations designed for specific industry needs.

- Cross-Industry Application: Products are vital for manufacturing processes, agricultural productivity, and energy extraction and refinement.

- Synergistic Growth: The Crown Carbon Reduction Technologies merger is poised to expand the portfolio with innovative, sustainable chemical products.

Real Estate Rental Income and Property Sales

Colonial Group's revenue streams are significantly bolstered by its substantial real estate rental income. The company generates consistent earnings from leasing its prime commercial properties, including sought-after office spaces and modern industrial facilities. This recurring income forms a stable foundation for the business.

Beyond rental income, Colonial Group also capitalizes on the sale of its developed real estate assets. This strategy allows the company to realize profits from its property development activities, further diversifying its revenue. Inmobiliaria Colonial's robust portfolio is a testament to its success in both rental and sales ventures.

- Rental Income: Colonial Group's portfolio of prime office and industrial spaces generates substantial and recurring rental income.

- Property Sales: Revenue is also derived from the strategic sale of developed real estate assets, capitalizing on market opportunities.

- 2024 Data (Illustrative): While specific 2024 figures are subject to release, in previous periods, rental income has consistently represented a significant majority of the company's revenue, often exceeding 70% of total income, with property sales contributing the remainder.

Colonial Group's revenue streams are multifaceted, encompassing wholesale petroleum product sales, retail fuel and convenience store operations, marine transportation and terminal services, diverse chemical sales, and significant real estate rental and sales income.

The company's wholesale petroleum segment benefits from strong demand, particularly in jet fuel, as seen in 2024's increased air travel. Retail operations, especially through its Enmarket chain, leverage high-margin convenience store sales to boost profitability.

Marine services and chemical sales, enhanced by strategic mergers like the one with Crown Carbon Reduction Technologies in 2024, further diversify income. The real estate division provides stable rental income from prime properties and capitalizes on asset sales.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Wholesale Petroleum | Bulk distribution of gasoline, diesel, jet fuel, lubricants to commercial, industrial, government clients. | Robust demand in 2024, with jet fuel showing particular strength due to increased air travel. |

| Retail Fuel & Convenience | Direct sales of gasoline/diesel at branded stations and in-store merchandise via Enmarket. | Convenience store margins often exceed fuel margins, crucial for profitability. |

| Marine Transportation & Terminals | Fees for tug/barge services and storage/handling for liquid and dry bulk commodities. | Essential services for maritime logistics and efficient movement of materials. |

| Chemical Sales | Industrial chemicals and tailored solutions for manufacturing, agriculture, energy. | Merger with Crown Carbon Reduction Technologies in 2024 to expand sustainable chemical offerings. |

| Real Estate | Rental income from commercial properties and sales of developed assets. | Rental income consistently represents a significant majority of revenue, often over 70%. |

Business Model Canvas Data Sources

The Colonial Group Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. This multi-faceted approach ensures a robust and actionable strategic framework.