China Overseas Land & Investment PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Overseas Land & Investment Bundle

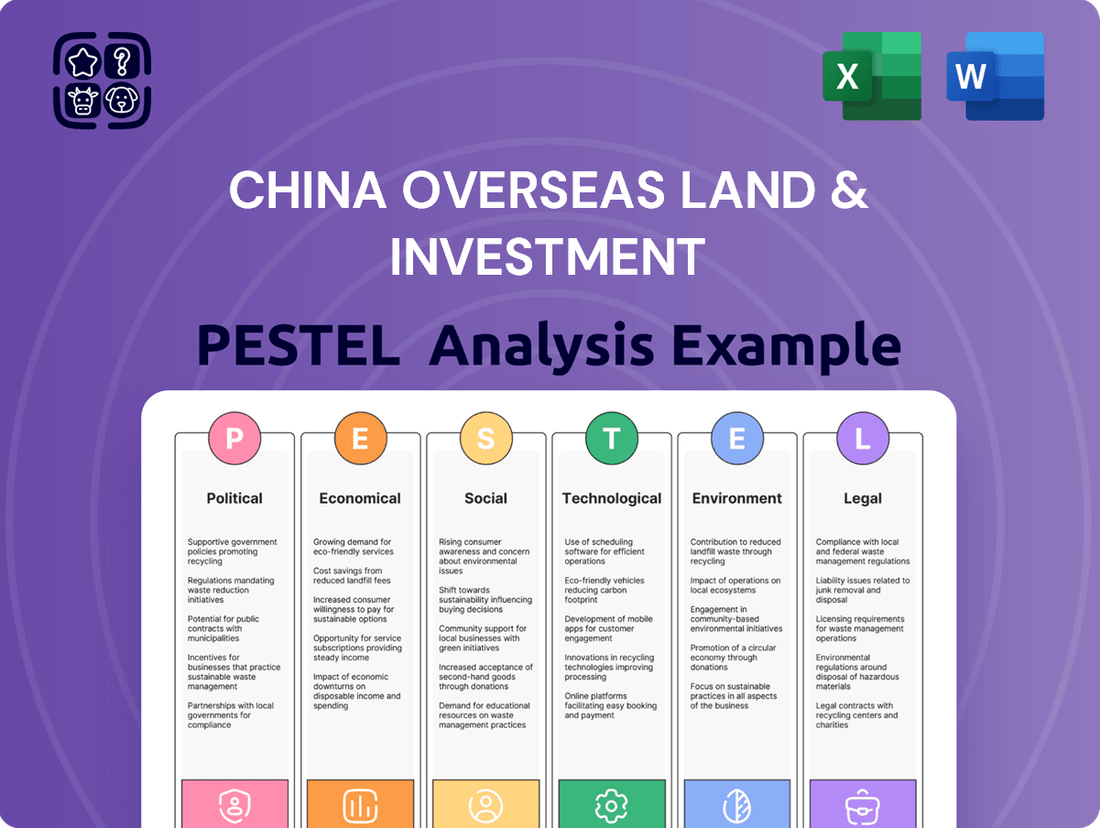

China Overseas Land & Investment operates within a dynamic global landscape, influenced by shifting political climates, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence to guide your decisions.

Political factors

The Chinese government's evolving policies on the real estate sector are a critical factor for China Overseas Land & Investment Ltd. (COLI). For instance, in 2023, the government continued to implement measures aimed at stabilizing the market, including adjustments to mortgage rates and down payment requirements in certain cities. These policies directly affect COLI's ability to secure land and manage sales volumes.

COLI's development pipeline and sales performance are heavily influenced by government directives on property cooling measures, land supply management, and overall housing market stability. In late 2023 and early 2024, Beijing maintained a cautious approach, balancing the need for market stability with efforts to curb excessive speculation. This environment shapes COLI's strategic land acquisition and project development decisions.

The broader national agenda, such as the 'common prosperity' drive and initiatives to de-risk the financial system, also dictates the operational landscape for developers like COLI. These overarching goals can translate into regulatory adjustments that impact financing availability, profit margins, and the types of projects prioritized, such as affordable housing initiatives.

China Overseas Land & Investment Ltd. (COLI) operates under a unique dynamic due to its significant state-owned enterprise (SOE) background. This backing provides a degree of insulation from extreme market volatility, as evidenced by its resilience during periods of economic stress. For instance, COLI's strong financial position, often supported by state-backed financing, allows it to navigate market downturns more effectively than many private competitors.

Government directives heavily influence COLI's strategic direction, particularly in large-scale urban development and infrastructure projects aligned with national economic plans. This alignment can translate into preferential treatment in land auctions and faster project approvals, offering a distinct competitive edge. In 2024, COLI continued to be a key player in China's urban renewal initiatives, securing prime development sites through government tenders.

Geopolitical tensions, especially those involving China, Hong Kong, and Macau, directly impact investor confidence and foreign direct investment in the property sectors where China Overseas Land & Investment (COLI) is active. A stable geopolitical climate is essential for a predictable investment environment, crucial for attracting both local and international buyers to COLI's developments. For instance, heightened tensions in 2023 and early 2024 have led to increased market uncertainty, potentially affecting transaction volumes and property valuations.

Urban Planning and Development Directives

Central and local government urban planning policies, including zoning laws and infrastructure development plans, significantly influence China Overseas Land & Investment's (COLI) growth. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes coordinated regional development, particularly in the Yangtze River Delta and the Greater Bay Area, creating opportunities for COLI's strategic land acquisition and project development in these key economic zones.

COLI must actively align its project pipeline with these evolving urban blueprints to secure prime land parcels and navigate the complex approval processes. Understanding regional growth strategies, such as the development of new city clusters and population redistribution efforts, is crucial for identifying future demand and investment locations. In 2024, many tier-1 and tier-2 cities are seeing continued investment in public transportation and green infrastructure, directly benefiting property developers like COLI.

- Zoning Laws: Government directives on land use dictate where and what type of projects COLI can undertake.

- Infrastructure Development: Planned investments in transportation and utilities, like high-speed rail extensions, open up new development areas.

- City Cluster Initiatives: Policies promoting integrated development in regions like the Greater Bay Area provide strategic advantages for companies with a strong presence there.

- Population Redistribution: Government plans to relocate populations or encourage migration to specific urban centers directly impact housing demand.

Anti-Corruption Campaigns

China's persistent anti-corruption campaigns significantly influence the real estate sector. These initiatives aim to ensure greater transparency and fairness in land acquisition and project approvals, which directly affects property developers like China Overseas Land & Investment. For instance, the Central Commission for Discipline Inspection (CCDI) has been instrumental in these efforts, with reports indicating thousands of officials investigated annually.

While these campaigns foster a more equitable marketplace, they can also introduce an element of unpredictability. Developers might face increased scrutiny, potentially leading to delays in project timelines or requiring more rigorous compliance measures. This heightened regulatory environment means adherence to strict ethical and legal standards is no longer optional but a critical aspect of business operations.

- Increased Scrutiny: Anti-corruption drives enhance oversight on land bidding and project approvals, impacting developer operations.

- Market Fairness: Efforts promote transparency, aiming for a level playing field in the property market.

- Operational Uncertainty: Campaigns can introduce delays and require developers to navigate complex compliance requirements.

- Compliance Imperative: Strict adherence to regulations is crucial for companies operating within China's evolving legal framework.

Government policies aimed at stabilizing the property market, including adjustments to mortgage rates and down payment requirements, directly influence China Overseas Land & Investment's (COLI) sales and land acquisition strategies. In 2023 and early 2024, Beijing continued to balance market stability with efforts to curb speculation, impacting developer decisions.

National agendas like common prosperity and financial de-risking translate into regulatory shifts affecting financing, profit margins, and project prioritization, such as affordable housing. COLI's state-owned enterprise background provides resilience, often supported by state-backed financing, enabling it to navigate market downturns more effectively than private competitors.

Urban planning policies and infrastructure development, such as those outlined in China's 14th Five-Year Plan, create strategic opportunities in key economic zones like the Greater Bay Area. COLI's alignment with these urban blueprints is crucial for securing prime land and navigating approval processes, with ongoing investments in public transport and green infrastructure in tier-1 and tier-2 cities benefiting developers.

China's anti-corruption campaigns enhance oversight on land bidding and project approvals, promoting market fairness and transparency but also introducing operational uncertainty and requiring rigorous compliance from developers like COLI.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting China Overseas Land & Investment, offering a comprehensive overview of its operating landscape.

A concise, PESTLE-driven overview of China Overseas Land & Investment's operating environment, designed to quickly identify and address external challenges impacting strategic decision-making.

Economic factors

The real estate market in China and Hong Kong is inherently cyclical, influenced by shifts in supply and demand, investor confidence, and speculative behaviors. This ebb and flow directly affects China Overseas Land & Investment's (COLI) financial performance, impacting its revenue streams and overall profitability.

COLI's success hinges on its ability to strategically manage these market cycles. This involves astute land acquisition, timely project releases, and flexible pricing strategies to ensure consistent growth. For instance, during 2023, while the broader Chinese property market faced headwinds, COLI demonstrated resilience, with its contracted sales reaching RMB 211.5 billion, showcasing its capacity to navigate challenging conditions through strategic execution.

Market downturns present significant challenges, often leading to an accumulation of unsold inventory and downward pressure on property prices. In 2024, the Chinese property market continued to grapple with these issues, with developers facing slower sales and increased financing costs, underscoring the importance of COLI's proactive approach to inventory management and financial planning.

Interest rate changes by the People's Bank of China and the Hong Kong Monetary Authority directly impact COLI's project financing costs and buyer mortgage affordability. For instance, a 25 basis point cut in the Loan Prime Rate in China during 2024 would lower borrowing expenses for new developments.

Credit availability is paramount; a tightening of lending policies for developers, as seen in some periods of 2023 and early 2024, can restrict COLI's ability to acquire land and fund ongoing construction, potentially delaying project timelines.

Consumer purchasing power, directly tied to disposable income and confidence, significantly impacts China Overseas Land & Investment's (COLI) property sales. As of early 2024, while urban disposable income saw a modest increase, consumer sentiment remained cautious due to lingering economic headwinds.

Economic uncertainties, including fluctuating employment figures and inflation concerns, directly influence prospective homebuyers' willingness to commit to substantial real estate investments. For instance, a slight uptick in the unemployment rate in certain regions during late 2023 could have deterred some potential buyers.

A downturn in consumer confidence, often reflected in surveys, can lead to a postponement of major purchases like homes, potentially increasing market inventory for developers like COLI. This hesitancy underscores the critical link between broader economic health and the real estate sector's performance.

Economic Growth and Urbanization

China's economic trajectory, marked by robust GDP growth, directly fuels demand for China Overseas Land & Investment (COLI)'s diverse property portfolio. The ongoing urbanization trend, with millions migrating to cities annually, creates a consistent need for residential units, commercial spaces, and industrial facilities, underpinning COLI's core operations.

Key economic indicators highlight this dynamic:

- China's GDP growth was projected to be around 5.0% in 2024, indicating sustained economic expansion.

- Urbanization continues, with the urban population share reaching approximately 66% by the end of 2023, a figure expected to climb further.

- This influx into urban centers directly translates to increased demand for housing and commercial real estate, benefiting developers like COLI.

Property Investment Environment

The property investment environment significantly influences China Overseas Land & Investment (COLI). Real estate's appeal as an investment class hinges on factors like returns from alternative investments, achievable rental yields, and potential for capital appreciation. For COLI, a strong investment climate spurs demand for its completed commercial and residential properties from both institutional and individual buyers, directly benefiting its property investment segment.

In 2024, China's property market continued to navigate challenges, with a focus on stabilizing prices and ensuring project delivery. While overall investment sentiment remained cautious, specific segments and regions showed resilience. For instance, prime commercial spaces in major tier-1 cities continued to attract interest due to their long-term rental income potential, even as residential market growth moderated.

A less favorable investment environment, characterized by economic uncertainty or tighter credit conditions, can negatively impact asset valuations and suppress rental income streams for COLI.

- Property Investment Attractiveness: Influenced by alternative investment returns, rental yields, and capital appreciation prospects, shaping demand for COLI's assets.

- Investor Confidence: A robust environment attracts institutional and individual investors, boosting demand for COLI's commercial and residential properties.

- Market Dynamics: In 2024, China's property market saw a cautious approach with resilience in prime commercial spaces, impacting asset valuations and rental income.

China's economic expansion, projected at around 5.0% for 2024, continues to be a primary driver for China Overseas Land & Investment (COLI). The ongoing urbanization, with the urban population share reaching approximately 66% by the end of 2023, fuels consistent demand for housing and commercial spaces. This sustained economic growth and demographic shift directly support COLI's business model.

COLI's financial performance is closely tied to interest rate policies set by the People's Bank of China and the Hong Kong Monetary Authority. For instance, interest rate adjustments in 2024 directly influence the cost of financing for new developments and the affordability of mortgages for potential buyers. Credit availability also remains critical; any tightening of lending policies for developers, as observed in periods of 2023 and early 2024, can hinder COLI's land acquisition and project funding capabilities.

Consumer purchasing power and confidence are key determinants of property sales for COLI. Despite a modest increase in urban disposable income in early 2024, cautious consumer sentiment persisted due to economic uncertainties. Fluctuations in employment figures and inflation concerns can further impact homebuyers' willingness to commit to significant real estate investments.

| Economic Factor | 2023/2024 Impact on COLI | Supporting Data/Trend |

|---|---|---|

| GDP Growth | Sustained demand for properties | China's GDP projected ~5.0% in 2024 |

| Urbanization | Increased need for residential/commercial space | Urban population share ~66% end-2023 |

| Interest Rates | Affects financing costs & buyer affordability | PBOC/HKMA policy adjustments in 2024 |

| Credit Availability | Impacts land acquisition & project funding | Tightening policies observed in 2023-2024 |

| Consumer Confidence | Influences property sales | Cautious sentiment in early 2024 |

Same Document Delivered

China Overseas Land & Investment PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Overseas Land & Investment details political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides an in-depth look at the external forces shaping China Overseas Land & Investment's strategic landscape.

Sociological factors

China's urbanization continues to be a significant driver for China Overseas Land & Investment (COLI). As of 2024, over 65% of China's population resides in urban areas, a figure projected to reach 70% by 2030. This ongoing shift from rural to urban centers fuels demand for COLI's diverse property portfolio, from residential housing to commercial spaces.

The migration patterns within China are also evolving. While Tier 1 and Tier 2 cities remain popular destinations, there's a growing trend of movement towards Tier 3 and Tier 4 cities, often driven by regional development initiatives and improved infrastructure. COLI's ability to adapt its development strategies to cater to the specific needs of these migrating populations in different city tiers is crucial for its continued success.

Government policies, such as adjustments to the hukou (household registration) system and regional development plans like the Yangtze River Delta integration, can significantly influence these migration trends. For instance, policies encouraging development in certain regions could redirect migration flows, impacting demand for property in those areas and requiring COLI to be agile in its market approach.

Chinese consumers increasingly desire smart home technology, with a significant portion of urban households expressing interest in features like automated lighting and security systems. This shift directly influences China Overseas Land & Investment (COLI) by necessitating the integration of advanced digital connectivity and smart building solutions into new developments to meet evolving buyer expectations.

There's a growing preference for green living and sustainable features, with many buyers actively seeking energy-efficient homes and eco-friendly building materials. COLI's commitment to sustainability, evidenced by its green building certifications, positions it to capitalize on this trend, appealing to environmentally conscious buyers and potentially reducing long-term operational costs.

The demand for larger living spaces and integrated communities offering a mix of residential, commercial, and leisure facilities is on the rise. For instance, in 2024, the average apartment size in major Chinese cities continued to see a slight increase, reflecting this preference. COLI's strategy of developing large-scale, mixed-use projects aligns with this, providing comprehensive amenities and fostering a sense of community that resonates with modern urban lifestyles.

China's rapidly aging population, with the proportion of citizens aged 65 and over projected to reach 21% by 2025, presents a significant demographic shift for China Overseas Land & Investment (COLI). This trend, coupled with declining birth rates, suggests a potential slowdown in new household formation, impacting overall demand for traditional housing units.

COLI may need to adapt its property development strategies to cater to evolving consumer preferences. This could include a greater focus on smaller, more manageable living spaces, properties designed for accessibility, or specialized senior living communities, reflecting the changing needs of an older demographic.

Furthermore, regional demographic variations across China necessitate careful consideration. Understanding these localized differences in age distribution and birth rates is paramount for COLI's long-term strategic planning, enabling the company to tailor its property offerings to meet the specific future housing demands of diverse geographic markets.

Social Stability and Housing Affordability

China's government places a significant emphasis on housing affordability and social stability, directly influencing China Overseas Land & Investment (COLI)'s strategic decisions. Policies designed to control housing prices and prevent market speculation, such as stricter mortgage regulations and purchase limits, can impact COLI's pricing flexibility and the types of projects it undertakes. For instance, in 2024, Beijing continued to implement measures to stabilize the property market, which may lead developers like COLI to focus more on mid-to-low-end housing segments to meet demand and comply with regulatory expectations.

The drive for social stability means that widespread dissatisfaction with housing affordability could trigger more stringent government interventions. This could translate into increased pressure on developers to offer more affordable housing options, potentially affecting profit margins on individual projects. COLI, like its peers, must navigate these evolving policy landscapes, balancing market demand with government objectives for equitable housing access. The government's stated goal of ensuring "housing is for living in, not for speculation" underscores this dynamic.

COLI's response to these societal pressures is crucial for its long-term success. The company's ability to adapt its development pipeline to include a greater proportion of affordable housing units or projects in less speculative markets will be key.

- Government Focus on Affordability: Policies in 2024 aimed at stabilizing housing prices, with average new home prices in major Chinese cities seeing a slight decrease year-on-year, impacting developer pricing strategies.

- Social Stability Mandate: Widespread housing affordability issues could lead to stricter regulations, potentially influencing COLI's project selection and profit margins.

- Developer Adaptation: COLI may need to increase its focus on mid-to-low-end housing segments to align with government directives and social expectations.

Cultural Values and Homeownership Aspirations

The deep-seated cultural value placed on homeownership in China remains a significant driver for the residential property market, directly benefiting China Overseas Land & Investment (COLI). This aspiration, deeply ingrained, provides a consistent base of demand for COLI's primary operations.

However, shifts in how property is viewed, moving from a purely investment vehicle to a primary living space, along with evolving family structures, are beginning to reshape market dynamics. COLI needs to remain attuned to these changing societal perceptions.

For instance, while homeownership remains a priority, the average household size in China has been declining, impacting the demand for larger units. Data from the National Bureau of Statistics of China indicated a trend towards smaller, more efficient living spaces in urban areas.

- Cultural Imperative: Homeownership is a cornerstone of Chinese societal values, underpinning demand for COLI's residential developments.

- Evolving Perceptions: A growing segment of the population now prioritizes property for living comfort over pure investment gains.

- Demographic Shifts: Declining average household sizes may influence the type and size of properties in demand, requiring COLI to adapt its product offerings.

China's rapidly aging population, projected to have 21% of citizens aged 65 and over by 2025, presents a demographic shift for China Overseas Land & Investment (COLI). This, combined with falling birth rates, could slow new household formation, potentially impacting demand for traditional housing. COLI may need to adapt by focusing on smaller, accessible, or senior-specific living communities to meet the needs of an older demographic.

Cultural emphasis on homeownership remains strong, supporting demand for COLI's residential projects. However, evolving views on property as a living space rather than just an investment, alongside shrinking household sizes, are reshaping market dynamics. COLI must stay attuned to these shifts, as indicated by declining average household sizes in urban areas, which suggests a move towards more compact living spaces.

| Sociological Factor | Description | Impact on COLI | 2024/2025 Data Point |

| Aging Population & Declining Birth Rate | China's population is aging, with the 65+ demographic expected to reach 21% by 2025, while birth rates decline. | Potential slowdown in new household formation, requiring adaptation in property types (e.g., smaller units, senior living). | Projected 21% of population aged 65+ by 2025. |

| Cultural Value of Homeownership | Homeownership is a deeply ingrained cultural aspiration in China. | Provides a consistent baseline demand for residential properties. | Remains a primary driver for the residential property market. |

| Evolving Family Structures & Living Preferences | Average household size is decreasing, leading to a preference for smaller, more efficient living spaces. | COLI needs to tailor product offerings to smaller unit demand and integrated community concepts. | Declining average household size in urban areas observed. |

Technological factors

China Overseas Land & Investment (COLI) is increasingly integrating property technology (PropTech) into its developments, aiming to create smarter, more efficient buildings. This includes leveraging the Internet of Things (IoT) for connected systems, artificial intelligence (AI) for predictive maintenance, and big data analytics to optimize building performance and tenant experiences. For instance, smart home features are becoming standard in new residential units, offering enhanced convenience and security.

The adoption of PropTech allows COLI to differentiate its portfolio by offering advanced property management solutions and data-driven insights into building operations. This focus on smart buildings not only improves operational efficiency but also enhances the overall value proposition for residents and commercial tenants. By embracing these technological advancements, COLI is positioning itself to meet the evolving demands of the modern real estate market.

Advances in construction technologies like Building Information Modeling (BIM), prefabrication, and robotics offer significant potential to boost efficiency and cut costs for China Overseas Land & Investment (COLI). For instance, the global construction robotics market is projected to reach $3.1 billion by 2027, indicating a strong trend towards automation. COLI's strategic adoption of these innovations can lead to faster project completion and improved quality.

Embracing modular construction and prefabrication can streamline COLI's building processes, reducing on-site labor needs and minimizing waste. Prefabricated construction, in particular, saw significant growth, with the global market size estimated to be around $157.4 billion in 2023. This focus on modern methods is crucial for COLI to maintain its competitive edge in the rapidly evolving real estate sector.

China Overseas Land & Investment (COLI) increasingly relies on digital marketing and sales platforms to connect with buyers. This includes using online channels for property listings, virtual property tours, and facilitating online transactions. By embracing these digital tools, COLI aims to broaden its market reach and streamline the sales process, which is essential for maintaining competitiveness in the evolving real estate landscape.

In 2024, the digital transformation of property sales continued its upward trajectory in China. E-commerce platforms and social media played a significant role, with many developers reporting a substantial portion of leads generated through these channels. For instance, major developers have seen engagement rates on platforms like WeChat and Douyin surge, indicating a strong consumer preference for digital interaction in property discovery and initial inquiry.

Data Analytics for Market Insights

China Overseas Land & Investment (COLI) leverages advanced data analytics to dissect market trends, consumer preferences, land valuations, and competitive landscapes. This granular understanding is crucial for shaping their strategic direction. For instance, in 2024, COLI's property sales reached approximately RMB 290 billion, a figure heavily influenced by data-informed decisions regarding project locations and pricing.

By employing data-driven methodologies, COLI can refine its land acquisition processes, optimize project development timelines, and tailor pricing strategies for maximum market penetration. This analytical rigor extends to marketing campaigns, ensuring resources are allocated efficiently to reach target demographics.

- Market Trend Analysis: Utilizing big data to identify emerging property hotspots and demand shifts.

- Consumer Behavior Insights: Understanding buyer preferences to inform product design and amenities.

- Land Value Optimization: Employing analytics to assess and bid on land parcels with the highest potential return.

- Competitor Activity Monitoring: Tracking competitor pricing, sales, and development strategies for competitive advantage.

Sustainable and Green Building Technologies

Technological advancements in sustainable building are reshaping China's real estate sector, directly impacting China Overseas Land & Investment (COLI). Innovations in energy efficiency, such as smart thermostats and advanced insulation, are becoming standard. For instance, by the end of 2023, China's installed solar power capacity reached approximately 600 GW, indicating a strong national push towards renewable energy integration, which COLI can leverage in its developments.

COLI's commitment to green building necessitates the adoption of technologies like solar panel integration and sophisticated water conservation systems. These not only contribute to environmental stewardship but also offer tangible cost savings through reduced utility expenses. The increasing demand for properties with certifications like LEED or the China Green Building Label underscores the market's growing preference for sustainable construction, a trend COLI is well-positioned to capitalize on.

- Energy Efficiency: COLI's projects increasingly incorporate smart building management systems to optimize energy consumption, reducing operational costs.

- Renewable Energy: The company is exploring solar photovoltaic integration in new developments, aligning with China's ambitious renewable energy targets.

- Sustainable Materials: COLI is prioritizing the use of low-carbon footprint building materials, contributing to a circular economy in construction.

- Water Conservation: Advanced rainwater harvesting and greywater recycling systems are being implemented to minimize water usage in residential and commercial properties.

COLI is integrating PropTech, using IoT and AI for smarter buildings, with smart home features becoming common in new residences. This focus on technology enhances property management and tenant experience, differentiating COLI in the market.

Advancements in construction tech like BIM and prefabrication are boosting efficiency for COLI. The global construction robotics market is projected to reach $3.1 billion by 2027, highlighting the trend towards automation and faster project completion.

COLI uses digital marketing and online sales platforms, including virtual tours, to reach buyers and streamline transactions. In 2024, e-commerce and social media played a crucial role in property sales, with developers seeing increased engagement on platforms like WeChat.

Data analytics are vital for COLI's strategy, informing decisions on market trends and consumer preferences. In 2024, COLI's property sales were around RMB 290 billion, a result of data-driven insights into project locations and pricing.

Legal factors

China Overseas Land & Investment (COLI) operates within a complex legal landscape concerning land. The laws governing how land is acquired, how it can be used, and who owns it are crucial for COLI's success in mainland China, Hong Kong, and Macau. These regulations dictate the very foundation of their development projects.

Any shifts in these land use and property rights laws, such as alterations to lease durations, new rules for urban redevelopment, or changes in how land can be taken for public use, have a direct and significant impact on COLI. For instance, a change in urban renewal regulations could affect the feasibility and profitability of a planned residential project, while stricter expropriation rules might limit expansion opportunities.

In 2024, China's ongoing efforts to stabilize its property market through regulatory adjustments, including those related to land supply and developer financing, underscore the importance of COLI's legal compliance. The company must diligently adhere to these evolving legal frameworks to ensure uninterrupted operations and mitigate risks associated with its extensive property portfolio across these key regions.

China Overseas Land & Investment (COLI) must strictly follow national and local building codes, safety standards, and quality control regulations for all its construction projects. Failure to comply can lead to substantial fines, project delays, or even demolition orders, which directly impact profitability and reputation. For instance, in 2023, China's Ministry of Housing and Urban-Rural Development continued to emphasize stringent enforcement of safety regulations across the construction sector, with reports indicating increased inspections and penalties for non-compliant projects.

The dynamic nature of these regulations means COLI needs to constantly adapt its design and construction methods to meet evolving standards. This includes incorporating new materials and techniques to ensure compliance with updated safety and environmental requirements, a process that demands ongoing investment in research and development.

China Overseas Land & Investment (COLI) faces increasingly strict environmental regulations. These laws cover construction waste, pollution, energy use, and carbon emissions, all of which directly impact COLI's building projects and operating expenses. For instance, China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 puts pressure on the construction sector to adopt greener practices.

COLI must navigate environmental impact assessments and implement eco-friendly construction methods to avoid fines and boost its reputation. This includes adhering to green building standards, which are becoming more prevalent. By 2023, China had a significant number of green buildings certified, reflecting the growing emphasis on sustainability in the real estate sector.

Financing and Banking Regulations

China Overseas Land & Investment Ltd. (COLI) operates within a dynamic legal and regulatory environment that significantly shapes its financing capabilities and market access. The People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) are key bodies influencing property financing. For instance, in 2024, the PBOC continued to adjust monetary policy, impacting interest rates and credit availability for both developers and homebuyers.

Regulations on loan-to-value (LTV) ratios and mortgage policies directly influence COLI's customer base. In late 2023 and into 2024, several major Chinese cities eased some property purchase restrictions and adjusted mortgage rates, aiming to stimulate demand. These shifts can bolster COLI's sales volume and revenue streams.

Developer lending rules, including restrictions on debt levels and the types of financing available, are crucial for COLI's project development. Capital market regulations, such as those governing bond issuance and equity financing, also play a vital role in COLI's funding strategies. The stability and predictability of these frameworks are paramount for maintaining financial liquidity and ensuring consistent sales performance.

- Mortgage Policies: In 2024, cities like Beijing and Shanghai maintained relatively stable but sometimes adjusted mortgage rates, with benchmark rates often reflecting PBOC guidance.

- Developer Lending: Regulations continued to focus on deleveraging, with authorities monitoring developer debt-to-equity ratios, impacting COLI's access to certain forms of credit.

- Capital Markets: COLI, as a major listed entity, navigates regulations on bond issuance and international financing, with access influenced by China's foreign exchange controls and capital account policies.

- Regulatory Stability: The ongoing evolution of real estate sector regulations in China, including measures to ensure financial stability, directly affects COLI's operational planning and investment decisions.

Consumer Protection and Real Estate Transaction Laws

China Overseas Land & Investment (COLI) operates within a legal framework that heavily emphasizes consumer protection in real estate transactions. Laws governing property sales contracts, dispute resolution mechanisms, and mandatory disclosure requirements are paramount to COLI's sales performance and customer relationship management. For instance, the Civil Code of the People's Republic of China, effective from January 1, 2021, consolidates various contract laws, including those pertaining to real estate, reinforcing consumer rights and seller obligations.

Ensuring strict compliance with these regulations is vital for fostering consumer trust and mitigating the risk of legal challenges. Any amendments or new legislation concerning consumer rights or real estate transactions necessitate prompt adjustments to COLI's sales processes and the contractual agreements it utilizes. Transparency and fairness are not merely best practices but legal mandates within the Chinese real estate market, directly impacting COLI's operational integrity.

- Consumer Protection Laws: The Civil Code of the PRC mandates fair practices and protects buyers from misleading information.

- Property Sales Contracts: Standardized contracts must adhere to legal requirements for clarity on terms, pricing, and delivery.

- Dispute Resolution: Legal avenues for resolving disputes, such as mediation, arbitration, and litigation, are established.

- Disclosure Requirements: Sellers are legally obligated to disclose material facts about properties, including any encumbrances or defects.

China Overseas Land & Investment (COLI) must navigate evolving legal frameworks governing land acquisition, usage, and property rights across mainland China, Hong Kong, and Macau. Changes in urban redevelopment or expropriation laws can significantly impact project feasibility and expansion opportunities, as seen with ongoing regulatory adjustments in 2024 aimed at stabilizing the property market.

Environmental factors

China Overseas Land & Investment (COLI) faces escalating physical risks from climate change, with an increasing frequency and intensity of extreme weather events like floods and typhoons. These events can directly impact the structural integrity and value of its extensive property portfolio across China. For instance, the heavy rainfall and flooding experienced in parts of Southern China during the summer of 2024 highlighted these vulnerabilities.

To mitigate these threats, COLI must invest in resilient design and construction practices, potentially leading to higher upfront costs but ensuring long-term asset protection. Furthermore, the company may see increased insurance premiums as the risk landscape evolves. Adapting to these climate impacts is not just about protecting existing assets; it's essential for maintaining operational continuity and stakeholder confidence in affected regions, especially as China aims for carbon neutrality.

China's commitment to sustainability is reshaping its real estate sector. By 2025, the government aims for 70% of new urban buildings to meet green building standards, a significant increase from earlier targets. This policy shift directly impacts China Overseas Land & Investment (COLI) by mandating more eco-friendly designs and materials.

COLI's strategic alignment with these green building standards, including certifications like LEED and China's own Green Building Label, is crucial for its market competitiveness. For instance, projects achieving higher green ratings often see reduced utility costs for occupants, making them more attractive. COLI's 2024 reports indicate a growing proportion of their new developments are incorporating advanced energy-efficient systems, such as smart HVAC controls and solar energy integration, to meet these evolving environmental expectations.

Resource scarcity significantly impacts China Overseas Land & Investment (COLI). The availability and cost of essential construction materials like steel and cement, along with water and energy, directly influence COLI's project budgets and operational expenses. For instance, fluctuations in global commodity prices, particularly for metals and energy, can lead to unpredictable cost increases, a trend observed throughout 2024 and projected to continue into 2025 due to ongoing geopolitical tensions and supply chain adjustments.

COLI's response to these environmental pressures involves adopting more efficient waste management strategies and prioritizing the sourcing of sustainable materials. This focus on recycling and eco-friendly procurement not only aids in cost control by reducing material waste but also ensures compliance with China's increasingly stringent environmental regulations. By integrating these practices, COLI aims to mitigate risks associated with resource availability and enhance its competitive edge in a market that values environmental responsibility.

Pollution Control and Biodiversity

China Overseas Land & Investment (COLI) navigates stringent environmental regulations, particularly concerning construction-related pollution and biodiversity preservation. These rules impact everything from where COLI can build to how they plan and operate their projects. For instance, in 2024, China continued to emphasize green building standards, with over 40% of new urban construction projects expected to meet high energy efficiency benchmarks, a trend COLI must align with. Controlling noise and dust during development is paramount for regulatory adherence and public perception.

COLI's commitment to minimizing its ecological footprint is crucial for both compliance and maintaining a favorable public image. This involves implementing robust measures for:

- Air Quality Management: Strict adherence to dust suppression techniques and emissions control from construction machinery.

- Water Pollution Prevention: Implementing systems to manage wastewater and prevent runoff from construction sites, especially near sensitive water bodies.

- Biodiversity Protection: Site selection processes increasingly consider the impact on local flora and fauna, with mitigation strategies employed where necessary.

- Noise Abatement: Adhering to local noise ordinances during construction phases to minimize disruption to surrounding communities.

Environmental, Social, and Governance (ESG) Reporting

China Overseas Land & Investment (COLI) faces increasing demands for thorough Environmental, Social, and Governance (ESG) reporting. This pressure stems from investors, regulators, and the public, all keen on understanding the company's sustainability practices. Meeting these expectations directly influences COLI's transparency and its overall corporate reputation in the market.

Demonstrating strong environmental performance is crucial for attracting responsible investment. COLI's commitment to robust data collection, clear reporting, and ambitious target setting for environmental impact is becoming a key differentiator. This focus helps build and maintain stakeholder trust, a vital asset in today's investment landscape.

The company's ESG performance is now a critical metric for assessing its long-term sustainability. For example, in 2024, many global real estate firms are setting net-zero carbon targets, with significant progress expected by 2030. COLI's ability to align with such trends will be a key indicator of its resilience and future viability.

- Investor Scrutiny: Global ESG investment reached an estimated $37.8 trillion in 2024, highlighting the financial significance of sustainability performance.

- Regulatory Landscape: China's own push for green finance and stricter environmental regulations means compliance is no longer optional but a strategic imperative.

- Stakeholder Expectations: Public awareness of climate change and social responsibility continues to grow, influencing brand perception and consumer loyalty.

- Data Transparency: Companies like COLI are expected to provide detailed metrics on energy consumption, waste management, and social impact initiatives.

China Overseas Land & Investment (COLI) faces increasing pressure to demonstrate robust Environmental, Social, and Governance (ESG) performance, driven by investor scrutiny and regulatory requirements. This focus on sustainability is becoming a critical factor for attracting investment and maintaining corporate reputation, with global ESG investments estimated at $37.8 trillion in 2024. COLI's commitment to transparent reporting and ambitious environmental targets, such as aligning with net-zero carbon goals by 2030, is key to its long-term viability and stakeholder trust.

PESTLE Analysis Data Sources

Our PESTLE analysis for China Overseas Land & Investment is built on a comprehensive review of official government publications, economic data from international financial institutions, and reputable industry-specific reports. We meticulously gather insights on political stability, economic growth forecasts, legal and regulatory changes, technological advancements, environmental policies, and socio-cultural trends impacting the Chinese real estate market.