China Overseas Land & Investment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Overseas Land & Investment Bundle

China Overseas Land & Investment navigates a landscape shaped by intense competition and evolving buyer demands. Understanding the power of suppliers and the threat of new entrants is crucial for its sustained success.

The complete report reveals the real forces shaping China Overseas Land & Investment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for China Overseas Land & Investment Ltd. (COLI) is notably high, primarily stemming from land owners. These suppliers include local governments and other developers, especially in sought-after urban locations where land availability is constrained and developer demand is robust.

This dynamic is particularly pronounced in China, where land auctions represent a substantial revenue stream for municipal authorities. For instance, in 2023, land sales revenue for Chinese local governments remained a critical component of their fiscal health, influencing land prices and terms offered to developers like COLI.

Suppliers of essential construction materials like steel and cement possess some bargaining power, particularly for specialized or high-quality components where fewer sources exist. While the market for generic materials might be competitive, this can shift for bespoke items.

However, recent trends indicate a moderation in construction costs for 2024, with material prices showing signs of stabilization. This suggests that the leverage of these suppliers may be slightly diminished compared to periods of rapid price escalation, offering some relief to companies like China Overseas Land & Investment.

China Overseas Land & Investment (COLI), like many in the construction sector, faces significant bargaining power from its labor force, particularly skilled and specialized construction teams. A tight labor market, as seen with ongoing shortages in certain trades, can drive up wages and impact project costs. For instance, in 2024, reports indicated persistent challenges in securing sufficient skilled construction labor across various global markets, a trend COLI likely navigates.

The potential for strong labor unions to negotiate favorable terms also contributes to supplier power. Increased labor costs or demands for better working conditions could directly affect COLI's project timelines and overall budgets. This dynamic remains a constant consideration in the industry, requiring proactive management of labor relations and workforce development.

Supplier Power 4

Financial institutions are key suppliers, providing essential capital through development loans and mortgages. In China's real estate market, which has seen many developers struggling with cash flow issues, banks and lenders hold considerable sway. For instance, as of early 2024, property developers in China continued to navigate a challenging financing environment, with many relying on extended payment terms and renegotiated loan conditions from their banking partners.

Government policies aimed at stabilizing the property market and supporting developers can moderate this supplier power. Initiatives to ensure the completion of pre-sold homes and to provide liquidity to struggling developers can shift some of the bargaining advantage back towards the developers, including China Overseas Land & Investment.

- Financial institutions' leverage is high due to developer liquidity challenges.

- Government intervention aims to balance power by supporting developers.

- China Overseas Land & Investment's access to capital is influenced by lender relationships and policy.

Supplier Power 5

Design and engineering firms, along with specialized consultants like environmental and legal experts, are key suppliers for China Overseas Land & Investment (COLI). While the market for these services is broad, firms possessing a strong reputation, niche expertise, or established ties with COLI can exert significant bargaining power. The sheer scale and intricate nature of COLI’s developments frequently demand the engagement of seasoned and dependable collaborators, potentially increasing supplier leverage.

For instance, in 2023, the global construction consulting market was valued at approximately $60 billion, indicating a substantial ecosystem of service providers. COLI’s reliance on top-tier architectural and engineering firms for its large-scale urban developments, such as the high-profile mixed-use projects in major Chinese cities, means these specialized suppliers hold considerable sway due to their critical role in project success and risk mitigation.

- Reputation and Expertise: Suppliers with proven track records and unique skills can command higher fees.

- Project Scale Dependence: COLI's large projects create a dependency on a limited pool of highly qualified consultants.

- Relationship Leverage: Long-term partnerships can give suppliers an edge in negotiating terms.

The bargaining power of suppliers for China Overseas Land & Investment (COLI) is substantial, particularly from land owners, including local governments and other developers, especially in prime urban areas. This is evident as land sales remained a critical revenue source for Chinese local governments in 2023, directly influencing land prices and terms offered to developers like COLI.

While suppliers of common construction materials like steel and cement have moderate power due to market competition, this can increase for specialized components. However, construction material costs showed signs of stabilization in 2024, potentially reducing supplier leverage.

Skilled labor is another significant supplier, with shortages in certain trades in 2024 driving up wages and impacting project costs for companies like COLI. The potential for strong labor unions to negotiate favorable terms also adds to this supplier power, requiring proactive labor management.

Financial institutions hold considerable power, especially given the challenging financing environment for many Chinese property developers as of early 2024, leading to reliance on renegotiated loan conditions. Government policies aimed at market stabilization and developer support are actively working to rebalance this power dynamic.

Reputable design and engineering firms, along with specialized consultants, also wield significant bargaining power due to their critical role in COLI's large-scale projects. The global construction consulting market, valued around $60 billion in 2023, highlights the importance of these expert service providers.

| Supplier Category | Key Factors Influencing Power | Impact on COLI | 2023/2024 Trend/Data |

|---|---|---|---|

| Land Owners (Govt. & Developers) | Land scarcity, developer demand, government revenue needs | High cost of acquisition, specific land sale terms | Land sales crucial for local govt. revenue (2023) |

| Construction Materials | Market competition, specialization of materials | Price volatility for common materials, higher costs for specialized items | Price stabilization observed in 2024 |

| Skilled Labor | Labor market tightness, unionization | Increased labor costs, potential project delays | Persistent skilled labor shortages reported (2024) |

| Financial Institutions | Developer liquidity, market conditions, government policy | Financing costs, loan terms, access to capital | Challenging financing environment for developers (early 2024) |

| Professional Services (Design, Eng.) | Reputation, niche expertise, project scale | Higher fees for specialized services, reliance on key partners | Global construction consulting market ~$60B (2023) |

What is included in the product

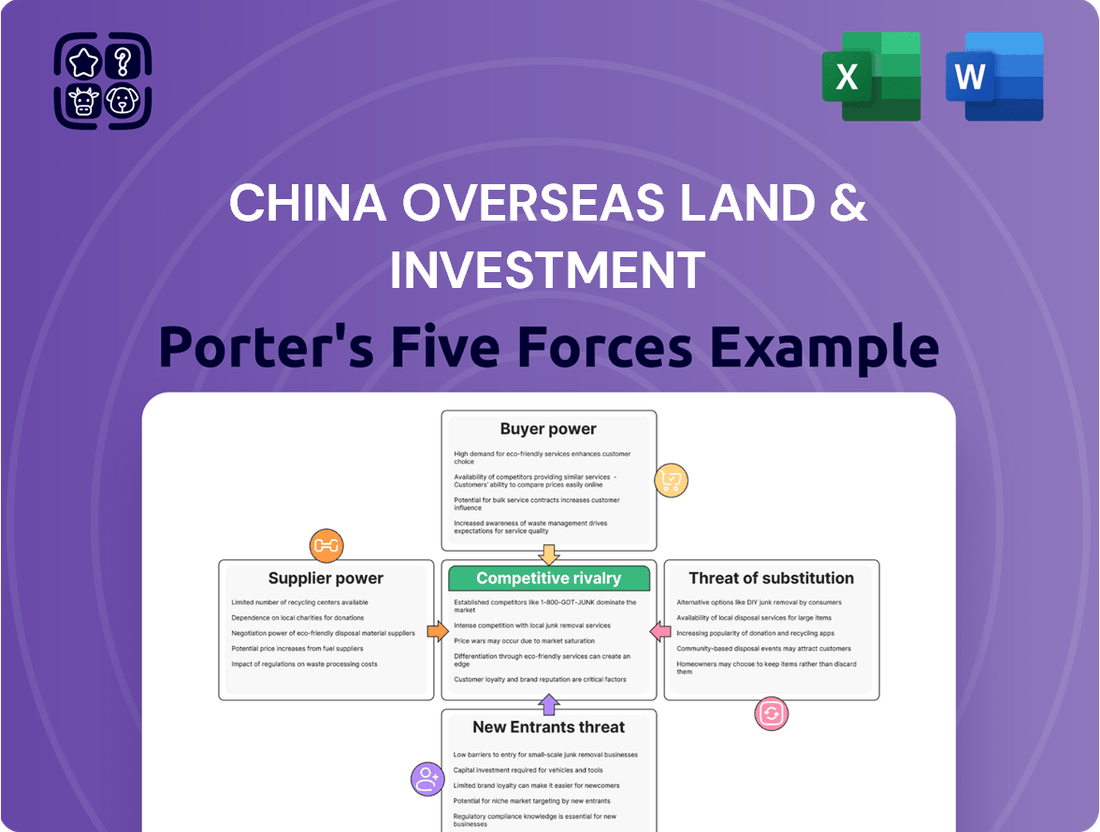

This analysis delves into the competitive forces impacting China Overseas Land & Investment, scrutinizing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for China Overseas Land & Investment.

Gain a competitive edge by pinpointing areas of high bargaining power for suppliers and buyers, enabling proactive strategy adjustments for China Overseas Land & Investment.

Customers Bargaining Power

China Overseas Land & Investment (COLI) faces moderate to high buyer power from individual homebuyers in the residential property market. This is especially true when the market experiences a slowdown. In 2024, China’s property market has seen price adjustments and an increase in unsold inventory, giving buyers more leverage to negotiate favorable terms and pricing.

For commercial and industrial properties, the bargaining power of customers, including businesses and investors, can be quite significant. These buyers are typically making large-scale investments and perform extensive due diligence, which naturally gives them a strong negotiation position.

The current market conditions, particularly elevated vacancy rates observed in certain commercial property sectors across Greater China, further amplify this buyer power. For instance, reports from late 2023 and early 2024 indicated that office vacancy rates in major Chinese cities like Shanghai and Beijing remained a concern, providing tenants and potential buyers with more leverage in lease negotiations and property acquisitions.

Government policies in China, like those implemented in 2024 to stimulate the property market, significantly boost buyer power. Easing purchase restrictions, lowering down payments, and reducing mortgage rates make properties more accessible and affordable for consumers.

These relaxed conditions, evident in the continued easing of housing policies across major Chinese cities throughout 2024, increase demand. While this can benefit developers like China Overseas Land & Investment, buyers are empowered by the improved affordability and wider access to the market.

Buyer Power 4

The bargaining power of customers for China Overseas Land & Investment (COLI) is influenced by the availability of alternative housing options. The presence of a robust second-hand housing market or readily available rental properties directly empowers buyers.

In 2024, a notable trend observed in several major Chinese cities is the growing preference among first-time homebuyers for the second-hand market. This shift can be attributed to factors like potentially lower entry prices and a wider selection of established neighborhoods. Consequently, this trend exerts considerable pressure on COLI's new home sales, as potential customers can more easily opt for existing properties.

- Increased competition from the resale market: Buyers can leverage the availability of pre-owned homes to negotiate better terms on new properties.

- Rental market alternatives: A strong rental market provides a viable, often more flexible, option for individuals delaying homeownership, reducing the urgency to purchase new builds.

- Price sensitivity of first-time buyers: This demographic is particularly sensitive to price, making them more likely to explore all available options, including those in the secondary market.

Buyer Power 5

Buyer power for China Overseas Land & Investment (COLI) is influenced by customer sentiment and confidence, especially during economic downturns. In 2024, with ongoing property market adjustments in China, potential buyers are more likely to delay purchases, adopting a wait-and-see approach. This cautious stance significantly enhances their bargaining position, enabling them to demand more favorable terms and concessions from developers like COLI.

This increased buyer leverage can manifest in several ways:

- Negotiating lower prices: Buyers may hold out for price reductions as developers seek to clear inventory.

- Demanding better payment terms: Flexible payment schedules or lower initial deposits become more common requests.

- Seeking added value: Buyers might push for upgrades or additional amenities to be included in the purchase price.

The bargaining power of customers for China Overseas Land & Investment (COLI) is considered moderate to high, particularly in the residential sector. In 2024, China's property market experienced price adjustments and increased unsold inventory, giving buyers more leverage to negotiate favorable terms. This is further amplified by government policies in 2024, such as eased purchase restrictions and lower mortgage rates, which improve affordability and buyer access.

The availability of alternative housing, like a robust second-hand market, also empowers buyers. For instance, in 2024, first-time homebuyers showed a growing preference for resale properties in major Chinese cities, putting pressure on new home sales. Customer sentiment and confidence also play a crucial role; during market adjustments in 2024, buyers adopted a wait-and-see approach, enhancing their ability to demand concessions.

| Factor | Impact on COLI | 2024 Context |

|---|---|---|

| Market Slowdown & Inventory | Increased buyer leverage | Price adjustments and higher unsold inventory in China's property market. |

| Government Policies | Enhanced affordability and access | Easing of housing policies, lower down payments, and reduced mortgage rates across major cities. |

| Alternative Housing Options | Pressure on new builds | Growing preference for second-hand market among first-time buyers in key Chinese cities. |

| Customer Sentiment | Demand for concessions | Cautious buyer approach ("wait-and-see") due to market adjustments, leading to negotiation for better terms. |

Full Version Awaits

China Overseas Land & Investment Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details China Overseas Land & Investment's competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. This comprehensive analysis is ready for immediate use.

Rivalry Among Competitors

China Overseas Land & Investment (COLI) navigates an intensely competitive landscape in the Chinese property development sector. The market is populated by a vast array of domestic and international developers, creating a dynamic and often challenging environment. For instance, in 2023, the total sales value of the top 100 Chinese real estate developers reached approximately 7.6 trillion yuan, highlighting the sheer scale and competition within the industry.

COLI's primary operational focus in mainland China, alongside its presence in Hong Kong and Macau, means it contends with a diverse set of rivals. These include formidable state-owned enterprises (SOEs) that often benefit from government support and access to capital, as well as agile private developers known for their market responsiveness. This broad spectrum of competitors necessitates continuous innovation and strategic pricing to maintain market share.

The current market downturn in China, marked by falling property sales and prices, significantly heightens competition among developers. This environment forces companies like China Overseas Land & Investment to compete fiercely for a smaller customer base, often resorting to aggressive pricing strategies and sales incentives to move inventory.

In 2023, China's property sales volume saw a notable decline, with many major cities experiencing double-digit percentage drops compared to the previous year. For instance, data from the China Real Estate Information Corporation (CRIC) indicated a significant contraction in sales for leading developers. This shrinking market directly fuels intense rivalry as developers battle for market share.

Government intervention significantly shapes competitive rivalry in China's property sector. Policies aimed at market stabilization, such as those encouraging local governments to purchase unsold housing stock, can indirectly favor state-owned enterprises (SOEs) like China Overseas Land & Investment (COLI) by providing a stable buyer base. In 2024, these policies are expected to continue, potentially creating a more predictable demand environment for larger, well-capitalized developers.

Competitive Rivalry 4

Competitive rivalry within China's property development sector is intense, with differentiation often hinging on brand prestige, construction quality, prime locations, and superior property management. China Overseas Land & Investment (COLI) leverages its strong brand recognition and a commitment to high-quality development, which aids in standing out amidst numerous competitors.

COLI's strategic emphasis on comprehensive property management services presents a significant competitive advantage. This focus not only enhances resident satisfaction but also creates recurring revenue streams and strengthens customer loyalty, differentiating them from developers who may not offer such integrated services. For instance, in 2024, COLI continued to expand its property management portfolio, aiming to enhance its service offerings across its extensive developments.

- Brand Reputation: COLI benefits from a well-established brand known for reliability and quality in the Chinese market.

- Property Management: Its integrated property management services offer a distinct advantage, fostering customer retention and service excellence.

- Quality and Location: The company's consistent focus on high-quality construction and strategic site selection remains a key differentiator.

- Market Presence: With a substantial land bank and ongoing projects, COLI maintains a significant competitive footprint across major Chinese cities.

Competitive Rivalry 5

The financial health of competitors significantly impacts competitive rivalry. Developers grappling with severe liquidity challenges might engage in aggressive pricing to move inventory, creating intense pressure on financially sound companies like China Overseas Land & Investment (COLI).

For instance, during the property market downturn in 2023 and early 2024, several smaller Chinese developers faced defaults, leading to distressed asset sales that depressed market prices in specific regions. This situation directly challenges COLI's ability to maintain its pricing power and margins when competing against these financially strained entities.

- Financial Distress of Competitors: Many smaller developers in China experienced significant financial distress in 2023, with some defaulting on their debt obligations, creating a more competitive pricing environment.

- Impact on COLI: Financially stable companies like COLI face pressure to adjust pricing strategies to remain competitive against developers offloading inventory at lower margins.

- Market Dynamics: The willingness of distressed competitors to accept lower prices can disrupt market equilibrium and impact the profitability of healthier players.

Competitive rivalry in China's property sector is intense, exacerbated by a market downturn and a large number of developers. China Overseas Land & Investment (COLI) faces competition from state-owned enterprises and agile private firms, all vying for a shrinking customer base. This environment necessitates strategic pricing and differentiation through brand, quality, and integrated services like property management, which COLI actively enhances.

The financial distress of many smaller developers in 2023 and early 2024 has intensified rivalry, forcing financially sound companies like COLI to contend with aggressive pricing from distressed competitors offloading inventory. This dynamic puts pressure on profit margins and market pricing equilibrium.

| Competitor Type | Key Characteristics | Impact on COLI | 2023/2024 Market Context |

|---|---|---|---|

| State-Owned Enterprises (SOEs) | Government backing, access to capital | Benefit from stable demand, potential for strategic partnerships | Continued government support for SOEs in market stabilization efforts |

| Private Developers | Market responsiveness, agility | Drive innovation in pricing and sales strategies | Increased competition due to market contraction |

| Financially Distressed Developers | Liquidity challenges, asset sales | Pressure on pricing and margins | Defaults and distressed sales in 2023/2024 led to lower market prices in certain areas |

SSubstitutes Threaten

For China Overseas Land & Investment (COLI), the threat of substitutes in the residential property market primarily comes from renting. In 2024, several factors have made renting a more appealing alternative for many. For instance, in certain major Chinese cities, rental prices have seen a slight decrease, making it more cost-effective for individuals and families to rent rather than commit to a property purchase.

Furthermore, the Chinese government's continued emphasis on expanding the supply of government-subsidized housing options has also amplified the substitute threat. This increased availability of affordable rental units provides consumers with more choices and strengthens their negotiating position with landlords, directly impacting the demand for COLI's for-sale residential properties.

Existing second-hand properties represent a substantial threat of substitution for new homes offered by companies like China Overseas Land & Investment. Many first-time homebuyers in 2024 are actively exploring the resale market, often driven by the appeal of lower entry prices or quicker occupancy compared to the often longer wait times for new constructions.

The threat of substitutes for China Overseas Land & Investment (COLI) is significant, particularly from alternative asset classes. Investors can readily shift capital from property to stocks, bonds, or other financial instruments if those markets offer more attractive returns. For instance, in 2023, global equity markets saw robust growth, with the S&P 500 returning over 24%, potentially drawing investment away from real estate.

In a sluggish or declining real estate market, this substitution effect becomes even more pronounced. If property values stagnate or fall, investors will actively seek out sectors with better growth prospects. This was evident in certain regional property markets in 2024, where interest rate hikes and economic uncertainty led some investors to pivot towards fixed-income securities offering higher yields.

4

The threat of substitutes for China Overseas Land & Investment (COLI) in the commercial property sector is significant, particularly in the office market. Businesses are increasingly exploring alternatives to traditional office leases, driven by cost-saving measures and evolving work models.

For instance, the rise of co-working spaces offers flexible and often more affordable solutions than long-term office leases. Remote work policies further reduce the demand for physical office footprints. In 2024, many companies continued to re-evaluate their office space needs, leading to a potential decrease in demand for traditional commercial properties.

- Co-working spaces: Offer flexible, cost-effective alternatives to traditional leases.

- Remote work models: Reduce the overall need for physical office space.

- Smaller office footprints: Businesses are downsizing to manage expenses.

- Hybrid work arrangements: Contribute to a reduced demand for large, centralized offices.

5

The threat of substitutes for China Overseas Land & Investment (COLI) is moderate. While government-provided affordable housing or social housing isn't a direct competitor to COLI's core business in residential, commercial, and industrial properties, it can serve as an alternative for lower-income segments of the population. For instance, in 2024, China continued its focus on expanding affordable housing initiatives, with significant investment allocated to these projects to stabilize the property market and address social housing needs.

This governmental push can divert demand from COLI's offerings, particularly for first-time homebuyers or those with more modest financial capabilities. While COLI targets a different market segment, the availability of government-subsidized options can indirectly impact overall market demand and pricing dynamics. For example, if a substantial portion of the population opts for government housing, it could lead to reduced purchasing power or interest in COLI's more premium products.

- Government affordable housing initiatives can absorb demand from lower-income buyers, indirectly affecting COLI's market.

- In 2024, China's continued investment in social housing projects highlights this substitute potential.

- While not direct competitors, these government programs offer alternative housing solutions, influencing overall market dynamics.

The threat of substitutes for China Overseas Land & Investment (COLI) is notable, particularly from alternative asset classes like stocks and bonds. In 2023, the S&P 500's over 24% return highlighted how attractive other investments can be, potentially drawing capital away from real estate. This trend intensifies when property markets face stagnation or decline, as seen in some Chinese regions in 2024 where interest rate hikes prompted investors to shift towards higher-yielding fixed-income securities.

| Asset Class | 2023 Return (Approx.) | Potential Impact on COLI |

|---|---|---|

| Equities (e.g., S&P 500) | 24%+ | Draws capital away from real estate investment. |

| Bonds (Yields) | Increasing (e.g., US 10-year Treasury yields rose significantly) | Offers a safer, potentially competitive return, reducing real estate appeal. |

| COLI Residential Property | Varies by location and segment | Faces competition from more liquid and potentially higher-returning financial assets. |

Entrants Threaten

The threat of new entrants in China's real estate development sector is generally low. This is primarily due to the immense capital required for land acquisition and construction, creating significant financial hurdles. For instance, in 2024, major developers like China Overseas Land & Investment (COLI) continued to demonstrate substantial financial strength, with COLI reporting revenues of approximately HK$192.5 billion for the fiscal year ending December 31, 2023, underscoring the scale of investment needed to compete effectively.

Furthermore, established players like COLI benefit from substantial land reserves, which act as a critical competitive advantage and a barrier to entry for newcomers. These reserves provide a pipeline for future development and price stability, making it difficult for new companies to gain a foothold without comparable strategic land holdings.

The threat of new entrants for China Overseas Land & Investment (COLI) is moderately low, primarily due to substantial regulatory and operational barriers in its core markets of mainland China, Hong Kong, and Macau. These hurdles include intricate land acquisition processes, stringent zoning laws, and evolving environmental standards that demand significant upfront investment and local expertise.

Navigating the complex web of property development regulations in China, Hong Kong, and Macau requires deep local knowledge and established relationships, acting as a significant deterrent to newcomers. For instance, in 2023, the average approval time for large-scale residential projects in major Chinese cities could extend over a year, involving multiple government departments.

The threat of new entrants for China Overseas Land & Investment (COLI) is moderate. Established brand reputation and customer loyalty, painstakingly built by COLI over years, create a significant barrier. Prospective newcomers struggle to match the trust and proven track record that are paramount in the real estate sector.

4

The threat of new entrants for China Overseas Land & Investment (COLI) is generally moderate. Established developers like COLI benefit from significant capital requirements and economies of scale, making it difficult for smaller newcomers to compete effectively. Access to reliable supply chains for materials and skilled labor, along with established distribution channels and sales networks, presents a substantial hurdle for new players. Existing developers often possess long-standing relationships with key suppliers and agents, which new entrants would struggle to replicate quickly.

However, certain factors can mitigate this threat. The Chinese real estate market, while vast, is also highly regulated, and obtaining necessary permits and approvals can be a lengthy and complex process, deterring many potential new entrants. Furthermore, brand reputation and a proven track record are crucial in this sector, and COLI's established presence and history of successful project delivery provide a competitive advantage. For instance, in 2023, COLI reported a contracted sales value of RMB 235.4 billion, demonstrating its significant market share and operational capacity.

- High Capital Requirements: Significant upfront investment is needed for land acquisition, construction, and marketing, acting as a barrier.

- Established Relationships: COLI's long-standing ties with suppliers, contractors, and sales agents create a more efficient and cost-effective operation than new entrants can easily match.

- Regulatory Hurdles: Navigating China's complex real estate regulations and obtaining necessary approvals can be a deterrent for new, less experienced companies.

- Brand Recognition and Trust: COLI's established reputation for quality and reliability in the market provides a distinct advantage over unknown new entrants.

5

The threat of new entrants in China's real estate sector, particularly for a company like China Overseas Land & Investment (COLI), is currently quite low. The industry is facing significant headwinds, making it a less appealing prospect for newcomers.

Challenging market conditions are a major deterrent. Declining sales volumes, coupled with widespread oversupply in many regions, create a difficult operating environment. Furthermore, many existing developers are experiencing considerable financial pressures, which makes the sector unattractive for fresh investment.

- Deterrent Factors: Current market conditions such as falling sales and oversupply discourage new companies from entering.

- Financial Pressures: Existing developers facing financial strain further reduce the appeal for new entrants.

- Limited Attractiveness: The overall industry landscape presents a less inviting environment for new capital and competition.

- COLI's Position: These factors protect established players like COLI from immediate new competitive threats.

The threat of new entrants for China Overseas Land & Investment (COLI) remains low, bolstered by substantial capital requirements and established relationships. Newcomers face significant hurdles in acquiring land and building a robust supply chain, as evidenced by COLI's 2023 contracted sales value of RMB 235.4 billion, indicating its scale and market penetration.

Regulatory complexities and the need for strong brand recognition further deter new players. COLI's established reputation and extensive experience navigating China's intricate property laws, which saw average project approval times exceeding a year in major cities in 2023, provide a distinct advantage.

| Factor | COLI's Advantage | Impact on New Entrants |

| Capital Requirements | High, supported by strong financials (e.g., HK$192.5 billion revenue in 2023) | Significant barrier to entry |

| Regulatory Navigation | Deep local expertise and established processes | Complex and time-consuming |

| Brand & Trust | Proven track record and customer loyalty | Difficult to replicate quickly |

| Market Conditions | Resilience amidst falling sales and oversupply | Discourages new investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Overseas Land & Investment leverages data from official company filings, including annual reports and investor presentations, supplemented by reputable industry research from firms like JLL and Knight Frank. We also incorporate macroeconomic data from sources such as the National Bureau of Statistics of China and financial databases like Bloomberg to provide a comprehensive understanding of the competitive landscape.