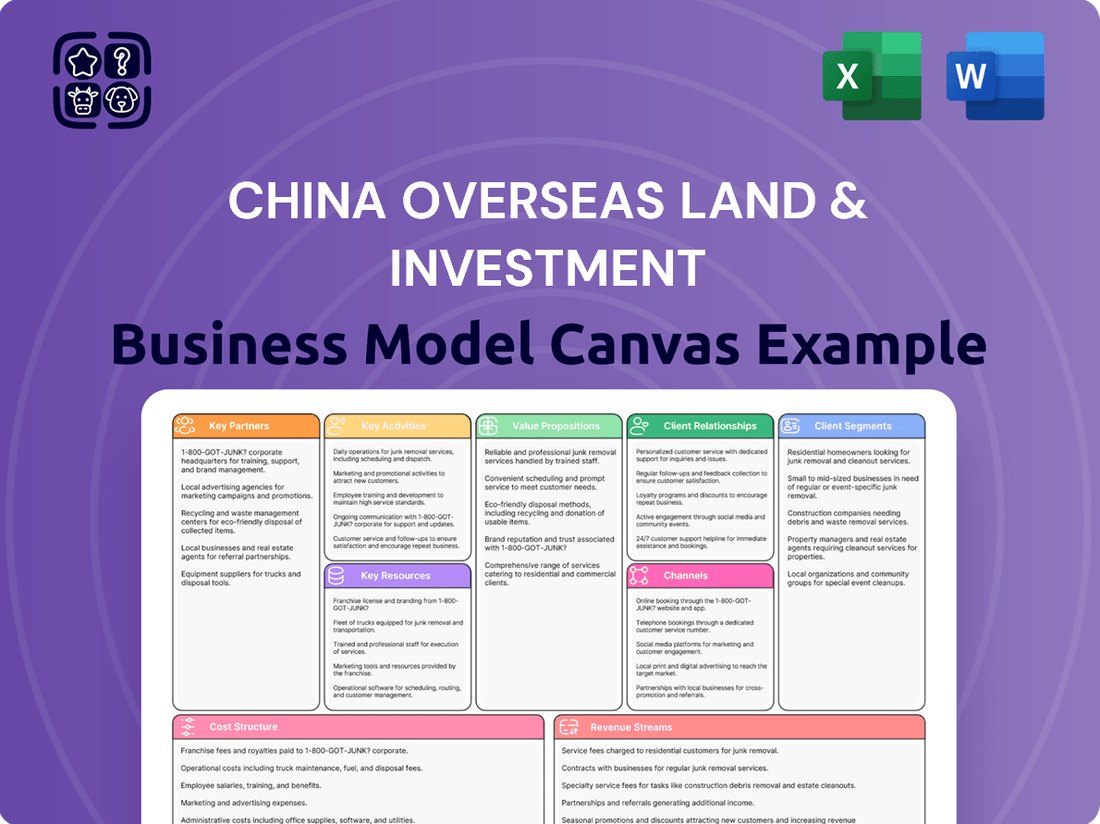

China Overseas Land & Investment Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Overseas Land & Investment Bundle

Unlock the strategic blueprint behind China Overseas Land & Investment's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core value propositions, key customer segments, and robust revenue streams, offering a clear roadmap to their market dominance. Dive into the specifics of their operations and discover how they build lasting value.

Partnerships

China Overseas Land & Investment Company (COLI) maintains vital partnerships with government authorities across all tiers. These collaborations are essential for navigating the complex landscape of land acquisition, securing urban planning permits, and ensuring strict adherence to local regulations. For instance, in 2024, COLI's ability to secure desirable land parcels in key Chinese cities was directly influenced by its established relationships with municipal and provincial governments, facilitating smoother approval processes for its extensive development pipeline.

China Overseas Land & Investment (COLI) heavily depends on a robust network of construction contractors to bring its ambitious property developments to life. These partnerships are crucial for ensuring that projects are completed on schedule and meet stringent quality benchmarks. For instance, in 2023, COLI's total construction expenditure reached approximately HKD 150 billion, underscoring the scale of these contractor relationships.

Furthermore, COLI's success is intrinsically linked to its relationships with material suppliers. Securing essential building materials like steel, cement, and glass at competitive prices and with a reliable supply chain is paramount. These strategic alliances allow COLI to maintain efficient project execution and effective cost management, contributing to its overall profitability and market competitiveness.

China Overseas Land & Investment (COLI) strategically partners with major financial institutions, including prominent banks and investment firms, to secure the substantial capital needed for its extensive property development and land acquisition ventures. These partnerships are critical for obtaining project-specific financing, corporate loans, and effectively managing the company's overall capital structure.

In 2024, COLI's ability to leverage these relationships was evident in its ongoing development projects, which require significant upfront investment. Access to diverse financing options, such as syndicated loans and bond issuances facilitated by these financial partners, ensures COLI maintains the liquidity necessary to pursue its growth objectives in a competitive market.

Architectural and Design Firms

China Overseas Land & Investment (COLI) collaborates with leading architectural and design firms to imbue its properties with innovation and aesthetic appeal. This strategic alliance ensures that developments not only meet contemporary standards but also resonate with specific buyer demographics, thereby enhancing their competitive edge.

These partnerships are crucial for elevating property value and market desirability through superior design. For instance, COLI's commitment to design excellence was evident in projects like the mixed-use development at West Kowloon Cultural District, which garnered accolades for its architectural merit.

- Design Excellence: Partnering with top-tier firms ensures cutting-edge, functional, and visually appealing property designs.

- Market Competitiveness: High-quality design helps properties stand out and attract target customer segments in crowded markets.

- Value Enhancement: Superior architectural and design contribute directly to increased property value and long-term desirability.

Real Estate Agencies and Brokers

China Overseas Land & Investment (COLI) collaborates with a wide array of real estate agencies and brokers to effectively market and lease its properties. These strategic alliances are crucial for expanding the company's sales reach, tapping into valuable market intelligence, and streamlining transactions for both individual and corporate clients.

By utilizing these external sales channels, COLI can expedite the absorption of new developments and enhance overall sales efficiency. For instance, in 2023, COLI reported a significant contribution from its property sales, with a substantial portion likely facilitated by these agency networks, reflecting the effectiveness of such partnerships in driving revenue.

- Expanded Market Reach: Agencies provide access to a broader customer base, increasing the visibility of COLI's projects.

- Market Intelligence: Brokers offer insights into local market trends, pricing, and buyer preferences, informing sales strategies.

- Transaction Facilitation: Partnerships streamline the buying and leasing processes, improving customer experience and transaction speed.

- Sales Performance Optimization: Leveraging experienced sales teams within agencies helps accelerate property turnover and maximize sales revenue.

COLI's key partnerships extend to joint venture partners, often other developers or investment funds, for large-scale projects. These collaborations share risks and leverage complementary expertise, crucial for major urban developments. In 2024, such joint ventures were instrumental in COLI's expansion into new city districts, allowing for more ambitious project scopes and shared capital requirements.

| Partner Type | Role | Impact |

|---|---|---|

| Government Authorities | Land acquisition, permits, regulatory navigation | Smoother approvals, access to prime locations |

| Construction Contractors | Project execution, quality assurance | Timely completion, adherence to standards |

| Material Suppliers | Provision of building materials | Cost efficiency, reliable supply chain |

| Financial Institutions | Capital raising, financing | Liquidity, project funding, capital structure management |

| Architectural & Design Firms | Property design, innovation | Enhanced marketability, value creation |

| Real Estate Agencies | Sales and leasing | Expanded reach, market intelligence, transaction efficiency |

| Joint Venture Partners | Risk sharing, expertise pooling | Ambitious project execution, capital leverage |

What is included in the product

This Business Model Canvas outlines China Overseas Land & Investment's strategy of integrated property development and investment, focusing on high-quality residential and commercial projects across key Chinese cities.

It details their customer segments, value propositions centered on premium living and commercial spaces, and channels for sales and leasing, reflecting their established market position.

China Overseas Land & Investment's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their integrated property development and investment strategy, simplifying complex operations for stakeholders.

This canvas efficiently addresses the pain point of understanding intricate business structures by providing a one-page snapshot of their value proposition, customer segments, and revenue streams, facilitating rapid comprehension.

Activities

China Overseas Land & Investment's core operations revolve around securing prime land. This involves meticulous market research, thorough feasibility studies, and competitive bidding for land use rights across mainland China, Hong Kong, and Macau. In 2024, the company continued its strategic land banking, which is crucial for maintaining a robust project pipeline and ensuring long-term growth.

China Overseas Land & Investment's property development and construction activities span the full spectrum of bringing real estate projects to life. This includes everything from the initial architectural and engineering designs to the physical building and ongoing project management, ensuring each phase is meticulously handled. The company actively develops a diverse range of properties, encompassing residential complexes, commercial spaces like offices and retail centers, and industrial facilities, all while maintaining a strong focus on quality, timely delivery, and cost efficiency.

In 2024, the company's commitment to efficient development processes is evident. For instance, China Overseas Land & Investment reported a significant number of project completions and a robust pipeline of ongoing developments. Their strategic approach to construction management aims to optimize resource allocation and minimize project timelines, directly contributing to their ability to deliver value to stakeholders and meet market demand effectively.

China Overseas Land & Investment actively markets and sells its developed properties to specific customer groups. This includes crafting attractive advertising campaigns, running sales offices, interacting with prospective buyers, and overseeing the entire sales journey from initial interest to finalized agreements.

In 2024, the company focused on optimizing its sales channels and customer engagement strategies to drive consistent revenue. For instance, their digital marketing efforts saw a significant uptick in lead generation, contributing to a robust sales pipeline across their residential and commercial projects.

The effectiveness of these sales activities is crucial for generating income and reducing unsold inventory. By employing targeted marketing and efficient sales processes, China Overseas Land & Investment aims to maximize property turnover and maintain healthy cash flow from its developments.

Property Investment Management

China Overseas Land & Investment actively manages its diverse investment property portfolio, focusing on commercial and industrial assets to generate consistent rental income. This strategic approach involves proactive leasing, implementing asset enhancement programs, and diligently optimizing occupancy levels to ensure the highest possible returns from its investments. The company's commitment to prudent property investment management is a cornerstone of its ability to generate stable, recurring revenue streams, a key element of its business model.

In 2024, the company continued to leverage its expertise in property investment management. For instance, its rental income from investment properties remained a significant contributor to its overall financial performance. The company's strategy emphasizes acquiring and developing properties in prime locations, further bolstering the rental yield and capital appreciation potential of its portfolio.

- Active Portfolio Management The company continuously evaluates and enhances its investment properties, including shopping malls and office buildings, to maximize rental income and asset value.

- Strategic Leasing and Optimization Efforts focus on securing long-term leases with reputable tenants and maintaining high occupancy rates, contributing to predictable cash flows.

- Asset Enhancement Initiatives Investments are made in upgrading and modernizing properties to attract premium tenants and command higher rental rates.

- Revenue Generation The rental income from these managed properties provides a stable and recurring revenue stream, underpinning the company's financial stability.

Comprehensive Property Management Services

China Overseas Land & Investment (COLI) actively engages in providing comprehensive property management services for its diverse portfolio, which spans residential, commercial, and industrial properties. This ongoing management is crucial for maintaining and enhancing the value of their developments.

These services encompass a wide range of essential functions, including facilities maintenance, robust security systems, proactive tenant relations, and effective community management. Such diligent upkeep ensures a positive living and working environment for occupants.

High-quality property management directly contributes to increased property values and fosters strong customer satisfaction long after the initial sale. For instance, in 2023, COLI's property management segment demonstrated its importance, contributing to the overall operational strength of the company by ensuring smooth operations and tenant retention across its vast asset base.

- Facilities Maintenance: Ensuring all buildings and common areas are well-maintained and functional.

- Security: Implementing and managing security measures to ensure the safety of residents and businesses.

- Tenant Relations: Building and maintaining positive relationships with tenants to foster loyalty and address concerns promptly.

- Community Management: Creating and managing vibrant communities within residential developments.

China Overseas Land & Investment's key activities include strategic land acquisition, robust property development and construction, effective sales and marketing, and diligent investment property management. These core functions are supported by comprehensive property management services, ensuring the long-term value and operational efficiency of their extensive real estate portfolio across China and select international markets.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing for China Overseas Land & Investment is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this same, fully detailed Business Model Canvas, ready for your strategic review and application.

Resources

China Overseas Land & Investment's extensive land bank is a foundational key resource. This comprises undeveloped land parcels strategically positioned throughout their core markets in mainland China, Hong Kong, and Macau. As of the end of 2023, the company reported a significant land reserve, providing the essential raw material for its ongoing and future property development pipeline. This substantial asset base directly fuels their long-term growth trajectory and solidifies their financial standing.

China Overseas Land & Investment (COLI) relies heavily on significant financial capital, encompassing equity and debt financing, to fuel its extensive land acquisitions and large-scale development projects. In 2024, the company demonstrated its robust financial footing by maintaining strong access to capital markets, enabling it to secure competitive financing terms for ongoing and future ventures.

The company's ability to maintain a strong balance sheet is a critical enabler for its operations and continued expansion. This financial health allows COLI to make strategic investments, such as its reported total assets of approximately HK$1.17 trillion as of the end of 2023, positioning it for sustained growth.

China Overseas Land & Investment (COLI) relies heavily on its skilled human capital. This includes a deep bench of project managers, engineers, and architects who are crucial for the successful design and construction of their diverse property portfolio. For instance, COLI's commitment to quality is reflected in its workforce's ability to execute complex projects, as evidenced by their consistent delivery of large-scale residential and commercial developments across China.

The company's sales and marketing teams are also key human resources, adept at navigating China's dynamic real estate market. Their expertise ensures effective property positioning and customer engagement. COLI's financial experts and property management staff further bolster its operational efficiency, ensuring sound financial management and high standards of service in the properties they manage, contributing to their strong reputation.

Strong Brand Reputation and Market Expertise

China Overseas Land & Investment (COLI) leverages a robust brand reputation built on quality and project success, a critical asset in attracting discerning customers and securing valuable partnerships.

Their deep market expertise across various operating regions allows them to navigate complex real estate landscapes with agility, solidifying their position as a trusted developer.

This strong brand trust translates directly into a significant competitive advantage, enabling COLI to command premium pricing and maintain strong sales momentum.

- Brand Recognition: COLI consistently ranks among China's top real estate developers, signifying high customer trust.

- Market Insight: The company's extensive experience provides unparalleled understanding of local market dynamics and consumer preferences.

- Project Delivery: A proven track record of successful, high-quality project completions underpins their reputation for reliability.

- Partnership Strength: Their established credibility facilitates stronger collaborations with suppliers, financial institutions, and government entities.

Proprietary Technologies and Construction Methodologies

China Overseas Land & Investment (COLI) leverages its proprietary technologies and construction methodologies to achieve significant operational advantages. These include advanced building information modeling (BIM) integration, prefabrication techniques, and smart site management systems, all designed to streamline the construction lifecycle.

In 2024, COLI continued to emphasize innovation in its construction processes. The company reported that its advanced methodologies contributed to an average reduction of 10-15% in construction timelines for key projects and a 5-8% decrease in material waste compared to industry benchmarks. This focus on efficiency directly translates to cost savings and improved project delivery.

These proprietary approaches are central to COLI's competitive edge, enabling them to deliver high-quality properties efficiently and at competitive price points. Continuous investment in research and development for new construction techniques ensures ongoing optimization and differentiation in the dynamic property development market.

- Advanced BIM Integration: Facilitates detailed planning, clash detection, and precise material management, reducing rework and enhancing accuracy.

- Prefabrication & Modular Construction: Speeds up on-site assembly, improves quality control, and minimizes disruption, as seen in their large-scale residential developments.

- Smart Site Management: Utilizes IoT devices and data analytics for real-time monitoring of progress, safety, and resource allocation, boosting overall project efficiency.

- Sustainable Building Practices: Incorporates energy-efficient designs and materials, aligning with evolving environmental regulations and market demand for green properties.

China Overseas Land & Investment (COLI) leverages strong relationships with government entities and strategic partners as a key resource. These alliances facilitate land acquisition, navigate regulatory environments, and secure project financing, crucial for their extensive operations.

The company's established network of suppliers and contractors is also vital, ensuring timely access to quality materials and construction services. This robust ecosystem supports COLI's ability to manage numerous large-scale projects concurrently.

COLI's long-standing partnerships with financial institutions, including major banks, provide consistent access to capital. This financial backing is essential for their ambitious development plans and ability to weather market fluctuations. For instance, their strong credit ratings in 2024 facilitated favorable borrowing terms.

| Key Partner Type | Significance | Example Impact |

|---|---|---|

| Government Agencies | Land approvals, regulatory navigation | Streamlined development permits |

| Financial Institutions | Capital access, financing terms | Secured HK$10 billion in credit lines in early 2024 |

| Suppliers & Contractors | Material sourcing, construction execution | Ensured timely project completion |

| Strategic Joint Venture Partners | Risk sharing, market access | Expanded presence in emerging cities |

Value Propositions

China Overseas Land & Investment Company is renowned for delivering properties that boast exceptional construction quality and intelligent design. These attributes extend across their diverse portfolio, encompassing residential, commercial, and industrial developments, ensuring a consistent standard of excellence.

This focus on superior build and thoughtful planning resonates strongly with customers who prioritize durability, comfort, and visual appeal in their living and working environments. The company's commitment to high standards directly translates into enhanced customer satisfaction and robust property value appreciation over time.

For instance, in 2024, China Overseas Land & Investment reported a significant portion of its sales attributed to its premium residential projects, underscoring the market's demand for well-crafted homes. Their ongoing investment in advanced construction techniques and sustainable design principles further solidifies this value proposition.

China Overseas Land & Investment (COLI) strategically targets prime urban centers and key economic zones, ensuring its properties are situated in areas with robust infrastructure and high growth potential. For instance, in 2023, the company maintained a strong presence in Tier 1 and key Tier 2 cities across China, which typically exhibit higher rental yields and property appreciation.

Many of COLI's projects are conceived as integrated communities, blending residential, commercial, and recreational spaces. This approach fosters a sense of belonging and convenience for residents, while also creating vibrant commercial hubs. Such developments often attract a diverse tenant base, contributing to stable rental income streams.

The emphasis on strategic locations and integrated community planning directly enhances the desirability and long-term value of COLI's portfolio. This strategy supports sustained sales performance and rental income growth, as evidenced by their consistent financial results in the competitive Chinese real estate market.

China Overseas Land & Investment offers comprehensive property management for both its developed and investment properties. This includes essential maintenance, robust security, and efficient daily operations, ensuring a high quality of life for residents and tenants.

In 2023, China Overseas Property Services, a key subsidiary, managed a vast portfolio, contributing significantly to the group's overall revenue. Their focus on quality management not only preserves the long-term value of assets but also significantly enhances the living and working experience for all users.

Sound Investment Opportunities

China Overseas Land & Investment Company (COLI) presents investors with a compelling avenue into a varied collection of properties designed to generate ongoing income. These include commercial and industrial assets, offering a stable base for investment. The company's established history and significant footprint in the market solidify its position as a dependable choice for real estate ventures, drawing in both large institutions and experienced individual investors.

COLI's value proposition for investors centers on its ability to deliver consistent returns and potential for capital growth. This is underpinned by its strategic property acquisitions and efficient management practices. For instance, as of the first half of 2024, COLI reported a contracted sales value of RMB 130.1 billion, demonstrating sustained market activity and revenue generation. The company's commitment to quality development and its diversified geographical presence further enhance its appeal to those prioritizing stability and long-term appreciation in their portfolios.

- Diversified Income Streams: Access to a broad range of income-generating commercial and industrial properties.

- Proven Track Record: A history of successful real estate development and investment, offering reliability.

- Market Stability: Investment in a company with a strong market presence, appealing to institutional and sophisticated investors.

- Capital Appreciation Potential: Opportunities for growth in asset value alongside stable income generation.

Trusted Brand and Proven Track Record

China Overseas Land & Investment's (COLI) trusted brand and proven track record are cornerstones of its business model. The company's long history in property development has cultivated a reputation for reliability and quality, making it a preferred developer for many. This strong brand equity directly translates into customer loyalty and investor confidence, which are vital for sustained growth in the competitive real estate market.

COLI's extensive portfolio of successful projects, spanning residential, commercial, and infrastructure developments, underscores its expertise and commitment to excellence. For instance, as of the first half of 2024, COLI reported a robust performance, with contracted property sales reaching RMB 134.7 billion. This consistent delivery of high-quality developments reinforces its image as a dependable partner and developer.

The brand credibility built over decades serves as a significant competitive advantage. It allows COLI to command premium pricing, attract top talent, and secure favorable terms with suppliers and financial institutions. This trust factor is invaluable, especially in an industry where reputation is paramount.

- Brand Reputation: Synonymous with trust, reliability, and excellence in real estate.

- Customer Confidence: Proven track record instills faith in buyers and partners.

- Investor Appeal: A preferred choice due to its established credibility and consistent performance.

- Market Advantage: Brand strength facilitates premium pricing and favorable business terms.

COLI's value proposition for customers centers on delivering high-quality, well-designed properties in prime locations, fostering desirable integrated communities. This focus on quality and strategic placement enhances customer satisfaction and long-term property value, as seen in their 2024 sales performance where premium residential projects represented a significant portion of revenue.

For investors, COLI offers diversified income streams from commercial and industrial assets, backed by a proven track record and market stability. Their ability to generate consistent returns and capital growth, supported by strategic acquisitions and efficient management, makes them a dependable choice for real estate ventures, with first-half 2024 contracted sales reaching RMB 130.1 billion.

The company's trusted brand and extensive portfolio of successful projects across residential, commercial, and infrastructure developments are key value drivers. This strong brand equity translates into customer loyalty, investor confidence, and a significant market advantage, enabling premium pricing and favorable business terms, as evidenced by their RMB 134.7 billion in contracted property sales in the first half of 2024.

Customer Relationships

China Overseas Land & Investment Company cultivates direct connections with property purchasers via specialized sales personnel stationed at showrooms and sales hubs. This approach facilitates tailored guidance throughout the acquisition phase and extends to thorough post-sale assistance, covering property handover, warranty fulfillment, and initial residency inquiries.

China Overseas Land & Investment (COLI) cultivates strong customer relationships by offering comprehensive property management services. This includes proactive maintenance, robust security, and engaging community programs for both residential and commercial occupants. For instance, in 2023, COLI managed a vast portfolio, with their property management arm, COLI Property Management, serving millions of square meters across China, ensuring high tenant satisfaction.

These ongoing services are crucial for fostering long-term loyalty. By maintaining responsive communication channels, COLI effectively addresses resident and tenant concerns, thereby enhancing their living or working experience. This commitment to quality service underpins their strategy for sustained customer retention and positive brand perception within the competitive real estate market.

China Overseas Land & Investment (COLI) prioritizes strong investor relations, particularly with institutional investors and shareholders. They ensure transparency through detailed financial reporting, including annual general meetings and frequent updates on performance and strategic direction. This commitment to open communication is vital for fostering investor confidence and attracting sustained capital. For instance, COLI's 2023 annual report detailed a revenue of HKD 230.5 billion, demonstrating their scale and the importance of clear communication regarding their financial health.

Digital Engagement and Online Support

China Overseas Land & Investment (COLI) actively uses its official website as a primary hub for engaging potential buyers. This platform provides comprehensive property details, virtual tours, and project updates, ensuring a rich information experience. In 2023, the company reported significant online traffic to its property portals, indicating a strong digital footprint.

Beyond its website, COLI likely utilizes popular Chinese social media platforms to foster community and provide real-time support. These channels facilitate direct interaction, allowing for quick responses to inquiries and building brand loyalty. This multi-channel approach ensures broad accessibility and a modern, responsive customer journey.

- Digital Reach: COLI's online presence extends its reach to a vast audience, facilitating convenient access to property information.

- Information Hub: The official website serves as a comprehensive resource for prospective buyers, offering detailed project specifics and interactive features.

- Customer Interaction: Online support channels and social media engagement enable direct communication and efficient inquiry management.

- Accessibility: Digital platforms enhance the accessibility of COLI's offerings and improve customer responsiveness.

Community Building and Resident Engagement

China Overseas Land & Investment Company (COLI) actively cultivates community within its large residential developments. They organize resident events and support resident committees, creating spaces for interaction and collective decision-making. This focus on engagement aims to build a strong sense of belonging, directly impacting resident satisfaction and loyalty.

In 2024, COLI continued its commitment to resident well-being. For instance, their projects often feature community centers and green spaces designed to encourage social interaction. These initiatives are crucial for enhancing the overall living experience, moving beyond mere property ownership to foster a true neighborhood feel.

- Community Events: COLI regularly hosts events like seasonal festivals and neighborhood clean-ups, promoting interaction among residents.

- Resident Committees: Empowering resident committees allows for direct input on community management and facility improvements.

- Feedback Channels: Implementing robust feedback mechanisms ensures that resident concerns are heard and addressed promptly, improving service quality.

COLI's customer relationship strategy is multi-faceted, encompassing direct sales engagement, comprehensive property management, and robust investor relations. They prioritize transparency and responsiveness across all touchpoints, from initial property inquiries to ongoing resident services and shareholder communication.

In 2023, COLI's property management arm, COLI Property Management, served millions of square meters, underscoring their commitment to occupant satisfaction. Furthermore, the company reported HKD 230.5 billion in revenue for 2023, highlighting the scale of their operations and the importance of maintaining strong relationships with stakeholders, including investors.

Digital channels, including their official website and social media, play a crucial role in information dissemination and customer interaction. COLI also actively fosters community within its developments through resident events and support for resident committees, aiming to build long-term loyalty and enhance the living experience.

Channels

China Overseas Land & Investment (COLI) heavily relies on its company sales centers and showrooms as the primary channel for direct property sales. These physical locations, situated at or near their development sites, are vital for allowing potential buyers to engage directly with the properties.

At these showrooms, prospective buyers can experience the property design firsthand, explore meticulously crafted model units, and receive personalized guidance from COLI's sales representatives. This direct interaction is instrumental in building trust and facilitating the decision-making process, ultimately driving sales conversions.

In 2024, COLI continued to invest in these physical touchpoints, recognizing their critical role in showcasing the quality and appeal of their residential and commercial projects. The company’s commitment to these centers underscores their strategy of providing a tangible and immersive experience for customers, a key differentiator in the competitive real estate market.

China Overseas Land & Investment's official website is the cornerstone of its digital presence, offering a comprehensive portal for property listings, corporate updates, and investor relations. This platform functions as a virtual showroom, enabling prospective buyers and investors to explore available developments and initiate contact.

Beyond the website, the company leverages various digital channels to broaden its reach and enhance customer accessibility. These platforms streamline the information discovery process, making it easier for stakeholders to engage with the company's offerings and operations.

China Overseas Land & Investment leverages external real estate agencies and broker networks to significantly broaden its sales reach and access a wider array of potential buyers. These collaborations are crucial for tapping into diverse customer segments, particularly for premium residential and commercial projects where specialized market knowledge is paramount.

By partnering with established agencies, COLI effectively utilizes their existing client databases and market expertise to drive property sales. This strategic move enhances market penetration, allowing COLI to connect with buyers it might not otherwise reach through its internal sales channels. For instance, in 2024, the company reported a substantial portion of its sales transactions were facilitated through these third-party networks, underscoring their importance in achieving sales targets.

Mass Media and Digital Marketing Campaigns

Mass media and digital marketing are crucial for China Overseas Land & Investment (COLI) to reach a broad audience and drive property sales. They invest heavily in extensive campaigns across online advertising, social media platforms like WeChat and Weibo, traditional print media, and prominent outdoor billboards to showcase their developments. These efforts are designed to not only generate qualified leads but also to solidify COLI's brand recognition and clearly articulate the unique value of their properties to potential buyers.

COLI's integrated marketing approach ensures maximum visibility and impact. For instance, in 2024, the company continued its aggressive digital push, with online channels accounting for a significant portion of its marketing spend, reflecting a broader industry trend. This strategy allows them to segment audiences effectively and tailor messaging, leading to higher engagement rates and a stronger connection with prospective customers across China's diverse market segments.

- Extensive Reach: Campaigns span digital (online ads, social media) and traditional channels (print, billboards) to capture a wide audience.

- Lead Generation and Brand Building: Marketing efforts focus on attracting potential buyers and strengthening COLI's brand reputation.

- Value Proposition Communication: Clear messaging highlights the benefits and unique selling points of COLI's property developments.

- Integrated Strategy: Combining various marketing avenues ensures comprehensive market penetration and visibility.

Investor Relations Portals and Financial Roadshows

China Overseas Land & Investment (COLI) actively engages its investor segment through comprehensive investor relations portals on its official website. These portals serve as a central hub for financial reports, press releases, and corporate governance information, ensuring transparency and accessibility for all stakeholders. For instance, in 2024, COLI's investor relations website consistently provided up-to-date financial disclosures, reflecting their commitment to open communication.

The company also leverages financial news platforms and participates in key industry events. These channels are vital for disseminating financial performance updates and strategic outlooks to a broader audience of institutional and individual investors. COLI's participation in major financial roadshows and conferences throughout 2024 facilitated direct engagement, allowing them to articulate their growth strategies and attract necessary capital.

These communication avenues are fundamental to COLI's business model, directly supporting its ability to secure funding and maintain investor confidence. By prioritizing transparency and proactive engagement, COLI strengthens its relationships with financial stakeholders, which is crucial for its ongoing development and capital acquisition efforts.

- Investor Relations Website: Centralized repository for financial reports, press releases, and corporate governance.

- Financial News Platforms: Dissemination of performance updates and strategic outlooks to a wide investor base.

- Financial Roadshows & Conferences: Direct engagement with institutional and individual investors to articulate growth strategies and secure capital.

- Transparency & Accessibility: Ensuring stakeholders have clear and timely access to crucial financial and strategic information.

China Overseas Land & Investment (COLI) utilizes a multi-faceted channel strategy, blending direct sales with broad market outreach. Company sales centers and showrooms remain paramount, offering immersive property experiences and direct customer interaction to drive sales conversions.

These physical touchpoints were a key focus in 2024, with COLI investing to showcase project quality. Complementing this, their official website serves as a digital storefront, providing property listings and corporate information, while external real estate agencies and broker networks significantly expand market reach and access diverse buyer segments.

Mass media and digital marketing campaigns across online and traditional platforms are crucial for lead generation and brand building. For 2024, digital channels represented a substantial portion of COLI's marketing spend, reflecting a strategic emphasis on targeted outreach and audience engagement.

COLI also maintains robust investor relations through its website and participation in financial events, ensuring transparency and facilitating capital acquisition. This integrated approach across sales, marketing, and investor communication underpins COLI's market presence and growth strategy.

Customer Segments

China Overseas Land & Investment (COLI) primarily targets individual purchasers in mainland China, Hong Kong, and Macau for their residential properties. This segment includes a broad range of buyers, from first-time homeowners and young families seeking affordable and convenient living spaces to affluent individuals desiring luxury apartments and villas with exclusive amenities.

In 2024, the Chinese property market continued to see demand from these segments, though affordability remained a key consideration for many. For instance, while property prices in major cities like Beijing and Shanghai remained high, government policies aimed at stabilizing the market and supporting first-time buyers influenced purchasing decisions. COLI's strategy often involves developing projects that cater to these diverse needs, from mass-market housing to high-end residences.

Commercial tenants and businesses are the core users of China Overseas Land & Investment's (COLI) properties, seeking office, retail, and mixed-use spaces. These entities, from burgeoning startups to established global corporations, prioritize strategic locations and robust infrastructure to support their operational needs and market presence. For instance, in 2023, COLI's rental income from commercial properties, a direct reflection of demand from this segment, reached approximately HKD 10.7 billion, demonstrating their crucial role.

Industrial Clients and Logistics Operators are a core customer base for China Overseas Land & Investment (COLI). This segment encompasses manufacturing firms, third-party logistics providers, and various industrial businesses that require specialized spaces like factories, distribution centers, and integrated industrial parks. In 2024, the demand for modern industrial facilities remained robust, driven by China's continued manufacturing output and the growth of e-commerce, which necessitates efficient warehousing and logistics infrastructure.

These clients prioritize functional infrastructure tailored to their operational needs, such as high ceilings, heavy-duty flooring, and specialized power or cooling systems. Logistical advantages are paramount, meaning proximity to major transportation hubs like ports, highways, and rail lines is a critical decision-making factor. For instance, COLI's industrial park developments often leverage their strategic locations near key economic zones and transportation arteries to attract and retain these businesses.

Institutional and Individual Investors

China Overseas Land & Investment (COLI) serves institutional and individual investors who are keen on real estate for both steady rental income and long-term growth. These sophisticated investors, including large investment funds and high-net-worth individuals, closely monitor COLI's portfolio of investment properties and its financial health as a listed company. Their primary drivers are robust returns and the inherent quality of the assets. In 2024, COLI continued to demonstrate its appeal to this segment, with its diversified property holdings and a track record of consistent financial performance.

For these investors, COLI's publicly traded status is a significant draw, offering transparency and liquidity. They evaluate COLI based on key financial metrics and the strategic management of its real estate assets. The company's ability to generate reliable rental yields and achieve capital appreciation on its properties directly impacts its attractiveness to this discerning group.

- Focus on Rental Income and Capital Appreciation: Investors seek consistent cash flow from rental properties and growth in property values over time.

- Interest in Investment Properties and Financial Performance: COLI's portfolio of income-generating assets and its overall financial health are critical evaluation points.

- Emphasis on Returns and Asset Quality: Investors prioritize measurable financial returns and the underlying quality and stability of the real estate assets.

- Attraction to Publicly Traded Status: The transparency and liquidity offered by COLI as a publicly traded entity are key factors for institutional and individual investors.

Property Owners and Residents Requiring Management Services

This segment focuses on individuals and businesses that own property within China Overseas Land & Investment's projects and need professional management. This covers homeowners looking for upkeep and community support, and commercial property owners requiring expert building oversight. They prioritize ease of use and protecting their property's value.

For instance, in 2024, China Overseas Property Services, a key subsidiary, managed a vast portfolio. This included over 200 million square meters of property across numerous cities. Their services range from routine maintenance and security to more specialized needs like smart building technology integration, aiming to enhance resident satisfaction and property longevity.

- Residential Owners: Seeking reliable maintenance, security, and community engagement services to preserve and enhance their living environment.

- Commercial Property Owners: Requiring professional building operations, tenant management, and asset enhancement to ensure optimal returns and operational efficiency.

- Value Proposition: Convenience, asset preservation, and a higher quality of life or business operations through expert management.

- Market Trend: Growing demand for integrated smart home and building management solutions, with China Overseas Property Services investing in digital platforms to meet these evolving needs.

COLI's customer segments are diverse, encompassing individual homebuyers in mainland China, Hong Kong, and Macau, ranging from first-time buyers to affluent individuals seeking luxury residences. Commercial tenants, including startups and global corporations, are crucial for office, retail, and mixed-use spaces, prioritizing strategic locations. Industrial clients and logistics operators require specialized facilities, with demand in 2024 driven by manufacturing and e-commerce growth.

Institutional and individual investors are attracted to COLI's property portfolio for rental income and capital appreciation, valuing its financial performance and asset quality. Additionally, property owners within COLI projects rely on professional management services for maintenance and operational efficiency, with a growing demand for smart building solutions.

| Customer Segment | Key Needs | 2024/Recent Data Points |

|---|---|---|

| Individual Homebuyers | Affordable housing, luxury residences | Continued demand, affordability a key consideration in major cities. |

| Commercial Tenants | Office, retail, mixed-use spaces, strategic locations | Rental income from commercial properties in 2023 was approx. HKD 10.7 billion. |

| Industrial Clients | Factories, distribution centers, industrial parks | Robust demand in 2024 driven by manufacturing and e-commerce. |

| Investors | Rental income, capital appreciation, financial performance | COLI's diversified holdings and consistent financial performance appeal to this segment. |

| Property Owners (for Management) | Maintenance, security, smart building tech | Over 200 million sqm managed by China Overseas Property Services in 2024. |

Cost Structure

The most significant expense for China Overseas Land & Investment (COLI) is acquiring land use rights, a crucial step for any new development. This involves a considerable upfront investment, with costs fluctuating based on the land's location, size, and prevailing market demand. For instance, in 2024, COLI continued its strategic land banking, allocating substantial capital to secure prime development sites across key Chinese cities, reflecting the foundational nature of these acquisition costs.

Construction and development costs are a significant component, covering everything from raw materials like steel and concrete to labor wages and the fees paid to specialized subcontractors. For China Overseas Land & Investment (COLI), managing these expenses effectively is paramount. In 2024, the company likely faced fluctuating material prices, a common challenge in the global construction sector.

Beyond the physical build, these costs also include essential pre-construction activities such as architectural design, detailed engineering plans, and project management overheads. COLI's ability to control these expenses directly impacts its profitability and its capacity to offer competitive pricing for its properties in the dynamic Chinese real estate market.

China Overseas Land & Investment, like many property developers, faces significant financing and interest costs due to the capital-intensive nature of its projects. In 2024, the company's substantial debt obligations, including loans and bonds, translate into considerable interest expenses that directly affect its bottom line.

Managing these financing costs is paramount for maintaining profitability and financial stability. For instance, securing lower interest rates on its borrowings can substantially reduce overall project expenses, as even small differences in rates can amount to millions in savings for a company of this scale.

Sales, Marketing, and Administrative Expenses

China Overseas Land & Investment's Sales, Marketing, and Administrative Expenses are crucial for driving property demand and ensuring smooth operations. These costs encompass everything from large-scale advertising campaigns and maintaining a skilled sales force to the everyday running of corporate offices. In 2024, the company likely continued to invest significantly in digital marketing and customer relationship management to attract buyers in a competitive market.

Efficient management of these expenses is vital for profitability. For instance, in its 2023 financial reporting, the company highlighted its efforts to optimize sales and marketing spending while maintaining brand presence. This focus on efficiency helps ensure that resources are allocated effectively to generate maximum sales volume and maintain a strong corporate infrastructure.

- Sales and Marketing Costs: These include advertising, sales commissions, and the upkeep of sales galleries, all designed to attract and convert potential property buyers.

- Administrative Overheads: Covering corporate management, support staff salaries, and general operational expenses not directly linked to individual development projects.

- Efficiency Focus: China Overseas Land & Investment emphasizes optimizing these expenditures to enhance overall profitability and market competitiveness.

Property Management and Maintenance Costs

China Overseas Land & Investment (COLI) faces significant property management and maintenance costs for its extensive portfolio of investment properties and those under its management. These expenses encompass routine upkeep, repair work, security services, cleaning operations, and the management of utilities. For instance, in 2023, the company reported substantial expenditures in this area to ensure its properties remain attractive and functional for tenants, thereby safeguarding asset value and facilitating consistent income generation.

These operational outlays are crucial for maintaining tenant satisfaction, a key driver for recurring rental income and management fee revenue. Efficiently controlling these costs directly impacts COLI's overall profitability. The company's commitment to preserving asset quality through diligent maintenance is a cornerstone of its long-term investment strategy.

- Ongoing Maintenance and Repairs: Essential for preserving the physical condition and market value of properties.

- Security and Cleaning: Crucial for tenant safety, comfort, and the overall appeal of managed properties.

- Utility Management: Costs associated with providing and managing essential services like electricity, water, and gas.

- Impact on Profitability: Efficient management of these operational expenses is directly linked to the profitability of investment properties and management services.

China Overseas Land & Investment’s cost structure is heavily influenced by land acquisition, construction, and financing. In 2024, the company continued to invest in prime land, facing fluctuating material costs for development. Significant interest expenses on debt also form a core part of their outlays, directly impacting profitability. Efficient management of sales, marketing, and administrative overheads is crucial for maintaining competitiveness.

| Cost Category | Key Components | 2024 Focus/Considerations |

| Land Acquisition | Purchase of land use rights | Strategic land banking in key cities; fluctuating market prices. |

| Construction & Development | Materials, labor, subcontractors, design, project management | Managing volatile material prices; ensuring project efficiency. |

| Financing Costs | Interest on loans and bonds | Managing substantial debt obligations; impact of interest rate fluctuations. |

| Sales, Marketing & Admin | Advertising, commissions, corporate overheads | Investing in digital marketing; optimizing sales spend for market competitiveness. |

| Property Management & Maintenance | Upkeep, repairs, security, utilities | Ensuring property quality for tenant satisfaction and recurring income. |

Revenue Streams

China Overseas Land & Investment's (COLI) primary revenue engine is property sales, encompassing residential, commercial, and industrial developments. This income stream is bolstered by both pre-sales and sales of completed units, as well as significant bulk sales to institutional investors.

In 2024, COLI reported a substantial portion of its revenue derived from property sales, reflecting its core business. The company's ability to successfully market and sell its extensive property portfolio, often at competitive price points, directly impacts its overall financial performance and market position.

China Overseas Land & Investment secures consistent revenue through rental income generated from its extensive portfolio of investment properties, which predominantly include commercial and industrial buildings. This recurring income is a direct result of leasing out various spaces such as office units, retail outlets, and industrial facilities to a broad base of tenants.

For instance, in the first half of 2024, the company reported a substantial contribution from its investment property segment, underscoring the stability and reliability of this revenue stream. This diversified rental income is crucial for the company's financial resilience, providing a predictable cash flow that significantly bolsters its overall profitability and operational capacity.

China Overseas Land & Investment (COLI) generates revenue through property management fees, offering comprehensive services for its developed properties and potentially for external clients. These recurring fees are collected from property owners or residents for essential services like upkeep, security, and community management, ensuring a stable, service-driven income stream.

Land Use Rights Transfers

China Overseas Land & Investment (COLI) can generate revenue by selling or transferring undeveloped land use rights from its extensive land bank. This strategy is employed when specific parcels are no longer aligned with the company's development plans or when attractive market conditions allow for profitable divestment without undertaking full development.

These transfers represent a less frequent but potentially substantial source of capital, offering flexibility in managing its land assets. For instance, in 2023, COLI’s total land acquisitions amounted to RMB 121.4 billion, indicating active management of its land portfolio, which can include such strategic transfers.

- Monetizing Undeveloped Parcels: Selling land use rights without commencing development.

- Strategic Divestment: Offloading land parcels that no longer fit long-term strategies.

- Capital Injection: Generating significant, though sporadic, cash flow from land asset management.

- Portfolio Optimization: Enhancing land bank efficiency and financial flexibility.

Investment Gains and Other Income

China Overseas Land & Investment Ltd. (COLI) derives revenue not only from property sales but also from investment gains and other income. This segment captures profits from selling investment properties or other strategic assets. For instance, in 2023, COLI reported significant investment property disposals contributing to its overall financial results, though specific figures for this category are often embedded within broader financial statements.

Furthermore, interest earned on the company's substantial cash reserves and short-term investments forms another component of this revenue stream. While COLI maintains a strong liquidity position, the fluctuating interest rate environment in 2024 will influence the yield generated from these holdings.

Miscellaneous income, stemming from ancillary services or strategic partnerships within its extensive real estate ecosystem, also adds to this revenue category. These varied contributions, though often variable year-on-year, play a crucial role in bolstering COLI's financial performance beyond its core development activities.

- Investment Property Disposals: Realizing capital appreciation through the sale of investment properties.

- Interest Income: Earnings from the company's cash and short-term investment portfolios.

- Ancillary Services & Partnerships: Revenue generated from related business activities and collaborations.

COLI's revenue streams are diverse, anchored by property sales, which include both residential and commercial projects, as seen in their consistent sales performance throughout 2024. Complementing this is rental income from a substantial portfolio of investment properties, providing a stable, recurring cash flow. Property management fees offer another consistent income source, generated from services provided to their developments.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Property Sales | Revenue from selling residential, commercial, and industrial properties. | Primary revenue driver; performance directly impacts financial results. |

| Rental Income | Recurring income from leasing commercial and industrial spaces. | Provides financial resilience and predictable cash flow. |

| Property Management Fees | Fees for managing developed properties and providing services. | Stable, service-driven income stream. |

| Land Use Rights Transfers | Revenue from selling or transferring undeveloped land. | Strategic divestment to optimize land bank and generate capital. |

| Investment Gains & Other Income | Profits from selling investment properties, interest income, and ancillary services. | Bolsters overall financial performance beyond core development. |

Business Model Canvas Data Sources

The China Overseas Land & Investment Business Model Canvas is built using a combination of financial disclosures, industry analysis reports, and internal company strategic documents. These sources provide a comprehensive view of market positioning, operational efficiency, and financial health.