China Overseas Land & Investment Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Overseas Land & Investment Bundle

China Overseas Land & Investment strategically crafts its product offerings, from premium residential spaces to integrated commercial developments, catering to diverse market needs. Their pricing reflects a balance of value and premium positioning, while their extensive distribution network ensures wide market reach. Discover the intricate details of their promotional campaigns and how these elements synergize for market dominance.

Unlock a complete 4Ps Marketing Mix Analysis for China Overseas Land & Investment, offering a strategic blueprint of their product innovation, pricing strategies, expansive distribution channels, and impactful promotional activities. This ready-to-use, editable report is perfect for business professionals and students seeking actionable insights into a market leader's success.

Product

China Overseas Land & Investment Ltd. (COLI) centers its product strategy on residential properties, aiming to satisfy a broad spectrum of buyer preferences. This includes everything from entry-level apartments to premium developments.

The company's 'Infinite Horizons' series, a prime example of its high-end offerings, demonstrated strong market performance, recording substantial sales figures in 2024. This success underscores COLI's ability to connect with discerning buyers.

COLI's commitment to quality construction and innovative design is a cornerstone of its product development, ensuring its properties remain competitive and appealing in a dynamic real estate market.

China Overseas Land & Investment (COLI) actively develops and manages a diverse range of commercial properties, including modern office buildings and vibrant retail spaces. This segment is a key growth driver for the company, with recent launches contributing to double-digit revenue increases.

COLI's commitment to innovation is evident in flagship projects like the Shenzhen China Overseas Building and Beijing China Overseas Finance Centre. These developments are recognized for their advanced green and zero-carbon features, aligning with sustainability trends in the commercial real estate market.

China Overseas Land & Investment (COLI) extends its real estate expertise beyond residential and commercial sectors into industrial properties, a strategic move to diversify its portfolio and capture opportunities in logistics and manufacturing. This segment allows COLI to cater to a broader range of client needs within the dynamic Chinese economy.

While specific project details for industrial developments are less frequently highlighted in public disclosures compared to their residential offerings, COLI's involvement signifies an intent to leverage its development capabilities across various real estate verticals. This diversification is particularly relevant as China continues to focus on upgrading its industrial base and supply chain infrastructure, with industrial property demand remaining a key indicator of economic activity.

Property Investment

China Overseas Land & Investment (COLI) actively pursues property investment, holding a portfolio of assets for rental income and long-term capital growth. This strategic approach diversifies revenue streams beyond development sales, contributing to the company's financial resilience. COLI's investment philosophy centers on acquiring premium quality properties in prime locations, aiming for sustainable recurring income.

As of the first half of 2024, COLI's investment property portfolio demonstrated its value, with rental income playing a significant role in its financial performance. The company reported steady rental yields, underscoring the effectiveness of its strategy to build a stable income base. This segment is crucial for COLI's long-term financial health, providing a buffer against market fluctuations in the development sector.

COLI's commitment to acquiring high-quality assets is evident in its ongoing investment activities. The company has strategically expanded its investment property holdings, focusing on commercial and residential properties with strong leasing potential. This focus ensures that the acquired assets are well-positioned to generate consistent rental income and appreciate in value over time.

- Rental Income Contribution: COLI's investment properties generated a notable portion of its recurring income in H1 2024.

- Asset Quality Focus: The company prioritizes acquiring prime real estate for its investment portfolio.

- Long-Term Value Appreciation: COLI targets properties with strong potential for capital growth.

- Financial Stability: The investment property segment enhances COLI's overall financial stability and income diversification.

Property Management Services

China Overseas Land & Investment (COLI) offers extensive property management services, covering both its developed and invested real estate assets. This commitment ensures that properties are well-maintained, enhancing their overall value and tenant experience.

These services are crucial for COLI's strategy to maintain high living standards for residents and efficient operational environments for commercial tenants. By focusing on customer satisfaction and long-term asset upkeep, COLI strengthens its brand reputation and secures recurring revenue streams.

In 2023, COLI's property management segment continued to be a significant contributor, reflecting the company's dedication to service excellence. For instance, the company manages a vast portfolio, with its property management business actively serving millions of square meters across various cities in China.

- Comprehensive Portfolio Management: COLI's property management arm oversees a wide range of residential, commercial, and industrial properties, ensuring consistent quality and operational efficiency.

- Enhancing Asset Value: Proactive maintenance and service delivery directly contribute to the long-term appreciation and marketability of COLI's real estate holdings.

- Customer Satisfaction Focus: The emphasis on high living standards and responsive tenant services fosters loyalty and reduces vacancy rates.

- Operational Efficiency: By streamlining management processes, COLI optimizes costs and maximizes the profitability of its managed properties.

COLI's product strategy is multifaceted, encompassing high-quality residential developments, from entry-level to premium segments, as exemplified by the strong sales of its 'Infinite Horizons' series in 2024. Beyond residential, the company actively develops and manages commercial properties like the Shenzhen China Overseas Building, noted for its green features, and is strategically diversifying into industrial properties to cater to China's evolving economic needs.

Furthermore, COLI maintains a robust investment property portfolio, focusing on prime commercial and residential assets to generate recurring rental income and achieve long-term capital growth, which contributed significantly to its recurring income in H1 2024. Complementing these are extensive property management services, ensuring asset value enhancement and customer satisfaction across its vast managed portfolio, which serves millions of square meters.

| Property Segment | Key Offerings | 2024/2025 Highlights |

|---|---|---|

| Residential | Entry-level apartments to premium developments | Strong sales for 'Infinite Horizons' series |

| Commercial | Office buildings, retail spaces | Double-digit revenue increases from new launches; Shenzhen China Overseas Building recognized for green features |

| Industrial | Logistics and manufacturing facilities | Strategic diversification into a key growth area for China's economy |

| Investment Properties | Premium commercial and residential assets | Notable contribution to recurring income in H1 2024; focus on prime locations and rental yields |

| Property Management | Maintenance, tenant services for all asset types | Manages millions of square meters, enhancing asset value and customer satisfaction |

What is included in the product

This analysis provides a comprehensive breakdown of China Overseas Land & Investment's marketing strategies, detailing their product offerings, pricing structures, distribution channels, and promotional activities.

It offers insights into how the company positions itself in the competitive real estate market, making it valuable for strategic planning and competitive benchmarking.

Simplifies China Overseas Land & Investment's complex 4Ps strategy into actionable insights, alleviating the pain of understanding their market approach.

Provides a clear, concise overview of COL's marketing mix, resolving the difficulty of grasping their competitive positioning.

Place

China Overseas Land & Investment (COLI) strategically centers its operations on mainland China, developing and investing in a diverse range of properties. This focus is fundamental to its market penetration and brand recognition.

COLI commands a significant market share in crucial Chinese cities, consistently ranking among the top three developers in major metropolises like Beijing, Shanghai, Guangzhou, and Shenzhen. For instance, in 2023, COLI was recognized as one of the top developers by sales in these tier-1 cities, underscoring its dominant position.

This deep and extensive footprint across mainland China is the cornerstone of COLI's marketing strategy, enabling it to leverage economies of scale and cater to a broad customer base within the nation's dynamic real estate landscape.

Hong Kong is a cornerstone for China Overseas Land & Investment (COLI), serving not only as its incorporation location but also as a vital market. The company's shares are traded on The Stock Exchange of Hong Kong Limited, underscoring its deep integration into the city's financial landscape. COLI's ongoing land acquisitions and property developments in Hong Kong demonstrate a persistent commitment to this key international financial center.

China Overseas Land & Investment (COLI) actively participates in Macau's property market, contributing to its diverse real estate landscape. While specific recent project announcements may be limited, COLI's presence signifies its strategic engagement with this key economic hub within China.

Strategic Land Acquisitions

Strategic land acquisitions are a cornerstone of China Overseas Land & Investment's (COLI) long-term growth strategy, ensuring a robust pipeline for future projects. The company consistently identifies and secures land parcels in key urban centers and economically vibrant regions across China. This proactive approach to land banking is crucial for maintaining competitive advantage and meeting evolving market demands.

COLI's commitment to strategic land acquisition was evident in mid-2025. For example, in June 2025, the company successfully acquired five significant land parcels. These acquisitions spanned major cities including Beijing, Qingdao, Tianjin, and Jinan. This move underscores COLI's focus on locations with substantial development potential and strong economic fundamentals.

- Strategic Land Banking: COLI actively replenishes its land reserves in key growth areas.

- Mid-2025 Acquisitions: Five land parcels were secured in June 2025.

- Key Locations: Acquisitions included Beijing, Qingdao, Tianjin, and Jinan.

- Future Development Focus: These strategic purchases support COLI's ongoing expansion and project pipeline.

Direct Sales and Marketing Channels

China Overseas Land & Investment (COLI) heavily relies on direct sales and marketing channels, a strategy that consistently drives strong performance at project launches. This direct-to-consumer approach allows COLI to capture market interest effectively and convert it into sales quickly. The company's commitment to this model is evident in its transparent reporting of contracted sales figures and sales areas, offering a clear view of its direct engagement with buyers.

COLI's sales performance is a key indicator of its marketing effectiveness. For instance, in the first half of 2024, COLI reported contracted sales of RMB 126.6 billion, demonstrating the power of its direct sales strategy. This figure represents a significant portion of its annual targets and highlights the success of its project launches in attracting direct buyer interest.

- Direct Sales Focus: COLI prioritizes direct sales channels to connect with customers, leading to robust launch sales.

- Performance Transparency: Regular disclosures of contracted sales and sales areas underscore the direct-to-consumer model.

- H1 2024 Sales: Contracted sales reached RMB 126.6 billion in the first half of 2024, showcasing strong market reception.

China Overseas Land & Investment (COLI) strategically focuses its development and investment activities primarily on mainland China, establishing a strong presence in key metropolitan areas. This geographical concentration allows COLI to cultivate deep market understanding and brand loyalty within China's rapidly urbanizing landscape.

COLI maintains a significant footprint in major Chinese cities, consistently ranking among the top developers by sales in tier-1 locations such as Beijing, Shanghai, Guangzhou, and Shenzhen. This dominance in crucial economic hubs ensures broad market access and brand recognition.

The company's operations extend to Hong Kong, where it is incorporated and actively engages in property development and land acquisition, reinforcing its position in this international financial center. COLI also participates in Macau's property market, contributing to its real estate sector.

COLI's strategic land acquisition in mid-2025, including five parcels in cities like Beijing and Tianjin, highlights its commitment to securing future development opportunities in high-potential regions. This proactive land banking ensures a steady pipeline of projects to meet market demand.

What You See Is What You Get

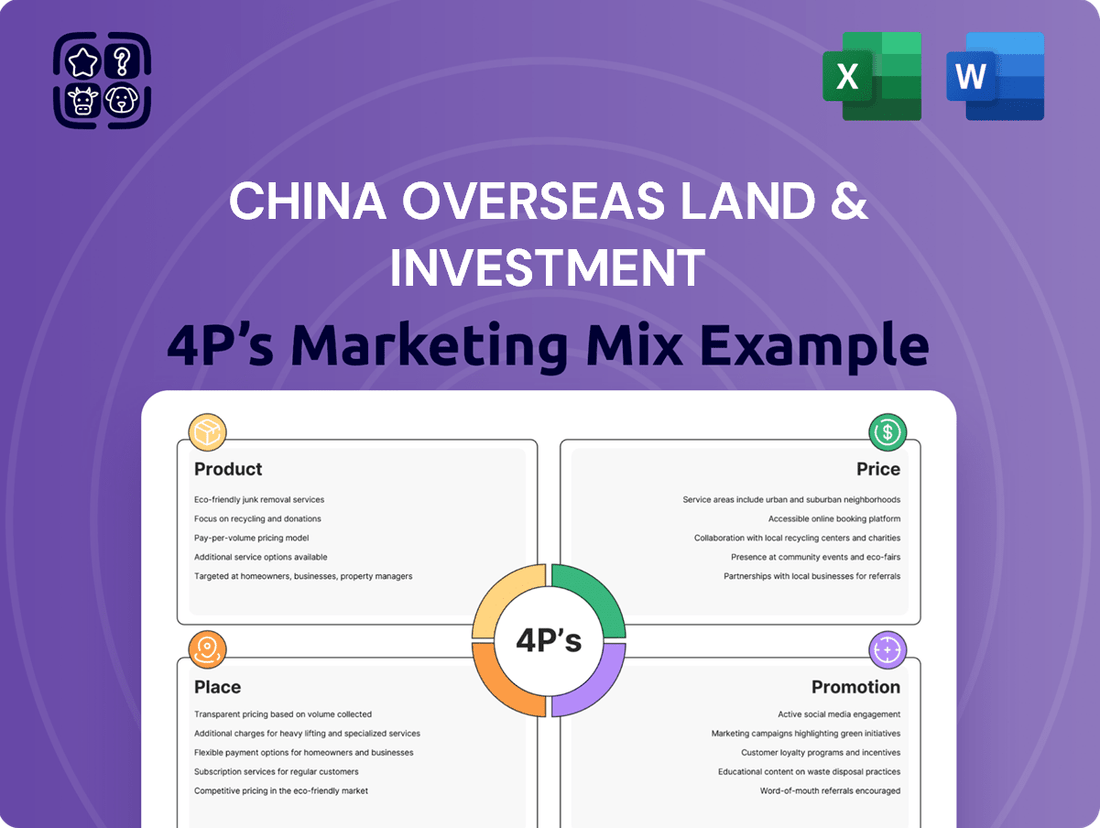

China Overseas Land & Investment 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Overseas Land & Investment 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

China Overseas Land & Investment (COLI) actively manages its investor relations through consistent financial reporting, including timely annual and interim reports, and participation in key investment conferences. This proactive approach ensures clear communication of the company's performance and strategic vision.

COLI's commitment to transparency is further demonstrated by its provision of Environmental, Social, and Governance (ESG) reports, offering stakeholders a comprehensive view of its operations. For instance, in its 2024 interim report, COLI highlighted a 5% year-on-year increase in revenue, underscoring its financial stability and growth trajectory.

China Overseas Land & Investment leverages its commitment to corporate sustainability and Environmental, Social, and Governance (ESG) reporting as a key promotional element. Their 'Four Excellences' strategy underpins this dedication, aiming for holistic development. This focus is further solidified by their comprehensive ESG reports, which detail their performance and initiatives.

The company's strong ESG credentials are well-recognized, evidenced by high ratings from MSCI ESG. For instance, in 2024, MSCI ESG rated COLI as AA, reflecting a robust approach to sustainability. This recognition, along with their inclusion in the S&P Global Sustainability Yearbook, significantly boosts their appeal to investors prioritizing social responsibility and long-term value creation.

China Overseas Land & Investment (COLI) excels at generating excitement for its developments through carefully orchestrated project-specific launches and sales events. These occasions are designed to capture immediate market attention and often result in impressive initial sales figures, demonstrating a potent promotional strategy.

For instance, COLI’s 'Protagonist of Time' project in Zhengzhou and 'Arbour I' in Shanghai both experienced record-breaking sales during their launch events. This highlights the company's ability to create significant market buzz, translating directly into rapid customer acquisition and sales momentum for new properties.

Awards and Recognitions

China Overseas Land & Investment (COLI) actively uses its achievements to build a stronger brand and assure customers about the quality of its offerings. These awards act as significant endorsements, reinforcing the company's commitment to excellence and innovation in the real estate sector.

For instance, COLI's recognition as a Platinum Winner at the 2024 MUSE Design Awards highlights its design prowess. Furthermore, being named the World's Number 1 LSEG ESG Real Estate Operations Company in 2024 underscores its leadership in sustainable and responsible business practices. These accolades directly support COLI's promotional strategies by providing tangible proof of its superior performance and market standing.

- Industry Accolades: COLI's commitment to design excellence is validated by awards such as the Platinum Winner at the 2024 MUSE Design Awards.

- ESG Leadership: The company’s dedication to environmental, social, and governance principles is recognized by its ranking as the World's Number 1 LSEG ESG Real Estate Operations Company in 2024.

- Brand Credibility: These recognitions enhance COLI's brand image and product credibility, serving as powerful promotional tools.

Brand Building and Market Leadership Communication

China Overseas Land & Investment (COLI) actively cultivates its brand by consistently communicating its market leadership and robust financial standing. This strategy aims to position COLI as a stable and preeminent property developer, thereby fostering trust among both prospective customers and investors.

COLI's communication emphasizes its top-tier performance, exemplified by its ranking as first in attributable sales and new land acquisition volume within the property sector. For instance, in 2023, COLI reported attributable sales of RMB 268.4 billion, underscoring its market dominance. This data reinforces the brand's image of reliability and strength in a competitive landscape.

Furthermore, the company highlights its significant market share in strategically important cities, demonstrating its deep penetration and influence in key economic hubs. This focus on localized strength complements its overall national leadership narrative.

- Market Leadership: COLI consistently ranks first in key industry metrics such as attributable sales and new land acquisition.

- Financial Strength: The company communicates its strong financial position to build confidence among stakeholders.

- Brand Reinforcement: By highlighting its market share in major cities, COLI solidifies its brand as a leading and stable developer.

- Investor Confidence: This communication strategy is designed to attract and retain both buyers and investors by showcasing stability and success.

COLI's promotional efforts effectively leverage project-specific launches and sales events to generate immediate market interest and drive initial sales. For example, the 'Protagonist of Time' project in Zhengzhou and 'Arbour I' in Shanghai achieved record sales during their launch events, showcasing COLI's ability to create buzz and capture customer attention rapidly.

The company also utilizes industry accolades and strong ESG credentials as promotional tools, enhancing brand credibility and appealing to socially conscious investors. COLI's recognition as a Platinum Winner at the 2024 MUSE Design Awards and its ranking as the World's Number 1 LSEG ESG Real Estate Operations Company in 2024 underscore its commitment to quality and sustainability.

Furthermore, COLI consistently promotes its market leadership and financial stability, reinforcing its brand as a reliable and preeminent developer. Reporting RMB 268.4 billion in attributable sales for 2023 highlights its dominant market position and provides tangible evidence of its strength to stakeholders.

| Promotional Tactic | Key Achievement/Example | Impact |

|---|---|---|

| Project Launches & Sales Events | Record sales for 'Protagonist of Time' (Zhengzhou) & 'Arbour I' (Shanghai) | Immediate market attention, rapid sales momentum |

| Industry Awards & ESG Recognition | 2024 MUSE Design Awards (Platinum Winner), World's #1 LSEG ESG Real Estate Operations Company (2024) | Enhanced brand credibility, appeal to ESG investors |

| Market Leadership & Financial Communication | RMB 268.4 billion attributable sales (2023) | Reinforced brand as stable, preeminent developer; built stakeholder trust |

Price

China Overseas Land & Investment (COLI) strategically employs competitive pricing to draw in its target clientele, ensuring its property offerings align with their perceived value. In 2023, COLI's average selling price per square meter across its projects demonstrated its market positioning, though specific figures vary by city and project tier. For instance, in Tier 1 cities like Beijing and Shanghai, prices often exceeded RMB 70,000 per square meter, reflecting premium locations and amenities, while Tier 2 cities saw averages closer to RMB 20,000-30,000 per square meter.

Operating within China's fluctuating real estate landscape, COLI consistently adapts its pricing to stay competitive and accessible. This involves closely monitoring market demand, competitor pricing strategies, and government policies. For example, during periods of market cooling, COLI might offer more flexible payment terms or minor discounts to maintain sales momentum and market share, a tactic observed in various regional markets throughout 2023 and early 2024.

Despite potential market downturns, COLI's objective remains to sustain robust sales performance. The company's pricing approach is designed to balance profitability with market penetration, even when facing economic headwinds. In 2024, the company continued to focus on quality developments and efficient cost management to support its pricing strategy, aiming to achieve its sales targets despite broader industry challenges.

China Overseas Land & Investment (COLI) likely employs value-based pricing for its premium offerings, such as the 'Infinite Horizons' residential projects. This strategy directly links the price to the exceptional design, advanced features, and overall quality that these high-end developments provide, appealing to a discerning, affluent customer base.

This approach allows COLI to command premium price points, reflecting the significant product differentiation and the perceived superior value delivered to buyers. For instance, in 2024, prime residential property in Tier 1 cities where COLI operates saw average price per square meter increases, underscoring the market’s willingness to pay for quality and exclusivity.

While China Overseas Land & Investment (COLI) doesn't publicly detail specific discount strategies, the company's performance in China's dynamic property sector suggests an ability to adapt pricing. For instance, COLI's monthly sales often reflect market conditions, hinting at the potential use of promotions to meet sales goals. This flexibility is crucial in a market where demand can fluctuate significantly.

However, the regulatory landscape plays a vital role. In 2024, some Chinese cities have advised developers against offering deep discounts, citing concerns about market stability and potential impacts on property values. This regulatory pressure means COLI's promotional activities, if any, would need to be carefully calibrated to comply with local guidelines while still stimulating buyer interest.

Financing Options and Credit Terms

China Overseas Land & Investment (COLI) likely structures its pricing with a keen eye on financing options and credit terms to broaden buyer accessibility. The company's robust financial standing and international credit ratings, such as an A- from S&P as of early 2024, enable attractive financing packages for its clientele.

COLI's optimized debt structure and low borrowing costs, evidenced by their average financing costs remaining competitive in the market, translate into more favorable loan terms for purchasers. This strategic approach to financing is crucial for making their property offerings more attainable.

- Favorable Financing: COLI leverages its strong credit ratings to secure advantageous financing terms for buyers, potentially including lower interest rates or extended repayment periods.

- Competitive Interest Rates: The company's low borrowing costs allow it to offer competitive mortgage rates, making property acquisition more affordable.

- Accessibility: By providing flexible credit terms, COLI aims to remove financial barriers, thereby expanding its customer base.

- Financial Strength: COLI's solid financial health underpins its ability to offer these customer-centric financing solutions.

Market Demand and Economic Conditions

China Overseas Land & Investment's (COLI) pricing is heavily influenced by the broader economic climate and real estate market demand, especially within China. The Chinese property sector has experienced considerable headwinds, impacting purchasing power and developer strategies.

COLI actively tracks sales performance and prevailing market sentiment. This allows them to fine-tune their pricing to meet annual sales objectives, even when facing market volatility. For instance, in the first half of 2024, COLI reported a 10.6% year-on-year decrease in property sales to RMB 142.7 billion, reflecting the challenging market conditions.

- Market Pressure: The Chinese real estate market's downturn in 2024 has put downward pressure on prices, forcing developers like COLI to be more competitive.

- Sales Monitoring: COLI closely watches sales figures and buyer interest to adapt its pricing in real-time.

- Target Achievement: Pricing adjustments are strategic, aiming to secure the company's annual operating and sales targets amidst economic uncertainty.

- Economic Sensitivity: COLI's pricing strategy is inherently linked to macroeconomic trends and consumer confidence in the property sector.

China Overseas Land & Investment (COLI) employs a dynamic pricing strategy, balancing premium positioning with market accessibility. In 2023, average selling prices in Tier 1 cities like Beijing and Shanghai often surpassed RMB 70,000 per square meter, reflecting prime locations. Conversely, Tier 2 cities saw prices averaging RMB 20,000-30,000 per square meter, demonstrating a tiered approach to different market segments.

COLI's pricing is sensitive to market fluctuations and regulatory guidance. While aiming for profitability, the company adapts to economic headwinds, as seen in its first half of 2024 sales performance, which declined by 10.6% year-on-year. This necessitates flexible pricing, potentially including promotions, though tempered by 2024 regulatory advice against deep discounts to maintain market stability.

The company also leverages its strong financial standing, evidenced by an S&P A- rating in early 2024, to offer attractive financing options. This makes property acquisition more attainable for buyers, underpinning COLI's ability to achieve sales targets by enhancing affordability and expanding its customer base, especially amidst a challenging property market.

| Metric | 2023 (Approx.) | H1 2024 (Approx.) | Notes |

| Tier 1 City Avg. Price/sqm | > RMB 70,000 | N/A | Reflects premium locations and amenities. |

| Tier 2 City Avg. Price/sqm | RMB 20,000-30,000 | N/A | Indicative of broader market accessibility. |

| Property Sales Value | N/A | RMB 142.7 billion | Represents a 10.6% YoY decrease, indicating market pressure. |

| S&P Credit Rating | N/A | A- | Facilitates favorable buyer financing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for China Overseas Land & Investment is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and market intelligence reports. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.