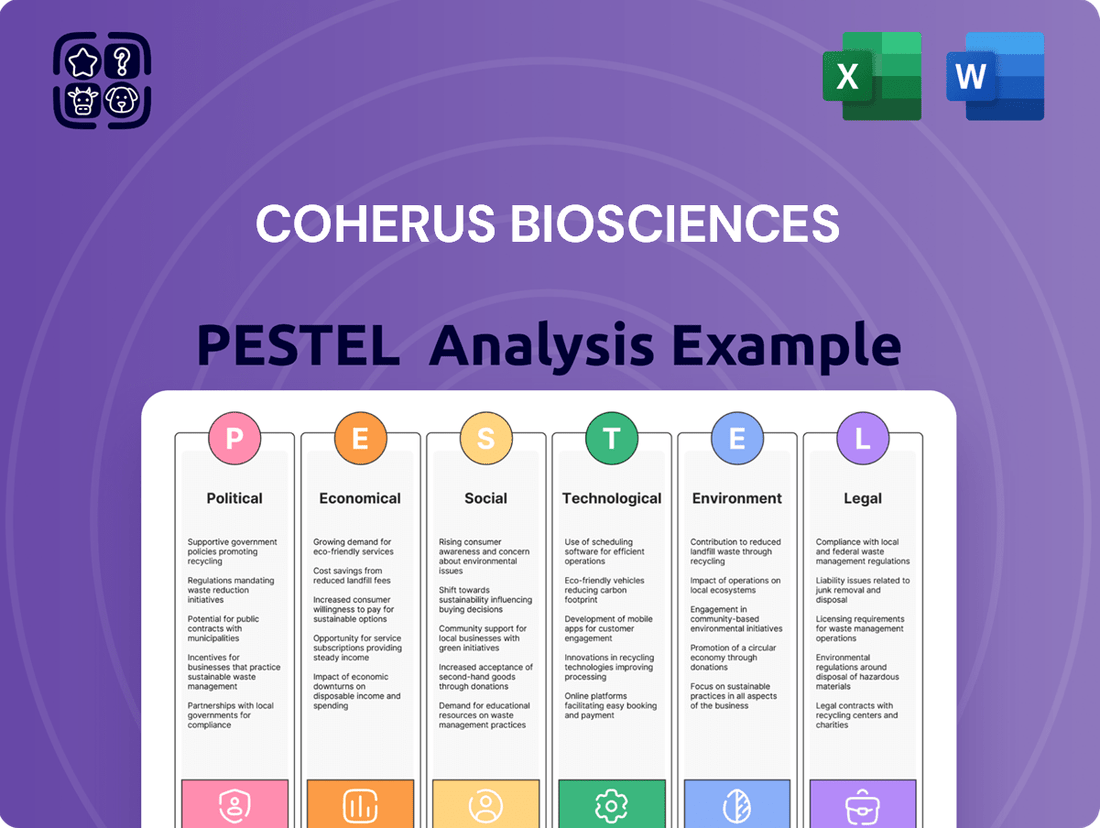

Coherus Biosciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherus Biosciences Bundle

Navigate the complex external forces shaping Coherus Biosciences's trajectory with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are creating both opportunities and challenges for the company. Gain a strategic advantage by leveraging these expert insights to inform your investment decisions or business planning. Download the full PESTLE analysis now and unlock a deeper understanding of Coherus Biosciences's market landscape.

Political factors

Government healthcare policies are a significant driver for Coherus BioSciences. Initiatives aimed at promoting biosimilar adoption, such as favorable reimbursement rates and streamlined approval pathways, directly benefit companies like Coherus. For instance, the Inflation Reduction Act of 2022, while primarily focused on drug price negotiation, also signals a broader political intent to manage healthcare costs, which indirectly supports the market for more affordable biosimilars.

Value-based care models, increasingly favored by policymakers, also play a crucial role. These models incentivize providers to focus on patient outcomes and cost-effectiveness, creating a fertile ground for biosimilars that offer comparable efficacy at a lower price point. Coherus's focus on developing and commercializing biosimilars for high-value biologics aligns well with this policy trend, potentially accelerating their market penetration and uptake.

Conversely, restrictive policies or a lack of political will to support biosimilar competition could pose challenges. Delays in regulatory review, inadequate reimbursement, or policies that favor originator biologics can create significant barriers to market entry and growth for Coherus. The political landscape's stance on healthcare affordability and innovation will continue to shape the opportunities and hurdles Coherus faces in the coming years.

The ongoing debate and implementation of drug pricing regulations, especially in key markets like the United States, directly impact Coherus Biosciences' revenue. Policies designed to curb pharmaceutical costs can boost demand for more affordable biosimilars, but they also create pressure on how Coherus prices its products. For instance, the Inflation Reduction Act of 2022, which allows Medicare to negotiate prices for certain high-cost drugs, could influence the market landscape for biologics and biosimilars in the coming years.

The clarity and efficiency of biosimilar approval pathways, like those managed by the FDA and EMA, directly impact Coherus Biosciences' ability to bring its products to market. Streamlined processes are crucial for reducing development timelines and costs, allowing for quicker market entry for biosimilars such as Coherus's Udenyca. For instance, the FDA's pathway, established by the Biologics Price Competition and Innovation Act (BPCIA), has been evolving, with the agency aiming to enhance predictability for developers.

Changes or ambiguities in these regulatory frameworks present significant hurdles for Coherus. The FDA's continued efforts to refine its biosimilar review process, including guidance on interchangeability, aim to foster greater competition. As of early 2024, the agency has approved over 40 biosimilars, demonstrating an ongoing commitment to facilitating market access, though specific pathway adjustments can still introduce uncertainty for pipeline planning.

International Trade Agreements

International trade agreements significantly shape Coherus Biosciences' global strategy, particularly concerning its biosimilar products. These agreements dictate market access, pricing, and the enforceability of intellectual property (IP) rights, which are crucial for biosimilar manufacturers. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, includes provisions on intellectual property that could influence how Coherus navigates these markets.

Tariffs and trade disputes can directly impact Coherus's supply chain and profitability. A notable example is the ongoing trade friction between the United States and China, which has seen fluctuating tariff rates on various goods. Such disruptions can increase the cost of raw materials or finished products, affecting the competitive pricing of biosimilars. In 2023, global trade growth was estimated to be around 0.9%, a slowdown that highlights the sensitivity of international commerce to political factors.

Expanding into new international markets necessitates a deep understanding of diverse political landscapes and existing trade relations. Coherus must consider the regulatory frameworks and patent protection laws in each target country. For example, the European Union's unified market and its specific regulations for biosimilars offer a different pathway compared to navigating individual national markets in Asia or Latin America. The World Trade Organization (WTO) plays a role in setting global trade rules, but regional agreements often take precedence in day-to-day operations.

- Intellectual Property Protection: Global trade pacts, like those overseen by the WTO, define the strength and duration of patent protections, directly impacting Coherus's ability to launch and compete with biosimilars.

- Market Access and Tariffs: Trade agreements can reduce or eliminate tariffs, facilitating easier market entry for Coherus's products, while trade disputes can impose barriers and increase costs. For example, the US Chamber of Commerce reported that tariffs can add significant costs to imported goods used in manufacturing.

- Regulatory Harmonization: International agreements can promote regulatory harmonization, simplifying the approval process for biosimilars across different countries, though significant variations still exist.

- Geopolitical Stability: The stability of trade relations and the absence of major geopolitical conflicts are essential for Coherus to maintain stable supply chains and predictable market conditions for its international sales.

Political Stability and Healthcare Budgets

Political stability in Coherus's key markets, particularly the United States and Europe, is crucial. Changes in government or policy can directly affect healthcare spending and reimbursement policies for biosimilars, impacting Coherus's revenue streams. For instance, shifts in US political administrations can alter the approach to drug pricing and biosimilar adoption incentives.

The allocation of national healthcare budgets significantly influences the purchasing power for pharmaceuticals, including biosimilars. Economic downturns or a reallocation of government priorities can lead to budget constraints within healthcare systems. This could result in reduced uptake or downward pressure on the pricing of biosimilars, directly affecting Coherus's market penetration and profitability.

Coherus must closely monitor these macro-political trends and their potential impact on its business.

- Political Stability: Continued stability in the US and EU markets supports predictable healthcare policies.

- Healthcare Budget Allocation: Government decisions on healthcare spending directly influence the market size for biosimilars.

- Reimbursement Policies: Favorable reimbursement landscapes are critical for biosimilar adoption and pricing.

- Regulatory Environment: Evolving regulatory frameworks for biosimilars can create both opportunities and challenges.

Government healthcare policies are a significant driver for Coherus BioSciences, with initiatives promoting biosimilar adoption directly benefiting the company. The Inflation Reduction Act of 2022, while focused on drug price negotiation, signals a broader political intent to manage healthcare costs, indirectly supporting the market for more affordable biosimilars.

Value-based care models, increasingly favored by policymakers, incentivize providers to focus on patient outcomes and cost-effectiveness, creating a fertile ground for biosimilars. Coherus's focus on developing biosimilars for high-value biologics aligns well with this trend, potentially accelerating market penetration.

Restrictive policies or a lack of political will to support biosimilar competition can pose challenges, such as delays in regulatory review or inadequate reimbursement. The political landscape's stance on healthcare affordability and innovation will continue to shape Coherus's opportunities and hurdles.

The clarity and efficiency of biosimilar approval pathways, managed by agencies like the FDA, directly impact Coherus's ability to bring products to market. Streamlined processes reduce development timelines and costs, allowing for quicker market entry. As of early 2024, the FDA had approved over 40 biosimilars, demonstrating a commitment to market access.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Coherus Biosciences, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic planning by identifying key opportunities and threats within the biosciences sector.

A clear, actionable summary of Coherus Biosciences' PESTLE analysis, presented with a focus on identifying and mitigating external threats and capitalizing on opportunities, thereby acting as a critical pain point reliever for strategic planning.

Economic factors

Global healthcare spending is projected to reach $11.6 trillion by 2025, up from an estimated $10 trillion in 2023, according to Deloitte. This upward trend in healthcare expenditures, driven by aging populations and advancements in medical technology, directly influences the market size and growth potential for biosimilar manufacturers like Coherus Biosciences.

The increasing financial burden of healthcare costs is a significant economic driver for biosimilar adoption. In the United States, prescription drug spending alone reached $348 billion in 2022, highlighting the substantial costs that payers and patients face. This economic pressure creates a favorable environment for biosimilars, which offer substantial cost savings compared to their originator biologic counterparts, thereby expanding market opportunities for Coherus.

The economic value proposition of biosimilars, offering significant cost savings compared to originator biologics, is a primary driver for their adoption. For instance, biosimilars for adalimumab, like Coherus's Udenyca, have shown the potential to reduce annual treatment costs by hundreds of millions of dollars for healthcare systems. Payers and healthcare systems are increasingly focused on cost-efficiency without compromising quality, making this a crucial factor.

Coherus's ability to clearly demonstrate the cost-effectiveness of its biosimilar products is key to market penetration. Studies in 2024 and projections for 2025 indicate that biosimilar uptake can lead to substantial savings, with some analyses suggesting billions in potential savings across various therapeutic areas. This focus on economic value directly influences formulary placement and reimbursement decisions, impacting Coherus's commercial success.

Inflation and interest rates significantly shape Coherus Biosciences' financial landscape. For instance, the US inflation rate hovered around 3.4% in April 2024, impacting the cost of raw materials and R&D. The Federal Reserve's benchmark interest rate, maintained between 5.25% and 5.50% as of May 2024, directly affects the cost of capital for Coherus's expansion and new drug development initiatives.

Competitive Landscape and Pricing Pressure

The biosimilar market is fiercely competitive, with numerous players vying for market share against both biosimilar rivals and established originator biologics. This intense rivalry directly translates into significant pricing pressure, forcing companies like Coherus to carefully calibrate their pricing strategies to remain competitive while ensuring profitability.

For Coherus, this means navigating complex tender processes and rebate structures common in the pharmaceutical industry. Successfully gaining market share often requires aggressive pricing, which can impact gross margins. For instance, in the U.S. biosimilar market, pricing discounts on biosimilars compared to reference products can range significantly, impacting revenue per unit.

- Intense Competition: The biosimilar market faces competition from multiple manufacturers and originator biologics.

- Pricing Pressure: Fierce competition leads to downward pressure on prices, affecting profit margins.

- Strategic Pricing: Coherus must balance market penetration with profitability through strategic pricing decisions.

- Navigating Rebates: The company must manage complex rebate programs and tender processes to secure market access.

Global Economic Growth

Global economic growth directly impacts Coherus BioSciences by influencing healthcare spending and the adoption of biosimilars. A robust global economy generally translates to higher disposable incomes, allowing patients and healthcare systems to afford more advanced treatments. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which could moderate healthcare investment, but still indicates expansion.

Economic downturns, conversely, can strain healthcare budgets, leading to increased price sensitivity and a greater demand for cost-effective alternatives like biosimilars. As of early 2025, many developed economies are navigating persistent inflation and higher interest rates, which could pressure healthcare providers to seek savings. This environment, however, could also accelerate biosimilar uptake as payers and providers look for ways to manage costs.

The accessibility of healthcare and government funding for health initiatives are also tied to the broader economic climate. In periods of strong growth, governments may allocate more resources to public health programs and drug reimbursements, benefiting companies like Coherus. Conversely, during economic contractions, such funding can be reduced, potentially impacting market access for new therapies.

- Global economic growth forecast for 2024: 3.2% (IMF projection).

- Impact on healthcare spending: Strong growth boosts disposable income and healthcare budgets.

- Economic contractions: Can lead to budget constraints and increased demand for cost-saving biosimilars.

- Inflationary pressures: May influence payer decisions towards biosimilar adoption in 2024/2025.

The global economic landscape significantly influences Coherus Biosciences' operational environment. Projected global growth of 3.2% for 2024, as per the IMF, suggests continued, albeit moderate, expansion in healthcare spending. However, persistent inflation and higher interest rates in many developed economies during 2024 and early 2025 are creating budget pressures for healthcare providers, potentially accelerating the adoption of cost-saving biosimilars like those offered by Coherus.

The company's financial health is directly impacted by inflation and interest rates. With US inflation around 3.4% in April 2024 and the Federal Reserve's benchmark rate at 5.25%-5.50% as of May 2024, Coherus faces increased costs for raw materials and R&D, alongside a higher cost of capital for expansion and development.

Intense competition within the biosimilar market, including from originator biologics, exerts significant pricing pressure. This necessitates strategic pricing by Coherus to balance market penetration with profitability, often involving navigating complex rebate structures and tender processes to secure market access.

| Economic Factor | 2024/2025 Data Point | Impact on Coherus Biosciences |

| Global Economic Growth | IMF projection: 3.2% for 2024 | Moderates healthcare investment but still indicates expansion. |

| Inflation Rate (US) | Approx. 3.4% (April 2024) | Increases costs for raw materials and R&D. |

| Federal Funds Rate (US) | 5.25%-5.50% (May 2024) | Raises the cost of capital for Coherus's initiatives. |

| Healthcare Spending Trend | Projected to reach $11.6 trillion by 2025 | Increases market size and growth potential for biosimilars. |

What You See Is What You Get

Coherus Biosciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Coherus Biosciences provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The world's population is getting older, and with that comes a rise in long-term health conditions. This is especially true for areas like cancer and immune system disorders, which are key markets for Coherus Biosciences. For instance, in 2023, the World Health Organization reported that non-communicable diseases, largely driven by aging, accounted for 74% of all deaths globally.

This demographic shift directly fuels a greater need for treatments that are not only effective but also cost-efficient. Biosimilars, like those developed by Coherus, are becoming increasingly important as a way to make healthcare more sustainable. By 2024, the global biosimilars market was projected to reach over $25 billion, highlighting the significant demand for these more affordable alternatives.

Patient and physician acceptance of biosimilars is a critical sociological factor influencing market penetration. While awareness is growing, trust remains a key hurdle, with some patients and providers still harboring misconceptions about their efficacy and safety compared to originator biologics. Education campaigns are actively working to bridge this gap; for instance, by mid-2024, over 70% of oncologists surveyed expressed increased confidence in biosimil data, a notable rise from previous years.

The positive perception of biosimilars directly impacts prescription rates and market uptake. As more real-world evidence emerges, demonstrating comparable effectiveness and safety profiles, this perception is expected to improve further. By the end of 2024, it's anticipated that biosimilar utilization in therapeutic areas like rheumatology will exceed 30% in the US market, driven by increased physician familiarity and patient comfort.

The public and healthcare providers' understanding of biosimilars, including their safety, effectiveness, and cost advantages, is crucial for their widespread acceptance. Coherus Biosciences needs to actively promote health literacy regarding biosimilars to build trust and encourage their use. For instance, in 2023, awareness campaigns for biosimilars saw a notable increase, with surveys indicating a 15% rise in general public understanding compared to the previous year.

Access to Affordable Healthcare

Societal demand for equitable access to high-quality, affordable healthcare is a significant driver for the biosimilar market, directly impacting companies like Coherus Biosciences. As healthcare costs continue to rise, placing a strain on individuals and national health systems, the pressure to adopt more cost-effective treatment options intensifies. For instance, in 2024, out-of-pocket healthcare spending in the US reached an estimated $1.4 trillion, highlighting the significant financial burden on consumers.

Coherus Biosciences is strategically positioned to meet this growing societal need. Their portfolio of biosimilar products offers a direct response to the increasing demand for less expensive alternatives to high-cost biologic drugs. This focus aligns with public health initiatives aimed at expanding access to essential medicines, a trend expected to accelerate as more biosimilars gain market approval and adoption. By 2025, the global biosimilar market is projected to reach over $100 billion, underscoring the substantial economic opportunity driven by this societal shift.

- Growing Healthcare Costs: The escalating cost of traditional biologic drugs creates a strong societal push for more affordable alternatives.

- Demand for Affordability: Patients and healthcare providers are actively seeking cost-effective treatment options to manage healthcare expenses.

- Coherus's Role: Coherus Biosciences directly addresses this demand by providing biosimilar products that offer comparable efficacy at a lower price point.

- Market Growth: The biosimilar market is expanding rapidly, projected to exceed $100 billion by 2025, fueled by this societal need for accessible and affordable treatments.

Lifestyle Changes and Disease Prevalence

Evolving lifestyles, environmental influences, and ongoing medical progress significantly shape disease prevalence, directly affecting the demand for particular treatments. Coherus Biosciences needs to stay ahead of these epidemiological shifts to ensure its biosimilar offerings match present and future healthcare demands, including monitoring changes in disease burdens.

For instance, the increasing rates of chronic diseases like diabetes and cardiovascular conditions, often linked to sedentary lifestyles and dietary changes, present a growing market for supportive therapies. The World Health Organization reported in 2023 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths annually, a trend likely to persist and grow through 2024 and 2025.

- Growing Chronic Disease Burden: Lifestyle factors contribute to rising rates of conditions like diabetes and heart disease, increasing the need for therapeutic interventions.

- Impact of Environmental Factors: Air pollution and other environmental exposures are increasingly linked to respiratory and other chronic illnesses, creating demand for related treatments.

- Advancements in Diagnostics: Better disease detection can lead to earlier treatment initiation, influencing the market size for various pharmaceuticals.

- Aging Population Trends: As populations age globally, the incidence of age-related diseases such as osteoporosis and certain cancers is expected to rise, impacting therapeutic demand.

Societal pressure for equitable access to affordable, high-quality healthcare is a major driver for biosimilars, directly benefiting Coherus Biosciences. As healthcare costs continue to climb, straining individuals and national health systems, the demand for cost-effective treatments intensifies. By 2025, the global biosimilar market is projected to surpass $100 billion, reflecting this societal shift towards accessible medicines.

Technological factors

Technological advancements in biopharmaceutical manufacturing, such as process optimization and the adoption of single-use technologies, are revolutionizing biosimilar production. These innovations directly influence the cost-effectiveness and efficiency of bringing biosimilars to market. Coherus Biosciences actively integrates these cutting-edge techniques to enhance scalability and lower production expenses, ensuring a consistent supply of high-quality products.

The shift towards continuous manufacturing, a key technological trend, offers further opportunities for Coherus to streamline operations and reduce batch-to-batch variability. For instance, by 2024, the global biopharmaceutical contract manufacturing market, which often incorporates these advanced technologies, was projected to reach over $25 billion, highlighting the industry's investment in manufacturing innovation. Staying ahead of these rapid technological evolutions is therefore paramount for maintaining a competitive edge in the biosimilar space.

Sophisticated analytical and characterization technologies are absolutely critical for Coherus Biosciences to prove their biosimilars are highly similar to the original biologic drugs. This involves using advanced techniques to meticulously compare every aspect of the products. For instance, in 2023, Coherus highlighted its robust analytical capabilities in its regulatory submissions, underscoring the importance of these technologies in gaining market approval.

Breakthroughs in areas like mass spectrometry, various forms of chromatography, and detailed immunological assays allow for incredibly precise comparisons. These advanced methods are the backbone of demonstrating biosimilarity, which is a key requirement for regulatory bodies like the FDA and EMA. Without them, establishing product quality and interchangeability would be significantly more challenging.

Coherus Biosciences actively leverages these cutting-edge analytical methods throughout its entire development pipeline. This commitment to advanced characterization ensures that their biosimilar candidates meet the stringent standards necessary for patient safety and therapeutic efficacy, directly impacting their success in the competitive biopharmaceutical market.

Coherus Biosciences' R&D innovation is a critical technological factor. The ongoing advancements in drug discovery platforms and a deeper understanding of disease mechanisms directly shape the market for originator biologics, which in turn dictates the opportunities for biosimilar development. Coherus actively monitors these scientific leaps to pinpoint new biosimilar targets and refine its own research and development strategies, ensuring it remains at the forefront of the evolving biopharmaceutical landscape.

Data Analytics and AI in Drug Development

The integration of data analytics, AI, and machine learning is revolutionizing drug development, significantly shortening timelines and refining decision-making across discovery, trials, and manufacturing. Coherus Biosciences can harness these powerful tools to streamline its biosimilar development pipeline, from pinpointing therapeutic targets to monitoring products post-launch, thereby boosting efficiency and mitigating inherent risks.

Leveraging these advancements can lead to tangible benefits:

- Accelerated Discovery: AI algorithms can analyze vast biological datasets to identify promising drug candidates at a much faster pace than traditional methods. For instance, AI platforms are reportedly reducing early-stage drug discovery timelines by up to 40-50%.

- Optimized Clinical Trials: Data analytics can improve patient selection, trial design, and outcome prediction, potentially reducing the duration and cost of clinical trials. Some estimates suggest AI can cut clinical trial costs by 15-20%.

- Enhanced Manufacturing: Predictive analytics can optimize manufacturing processes, ensuring consistent quality and reducing batch failures, a critical aspect for biosimilar production where cost-efficiency is paramount.

Intellectual Property and Patent Landscape

The technological environment for Coherus Biosciences is intrinsically linked to intellectual property, especially the patents safeguarding original biologic drugs. Successfully bringing biosimilars to market necessitates a sophisticated understanding and navigation of these intricate patent landscapes. Coherus must deploy strong legal and scientific approaches to contest or circumvent existing patents, demanding considerable expertise in both domains.

Navigating the patent thicket is crucial for biosimilar developers like Coherus. For instance, the pathway to market for biosimilars often involves extensive litigation over patents, with significant costs and timelines. Coherus's strategy in 2024 and 2025 will heavily depend on its ability to secure favorable patent settlements or successfully challenge patents that could block its biosimilar products, such as those for adalimumab (Humira) or pegfilgrastim (Neulasta).

- Patent Expiries: Monitoring and strategically targeting biosimilar opportunities linked to upcoming originator patent expirations is a core technological and legal strategy.

- Design Arounds: Developing manufacturing processes and formulations that are distinct enough to avoid infringing on existing patents is a key technological differentiator.

- Litigation Costs: The financial burden of patent litigation can be substantial, impacting R&D budgets and market entry timelines for biosimilars.

- Regulatory Exclusivities: Understanding and leveraging regulatory data exclusivity periods, separate from patents, also plays a role in market access strategies.

Technological advancements are pivotal for Coherus Biosciences, particularly in sophisticated analytical techniques required to prove biosimilarity. These methods, including advanced mass spectrometry and chromatography, are essential for regulatory approval, as highlighted by Coherus's emphasis on these capabilities in its 2023 submissions.

Legal factors

The legal frameworks governing biosimilar approval, such as the Biologics Price Competition and Innovation Act (BPCIA) in the U.S. and European Medicines Agency (EMA) guidelines, directly shape Coherus Biosciences' market entry strategies. These regulations, which require rigorous demonstration of biosimilarity to reference biologics, are critical for obtaining product authorization and enabling commercialization.

Coherus Biosciences actively navigates patent litigation, a common hurdle in the biosimilar market. These legal contests, often against originator biologic manufacturers, are critical for securing market access for their biosimilar products. For instance, Coherus has been involved in disputes concerning its Udenyca (pegfilgrastim-cbkb) biosimilar, aiming to resolve intellectual property claims that could affect its market exclusivity period.

The success or failure in these patent disputes directly influences Coherus's ability to launch and compete effectively. A favorable outcome can accelerate market entry and enhance commercial viability, as seen with the company's strategy to challenge patents on key biologic drugs. Conversely, adverse rulings can lead to delays and increased legal costs, impacting revenue projections. In 2023, Coherus reported significant legal expenses related to ongoing patent challenges, underscoring the financial commitment required.

Coherus Biosciences operates within a stringent regulatory environment, necessitating strict adherence to healthcare compliance, including anti-kickback statutes and fraud and abuse regulations. Failure to comply can lead to significant penalties; for example, in 2023, the Department of Justice recovered over $2.6 billion in healthcare fraud cases, highlighting the financial risks involved.

The company must also navigate complex promotional guidelines to ensure all marketing activities are ethical and legal. Developing and maintaining robust internal compliance programs is therefore critical for Coherus to safeguard its operations against severe penalties and reputational damage.

Product Liability and Safety Regulations

Coherus Biosciences operates within a stringent legal framework governing product liability and safety. As a pharmaceutical entity, the company must adhere to extensive regulations ensuring the safety and efficacy of its biosimilar products. This includes rigorous clinical testing and ongoing post-market surveillance to identify and address any potential adverse events. Failure to meet these standards can result in significant legal repercussions and intense regulatory oversight.

The company's commitment to patient safety is paramount, directly impacting its legal standing and market reputation. For instance, in 2023, the FDA continued to emphasize post-market monitoring for biosimilars, with specific guidance issued to manufacturers regarding pharmacovigilance plans. Coherus's proactive approach to these regulations is crucial for mitigating risks associated with product liability claims.

- Regulatory Compliance: Adherence to FDA and EMA guidelines for biosimilar approval and post-market surveillance is a non-negotiable legal requirement.

- Product Liability: Coherus faces potential lawsuits if its products cause harm, necessitating robust quality control and risk management.

- Adverse Event Reporting: Timely and accurate reporting of any adverse events is mandated by law and critical for maintaining regulatory approval.

- Intellectual Property: Navigating patent litigation related to biosimilar development and market entry is a significant legal challenge.

Data Privacy and Cybersecurity Laws

Coherus Biosciences operates within a landscape of increasingly stringent data privacy and cybersecurity laws. Compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is paramount, especially given the sensitive nature of patient data and clinical trial information handled by the company. Failure to adhere to these laws can result in significant penalties, impacting financial performance and reputation.

The digitalization of healthcare and business operations necessitates robust cybersecurity measures. Coherus must invest in and maintain advanced systems to safeguard patient records, proprietary research, and corporate data against breaches. The global cost of data breaches continues to rise, with the average cost reaching $4.35 million in 2024, underscoring the financial imperative for strong cybersecurity defenses.

- HIPAA Compliance: Essential for protecting protected health information (PHI) in the US.

- GDPR Adherence: Critical for handling personal data of EU citizens, impacting clinical trial recruitment and data management.

- Cybersecurity Investments: Legal mandates require significant spending on data protection technologies and protocols.

- Breach Notification Laws: Strict requirements exist for reporting data breaches to authorities and affected individuals, often within tight deadlines.

Legal frameworks like the BPCIA and EMA guidelines are foundational for Coherus's biosimilar approvals, dictating the rigorous scientific and procedural requirements for market entry. The company's engagement in patent litigation, such as disputes around Udenyca, directly impacts its ability to secure market exclusivity and revenue streams, with legal costs in 2023 reflecting significant investment in these challenges. Strict adherence to healthcare compliance, including anti-kickback statutes, and robust data privacy laws like HIPAA and GDPR are critical to avoid substantial penalties and maintain operational integrity.

| Legal Area | Impact on Coherus | 2023/2024 Data Point |

|---|---|---|

| Biosimilar Approval Pathways | Dictates market access and commercialization strategies. | FDA approved 5 new biosimilars in 2023. |

| Patent Litigation | Affects market exclusivity and revenue potential. | Coherus reported significant legal expenses in 2023 related to patent challenges. |

| Healthcare Compliance | Ensures adherence to anti-fraud and abuse regulations. | US DOJ recovered over $2.6 billion in healthcare fraud cases in 2023. |

| Data Privacy & Cybersecurity | Mandates protection of sensitive patient and corporate data. | Average cost of a data breach reached $4.35 million in 2024. |

Environmental factors

The environmental footprint of pharmaceutical manufacturing, encompassing energy use, water consumption, and waste production, is under increasing scrutiny. Coherus Biosciences, like its peers, faces growing pressure to embrace sustainable practices and lower its carbon emissions. This involves refining production methods and investing in greener technologies to comply with environmental laws and satisfy stakeholder demands.

For instance, the pharmaceutical industry's energy intensity is significant, with some estimates suggesting it accounts for a substantial portion of its operational costs and environmental impact. Coherus's commitment to optimizing processes, such as implementing continuous manufacturing techniques, can lead to reduced energy consumption per unit of product. Furthermore, investments in renewable energy sources for its facilities, a trend gaining traction across the sector, will be crucial in meeting future environmental targets and demonstrating corporate responsibility.

Coherus Biosciences, like all biotech firms, faces significant environmental scrutiny regarding the disposal of biological waste from its biosimilar operations. Stringent regulations govern the handling and disposal of potentially hazardous materials generated during research, development, and manufacturing.

Implementing robust waste management protocols is paramount for Coherus to ensure both environmental protection and regulatory compliance. This includes proper segregation, treatment, and disposal of all biological waste streams.

Failure to adhere to these protocols can result in substantial fines and reputational damage. For instance, in 2023, companies in the pharmaceutical sector faced an average of $50,000 in fines for environmental non-compliance related to waste management.

Coherus Biosciences faces growing pressure to understand and reduce the environmental impact of its entire supply chain, from where its raw materials come from to how its finished products reach patients. This includes looking at everything from manufacturing processes to the carbon emissions generated by shipping and logistics.

For instance, the pharmaceutical industry's transportation sector alone accounted for approximately 24% of global greenhouse gas emissions in 2023, a figure Coherus must consider. The company is therefore tasked with evaluating and addressing environmental risks, such as the sustainability practices of its suppliers and the emissions from its distribution networks, to ensure it meets its corporate environmental responsibility goals.

Climate Change Impact on Operations

Climate change presents tangible risks to Coherus BioSciences' operations. Extreme weather events, such as floods or severe storms, could disrupt the supply chains for critical raw materials or finished products, impacting manufacturing and distribution timelines. For instance, the increasing frequency of extreme weather events globally, as noted by the IPCC's Sixth Assessment Report in 2021-2022, highlights the growing vulnerability of logistical networks.

Furthermore, research and development facilities, essential for Coherus's pipeline, could face operational challenges due to climate-related impacts, such as water scarcity affecting laboratory functions or increased energy costs for climate control. The pharmaceutical industry, in general, is increasingly scrutinizing its environmental footprint and the resilience of its infrastructure against these evolving climate patterns. For example, a 2024 report by McKinsey & Company indicated that over 70% of surveyed companies in the life sciences sector are already experiencing climate-related risks impacting their operations.

- Supply Chain Vulnerability: Extreme weather events can cause significant delays and cost increases in the transportation of pharmaceutical ingredients and finished goods.

- R&D Facility Resilience: Ensuring that research sites are equipped to handle potential climate impacts, such as heatwaves or increased energy demand, is crucial for uninterrupted innovation.

- Disease Pattern Shifts: Changes in climate can influence the prevalence and spread of certain diseases, potentially impacting the demand for specific therapeutic areas Coherus focuses on.

Corporate Social Responsibility (CSR) and ESG Reporting

Growing investor and public demand for corporate social responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting significantly influences Coherus's operational transparency. For instance, in 2024, the global sustainable investment market was projected to reach over $50 trillion, highlighting the financial imperative for robust ESG disclosures.

Adhering to high environmental standards and transparently reporting on these efforts builds trust with stakeholders and investors. Coherus's commitment to sustainable practices, extending beyond mere regulatory compliance, is crucial for maintaining its social license to operate and attracting capital in an increasingly ESG-conscious market.

Key areas of focus for Coherus's ESG reporting in 2024-2025 include:

- Environmental Impact: Initiatives related to waste reduction, energy efficiency in manufacturing, and responsible supply chain management.

- Social Responsibility: Programs focused on patient access to affordable medicines, employee well-being, and community engagement.

- Governance Practices: Transparency in executive compensation, board diversity, and ethical business conduct.

Coherus Biosciences, like other pharmaceutical companies, faces increasing environmental regulations and pressure to adopt sustainable practices. This includes managing waste from biosimilar production and reducing its carbon footprint throughout its supply chain. The company must also consider the impact of climate change on its operations and supply chain resilience.

Investor and public demand for strong Environmental, Social, and Governance (ESG) performance is a significant driver for Coherus. Transparent reporting on environmental initiatives, such as waste reduction and energy efficiency, is crucial for attracting investment and maintaining its social license to operate. Key reporting areas for 2024-2025 include environmental impact, social responsibility, and governance practices.

| Environmental Factor | Impact on Coherus Biosciences | Data/Trend (2023-2025) |

|---|---|---|

| Regulatory Compliance | Need to adhere to stricter environmental laws regarding manufacturing and waste disposal. | Pharmaceutical sector fines for non-compliance averaged $50,000 in 2023. |

| Climate Change Risks | Potential disruption to supply chains and operations from extreme weather events. | Over 70% of life sciences companies reported experiencing climate-related operational impacts in a 2024 survey. |

| ESG Investor Demand | Pressure to demonstrate strong ESG performance and transparent reporting. | Global sustainable investment market projected to exceed $50 trillion in 2024. |

PESTLE Analysis Data Sources

Our Coherus Biosciences PESTLE Analysis is built on a robust foundation of data from leading financial news outlets, regulatory filings, and industry-specific market research. We meticulously gather information on economic indicators, technological advancements, and socio-political shifts impacting the biopharmaceutical sector.