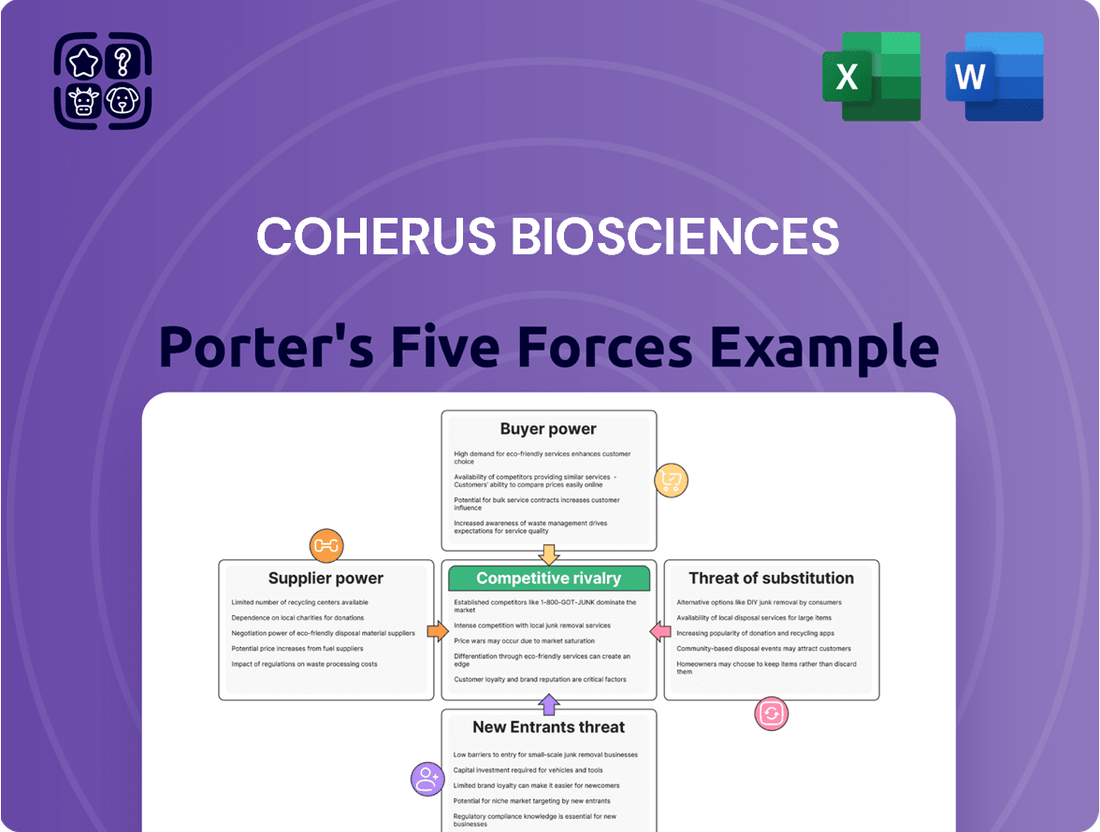

Coherus Biosciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherus Biosciences Bundle

Coherus Biosciences operates in a dynamic biopharmaceutical landscape, where the threat of new entrants is moderate due to high R&D costs and regulatory hurdles, but the bargaining power of buyers, particularly large payers, can significantly impact pricing. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Coherus Biosciences’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Coherus BioSciences, like many biopharma firms, depends on specialized contract manufacturing organizations (CMOs) for critical production steps, including active pharmaceutical ingredients (APIs) and final product assembly. The scarcity of CMOs possessing the required advanced expertise and stringent regulatory approvals for complex biologics and oncology drugs grants these suppliers considerable bargaining power.

Any limitations in manufacturing capacity or prior commitments by these specialized CMOs can directly affect product availability and Coherus's revenue streams. This was evident with the temporary UDENYCA supply interruption experienced in late 2024, underscoring the vital importance of these supplier relationships and their capacity to influence Coherus's operational continuity.

Suppliers of advanced biotechnology equipment, specialized reagents, and proprietary cell lines wield significant influence over Coherus Biosciences. Their offerings are often unique and patented, making it difficult for Coherus to find readily available alternatives. For instance, the cost of specialized bioreactors or unique cell culture media can represent a substantial portion of a drug's manufacturing expenses.

The switching costs associated with these critical inputs are notably high. This is due to the substantial capital investment required for new equipment, the rigorous validation processes needed to ensure product quality and regulatory compliance, and the extensive training personnel must undergo. This dependency directly impacts Coherus's input costs and can restrict its manufacturing agility.

To counter this supplier power, Coherus can explore strategies such as negotiating long-term supply agreements to lock in pricing and ensure availability. Diversifying its sources for essential equipment and reagents, where feasible, also serves to reduce reliance on any single supplier, thereby strengthening its bargaining position.

The drug development journey, especially for cutting-edge oncology treatments, is intricate and time-consuming. This complexity demands specialized R&D services from entities like Contract Research Organizations (CROs), preclinical testing labs, and data management firms.

The high level of expertise and strict regulatory adherence needed for these services means there's a limited pool of highly respected providers. This scarcity gives these suppliers significant leverage, impacting both the pace and expense of Coherus's pipeline advancement.

Coherus's current clinical trials, such as those for CHS-114 and casdozokitug, are heavily dependent on the capabilities of these external R&D partners.

Intellectual Property Licensors

Intellectual property licensors wield significant bargaining power, especially when Coherus Biosciences relies on in-licensed technologies or molecules for its biosimilar and oncology products. These agreements often dictate royalty rates and milestone payments, directly influencing Coherus's financial performance. For instance, the 2023 divestiture of UDENYCA involved transferring associated licensing agreements, highlighting the impact of such contractual terms on strategic decisions.

The terms of these licensing deals can be highly favorable to the licensor, particularly if the licensed IP is critical to Coherus's product pipeline or market entry. This leverage allows licensors to command substantial upfront fees, ongoing royalties, and even equity stakes. As of early 2024, the biosimilar market continues to see intense competition, making access to differentiated or first-to-market technologies through licensing even more valuable, thereby strengthening licensor power.

- Critical IP dependence: Coherus's reliance on licensed intellectual property for key products grants licensors considerable leverage.

- Royalty and milestone structures: Favorable terms for licensors can significantly impact Coherus's cost of goods sold and profitability.

- Strategic divestitures: The transfer of licensing agreements during asset sales, like the UDENYCA divestiture, underscores the importance of these contracts.

- Market dynamics: The competitive landscape in biosimilars and oncology can amplify the bargaining power of IP holders.

Talent and Human Capital

The biopharmaceutical sector, especially in areas like oncology drug development, faces a significant challenge in securing specialized talent. This scarcity directly translates to increased bargaining power for skilled employees. For instance, in 2024, the demand for experienced oncology researchers and regulatory affairs specialists remained exceptionally high, driving up salary expectations and retention costs for companies like Coherus Biosciences.

The bargaining power of talent is amplified by the niche expertise required. Professionals with proven track records in biosimilar commercialization or complex clinical trial management can command premium compensation packages. This directly impacts Coherus's operating expenses, as attracting and retaining such individuals necessitates competitive remuneration and benefits.

- Talent Scarcity: High demand for specialized skills in oncology and biosimil development grants employees significant leverage.

- Increased Costs: Top talent acquisition and retention efforts drive up compensation and benefits, impacting operating expenses.

- Strategic Workforce Management: Coherus's organizational streamlining, including workforce adjustments, reflects a deliberate approach to managing human capital costs and aligning with its oncology focus.

The bargaining power of suppliers for Coherus Biosciences is significant, particularly for specialized contract manufacturing organizations (CMOs) and providers of advanced biotechnology equipment. These suppliers often possess unique expertise and regulatory approvals, making alternatives scarce and switching costs high.

This dependence was highlighted by a UDENYCA supply interruption in late 2024, demonstrating how supplier capacity and commitments directly impact Coherus's revenue and operations. The cost of specialized inputs, like bioreactors or cell culture media, can also represent a substantial portion of manufacturing expenses.

To mitigate this, Coherus can pursue long-term supply agreements and diversify its supplier base where possible, thereby enhancing its negotiation position and ensuring continuity.

What is included in the product

This analysis unpacks the competitive forces impacting Coherus Biosciences, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the biopharmaceutical market.

Coherus Biosciences' Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, offering instant clarity for strategic decision-making and pain point relief in understanding market dynamics.

Customers Bargaining Power

Healthcare systems and Pharmacy Benefit Managers (PBMs) hold considerable sway over Coherus Biosciences due to their substantial purchasing power. These entities, acting as major buyers, can negotiate aggressively on price and terms, directly influencing Coherus's profitability. For instance, PBMs manage drug formularies, deciding which medications are preferred, and their decisions can significantly impact a biosimilar's market access and adoption. In 2024, the increasing consolidation among PBMs, with the top three PBMs covering a significant portion of insured Americans, amplifies their bargaining leverage.

Government payers like Medicare and private insurers wield considerable influence through their reimbursement and coverage decisions. For biosimilars, including those Coherus is involved with, these policies are critical, directly impacting market uptake and financial success. For example, Medicare reimbursement rates can sometimes favor established, higher-priced reference products, which can make biosimilars less appealing to healthcare providers and patients.

The increasing emphasis on oncology within Coherus's strategy necessitates a deep understanding of the intricate reimbursement pathways prevalent in cancer care. Navigating these complex oncology reimbursement landscapes is a key challenge, as policies here can significantly shape the economic viability of biosimilar treatments in this high-value therapeutic area.

Physicians and other prescribers hold significant sway in determining which medications patients receive, often showing a strong preference for well-established biologic drugs. This brand loyalty can be a hurdle for biosimilars, even with clear evidence of similarity and potential cost reductions. For instance, in 2023, the U.S. biosimilar market penetration for biologics was still developing, with some therapeutic areas seeing lower adoption rates than anticipated, highlighting the need for physician education.

Coherus Biosciences faces the challenge of overcoming this ingrained loyalty by investing in comprehensive education for healthcare providers regarding the clinical value and safety of its biosimilars. This is crucial as they aim to increase the uptake of products like their oncology treatment, LOQTORZI, by demonstrating its efficacy and differentiating it in a competitive landscape.

Patient Advocacy Groups and Patient Preferences

Patient advocacy groups and individual patient preferences significantly influence the bargaining power of customers in the biosimilar market. Patients, guided by these groups and personal experiences, can either embrace or resist biosimilar treatments. This resistance often stems from concerns about efficacy, potential side effects, or a general lack of understanding regarding biosimilars, leading them to favor established reference products. For instance, a 2024 survey indicated that while awareness of biosimilars is growing, a notable percentage of patients still express reservations about switching from their current medications due to perceived risks.

Coherus Biosciences' ability to foster trust among patients and their advocates is paramount. Demonstrating that their biosimilar products are not only high-quality and safe but also as effective as their reference counterparts is crucial for overcoming patient hesitancy. The company's stated mission to expand access to affordable, high-quality therapeutics directly addresses this by emphasizing the value proposition to patients.

- Patient Preferences: Patients' willingness to switch to biosimilars is a key factor.

- Advocacy Group Influence: Patient advocacy groups can shape perceptions and drive demand or resistance.

- Trust and Perception: Coherus must build confidence in the safety and efficacy of its biosimilars.

- Access and Affordability: The company's focus on these aspects aims to increase patient acceptance.

Group Purchasing Organizations (GPOs) and Integrated Delivery Networks (IDNs)

Large Group Purchasing Organizations (GPOs) and Integrated Delivery Networks (IDNs) wield considerable influence by consolidating the purchasing power of numerous healthcare providers. This aggregation allows them to negotiate significant price reductions from pharmaceutical manufacturers like Coherus Biosciences. For instance, in 2024, major GPOs reported managing purchasing for thousands of hospitals and healthcare facilities, representing billions of dollars in annual spending.

Coherus must actively compete within these GPO and IDN frameworks to secure contracts and ensure market access for its biosimilar and oncology products. The pressure to gain formulary placement and secure volume-based agreements means these powerful entities directly shape Coherus's sales and pricing strategies. This bargaining power is a critical consideration, particularly for biosimil competitors aiming to displace originator drugs.

- Aggregated Purchasing Power: GPOs and IDNs represent a consolidated demand, enabling them to negotiate substantial discounts.

- Contract Negotiation: Coherus faces intense competition to win contracts within these purchasing groups.

- Influence on Pricing and Sales: Formulary placement and volume agreements dictated by GPOs/IDNs significantly impact Coherus's revenue.

- Biosimilar Market Impact: This factor is especially crucial for biosimil manufacturers seeking to compete on price and access.

The bargaining power of customers for Coherus Biosciences is substantial, primarily driven by large purchasers like Pharmacy Benefit Managers (PBMs) and government payers who can dictate terms and pricing. In 2024, the consolidation of PBMs, with the top three entities covering a significant majority of insured Americans, intensifies their leverage. This allows them to negotiate aggressively on price and formulary placement, directly impacting Coherus's profitability and market access for biosimilars.

| Customer Segment | Bargaining Power Drivers | Impact on Coherus Biosciences (2024 Focus) |

|---|---|---|

| PBMs & Insurers | Consolidated purchasing, formulary control, reimbursement policies | Significant price pressure, market access challenges for biosimilars |

| Group Purchasing Organizations (GPOs) & IDNs | Aggregated demand, volume-based contract negotiation | Intense competition for contracts, pressure on pricing and sales strategies |

| Physicians & Patients | Brand loyalty, preference for established biologics, trust/perception of biosimilars | Hurdles for biosimilar adoption, need for extensive education and trust-building |

Full Version Awaits

Coherus Biosciences Porter's Five Forces Analysis

This preview showcases the complete Coherus Biosciences Porter's Five Forces Analysis, providing a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into Coherus's market landscape.

Rivalry Among Competitors

The biosimilar market is a battleground, with increasing competition as more products get the green light and enter the fray. This surge is largely due to patent expirations on high-selling biologic drugs. Major global pharmaceutical giants such as Amgen, Pfizer, and Sandoz are all vying for a piece of this market, creating significant pressure on pricing and driving strategies focused on capturing market share.

Coherus Biosciences' strategic shift into innovative oncology introduces a heightened competitive rivalry. With LOQTORZI as its flagship product and a promising pipeline featuring CHS-114 and casdozokitug, Coherus is now competing against both large, established pharmaceutical companies with deep oncology portfolios and nimble emerging biotechs developing cutting-edge cancer treatments.

This intensified competition hinges on factors like demonstrating clear clinical superiority for new therapies, achieving rapid market entry for expanded indications, and showcasing improved patient outcomes. For instance, in the competitive landscape of oncology, companies are often evaluated on their ability to secure regulatory approvals swiftly and demonstrate efficacy in head-to-head trials. Coherus's success will depend on its capacity to differentiate LOQTORZI and its pipeline assets in this dynamic market.

The biosimilar and oncology sectors are characterized by extreme price sensitivity, leading to considerable downward pressure on average sales prices for biosimilar products. This intense rivalry directly impacts Coherus Biosciences, as seen in its Q1 2025 revenue decline, partly attributed to divestitures and a subsequent loss of market share.

For LOQTORZI, its current unique FDA approval for nasopharyngeal carcinoma provides a competitive edge. However, future efforts to expand its approved uses will inevitably encounter robust competition from established PD-1 inhibitors and emerging combination therapies already present or in development within the oncology landscape.

R&D Capabilities and Pipeline Depth

Competitive rivalry in the biopharmaceutical sector, particularly for companies like Coherus Biosciences, is heavily influenced by research and development (R&D) capabilities and the depth of a company's product pipeline. Innovation is key to survival and growth, with the ability to bring new therapies to market being a primary driver of competitive advantage.

Coherus's strategic investment in its immuno-oncology pipeline, notably with candidates like CHS-114 and casdozokitug, underscores the importance of R&D for its future competitiveness. These initiatives are designed to address unmet medical needs and capture market share in a dynamic therapeutic area.

The threat from rivals is amplified by those possessing more extensive pipelines, larger R&D budgets, and more advanced clinical programs. For instance, in 2024, major biopharma companies continued to report substantial R&D expenditures, with many allocating billions to early-stage research and late-stage clinical trials. Coherus's progress in its clinical trials and the timely release of data in 2026 will be pivotal in determining its standing against these well-resourced competitors.

- R&D Investment: Companies like Coherus must continually invest in R&D to maintain a competitive edge.

- Pipeline Strength: The breadth and depth of a company's drug pipeline, including early-stage and late-stage candidates, directly impact its long-term viability.

- Clinical Trial Success: The speed and success rate of clinical trials are critical determinants of market entry and competitive positioning.

- Competitive Landscape: Rivals with greater financial resources and more advanced R&D programs present a significant challenge to companies like Coherus.

Sales and Marketing Strength

Coherus Biosciences is actively building its commercialization capabilities to support the launch of LOQTORZI, focusing on its sales force and marketing outreach to prescribers and payers. This strategy aims to drive patient demand for their new product.

However, the competitive landscape presents a significant hurdle. Larger pharmaceutical giants often command vastly superior sales and marketing infrastructures. This disparity can create substantial challenges for smaller companies like Coherus in achieving widespread market penetration, particularly within broad oncology indications where established relationships and extensive reach are paramount.

- Sales Force Size: Coherus is scaling its sales force to effectively cover key oncology centers and target prescribers for LOQTORZI.

- Marketing Reach: The company is investing in targeted marketing campaigns to raise awareness among healthcare professionals and patients.

- Prescriber & Payer Relationships: Building and leveraging relationships with key opinion leaders and formulary decision-makers is crucial for LOQTORZI's market access.

- Competitive Infrastructure: Major competitors in the oncology space, such as Merck and Bristol Myers Squibb, possess sales forces numbering in the thousands and extensive marketing budgets, creating a significant competitive advantage.

Competitive rivalry is intense for Coherus Biosciences, particularly in the biosimilar and oncology markets. The expiration of patents on blockbuster biologic drugs fuels this competition, drawing in major players like Amgen, Pfizer, and Sandoz, all vying for market share and driving down prices.

Coherus's move into oncology with LOQTORZI and its pipeline candidates places it against both established pharmaceutical giants with deep portfolios and agile biotech firms. Success hinges on demonstrating clinical superiority, achieving rapid market entry, and improving patient outcomes, all while navigating a market highly sensitive to pricing.

The company's Q1 2025 revenue decline, partly due to divestitures and market share loss, highlights the impact of this rivalry. While LOQTORZI's current unique FDA approval for nasopharyngeal carcinoma offers an initial advantage, expanding its indications will mean competing directly with established PD-1 inhibitors and emerging combination therapies.

Moreover, Coherus faces rivals with significantly larger R&D budgets and more advanced clinical programs. For instance, in 2024, leading biopharmaceutical companies continued to allocate billions to R&D. Coherus's ability to execute its clinical trials and data releases in 2026 will be crucial against these well-resourced competitors, who often boast sales forces in the thousands and extensive marketing budgets.

| Company | Key Oncology Product(s) | 2024 R&D Spend (Est. Billions USD) | Sales Force Size (Est.) |

|---|---|---|---|

| Merck | Keytruda | ~13.5 | >10,000 |

| Bristol Myers Squibb | Opdivo, Yervoy | ~12.0 | >8,000 |

| Pfizer | Ibrance, Xeljanz | ~14.0 | >7,000 |

| Amgen | Enbrel, Imlygic | ~4.5 | ~5,000 |

| Coherus Biosciences | LOQTORZI | ~150-200 Million (Guidance for 2025) | Scaling up, targeting hundreds |

SSubstitutes Threaten

The primary substitutes for biosimilars are the original branded biologic drugs themselves. These originator products benefit from significant brand loyalty built over years of use and extensive marketing efforts by their manufacturers. For example, in 2024, established biologics continued to command substantial market share despite the availability of biosimilar alternatives, reflecting the inertia in physician and patient preferences.

Despite the cost advantages biosimilars offer, the deep-rooted trust and familiarity physicians and patients have with originator products present a considerable hurdle. This established clinical experience and marketing power create a strong barrier to entry for biosimilars, influencing adoption rates. Coherus Biosciences, however, has strategically navigated this by focusing on markets where this substitution threat is less pronounced or has been mitigated through its business model evolution.

Novel small molecule therapies represent a significant threat to Coherus Biosciences, particularly in disease areas where these drugs can offer alternatives to biologics. For instance, in oncology, oral targeted therapies are increasingly competing with injectable immunotherapies, potentially shifting patient preference and market share. The pharmaceutical industry's robust R&D pipeline consistently introduces new small molecule candidates with improved efficacy or convenience, such as oral administration, which can directly substitute for Coherus's biologic and immuno-oncology products.

The rise of advanced therapies like gene and cell therapies presents a significant threat of substitution for Coherus Biosciences. These cutting-edge treatments, while currently niche, are demonstrating potential to replace existing therapies, including those in oncology. For instance, the global gene therapy market was valued at approximately $7.5 billion in 2023 and is projected to grow substantially, indicating a shift in treatment paradigms.

As these novel modalities become more effective and accessible, they could offer curative or significantly improved outcomes compared to current biologics and small molecules. This poses a direct challenge to Coherus's product portfolio, especially as the company strategically moves into innovative oncology, placing it directly in the path of these disruptive technologies.

Alternative Treatment Modalities and Lifestyle Interventions

The threat of substitutes for Coherus Biosciences' therapies, particularly in oncology and immunology, is generally considered moderate to low. While non-pharmacological interventions, surgical procedures, and lifestyle modifications can serve as alternatives for certain chronic diseases, they are often less effective or unsuitable for the complex, severe conditions Coherus targets. For instance, in advanced cancer treatment, these alternatives rarely fully replace targeted biologic therapies. In 2024, the market for biologics in oncology continued to grow robustly, underscoring the limited substitutability for many patients needing these advanced treatments.

However, for specific indications, the substitutability can be more pronounced. Consider conditions where lifestyle changes or less invasive procedures can manage symptoms or even achieve remission. For example, in some inflammatory conditions, significant dietary changes or physical therapy might reduce reliance on biologic drugs. While Coherus's focus on high-need areas like cancer generally insulates it from the most direct substitution threats, ongoing innovation in alternative treatment modalities means this remains a factor to monitor.

- Moderate to Low Threat: For Coherus's core markets like oncology and immunology, direct substitutes that offer comparable efficacy are limited.

- Lifestyle and Surgical Alternatives: For less severe or different chronic conditions, lifestyle changes and surgical interventions can reduce the need for drug therapies.

- Focus on Severe Diseases: Coherus's strategic focus on complex and severe diseases inherently lowers the threat of substitution compared to companies in less critical therapeutic areas.

- Market Dynamics: The continued growth of the biologics market in oncology in 2024 indicates a strong demand for these advanced therapies, suggesting limited broad substitutability in these specific indications.

'Next-Generation' Biologics from Competitors

Competitors are actively developing next-generation biologics that could rival or surpass Coherus's current offerings in terms of efficacy, safety, or patient convenience. These advanced biologics, even if within the same therapeutic class, function as substitutes by presenting a more compelling option to healthcare providers and patients. For instance, while Coherus has introduced LOQTORZI, a novel PD-1 inhibitor, the ongoing innovation by other pharmaceutical companies in their pipelines means there's a persistent risk of more advanced substitutes emerging.

The threat of substitutes is amplified as competitors invest heavily in R&D to bring differentiated biologics to market. For example, the global biologics market, valued at approximately $420 billion in 2023, continues to see significant investment in innovative therapies. This creates a dynamic environment where existing treatments, including those from Coherus, face the potential for erosion of market share if superior alternatives become available.

- Competitors are developing next-generation biologics with potentially improved efficacy and safety profiles.

- These advanced biologics act as substitutes by offering more attractive alternatives to prescribers and patients.

- Coherus's LOQTORZI faces the threat of superior next-generation PD-1 inhibitors from other companies.

- The ongoing innovation in the biologics market, projected for continued growth, intensifies the threat of substitutes.

The threat of substitutes for Coherus Biosciences' products is generally moderate to low, particularly in its core oncology and immunology markets. While lifestyle changes or surgical options can address some chronic conditions, they rarely fully replace advanced biologic therapies for severe diseases like cancer. For instance, the robust growth of the oncology biologics market in 2024 highlights the limited substitutability for many patients needing these treatments.

However, novel small molecule therapies and cutting-edge treatments like gene and cell therapies pose a more significant substitution risk. Oral targeted therapies are increasingly competing with injectable biologics in oncology, and advancements in gene therapy, with its market valued at approximately $7.5 billion in 2023, signal a potential shift in treatment paradigms. Coherus must monitor these disruptive technologies as they become more effective and accessible.

| Therapy Type | Example | Substitution Threat Level for Coherus | Rationale |

|---|---|---|---|

| Original Branded Biologics | Humira (adalimumab) | Moderate | Strong brand loyalty and established clinical experience create inertia, but biosimilars are gaining traction. |

| Novel Small Molecule Therapies | Targeted oral oncology drugs | High | Offer improved convenience and efficacy, directly competing with injectable biologics. |

| Advanced Therapies (Gene/Cell) | CAR T-cell therapy | High | Potential for curative outcomes, representing a paradigm shift that could replace existing treatments. |

| Non-pharmacological Interventions | Dietary changes, physical therapy | Low to Moderate | Applicable for less severe conditions, but generally insufficient for the complex diseases Coherus targets. |

Entrants Threaten

The biopharmaceutical sector, particularly for advanced treatments like biologics and novel cancer therapies, presents formidable barriers to entry due to stringent regulatory requirements. New companies must successfully navigate the intricate and protracted FDA approval pathway, which involves extensive preclinical research and multi-stage clinical trials, demanding significant time and capital investment.

For biosimilar manufacturers, the challenge is amplified by the need to meticulously prove biosimilarity and, in many cases, achieve interchangeability status, adding layers of regulatory complexity and cost to market entry. In 2024, the average cost to bring a new drug to market, including the extensive clinical trial phases, is estimated to exceed $2 billion, a figure that underscores the immense financial commitment required.

Developing and launching biologic and oncology products demands massive capital for research, development, and manufacturing. Bringing a single biosimilar to market can cost over $100 million, with innovative oncology drugs incurring even higher expenses. This substantial financial commitment creates a significant hurdle for new players, as only companies with considerable funding or robust investor support can enter this arena.

The intellectual property landscape, particularly around patents, acts as a significant barrier to entry for new competitors in the biopharmaceutical space. Originator companies often employ aggressive strategies to defend their patents, which can result in protracted and expensive litigation. This legal maneuvering frequently serves to delay or entirely block the market entry of biosimilar or generic alternatives. For instance, in 2024, the cost of patent litigation for major pharmaceutical companies continued to be substantial, with some cases involving hundreds of millions of dollars in legal fees and potential damages, underscoring the financial commitment required to navigate these challenges.

Even for companies like Coherus Biosciences, which focus on biosimilars, the complexity of patent thickets presents a formidable hurdle. Successfully bringing a biosimilar to market requires not only scientific and manufacturing expertise but also substantial legal acumen and financial resources to manage the intricate web of intellectual property rights. Coherus has experienced this firsthand, engaging in legal battles to clear pathways for its biosimilar products, demonstrating the reality of these IP challenges.

Manufacturing Complexity and Expertise

The manufacturing of complex biological molecules, like those Coherus Biosciences develops, demands highly specialized facilities, a deep bench of skilled scientists and technicians, and rigorous quality control systems. These aren't easily replicated; building these capabilities from scratch is a formidable and costly undertaking, acting as a significant deterrent for potential new players entering the market.

Compliance with Good Manufacturing Practice (GMP) regulations is non-negotiable in this industry, adding another layer of complexity and expense. Furthermore, the ability to scale production efficiently while maintaining quality is crucial, a challenge that requires substantial upfront investment and ongoing operational expertise. Coherus's own history of significant investment in its supply chain underscores the inherent difficulties and capital requirements associated with biologic manufacturing.

- High Capital Investment: Establishing GMP-compliant manufacturing facilities for biologics can cost hundreds of millions of dollars.

- Specialized Workforce: Access to highly trained personnel in areas like bioprocessing, quality assurance, and regulatory affairs is critical and often scarce.

- Regulatory Hurdles: Navigating the stringent regulatory approval processes for manufacturing sites and processes requires extensive time and resources.

- Technical Know-How: The intricate nature of biologic production, including cell culture, purification, and sterile filling, demands specialized technical expertise.

Established Commercial Infrastructure and Market Access

New entrants into the biosimilar market, like those Coherus Biosciences operates within, face significant hurdles in establishing the necessary commercial infrastructure. This includes building out extensive sales forces, sophisticated marketing teams, and cultivating crucial relationships with healthcare providers, insurance payers, and Pharmacy Benefit Managers (PBMs). For instance, securing formulary access and reimbursement for a new biosimilar is a complex, time-consuming, and capital-intensive undertaking.

Companies with existing, proven commercial capabilities, such as Coherus’s established presence in the oncology sector, possess a distinct advantage. This existing network and experience make it considerably more difficult for new, less-established players to effectively penetrate the market and gain traction for their own biosimilar products.

The threat of new entrants for Coherus Biosciences is considerably low due to the immense capital required for research, development, and regulatory approval in the biopharmaceutical sector. For example, bringing a new drug to market in 2024 averaged over $2 billion, a significant barrier for potential new players. Biosimilar development alone can exceed $100 million, further limiting entry.

Intellectual property protection and complex patent landscapes also deter new companies, as navigating and defending against patent litigation is costly and time-consuming. Furthermore, the specialized manufacturing capabilities and stringent GMP compliance needed for biologics demand substantial investment and technical expertise, which new entrants often lack.

The established commercial infrastructure, including sales forces and payer relationships, held by companies like Coherus also presents a significant hurdle for newcomers seeking market access and reimbursement for their products.

| Barrier to Entry | Estimated Cost/Requirement | Impact on New Entrants |

| Regulatory Approval (FDA) | Years of trials, billions in R&D | Extremely High Barrier |

| Biosimilarity & Interchangeability Proof | Tens to hundreds of millions USD | High Barrier |

| Intellectual Property Navigation | Hundreds of millions in litigation | High Barrier |

| Biologic Manufacturing Facilities | Hundreds of millions USD | Very High Barrier |

| Specialized Workforce & Expertise | Scarce and expensive talent | High Barrier |

| Commercial Infrastructure & Payer Access | Significant investment in sales/marketing | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coherus Biosciences is built upon a robust foundation of data, drawing from SEC filings, annual reports, and industry-specific market research from reputable firms like IQVIA and EvaluatePharma to ensure comprehensive competitive insights.