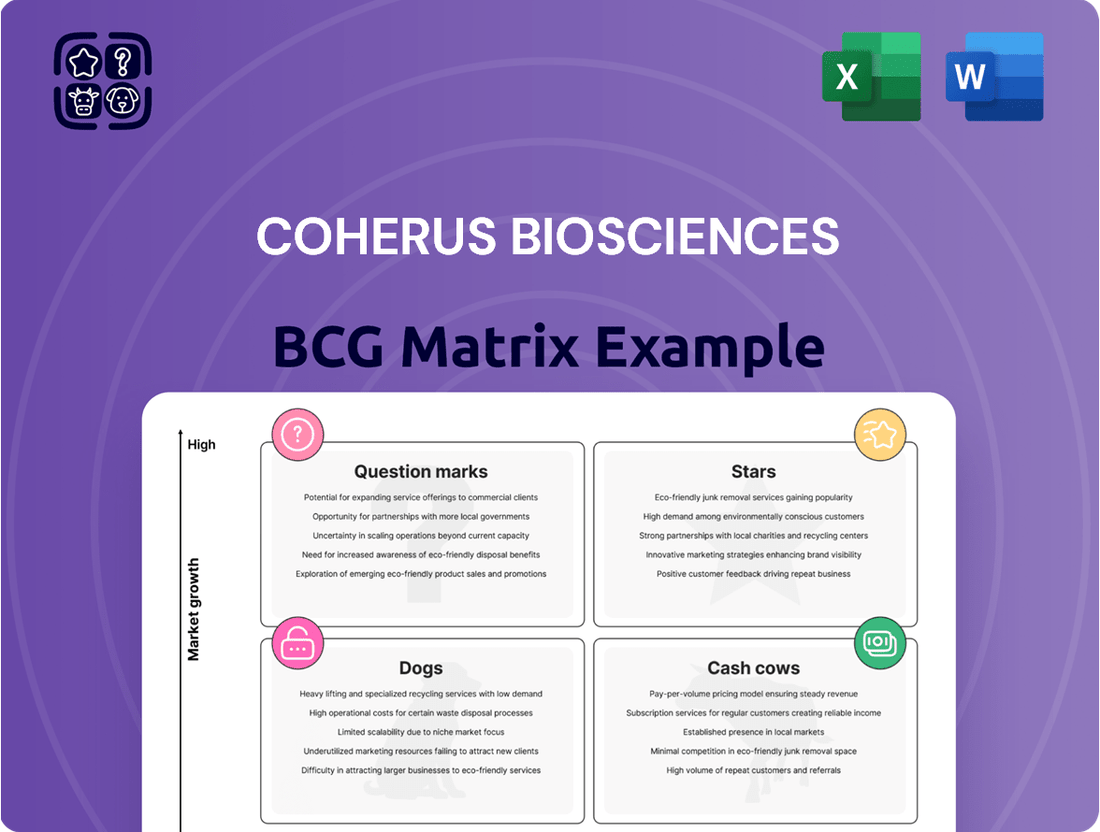

Coherus Biosciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherus Biosciences Bundle

Curious about Coherus Biosciences' product portfolio? Our BCG Matrix analysis highlights key areas like their potential "Stars" and established "Cash Cows."

This preview offers a glimpse into how Coherus Biosciences' products are positioned in the market. To truly understand their strategic direction and identify growth opportunities, you need the full picture.

Purchase the complete Coherus Biosciences BCG Matrix for a detailed quadrant-by-quadrant breakdown and actionable insights to inform your investment and product strategies.

Stars

LOQTORZI, Coherus's flagship oncology product, is positioned as a star in their BCG matrix. It holds the distinction of being the first and only FDA-approved therapy for all patient groups and lines of treatment in recurrent or metastatic nasopharyngeal carcinoma (NPC). This unique market position suggests high growth potential.

The financial performance of LOQTORZI is robust, with net revenue climbing 29% from the third quarter to the fourth quarter of 2024. Furthermore, patient demand saw a significant uptick of over 15% in the first quarter of 2025 compared to the preceding quarter, underscoring its growing market traction.

Coherus is strategically focused on amplifying LOQTORZI's revenue streams. This involves broadening its application within NPC and exploring new therapeutic areas through combinations with its existing pipeline and external partnerships, solidifying its star status.

CHS-114, an anti-CCR8 antibody from Coherus Biosciences, is currently in Phase 1 trials for advanced solid tumors, including head and neck squamous cell carcinoma (HNSCC). This selective antibody targets and depletes CCR8+ regulatory T cells, demonstrating a favorable safety profile in early studies.

Positive Phase 1b data for CHS-114 in head and neck cancer were presented at the 2025 AACR Annual Meeting, highlighting its potential. Coherus is actively pursuing combination studies with LOQTORZI in second-line HNSCC and gastric cancer, with anticipated data readouts in Q2 2026.

Casdozokitug, an IL-27 antagonist antibody, is positioned as a potential Star in Coherus Biosciences' BCG Matrix. Its first-in-class status and ongoing evaluation in Phase 1/2 studies for advanced solid tumors, alongside a Phase 2 study in hepatocellular carcinoma (HCC), highlight its significant growth potential.

The company is actively enrolling patients in a Phase 2 randomized trial combining casdozokitug with toripalimab and bevacizumab for first-line HCC treatment. Initial data from this crucial trial is anticipated in the first half of 2026, which could further solidify its Star status if positive.

Future LOQTORZI Combinations

Coherus Biosciences is strategically expanding LOQTORZI's utility by exploring combinations with both its own pipeline candidates and external therapies. This approach is designed to overcome immune resistance and create synergistic benefits, positioning LOQTORZI as a foundational element in future cancer treatment regimens.

The company is actively investigating LOQTORZI's potential when paired with promising oncology agents during 2025. This initiative is geared towards achieving significant sales multiples and realizing synergistic growth opportunities.

- LOQTORZI Combination Pipeline: Coherus is developing novel combinations for LOQTORZI, targeting immune resistance and synergistic effects.

- 2025 Evaluation Focus: The company plans to evaluate LOQTORZI with promising cancer agents in 2025 to drive sales multiples and synergies.

- Strategic Partnerships: Coherus is pursuing external partnerships to broaden LOQTORZI's combination therapy options.

Oncology Pipeline Expansion

Coherus Biosciences is strategically expanding into oncology with a focus on innovative immuno-oncology candidates. These aim to boost the body's immune response against cancer, potentially leading to better patient outcomes.

The company anticipates significant progress with multiple clinical data readouts from its oncology pipeline expected in 2025 and 2026. This aggressive development schedule underscores Coherus's dedication to introducing novel, high-growth products in the expanding oncology market.

- Pipeline Focus: Innovative immuno-oncology candidates.

- Strategic Goal: Enhance immune responses and improve cancer patient outcomes.

- Key Milestones: Multiple clinical data readouts anticipated in 2025-2026.

- Market Position: Targeting growth in the expanding oncology sector.

LOQTORZI, Coherus's leading oncology product, is firmly established as a Star in their BCG matrix. Its position as the sole FDA-approved therapy for all patient groups and treatment lines in recurrent or metastatic nasopharyngeal carcinoma (NPC) signifies substantial market potential and high growth. The company is actively working to maximize LOQTORZI's revenue by expanding its use in NPC and exploring new therapeutic avenues through strategic combinations.

Casdozokitug, an IL-27 antagonist antibody, is also identified as a potential Star. Its first-in-class status and ongoing Phase 1/2 trials for advanced solid tumors, including a Phase 2 study in hepatocellular carcinoma (HCC), underscore its significant growth prospects. Coherus is actively pursuing a Phase 2 randomized trial combining casdozokitug with established therapies for first-line HCC, with initial data expected in the first half of 2026.

| Product | BCG Matrix Position | Key Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| LOQTORZI | Star | First and only FDA-approved for all NPC lines; expanding combinations | Net revenue up 29% Q3-Q4 2024; Patient demand up >15% Q1 2025 |

| Casdozokitug | Potential Star | First-in-class IL-27 antagonist; ongoing Phase 1/2 & 2 trials | Data from first-line HCC combination trial anticipated H1 2026 |

What is included in the product

This BCG Matrix analysis provides a tailored overview of Coherus Biosciences' product portfolio, identifying strategic opportunities and challenges within each quadrant.

Coherus Biosciences' BCG Matrix offers a clear, visual pain point reliever by simplifying complex portfolio analysis.

This tool provides a strategic roadmap, alleviating the pain of resource allocation decisions.

Cash Cows

UDENYCA, a biosimilar to Neulasta, has been a cornerstone of Coherus Biosciences' revenue, demonstrating robust growth. In fiscal year 2024, net product sales for UDENYCA surged by an impressive 62% year-over-year, reaching $206.0 million. This strong performance underscores its position as a significant cash cow for the company.

By the third quarter of 2024, UDENYCA held a solid 28% market share in the pegfilgrastim sector, maintaining its second-place ranking. Despite Coherus's announcement in December 2024 regarding the planned divestiture of the UDENYCA franchise, with the sale anticipated to finalize in the first or second quarter of 2025, its historical contribution as a substantial cash generator remains a key aspect of its profile.

UDENYCA On-Body Injector, launched in February 2024, is positioned as a strong Cash Cow for Coherus Biosciences. Its rapid adoption, fueled by substantial customer demand and secured payer coverage, highlights its market strength.

The success is evident in the unit demand for the autoinjector, which surged by an impressive 158% in the first quarter of 2024 when compared to the preceding quarter. This growth trajectory indicates a robust and expanding market presence, solidifying its Cash Cow status.

Before its strategic shift, Coherus Biosciences had a solid foundation with established biosimilar products like UDENYCA. These offerings were in mature markets, meaning they typically held significant market share and reliably generated cash with reduced marketing spend. This cash flow was crucial for funding the company's later transition.

Operational Efficiency from Biosimilar Experience

Coherus Biosciences' deep bench of experience in the biosimilar market has honed its operational capabilities, creating a significant advantage for its new oncology ventures. This expertise translates into streamlined development pathways and efficient commercialization strategies.

The company's track record in navigating complex regulatory landscapes for biosimilars, even with divested products, demonstrates a robust and adaptable business model. This operational muscle can be directly applied to accelerating the launch and market penetration of its oncology pipeline.

- Operational Efficiency: Coherus has a proven ability to manage the entire lifecycle of biosimilar products, from development to market.

- Regulatory Expertise: Successfully brought multiple biosimilars to market, indicating strong regulatory submission and approval capabilities.

- Commercialization Prowess: Established commercial infrastructure and experience in marketing and distributing complex biologic products.

- Cost Management: Biosimilar development often necessitates stringent cost controls, which Coherus has likely mastered and can leverage in its oncology segment.

Strategic Divestitures for Capital Generation

Coherus Biosciences strategically divested its UDENYCA franchise, a move that generated substantial capital. The deal was valued at up to $558.4 million, with a significant portion, $483.4 million, received upfront by April 2025. This infusion of cash was crucial for strengthening the company's financial standing.

This divestiture was part of a broader strategy to optimize the company's portfolio and generate capital. By converting existing assets into readily available funds, Coherus aimed to achieve several key financial objectives. The primary goal was to reduce outstanding debt, thereby improving the company's balance sheet.

Furthermore, the capital generated from these strategic divestitures, including the earlier sales of CIMERLI and YUSIMRY, was earmarked for investment in Coherus's promising oncology pipeline. This proactive approach allows the company to fund the development of innovative treatments, positioning it for future growth and market leadership.

- UDENYCA Franchise Divestiture: Up to $558.4 million in total value.

- Upfront Payment Received: $483.4 million by April 2025.

- Strategic Objectives: Debt reduction and funding of the oncology pipeline.

- Portfolio Optimization: Converting existing assets into capital for future innovation.

UDENYCA, a biosimilar to Neulasta, served as a significant cash cow for Coherus Biosciences, demonstrating substantial revenue generation. In fiscal year 2024, net product sales for UDENYCA increased by 62% year-over-year, reaching $206.0 million, highlighting its role as a key financial contributor. Although Coherus announced plans in December 2024 to divest the UDENYCA franchise, with the sale expected to conclude in early to mid-2025, its historical performance as a strong cash generator is undeniable.

| Product | Fiscal Year 2024 Net Sales | Market Share (Q3 2024) | Key Characteristic |

|---|---|---|---|

| UDENYCA | $206.0 million | 28% (Pegfilgrastim Sector) | Established Cash Cow, recently divested |

Delivered as Shown

Coherus Biosciences BCG Matrix

The Coherus Biosciences BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready report. You can be confident that the strategic insights and professional presentation you see now will be yours to use immediately. This ensures you're getting precisely what you need for your business planning and decision-making processes without any alteration or compromise.

Dogs

CIMERLI, a ranibizumab biosimilar, represented a significant, albeit complex, asset for Coherus Biosciences. Despite achieving a notable 38% market share in the ranibizumab market during 2023, its profitability was significantly hampered by substantial royalty payments on its sales. This made CIMERLI, in essence, a low-profitability asset within Coherus's portfolio.

The strategic decision to divest CIMERLI to Sandoz in April 2024 for a potential $190 million, including a $170 million upfront payment, underscores its position. While this sale provided immediate capital, it also signaled a move away from a product that, despite market penetration, was deemed the least profitable. This divestiture aligns with a strategy to focus on higher-margin opportunities.

YUSIMRY (adalimumab-aqvh), a low-concentration biosimilar of adalimumab, represented a weak player in Coherus Biosciences' portfolio. In June 2024, the company divested YUSIMRY to a Chinese firm for $40 million, reflecting its limited strategic value.

The biosimilar struggled significantly in the market, holding a mere 0.3% market share in the third quarter of 2023. This anemic performance underscored its low market penetration and highlighted the intense competition within the adalimumab biosimilar space.

Coherus' decision to sell YUSIMRY was a strategic move to streamline its focus, particularly shifting its attention towards the more promising oncology sector. This divestiture allowed the company to reallocate resources to areas with higher growth potential.

Coherus Biosciences' strategic pivot towards oncology means its biosimilar assets outside this core area are now considered non-core. These products, potentially including those in immunology or other therapeutic areas, are likely candidates for the question mark category in a BCG analysis.

As Coherus prioritizes its oncology portfolio, investment and management attention will naturally shift away from these non-core biosimilars. Without significant growth potential or a clear path to market leadership, these assets could become cash drains, necessitating a strategic decision regarding their future, such as divestiture.

Products with High Royalty Burdens

Products with high royalty burdens, like CIMERLI for Coherus Biosciences, can be categorized as Cash Cows with a caveat. While they might capture significant market share and generate substantial revenue, their profitability is significantly hampered by these ongoing royalty payments. This means that despite their sales volume, their contribution to the company's net profit is disproportionately low.

For instance, CIMERLI, a biosimilar to bevacizumab, has faced challenges due to its royalty structure. While it contributes to Coherus's revenue stream, the high cost of royalties directly impacts its net margin. This situation highlights how a strong market presence doesn't automatically translate to high profitability when significant portions of revenue are allocated to external obligations.

- CIMERLI's profitability is constrained by substantial royalty obligations.

- High royalties reduce the net profit contribution of otherwise strong-selling products.

- Such products consume revenue without delivering proportional profit growth.

Early-Stage Biosimilar Projects (discontinued)

Early-stage biosimilar projects that Coherus Biosciences discontinued, particularly those phased out during its strategic pivot towards oncology, would fall into the 'cash trap' category of the BCG Matrix. These initiatives, while consuming valuable research and development capital, failed to advance towards market entry, representing a drain on resources without generating future revenue streams. For instance, Coherus has actively worked to reduce costs associated with its biosimilar portfolio, a move that underscores its strategic redirection and the cessation of investment in such stalled projects.

- Discontinued Early-Stage Biosimilar Projects: These represent investments in biosimilar development that did not progress to commercialization.

- Resource Consumption: Such projects consumed R&D funds and personnel time without yielding a marketable product.

- Strategic Pivot Impact: Coherus's shift in focus towards oncology led to the discontinuation of certain biosimilar pipelines.

- Cost Reduction Efforts: The company's actions to lower biosimilar-related expenses confirm the winding down of these earlier-stage, non-advancing ventures.

Coherus Biosciences' divestiture of CIMERLI and YUSIMRY in 2024 signals a strategic move away from products with limited profitability or market traction, aligning with the BCG Matrix's concept of "Dogs." CIMERLI, despite a 38% market share in 2023, was burdened by high royalty payments, making it a low-profitability asset. YUSIMRY, with a mere 0.3% market share in Q3 2023, represented a clear underperformer. The sale of these assets for $190 million and $40 million respectively frees up resources for Coherus's prioritized oncology sector.

| Product | Market Share (2023) | Divestiture Value (2024) | Strategic Rationale |

| CIMERLI | 38% (Ranibizumab market) | Up to $190 million | High royalty burden, low profitability |

| YUSIMRY | 0.3% (Adalimumab market, Q3) | $40 million | Low market penetration, limited strategic value |

Question Marks

CHS-1000, an investigational drug from Coherus Biosciences, falls into the Question Mark category within the BCG Matrix. The FDA permitted its Investigational New Drug (IND) application to move forward in the second quarter of 2024, a positive step. However, the crucial decision to initiate a first-in-human clinical study remains pending, contingent on Coherus's internal portfolio prioritization. This means CHS-1000’s future development and market success are still uncertain, requiring significant investment to determine its potential.

Coherus Biosciences' early-stage immuno-oncology pipeline, beyond its more advanced candidates like CHS-114 and casdozokitug, likely includes several unpublicized or pre-clinical assets. These represent significant future growth opportunities within the rapidly expanding oncology market, though they currently hold minimal market share and necessitate considerable investment for development and validation.

Coherus Biosciences is exploring new indications for LOQTORZI, particularly in combination therapies. These ventures are crucial for future growth, aiming to expand LOQTORZI's market reach beyond its current approved uses.

Several of these combination studies are in their nascent stages, meaning they are still being tested and evaluated. While the potential for high growth is present, the success of these unproven combinations is not guaranteed, placing them in the 'Question Mark' category of the BCG matrix.

For instance, Coherus reported in their Q1 2024 earnings call that ongoing research includes combinations with other oncology agents. The company’s investment in these early-stage trials reflects a strategic bet on future market opportunities, though significant capital is needed to navigate clinical development and regulatory hurdles.

Undisclosed Future Partnerships

Coherus Biosciences actively seeks capital-efficient external partnerships to expand LOQTORZI's label indications and broaden its revenue streams. These potential collaborations represent future growth opportunities that are currently unconfirmed and carry inherent market uncertainty.

Given their speculative nature and the lack of demonstrated market impact, these undisclosed future partnerships are categorized as Question Marks within the BCG Matrix. Their eventual success and contribution to Coherus's portfolio will depend on successful negotiation, regulatory approval, and market adoption.

- Potential for Growth: Future partnerships could unlock new markets and revenue for LOQTORZI.

- Uncertainty: The success and market impact of these partnerships are currently unknown.

- Capital Efficiency: Coherus is prioritizing partnerships that are financially prudent.

Any New Product Candidates from Internal Research

Coherus Biosciences' internal research pipeline likely harbors promising new product candidates, particularly within oncology. These early-stage discoveries would typically be classified as Question Marks in a BCG Matrix. This means they represent high potential in a growing market but currently have minimal market share, demanding significant investment in research and development, alongside successful clinical trials to mature.

As of early 2024, Coherus has been actively advancing its oncology portfolio, including UDENYCA (pegfilgrastim-cbkn) and the acquisition of biosimilar assets. While specific internal research candidates are not publicly detailed until later stages, the company's strategic shift towards innovation suggests a robust effort in identifying novel oncology targets. For instance, the company's focus on immuno-oncology and targeted therapies indicates potential areas for internal discovery.

- High Growth Potential: New oncology drug candidates often target rapidly expanding markets driven by unmet medical needs and advancements in personalized medicine.

- Low Current Market Share: Being in the early research phase, these candidates have no existing market share.

- Substantial R&D Investment: Bringing a new drug from discovery to market requires significant financial commitment, often in the hundreds of millions of dollars, for preclinical and clinical development.

- High Risk and Uncertainty: The success rate for new drug candidates is historically low, with many failing during clinical trials.

Coherus Biosciences' Question Marks represent promising but unproven opportunities, demanding significant investment. These include early-stage pipeline assets like CHS-1000, new indications for LOQTORZI, and potential future partnerships, all characterized by high growth potential but currently low market share and substantial risk. The company's strategic focus on oncology innovation suggests a pipeline of internal research candidates, also fitting the Question Mark profile due to their early stage and inherent uncertainties.

| Asset/Opportunity | Category | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|---|

| CHS-1000 | Question Mark | High (Immuno-oncology) | None | High (Clinical Trials) | High |

| LOQTORZI Combination Therapies | Question Mark | High (Oncology Market Expansion) | Low (New Indications) | Moderate (Clinical Trials) | Moderate to High |

| Undisclosed Future Partnerships | Question Mark | High (Market Expansion) | None | Variable (Negotiation Dependent) | High |

| Internal Early-Stage Oncology Pipeline | Question Mark | High (Oncology Market) | None | Very High (R&D) | Very High |

BCG Matrix Data Sources

Our Coherus Biosciences BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth forecasts, and competitor analyses, to provide strategic insights.