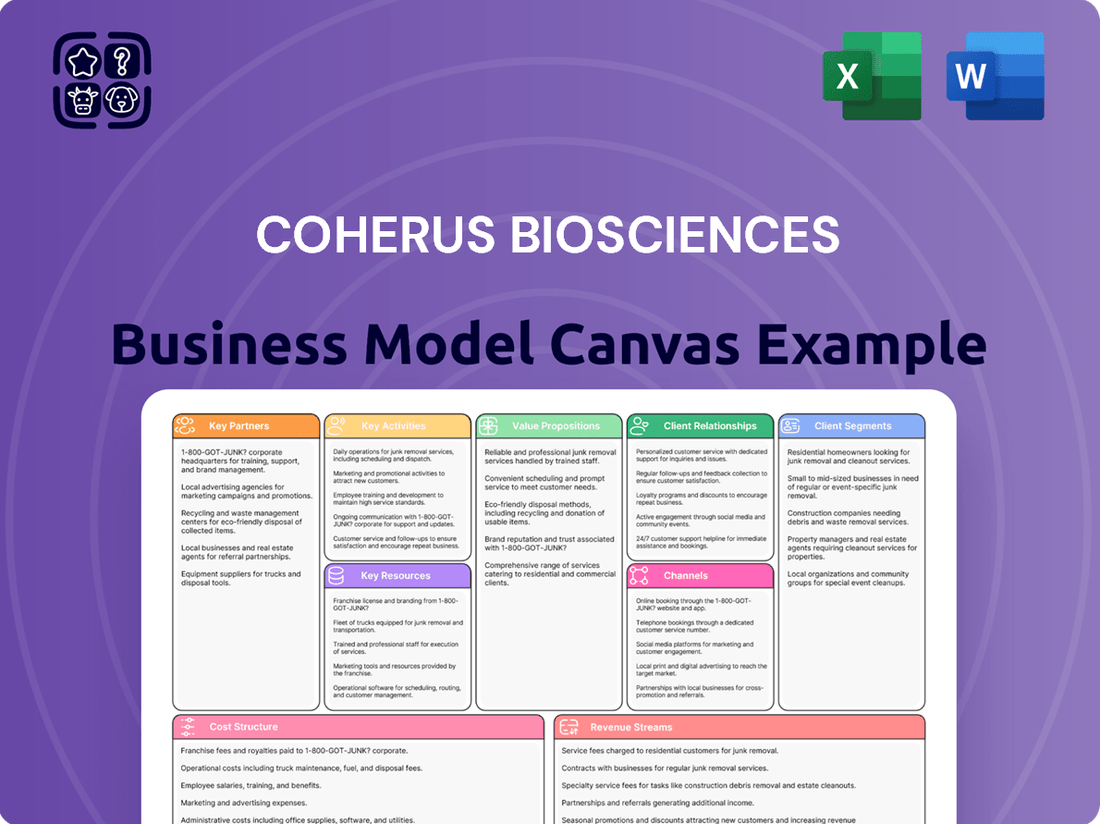

Coherus Biosciences Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherus Biosciences Bundle

Unlock the full strategic blueprint behind Coherus Biosciences's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Coherus Biosciences actively cultivates strategic alliances with other pharmaceutical and biotech firms. These partnerships are crucial for the co-development and rigorous evaluation of innovative cancer treatments, specifically to broaden the approved uses and enhance the effectiveness of their immuno-oncology portfolio.

A key aspect of these collaborations involves testing LOQTORZI, Coherus's flagship immuno-oncology product, in combination with emerging, high-potential cancer therapies. For instance, in 2024, Coherus announced a collaboration to explore LOQTORZI alongside a novel small molecule inhibitor, aiming to achieve synergistic anti-tumor effects.

Coherus Biosciences actively partners with academic and research institutions to drive innovation in oncology. These collaborations are vital for deepening scientific knowledge, exploring novel therapeutic avenues, and pinpointing promising new targets for cancer treatment. For instance, in 2024, Coherus continued to engage with leading universities and research centers, fostering an environment where cutting-edge discoveries can be translated into potential clinical applications.

Coherus Biosciences relies on Contract Manufacturing Organizations (CMOs) for the crucial production and packaging of its existing drug portfolio and its developing pipeline. These partnerships are vital for maintaining a consistent and compliant supply chain.

The strategic importance of CMOs is underscored by the resumption of UDENYCA production in late 2024, handled by these third-party manufacturers. This demonstrates Coherus’s ongoing need for external manufacturing expertise to ensure product availability and meet stringent regulatory requirements.

Distribution and Commercialization Partners (Historical/Divested Biosimilars)

Coherus Biosciences has historically relied on key partnerships for the distribution and commercialization of its biosimilar products. These collaborations were crucial for market access in specific geographic regions.

A notable example is the partnership with Daiichi Sankyo, which handled the commercialization of Coherus's biosimilar etanercept and rituximab in select Asian markets. While Coherus is strategically shifting away from biosimilars, these past arrangements highlight the importance of distribution networks.

Even with the divestment from biosimilars, any residual distribution agreements or transitional arrangements for existing biosimilar assets remain relevant to the business model. These partnerships allowed Coherus to leverage established commercial infrastructure.

The company's strategic pivot means that future partnerships will likely focus on its oncology pipeline, rather than the historical biosimilar distribution arrangements.

Healthcare Providers and Networks

Coherus Biosciences actively cultivates relationships with healthcare providers and networks, including hospitals, specialized oncology clinics, and integrated delivery networks. These collaborations are fundamental to securing market access for its biosimilar and innovative oncology therapies, driving product adoption, and collecting crucial real-world evidence to support their efficacy and value proposition.

Direct engagement with healthcare professionals, especially oncologists, forms the bedrock of Coherus' sales and marketing initiatives. This focused approach ensures that clinicians are well-informed about the benefits and appropriate use of Coherus' treatments. For instance, in 2024, Coherus continued to expand its commercial reach, aiming to capture a significant share of the oncology biosimilar market, which is projected to grow substantially in the coming years.

- Hospital and Clinic Partnerships: Coherus collaborates with a wide array of healthcare institutions to facilitate patient access to its oncology drugs.

- Oncologist Engagement: Direct sales force efforts and medical affairs teams focus on educating oncologists about product profiles and clinical data.

- Real-World Evidence Generation: Partnerships enable the collection of data demonstrating product performance and patient outcomes in clinical practice.

- Market Access Strategy: Collaborations are key to navigating payer landscapes and securing formulary placement for Coherus' therapies.

Coherus Biosciences' key partnerships are vital for its strategic focus on oncology, particularly with other biotech firms for co-development and clinical trials of its immuno-oncology product, LOQTORZI. These collaborations, including a 2024 agreement to test LOQTORZI with a novel small molecule inhibitor, aim to enhance anti-tumor effects and expand treatment options.

The company also leverages partnerships with academic and research institutions to advance scientific understanding and identify new therapeutic targets, a strategy actively pursued in 2024. Furthermore, Coherus relies on Contract Manufacturing Organizations (CMOs) for production, as demonstrated by the 2024 resumption of UDENYCA manufacturing by these external partners, ensuring supply chain integrity.

| Partnership Type | Focus Area | 2024 Impact/Activity |

|---|---|---|

| Biotech/Pharma Collaborations | Oncology Drug Co-development (e.g., LOQTORZI combinations) | Announced collaboration with a novel small molecule inhibitor for synergistic effects. |

| Academic/Research Institutions | Scientific Knowledge Advancement, Target Identification | Continued engagement with universities for translating discoveries into clinical applications. |

| Contract Manufacturing Organizations (CMOs) | Drug Production and Packaging | Resumed UDENYCA production, highlighting reliance for supply chain. |

What is included in the product

Coherus Biosciences' business model focuses on developing and commercializing high-quality, affordable biosimil products, targeting physicians and payers with a value-driven approach to healthcare access.

This model emphasizes efficient manufacturing, strategic partnerships, and a robust sales and marketing infrastructure to capture market share in the growing biosimilar landscape.

Coherus Biosciences' Business Model Canvas acts as a pain point reliever by offering a clean and concise layout ready for boardrooms or teams to quickly identify core components and understand their strategy for bringing biosimil products to market.

This model saves hours of formatting and structuring, providing a shareable and editable snapshot for team collaboration and adaptation, effectively addressing the pain of complex strategy communication.

Activities

Coherus Biosciences' core activity is the relentless pursuit of groundbreaking immuno-oncology treatments. This involves not only pushing forward existing promising therapies like LOQTORZI into new areas of cancer treatment but also nurturing a robust pipeline of future innovations, including promising candidates such as casdozokitug and CHS-114.

A critical component of this R&D is the meticulous execution of clinical trials. These trials span multiple phases, from early-stage safety assessments to larger-scale efficacy studies, ensuring that new therapies meet rigorous scientific and regulatory standards before they can reach patients.

Coherus Biosciences' key activities include the commercialization and marketing of its approved oncology products, most notably LOQTORZI, a PD-1 inhibitor. The company is actively focused on maximizing LOQTORZI's revenue potential within its approved indications, such as nasopharyngeal carcinoma.

Their sales and marketing approach is built around direct engagement with healthcare professionals, ensuring targeted outreach and education about LOQTORZI's benefits. This direct interaction is crucial for driving adoption and market penetration.

For the first quarter of 2024, Coherus reported net product sales of $72.9 million, with LOQTORZI contributing $26.6 million in its initial launch period. This demonstrates early traction for the product.

Coherus Biosciences actively manages the entire lifecycle of its clinical trials, a crucial activity for bringing new therapies to market. This involves meticulous planning, execution, and rigorous data analysis to ensure the safety and efficacy of their drug candidates.

Navigating complex regulatory landscapes is paramount. Coherus's commitment to regulatory affairs ensures compliance with agencies like the U.S. Food and Drug Administration (FDA), facilitating the progression of their drug candidates through the development pipeline and toward potential market authorization.

In 2024, Coherus continued to advance its pipeline, with key clinical trial milestones being reported across its portfolio. For instance, their work on UDENYCA (pegfilgrastim-cbkn) and CIMERLI (biosimilar trastuzumab-qyjp) demonstrates their ongoing engagement in managing and progressing late-stage clinical development and regulatory submissions.

Intellectual Property Management and Protection

Coherus Biosciences actively manages and protects its intellectual property, a critical component for its oncology pipeline and established products. This strategy is vital for securing its competitive edge in the biopharmaceutical market.

The company diligently pursues patent filings for new discoveries and vigorously defends its existing patent portfolio. This proactive approach ensures the exclusivity of its innovative therapies.

- Patent Filings: Coherus continues to file new patents to cover its ongoing research and development in oncology.

- Patent Defense: The company actively monitors and defends its issued patents against potential infringements, safeguarding its market position.

- Portfolio Strength: A robust intellectual property portfolio is key to Coherus's valuation and its ability to attract investment and partnerships.

Strategic Business Development and Portfolio Management

Coherus Biosciences actively engages in strategic business development by divesting non-core biosimilar assets to sharpen its focus. For instance, the divestiture of UDENYCA (pegfilgrastim-cbqv) and their CIMERLI (biosimilar ranibizumab-eqni) and YUSIMRY (biosimilar adalimumab-aqv) biosimilar franchises were key moves. This strategy aims to bolster their financial health and concentrate resources on their promising oncology pipeline.

- Strategic Divestitures: Coherus completed the divestiture of its UDENYCA and CIMERLI biosimilar franchises to Syngene International Limited in 2024, generating significant upfront payments and potential milestone payments.

- Portfolio Prioritization: This divestiture allowed Coherus to streamline its operations, focusing capital and management attention on advancing its late-stage oncology assets.

- Financial Enhancement: The transactions are designed to improve Coherus's balance sheet and provide runway for ongoing clinical development and potential future acquisitions.

- Future Opportunities: The company continues to evaluate in-licensing and out-licensing opportunities to complement its existing portfolio and drive long-term growth in the oncology space.

Coherus Biosciences' key activities revolve around advancing its oncology pipeline, particularly with immuno-oncology therapies like LOQTORZI. This involves rigorous clinical trial execution across multiple phases to ensure safety and efficacy, alongside meticulous management of the entire trial lifecycle from planning to data analysis.

Commercialization and marketing of approved products, such as LOQTORZI for nasopharyngeal carcinoma, are central. This includes direct engagement with healthcare professionals to drive product adoption and market penetration. Furthermore, Coherus actively manages its intellectual property through patent filings and defense, safeguarding its competitive edge.

Strategic business development, including the divestiture of non-core biosimilar assets, is another crucial activity. These divestitures, such as the 2024 sale of UDENYCA and CIMERLI franchises, aim to enhance financial health and concentrate resources on their promising oncology pipeline.

| Key Activity | Description | 2024 Data/Impact |

| Oncology Pipeline Advancement | Developing and advancing novel immuno-oncology treatments. | Continued progress on LOQTORZI, casdozokitug, and CHS-114. |

| Clinical Trial Execution | Managing all phases of clinical trials for drug candidates. | Ongoing trials for multiple oncology assets. |

| Product Commercialization | Marketing and sales of approved products like LOQTORZI. | Q1 2024 LOQTORZI sales of $26.6 million. |

| Intellectual Property Management | Filing and defending patents for its therapies. | Active patent filings to protect R&D discoveries. |

| Strategic Divestitures | Selling non-core biosimilar assets to focus on oncology. | Divestiture of UDENYCA and CIMERLI franchises in 2024. |

Full Version Awaits

Business Model Canvas

This preview showcases the actual Coherus Biosciences Business Model Canvas, offering a transparent glimpse into the comprehensive analysis you will receive. Upon purchase, you gain full access to this exact document, meticulously detailing Coherus's strategic framework, value proposition, customer segments, and revenue streams.

Resources

Coherus' proprietary oncology pipeline, featuring LOQTORZI (toripalimab-tpzi) and promising clinical-stage assets like casdozokitug and CHS-114, forms the bedrock of its business model. These innovative drug candidates represent significant intellectual capital and are poised to be the primary drivers of future revenue growth.

LOQTORZI, a next-generation PD-1 inhibitor, received FDA approval in October 2023 for the treatment of nasopharyngeal carcinoma, a critical milestone. This approval, along with ongoing clinical trials for other indications, underscores the value and potential of Coherus' internal research and development efforts.

Coherus Biosciences' scientific and clinical expertise is a cornerstone of its business model. This human capital comprises a team with deep knowledge in oncology and immunology, crucial for developing and bringing biosimilar products to market. Their collective experience in drug development and navigating regulatory pathways is essential for success.

This world-class team is directly responsible for driving Coherus' research and development pipeline, ensuring the scientific rigor and clinical validity of their biosimilar candidates. Their ability to identify promising molecules and manage complex clinical trials is a critical resource, directly impacting the company's ability to deliver innovative treatments.

Coherus Biosciences heavily relies on its intellectual property portfolio, particularly patents, to safeguard its innovative oncology therapies and the sophisticated development processes behind them. This robust IP protection acts as a significant competitive moat, reinforcing the company's unique value proposition in a demanding market.

As of early 2024, Coherus had a strong patent strategy in place, with numerous patents covering its key biosimilar products, including UDENYCA® (pegfilgrastim-cbkn) and CIMERLI® (biosimilar trastuzumab-ekko). These patents are crucial for maintaining market exclusivity and preventing direct competition, thereby supporting its revenue streams and future growth potential.

Financial Capital and Cash Reserves

Coherus Biosciences relies on robust financial capital and substantial cash reserves to fuel its demanding research and development pipeline, navigate complex clinical trials, and execute successful commercialization strategies. These resources are the lifeblood of innovation in the biopharmaceutical sector.

Recent strategic moves, including divestitures, have been instrumental in bolstering the company's cash position. This strengthening is crucial for providing the necessary runway to advance its promising pipeline candidates through various stages of development.

- Cash Position: As of Coherus Biosciences' Q1 2024 earnings report, the company reported cash, cash equivalents, and marketable securities totaling approximately $339 million.

- Funding R&D: This capital is essential for funding the extensive preclinical and clinical research required for novel therapies, such as their IgA nephropathy program.

- Strategic Divestitures: The divestiture of UDENYCA in early 2024, for example, generated significant proceeds aimed at enhancing financial flexibility and supporting pipeline advancement.

- Operational Runway: The bolstered cash reserves are projected to provide an extended operational runway, enabling Coherus to meet its financial obligations and strategic objectives through 2025 and beyond.

Manufacturing and Supply Chain Infrastructure (Internal & External)

Coherus Biosciences relies on a hybrid approach for its manufacturing and supply chain infrastructure, utilizing both internal capabilities and external Contract Manufacturing Organizations (CMOs). This strategy ensures access to specialized facilities, particularly for biologics production, which is critical for their therapeutic offerings. For instance, in 2024, Coherus continued to manage its supply chain with a focus on reliability and quality, a key factor given the complexities of biosimilar manufacturing.

Access to robust manufacturing capabilities and a secure supply chain, whether internal or through partnerships, is essential for producing high-quality therapeutics and ensuring product availability. This includes specialized facilities for biologics production, a cornerstone of Coherus's product portfolio. Their commitment to maintaining a strong supply chain was evident in their operational focus throughout 2024, aiming to meet market demand effectively.

- Internal Capabilities: Maintaining some in-house manufacturing expertise for critical processes or quality control.

- CMO Partnerships: Leveraging external CMOs for large-scale production and specialized biologics manufacturing.

- Supply Chain Security: Implementing robust systems to ensure the integrity and timely delivery of raw materials and finished products.

- Quality Assurance: Strict adherence to quality standards across all manufacturing and supply chain operations to guarantee therapeutic efficacy and patient safety.

Coherus' key resources are its innovative oncology pipeline, including LOQTORZI, its scientific and clinical expertise, a robust intellectual property portfolio, substantial financial capital, and a hybrid manufacturing and supply chain strategy.

The company's internal R&D efforts, particularly with LOQTORZI, are central. This is supported by a team of experts in oncology and immunology, crucial for navigating the complex drug development process. Their intellectual property provides a competitive edge, safeguarding their therapies.

Financial strength, with $339 million in cash, cash equivalents, and marketable securities as of Q1 2024, fuels R&D and commercialization. Strategic divestitures, like that of UDENYCA, bolster this financial flexibility, ensuring runway through 2025.

The manufacturing and supply chain leverage both internal capabilities and external CMOs, ensuring quality and availability of biologics. This dual approach is vital for delivering their therapeutic offerings to market effectively.

| Key Resource | Description | Status/Data Point |

| Oncology Pipeline | Proprietary drug candidates | LOQTORZI (toripalimab-tpzi) FDA approved Oct 2023; clinical-stage assets |

| Scientific & Clinical Expertise | Human capital in oncology/immunology | World-class team driving R&D |

| Intellectual Property | Patents protecting therapies | Strong patent strategy for UDENYCA®, CIMERLI® |

| Financial Capital | Cash reserves for operations | $339 million cash, cash equivalents, marketable securities (Q1 2024) |

| Manufacturing & Supply Chain | Internal capabilities and CMO partnerships | Hybrid approach for biologics production, focus on quality and security |

Value Propositions

Coherus is dedicated to making cutting-edge cancer treatments available to more patients, especially those facing rare or aggressive cancers with limited options, such as nasopharyngeal carcinoma. Their strategy centers on delivering next-generation immuno-oncology drugs.

By focusing on these innovative therapies, Coherus aims to address significant unmet medical needs in oncology, potentially improving patient outcomes in challenging disease areas. This commitment to novel treatments underscores their value proposition.

Coherus Biosciences is focused on creating new combination therapies by pairing LOQTORZI with its pipeline drugs. This approach aims to boost the body's immune response against cancer, overcome resistance mechanisms, and ultimately offer longer survival times for patients.

For instance, the company is actively investigating LOQTORZI in combination with other agents for various solid tumors. In 2024, Coherus reported promising early-stage data for a LOQTORZI combination in advanced unresectable hepatocellular carcinoma, showing encouraging objective response rates that suggest a significant improvement over current standards of care.

Coherus Biosciences historically offered high-quality, affordable biosimilars, providing significant cost savings to healthcare systems and improving patient access to critical treatments. This value proposition was central to their strategy, particularly with divested assets.

For instance, in 2023, Coherus reported net product sales of $223.7 million, driven by its biosimilar portfolio, demonstrating the market's embrace of these cost-effective alternatives.

Synergistic Immuno-Oncology Pipeline

Coherus Biosciences is building a powerful immuno-oncology franchise around its approved PD-1 inhibitor, LOQTORZI. This strategy focuses on creating a synergistic pipeline of novel therapies designed to enhance patient responses and broaden treatment options across a range of cancers.

The pipeline features promising candidates such as casdozokitug, a potential first-in-class ILT4 antibody, and CHS-114, an investigational antibody-drug conjugate. These agents are being developed to work alongside LOQTORZI, aiming to overcome resistance mechanisms and improve outcomes for patients who may not fully respond to PD-1 monotherapy.

- Synergistic Development: Coherus is strategically advancing its pipeline candidates, including casdozokitug and CHS-114, to complement LOQTORZI's efficacy.

- Broad Applicability: The goal is to offer comprehensive treatment solutions for various tumor types by combining different immuno-oncology mechanisms.

- Clinical Progress: Casdozokitug is being evaluated in combination with LOQTORZI in clinical trials, demonstrating the company's commitment to this integrated approach.

- Market Potential: This pipeline expansion aims to capture a significant share of the growing immuno-oncology market, which was projected to reach over $100 billion globally by 2027.

Proven Commercial Capabilities in Oncology

Coherus Biosciences is making a significant push into oncology, and a key part of their strategy is using their existing commercial muscle. This means they're not starting from scratch; they're building on a foundation of proven experience in bringing drugs to market and driving sales. Their established infrastructure is a major asset as they introduce new cancer therapies.

This proven capability allows Coherus to effectively launch and grow sales for their innovative cancer treatments. They have a demonstrated ability to get their products into the hands of doctors and patients, showing a strong capacity to penetrate the competitive oncology market. For example, in 2023, Coherus reported total revenue of $238.7 million, a significant portion of which is expected to come from their oncology portfolio as it expands.

- Leveraging Existing Commercial Infrastructure: Coherus can deploy its established sales force, marketing teams, and distribution networks to support new oncology products.

- Demonstrated Market Penetration: The company has a track record of successfully launching and gaining market share for biopharmaceutical products.

- Focus on Oncology Growth: This value proposition highlights their strategic commitment to becoming a significant player in the cancer treatment space.

- Maximizing Launch Success: By utilizing their proven capabilities, Coherus aims to ensure the successful commercialization and adoption of its oncology pipeline.

Coherus Biosciences is focused on delivering innovative immuno-oncology treatments, particularly for challenging cancers like nasopharyngeal carcinoma. Their strategy involves developing next-generation therapies and combination treatments designed to improve patient outcomes.

The company is building a strong immuno-oncology franchise around its PD-1 inhibitor, LOQTORZI, by creating a synergistic pipeline of novel agents like casdozokitug and CHS-114. This approach aims to enhance patient responses and broaden treatment options across various cancers.

Coherus leverages its established commercial infrastructure, including a sales force and distribution networks, to effectively launch and grow sales for its oncology products. This proven capability supports market penetration and aims to maximize the success of their new cancer therapies.

For instance, Coherus reported total revenue of $238.7 million in 2023, demonstrating their commercial strength as they expand into the oncology market. The company is also actively pursuing clinical trials for LOQTORZI combinations, with early 2024 data showing promising response rates in advanced hepatocellular carcinoma.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Innovative Immuno-Oncology Treatments | Making cutting-edge cancer therapies available to patients with limited options, focusing on next-generation immuno-oncology drugs. | Targeting rare/aggressive cancers like nasopharyngeal carcinoma; developing combination therapies with LOQTORZI. |

| Synergistic Pipeline Development | Building an immuno-oncology franchise around LOQTORZI by developing complementary pipeline candidates. | Pipeline includes casdozokitug (ILT4 antibody) and CHS-114 (ADC); aim to overcome resistance and improve responses. |

| Leveraging Commercial Expertise | Utilizing established commercial infrastructure to successfully launch and grow sales for new oncology products. | Proven track record in bringing biopharmaceutical products to market; 2023 total revenue of $238.7 million. |

Customer Relationships

Coherus Biosciences cultivates direct relationships with oncologists, providing them with comprehensive medical education and robust clinical support. This direct engagement is paramount for effectively introducing and detailing their oncology portfolio, ensuring healthcare professionals are well-informed about the benefits and usage of Coherus' innovative therapies.

In 2023, Coherus reported significant growth in its oncology segment, driven by strong physician adoption. This direct sales and education model has been instrumental in their market penetration strategies for key products like UDENYCA® (pegfilgrastim-cbqv) and CIMERLI® (biosimilar trastuzumab-qyjp).

Coherus Biosciences actively cultivates relationships with patient advocacy groups to gain crucial insights into patient needs and challenges. These partnerships are vital for developing effective support programs that improve therapy access and foster trust.

In 2024, Coherus continued to invest in patient support services, aiming to ease the burden of treatment for individuals managing chronic conditions. Such programs often include educational resources, financial assistance navigation, and adherence support, directly addressing patient-reported needs.

Coherus Biosciences employs a dedicated key account management strategy for its commercialized products, targeting major institutions like hospitals, cancer centers, and integrated health networks. This approach is crucial for establishing and nurturing relationships with these high-value customers, particularly for their oncology treatments. For instance, in 2024, Coherus continued to build upon its commercial foundation, emphasizing direct engagement with key decision-makers within these healthcare systems to ensure access and adoption of its therapies.

Investor Relations and Communication

Coherus Biosciences prioritizes clear and consistent communication with its investor base. This involves providing timely updates on clinical development, regulatory milestones, and commercial performance. For instance, in 2024, Coherus actively engaged with the financial community through earnings calls and investor presentations, detailing progress on its biosimilar portfolio and pipeline expansion.

The company's investor relations strategy includes:

- Regular Financial Reporting: Adherence to SEC filing deadlines and providing detailed quarterly and annual financial statements.

- Business Updates: Disseminating information on key operational achievements and strategic initiatives through press releases and investor decks.

- Investor Conference Participation: Actively presenting at industry and financial conferences to connect with analysts and potential investors.

- Proactive Engagement: Maintaining an open dialogue with stakeholders to address inquiries and provide insights into the company's trajectory.

Strategic Partnerships and Collaborations

Coherus Biosciences cultivates strategic partnerships and collaborations to bolster its development, manufacturing, and commercialization efforts. These relationships are meticulously managed via formal agreements, ensuring a shared vision and seamless execution of strategic objectives.

The company actively engages with development partners to advance its pipeline, often sharing risks and rewards. For instance, in 2024, Coherus continued its collaboration with established biopharmaceutical firms, leveraging their expertise in specific therapeutic areas to accelerate drug development timelines.

Manufacturing partnerships are critical for Coherus, ensuring reliable supply chains. By outsourcing certain manufacturing processes to specialized contract manufacturing organizations (CMOs), Coherus can maintain flexibility and focus on its core competencies. This approach proved beneficial in 2024, allowing them to scale production efficiently for their key products.

- Development Collaborations: Partnerships focused on co-development of novel therapies, sharing R&D costs and market access.

- Manufacturing Alliances: Agreements with CMOs for efficient and scalable production of biosimilars and other biologics.

- Commercialization Partnerships: Collaborations with pharmaceutical companies for marketing and distribution in specific territories or for particular indications.

- Licensing Agreements: Acquiring rights to develop and commercialize third-party assets, expanding the product portfolio.

Coherus Biosciences prioritizes direct engagement with oncologists and healthcare professionals, offering extensive medical education and clinical support to ensure optimal understanding and utilization of their oncology treatments. This direct approach was a key driver for their 2023 growth, particularly for products like UDENYCA® and CIMERLI®.

The company also fosters relationships with patient advocacy groups to better understand and address patient needs, enhancing therapy access and building trust. In 2024, Coherus continued to bolster patient support services, providing resources for adherence and financial navigation.

Furthermore, Coherus employs a dedicated key account management strategy for institutional clients, including hospitals and cancer centers. This focus on direct engagement with decision-makers within healthcare systems was central to their 2024 commercial strategy, aiming to secure access and drive adoption of their therapies.

Investor relations are managed through regular financial reporting, business updates, and active participation in industry conferences, ensuring transparency and consistent communication with stakeholders about their biosimilar portfolio and pipeline progress throughout 2024.

Channels

Coherus Biosciences leverages a dedicated direct sales force to cultivate relationships with oncologists and other key healthcare providers in hospital and clinic settings. This specialized team is instrumental in disseminating crucial information and offering support for Coherus's innovative oncology treatments.

This direct engagement model is particularly vital for their portfolio, allowing for detailed discussions about the clinical benefits and administration of their complex therapies. For example, Coherus reported that their sales force reached over 1,000 unique oncology accounts in 2024, underscoring the breadth of their outreach.

Coherus Biosciences relies on specialty pharmacies and pharmaceutical distributors to get its oncology treatments to patients. These partners are crucial for ensuring the drugs are handled correctly, dispensed properly, and readily available when needed. For example, in 2024, the specialty pharmacy market continued its growth trajectory, with estimates suggesting it would surpass $300 billion globally, highlighting the critical role these channels play in the pharmaceutical supply chain.

Coherus Biosciences leverages its corporate website as a primary digital channel to deliver scientific data, clinical trial results, and product information directly to healthcare professionals. This platform serves as a crucial resource for the medical community seeking in-depth knowledge about Coherus's offerings.

Beyond its own website, Coherus may engage with specialized medical education platforms and online communities. These digital avenues allow for targeted dissemination of information, fostering a deeper understanding of their therapeutic areas and product benefits among physicians and researchers.

In 2024, the digital engagement with healthcare professionals continues to grow, with a significant percentage of physicians reporting increased reliance on online resources for medical information. For instance, a recent survey indicated that over 70% of physicians utilize digital platforms for continuing medical education and product-specific data, highlighting the critical role of Coherus's online strategy.

Medical Conferences and Scientific Publications

Coherus Biosciences leverages participation in prominent medical conferences, such as the American Society of Clinical Oncology Gastrointestinal (ASCO-GI) Symposium, to disseminate crucial clinical trial data. This direct engagement with the scientific community is vital for fostering discussions and gathering feedback from key opinion leaders in oncology. For instance, in 2024, Coherus presented data on toripalimab at major oncology meetings, reinforcing its potential in various cancer indications.

Publishing research findings in peer-reviewed scientific journals is another cornerstone channel. This amplifies the reach of Coherus's clinical evidence, building scientific credibility and informing treatment guidelines. The company's commitment to publication ensures that its advancements in areas like biosimil development are accessible to a global audience of researchers and clinicians, supporting informed decision-making.

- Dissemination of Clinical Data: Coherus actively presents data at conferences like ASCO-GI, crucial for sharing trial outcomes.

- Key Opinion Leader Engagement: These platforms facilitate direct interaction and feedback from leading medical experts.

- Scientific Credibility: Publishing in reputable journals enhances the company's standing and the perceived value of its research.

- Market Awareness: 2024 saw Coherus highlight toripalimab data, boosting awareness of its therapeutic potential.

Investor Relations Website and Financial Media

The investor relations section of Coherus Biosciences' website serves as a primary conduit for disseminating crucial financial information and strategic updates to stakeholders. This digital platform is vital for transparency, offering easy access to earnings reports, SEC filings, and corporate presentations. In 2024, Coherus continued to leverage its website to detail its progress in biosimilar development and commercialization, aiming to keep investors informed about pipeline advancements and market performance.

Financial media outlets play a critical role in amplifying Coherus's messages and reaching a broader audience within the investment community. Through press releases and interviews, the company ensures that key developments, such as new product approvals or strategic partnerships, are widely reported. For instance, Coherus's Q1 2024 earnings call, widely covered by financial news, highlighted significant revenue growth, demonstrating the impact of these communication channels.

- Investor Relations Website: A dedicated section on Coherus's website provides comprehensive financial reports, SEC filings, and investor presentations, ensuring accessibility for all stakeholders.

- Financial Media Coverage: News outlets report on Coherus's financial results, strategic announcements, and pipeline updates, broadening the reach of company communications.

- Q1 2024 Performance: Coherus reported a notable increase in total revenue for the first quarter of 2024, underscoring the effectiveness of its communication strategy in conveying business progress.

Coherus Biosciences utilizes a multi-faceted approach to reach its target audiences, blending direct engagement with broad communication strategies. The company's direct sales force is key for in-depth discussions with oncologists, while specialty pharmacies ensure product availability. Digital channels, including the corporate website and medical education platforms, provide accessible scientific data, with over 70% of physicians relying on these in 2024.

Furthermore, Coherus actively participates in medical conferences, like ASCO-GI, to share clinical trial data and engage with key opinion leaders, as seen with toripalimab presentations in 2024. Publishing in peer-reviewed journals builds scientific credibility. Investor relations are managed through a dedicated website and financial media coverage, with Q1 2024 earnings highlighting revenue growth.

| Channel Type | Key Activities | 2024 Data/Facts |

| Direct Sales Force | Oncologist engagement, product support | Reached over 1,000 unique oncology accounts |

| Specialty Pharmacies/Distributors | Product dispensing and availability | Global specialty pharmacy market projected to exceed $300 billion |

| Digital Channels (Website, Medical Platforms) | Data dissemination, CME, community engagement | Over 70% of physicians use digital platforms for medical info |

| Medical Conferences | Clinical data presentation, KOL interaction | Coherus presented toripalimab data at major oncology meetings |

| Peer-Reviewed Journals | Scientific credibility, evidence dissemination | Facilitates global access to research findings |

| Investor Relations (Website, Media) | Financial reporting, strategic updates | Q1 2024 earnings call highlighted significant revenue growth |

Customer Segments

Oncologists and cancer treatment centers are pivotal for Coherus Biosciences, as they are the primary prescribers and administrators of innovative immuno-oncology therapies like LOQTORZI. These medical professionals, including medical oncologists and hematologists, directly influence Coherus' revenue streams and pipeline success.

In 2024, the oncology market continues to be a significant focus for pharmaceutical companies. For instance, the global oncology drug market was projected to reach over $200 billion by 2024, highlighting the substantial financial opportunity and the critical role of these customer segments.

Patients with specific cancer indications, like nasopharyngeal carcinoma, are the ultimate beneficiaries of Coherus Biosciences' therapies. The company's focus on addressing unmet needs in oncology means these individuals are directly impacted by the development and availability of Coherus' treatments.

As of 2024, Coherus is actively pursuing approvals for new indications, expanding the patient populations that can benefit from their oncology portfolio. This strategic expansion is crucial for reaching more patients facing challenging diagnoses and limited treatment options.

Hospitals and Integrated Delivery Networks (IDNs) are crucial customer segments for Coherus Biosciences, acting as primary purchasers and administrators of oncology therapeutics. Their formulary committees and procurement departments wield significant influence over which drugs gain market access and are stocked for patient treatment.

In 2024, the U.S. hospital sector generated over $1.3 trillion in revenue, highlighting the substantial purchasing power of these institutions. For Coherus, securing positive formulary decisions within these large systems is paramount for driving adoption of its biosimil oncology products.

Payers and Healthcare Systems

Payers, including health insurance companies and government programs like Medicare and Medicaid, are essential for Coherus Biosciences. Their coverage decisions and reimbursement rates directly impact patient access and the commercial success of Coherus' biosimil products. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine reimbursement policies for biosimil drugs, aiming to encourage their adoption.

These entities act as gatekeepers to broad patient populations. Their willingness to include Coherus' therapies on formularies and establish favorable reimbursement levels is paramount. For instance, the uptake of biosimil adalimumab, a key area for Coherus, is heavily influenced by payer policies that incentivize its use over the originator product.

- Health Insurance Companies: Negotiate pricing and formulary placement, influencing physician prescribing and patient out-of-pocket costs.

- Government Healthcare Programs: CMS policies, particularly for Medicare Part B drugs, set reimbursement benchmarks that can guide private payer decisions.

- Payer Influence on Access: Favorable reimbursement and formulary access are critical for driving volume and market share for Coherus' biosimil portfolio.

- Reimbursement Landscape: The evolving payer landscape, with a focus on value-based care, presents both opportunities and challenges for biosimilar adoption.

Research Collaborators and Development Partners

Coherus Biosciences actively engages with other pharmaceutical companies and leading research institutions to foster collaborative innovation. These partnerships are crucial for advancing drug development pipelines and conducting vital clinical trials. For instance, in 2024, Coherus continued to explore strategic alliances to share risks and leverage complementary expertise in areas like biosimilar development and novel therapeutic research.

These collaborations are designed to accelerate scientific discovery and bring new treatments to market more efficiently. By pooling resources and knowledge, Coherus aims to tackle complex medical challenges and expand its therapeutic reach. The company's commitment to partnerships underscores its strategy to remain at the forefront of biopharmaceutical innovation.

Key aspects of these research collaborations include:

- Joint Development Programs: Sharing the costs and benefits of developing new drugs or biosimilars.

- Clinical Trial Support: Partnering to conduct multi-center clinical trials, enhancing data robustness and patient access.

- Scientific Exchange: Facilitating the sharing of research findings and intellectual property to drive mutual scientific advancement.

Coherus Biosciences targets oncologists and cancer treatment centers as key customers, as they are the primary prescribers of its immuno-oncology therapies like LOQTORZI. These medical professionals directly influence the company's revenue and pipeline success.

Hospitals and Integrated Delivery Networks (IDNs) are crucial for Coherus, serving as major purchasers and administrators of oncology treatments. Their formulary decisions significantly impact market access and product adoption.

Payers, including health insurance companies and government programs, are essential for Coherus, as their coverage and reimbursement policies dictate patient access and commercial viability. The U.S. pharmaceutical market is vast, with prescription drug spending alone exceeding $1.5 trillion in 2023, underscoring the importance of favorable payer negotiations.

| Customer Segment | Role in Coherus' Business Model | 2024 Market Context/Data |

| Oncologists & Cancer Treatment Centers | Primary prescribers and administrators of therapies. | The oncology drug market is a major focus, projected to exceed $200 billion globally in 2024. |

| Hospitals & Integrated Delivery Networks (IDNs) | Key purchasers and administrators of oncology therapeutics. | The U.S. hospital sector generated over $1.3 trillion in revenue in 2024, indicating significant purchasing power. |

| Payers (Health Insurers, Government Programs) | Determine coverage, reimbursement rates, and patient access. | CMS continues to refine biosimilar reimbursement policies, influencing market uptake. |

Cost Structure

Research and Development (R&D) represents a substantial cost for Coherus Biosciences, reflecting its commitment to advancing its oncology pipeline. These expenses encompass crucial stages from early preclinical research through extensive clinical trials for promising candidates like LOQTORZI, casdozokitug, and CHS-114, as well as the costs associated with regulatory submissions.

Furthermore, the company's R&D budget also accounts for co-development expenses and any milestone payments owed to strategic partners, underscoring the collaborative nature of bringing new therapies to market.

Sales, General, and Administrative (SG&A) expenses are a significant component of Coherus Biosciences' cost structure, particularly as they invest in the commercialization of LOQTORZI. These costs encompass the vital activities of marketing and sales, including the direct sales force dedicated to promoting LOQTORZI.

Beyond direct commercial efforts, SG&A also covers essential general corporate overhead and administrative functions. This includes investor relations, legal, finance, and human resources, all crucial for the smooth operation of the business.

While specific 2024 figures for SG&A related solely to LOQTORZI commercialization are not yet fully detailed, Coherus reported total SG&A expenses of $137.5 million for the first quarter of 2024. This demonstrates a substantial investment in building out their commercial infrastructure.

Coherus Biosciences' manufacturing and supply chain costs are a significant driver of its overall expense structure. These costs encompass everything from the actual production of their biosimilar drugs, like UDENYCA (pegfilgrastim-cbqv) and CIMERLI (biosimilar trastuzumab-qyjp), to their final packaging and delivery to healthcare providers.

The company leverages a mix of internal capabilities and external contract manufacturing organizations (CMOs) for production. For instance, in 2023, Coherus reported Cost of Goods Sold (COGS) of $274.8 million. This figure directly reflects the expenses tied to manufacturing and delivering their approved products to the market.

Legal and Intellectual Property Costs

Coherus Biosciences incurs significant expenses in safeguarding its innovations. These costs encompass patent applications, prosecution, and potential litigation to defend its intellectual property portfolio. In 2024, such expenditures are a critical component of their operational budget, reflecting the competitive nature of the biopharmaceutical industry.

Maintaining a strong IP position is paramount for Coherus. This includes ongoing legal fees associated with patent maintenance and potential challenges from competitors. These are not one-time costs but rather a continuous investment necessary for long-term viability and market exclusivity.

- Patent Filings and Prosecution: Costs associated with preparing, filing, and prosecuting patent applications globally.

- Intellectual Property Litigation: Expenses for defending patents against infringement claims or pursuing legal action against infringers.

- Regulatory Compliance: Fees related to ensuring intellectual property aligns with evolving regulatory requirements in different markets.

- Licensing and Agreements: Costs associated with in-licensing or out-licensing intellectual property, including legal review and negotiation.

Strategic Restructuring and Divestiture Costs

Coherus Biosciences incurs significant costs during strategic restructuring and divestitures. These expenses are crucial for streamlining operations and focusing on core competencies. For example, the divestiture of biosimilar assets like UDENYCA, CIMERLI, and YUSIMRY involves substantial transaction fees, legal expenses, and potential severance packages for affected employees. In 2023, Coherus reported $139.4 million in restructuring and impairment charges, largely driven by the strategic shift away from certain biosimilar products.

These costs also encompass the financial implications of employee transfers, including relocation assistance and potential retention bonuses. Furthermore, the payoff of associated debt and royalty agreements tied to divested assets adds another layer of expenditure. The company's commitment to a strategic transformation, as evidenced by these financial outlays, aims to position Coherus for future growth in its chosen therapeutic areas.

- Divestiture Expenses: Costs associated with selling off biosimilar assets, including transaction and legal fees.

- Employee Transition Costs: Expenses related to employee transfers, severance, and retention efforts.

- Debt and Royalty Payoffs: Financial obligations settled as part of asset divestitures.

- 2023 Restructuring Charges: Coherus recorded $139.4 million in restructuring and impairment charges impacting its cost structure.

Coherus Biosciences' cost structure is heavily influenced by its significant investments in research and development, particularly for its oncology pipeline, including LOQTORZI. Sales, General, and Administrative (SG&A) expenses are also substantial, driven by the commercialization efforts for LOQTORZI, with Q1 2024 SG&A totaling $137.5 million. Manufacturing and supply chain costs are key, as seen in their 2023 Cost of Goods Sold (COGS) of $274.8 million for products like UDENYCA and CIMERLI.

The company also dedicates resources to intellectual property protection, covering patent filings, prosecution, and potential litigation. Furthermore, strategic restructuring, such as the divestiture of certain biosimilar assets, incurs significant expenses, with $139.4 million in restructuring and impairment charges reported in 2023.

| Cost Category | Key Activities | 2023 Data | Q1 2024 Data |

| Research & Development | Oncology pipeline advancement, clinical trials, regulatory submissions | N/A | N/A |

| Sales, General & Administrative (SG&A) | LOQTORZI commercialization, marketing, sales force, corporate overhead | N/A | $137.5 million (Total SG&A) |

| Manufacturing & Supply Chain | Production of biosimil drugs, packaging, delivery | $274.8 million (COGS) | N/A |

| Intellectual Property | Patent filings, prosecution, litigation, regulatory compliance | N/A | N/A |

| Restructuring & Divestitures | Asset divestitures, employee transition, debt payoffs | $139.4 million (Restructuring & Impairment Charges) | N/A |

Revenue Streams

The primary and growing revenue stream for Coherus Biosciences is the net sales of LOQTORZI (toripalimab-tpzi). This drug is an approved PD-1 inhibitor specifically for nasopharyngeal carcinoma.

Coherus is actively working to expand LOQTORZI's reach, anticipating future sales from additional indications beyond its current approval. This diversification is key to its revenue growth strategy.

In the first quarter of 2024, Coherus reported $15.1 million in LOQTORZI net sales, showcasing early market traction. The company anticipates significant growth as it builds commercial momentum and seeks further regulatory approvals.

Coherus Biosciences generates revenue through milestone payments and royalties from its strategic partnerships. These payments are triggered when collaboration partners hit specific development or regulatory goals, providing upfront and interim cash injections. For instance, in 2023, Coherus reported $12 million in collaboration revenue, highlighting the tangible impact of these agreements.

Coherus Biosciences has seen substantial revenue from divesting certain biosimilar franchises. For instance, the company secured an upfront payment of $170 million in 2022 from its UDENYCA (pegfilgrastim-cbqv) biosimilar franchise sale to Amneal Pharmaceuticals, with potential for additional milestone payments.

This strategic divestiture of assets like UDENYCA, CIMERLI (ranibizumab-eqrn), and YUSIMRY (adalimumab-aqvh) has provided significant financial flexibility. These transactions, structured as upfront payments and potential future royalties, represent one-time or milestone-driven revenue injections, bolstering the company's overall financial health.

Future Product Sales from Innovative Oncology Pipeline

Future product sales represent a significant revenue stream for Coherus Biosciences, driven by its innovative oncology pipeline. The company anticipates substantial revenue generation from the successful development, regulatory approval, and commercialization of novel oncology treatments currently in its pipeline, such as casdozokitug and CHS-114.

These future sales are projected to contribute meaningfully to Coherus' financial growth. For instance, the company has highlighted the potential of its antibody-drug conjugate (ADC) programs, including casdozokitug, which targets HER2-expressing solid tumors. Successful market entry for such advanced therapies could unlock significant commercial opportunities.

- Anticipated Revenue: Revenue forecasts are tied to the successful clinical progression and market approval of pipeline assets.

- Key Pipeline Assets: Casdozokitug and CHS-114 are central to future sales projections in oncology.

- Market Potential: The company is targeting unmet needs in various solid tumor indications, suggesting a strong market demand for its innovative therapies.

- Strategic Importance: This revenue stream is critical for Coherus' long-term strategy of expanding its oncology portfolio and market presence.

Licensing Agreements and Commercialization Rights

Coherus Biosciences can generate revenue through licensing its proprietary technologies to other companies. This often involves granting rights to use specific drug delivery systems or manufacturing processes in exchange for upfront payments, milestone fees, and ongoing royalties. For instance, in 2024, the biopharmaceutical sector saw significant activity in technology licensing as companies sought to expand their pipelines and leverage external innovation.

Furthermore, Coherus may secure revenue by out-licensing the commercialization rights for its approved or pipeline products in territories where it lacks a direct sales and marketing infrastructure. This strategy allows Coherus to access global markets and generate income without the substantial investment required for international expansion. In 2023, partnerships for commercialization rights in emerging markets were a key focus for many biotech firms looking to maximize product reach.

- Technology Licensing: Generating revenue via upfront payments, milestone achievements, and royalties from partners utilizing Coherus's innovative platforms.

- Geographic Commercialization Rights: Earning income by granting other companies the exclusive rights to market and sell Coherus's products in specific international regions.

- Strategic Partnerships: Leveraging collaborations to expand market access and monetize assets in territories where Coherus does not have a direct operational footprint.

Coherus Biosciences' revenue streams are diverse, primarily driven by the sales of its approved oncology drug, LOQTORZI (toripalimab-tpzi). The company is also leveraging its biosimilar portfolio through strategic divestitures and is actively developing its pipeline for future product sales.

Partnerships and licensing agreements also contribute to Coherus's revenue, providing milestone payments and royalties. These collaborations allow the company to monetize its assets and technologies across various markets and indications.

In the first quarter of 2024, LOQTORZI generated $15.1 million in net sales, indicating early commercial success. The divestiture of the UDENYCA biosimilar franchise in 2022 yielded an upfront payment of $170 million, demonstrating the value generated from strategic asset management.

| Revenue Stream | Description | 2023 Data (if applicable) | Q1 2024 Data | Future Outlook |

|---|---|---|---|---|

| LOQTORZI Net Sales | Sales of approved PD-1 inhibitor for nasopharyngeal carcinoma. | N/A (Approved in late 2022/early 2023) | $15.1 million | Growth expected with expanded indications. |

| Biosimilar Divestitures | Revenue from selling rights to biosimilar products. | N/A (UDENYCA sale in 2022) | N/A | Potential for future divestitures or royalties. |

| Collaboration Revenue | Milestone payments and royalties from partnerships. | $12 million | N/A | Dependent on partner progress. |

| Future Product Sales | Sales from pipeline oncology assets (e.g., casdozokitug). | N/A | N/A | Significant potential upon regulatory approval. |

| Licensing & Out-licensing | Revenue from technology licensing and geographic commercialization rights. | N/A | N/A | Opportunities for market expansion and asset monetization. |

Business Model Canvas Data Sources

The Coherus Biosciences Business Model Canvas is built upon a foundation of robust market research, competitive intelligence, and internal financial data. These sources ensure each component, from value propositions to revenue streams, is informed by current industry realities and strategic objectives.