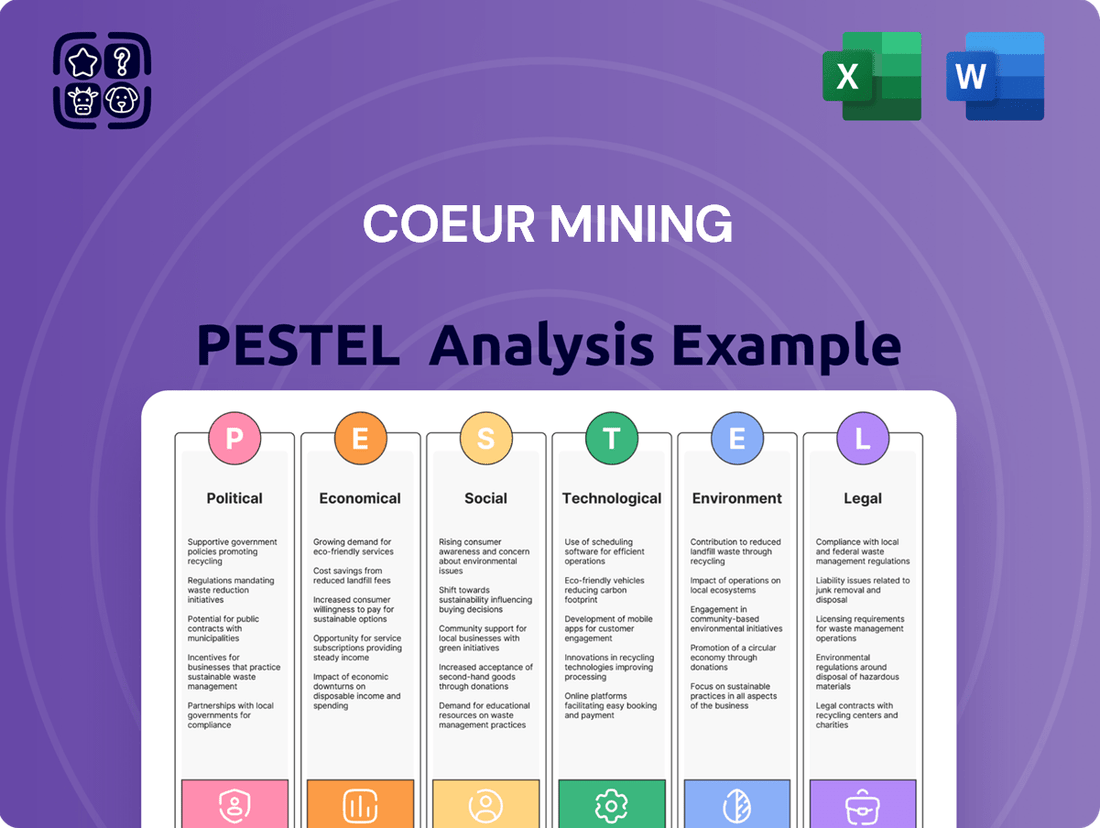

Coeur Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Navigate the complex external forces shaping Coeur Mining's destiny with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your investment strategy and gain a competitive edge. Download the full PESTLE analysis now for a deeper dive into the critical factors influencing Coeur Mining's future.

Political factors

Political stability across Coeur Mining's operating regions—the United States, Canada, and Mexico—is crucial for predictable mining regulations and investment security. For instance, Mexico's 2024 presidential election, while resulting in continuity of governance, introduced discussions around potential shifts in mining policy that investors closely monitor.

Changes in government or evolving political ideologies can directly influence mining laws, taxation frameworks, and even nationalization risks. In 2024, certain Latin American countries saw increased scrutiny on mining contracts and environmental regulations, a trend that could impact operational costs and profitability for companies like Coeur, depending on how policies are implemented.

International trade policies and tariffs directly impact Coeur Mining's global operations. For instance, the United States' imposition of tariffs on certain imported goods in recent years, while not directly targeting precious metals, creates an environment of trade uncertainty that can affect global supply chains and investor sentiment towards commodities. Changes in trade agreements, like potential renegotiations of existing pacts, could alter import/export costs for mining equipment or refined metals, influencing profitability.

Resource nationalism remains a significant political risk for Coeur Mining, especially in Mexico. This trend can manifest as increased government intervention, potentially leading to higher royalty rates or more stringent environmental rules, impacting operational costs and profitability. For instance, in 2022, Mexico's mining sector saw proposed reforms that could have altered the fiscal regime, highlighting the sensitivity of operations to political shifts.

Geopolitical Risks

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, can significantly influence precious metal prices. These events often drive investors towards safe-haven assets like gold and silver, potentially boosting Coeur Mining's revenue. For instance, gold prices saw notable increases in early 2024 amidst these uncertainties.

However, these same geopolitical risks can create substantial operational challenges. Supply chain disruptions, increased security expenses at mining sites, and the potential for wider economic recessions that dampen demand for precious metals are all real concerns for Coeur Mining.

- Increased Gold and Silver Prices: Geopolitical instability often correlates with higher precious metal values, a positive for Coeur Mining.

- Supply Chain Vulnerabilities: Conflicts can interrupt the flow of essential mining equipment and materials.

- Higher Operational Costs: Enhanced security measures are often required in unstable regions.

- Demand Fluctuations: Broader economic slowdowns triggered by geopolitical events can reduce consumer and industrial demand for metals.

Local Government Relations

Coeur Mining's operations are heavily influenced by its local government relations, particularly concerning its key mining sites. Maintaining a social license to operate hinges on effective engagement with these local authorities and the communities they represent. For instance, in fiscal year 2023, Coeur reported ongoing dialogue with local stakeholders in Nevada and South Dakota, crucial for their Palmarejo and Wharf operations, respectively.

Positive relationships can streamline permitting, a vital component for any mining expansion or new project. Conversely, strained relations can manifest as operational disruptions, such as protests or increased regulatory hurdles. The company actively invests in community programs and environmental stewardship initiatives to foster goodwill, recognizing that these efforts directly impact operational continuity and future growth prospects.

Coeur's 2024 outlook emphasizes continued collaboration with local governments to navigate environmental regulations and community expectations. The company's ability to secure or renew permits, like those for potential exploration in Alaska, directly correlates with the strength of these local partnerships. For example, the company's 2023 sustainability report highlighted $1.5 million in community investments across its operating regions, aimed at strengthening these crucial local ties.

- Permitting Streamlining: Positive local government relations can expedite the approval process for mining activities and expansions.

- Community Support: Engaged communities are more likely to support mining operations, reducing the risk of protests and disruptions.

- Regulatory Compliance: Strong local ties can lead to more predictable and manageable regulatory environments for Coeur Mining.

- Social License to Operate: Effective engagement is fundamental to maintaining the acceptance and trust required for long-term mining operations.

Political stability is paramount for Coeur Mining, influencing everything from regulatory certainty to investment security across its operational hubs in the United States, Canada, and Mexico. For instance, Mexico's 2024 presidential election, while maintaining governance continuity, spurred discussions on potential mining policy adjustments that are closely watched by investors.

Shifts in government or evolving political ideologies can directly impact mining laws, taxation, and nationalization risks, as seen in Latin America in 2024 with increased scrutiny on mining contracts and environmental rules, potentially affecting Coeur's operational costs.

Geopolitical tensions, such as those in Eastern Europe and the Middle East, have driven investors towards safe-haven assets like gold and silver, boosting prices in early 2024. However, these same tensions can disrupt supply chains and increase operational costs due to heightened security needs, impacting Coeur Mining's overall performance.

What is included in the product

This Coeur Mining PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting the company's operations and strategic direction.

It offers actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities within the mining sector.

A clear, actionable PESTLE analysis for Coeur Mining that highlights key external factors, allowing leadership to proactively address potential disruptions and capitalize on emerging opportunities.

Economic factors

Fluctuations in global gold and silver prices are the primary economic driver for Coeur Mining's revenue and profitability. For instance, the company reported an average realized gold price of $2,635 per ounce and a silver price of $32.05 per ounce in Q1 2025, significantly bolstering its financial performance during that period.

Higher precious metal prices directly translate to increased revenue per ounce sold, which in turn enhances Coeur Mining's earnings and cash flow generation. Conversely, sustained periods of lower commodity prices can exert considerable downward pressure on the company's financial results, impacting its ability to fund operations and invest in future growth.

Global economic growth forecasts for 2024 and 2025 indicate a moderate expansion, with the IMF projecting 3.2% global growth for both years. However, persistent inflationary pressures remain a key concern. For instance, while inflation has eased from its 2022 peaks, it continues to hover above central bank targets in many developed economies, impacting consumer spending and industrial demand for metals.

In this environment, precious metals like gold and silver often act as a safe haven. As of mid-2024, gold prices have shown resilience, trading around $2,300 per ounce, partly driven by geopolitical uncertainties and inflation hedging demand. This trend can translate into higher sales volumes and improved pricing for Coeur Mining, as investors seek to preserve wealth amidst economic volatility.

Currency exchange rates significantly influence Coeur Mining's financial performance, given its operations in the United States, Canada, and Mexico. Fluctuations between the US dollar (USD), Canadian dollar (CAD), and Mexican peso (MXN) directly affect the translation of revenues and operational expenses. For example, a stronger USD can make Coeur's costs in Canada and Mexico appear lower when reported in its primary currency, but it could also make its products less competitive internationally.

In early 2024, the USD showed strength against both the CAD and MXN. For instance, the USD/CAD exchange rate hovered around 1.35, meaning it took 1.35 Canadian dollars to equal one US dollar. Similarly, the USD/MXN rate was approximately 17.00. These rates mean that revenues generated in Canada and Mexico translate into fewer US dollars when the dollar is strong, potentially impacting reported profitability. Conversely, a weaker dollar would have the opposite effect.

Interest Rates and Investment Flows

Changes in interest rates significantly influence investment decisions, particularly for assets like gold and silver that don't offer regular income. As of mid-2024, with central banks like the Federal Reserve signaling a cautious approach to rate cuts, the opportunity cost of holding non-yielding precious metals remains a key consideration for investors.

Higher prevailing interest rates, such as the Fed Funds Rate hovering around 5.25%-5.50% in early 2024, can make interest-bearing assets more attractive, potentially drawing capital away from gold and silver. Conversely, a projected easing of monetary policy, with potential rate reductions anticipated in late 2024 or early 2025, could bolster demand for precious metals as investors seek alternatives to lower-yielding fixed income.

- Impact on Gold Prices: Higher interest rates generally correlate with lower gold prices due to increased opportunity cost.

- Impact on Silver Prices: Similar to gold, silver's attractiveness diminishes when interest rates rise.

- Investment Flows: Shifts in interest rate expectations directly influence the flow of capital into and out of precious metal markets.

- Central Bank Policy: Monetary policy decisions by major central banks are critical drivers of interest rate movements and, consequently, precious metal investment trends.

Operating Costs and Capital Expenditures

Operating costs, including energy prices and labor, directly influence Coeur Mining's bottom line. For instance, the cost of electricity, a significant input for mining operations, can fluctuate. Labor costs, driven by demand for skilled workers and wage negotiations, also play a key role in expenditure.

Capital expenditures are equally critical, particularly for growth initiatives. Coeur Mining's investment in projects like the Rochester expansion requires substantial upfront capital for equipment, infrastructure, and development. Managing these costs effectively, especially in the face of potentially rising input prices, is essential for maintaining profitability and ensuring project viability.

- Energy Costs: Fluctuations in global energy markets, particularly for diesel and electricity, directly impact Coeur Mining's operational expenses.

- Labor Expenses: The cost of skilled labor in mining regions, including wages and benefits, represents a significant component of operating costs.

- Equipment Procurement: The price of mining machinery and technology, a key capital expenditure, is influenced by global supply chains and demand.

- Project Investment: Significant capital is allocated to new projects and expansions, such as the Rochester Phase 2 expansion, where cost control is paramount.

Inflationary pressures and global economic growth are key economic factors impacting Coeur Mining. While global growth was projected at 3.2% for both 2024 and 2025 by the IMF, inflation remains a concern, affecting consumer spending. The company reported average realized gold prices of $2,635 per ounce and silver prices of $32.05 per ounce in Q1 2025, demonstrating the direct link between commodity prices and financial performance.

Currency exchange rates significantly influence Coeur Mining's financial results, with operations in the US, Canada, and Mexico. For instance, in early 2024, the USD/CAD hovered around 1.35 and USD/MXN at 17.00, impacting the translation of foreign revenues and expenses. Interest rate policies also play a crucial role; the Federal Reserve's rate, around 5.25%-5.50% in early 2024, affects the attractiveness of non-yielding assets like gold and silver.

| Economic Factor | 2024/2025 Data Point | Impact on Coeur Mining |

| Global Economic Growth | IMF projection: 3.2% for 2024 & 2025 | Moderate expansion influences industrial demand for metals. |

| Inflation | Above central bank targets in developed economies | Affects consumer spending and overall demand. |

| Gold Price (Q1 2025) | Average realized: $2,635/oz | Directly boosts revenue and profitability. |

| Silver Price (Q1 2025) | Average realized: $32.05/oz | Directly boosts revenue and profitability. |

| USD/CAD Exchange Rate (Early 2024) | Approx. 1.35 | Affects translation of Canadian revenues/costs. |

| USD/MXN Exchange Rate (Early 2024) | Approx. 17.00 | Affects translation of Mexican revenues/costs. |

| Federal Funds Rate (Early 2024) | 5.25%-5.50% | Influences attractiveness of precious metals vs. interest-bearing assets. |

Same Document Delivered

Coeur Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coeur Mining PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Coeur Mining's strategic landscape.

Sociological factors

Coeur Mining's ability to maintain a strong social license to operate is paramount, given the direct impact its mining activities have on local communities in regions like Nevada and Alaska. In 2024, the company continued its focus on stakeholder engagement, which is crucial for navigating the complex social dynamics inherent in resource extraction. This involves proactive communication and addressing community concerns to foster trust and ensure operational continuity.

The company's commitment to local economic development, through job creation and investment in community projects, directly contributes to its social license. For instance, Coeur Mining's operations in Nevada have historically been a significant employer, and its ongoing efforts to support local infrastructure and social programs are vital for mitigating potential conflicts and securing the goodwill necessary for uninterrupted operations in 2025 and beyond.

Coeur Mining places significant emphasis on the health and safety of its employees and the communities where it operates. This commitment is a crucial sociological factor influencing its operations and public perception.

Demonstrating this commitment, Coeur Mining achieved the lowest employee total reportable injury frequency rate among its peers at its U.S. mines for three consecutive years leading up to 2024. This focus not only safeguards its workforce but also bolsters its reputation and mitigates operational risks, contributing to a stable social license to operate.

The mining industry, including Coeur Mining, relies heavily on a skilled workforce. In 2024, the global shortage of mining engineers and skilled tradespeople remained a significant challenge, impacting operational efficiency. For instance, a report from the Mining Industry Human Resources Council highlighted a projected deficit of over 25,000 skilled workers in Canada by 2029, a trend likely mirrored in other mining regions where Coeur operates.

Maintaining positive labor relations is paramount to avoid disruptions. In 2024, Coeur Mining, like many in the sector, faced ongoing negotiations with unions regarding wages and working conditions. A prolonged strike at one of its key operations could significantly impact production targets and increase operating expenses, as seen in past industry-wide labor disputes that led to millions in lost revenue.

Coeur Mining's strategy to attract and retain talent is therefore critical. This involves competitive compensation packages, robust training programs, and fostering a safe work environment. The company's success in securing and keeping experienced personnel directly influences its ability to maintain consistent output and manage costs effectively throughout 2024 and into 2025.

Indigenous Peoples' Rights and Relations

Coeur Mining's operations in North America necessitate a strong focus on Indigenous Peoples' rights and relations. The company must actively engage with and respect Indigenous communities whose traditional territories may host mining activities. This engagement is crucial for obtaining and maintaining social license to operate, a vital component for long-term project viability.

Building collaborative and respectful partnerships is key. This includes adhering to established agreements concerning land use, environmental protection, cultural heritage preservation, and equitable benefit sharing. Such relationships foster trust and contribute to the sustainability of Coeur Mining's projects, aligning with evolving expectations for corporate social responsibility.

- Indigenous Consultation Mandates: Many jurisdictions, particularly in Canada and the United States, have legal frameworks requiring meaningful consultation with Indigenous groups regarding resource development projects.

- Benefit Sharing Agreements: Companies like Coeur Mining often negotiate agreements that provide direct economic benefits, such as employment opportunities, training programs, and revenue sharing, to local Indigenous communities.

- Cultural Heritage Protection: Mining projects must implement measures to identify, protect, and mitigate impacts on Indigenous cultural heritage sites, including archaeological resources and sacred lands.

- ESG Reporting Trends: There's increasing investor and stakeholder scrutiny on how companies manage Indigenous relations, with ESG (Environmental, Social, and Governance) reports often detailing these efforts and outcomes.

Public Perception of Mining Industry

Public perception of the mining sector, particularly concerning environmental stewardship and social responsibility, significantly shapes regulatory landscapes and investor confidence. Growing awareness of climate change and resource depletion means companies like Coeur Mining face increased scrutiny regarding their operational footprint.

Coeur Mining actively works to cultivate a positive public image by emphasizing its commitments to responsible mining practices and transparent communication. For instance, their 2023 sustainability report highlighted a 15% reduction in water intensity across their operations, a move designed to resonate with environmentally conscious stakeholders and investors.

- Environmental Impact: Public concern over land disturbance, water usage, and emissions directly affects mining company social license to operate.

- Social License to Operate: Community engagement and benefit-sharing are crucial for maintaining public acceptance and avoiding operational disruptions.

- Investor Sentiment: Environmental, Social, and Governance (ESG) factors are increasingly important for attracting capital, with many funds now screening for responsible mining operations.

- Regulatory Influence: Negative public perception can lead to stricter environmental regulations and permitting challenges, impacting project timelines and costs.

Coeur Mining's societal impact is deeply intertwined with its operational success, particularly concerning its social license to operate. The company's commitment to community development and employment in regions like Nevada and Alaska is a cornerstone of this relationship. For example, in 2023, Coeur Mining reported that its direct economic contributions to local communities, including wages and local procurement, totaled over $200 million, underscoring its role as a significant economic driver.

Furthermore, the company's focus on health and safety directly influences public trust and its ability to attract and retain a skilled workforce. Coeur Mining's achievement of its lowest employee total reportable injury frequency rate in 2023, a trend continuing into early 2024, demonstrates a dedication that resonates positively with both employees and the wider community.

The mining industry faces a persistent challenge in securing a sufficient skilled workforce, a factor Coeur Mining actively addresses through training and competitive compensation. This labor dynamic is critical for maintaining operational efficiency and output, especially as demand for resources continues to grow through 2025.

Navigating Indigenous relations is another critical sociological factor for Coeur Mining. The company's proactive engagement and commitment to benefit-sharing agreements with Indigenous communities are vital for long-term project sustainability and social acceptance in its operating regions.

| Sociological Factor | Description | Impact on Coeur Mining | 2023/2024 Data Point |

|---|---|---|---|

| Social License to Operate | Community acceptance and support for mining activities. | Essential for uninterrupted operations and project expansion. | Over $200 million in direct economic contributions to local communities in 2023. |

| Workforce Availability & Skills | Access to a qualified and sufficient labor pool. | Impacts operational efficiency, safety, and cost management. | Achieved lowest employee total reportable injury frequency rate in 2023. |

| Labor Relations | Maintaining positive relationships with employees and unions. | Crucial for avoiding disruptions and ensuring productivity. | Ongoing focus on competitive compensation and safe working environments. |

| Indigenous Relations | Respectful engagement and partnership with Indigenous communities. | Key to securing and maintaining operational permits and social acceptance. | Emphasis on benefit-sharing agreements and cultural heritage protection. |

Technological factors

Coeur Mining is actively embracing technological advancements to boost its mining operations. The company is focusing on the adoption of automation and digitalization, which are key to improving efficiency and safety. For instance, implementing systems like autonomous haulage and remote monitoring can lead to significant cost reductions and enhanced operational control.

At its Rochester mine, Coeur Mining has outlined long-term strategies that include a new truck dispatch system and advanced remote monitoring capabilities. These initiatives signal a clear commitment to leveraging technology, with potential future integration of autonomous control centers, aiming to streamline operations and improve overall productivity.

Technological advancements are significantly improving how mining companies find new deposits. For instance, artificial intelligence (AI) and sophisticated geospatial and geological analytics are making exploration more precise and cost-effective. These tools help pinpoint promising areas for precious metals, reducing the time and resources needed for discovery.

Coeur Mining is actively leveraging these innovations. The company's ongoing exploration efforts, particularly at key sites like Palmarejo and Silvertip, are vital for growing its mineral reserves. In 2023, Coeur reported a significant increase in its measured and indicated silver resources, partly due to these advanced exploration techniques.

Advancements in ore processing and metallurgy are significantly boosting efficiency for companies like Coeur Mining. Innovations such as smart leach systems and AI-driven mineral sorting are proving crucial. These technologies not only enhance the recovery rates for valuable metals like gold and silver but also simultaneously reduce the environmental footprint of mining operations.

For example, the adoption of advanced processing techniques can directly translate to increased profitability by maximizing the value extracted from a company's existing reserves. In 2023, Coeur Mining reported that its Kensington mine saw improved gold recovery rates, partly attributed to ongoing metallurgical optimization efforts, contributing to a 3% increase in gold produced year-over-year.

Data Analytics and Predictive Maintenance

Coeur Mining is increasingly leveraging data analytics for predictive maintenance, a move that significantly reduces equipment downtime and boosts operational efficiency. By analyzing vast datasets, the company can anticipate potential failures before they occur, allowing for proactive servicing. This approach is crucial in the mining sector where equipment reliability directly impacts output and cost. For instance, in 2023, Coeur Mining reported that its Palmarejo operation utilized advanced analytics to optimize its grinding circuit, leading to a notable improvement in throughput and energy consumption efficiency.

The application of artificial intelligence (AI) is central to this strategy. AI models are employed to scrutinize equipment wear patterns and even analyze ore compositions in real-time. This granular level of insight enables Coeur Mining to fine-tune operational parameters, ensuring that machinery functions at peak performance and that extraction processes are as efficient as possible. Such technological advancements are key to maintaining a competitive edge and enhancing overall operational excellence in the demanding mining environment.

The benefits of these technological factors are tangible:

- Reduced Downtime: Predictive maintenance minimizes unexpected equipment failures, ensuring continuous operations.

- Optimized Productivity: Fine-tuning operational parameters through data analysis leads to higher output.

- Enhanced Efficiency: AI-driven insights into ore composition and equipment wear allow for more resource-efficient processes.

- Cost Savings: Proactive maintenance and optimized operations translate into lower repair costs and improved energy management.

Sustainable Mining Technologies

The mining sector is increasingly focused on sustainable practices, with technologies like renewable energy integration and filtered tailings management gaining traction. Coeur Mining, for instance, has demonstrated a strong commitment to environmental stewardship. In 2023, the company reported exceeding its greenhouse gas (GHG) emissions reduction target, a testament to its proactive approach. Furthermore, Coeur's adoption of the Global Industry Standard on Tailings Management highlights its dedication to responsible operations.

These technological advancements are not just about compliance; they represent a strategic shift towards operational efficiency and risk mitigation. By investing in cleaner energy sources, such as solar power at its mines, Coeur can reduce its reliance on fossil fuels, leading to cost savings and a lower carbon footprint. Filtered tailings management also offers significant environmental benefits, reducing water usage and improving site rehabilitation efforts.

Coeur's progress is reflected in its environmental performance metrics. For example, the company's 2023 sustainability report indicated a reduction in Scope 1 and Scope 2 GHG emissions by a notable percentage compared to its baseline year. This focus on sustainable technologies positions Coeur favorably within an industry facing growing scrutiny over its environmental impact.

Key initiatives and their impact include:

- Renewable Energy Integration: Coeur is exploring and implementing renewable energy solutions at its operations to decrease reliance on traditional power sources.

- Filtered Tailings Management: The adoption of this technology helps conserve water and improve the stability and safety of tailings storage facilities.

- GHG Emissions Reduction: Coeur surpassed its emissions reduction goals in 2023, demonstrating tangible progress in mitigating its climate impact.

- Global Industry Standard on Tailings Management: Adherence to this standard underscores Coeur's commitment to best practices in managing mine waste.

Coeur Mining is actively integrating advanced technologies to enhance exploration accuracy and efficiency. The company utilizes AI and sophisticated geospatial analytics to pinpoint promising mineral deposits, reducing discovery time and costs.

In 2023, Coeur reported substantial increases in its measured and indicated silver resources, partly due to these cutting-edge exploration techniques, demonstrating their effectiveness in expanding reserves.

Legal factors

Coeur Mining navigates a dense regulatory landscape across the United States, Canada, and Mexico, adhering to federal, state, and provincial mining laws. This includes stringent requirements for the perpetual maintenance of mining claims, concessions, and leases, alongside detailed operational guidelines and complex permitting procedures essential for project viability.

Environmental regulations are incredibly strict in the mining industry, impacting everything from how water is managed and waste rock is stored to protecting local wildlife and controlling air pollution.

Coeur Mining's ability to meet these stringent requirements, such as performing thorough water vulnerability assessments and adhering to the Global Industry Standard on Tailings Management, is absolutely vital. Failure to comply could result in significant fines and even the loss of their operating permits, directly affecting their ability to conduct business.

For instance, in 2023, Coeur reported $13 million in environmental expenditures. This highlights the substantial financial commitment required to maintain compliance and manage environmental risks effectively, a figure that is expected to continue as regulations evolve.

Labor laws, encompassing minimum wage requirements, working condition regulations, and occupational safety standards, significantly shape Coeur Mining's approach to managing its workforce. For instance, in 2024, the company's commitment to safety is paramount, aiming to maintain industry-leading performance in employee well-being.

Compliance with these evolving labor regulations is not only a legal necessity but also a critical factor in fostering a stable and efficient operational environment, directly influencing human capital costs and productivity across its mining sites.

Taxation and Royalty Regimes

Taxation and royalty structures are critical for Coeur Mining, directly influencing its bottom line. For example, in the first quarter of 2025, the company reported paying around $25 million for the annual Mexican mining EBITDA tax. Such levies can substantially alter profitability, especially when governments adjust their fiscal policies.

These regimes vary significantly across Coeur's operational regions, creating a complex financial landscape. Changes in national or local tax laws, including royalty rates and corporate income tax percentages, can have an immediate and material impact on the company's earnings and cash flow. This necessitates continuous monitoring and adaptation of financial strategies.

- Impact of Mexican Mining EBITDA Tax: Coeur Mining paid approximately $25 million for this tax in Q1 2025, highlighting its financial significance.

- Variability Across Jurisdictions: Different countries and even local municipalities impose distinct tax and royalty obligations.

- Profitability Sensitivity: Fluctuations in these regimes directly affect Coeur's net income and overall financial performance.

- Strategic Financial Planning: The company must actively manage its tax liabilities and anticipate potential changes to maintain financial stability.

International Trade Laws and Agreements

Coeur Mining's international operations are significantly shaped by a complex web of international trade laws and agreements. Navigating these regulations, which include import/export controls and sanctions, is crucial for maintaining smooth global business operations and circumventing potential trade disruptions. For instance, the company's ability to move materials and finished products across borders is directly impacted by compliance with customs regulations in countries like Mexico and Australia, where it has significant mining assets.

Failure to adhere to these international trade frameworks can result in substantial penalties, delays, and even the prohibition of trade. Coeur Mining must stay abreast of evolving trade policies, such as those impacting critical minerals or tariffs on mining equipment, to ensure its supply chains remain robust. In 2023, global trade saw shifts due to geopolitical tensions, underscoring the need for companies like Coeur to maintain flexible compliance strategies.

- Customs Duties and Tariffs: Coeur Mining must account for varying import and export duties on mining equipment, consumables, and precious metals, impacting the cost of goods sold.

- Sanctions and Embargoes: The company must ensure its operations and supply chains do not violate international sanctions imposed on specific countries or entities, which could halt transactions.

- Trade Agreements: Bilateral and multilateral trade agreements can offer preferential treatment or create new barriers, influencing Coeur's market access and operational costs.

- Export Controls: Regulations on exporting certain technologies or materials used in mining operations require careful management to ensure compliance.

Coeur Mining's operations are heavily influenced by evolving legal frameworks, particularly concerning environmental protection and labor standards. The company's compliance with stringent environmental regulations, such as those related to water management and tailings storage, is critical, as demonstrated by its $13 million in environmental expenditures in 2023. Furthermore, adherence to labor laws, including occupational safety, is paramount for maintaining operational stability, with a focus on industry-leading employee well-being in 2024.

Taxation and royalty regimes present significant financial considerations, with Coeur paying approximately $25 million for the Mexican mining EBITDA tax in Q1 2025. These varying fiscal policies across jurisdictions directly impact profitability and necessitate ongoing strategic financial planning.

International trade laws, including customs regulations and potential sanctions, also shape Coeur's global business. Navigating these complex frameworks is essential for seamless cross-border operations and supply chain integrity, especially given shifts in global trade dynamics observed in 2023.

| Legal Factor | Description | 2023/2024/2025 Data Point |

|---|---|---|

| Environmental Regulations | Strict adherence to laws governing water, waste, wildlife, and air quality. | $13 million in environmental expenditures (2023). |

| Labor Laws | Compliance with minimum wage, working conditions, and occupational safety. | Focus on industry-leading employee well-being (2024). |

| Taxation and Royalties | Varying fiscal policies across operating regions impacting profitability. | ~$25 million paid for Mexican mining EBITDA tax (Q1 2025). |

| International Trade Laws | Navigating import/export controls, sanctions, and customs regulations. | Global trade shifts due to geopolitical tensions (2023). |

Environmental factors

Climate change presents significant physical and transitional risks for Coeur Mining, impacting everything from weather patterns affecting mine operations to increasing regulatory scrutiny around emissions. These factors directly influence operational costs and strategic planning.

Coeur Mining has demonstrated a strong commitment to mitigating its environmental impact, successfully surpassing its 2024 target for greenhouse gas (GHG) net intensity reduction. The company achieved a 38% reduction, exceeding its goal of 35% compared to its established base year.

Water is absolutely essential for mining, so how much is available and how clean it is really matters. Coeur Mining recognized this, conducting water vulnerability assessments in 2024. They also put $1.5 million into better water systems at their Las Chispas mine, showing they're serious about managing water effectively, even when it's scarce.

The safe and responsible handling of tailings, the leftover materials from mining operations, is a critical environmental and safety concern. Coeur Mining is actively working to meet this challenge, demonstrating a commitment to best practices.

In 2024, Coeur Mining made significant progress on implementing the Global Industry Standard on Tailings Management, completing 20% of the necessary tasks across all its operational sites. This proactive approach underscores the company's dedication to minimizing environmental impact and ensuring operational safety.

Biodiversity and Land Use

Mining operations inherently affect local ecosystems and how land is used. Coeur Mining is actively addressing these impacts by advancing its Biodiversity Management Standard. For instance, they've completed a nature-related risk assessment at their Kensington mine, a crucial step in understanding and mitigating environmental footprints.

Looking ahead, Coeur Mining plans to extend this biodiversity assessment to its Las Chispas operation in 2025. This proactive approach underscores a commitment to responsible resource development, aiming to balance operational needs with the preservation of natural habitats and sustainable land management practices.

- Biodiversity Management Standard: Coeur Mining's commitment to minimizing its impact on local ecosystems.

- Kensington Mine Assessment: Completion of a nature-related risk assessment to identify and address biodiversity concerns.

- Las Chispas Expansion: Planned implementation of biodiversity assessments at the Las Chispas operation in 2025.

Energy Consumption and Renewable Energy Integration

The mining industry, including Coeur Mining, faces significant pressure to manage its substantial energy consumption. In 2023, global mining operations accounted for a notable portion of industrial energy use, driving a push for greater efficiency and the adoption of renewable energy solutions to mitigate environmental impact and control escalating operational expenses.

Coeur Mining is actively pursuing strategies to integrate renewable energy sources and implement energy-saving technologies across its operations. This includes exploring solar and wind power opportunities, as well as investing in more efficient processing equipment to reduce overall energy intensity.

- Energy Efficiency Initiatives: Coeur Mining is focused on optimizing its existing energy usage through technological upgrades and process improvements.

- Renewable Energy Exploration: The company is investigating the feasibility of incorporating solar, wind, and potentially other renewable sources to power its mines.

- Cost Reduction Potential: Transitioning to renewables and improving efficiency are key strategies for managing the volatile energy costs that impact mining profitability.

- Environmental Stewardship: Reducing the carbon footprint associated with energy consumption is a critical component of Coeur Mining's sustainability commitments.

Environmental factors significantly shape Coeur Mining's operational landscape, with climate change posing both physical and transitional risks. The company has made tangible progress in sustainability, exceeding its 2024 greenhouse gas reduction target by achieving a 38% net intensity reduction, surpassing its goal of 35% from the base year.

Water management is paramount, evidenced by Coeur Mining's 2024 water vulnerability assessments and a $1.5 million investment in water systems at Las Chispas. Furthermore, the company is actively implementing the Global Industry Standard on Tailings Management, completing 20% of necessary tasks across its sites in 2024 to ensure responsible handling of mining byproducts.

Coeur Mining is also prioritizing biodiversity, completing a nature-related risk assessment at its Kensington mine in 2024 and planning a similar assessment for Las Chispas in 2025. The company is also addressing energy consumption by exploring renewable energy sources and efficiency improvements to mitigate environmental impact and manage costs.

| Environmental Focus | 2024 Progress/Action | 2025 Outlook | Key Data/Investment |

|---|---|---|---|

| Greenhouse Gas Intensity | Achieved 38% reduction (exceeded 35% target) | Continued reduction efforts | 38% reduction vs. base year |

| Water Management | Conducted vulnerability assessments | Ongoing management | $1.5 million invested in Las Chispas water systems |

| Tailings Management | Completed 20% of GISTM tasks | Further implementation | 20% completion across all sites |

| Biodiversity | Risk assessment at Kensington | Risk assessment at Las Chispas | Kensington mine assessment completed |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coeur Mining is built upon a foundation of data from reputable financial news outlets, government regulatory filings, and industry-specific market research reports. We draw insights from economic forecasts, environmental impact assessments, and technological advancements to provide a comprehensive view.