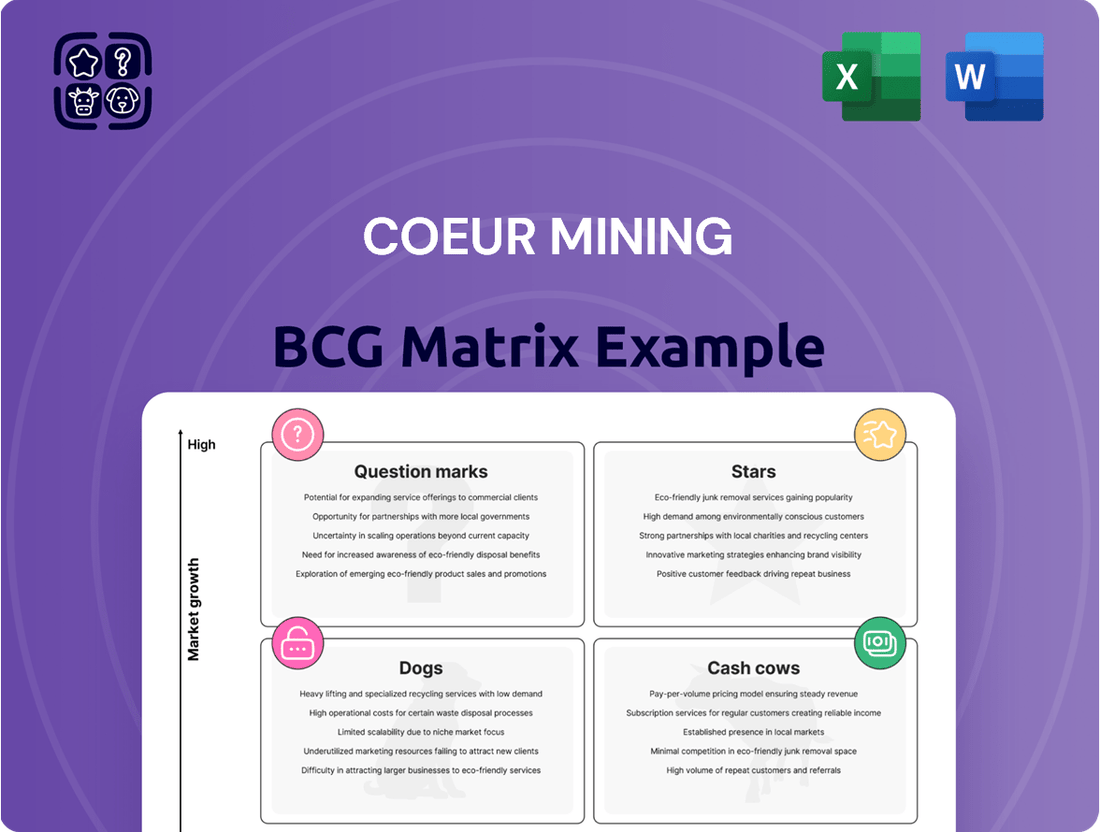

Coeur Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Explore the strategic positioning of Coeur Mining's diverse portfolio with our insightful BCG Matrix preview. Understand which assets are driving growth and which require careful consideration, setting the stage for informed decisions.

Unlock the full potential of this analysis by purchasing the complete Coeur Mining BCG Matrix report. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment strategy and product development.

Stars

The Las Chispas mine, a recent addition to Coeur Mining's portfolio, is quickly establishing itself as a major contributor to the company's revenue. This high-grade, low-cost silver and gold operation has already made a significant impact, bolstering financial performance and being recognized as a 'crown jewel' asset.

In Q1 2025, Las Chispas immediately boosted Coeur Mining's revenue, demonstrating its immediate value. The mine's strong initial performance, especially within a favorable precious metals market, indicates a high market share in a growing industry segment.

The expanded Rochester mine, achieving commercial production in early 2024, is poised to become the leading U.S. producer of refined silver. This significant development is expected to fuel substantial growth for Coeur Mining, driving positive free cash flow as production ramps up to full capacity.

Coeur Mining's strategic pivot towards high-margin operations is a game-changer. Their acquisition of the Las Chispas mine, for instance, has been instrumental in boosting profitability, allowing them to leverage the current strong precious metals market. This focus is designed to maximize revenue and adjusted EBITDA growth.

By concentrating on mines that offer the best returns, Coeur is solidifying its standing in the market. This approach not only drives revenue but also enhances the cash generation capabilities of their prime assets, a crucial element for sustained growth.

Overall Silver Production Growth

Coeur Mining experienced a significant boost in silver production, with a 17% quarter-over-quarter increase in Q1 2025. This surge translated to an impressive 44% year-over-year growth. The expansion of the Rochester operation and strong performance at Las Chispas were key drivers behind this substantial rise in output.

This upward trend in silver production is well-timed, coinciding with forecasts for stable silver prices and growing demand. Industrial applications, in particular, are expected to fuel this demand, making Coeur Mining's increased silver output a strategic advantage.

The company's expanding silver production capabilities place it in a strong position within a vital segment of the precious metals market.

- Q1 2025 Silver Production Growth: 17% quarter-over-quarter.

- Year-over-Year Silver Production Increase: 44%.

- Key Production Drivers: Rochester operation expansion and Las Chispas.

- Market Outlook: Projected steady silver prices and increasing industrial demand.

Strong Gold Market Performance

The gold market is experiencing robust performance, with prices hitting record highs in 2024. This strength is underpinned by ongoing geopolitical uncertainties and sustained buying from central banks, creating a favorable environment for gold producers like Coeur Mining.

Coeur Mining's substantial gold assets are strategically positioned to capitalize on these elevated prices. The company's mines, including Wharf and Kensington, are contributing significantly to its gold production, directly benefiting from the strong market conditions.

- Gold prices reached new all-time highs in 2024, trading above $2,300 per ounce at various points.

- Central bank gold reserves increased by approximately 150 metric tons in the first quarter of 2024.

- Coeur Mining reported a 12% increase in gold production for the first quarter of 2024 compared to the previous year.

- The Wharf mine in South Dakota produced over 30,000 ounces of gold in Q1 2024.

Stars represent Coeur Mining's most promising assets, characterized by high growth potential and strong market positions. The Las Chispas mine, a recent acquisition, is a prime example, significantly boosting revenue and profitability. The expanded Rochester mine, now a leading U.S. silver producer, is set to drive substantial growth and positive cash flow.

These assets are performing exceptionally well in favorable market conditions, with silver production up 44% year-over-year in Q1 2025, driven by Rochester and Las Chispas. Gold production also saw a 12% increase in Q1 2024, with Wharf contributing over 30,000 ounces, capitalizing on record gold prices exceeding $2,300 per ounce in 2024.

| Asset | Growth Potential | Market Position | Key Metrics (as of latest available data) |

|---|---|---|---|

| Las Chispas | High | Strong contributor to revenue and profitability | Significant revenue boost in Q1 2025; High-grade silver and gold |

| Rochester | High | Leading U.S. refined silver producer | Achieved commercial production in early 2024; Expected to drive substantial growth and positive free cash flow |

| Wharf | Moderate | Solid gold producer | Produced over 30,000 ounces of gold in Q1 2024; Benefiting from record gold prices |

What is included in the product

This BCG Matrix overview highlights Coeur Mining's portfolio, identifying which segments to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Coeur Mining's portfolio, simplifying strategic decisions and relieving the pain of resource allocation uncertainty.

Cash Cows

The Palmarejo Gold-Silver Complex stands as a quintessential Cash Cow for Coeur Mining. In 2024, it was a powerhouse, contributing a substantial portion to the company's silver and gold output, underscoring its mature and robust performance.

This complex consistently churns out significant cash flow, acting as a bedrock for Coeur's financial health and providing the capital needed to fuel other growth initiatives within the company. Its reliability is a key factor in maintaining overall financial stability.

While ongoing exploration efforts are focused on extending its operational lifespan, the primary mining activities at Palmarejo represent a stable, high-market-share operation within a well-established precious metals market. This positions it firmly as a dependable cash generator.

The Wharf Gold Mine is a prime example of a Cash Cow for Coeur Mining. In 2024, it reached its highest gold production in eight years, showcasing its consistent operational strength and reliable output.

The mine's resource base has seen significant growth, with substantial increases in measured and indicated gold resources, indicating a strong potential for extended mine life.

This sustained performance translates into robust free cash flow generation, solidifying Wharf's position as a dependable and valuable asset within Coeur Mining's portfolio.

The Kensington Gold Mine, a key asset for Coeur Mining, is performing well, fitting the profile of a Cash Cow. In 2024, it demonstrated robust operational results, including increased gold production. This strong output has also allowed for an extension of its reserve-based mine life, now projected for another five years.

Looking ahead, Kensington is anticipated to achieve positive free cash flow in 2025. This forecast highlights its financial stability and its capacity to generate reliable profits for Coeur Mining, a hallmark of a mature, productive asset.

As a well-established operation, Kensington offers consistent gold output. Crucially, following recent significant development phases, its ongoing investment requirements are now reduced, allowing it to contribute steadily to cash generation without substantial capital outlays.

Consistent Free Cash Flow Generation

Coeur Mining's consistent free cash flow generation is a hallmark of its Cash Cows. In Q1 2025, the company reported positive free cash flow, with projections for significant generation throughout the rest of the year. This strong cash flow is primarily driven by its high-margin operations, demonstrating their established and stable performance.

- Established Operations: Coeur Mining's existing mines are mature assets that reliably produce cash.

- Financial Stability: This consistent cash generation allows for debt reduction, investment in R&D, and potential dividend payouts.

- Low Reinvestment Needs: Cash Cows typically require minimal capital for expansion, as their primary role is to fund other business areas.

Deleveraging and Balance Sheet Strengthening

Coeur Mining's mature, high-performing assets are the bedrock of its deleveraging strategy. These operations generated substantial cash flow, enabling the company to significantly reduce its net debt. For instance, by the end of the first quarter of 2024, Coeur Mining reported a notable reduction in its outstanding revolving credit facility balance, a direct result of this strong cash generation.

This strategic focus on strengthening the balance sheet is a testament to the company's ability to leverage its cash cows for financial stability. By actively paying down debt, Coeur Mining enhances its financial resilience and operational flexibility, positioning itself for future growth and investment opportunities.

- Net Debt Reduction: Coeur Mining has made substantial progress in lowering its overall debt levels.

- Revolving Credit Facility: The balance on its revolving credit facility saw a significant decrease in Q1 2024.

- Cash Flow Generation: Mature, high-performing assets are the primary drivers of this deleveraging.

- Financial Resilience: These actions bolster the company's financial health and adaptability.

Coeur Mining's Cash Cows are its mature, high-performing assets that consistently generate significant free cash flow. These operations, like Palmarejo, Wharf, and Kensington, are characterized by stable production and reduced reinvestment needs, allowing them to fund debt reduction and other strategic initiatives. In Q1 2025, the company reported positive free cash flow, underscoring the strength of these cash-generating units.

| Asset | Contribution to Coeur's Portfolio | 2024 Performance Highlight | Cash Flow Generation |

|---|---|---|---|

| Palmarejo Gold-Silver Complex | Significant silver and gold output | Mature, robust performance | Bedrock for financial health |

| Wharf Gold Mine | Consistent gold production | Highest gold production in eight years | Robust free cash flow generation |

| Kensington Gold Mine | Stable gold output, extended mine life | Increased gold production, projected 5 more years | Anticipated positive free cash flow in 2025 |

Delivered as Shown

Coeur Mining BCG Matrix

The Coeur Mining BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Coeur Mining's business units within the Boston Consulting Group framework, is ready for immediate strategic application. You'll gain access to the complete, unwatermarked document, enabling you to effectively assess market share and growth potential for each of Coeur Mining's operations. This is not a sample; it's the final, actionable report for your business intelligence needs.

Dogs

Coeur Mining's financial disclosures occasionally highlight 'other segments' that report zero revenue. These represent business units not currently contributing to the company's sales, possibly due to their non-strategic nature or minimal operational activity.

These segments typically possess a negligible market share and limited potential for future growth. They can become drains on resources if they necessitate continued investment for upkeep without generating any financial returns.

Coeur Mining, like many established mining firms, likely holds onto historical properties that are no longer economically viable. These sites, often depleted or facing challenging extraction economics, represent a low market share and minimal growth prospects. For instance, while specific current figures for Coeur's uneconomic legacy sites aren't publicly detailed, such assets typically require ongoing expenditure for environmental compliance or minimal oversight, without generating any revenue.

Underperforming Non-Strategic Investments represent ventures outside Coeur Mining's core precious metals focus that consistently miss performance targets. These could include minor stakes in unrelated industries or experimental projects that haven't gained traction. For instance, if Coeur had a small investment in a technology startup that showed no revenue growth in 2024, it would fit this description.

These investments typically exhibit a low market share within their niche and lack a clear path for significant future growth. They drain resources without contributing meaningfully to the company's overall strategic objectives. An example could be a small, unprofitable mining equipment subsidiary that Coeur acquired years ago but no longer fits its operational needs.

Given their lack of strategic alignment and poor financial returns, these underperformers are prime candidates for divestment or significant capital reduction. This frees up cash for more promising, core-business opportunities. In 2024, if Coeur Mining’s non-core asset portfolio generated only a fraction of a percent of its total revenue, it would highlight the need for such strategic pruning.

Projects Lacking Economic Viability

Some of Coeur Mining's exploration projects, especially those that don't progress beyond early phases or fail to prove economically sound, could be categorized as Dogs in a BCG matrix. These ventures tie up capital without yielding returns or capturing market presence, fitting the low-growth, low-market-share profile. For instance, in 2023, Coeur Mining reported exploration expenditures of $73.1 million, a significant investment where not all projects will necessarily reach commercial production.

These projects represent a drain on resources, consuming cash without the prospect of future growth or market dominance. The inherent uncertainty in mining exploration means that a portion of these investments are unlikely to mature into profitable operations.

- Exploration Investment: Coeur Mining invested $73.1 million in exploration in 2023.

- Risk Factor: Not all exploration projects are guaranteed to become commercially viable mines.

- Resource Allocation: Projects that don't advance beyond initial stages consume capital without generating revenue.

Legacy Infrastructure with High Maintenance

Coeur Mining's legacy infrastructure, particularly at sites like the former Sterling mine in Illinois, can be categorized as a Dog. These older facilities often come with substantial ongoing maintenance expenses, as exemplified by the costs associated with site remediation and monitoring. For instance, environmental compliance and caretaking of inactive sites can represent significant, non-revenue-generating expenditures.

Assets in this category, while potentially holding historical value, contribute negatively to overall profitability due to their lack of active production and absence of market share. Coeur Mining, like many in the industry, aims to strategically manage or divest such legacy burdens to free up capital and focus resources on more productive operations. The company's 2023 financial reports, for example, would likely detail ongoing costs associated with environmental liabilities and site closure activities, even for mines that ceased operations years prior.

- High Maintenance Costs: Legacy infrastructure often incurs significant upkeep expenses without generating revenue.

- No Market Share: These assets do not contribute to the company's active market presence or sales.

- Negative Profitability Impact: Maintenance and operational costs associated with legacy sites reduce overall profitability.

- Divestment Strategy: Companies typically seek to minimize or exit these types of liabilities over time.

Coeur Mining's "Dogs" likely include certain legacy exploration projects that have not shown promise for commercial viability. These are ventures that consume capital, such as the $73.1 million spent on exploration in 2023, without contributing to current revenue or market share. Such projects, by definition, operate in low-growth, low-market-share segments and represent a drain on resources.

These underperforming assets, like inactive or uneconomic mining sites requiring ongoing environmental compliance costs, fit the Dog profile. They represent a low market share and minimal future growth prospects, tying up funds without generating returns. Coeur Mining, like other mining companies, strategically manages these to free up capital for more promising ventures.

The company's approach would involve minimizing investment in these Dog segments, potentially through divestment or winding down operations. This strategic pruning allows for reallocation of resources towards core, higher-potential assets, thereby improving overall portfolio efficiency and profitability.

For example, a small, unprofitable subsidiary or a historical property with significant remediation costs but no production would be considered a Dog. In 2024, if such an asset contributed less than 0.5% of Coeur's total revenue, it would strongly indicate its Dog status and the need for strategic review.

| BCG Category | Characteristics | Coeur Mining Examples (Potential) | 2023 Data Relevance |

| Dogs | Low Market Share, Low Growth Potential | Underperforming exploration projects, legacy inactive mine sites requiring ongoing costs | $73.1 million exploration spend; ongoing environmental liabilities for inactive sites |

| Resource Drain, Negative Profitability | Sites with high maintenance without revenue generation | Costs associated with site remediation and monitoring | |

| Candidates for Divestment or Capital Reduction | Non-core assets with no strategic alignment | Focus on core precious metals operations |

Question Marks

The Silvertip polymetallic exploration project in British Columbia represents a classic 'Question Mark' in Coeur Mining's BCG Matrix. While it currently generates no revenue, significant investment in 2024, with further exploration planned for 2025, underscores its high growth potential.

Coeur Mining has committed substantial capital to Silvertip, aiming to unlock its potential as a future high-quality growth asset. This project is characterized by its high growth prospects but a low current market share, necessitating continued cash infusion to realize its full value.

Coeur Mining's newly acquired exploration concessions, such as Palmarejo East, fit squarely into the question mark category of the BCG Matrix. These areas adjacent to the Palmarejo complex offer significant growth potential, aiming to extend the mine's life. However, they currently have no production, meaning they represent high-growth, low-market-share opportunities.

The strategic acquisition of these concessions, specifically noted as unencumbered by the existing Franco-Nevada gold stream, highlights Coeur's focus on future resource development. As of early 2024, these concessions represent a substantial investment need to convert exploration potential into actual production, a hallmark of question mark assets.

Coeur Mining holds an option on the Tim Silver Property, with significant exploration and drilling planned for 2024 and 2025. This initiative is focused on identifying Carbonate Replacement Deposit (CRD) style mineralization, mirroring the success seen at their Silvertip mine.

The Tim Silver Property is positioned as a high-growth prospect for expanding Coeur Mining's silver resource base, currently holding no market share. Substantial exploration investment is necessary to ascertain its commercial viability and future production potential.

Early-Stage Regional Exploration Targets

Coeur Mining actively pursues district-scale exploration, seeking new high-potential targets outside its current operational footprint. This proactive approach aims to fuel future growth by identifying promising geological areas. For instance, in 2024, Coeur continued its extensive fieldwork and scout drilling programs across various regions, demonstrating a commitment to organic growth.

These early-stage exploration targets represent significant growth opportunities but come with inherent risks. They currently have zero market share and demand considerable upfront capital for geological evaluation and initial drilling phases. The success of these ventures hinges entirely on defining viable resources and confirming economic feasibility through detailed studies.

- High Growth Potential: These targets offer the possibility of discovering substantial new mineral deposits, significantly expanding Coeur's resource base.

- No Current Market Share: As they are in the exploration phase, these projects do not contribute to current revenue or production.

- Substantial Upfront Investment: Significant capital is required for geological surveys, mapping, geochemical sampling, and initial drilling campaigns.

- Dependence on Resource Definition: Future value creation is entirely contingent on successfully defining economically extractable mineral reserves.

Potential for New Precious Metals Deposits

Coeur Mining's exploration efforts are designed to uncover new precious metals deposits, a core component of its strategy to grow its resource base and future production. These potential new discoveries are classified as Question Marks in the BCG matrix. This is because they hold significant promise for future growth but demand substantial investment and time to develop, with no guarantee of commercial success or market dominance.

In 2024, Coeur Mining continued its active exploration programs across its key regions. For instance, their exploration expenditure in 2023 totaled $63.4 million, with a significant portion allocated to greenfield and brownfield projects aimed at discovering new resources. The outcome of these investments, particularly in identifying and bringing new deposits into production, remains uncertain, reflecting the inherent risks associated with exploration.

- Exploration Investment: Coeur Mining allocated $63.4 million to exploration in 2023, a key indicator of its commitment to finding new deposits.

- Uncertainty of Success: New discoveries are Question Marks because the path from discovery to profitable production is long, capital-intensive, and carries a high risk of failure.

- Growth Potential: Successfully developing a new deposit could significantly boost Coeur's resource base and future revenue streams, offering substantial growth.

- Capital Requirements: Moving a new deposit from exploration to a producing mine requires extensive capital for drilling, feasibility studies, permitting, and construction.

Coeur Mining's exploration projects, such as the Tim Silver Property and new Palmarejo concessions, are prime examples of Question Marks. These ventures represent high-growth potential but currently lack market share, necessitating significant ongoing investment. In 2024, Coeur continued to pour capital into these early-stage assets, aiming to unlock future production and expand its resource base.

The strategic importance of these Question Marks lies in their ability to fuel long-term growth for Coeur Mining. While they demand substantial upfront capital and carry inherent exploration risks, successful development could lead to significant returns and a stronger market position. The company's 2023 exploration expenditure of $63.4 million underscores its commitment to identifying and developing these future revenue drivers.

| Project | BCG Category | Growth Potential | Current Market Share | Investment Focus (2024/2025) |

|---|---|---|---|---|

| Silvertip | Question Mark | High | None | Exploration & Development |

| Palmarejo East Concessions | Question Mark | High | None | Exploration & Resource Definition |

| Tim Silver Property | Question Mark | High | None | Exploration & Drilling |

BCG Matrix Data Sources

Our Coeur Mining BCG Matrix leverages financial disclosures, industry growth forecasts, and internal operational data to accurately position each business unit.