Coeur Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Uncover the strategic engine driving Coeur Mining's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap to their operational excellence.

Dive into the core of Coeur Mining's business strategy with our full Business Model Canvas. This professionally crafted document reveals their unique value propositions and cost structures, providing invaluable insights for anyone looking to understand or replicate their market position.

Ready to dissect Coeur Mining's operational blueprint? Our complete Business Model Canvas offers an in-depth look at their channels, partnerships, and competitive advantages, making it an essential tool for strategic analysis and business development.

Partnerships

Coeur Mining actively seeks strategic acquisition partners to bolster its operational footprint and production capacity. These partnerships are vital for accelerating growth and solidifying market presence.

A prime illustration of this strategy is the February 2025 acquisition of SilverCrest Metals Inc. This move brought the high-grade Las Chispas operation into Coeur's portfolio, a significant development that immediately strengthened its standing in the global silver market.

Coeur Mining depends on a robust network of equipment and service suppliers for its mining operations. These partnerships are critical for securing everything from heavy machinery and drilling equipment to essential consumables like chemical reagents and explosives. For instance, in 2023, Coeur's cost of sales, which includes many supplier-provided inputs, was $798.4 million, highlighting the significant role these relationships play in the company's financial performance and operational continuity.

Coeur Mining relies on specialized third-party refiners and smelters to transform its extracted precious metals into saleable products. These partnerships are essential for achieving the high purity levels required for gold and silver to be traded on international exchanges.

The efficiency and quality of these refining and smelting operations directly influence Coeur's revenue generation. For example, in 2023, Coeur processed a significant portion of its silver and gold through external facilities, highlighting the importance of these relationships for its financial performance.

Financial Institutions and Investors

Coeur Mining relies heavily on financial institutions for crucial capital, including debt financing and sophisticated risk management instruments like hedging. These partnerships are vital for maintaining operational stability and executing strategic financial maneuvers.

Furthermore, Coeur Mining cultivates relationships with both institutional and individual investors. These stakeholders provide essential capital through equity investments and the purchase of debt, directly funding the company's ongoing operations, ambitious expansion projects, and vital exploration activities. This broad investor base ensures Coeur Mining possesses the necessary financial liquidity and strategic investment capacity to pursue growth opportunities.

- Capital Access: Securing funds for operations, exploration, and acquisitions through equity and debt markets.

- Risk Management: Utilizing financial instruments like hedging to mitigate commodity price volatility.

- Investor Relations: Maintaining strong ties with institutional and individual investors to ensure continued financial support.

- Financing Growth: Attracting capital for capital expenditures, project development, and potential mergers or acquisitions.

Local Communities and Government Bodies

Coeur Mining actively cultivates robust relationships with local communities and government bodies across its operating regions in the United States, Canada, and Mexico. These vital partnerships are fundamental to securing and maintaining its social license to operate, streamlining permitting, and advancing environmental and social responsibility programs. The company's 2024 Responsibility Report underscores its ongoing commitment to community engagement.

These collaborations are crucial for Coeur Mining's operational continuity and reputation. By fostering trust and open communication, the company aims to mitigate risks associated with project development and ongoing operations, ensuring alignment with local expectations and regulatory frameworks.

- Social License to Operate: Maintaining positive community relations is essential for uninterrupted mining activities.

- Permitting Facilitation: Strong government ties expedite the approval processes for new projects and expansions.

- Environmental and Social Initiatives: Partnerships enable collaborative efforts in areas like conservation and community development.

- Regulatory Compliance: Proactive engagement with government bodies ensures adherence to all relevant laws and regulations.

Coeur Mining's key partnerships extend to strategic alliances with other mining companies for potential joint ventures or acquisitions, aiming to expand its resource base and operational synergies. The company also relies on a network of specialized service providers, including geological consultants and environmental experts, who contribute critical technical knowledge and support for its exploration and development activities.

Furthermore, strong relationships with financial institutions are paramount, providing access to capital through debt financing and equity offerings. These partnerships are essential for funding large-scale projects and managing financial risks, as demonstrated by Coeur's successful debt issuance in early 2024 to support its ongoing capital programs.

The company also values its partnerships with local communities and government bodies, which are crucial for maintaining its social license to operate and navigating regulatory landscapes. Coeur's commitment to these relationships is reflected in its 2024 sustainability reports, detailing community investment and engagement initiatives.

| Partnership Type | Key Role | Example/Impact |

| Acquisition Partners | Operational expansion, production growth | February 2025 acquisition of SilverCrest Metals Inc. |

| Equipment & Service Suppliers | Operational continuity, cost management | $798.4 million cost of sales in 2023 includes supplier inputs |

| Refiners & Smelters | Product quality, revenue generation | Processing significant metal volumes through external facilities |

| Financial Institutions | Capital access, risk management | Debt financing and hedging instruments; early 2024 debt issuance |

| Investors | Funding for operations, exploration, expansion | Equity and debt investments |

| Local Communities & Governments | Social license, permitting, regulatory compliance | 2024 Responsibility Report highlights engagement |

What is included in the product

Coeur Mining's business model focuses on efficiently extracting and processing precious metals from its owned and operated mines, targeting global industrial consumers and investors seeking diversified commodity exposure.

This model emphasizes operational excellence, strategic mine development, and a robust cost structure to deliver shareholder value through the production of silver and gold.

Coeur Mining's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex mining strategies for quick understanding and internal alignment.

This structured approach allows Coeur Mining to efficiently identify and address operational inefficiencies by visualizing key activities and cost drivers.

Activities

Coeur Mining's core operations revolve around extracting precious metals, primarily gold and silver, from its wholly-owned mines in North America. These key sites include Las Chispas, Palmarejo, Rochester, Kensington, and Wharf, representing the heart of their production capacity.

The company manages the entire mining process, from the initial breaking of ore to its internal transportation within the mine site, ensuring a streamlined and controlled extraction phase. This comprehensive approach to mining operations is crucial for their business.

In 2024, Coeur Mining reported significant production figures, with total attributable gold production reaching 334,584 ounces and silver production totaling 13,758,000 ounces. These numbers underscore the scale and output of their extraction activities.

After the ore is extracted from the earth, Coeur Mining's key activity shifts to mineral processing. This vital stage transforms the raw ore into valuable gold and silver concentrates or dore. It involves a series of complex metallurgical techniques, including crushing, grinding, and leaching, all designed to efficiently separate the precious metals from the surrounding rock.

The company's commitment to enhancing these operations is evident in recent expansions. For instance, the Rochester mine in Nevada saw the completion of a new processing facility and an expanded heap leach pad. This strategic investment is crucial for increasing production capacity and improving the overall efficiency of metal recovery, reflecting a significant operational focus in 2024.

Coeur Mining's core strategy heavily relies on exploration and resource development to fuel future growth. This involves actively seeking out new precious metals deposits and expanding their existing reserves.

The company undertakes both brownfield exploration, focusing on extending the life of current operations, and greenfield exploration to uncover entirely new discoveries. This dual approach is crucial for maintaining a robust resource pipeline.

Coeur allocated a significant portion of its capital to exploration in 2024, with substantial investments planned for 2025. For instance, their 2024 guidance included approximately $70 million for exploration, underscoring their commitment to this vital activity.

Mine Planning and Optimization

Continuous mine planning and optimization are central to Coeur Mining's operations, aiming to boost efficiency, cut expenses, and prolong the lifespan of their mines. This process relies on detailed geological modeling and accurate reserve estimations to inform strategic adjustments.

At Coeur's Wharf and Kensington sites, significant optimization efforts have been undertaken. These initiatives are designed to substantially grow mineral resources and extend the operational life of these key mining locations.

- Geological Modeling and Reserve Estimation: Coeur Mining regularly updates its geological models and reserve estimates, a foundational step for effective mine planning. For instance, as of the first quarter of 2024, Coeur reported updated mineral reserves and resources across its portfolio, reflecting ongoing exploration and technical studies.

- Operational Adjustments: Strategic operational adjustments are made based on these models, including optimizing drill and blast patterns, haulage routes, and processing schedules to maximize metal recovery and minimize waste.

- Life-of-Mine Extension: The primary goal of these activities is to extend the life-of-mine at its properties. Coeur Mining's 2024 guidance and strategic updates often highlight projected mine life extensions at various assets, driven by successful optimization and exploration programs.

- Efficiency Gains and Cost Reduction: Optimization directly translates to improved operational efficiency and reduced costs per ounce of metal produced, a critical factor for profitability in the mining sector.

Environmental and Social Responsibility

Coeur Mining's key activities in environmental and social responsibility focus on tangible actions to minimize impact and foster positive relationships. These include rigorous water management assessments across their operations, ensuring responsible water use and discharge. They also actively implement biodiversity management standards to protect ecosystems surrounding their mine sites.

Furthermore, Coeur Mining is committed to reducing its environmental footprint by actively working on decreasing greenhouse gas emissions. This commitment is underscored by their dedication to maintaining high health and safety standards for all employees and contractors, a crucial element of social responsibility. Their annual Responsibility Report serves as a transparent disclosure of these efforts and progress.

- Water Management Assessments: Coeur Mining conducts detailed assessments to ensure responsible water usage and quality control at its sites.

- Biodiversity Management Standards: Implementation of standards aimed at protecting and enhancing biodiversity in areas adjacent to operations.

- Greenhouse Gas Emission Reduction: Active initiatives and targets to lower the company's carbon footprint.

- Health and Safety Standards: Maintaining robust health and safety protocols to safeguard personnel.

- Responsibility Reporting: Publishing annual reports detailing performance and commitments to sustainable mining practices.

Coeur Mining's key activities center on the extraction and processing of gold and silver from its North American mines. This includes managing the entire mining cycle from ore extraction to its transformation into valuable concentrates or dore. The company also heavily invests in exploration and resource development to secure future growth, alongside continuous mine planning and optimization for efficiency and longevity.

Environmental and social responsibility are integral, focusing on water management, biodiversity, emissions reduction, and health and safety. These efforts are transparently reported annually.

| Activity | Description | 2024 Data/Focus |

|---|---|---|

| Extraction & Processing | Mining and processing of gold and silver. | Attributable gold production: 334,584 oz; Attributable silver production: 13,758,000 oz. Expansion of Rochester mine's processing facility and heap leach pad. |

| Exploration & Development | Seeking new deposits and expanding existing reserves. | Approximately $70 million allocated for exploration in 2024. Focus on brownfield and greenfield exploration. |

| Mine Planning & Optimization | Enhancing efficiency, reducing costs, and extending mine life. | Optimization efforts at Wharf and Kensington mines. Regular updates to geological models and reserve estimates. |

| Environmental & Social Responsibility | Minimizing impact and fostering positive relationships. | Water management assessments, biodiversity standards, greenhouse gas reduction initiatives, robust health and safety protocols. |

What You See Is What You Get

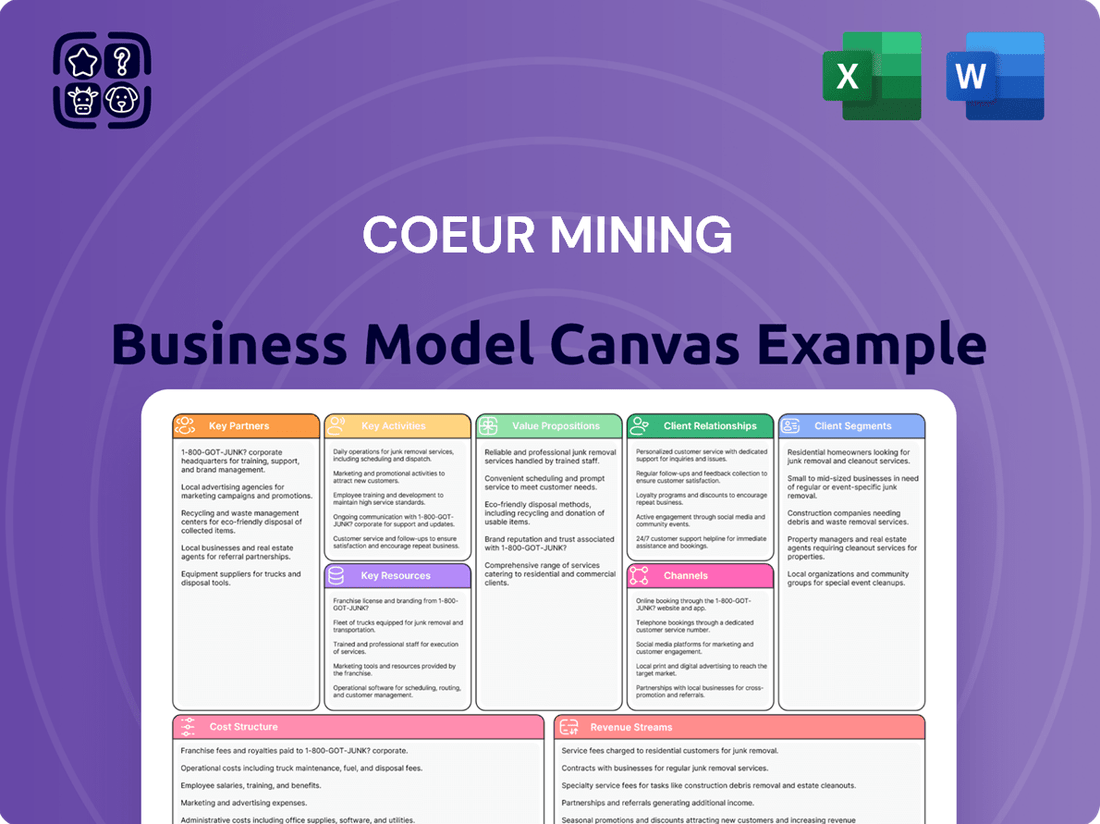

Business Model Canvas

The Coeur Mining Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited version of the strategic framework, offering full insight into their operations and future plans. Once your order is complete, you'll have immediate access to this exact file, ready for your analysis.

Resources

Coeur Mining's most critical asset is its extensive portfolio of precious metal mineral reserves and resources, predominantly gold and silver, with significant zinc and lead contributions. These valuable deposits are strategically situated across its five wholly-owned mining operations located in the United States, Canada, and Mexico.

As of year-end 2024, Coeur reported substantial proven and probable reserves, totaling approximately 1.5 million ounces of gold and 49.6 million ounces of silver. These reserves represent the bedrock of the company's long-term production capacity and future revenue streams.

Coeur Mining's key resources include its substantial physical infrastructure, encompassing its five operating mines: Las Chispas, Palmarejo, Rochester, Kensington, and Wharf. These sites are equipped with essential processing facilities and the necessary machinery to extract and refine precious metals.

The company recently completed a significant expansion at its Rochester mine. This project involved the construction of a new processing facility and an expanded heap leach pad, representing a considerable capital outlay of approximately $200 million, bolstering its operational capacity.

Coeur Mining's operations rely heavily on a highly skilled workforce. This includes specialized professionals like geologists, mining engineers, metallurgists, and experienced mine operators. Their collective expertise is fundamental to the company's success in exploration, mine development, and efficient operational management.

The deep knowledge possessed by these individuals is crucial for Coeur's innovation and adherence to stringent safety protocols. In 2023, Coeur reported a total recordable incident rate (TRIR) of 1.14, demonstrating a strong commitment to employee safety, which directly reflects the value placed on its human capital and their well-being.

Financial Capital and Liquidity

Coeur Mining's access to and adept management of financial capital are fundamental to its operations. This capital fuels day-to-day activities, supports expansion projects, and facilitates strategic acquisitions, ensuring the company's forward momentum.

The company's financial health is directly tied to its revenue streams and operational cash flow. In 2024, Coeur Mining reported robust performance, with total revenue reaching approximately $890 million for the first nine months, demonstrating its capacity to generate substantial income.

Furthermore, Coeur Mining leverages various financing avenues to bolster its capital position. For instance, the company has utilized lease financing for essential equipment, a strategy that allows for efficient asset acquisition without significant upfront capital outlay, thereby supporting ongoing growth and operational stability.

- Revenue Generation: In the first nine months of 2024, Coeur Mining's total revenue was approximately $890 million.

- Cash Flow: Positive cash flow from operations is critical for funding ongoing mining activities and capital expenditures.

- Financing Strategies: Lease financing arrangements are employed to acquire necessary equipment, optimizing capital deployment.

- Investment Capacity: Financial capital enables investment in exploration, development, and potential acquisitions to expand the company's asset base.

Permits, Licenses, and Intellectual Property

Coeur Mining's operations are fundamentally dependent on obtaining and maintaining a wide array of permits and licenses from governmental and regulatory bodies across its various operating jurisdictions. These authorizations are critical for everything from exploration and development to production and environmental stewardship. For instance, in 2023, the company continued to navigate complex regulatory landscapes, ensuring compliance with local, state, and federal requirements in regions like Nevada, Alaska, and Mexico.

Beyond regulatory compliance, Coeur Mining leverages its significant intellectual property, which encompasses proprietary mining techniques, advanced exploration methodologies, and specialized processing know-how. This accumulated expertise provides a distinct competitive advantage, enhancing operational efficiency and cost-effectiveness. This intellectual capital is a key intangible asset that supports the company's ability to extract and process valuable mineral resources successfully.

- Permitting Compliance: Coeur Mining's ability to operate hinges on securing and adhering to permits from agencies such as the Bureau of Land Management (BLM) in the U.S. and equivalent bodies internationally.

- Intellectual Property Value: Proprietary technologies in areas like ore processing and mine planning contribute to Coeur's operational efficiency, potentially reducing costs and improving recovery rates.

- Regulatory Landscape: The company's 2023 filings indicated ongoing efforts to manage environmental permits and social license to operate in all its active mining regions.

- Competitive Edge: The unique mining and processing techniques developed by Coeur represent a significant barrier to entry for competitors and a driver of its financial performance.

Coeur Mining's key resources are its vast mineral reserves, particularly gold and silver, located across its five mines in the US, Canada, and Mexico. These reserves form the foundation for its production and future earnings. The company also possesses significant physical assets, including its operating mines, processing facilities, and essential equipment, all vital for extraction and refinement.

The company's workforce is a critical resource, comprising skilled geologists, engineers, and operators whose expertise drives exploration, development, and efficient operations. Financial capital is another cornerstone, enabling daily activities, expansion projects, and strategic moves, ensuring the company's continued growth and stability.

Coeur Mining also relies on its intellectual property, including proprietary mining and processing techniques, which offer a competitive advantage and enhance operational efficiency. Obtaining and maintaining necessary permits and licenses from regulatory bodies are also crucial resources for its continued operations.

| Resource Category | Key Components | 2024 Data/Notes |

|---|---|---|

| Mineral Reserves & Resources | Gold, Silver, Zinc, Lead | Proven & Probable Reserves (as of year-end 2024): ~1.5M oz Gold, ~49.6M oz Silver |

| Physical Infrastructure | Five Operating Mines (Las Chispas, Palmarejo, Rochester, Kensington, Wharf), Processing Facilities, Equipment | Rochester Mine expansion: ~$200M investment |

| Human Capital | Geologists, Mining Engineers, Metallurgists, Mine Operators | 2023 Total Recordable Incident Rate (TRIR): 1.14 (demonstrating safety focus) |

| Financial Capital | Revenue, Cash Flow, Financing Access | First nine months of 2024 Revenue: ~$890M; Utilizes lease financing for equipment |

| Intellectual Property & Licenses | Proprietary Mining Techniques, Exploration Methodologies, Permits | Ongoing compliance with regulatory requirements in operating jurisdictions |

Value Propositions

Coeur Mining offers a dependable stream of gold and silver, with a strategic emphasis on expanding its production capabilities. The company achieved robust full-year 2024 output, demonstrating year-over-year gains in both gold and silver.

Looking ahead to 2025, Coeur forecasts continued production growth, fueled by key initiatives such as the expansion at its Rochester mine and the integration of the Las Chispas acquisition. This consistent and increasing supply is highly valued by refiners and industrial consumers who rely on a steady inflow of these precious metals.

Coeur Mining offers a robust portfolio of gold and silver assets strategically positioned within stable North American jurisdictions, including the United States, Canada, and Mexico. This geographical spread significantly mitigates geopolitical risks and ensures a reliable operating environment, appealing to investors and customers prioritizing supply chain security.

The company's North American focus is further bolstered by the inclusion of the high-grade Las Chispas operation, a key asset contributing to the overall strength and attractiveness of its diversified mining portfolio.

Coeur Mining is actively enhancing its financial performance, with a clear focus on generating robust free cash flow. This strategic emphasis is designed to showcase the company's operational efficiency and profitability.

The company anticipates strong free cash flow generation and adjusted EBITDA growth in late 2024 and early 2025. For instance, projections suggest free cash flow could reach approximately $150 million in 2025, a significant increase from 2023 levels.

This improved financial health is particularly attractive to investors who value companies with a strong ability to manage debt and potentially return capital. The anticipated growth in adjusted EBITDA, potentially exceeding $500 million in 2025, underscores this financial strength.

Commitment to Responsible and Sustainable Mining

Coeur Mining emphasizes environmental stewardship, social responsibility, and ethical governance as core value propositions. This commitment is detailed in their 2024 Responsibility Report, showcasing progress in key areas like water management and biodiversity protection.

Stakeholders and investors increasingly value this dedication, recognizing its impact on the company's reputation and its social license to operate. For example, Coeur reported a 15% reduction in water intensity across its operations in 2023, a metric closely watched by environmentally conscious investors.

- Environmental Stewardship: Initiatives in water management, biodiversity, and climate resilience.

- Social Responsibility: Focus on employee safety and community engagement.

- Ethical Governance: Commitment to transparent and responsible business practices.

- Stakeholder Value: Enhancing reputation and social license to operate through sustainability efforts.

Significant Exploration Upside and Mine Life Extension

Coeur Mining consistently unlocks long-term value by successfully expanding its mineral reserves and resources through dedicated exploration programs. This strategic focus on brownfield exploration is a significant advantage, as demonstrated by its success in extending mine lives at key operations. For instance, at the Wharf mine, exploration efforts have bolstered reserves, ensuring continued production. Similarly, at Palmarejo, ongoing exploration has added significant ounces, highlighting the potential for extended mine life and sustained value generation. Kensington also benefits from this approach, with exploration contributing to a longer operational horizon.

This commitment to exploration directly translates into a robust pipeline of future production and value creation. Coeur’s 2023 year-end results showcased this, with exploration drilling at Wharf adding 249,000 gold ounces to measured and indicated resources, a notable increase. This ongoing success in identifying and defining new mineral ounces is a core element of Coeur's strategy to maximize the economic potential of its existing asset base and deliver enduring shareholder value.

- Exploration Success Drives Reserve Growth: Coeur's exploration activities consistently add to its mineral reserve and resource base, underpinning long-term production potential.

- Brownfield Focus Extends Mine Life: The company's emphasis on exploring within its existing mine footprints, such as at Wharf, Palmarejo, and Kensington, is crucial for extending operational longevity.

- 2023 Reserve Additions: At year-end 2023, exploration at Wharf alone added 249,000 gold ounces to the measured and indicated resource category, demonstrating tangible results.

- Sustained Value Creation: By continually identifying new mineral ounces, Coeur enhances its asset value and ensures a more predictable and extended revenue stream from its operations.

Coeur Mining provides a reliable and growing supply of gold and silver, bolstered by strategic acquisitions and mine expansions. The company's 2024 production figures showed year-over-year increases in both metals, with projections for 2025 indicating continued growth, particularly from the Rochester mine expansion and the Las Chispas acquisition.

The company's portfolio is anchored in stable North American jurisdictions, offering security and mitigating geopolitical risks for customers and investors. The inclusion of the high-grade Las Chispas operation further strengthens this diversified asset base.

Coeur Mining prioritizes strong financial performance, aiming for robust free cash flow generation and adjusted EBITDA growth. Projections for 2025 anticipate free cash flow around $150 million and adjusted EBITDA exceeding $500 million, signaling a healthy financial position attractive to investors.

A core value is Coeur's commitment to environmental stewardship, social responsibility, and ethical governance, as detailed in their 2024 Responsibility Report. Initiatives like a 15% reduction in water intensity in 2023 highlight their dedication to sustainability and maintaining a strong social license to operate.

Coeur Mining consistently enhances long-term value through successful exploration, expanding mineral reserves and resources. Their brownfield exploration strategy, exemplified by reserve additions at Wharf and extended mine life at Palmarejo and Kensington, ensures a robust pipeline of future production.

| Value Proposition | Description | Key Data/Examples |

| Reliable & Growing Metal Supply | Dependable stream of gold and silver with expanding production capabilities. | Year-over-year production gains in 2024; forecast for continued growth in 2025. |

| Geographically Diversified Assets | Portfolio of gold and silver assets in stable North American jurisdictions. | Operations in the United States, Canada, and Mexico; inclusion of high-grade Las Chispas. |

| Strong Financial Performance | Focus on generating robust free cash flow and growing adjusted EBITDA. | Projected free cash flow of ~$150 million and adjusted EBITDA >$500 million in 2025. |

| Commitment to ESG | Emphasis on environmental stewardship, social responsibility, and ethical governance. | 2024 Responsibility Report; 15% water intensity reduction in 2023. |

| Exploration-Driven Value Growth | Expansion of mineral reserves and resources through dedicated exploration programs. | Wharf mine reserve additions; extended mine life at Palmarejo and Kensington. |

Customer Relationships

Coeur Mining cultivates direct sales and contractual relationships with its core clientele, primarily precious metal refiners and industrial consumers. These engagements are fundamentally transactional, centered on the sale and timely delivery of gold and silver in bullion or concentrate forms.

The company relies on these direct contracts to secure predictable revenue, a cornerstone of its financial stability. For instance, in the first quarter of 2024, Coeur Mining reported total revenue of $248.6 million, a significant portion of which would be attributed to these established customer relationships.

Coeur Mining prioritizes transparent investor relations for its financial stakeholders. This includes regular earnings calls, detailed presentations, and comprehensive annual reports and SEC filings, ensuring all financial and operational data is readily available.

In 2024, Coeur Mining reported significant operational updates, including production figures and cost management strategies during its quarterly earnings calls. For instance, their Q1 2024 earnings call detailed gold production of 77,639 ounces and silver production of 3,290,000 ounces, alongside an all-in sustaining cost (AISC) of $1,400 per gold ounce equivalent.

This consistent flow of information aims to foster trust and offer valuable, actionable insights to both existing and potential investors, enabling them to make informed decisions.

Coeur Mining actively cultivates strong ties with the communities where it operates, understanding that a social license is crucial for sustained success. This commitment is demonstrated through targeted community development projects and proactive environmental stewardship.

The company prioritizes open communication channels to effectively address and resolve local concerns, fostering trust and mutual respect. For instance, Coeur's 2024 Responsibility Report details specific initiatives aimed at enhancing these vital community relationships.

Regulatory Compliance and Government Relations

Coeur Mining actively manages its relationships with governmental and regulatory bodies by consistently adhering to mining, environmental, and safety regulations. This proactive approach ensures ongoing operational continuity and significantly reduces potential regulatory risks.

The company engages directly with these authorities to obtain and maintain essential permits and licenses. This ensures all operations are conducted strictly within legal frameworks and meet rigorous industry standards.

- Regulatory Adherence: Coeur Mining's commitment to compliance with mining, environmental, and safety laws is paramount.

- Permitting and Licensing: Direct engagement with regulatory bodies is key to securing and maintaining necessary operational permits and licenses.

- Risk Mitigation: Strict adherence to legal frameworks and industry standards minimizes operational disruptions and regulatory liabilities.

- Operational Continuity: Maintaining strong relationships and compliance ensures uninterrupted mining activities and project development.

Analyst and Media Outreach

Coeur Mining actively engages with financial analysts and media outlets to communicate its operational performance, strategic initiatives, and future outlook. This proactive communication is crucial for transparency and building trust with the investment community.

By participating in key industry conferences and delivering presentations, Coeur Mining aims to shape positive market perception and cultivate investor interest. These forums provide opportunities to highlight achievements and articulate the company's growth trajectory.

- Dissemination of Information Coeur Mining regularly provides updates on its financial results, exploration progress, and operational efficiency to analysts and media.

- Market Perception Shaping Participation in events like the Denver Gold Forum and investor days helps convey the company's value proposition and strategic direction.

- Investor Attraction Effective outreach is designed to attract new investors and retain existing ones by fostering confidence in the company's management and assets.

- Capital Access Maintaining strong relationships with the financial community is essential for facilitating access to capital markets for future growth and development projects.

Coeur Mining's customer relationships are primarily transactional, focused on supplying precious metals to refiners and industrial users. The company also nurtures relationships with its financial stakeholders through transparent communication and regular updates. Furthermore, Coeur actively engages with local communities and regulatory bodies to maintain its social license to operate and ensure compliance.

Channels

Coeur Mining's primary sales channel involves direct transactions with specialized refiners and industrial buyers across the globe. This approach allows for direct negotiation of pricing and terms, cutting out the need for intermediaries.

This direct engagement ensures the efficient movement of significant volumes of gold and silver. For instance, in the first quarter of 2024, Coeur reported that its Whittle Hill project produced approximately 33,000 ounces of gold and 1.2 million ounces of silver, all of which would typically be channeled through these direct sales.

Coeur Mining leverages its official company website and dedicated investor relations portals as primary channels to disseminate crucial information. These platforms are vital for sharing quarterly earnings reports, annual filings, and proxy statements, ensuring stakeholders receive timely updates.

Additionally, Coeur utilizes established financial news services to distribute press releases and other significant company announcements. This multi-channel approach guarantees broad access to comprehensive financial data and strategic updates for all interested parties, including the 2024 financial performance summaries.

Coeur Mining's shares are traded on the New York Stock Exchange (NYSE) under the ticker symbol CDE. This listing is a crucial channel for capital raising, allowing the company to access public equity markets. In early 2024, Coeur Mining's market capitalization fluctuated, demonstrating the dynamic nature of its presence on the NYSE.

Industry Conferences and Presentations

Coeur Mining actively participates in major global mining conferences and investor roadshows, providing a vital channel for direct engagement. These events are key for connecting with potential investors, analysts, and industry stakeholders, allowing management to showcase the company's strategic vision and operational successes.

In 2024, Coeur Mining's presence at events like the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference and the PDAC Convention offered platforms to discuss their project pipeline and financial performance. For instance, during the first quarter of 2024, Coeur reported a significant increase in gold production, which was a key talking point at these industry gatherings.

- Investor Engagement: Direct interaction with investors to build confidence and attract capital.

- Strategic Communication: Presenting Coeur's growth strategy and operational updates to a targeted audience.

- Industry Visibility: Enhancing brand recognition and networking with peers and potential partners.

- Market Feedback: Gathering insights from the investment community on performance and future outlook.

Public and Media Relations

Public and Media Relations are crucial for Coeur Mining to shape its narrative and manage its reputation. Through press releases and corporate publications, Coeur informs the public and media about its operations, successes, and dedication to responsible mining practices. This proactive communication strategy aims to build trust and enhance brand image among a wide range of stakeholders, not just investors.

For instance, Coeur Mining's 2023 Responsibility Report, released in early 2024, detailed significant progress in environmental, social, and governance (ESG) initiatives. The company highlighted a 15% reduction in water intensity across its operations compared to 2022, demonstrating a tangible commitment to sustainability that resonates with the public and media.

- Press Releases: Coeur utilizes press releases to announce key operational updates, financial results, and significant project milestones, ensuring timely dissemination of information.

- Corporate Publications: The annual Responsibility Report serves as a primary channel to showcase Coeur's commitment to ESG principles and transparently report on its performance.

- Media Engagement: Building positive relationships with journalists and media outlets helps Coeur secure favorable coverage, manage crises effectively, and maintain a consistent public profile.

- Stakeholder Communication: This channel extends beyond investors to include local communities, government bodies, and employees, fostering understanding and support for Coeur's activities.

Coeur Mining's channels are multifaceted, ranging from direct sales of precious metals to sophisticated investor and public relations efforts. These channels are critical for revenue generation, capital access, and reputation management, all vital for sustained operations and growth.

The company's direct sales to refiners and industrial buyers are its primary revenue stream, ensuring efficient movement of commodities like the gold and silver produced at its mines. In Q1 2024, Coeur's production figures, such as the 33,000 ounces of gold and 1.2 million ounces of silver from Whittle Hill, highlight the volume handled through these direct channels.

Furthermore, Coeur utilizes its website and investor relations portals for transparent communication of financial results and strategic updates, reinforcing its connection with shareholders. The NYSE listing under CDE is a key channel for equity financing, with market capitalization reflecting investor sentiment in 2024.

Participation in industry conferences and roadshows, like the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference in 2024, provides vital platforms for engagement with investors and industry peers, allowing for the discussion of operational successes and future plans.

| Channel Type | Specific Channels | Purpose | 2024 Relevance |

|---|---|---|---|

| Sales | Direct sales to refiners and industrial buyers | Revenue generation from metal sales | Q1 2024 production figures (e.g., 33k oz gold, 1.2M oz silver) demonstrate sales volume. |

| Information Dissemination | Company website, investor relations portals, financial news services | Sharing financial reports, press releases, strategic updates | Timely dissemination of Q1 2024 earnings and operational highlights. |

| Capital Markets | New York Stock Exchange (NYSE) listing (CDE) | Equity financing, investor access | Active trading and market capitalization fluctuations in early 2024. |

| Stakeholder Engagement | Mining conferences, investor roadshows | Networking, investor relations, strategic communication | Presence at 2024 conferences to discuss project pipeline and performance. |

| Public Relations | Press releases, corporate publications (e.g., Responsibility Report) | Reputation management, ESG communication | 2023 Responsibility Report (released early 2024) highlighted a 15% reduction in water intensity. |

Customer Segments

Precious Metal Refiners and Traders represent Coeur Mining's primary customer segment. These businesses acquire Coeur's raw or semi-processed gold and silver, playing a crucial role in transforming these metals into refined products ready for the global market.

In 2024, the global precious metals refining market saw significant activity. For instance, the London Bullion Market Association (LBMA) accredited refiners processed substantial volumes, with market reports indicating a steady demand for high-purity gold and silver. Coeur Mining's output, meeting these stringent quality standards, directly feeds into this vital supply chain, ensuring their metals can be effectively distributed for industrial, investment, and jewelry applications.

Industrial manufacturers represent a key customer segment for Coeur Mining, seeking gold and silver as essential raw materials. These precious metals are vital components in a variety of products, from intricate electronics and robust automotive parts to advanced solar panels.

The demand for silver, in particular, is experiencing a significant upswing. This growth is largely driven by its critical role in the expanding photovoltaics industry, where silver paste is a fundamental element in solar cell production. In 2023, the solar sector consumed an estimated 139 million ounces of silver, a figure projected to rise as renewable energy adoption accelerates.

Institutional investors, including major financial institutions, mutual funds, hedge funds, and pension funds, form a key customer segment for Coeur Mining. These sophisticated investors are drawn to Coeur's stock due to its financial performance, growth potential, and dividend prospects. For instance, as of early 2024, Coeur Mining's market capitalization positions it as a significant player for these large-scale investment vehicles.

Individual Investors

Individual investors often turn to Coeur Mining's stock for a way to diversify their portfolios, seeking growth opportunities and a hedge against inflation through precious metals exposure. These investors typically rely on readily available financial reports and market analysis to guide their decisions.

For instance, as of the first quarter of 2024, Coeur Mining reported total revenue of $236.1 million, demonstrating its operational scale which is a key factor for many retail investors assessing potential. The company’s share price performance, influenced by gold and silver prices, is a significant draw for this segment.

- Diversification: Retail investors use Coeur Mining shares to add precious metals exposure to their investment portfolios.

- Capital Appreciation: The potential for stock price growth, driven by operational performance and metal prices, attracts these investors.

- Information Reliance: Individual investors depend on accessible financial data, news releases, and analyst reports to make informed choices about Coeur Mining.

- Market Sensitivity: This segment is particularly attuned to the fluctuations in gold and silver prices, which directly impact Coeur Mining's valuation.

Central Banks and Sovereign Wealth Funds

Central banks and sovereign wealth funds are significant players in the precious metals market, acting as indirect but influential customers for companies like Coeur Mining. While they don't engage in day-to-day purchasing, their decisions to hold gold and silver as reserve assets can significantly impact market demand and pricing.

Their influence stems from their sheer scale and the strategic importance of precious metals in global financial stability. For instance, central banks globally held approximately 35,600 tonnes of gold as of the first quarter of 2024, according to the World Gold Council. These holdings represent a substantial portion of global gold reserves, and any shifts in their accumulation or divestment strategies directly affect market dynamics, thereby influencing Coeur's revenue streams.

- Reserve Asset Demand: Central banks and sovereign wealth funds often view gold and silver as safe-haven assets, particularly during periods of economic uncertainty or inflation.

- Market Influence: Their large-scale transactions, even if infrequent, can move precious metal prices, impacting Coeur Mining's profitability.

- Policy Impact: Monetary policies enacted by central banks, such as interest rate adjustments, can indirectly affect the attractiveness of holding precious metals versus other financial assets.

- Global Holdings: As of early 2024, central bank gold reserves accounted for roughly 17% of all above-ground gold stocks, underscoring their market-moving potential.

Jewelry manufacturers and artisanal creators represent a significant customer base for Coeur Mining's precious metals. They utilize gold and silver for their aesthetic appeal and inherent value in crafting a wide range of adornments and decorative items.

The global jewelry market continues to show resilience. In 2023, the demand for gold jewelry, a key outlet for Coeur's production, remained robust, particularly in emerging markets. Similarly, silver's affordability and shine make it a perennial favorite for everyday wear and fashion pieces, directly benefiting suppliers like Coeur.

Cost Structure

Operating costs represent a substantial component of Coeur Mining's expenditures, encompassing essential inputs like labor, fuel, electricity, chemical reagents, explosives, steel, and concrete. These are the fundamental expenses incurred in the daily operations of their mining and processing activities.

These direct operating costs are inherently susceptible to market volatility, particularly fluctuations in commodity prices. For instance, the cost of fuel and electricity can significantly impact profitability, as seen in the broader mining sector where energy prices saw considerable movement throughout 2024.

Capital expenditures are essential for both keeping Coeur Mining's current mines running smoothly and for building out new opportunities. These investments ensure the company can continue producing efficiently and explore growth avenues.

In 2023, Coeur Mining reported total capital expenditures of $259.5 million. A significant portion of this, $114.6 million, was allocated to sustaining capital, which is vital for maintaining operational capacity. The remaining $144.9 million was directed towards development capital, fueling projects like the Rochester expansion.

Coeur Mining's exploration expenses are a significant investment in future growth. These costs, encompassing activities like drilling and geological surveys, are crucial for discovering new mineral deposits and expanding the potential of current operations. In 2024, Coeur dedicated around $55 million to these vital exploration efforts.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Coeur Mining encompass the essential corporate overhead needed to run the business. This includes the costs associated with executive leadership, support staff, maintaining corporate offices, legal and compliance activities, and other administrative functions not directly tied to mining operations. For instance, in 2023, Coeur Mining reported G&A expenses of $46.7 million. Efficient management of these costs is crucial for overall profitability, as they represent a significant, albeit often smaller, portion of the total expenditure compared to operational or capital outlays.

These G&A costs are vital for the strategic direction and governance of the company. They ensure the business operates legally, ethically, and with effective management oversight. While not directly producing metal, these functions are indispensable for the company's long-term sustainability and success.

- Executive Salaries and Benefits: Compensation for senior leadership responsible for strategic decision-making.

- Administrative Staff: Costs for personnel in finance, human resources, legal, and IT departments.

- Corporate Office Facilities: Expenses related to office leases, utilities, and maintenance.

- Legal and Professional Fees: Costs incurred for legal counsel, auditing, and consulting services.

Taxes and Debt Service Costs

Coeur Mining's cost structure is significantly influenced by taxes and debt service. The company makes substantial cash tax payments, especially in Mexico, which directly affect its profitability. For instance, in 2023, Coeur Mining reported income tax expense of $119.6 million, a notable portion of which relates to its Mexican operations.

Interest expenses on its outstanding debt also represent a considerable cost. In 2023, the company incurred $46.3 million in interest expense. These financial obligations are critical components of its cost structure, impacting both net income and the generation of free cash flow. Effective management of its debt portfolio and strategic tax planning are therefore paramount for Coeur Mining's financial health.

- Cash Tax Payments: Significant outflows, particularly from Mexican operations, impacting net income.

- Interest Expenses: Costs associated with servicing outstanding debt obligations.

- Financial Impact: Both taxes and interest directly reduce net income and free cash flow.

- Management Focus: Optimizing tax strategies and managing debt levels are key financial priorities.

Coeur Mining's cost structure is primarily driven by operating expenses, capital expenditures, exploration, general and administrative costs, and financial obligations like taxes and interest.

These elements collectively shape the company's financial performance and investment decisions, with a notable focus on managing volatile commodity prices and investing in future growth.

The company's 2023 financial report highlights significant outlays in these areas, underscoring the capital-intensive nature of the mining industry.

Understanding these cost drivers is crucial for assessing Coeur Mining's profitability and strategic direction.

| Cost Category | 2023 Actual (USD Millions) | Key Drivers |

|---|---|---|

| Operating Costs | (Not explicitly itemized as a single figure, but includes labor, fuel, electricity, reagents, etc.) | Commodity prices, energy costs, supply chain efficiency |

| Capital Expenditures | 259.5 | Sustaining operations, new mine development (e.g., Rochester expansion) |

| Exploration Expenses | (Approx. $55 million allocated for 2024) | New discoveries, resource expansion |

| General & Administrative (G&A) | 46.7 | Executive compensation, corporate overhead, legal & compliance |

| Income Tax Expense | 119.6 | Profitability, tax regulations (especially in Mexico) |

| Interest Expense | 46.3 | Debt levels, interest rates |

Revenue Streams

Gold sales represent Coeur Mining's most significant revenue source. In 2024, the company's financial reports indicated that gold sales were a substantial driver of overall revenue, reflecting robust production levels.

Looking ahead to 2025, Coeur Mining anticipates sustained strong gold output, which is expected to continue bolstering this key revenue stream. The financial performance of this segment is intrinsically linked to the average realized gold price, a critical factor influencing profitability.

Coeur Mining's revenue is significantly driven by silver sales, both in the form of bullion and concentrates. This stream is bolstered by anticipated double-digit production growth, largely attributed to the ongoing Rochester expansion and the strategic acquisition of Las Chispas.

In 2024, silver sales played a crucial role, forming a substantial part of Coeur's quarterly revenue. This trend continued into the first quarter of 2025, underscoring the importance of this precious metal to the company's financial performance.

Coeur Mining's operations, especially at sites like Las Chispas and Silvertip, generate additional revenue through the sale of by-products. These can include valuable metals such as zinc and lead, which are often found alongside gold and silver in polymetallic deposits. This diversification of income streams enhances the company's overall financial resilience.

Streaming and Royalty Agreements

While Coeur Mining has an existing gold stream agreement at its Palmarejo mine with Franco Nevada, this represents an ongoing obligation rather than a new revenue stream. For mining companies, however, the strategic use of new streaming or royalty agreements can be a crucial method for securing upfront capital or generating consistent revenue based on a portion of future mineral production.

These agreements essentially allow a company to sell a portion of its future production at a predetermined price, or a percentage of the market price, in exchange for an upfront payment. This can provide significant financial flexibility, especially for funding exploration, development, or capital expenditures without diluting equity.

- Revenue Generation: Royalties provide a percentage of revenue from a mine, while streams offer a percentage of metal production, often at a fixed cost.

- Capital Infusion: Stream and royalty agreements can offer substantial upfront cash payments, providing immediate capital for operations or growth.

- Risk Mitigation: By selling future production, companies can lock in prices and reduce exposure to commodity price volatility.

- 2024 Outlook: While specific new agreements for 2024 are not detailed, the broader mining sector continues to explore these financial instruments to bolster balance sheets and fund projects.

Hedging Gains and Commodity Price Fluctuations

Coeur Mining, like many precious metals producers, generates revenue not only from the direct sale of gold and silver but also from its strategic use of derivative contracts. These financial instruments are primarily employed to mitigate the impact of volatile commodity prices on its earnings. While their main purpose is risk reduction, successful hedging strategies or unexpected favorable market shifts can lead to realized gains that supplement core operational revenues.

For Coeur Mining, these hedging gains are a distinct revenue stream, albeit one that is inherently linked to market volatility and the effectiveness of their risk management. For instance, in 2024, the company's approach to managing price exposure for its anticipated production would have been a key factor. While specific hedging gain figures for 2024 are part of ongoing financial reporting, the principle remains: effective management can turn potential losses into gains.

- Hedging contracts are used to lock in prices for future production, reducing downside risk.

- Favorable market movements against these hedges can result in realized gains, adding to revenue.

- The effectiveness of these strategies directly impacts the magnitude of hedging-related revenue.

- Opportunity cost is a factor; overly restrictive hedges can limit upside participation if prices surge unexpectedly.

Coeur Mining's revenue is primarily generated from the sale of gold and silver. In 2024, gold sales constituted the largest portion of the company's revenue, a trend expected to continue into 2025 due to strong production. Silver sales, including bullion and concentrates, are also a significant contributor, bolstered by planned production growth from projects like Rochester and Las Chispas.

Beyond its primary precious metals, Coeur Mining also realizes revenue from the sale of by-product metals such as zinc and lead, particularly from polymetallic operations like Las Chispas and Silvertip. This diversification helps to enhance the company's overall financial stability.

Additionally, Coeur Mining utilizes derivative contracts for hedging purposes. While primarily aimed at mitigating commodity price volatility, successful hedging strategies can lead to realized gains that supplement operational revenues. These hedging gains represent a distinct, albeit market-dependent, revenue stream.

| Revenue Source | Key Drivers | 2024 Significance |

| Gold Sales | Production volume, realized gold price | Largest revenue contributor |

| Silver Sales | Production volume, realized silver price, Rochester expansion, Las Chispas acquisition | Substantial revenue contributor |

| By-product Sales (Zinc, Lead) | Polymetallic deposit composition, market prices for by-products | Diversifies income, enhances financial resilience |

| Hedging Gains | Effectiveness of risk management strategies, commodity price movements | Supplements revenue, dependent on market conditions |

Business Model Canvas Data Sources

The Coeur Mining Business Model Canvas is informed by a blend of financial disclosures, operational data from its mining sites, and extensive market research on commodity prices and demand. These sources provide a robust foundation for understanding the company's strategic positioning and revenue generation.