Coeur Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coeur Mining Bundle

Coeur Mining navigates a landscape shaped by powerful industry forces, from the bargaining power of its buyers to the intense rivalry among existing players. Understanding these dynamics is crucial for any investor or strategist looking to grasp Coeur's competitive position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Coeur Mining’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Coeur Mining is typically viewed as low to moderate. This stems from the mining sector's broad reliance on a wide array of suppliers for essential resources like equipment, skilled labor, and various operational services, with many of these supply chains not exhibiting significant concentration.

However, this dynamic can shift. When Coeur Mining requires highly specialized machinery or unique, critical components, the influence of a limited number of dominant suppliers for those specific items can indeed escalate, potentially increasing their bargaining leverage.

Switching costs for Coeur Mining can vary significantly. While basic consumables might have low switching costs, transitioning to new suppliers for specialized mining equipment or advanced technological systems can incur substantial expenses and operational interruptions. For instance, in 2023, Coeur Mining reported capital expenditures of $314 million, a portion of which would be allocated to equipment and technology, highlighting the potential investment involved in supplier changes.

The uniqueness of inputs plays a role in supplier bargaining power. While many mining consumables like steel and chemicals are commodity items, specialized mining equipment, proprietary extraction technologies, or rare earth elements crucial for certain advanced operations can be unique. This uniqueness can grant suppliers of these specialized inputs greater leverage over Coeur Mining.

For Coeur Mining, the impact of input uniqueness might be somewhat mitigated by its operational focus. As of early 2024, Coeur primarily operates existing, well-established mines, which may require fewer highly unique, site-specific inputs compared to companies engaged in extensive greenfield exploration and development. This reliance on more standard inputs for ongoing operations can temper the bargaining power of some suppliers.

Threat of Forward Integration

The threat of suppliers integrating forward into Coeur Mining's operations is generally quite low. Most suppliers in the mining industry lack the immense capital, specialized technical knowledge, and experience navigating the complex regulatory landscape essential for precious metals extraction.

This lack of capability significantly restricts their ability to directly compete by taking over mining activities. For instance, a supplier of specialized drilling equipment would find it prohibitively expensive and complex to acquire the necessary permits, geological expertise, and operational infrastructure to become a miner themselves.

Consequently, suppliers are largely unable to leverage forward integration as a means to increase their bargaining power over Coeur Mining.

- Limited Capital: Most suppliers lack the billions of dollars required to establish and operate a mine.

- Regulatory Barriers: Obtaining mining permits and complying with environmental regulations are significant hurdles.

- Technical Expertise Gap: Running a sophisticated mining operation demands specialized geological, engineering, and operational skills.

- Focus on Core Competencies: Suppliers typically concentrate on their existing product or service offerings rather than venturing into complex mining operations.

Importance of Supplier to Industry

While suppliers are crucial for the mining industry, providing essential materials and services, their individual bargaining power over large companies like Coeur Mining is generally limited. This is due to the diversified nature of the mining supply chain, meaning no single supplier typically dominates to the extent that they can unilaterally dictate terms. For instance, in 2024, the global mining equipment market, a key supplier segment, is highly competitive with numerous players, preventing any one from wielding excessive influence.

The sheer volume of purchases made by major mining firms also shifts the balance of power. Coeur Mining, with its significant operational scale, can leverage its purchasing power to negotiate favorable pricing and terms. The industry's ability to switch suppliers, especially for common consumables or services, further diminishes individual supplier leverage. For example, the availability of multiple providers for explosives or drilling services in 2024 ensures that Coeur Mining has options.

- Diversified Supply Chain: The mining sector relies on a wide array of suppliers for everything from heavy machinery to specialized chemicals, preventing any single entity from holding a dominant position.

- Purchasing Power of Major Miners: Large companies like Coeur Mining can negotiate better terms due to their substantial order volumes.

- Availability of Substitutes: For many essential mining inputs, alternative suppliers or even substitute materials exist, reducing the dependence on any one source.

- Industry Competition: A competitive supplier landscape, evident in sectors like mining equipment manufacturing in 2024, limits the ability of individual suppliers to exert significant price control.

The bargaining power of suppliers for Coeur Mining is generally low to moderate, largely due to the diversified nature of its supply chain and its significant purchasing power. While specialized equipment can create leverage for specific suppliers, the overall competitive landscape for essential inputs in 2024 limits their ability to dictate terms.

Coeur Mining's scale allows it to negotiate favorable pricing, and the availability of multiple providers for many consumables and services further reduces individual supplier influence. The threat of suppliers integrating forward is minimal due to the high capital and expertise required for mining operations.

| Factor | Assessment for Coeur Mining | Supporting Data/Context (2023-2024) |

|---|---|---|

| Supplier Concentration | Low to Moderate | Mining equipment market in 2024 is competitive with numerous players. |

| Switching Costs | Varying (Low for consumables, High for specialized tech) | 2023 CapEx: $314 million (indicates investment in equipment/tech). |

| Uniqueness of Inputs | Generally Low, but High for specialized tech | Reliance on established mines may reduce need for highly unique inputs. |

| Threat of Forward Integration | Very Low | Suppliers lack capital, regulatory knowledge, and technical expertise for mining. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Coeur Mining's position in the precious metals sector.

Effortlessly analyze Coeur Mining's competitive landscape with a visual spider chart, instantly highlighting key pressures from rivals, suppliers, buyers, new entrants, and substitutes.

Customers Bargaining Power

The bargaining power of customers for Coeur Mining is typically low, primarily due to the nature of gold and silver as global commodities. These precious metals have a wide array of buyers, from industrial consumers to individual investors and even national central banks, meaning no single customer holds significant sway over Coeur's sales volume or pricing.

Coeur Mining's customer base is highly fragmented. In 2023, the company's sales were distributed across numerous industrial clients and financial market participants, with no single customer representing more than 10% of total revenue, underscoring the lack of concentrated customer purchasing power.

Customers in the precious metals market, including those dealing with gold and silver, generally face negligible switching costs. This ease of transition means buyers can readily shift their purchases between different producers or market platforms without incurring significant expenses or effort, which directly impacts the bargaining power they hold.

The highly fungible nature of gold and silver further amplifies this lack of switching costs. Since these metals are essentially interchangeable, customers are not tied to specific suppliers due to product differentiation or proprietary technology. For instance, in 2024, the global gold market saw a consistent flow of transactions where buyers prioritized price and availability over supplier relationships, underscoring the minimal barriers to changing vendors.

The availability of substitutes for customers significantly influences Coeur Mining's bargaining power. While gold and silver are unique as precious metals, investors can choose alternative assets like stocks, bonds, or real estate. This broadens investment options, potentially lessening demand for physical precious metals if other markets offer more attractive returns.

Furthermore, in industrial applications, while gold and silver possess specific desirable properties, some industries might explore alternative materials if cost or availability becomes a significant issue. For example, advancements in materials science could lead to new alloys or composites that partially replace silver in electronics or jewelry, thereby increasing customer leverage.

Customer Price Sensitivity

Customer price sensitivity for precious metals like gold and silver is inherently high. This is because their prices are largely dictated by global market forces, the interplay of supply and demand, and shifts in investor sentiment, rather than individual company pricing strategies.

Coeur Mining operates as a price taker in this environment. This means the company has to accept the prevailing market prices for the gold and silver it produces. These global prices are influenced by a wide array of economic indicators and geopolitical events, making it challenging for any single producer to significantly impact them.

- High Price Sensitivity: Precious metals prices are volatile and driven by global factors, not individual company actions.

- Price Taker Status: Coeur Mining must accept market-determined prices for its gold and silver.

- Global Influences: Economic conditions and geopolitical stability significantly impact metal prices, affecting Coeur Mining's revenue.

- 2024 Market Outlook: Analysts projected continued price volatility for gold and silver in 2024, with factors like inflation and central bank policies being key drivers. For instance, the average gold price in the first quarter of 2024 hovered around $2,070 per ounce, demonstrating this sensitivity.

Threat of Backward Integration

The threat of customers backward integrating into precious metals mining is exceptionally low for companies like Coeur Mining. The immense capital required for exploration, extraction, and processing, often running into billions of dollars, alongside the need for highly specialized geological and engineering expertise, creates a significant barrier to entry. For instance, developing a new gold mine can cost upwards of $1 billion, a prohibitive sum for most downstream consumers of precious metals.

This impracticality for customers to undertake mining operations themselves directly translates to reduced bargaining power for them. Without the ability to produce their own raw materials, customers remain reliant on suppliers like Coeur Mining, strengthening the supplier's position.

- Low Capital Availability for Customers: Most customers in industries like jewelry or electronics lack the billions of dollars needed to establish mining operations.

- High Technical Expertise Required: Precious metals mining demands specialized geological, metallurgical, and engineering knowledge, which customers typically do not possess.

- Significant Operational Risks: Mining is inherently risky, involving price volatility, regulatory hurdles, and operational challenges, deterring customer integration.

- Absence of Backward Integration: This lack of customer capability to produce their own precious metals significantly limits their bargaining power against Coeur Mining.

The bargaining power of customers for Coeur Mining remains low. This is largely because gold and silver are global commodities with many buyers, meaning no single customer can significantly influence prices or Coeur's sales volume. The company's customer base is fragmented, with no single client accounting for more than 10% of revenue in 2023, further diluting individual customer influence.

Customers face minimal switching costs and the fungible nature of precious metals means they can easily buy from different producers. For instance, in 2024, the gold market prioritized price and availability over supplier relationships. While alternative investments exist, the unique properties of gold and silver, coupled with the prohibitive cost and technical expertise required for backward integration into mining, significantly limit customer leverage.

| Factor | Impact on Coeur Mining | 2024 Data/Context |

|---|---|---|

| Customer Concentration | Low (Fragmented base) | No single customer > 10% of revenue (2023) |

| Switching Costs | Negligible | Ease of moving between producers, price-driven transactions |

| Product Differentiation | Low (Fungible commodities) | Interchangeable nature of gold and silver |

| Backward Integration Threat | Extremely Low | Billions in capital and specialized expertise required for mining |

Preview Before You Purchase

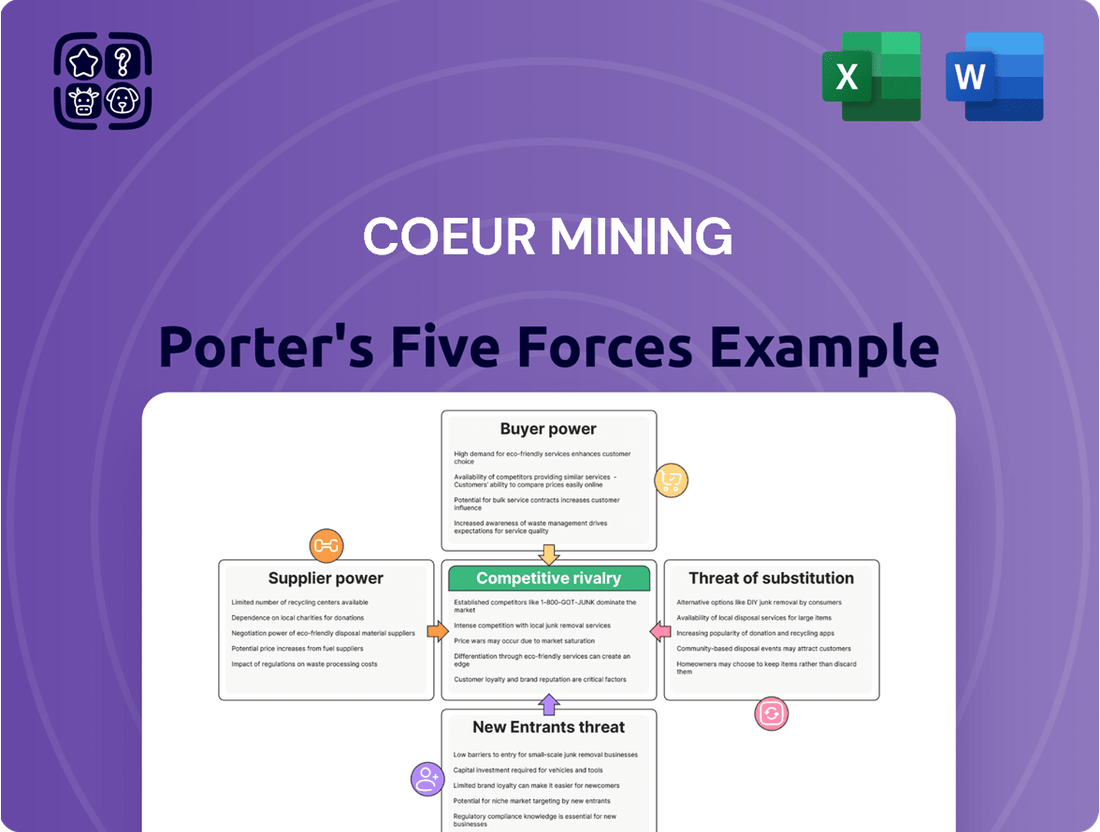

Coeur Mining Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Coeur Mining, offering an in-depth examination of competitive forces within the mining industry. The document you see here is precisely what you will receive immediately after purchase, providing a fully formatted and actionable strategic overview. Understand the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on Coeur Mining's operations and profitability.

Rivalry Among Competitors

The precious metals mining sector, where Coeur Mining operates, is populated by a substantial number of companies, both globally and regionally. These range from massive, established multinational mining giants to smaller, more specialized exploration and development firms, creating a diverse competitive environment.

In 2024, the industry's competitive intensity is high. For instance, major players like Barrick Gold and Newmont Corporation, with market capitalizations in the tens of billions of dollars, directly compete with Coeur Mining for resources, talent, and market share. Coeur Mining itself reported revenues of approximately $900 million in 2023, placing it as a significant mid-tier producer within this competitive arena.

The precious metals mining industry's growth rate is closely tied to metal prices. In 2024, gold and silver prices have experienced notable increases, a trend expected to continue into 2025. This strength is largely driven by ongoing geopolitical uncertainties and robust investment demand, creating an attractive environment for industry participants.

This favorable market outlook can heighten competitive rivalry. As companies see opportunities to profit from elevated metal prices, they will likely increase efforts to expand production, acquire new assets, or improve operational efficiencies. This pursuit of market share in a growing sector naturally intensifies competition among existing players and can attract new entrants.

Coeur Mining, like many in the precious metals sector, faces intense competition where product differentiation is inherently limited. Gold and silver, the core products, are largely seen as undifferentiated commodities. This means that while companies can strive for differentiation through factors like efficient production costs, strong Environmental, Social, and Governance (ESG) initiatives, or a strategic focus on specific mining regions, the fundamental product remains the same. Consequently, competition often boils down to price and operational efficiency.

Exit Barriers

Exit barriers in the mining sector, including for companies like Coeur Mining, are substantial. These stem from the massive capital already sunk into exploration, mine development, and processing facilities. For instance, the upfront cost to develop a new gold mine can easily run into hundreds of millions, even billions, of dollars.

Furthermore, long-term contracts with suppliers, labor agreements, and significant investments in local infrastructure and community relations create additional sticky situations. Companies also face stringent and often lengthy environmental remediation obligations post-operation, making a clean exit complex and costly.

These high exit barriers mean that even when market conditions deteriorate, mining companies are often compelled to continue operations, albeit at reduced capacity, rather than cease altogether. This persistence can intensify competitive rivalry, as firms fight to maintain market share and cover their fixed costs.

- Significant Capital Investment: Developing a new mine can cost hundreds of millions to billions of dollars, representing a substantial sunk cost.

- Long-Term Commitments: Contracts with suppliers, labor, and community engagement create ongoing obligations.

- Environmental Regulations: Post-mining site remediation and ongoing compliance are costly and time-consuming, acting as a significant exit deterrent.

- Operational Persistence: High fixed costs and the desire to recover investments encourage continued operation even in unfavorable market conditions, fueling sustained competition.

Diversity of Competitors

Competitors in the precious metals sector, including those vying with Coeur Mining, employ a wide array of strategies. Some focus on specific geographic regions, while others diversify their metal portfolios, ranging from gold and silver to base metals. This strategic divergence influences how they approach market share and operational efficiency, creating a dynamic competitive landscape.

This diversity means that competitive approaches can vary significantly. Some companies might pursue aggressive expansion, acquiring new assets or developing existing ones rapidly. Others might prioritize a cost leadership strategy, aiming to be the lowest-cost producer in their chosen markets. For example, in 2024, major gold producers continued to invest in exploration and development, with total global exploration spending projected to reach over $10 billion, indicating a push for growth among many players.

- Regional Focus: Competitors may concentrate on specific mining districts or countries, leveraging local expertise and regulatory environments.

- Metal Mix Specialization: Some firms specialize in gold, others in silver, or a combination, impacting their revenue streams and hedging strategies.

- Operational Efficiency: Companies differentiate through cost management, technological adoption, and mine planning to achieve lower production costs per ounce.

- Strategic Alliances: Partnerships and joint ventures are common, allowing smaller players to access capital or larger firms to share exploration risks.

Competitive rivalry in the precious metals sector, where Coeur Mining operates, is intense due to numerous players and limited product differentiation. Companies like Barrick Gold and Newmont Corporation, with market caps in the tens of billions, directly challenge Coeur Mining, which reported approximately $900 million in revenue in 2023. The industry's growth, fueled by rising gold and silver prices in 2024, further exacerbates this competition as firms seek to capitalize on favorable market conditions.

| Competitor | Approximate 2023 Revenue (USD Billions) | Primary Metals |

|---|---|---|

| Barrick Gold | ~11.5 | Gold, Copper |

| Newmont Corporation | ~14.4 | Gold, Copper, Silver, Zinc |

| Coeur Mining | ~0.9 | Silver, Gold |

SSubstitutes Threaten

For gold and silver, particularly in their roles as investment vehicles and materials for jewelry, the threat of direct substitutes is quite low. These precious metals possess a unique combination of intrinsic value, deep historical significance, and a long-standing reputation as a store of wealth that is difficult for other commodities to replicate. This inherent distinctiveness significantly curbs the power of direct substitutes to erode demand or pricing power for Coeur Mining.

While other investment vehicles like real estate, stocks, and bonds exist, they don't offer the same unique properties as gold and silver, especially during economic uncertainty or as an inflation hedge. For instance, in 2024, while the S&P 500 saw significant gains, gold prices also demonstrated resilience, often acting as a safe haven when equity markets faced volatility.

Customer propensity to substitute is generally low for the core uses of precious metals like gold and silver. Their intrinsic value and historical role as stores of wealth are not easily replicated by other commodities.

While industrial uses of silver, for example, might see some minor substitution or thrifting in response to price volatility, the fundamental demand for gold and silver as precious metals remains strong. This is due to their unique chemical and physical properties, which are critical in sectors like jewelry, investment, and certain high-tech applications.

Technological Advancements in Substitutes

Technological advancements are unlikely to produce a direct substitute for gold and silver's core value as precious metals. However, in industrial sectors, particularly for silver, ongoing research could yield alternative materials possessing comparable conductive or reflective qualities. This could potentially affect a segment of silver's market demand.

For instance, advancements in synthetic materials or novel alloys might offer performance characteristics similar to silver in specific electronic or photovoltaic applications. While these substitutes may not replicate gold's unique appeal in jewelry or as a store of value, they represent a tangible threat to industrial silver consumption.

Consider these potential impacts:

- Development of advanced conductive polymers: These could replace silver paste in certain printed electronics, reducing reliance on silver.

- Emergence of new reflective coatings: Innovations in mirror technology or specialized surface treatments might offer alternatives to silver-based coatings in optics and solar concentrators.

- Increased use of copper or aluminum alloys: In some electrical conductivity applications where silver's premium is not essential, these more abundant metals could see greater adoption due to technological improvements in their processing and performance.

Indirect Substitution through Investment Alternatives

The primary threat of substitution for Coeur Mining stems from alternative investment opportunities. When other asset classes, such as bonds or equities, offer more attractive risk-adjusted returns, investors may divert capital away from precious metals. For instance, in early 2024, rising interest rates in developed economies made fixed-income investments more appealing, potentially drawing some capital that might otherwise flow into gold and silver.

However, precious metals like gold and silver often act as safe-haven assets during times of economic uncertainty or high inflation. This inherent characteristic can mitigate the threat of substitution. For example, global geopolitical tensions and persistent inflation concerns in late 2023 and early 2024 supported gold prices, demonstrating its appeal as a hedge against instability.

- Alternative Investments: Investors can choose from a wide array of assets like stocks, bonds, real estate, and cryptocurrencies, each with varying risk and return profiles.

- Safe Haven Appeal: Gold and silver historically perform well during economic downturns and inflationary periods, attracting investors seeking capital preservation.

- Market Dynamics: Shifts in interest rates, currency valuations, and global economic sentiment directly influence the attractiveness of precious metals compared to other investment options.

The threat of substitutes for Coeur Mining's core products, gold and silver, is generally low, particularly in their roles as investment vehicles and in jewelry. Their unique intrinsic value, historical significance, and established reputation as a store of wealth are difficult for other assets to replicate. While other investments like stocks and bonds exist, they don't offer the same safe-haven qualities, as seen in 2024 when gold's resilience contrasted with equity market volatility.

However, for industrial applications, especially for silver, there's a moderate threat from substitutes. Technological advancements in areas like conductive polymers or new reflective coatings could offer alternatives to silver in electronics and solar technology. For example, improved copper or aluminum alloys might replace silver in certain electrical conductivity uses where its premium isn't essential.

| Substitute Category | Key Characteristics | Impact on Coeur Mining |

|---|---|---|

| Alternative Investments (Stocks, Bonds, Real Estate) | Varying risk/return profiles, influenced by interest rates and economic sentiment. | Potential diversion of investor capital from precious metals, especially when fixed income offers attractive yields, as observed in early 2024. |

| Industrial Alternatives (e.g., Conductive Polymers, Copper Alloys) | Performance parity in specific applications, cost-effectiveness, technological advancements. | Moderate threat to industrial silver demand, potentially impacting a segment of the market if performance and cost become more competitive. |

Entrants Threaten

The capital requirements for entering the precious metals mining sector are a formidable barrier. Developing a new mine, from initial exploration and permitting to constructing processing plants and infrastructure, can easily run into hundreds of millions, if not billions, of dollars. For instance, major gold and silver projects often require upfront investments exceeding $500 million, making it incredibly difficult for smaller, less capitalized entities to compete.

Established mining companies, including Coeur Mining, benefit from deeply entrenched relationships with refiners, smelters, and diverse market channels crucial for selling precious metals. These existing networks are vital for efficient and profitable operations.

New entrants face a significant hurdle in replicating these established distribution channels. They must invest considerable time and resources to forge new relationships and secure essential off-take agreements, a process that can be both lengthy and fraught with difficulty.

For instance, the global gold refining market, a key distribution channel, is dominated by a few major players. In 2023, the London Bullion Market Association (LBMA) accredited refiners handled a substantial volume of gold, underscoring the importance of these established relationships for market access.

Existing large-scale producers like Coeur Mining gain significant cost advantages through economies of scale. For instance, in 2023, Coeur Mining reported total production costs of $1,276 per silver ounce equivalent, a figure that benefits from their established infrastructure and operational efficiencies.

New entrants would struggle to match these per-unit costs, as they would lack the established infrastructure for exploration, extraction, and processing, leading to higher initial overheads and a competitive pricing disadvantage.

Regulatory and Environmental Hurdles

The precious metals mining sector faces substantial regulatory and environmental challenges that deter new companies. Obtaining permits and adhering to strict environmental standards, including those related to water usage and waste disposal, can be incredibly time-consuming and expensive. For instance, in 2024, the average time to secure mining permits in many jurisdictions continued to stretch into several years, significantly increasing upfront capital requirements.

These extensive compliance requirements act as a formidable barrier to entry. New entrants must invest heavily in environmental impact assessments, community consultations, and ongoing monitoring to gain and maintain social license to operate. This complexity can easily add tens of millions of dollars to project development costs, making it difficult for smaller or less capitalized firms to compete.

- Stringent environmental regulations require significant investment in compliance and monitoring technologies.

- Lengthy permitting processes can delay project commencement by several years, increasing capital costs.

- Social licensing requirements necessitate extensive community engagement and benefit-sharing agreements.

Proprietary Technology and Expertise

The mining industry, while seemingly open, presents significant barriers to new entrants, particularly concerning proprietary technology and specialized expertise. Established companies like Coeur Mining often possess unique operational knowledge and geological insights into specific ore bodies that are not easily replicated. For instance, developing advanced processing techniques to efficiently extract metals from complex ores requires substantial investment in research and development, often spanning years. This accumulated expertise acts as a formidable deterrent, as newcomers would need to invest heavily in acquiring similar capabilities or risk operating with less efficient methods.

Consider the significant capital expenditure involved in developing and implementing cutting-edge mining technologies. In 2023, the average capital intensity for developing a new gold mine could range from $500 million to over $1 billion, depending on scale and complexity. New entrants must not only secure this funding but also demonstrate the technical prowess to manage these advanced operations effectively. Coeur Mining, for example, has invested in technologies like advanced automation and in-situ recovery methods at some of its sites, which are not readily transferable or accessible to those without deep operational understanding.

- Proprietary Processing: Existing firms may hold patents or trade secrets on specific ore processing methods that enhance recovery rates or reduce costs, creating a competitive edge.

- Geological Expertise: Deep, site-specific geological knowledge, often built over decades, allows incumbents to optimize exploration and extraction strategies, a critical advantage for new entrants to overcome.

- Technological Investment: The high cost of acquiring and mastering advanced mining and metallurgy technologies, such as those used for extracting metals from refractory ores, is a substantial barrier.

- Operational Know-How: The accumulated experience in managing complex mining operations, including safety protocols, environmental compliance, and supply chain logistics, is difficult and time-consuming for new players to replicate.

The threat of new entrants in the precious metals mining sector is considerably low due to immense capital requirements, with new mine development often exceeding $500 million. Existing players like Coeur Mining benefit from established relationships with refiners and smelters, which new entrants struggle to replicate, as seen with the LBMA accredited refiners handling significant volumes in 2023. Economies of scale also provide a cost advantage; Coeur Mining's 2023 production costs of $1,276 per silver ounce equivalent are difficult for newcomers to match without established infrastructure.

Furthermore, stringent environmental regulations and lengthy permitting processes, which can take several years as of 2024, add significant costs and complexity for new companies. Proprietary technology, specialized expertise, and decades of geological knowledge are also significant barriers, requiring substantial R&D investment and operational know-how that new entrants find challenging to acquire.

| Barrier Type | Description | Example Data/Fact |

| Capital Requirements | High upfront investment for mine development. | New gold mine development costs can range from $500 million to over $1 billion (2023). |

| Distribution Channels | Established relationships with refiners and markets. | LBMA accredited refiners processed substantial gold volumes in 2023. |

| Economies of Scale | Lower per-unit costs for established producers. | Coeur Mining's 2023 silver equivalent production cost: $1,276/oz. |

| Regulatory & Environmental | Time-consuming and costly permitting and compliance. | Permitting processes can extend for several years (2024). |

| Proprietary Technology & Expertise | Unique operational knowledge and advanced extraction methods. | Investment in advanced automation and in-situ recovery by incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coeur Mining is built upon a foundation of reliable data, including Coeur's annual reports and SEC filings, industry-specific market research from firms like S&P Global Market Intelligence, and macroeconomic data from sources such as the World Bank.