Codan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

Codan's robust product portfolio and strong brand recognition present significant market opportunities. However, understanding the full scope of their competitive landscape and potential operational challenges is crucial for strategic decision-making.

Unlock the complete picture of Codan's market position and future potential with our in-depth SWOT analysis. This comprehensive report provides actionable insights and expert commentary, empowering you to strategize with confidence.

Ready to gain a competitive edge? Purchase the full SWOT analysis to access a professionally written, editable report designed to inform your investment, planning, and research efforts.

Strengths

Codan Limited's strength lies in its diversified technology portfolio, encompassing radio communications, metal detection, and tracking solutions. This strategic breadth allows the company to serve a wide array of global markets, including critical commercial and defense sectors, thereby mitigating risks associated with over-reliance on any single segment. For instance, in the fiscal year 2023, Codan's Communications division reported revenue growth, demonstrating the resilience of its diverse offerings even as other sectors experienced market fluctuations.

Codan has showcased impressive financial results, marked by substantial revenue and profit expansion. In the first half of fiscal year 2025, the company achieved a 15% revenue increase, reaching $305.6 million, alongside a 21% surge in net profit after tax to $46.1 million. This sustained upward trend, evident in four consecutive halves of growth, highlights effective operational management and a dedication to enduring profitability.

Codan's leadership in niche markets, particularly through its Minelab metal detection business, is a significant strength. Minelab holds a world-leading position in handheld metal detection for recreational, gold mining, demining, and military uses. This strong market standing, bolstered by ongoing investment in new technologies and wider distribution, sets the stage for continued expansion. In 2023, Minelab contributed a substantial portion to Codan's revenue, demonstrating its market dominance and growth potential.

Strategic Acquisitions and Expanded Market Reach

Codan has strategically bolstered its market position through key acquisitions, notably integrating Kägwerks, Zetron UK, and Wave Central into its operations. These moves significantly enhance its product portfolio and extend its geographical and customer reach, particularly within the vital Communications segment. This inorganic growth is designed to tap into new markets and secure a more predictable revenue base.

The acquisition of companies like Zetron, a leader in interoperable public safety communications, has directly expanded Codan's total addressable market. This has opened doors to significant new customer segments, including major government bodies like the US Department of Defense. These strategic integrations are crucial for diversifying revenue and strengthening market share in competitive sectors.

- Acquisition Impact: Integration of Kägwerks, Zetron UK, and Wave Central enhances product offerings and market reach.

- Market Expansion: Access to new customers, including the US Department of Defense, through strategic acquisitions.

- Revenue Diversification: Inorganic growth complements organic efforts, aiming for increased recurring revenue streams.

Innovation and Engineering Investment

Codan's commitment to innovation is a significant strength, with the company consistently investing around 10% of its group sales into engineering. This substantial allocation to research and development fuels the creation of cutting-edge products and solutions, keeping Codan's technologies competitive and advanced within the market. This strategic investment directly supports the achievement of positive operating leverage and strengthens its overall market standing.

Key aspects of Codan's innovation and engineering investment include:

- Consistent R&D Spending: Approximately 10% of group sales are dedicated to engineering, ensuring continuous product development.

- Next-Generation Technologies: This investment enables the creation of advanced products, maintaining a competitive edge.

- Market Leadership: Focus on R&D is critical for enhancing market position and delivering operating leverage.

Codan's diversified technology portfolio, spanning radio communications, metal detection, and tracking solutions, provides a strong foundation. This breadth allows the company to serve various global markets, including defense and commercial sectors, reducing reliance on any single area. The Communications division, for example, showed revenue growth in FY23, illustrating the resilience of its varied offerings.

What is included in the product

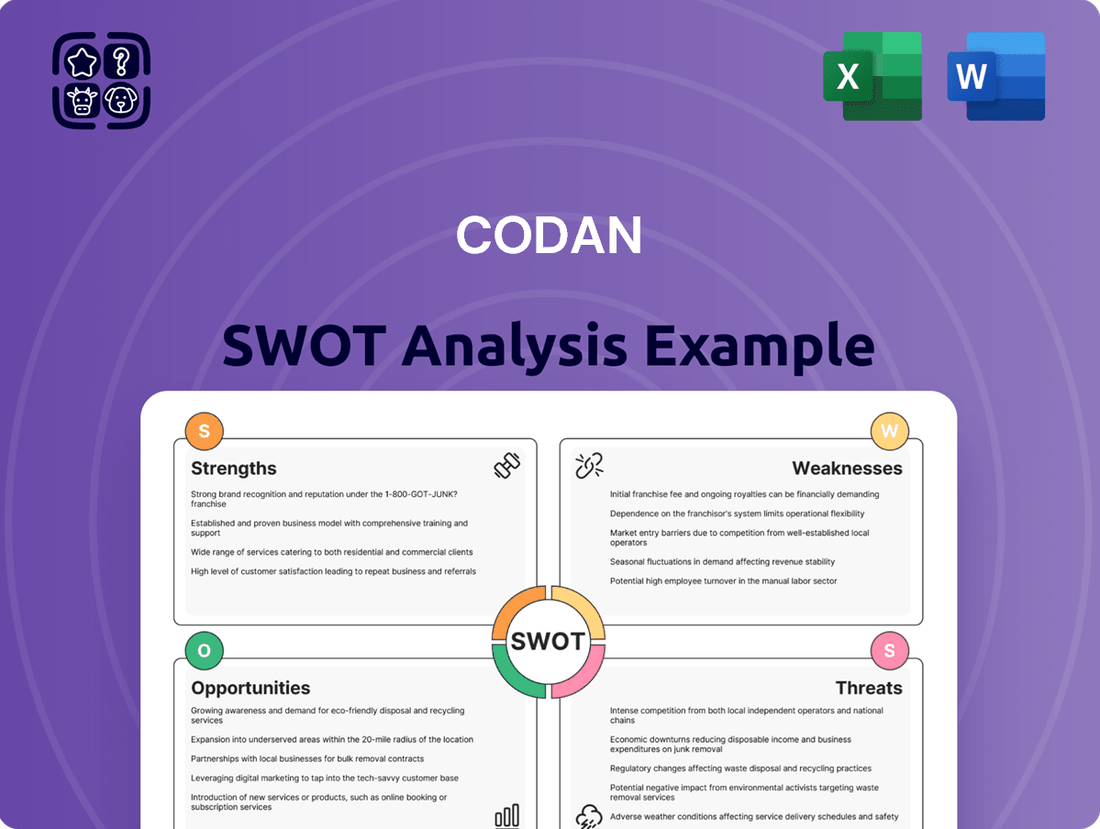

Analyzes Codan’s competitive position through key internal and external factors, highlighting strengths, weaknesses, opportunities, and threats.

Codan's SWOT analysis provides a structured framework to identify and address potential business challenges, acting as a proactive pain point reliever by highlighting areas for improvement and strategic advantage.

Weaknesses

Codan's metal detection segment, especially its applications in artisanal gold mining, faces a significant vulnerability due to its dependence on geopolitical stability. Historical sales data, such as the notable impact of disruptions in the Sudan region, highlights this sensitivity. Even with revenue diversification, instability in critical markets can still create headwinds for this business line.

Acquisitions, while a key growth lever for Codan, inherently carry integration risks. Successfully merging acquired entities such as Kägwerks, Zetron UK, and Wave Central into Codan's established operational framework is paramount to achieving projected synergies and margin enhancements.

The financial year 2023 saw Codan complete the acquisition of Zetron for $37 million, adding to its portfolio. Any disruption in integrating these businesses could manifest as unforeseen costs or a drag on operational efficiency, potentially impacting the company's profitability targets.

Codan faces intense competition across its communications and metal detection segments. The presence of numerous global players, some with significantly larger resources, presents a considerable challenge. For instance, in the secure communications market, competitors like Thales and L3Harris Technologies are major forces.

Sustaining and expanding market share necessitates a relentless focus on innovation, aggressive pricing strategies, and robust distribution networks. The company must continually invest in R&D to differentiate its offerings and maintain a competitive edge against these well-entrenched rivals.

Exposure to Currency Fluctuations

Codan's significant international presence, with over 85% of its sales derived from exports and operations spanning multiple countries, inherently exposes it to currency fluctuations. This can directly affect its financial performance when earnings generated in foreign currencies are translated back into Australian dollars for reporting purposes. For instance, a strengthening Australian dollar against other major currencies could reduce the reported value of its overseas profits, impacting overall profitability.

The company's reliance on international markets means that adverse movements in exchange rates can create volatility in its reported revenues and earnings. This exposure is a key weakness that necessitates careful financial management and hedging strategies to mitigate potential negative impacts on its bottom line.

- International Sales Dependence: Over 85% of Codan's sales are from exports, increasing vulnerability to currency shifts.

- Profitability Impact: Fluctuations in exchange rates can directly reduce the reported value of foreign earnings when converted to AUD.

- Financial Volatility: Currency movements can introduce unpredictability into Codan's revenue and profit figures.

Potential for Supply Chain Disruptions

While Codan experienced a normalization of supply chains in FY24, the company continues to face inherent risks from potential future disruptions. Global geopolitical events, fluctuations in raw material availability, and persistent logistics challenges remain significant threats. These factors can directly impact manufacturing processes, increase production costs, and hinder the timely delivery of vital products, ultimately affecting revenue streams and overall profitability.

The company's reliance on a global network for sourcing and distribution exposes it to vulnerabilities. For instance, disruptions in key component manufacturing regions or extended shipping delays, as seen in various sectors throughout 2023 and into early 2024, could significantly impede Codan's operational efficiency. This susceptibility means that even with improved conditions, proactive risk mitigation remains crucial.

- Vulnerability to Global Events: Geopolitical instability or natural disasters in key sourcing regions can halt production.

- Raw Material Price Volatility: Fluctuations in the cost of essential components directly impact manufacturing expenses.

- Logistics and Shipping Delays: Port congestion or transportation network issues can delay product delivery, impacting sales cycles.

- Impact on Production Costs: Supply chain bottlenecks often lead to increased freight and component acquisition costs.

Codan's significant reliance on international markets, with over 85% of its sales originating from exports, exposes it to substantial currency fluctuation risks. This global footprint means that adverse movements in exchange rates, such as a strengthening Australian dollar against other major currencies, can directly reduce the reported value of its overseas profits when converted back into AUD. This volatility can create unpredictability in revenue and profit figures, impacting overall financial performance.

The company's metal detection segment, particularly its exposure to artisanal gold mining, is vulnerable to geopolitical instability. Past sales disruptions, such as those experienced in the Sudan region, underscore this sensitivity. Despite efforts to diversify revenue streams, instability in critical markets can still pose significant challenges to this business line.

Codan faces intense competition across its communications and metal detection sectors. Major global players with substantial resources, like Thales and L3Harris Technologies in secure communications, present a considerable challenge. Maintaining and growing market share requires continuous innovation, competitive pricing, and strong distribution networks to stay ahead of well-established rivals.

Acquisitions, a key driver of Codan's growth, introduce inherent integration risks. The successful assimilation of acquired entities, such as the $37 million acquisition of Zetron in FY23, into Codan's existing operational framework is critical to realizing projected synergies and improving margins. Any integration hiccups could lead to unexpected costs or reduced operational efficiency, potentially hindering profitability targets.

Full Version Awaits

Codan SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the complete, unedited report, ready for your strategic planning needs.

Opportunities

Heightened geopolitical tensions across the globe are a significant tailwind for Codan, with defense spending on the rise. Nations, particularly within the Five Eyes intelligence community—Australia, Canada, New Zealand, the UK, and the USA—are prioritizing robust communication systems. This trend directly benefits Codan, whose mission-critical communication solutions are designed for military and public safety applications.

Codan is strategically positioned to benefit from this increased defense expenditure. The company's expertise in providing reliable communication technology for challenging environments aligns perfectly with the evolving needs of modern defense forces. For instance, global defense spending was projected to reach over $2.2 trillion in 2024, a substantial increase reflecting these geopolitical realities.

Furthermore, Codan's recent acquisitions, such as Kägwerks, have bolstered its capabilities in tactical military communications. This integration enhances its product portfolio, making it more attractive to defense clients seeking advanced and integrated communication solutions. This strategic move allows Codan to offer more comprehensive packages, further solidifying its competitive edge in a growing market.

Codan's extensive marketing reach across over 150 countries presents a substantial runway for geographic expansion. The company can leverage this existing network to penetrate new, untapped markets, particularly in high-growth regions identified for their increasing disposable income and interest in recreational metal detecting.

Strengthening its distribution channels, especially for metal detection products in North America and Europe, offers a direct path to increased market share. For instance, by securing partnerships with key retailers or establishing more direct-to-consumer online sales infrastructure in these mature markets, Codan can capture a larger portion of the estimated $1.5 billion global metal detector market, which saw a notable 8% growth in 2024.

Codan's commitment to research and development, particularly in integrating AI and machine learning, presents significant opportunities. This focus can lead to the creation of entirely new revenue streams and the enhancement of current product offerings, keeping them relevant and competitive in a rapidly evolving market.

The development of advanced products, such as the Dock Ultra with AI capabilities tailored for military use, offers a distinct competitive advantage. This strategic innovation is poised to unlock new market segments and solidify Codan's position as a leader in specialized communication solutions.

Growth in Public Safety and Smart City Initiatives

The push for smarter, safer cities worldwide is a major tailwind for Codan. As municipalities invest in integrated systems for public safety, utilities, and transportation, there's a growing need for reliable command and control solutions, which is exactly what Codan's Communications segment, like Zetron, provides. This trend is particularly evident in the expanding next-generation 911 (NG911) market, which requires advanced communication infrastructure.

This opportunity is backed by significant market growth. For instance, the global smart city market was valued at approximately USD 400 billion in 2023 and is projected to reach over USD 1.5 trillion by 2030, with public safety being a core component. Within this, the market for public safety communications is expected to see robust expansion as cities upgrade their emergency response capabilities. In 2024, investments in smart city technology, especially those enhancing public safety, are anticipated to increase by 15-20% year-over-year.

Key areas of opportunity include:

- Expansion in NG911 deployments: As more regions adopt NG911 standards, the demand for compatible dispatch and communication systems will rise.

- Integrated public safety platforms: Cities are seeking unified solutions that can manage various emergency services, from police and fire to ambulance dispatch.

- Smart transportation and utility management: Codan's technology can also support communication needs for smart grids and intelligent traffic management systems, further broadening its addressable market.

- Increased government spending: Many governments are prioritizing public safety and smart city infrastructure in their 2024-2025 budgets, allocating substantial funds to these initiatives.

Shift Towards Recurring Revenue Models and Software Sales

Codan's strategic pivot towards recurring revenue streams, especially within government contracts, is a significant opportunity. This focus, coupled with an increasing share of software sales in its Communications division, aims to build a more predictable and stable earnings base. For instance, in the fiscal year ending June 30, 2024, Codan reported that its Communications segment saw a notable increase in recurring revenue, contributing to a more robust financial outlook.

This transition is expected to enhance Codan's financial predictability, potentially leading to higher valuation multiples as investors favor businesses with reliable income. The company's commitment to expanding its software offerings within Communications is a key driver of this strategy, aiming to capture a larger share of the market for advanced communication solutions.

Key aspects of this opportunity include:

- Focus on Government Contracts: Securing long-term, recurring revenue agreements with government entities provides a stable income foundation.

- Growing Software Sales: The increasing proportion of revenue from software in the Communications division signals a shift towards higher-margin, scalable offerings.

- Enhanced Earnings Predictability: The combination of recurring revenue models and software sales is designed to smooth out revenue fluctuations and improve forecasting accuracy.

- Potential Valuation Uplift: A more predictable earnings profile often commands higher valuation multiples from the market.

Codan is well-positioned to capitalize on increased global defense spending, projected to exceed $2.2 trillion in 2024, as nations bolster their communication systems. The company's acquisition of Kägwerks strengthens its tactical military communication offerings, making it more appealing to defense clients seeking integrated solutions.

The company's broad marketing reach across over 150 countries offers significant potential for geographic expansion, particularly in regions with growing disposable income and interest in recreational metal detecting. Strengthening distribution channels for metal detectors in North America and Europe could capture more of the estimated $1.5 billion global market, which grew by 8% in 2024.

Codan's investment in R&D, especially in AI and machine learning, presents opportunities for new revenue streams and enhanced product competitiveness, exemplified by advanced products like the Dock Ultra with AI. The growing smart city market, expected to reach over $1.5 trillion by 2030, presents a significant opportunity for Codan's public safety communication solutions, with smart city investments anticipated to rise 15-20% in 2024.

A strategic shift towards recurring revenue, particularly through government contracts and increased software sales in its Communications division, aims to create a more stable financial base. This strategy is supported by a notable increase in recurring revenue within the Communications segment for the fiscal year ending June 30, 2024, enhancing earnings predictability.

| Opportunity Area | Key Driver | Market Data Point |

| Defense Spending | Geopolitical Tensions | Global defense spending projected over $2.2 trillion in 2024. |

| Geographic Expansion | Extensive Marketing Reach | Metal detector market grew 8% in 2024, valued at $1.5 billion globally. |

| Smart City Integration | Public Safety Needs | Smart city market projected to exceed $1.5 trillion by 2030. |

| Recurring Revenue | Software & Gov Contracts | FY24 Communications segment saw increased recurring revenue. |

Threats

Codan faces significant headwinds from a crowded marketplace in both its radio communications and metal detection divisions. Established global brands and nimble, emerging competitors alike are vying for market share, creating a highly dynamic and challenging environment. This intense competition can force pricing adjustments, potentially squeezing profit margins and impacting Codan's ability to invest in future innovation.

Market saturation in certain segments, particularly in mature radio communications markets, presents a substantial threat. As more companies offer similar solutions, the demand for new products can dwindle, leading to price wars. For instance, the global radio communications market, while growing, is seeing increased competition from low-cost providers, a trend that could affect Codan's revenue streams if not strategically managed.

Economic downturns pose a significant threat to Codan, as reduced consumer and government spending directly impacts demand for its diverse product lines. For example, sales of recreational metal detectors, a segment reliant on discretionary income, are particularly vulnerable during periods of economic contraction. In 2024, global economic growth forecasts have been revised downwards by institutions like the IMF, signaling a challenging environment for companies with significant consumer-facing segments.

Furthermore, shifts in government spending priorities and budget constraints can negatively affect Codan's defense and public safety sectors. As nations grapple with economic pressures, defense budgets may be scrutinized, potentially leading to delays or cancellations of contracts. This was observed in some regions during the 2023 fiscal year, where defense spending saw modest growth but faced calls for reallocation of resources.

The fast-paced nature of the technology sector means Codan faces a constant threat from rapid technological obsolescence. New innovations emerge quickly, making existing products outdated. For instance, the telecommunications industry, where Codan operates, saw significant shifts with the rollout of 5G technology, requiring substantial investment to adapt.

To combat this, Codan must maintain a robust commitment to research and development, ensuring its offerings stay ahead of the curve. Failure to do so could severely impact its market position. In 2023, global R&D spending in the tech sector continued its upward trend, with many companies allocating over 15% of revenue to innovation to stay competitive.

If Codan cannot keep pace with these technological advancements, it risks losing market share to more agile competitors and experiencing a decline in profitability. This is a critical challenge for any company in this dynamic field.

Supply Chain Risks and Geopolitical Events

Ongoing global supply chain vulnerabilities present a significant threat to Codan. Shortages of critical components, like semiconductors, and disruptions in logistics networks, exemplified by the ongoing challenges in maritime shipping which saw container freight rates remain elevated throughout much of 2024, could directly impact Codan's manufacturing efficiency and its ability to deliver products to market on time.

Geopolitical events further exacerbate these risks. Trade disputes, such as those impacting key manufacturing regions, or regional conflicts can disrupt access to essential raw materials, increase production costs due to tariffs or altered trade routes, and potentially limit market access for Codan's products. For instance, the ongoing tensions in Eastern Europe continued to influence energy prices and global trade flows in early 2025, creating an unpredictable operating environment.

- Component Shortages: Continued reliance on global suppliers for specialized components, such as advanced medical device parts, makes Codan susceptible to widespread shortages.

- Logistics Disruptions: Port congestion and elevated shipping costs, which persisted through 2024 and into early 2025, can delay product delivery and increase operational expenses.

- Trade Policy Uncertainty: Evolving trade policies and tariffs between major economic blocs could impact the cost of imported materials and the competitiveness of Codan's exported goods.

- Regional Instability: Conflicts or political instability in regions where Codan sources materials or has significant markets could lead to supply interruptions and reduced demand.

Regulatory and Compliance Risks

Codan's global operations, especially within the defense and public safety industries, mean it must navigate a complex maze of international trade laws, export controls, and various compliance mandates. Failure to adhere to these rules can lead to severe fines, damage to its reputation, and limitations on its ability to enter or operate in key markets.

For instance, in 2023, companies in the defense sector faced increased scrutiny over supply chain transparency and adherence to sanctions, with some facing multi-million dollar penalties for export control violations. Codan's reliance on international sales, which represented a significant portion of its revenue in FY23, makes it particularly vulnerable to these evolving regulatory landscapes.

- Navigating diverse international trade regulations.

- Adhering to strict export control regimes.

- Risk of substantial penalties for non-compliance.

- Potential for reputational damage and market access restrictions.

Intense competition from both established global players and emerging companies poses a significant threat to Codan across its product lines. This crowded market can lead to pricing pressures, potentially impacting profit margins and the capacity for innovation. For example, the radio communications sector, a key area for Codan, has seen an influx of lower-cost providers, intensifying the competitive landscape.

Economic downturns are a substantial risk, as reduced consumer and government spending directly affects demand for Codan's products. Recreational metal detectors, for instance, are particularly sensitive to discretionary spending, which often declines during economic contractions. Global economic growth forecasts for 2024, as indicated by institutions like the IMF, suggest a potentially challenging environment.

Rapid technological advancements represent a constant threat of obsolescence. Codan must invest heavily in research and development to keep its offerings competitive, as seen in the telecommunications sector's swift adoption of 5G. Global R&D spending in technology continued to rise in 2023, with many firms dedicating over 15% of revenue to innovation.

Supply chain disruptions and geopolitical instability further compound these risks. Component shortages, such as semiconductors, and elevated shipping costs, which remained high through 2024, can impede production and delivery. Trade disputes and regional conflicts can also disrupt material access and market access, as evidenced by the impact of ongoing global tensions on trade flows in early 2025.

SWOT Analysis Data Sources

This Codan SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and insights from industry experts. These sources provide the reliable, data-driven context necessary for a thorough and accurate assessment of Codan's strategic position.