Codan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

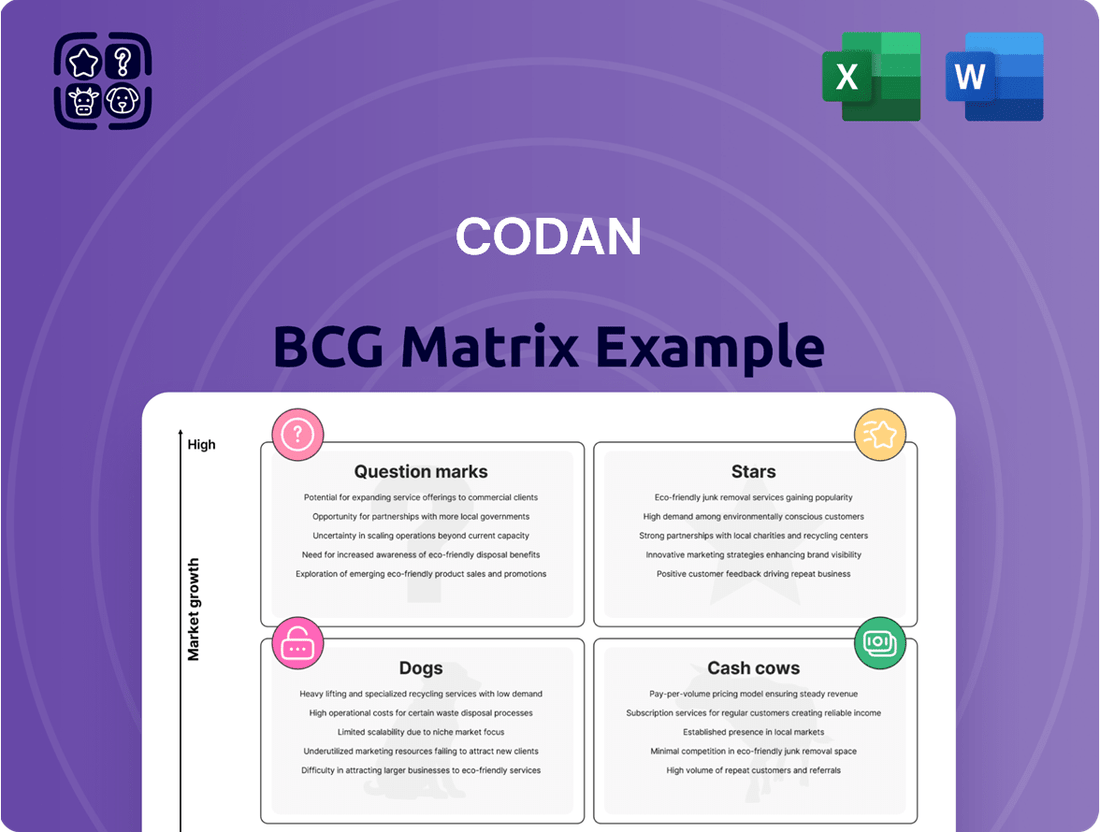

Unlock the strategic potential of the Codan BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of market performance and growth opportunities. Don't just guess where to invest; know exactly where your resources will yield the greatest returns.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Codan's Communications segment, encompassing both tactical and Zetron solutions, has shown impressive growth. In the first half of fiscal year 2025, this segment achieved a revenue of $187.0 million, marking a substantial 22% increase. This performance comfortably surpassed the company's targeted growth range of 10% to 15% for the period.

The strong revenue performance is further supported by a robust orderbook. As of December 2024, the Communications segment's orderbook stood at $247 million. This represents a significant 35% year-on-year increase, indicating sustained demand and a healthy pipeline for future revenue generation.

Codan's Tactical Communications segment, especially after acquiring Kägwerks in September 2024, is a significant growth driver. Kägwerks’ advanced dismounted soldier systems and intellectual property bolster Codan's military radio offerings.

This strategic move is projected to contribute substantially to revenue and EBITDA within its initial 12 months, underscoring its importance to Codan's market position.

Global defense spending is on the rise, with projections indicating continued growth. For instance, the Stockholm International Peace Research Institute (SIPRI) reported that global military expenditure reached an estimated $2,443 billion in 2023, a 6.8% increase in real terms from 2022. This surge is fueled by escalating geopolitical tensions and a renewed focus on national security across many regions.

Countries such as the United States, Australia, South Korea, and various European nations are significantly increasing their defense budgets. This heightened investment directly benefits companies like Codan, particularly its communications segment. The demand for advanced and secure communication technologies is paramount as nations upgrade their military capabilities.

Codan's mission-critical communication solutions, including its secure high-frequency (HF) radios and tactical communication systems, are well-positioned to capitalize on this trend. The increased defense spending translates into a high-growth market opportunity for these specialized products, essential for reliable operations in challenging environments.

Drone and Unmanned Systems Market

Codan’s involvement in the drone and unmanned systems market is a significant growth area, leveraging its expertise in communication devices. The company’s products are well-suited for integration into these platforms, enabling enhanced operational capabilities.

The DTC BluSDR™ is a prime example of this, seeing increased adoption for mid-range air platforms within military sectors worldwide. This trend highlights Codan’s competitive edge in a market that is expanding rapidly. For instance, the global military drone market was valued at approximately $15 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating substantial growth potential.

- Market Presence: Codan’s communication devices are integral to the expanding unmanned systems sector.

- Key Product Adoption: The DTC BluSDR™ is a preferred choice for mid-range military air platforms globally.

- Growth Indicators: The increasing demand for advanced communication solutions in drones signals robust market penetration.

- Market Value: The military drone market’s significant projected growth underscores the opportunity for Codan.

New Product Development in Communications

Codan's new product development in communications, particularly its multi-waveform solution for Federal Government customers, positions it as a potential Star in the BCG matrix. This strategic focus on innovation targets the high-growth defense communications sector.

The company's aim to develop Tactical's radio waveform for longer-term defense programs further solidifies this potential. By investing in cutting-edge technology, Codan is striving to capture significant market share in a rapidly evolving industry.

- Federal Government Contracts: Codan secured a significant contract in late 2023 for its advanced communications technology, underscoring government demand.

- Market Growth Projection: The global defense communication market is projected to grow at a CAGR of over 5% through 2028, indicating substantial opportunity.

- R&D Investment: Codan's increased investment in research and development for new waveforms demonstrates a commitment to future growth.

- Competitive Landscape: The company's multi-waveform approach offers a distinct advantage over competitors with more limited capabilities.

Stars represent high-growth, high-market-share business units. Codan's Communications segment, particularly its tactical solutions bolstered by the Kägwerks acquisition, is demonstrating Star-like characteristics. The segment's robust revenue growth of 22% in H1 FY25 and a 35% year-on-year increase in its orderbook to $247 million as of December 2024 highlight its strong market position and rapid expansion within a growing defense sector.

What is included in the product

The Codan BCG Matrix provides a strategic overview of a company's product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

This framework offers insights into which units to invest in, hold, or divest to optimize resource allocation and achieve strategic objectives.

Codan BCG Matrix provides a clear, one-page overview placing each business unit in a quadrant, alleviating the pain of unclear strategic direction.

Cash Cows

Minelab Metal Detection, a key player in recreational, gold mining, demining, and military sectors, stands as a prime example of a Cash Cow within the Codan BCG Matrix. This division demonstrated exceptional performance in FY24, achieving a 25% revenue surge to $219.9 million and a substantial 37% increase in segment profit, reaching $77.9 million.

The division's robust revenue growth and impressive profit margins, evidenced by its FY24 figures, underscore its position as a significant cash generator. This strong financial performance solidifies Minelab's role in consistently providing substantial returns and funding other business ventures.

Cash Cows in the Codan BCG Matrix are businesses with high market share in slow-growing industries. These are mature products that generate more cash than they consume, providing stable profits. Codan's overall net profit margins have shown positive growth, reaching 15.1% in FY24, a notable increase from the prior year.

The Metal Detection segment exemplifies a Cash Cow for Codan. In FY24, this segment achieved an impressive profit margin of 35%. This strong performance highlights its efficiency and consistent ability to generate substantial cash flow, reinforcing its status as a key contributor to the company's financial stability.

Codan's consistent dividend payments highlight its status as a Cash Cow. The company's ability to generate substantial cash flow allows for regular distributions to shareholders, a key characteristic of this BCG Matrix category. This financial strength is evidenced by its history of increasing payouts.

For instance, in the first half of fiscal year 2025, Codan announced an interim dividend of 12.5 cents per share, marking a significant 19% increase compared to the same period in the previous year. This upward trend continued from the full fiscal year 2024, where the total annual dividend reached 22.5 cents per share, a robust 21.6% jump from fiscal year 2023.

Established Global Presence

Codan's established global presence is a key characteristic of its Cash Cow status within the BCG Matrix. With operations and marketing reach extending to over 150 countries, the company benefits from a diversified revenue stream that mitigates risks associated with any single market. This extensive international footprint, particularly in mature markets for its established product lines, underpins its ability to generate consistent and predictable cash flows.

The fact that exports contribute over 85% of Codan's sales highlights its reliance on international markets. This high export ratio, coupled with a presence in numerous mature economies, suggests a strong brand recognition and a well-entrenched distribution network. These factors are crucial for maintaining market share and profitability in established product categories, which are hallmarks of a Cash Cow.

- Global Reach: Operations in over 150 countries.

- Export Dominance: Exports account for more than 85% of sales.

- Market Maturity: Strong presence in mature markets for core products.

- Predictable Cash Flow: Benefits from stable and consistent revenue generation.

Strong Operational Execution

Codan's consistent delivery of sustainable growth across recent reporting periods highlights its robust operational execution, particularly within its mature segments like metal detection. This efficiency translates into impressive profit margins and dependable cash flows, minimizing the need for significant reinvestment in marketing or development to maintain momentum.

The company's established product lines, such as Minelab metal detectors, act as powerful cash cows. For instance, in the fiscal half ending December 31, 2023, Codan reported a 15% year-on-year increase in revenue for its Metal Detection segment, reaching AUD 96.7 million, demonstrating continued market strength and operational effectiveness.

- Strong Revenue Growth: The Metal Detection segment achieved AUD 96.7 million in revenue for the half-year ending December 31, 2023, a 15% increase year-on-year.

- High Profitability: Operational efficiencies within this segment contribute to substantial profit margins, generating reliable cash for the business.

- Low Reinvestment Needs: Established products require minimal new investment for promotion or innovation, allowing for efficient cash extraction.

Cash Cows are established products or divisions with a high market share in slow-growing industries, generating more cash than they consume. Codan's Minelab Metal Detection segment exemplifies this, showing strong revenue and profit growth. For example, in FY24, Minelab's revenue grew 25% to $219.9 million, with segment profit up 37% to $77.9 million, highlighting its consistent cash generation. This allows Codan to fund other ventures and provide shareholder returns, as seen in their increasing dividend payouts.

| Segment | FY24 Revenue | FY24 Segment Profit | FY24 Profit Margin |

|---|---|---|---|

| Minelab Metal Detection | $219.9 million | $77.9 million | 35% |

| Codan (Overall) | 15.1% |

What You’re Viewing Is Included

Codan BCG Matrix

The Codan BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means no hidden charges, no watermarks, and no incomplete sections; you get the entire strategic analysis as is, ready for immediate implementation or presentation.

Dogs

Older metal detector models, particularly within Minelab's GPX series, are showing a surprising resurgence thanks to aftermarket modifications. While Minelab as a whole is a strong cash cow, these older, modified units could potentially cannibalize sales of newer models. This trend suggests that while these discontinued detectors still have a dedicated user base, they may not be actively growing market share and could become cash traps if their lifecycle isn't strategically managed.

Codan's 'other revenue' saw a dip from $5.9 million to $3.7 million in fiscal year 2024. While this segment isn't a major contributor to their overall financial performance, the decline signals potential weakness in areas outside their primary communications and metal detection businesses.

These less significant revenue streams, characterized by limited market presence and shrinking income, could be categorized as Dogs within the BCG framework. Such segments often drain resources without delivering substantial returns, making them candidates for divestment or strategic review.

Products in mature markets with low market share and no distinct competitive edge would be classified as Dogs within Codan's BCG Matrix. These offerings often consume resources without generating significant returns, representing a drain on the company's overall performance. For instance, if a legacy product line for Codan, like older telecommunications equipment, now faces intense competition in a saturated market and holds a minimal share, it would likely fall into this category.

Inefficient Legacy Systems

Inefficient legacy systems, such as older communication platforms or outdated metal detection technology, can be categorized as Dogs within the BCG Matrix. These systems often demand significant maintenance and support without delivering commensurate returns or a competitive edge. For instance, a company might find its 2018-era communication software is no longer compatible with newer security protocols, forcing costly upgrades or replacement.

Investing in extensive turnaround plans for these underperforming assets is often ill-advised. Consider a scenario where a business relies on a legacy ERP system that incurs annual maintenance fees of $150,000 but offers no new functionalities or efficiency gains. In 2024, the market for more agile cloud-based solutions presents a clear alternative, making continued investment in the legacy system a poor strategic choice.

- Dogs represent businesses or products with low market share and low market growth.

- Legacy systems often fall into this category due to technological obsolescence and declining demand.

- In 2024, companies are increasingly divesting from or phasing out legacy IT infrastructure to focus on more innovative and profitable ventures.

Underperforming Acquisitions

Underperforming acquisitions, when not integrated effectively or failing to capture anticipated market share, can become Codan's 'Dogs'. These are segments where initial investment hasn't translated into the desired high market position within a growing sector, resulting in a diminished return on invested capital.

For instance, if Codan acquired a company in the burgeoning fintech space in 2022, but by mid-2024 it only holds a 3% market share and is not showing significant profit growth, it would likely be categorized as a Dog. This scenario highlights the challenge of turning strategic intent into tangible market dominance and profitability.

- Low Market Share: These units typically possess a small percentage of their respective market, often below 10%.

- Slow Market Growth: The industries or product categories these acquisitions operate in are not expanding rapidly, limiting organic growth potential.

- Negative or Low Profitability: They may be operating at a loss or generating minimal profits, thus draining resources.

- Limited Future Prospects: Without significant strategic intervention or market shifts, their outlook for improvement is bleak.

Codan's 'Dogs' are products or business segments with low market share in slow-growing industries. These often require significant resources for maintenance or turnaround efforts that yield minimal returns. For example, older, less popular product lines that haven't kept pace with technological advancements or market demand would fall into this category. In 2024, many companies are actively identifying and divesting these underperforming assets to streamline operations and reallocate capital to more promising areas.

These segments are characterized by their inability to generate substantial profits or growth, often becoming cash drains. A key indicator is a consistently low market share, typically below 10%, within a mature or declining market. Without a clear path to significant improvement, such as a disruptive innovation or a major market shift, these 'Dogs' represent a drag on overall company performance.

Managing 'Dogs' often involves difficult decisions, ranging from divestment to complete discontinuation. The goal is to free up capital and management attention for 'Stars' and 'Question Marks' that have higher growth potential. For instance, if a legacy product line in 2024 is incurring more in support costs than it generates in revenue, its continued existence becomes questionable.

The challenge lies in accurately identifying these segments and avoiding emotional attachment to legacy products. A thorough analysis of market trends, competitive landscape, and internal resource allocation is crucial. By strategically addressing 'Dogs', companies can improve their overall financial health and competitive positioning.

| Category | Market Share | Market Growth | Profitability | Example |

| Dogs | Low (e.g., <10%) | Low/Negative | Low/Negative | Legacy communication systems with declining demand |

| Dogs | Low (e.g., <5%) | Low/Negative | Low/Negative | Underperforming acquired business units in mature sectors |

| Dogs | Low (e.g., <15%) | Low/Negative | Low/Negative | Older, unmodified metal detector models in a saturated market |

Question Marks

Codan's September 2024 acquisition of Kägwerks for $33.6 million positions it as a strategic move to bolster tactical communications capabilities. This investment is anticipated to be highly accretive, yet the dynamic nature of the military communications sector means its market share is still developing.

The successful integration of Kägwerks and the achievement of its projected revenue and EBITDA targets are critical for its future performance. Until these milestones are firmly established and its competitive standing is clear, Kägwerks will remain a 'Question Mark' within Codan's BCG Matrix.

Codan's new multi-waveform communications solution for Federal Government customers exemplifies a Question Mark in the BCG Matrix. This initiative targets high-growth markets, a positive indicator, but its future success and market adoption remain uncertain. Such ventures demand significant investment due to their inherent risk and the need for extensive research and development.

Expansion into new geographic markets for communications solutions, such as Codan's strategic moves into the US through acquisitions like Kägwerks, are classic examples of 'Question Marks' in the BCG Matrix. These ventures require significant investment to establish a foothold and gain market share.

Success in these new territories hinges on outmaneuvering established competitors. For instance, the global market for mission-critical communication systems, a key area for Codan, was projected to reach $35.9 billion in 2024, indicating substantial opportunity but also fierce competition.

Untapped Niche Applications for Existing Technologies

Codan might be identifying underserved sectors for its established radio communication and metal detection technologies. These could be emerging markets with significant growth potential but where Codan's presence is currently minimal, placing them firmly in the question mark category of the BCG matrix.

For instance, specialized drone communication systems or advanced underground utility detection could represent such niches. While these areas show promise, they necessitate substantial investment in research, development, and targeted marketing to gain traction and transition from question marks to stars or cash cows.

- Niche Market Identification: Exploring sectors like specialized agricultural sensing or critical infrastructure monitoring for radio communications.

- Metal Detection Expansion: Targeting niche applications such as forensic archaeology or industrial quality control for metal detection.

- Investment Requirements: Significant R&D funding and aggressive go-to-market strategies are crucial for these potential new ventures.

- Market Share Growth: Success hinges on capturing a meaningful share in these nascent, high-growth potential markets.

Potential Future Product Lines Beyond Current Specializations

Codan could explore speculative ventures into emerging high-growth sectors, such as advanced drone communication systems or secure satellite IoT solutions. These represent high-risk, high-reward opportunities requiring significant capital investment to establish market presence.

Such diversification would position Codan to capitalize on future technological shifts, potentially creating new revenue streams beyond their established specializations. For instance, investing in AI-driven cybersecurity for critical infrastructure could leverage their existing expertise in secure communications.

- Drone Communication Systems: Targeting the rapidly expanding commercial drone market, projected to reach over $40 billion globally by 2026, focusing on reliable, long-range, and secure data links.

- Satellite IoT Solutions: Capitalizing on the growing demand for connected devices in remote areas, with the global IoT market expected to exceed $1.5 trillion by 2025, offering robust connectivity for agriculture, logistics, and environmental monitoring.

- AI-Powered Cybersecurity: Developing advanced threat detection and prevention solutions for critical infrastructure, a sector where cybersecurity spending is anticipated to grow by 10-15% annually.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require substantial investment to increase market share and move towards becoming Stars. Codan's strategic acquisition of Kägwerks for $33.6 million in September 2024 is a prime example, aiming to enhance tactical communications capabilities in a growing sector.

The success of new initiatives, like Codan's multi-waveform communications solution for federal government customers, hinges on market adoption and competitive positioning. Despite targeting high-growth markets, the inherent uncertainty and significant R&D investment required place these endeavors firmly in the Question Mark category until their trajectory is clearer.

Expanding into new geographic markets, such as Codan's US entry via acquisitions, also falls under Question Marks. These moves demand considerable capital to establish a presence and compete against entrenched players, mirroring the competitive landscape of the global mission-critical communication systems market, valued at an estimated $35.9 billion in 2024.

Codan's exploration of niche sectors, like specialized drone communication systems or advanced underground utility detection, also fits the Question Mark profile. These areas offer high growth potential but necessitate significant investment in R&D and marketing to gain traction and potentially evolve into Stars.

| Codan Initiative | Industry Growth | Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Kägwerks Acquisition | High (Tactical Comms) | Developing | High | Question Mark |

| Multi-waveform Solution | High (Govt. Comms) | Uncertain | High | Question Mark |

| US Market Expansion | High (Mission-Critical Comms) | Developing | High | Question Mark |

| Drone Comms Systems | Very High (Drone Market) | Nascent | High | Question Mark |

BCG Matrix Data Sources

Our Codan BCG Matrix is built on robust market intelligence, integrating financial performance data, industry growth trends, and competitive landscape analysis for strategic decision-making.