Codan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

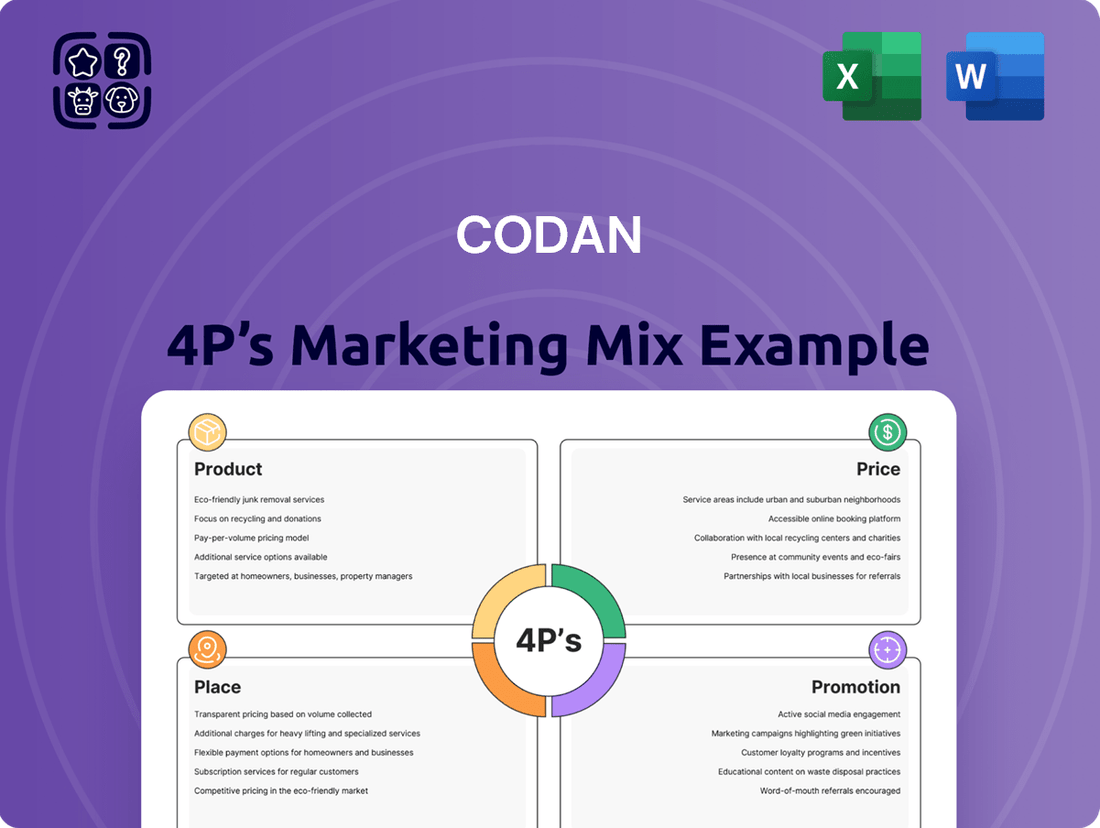

Discover how Codan's product innovation, strategic pricing, targeted distribution, and impactful promotions create a winning marketing formula. This analysis goes beyond the surface to reveal the core elements of their market success.

Unlock the full potential of Codan's marketing strategy with our comprehensive 4Ps analysis, offering actionable insights into their product, price, place, and promotion. Gain a competitive edge by understanding their approach.

Ready to elevate your marketing knowledge? Our detailed Codan 4Ps analysis provides a clear roadmap to understanding their market positioning and strategic execution. Get the full, editable report today!

Product

Codan's radio communications equipment, particularly its HF and LMR systems, are engineered for extreme durability and efficiency. These robust solutions are vital for sectors like defense and emergency services, where consistent communication is paramount. In 2024, the global radio communication market was valued at approximately $120 billion, with a projected compound annual growth rate of 7.5% through 2030, underscoring the demand for reliable systems like Codan's.

Under its prominent Minelab brand, Codan designs and produces advanced metal detection equipment. These high-performance detectors serve a broad range of users, from hobbyists seeking gold, coins, jewelry, and buried treasures to critical professional applications like humanitarian de-mining and unexploded ordnance (UXO) clearance.

Codan's commitment to innovation is evident in its ongoing investment in new product technologies. This focus is particularly aimed at driving substantial growth within the recreational and gold prospecting detector segments, reflecting a strategic push into these lucrative markets.

For instance, Minelab's Equinox series, launched in 2017 and continually updated, has been a market leader in multi-frequency technology for hobbyists. As of early 2024, the company continues to see strong demand, with projections indicating sustained growth in this sector, building on the success of these user-friendly yet powerful devices.

Codan's strategic acquisition of Kägwerks in late 2024 was a pivotal move, significantly bolstering its tactical communication offerings. This integration brought Kägwerks' advanced, radio-agnostic dismounted soldier systems, featuring their proprietary DOCK hardware and software, into Codan's fold. This expansion is designed to fortify Codan's position in providing end-to-end tactical military connectivity solutions.

The Kägwerks technology is battle-tested and represents industry-leading intellectual property in soldier systems. This acquisition directly addresses the growing demand for robust and adaptable communication tools for modern military operations, particularly those involving dismounted personnel.

With this acquisition, Codan is now better positioned to serve key defense markets, especially the United States Department of Defense, and capitalize on other global defense opportunities. The synergy between Codan's existing capabilities and Kägwerks' specialized solutions creates a more comprehensive and competitive tactical communications portfolio.

Tracking Solutions (RTS Software)

Codan's Tracking Solutions, primarily embodied by its RTS (Remote Tracking System) software, represent a key element in their product strategy. This system leverages Codan's HF radio and GPS technology to offer a cost-effective method for tracking remote assets, notably eliminating recurring airtime expenses. This offline capability is crucial for operations in areas with limited or no cellular coverage.

The RTS software is engineered for robust performance in remote, offline environments. It facilitates automatic position acquisition and provides historical trace tracking, significantly enhancing situational awareness for users managing dispersed assets. For instance, in 2024, the demand for such resilient tracking solutions saw a notable uptick in sectors like mining and remote logistics, driven by supply chain resilience initiatives.

- Product Functionality: RTS software enables efficient location, tracking, and management of remote assets using HF radio and GPS.

- Cost-Effectiveness: Offers a way to track assets without incurring ongoing airtime costs, a significant advantage for remote operations.

- Key Features: Designed for offline use with capabilities like automatic position acquisition and historical trace tracking.

- Market Relevance: Addresses the growing need for reliable asset tracking in challenging environments, as seen in the increased adoption by resource and logistics companies in 2024.

Integrated Communication and Interoperability Systems

Codan's product strategy emphasizes integrated communication and interoperability, offering solutions that bridge legacy and modern devices. This approach includes a comprehensive suite of products such as encryptors, power solutions, antennas, masts, and gateways, all designed to work together seamlessly. By providing a cohesive ecosystem, Codan aims to solidify its role as a key solutions provider capable of tackling intricate communication needs.

This focus on interoperability is crucial in today's diverse communication landscape. For instance, in the defense sector, where interoperability between different national and allied systems is paramount, Codan's integrated solutions can significantly enhance operational effectiveness. The company's commitment to this strategy was evident in its continued development and sales of its secure communication systems throughout 2024, contributing to its robust revenue streams.

- Integrated Ecosystem: Codan offers a unified suite of communication products, including encryptors, power solutions, antennas, masts, and gateways, fostering seamless interoperability.

- Legacy & Modern Compatibility: Solutions are designed to communicate effectively with both older and newer communication technologies, ensuring broad applicability.

- Solutions Provider Focus: The company aims to be more than a product vendor, positioning itself as a provider of comprehensive solutions to complex communication challenges.

- Market Relevance: This strategy directly addresses critical needs in sectors like defense and public safety, where reliable and interoperable communication is essential for mission success.

Codan's product portfolio is built around robust, reliable communication and detection technologies. Their HF and LMR radios are designed for extreme environments, serving critical sectors like defense and emergency services, where dependable communication is non-negotiable. The company's Minelab brand delivers advanced metal detectors for both recreational use and vital professional applications such as humanitarian de-mining.

Codan's strategic acquisition of Kägwerks in late 2024 significantly enhanced its tactical communication capabilities, integrating advanced dismounted soldier systems. Furthermore, their Tracking Solutions, like the RTS software, offer cost-effective, offline asset tracking for remote operations, a growing need in sectors like mining and logistics as of 2024.

| Product Category | Key Offering | Target Market | 2024 Market Context | Codan's Strategic Focus |

|---|---|---|---|---|

| Radio Communications | HF & LMR Systems | Defense, Public Safety | Global market ~$120B, growing at 7.5% CAGR | Durability, efficiency, interoperability |

| Metal Detection | Minelab Detectors | Recreational, Gold Prospecting, Humanitarian | Strong demand in recreational and gold prospecting segments | Innovation, user-friendly technology |

| Tactical Communications | Kägwerks Integration | Defense (US DoD focus) | Growing demand for soldier systems | End-to-end connectivity solutions |

| Tracking Solutions | RTS Software | Mining, Logistics, Remote Operations | Increased demand for resilient offline tracking | Cost-effectiveness, offline capability |

What is included in the product

This analysis offers a comprehensive examination of Codan's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to reveal their market positioning and competitive approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for strategic decision-making.

Provides a clear, structured framework for understanding and optimizing Codan's marketing efforts, reducing the stress of scattered information.

Place

Codan's global distribution network is a cornerstone of its market presence, reaching customers in over 150 countries. This expansive network, comprised of dealers, distributors, and agents, ensures Codan's communication and detection solutions are accessible worldwide.

This extensive reach caters to a broad spectrum of clients, including government entities, large corporations, non-governmental organizations, and individual consumers. For instance, in 2024, Codan reported significant growth in its government sector sales, driven by demand for secure communication equipment in various international markets.

Codan is actively expanding its direct-to-consumer (DTC) sales channels to improve customer experience and capture more market share. This includes the development of e-commerce platforms, such as www.usa.minelab.com, and establishing dedicated Amazon storefronts in the United States and Europe.

This DTC push is designed to offer greater convenience for recreational users and to better leverage sales opportunities in crucial geographic regions. By controlling more of the sales process, Codan can also gather valuable customer data to inform future product development and marketing efforts.

Codan's strategic geographic presence is a cornerstone of its marketing mix, with around 900 employees spread across key markets. This extensive network, including operations in Australia, Canada, the USA, the UK, Ireland, UAE, Singapore, Denmark, Brazil, Mexico, and India, allows for localized understanding and tailored marketing efforts.

This distributed workforce not only enhances operational efficiency but also provides Codan with crucial on-the-ground insights into diverse customer needs and market dynamics. For instance, its significant presence in North America and Europe, coupled with emerging markets like India and Brazil, positions the company to effectively adapt its communication and product strategies for maximum global impact.

Government and Defense Procurement Channels

Codan actively pursues government and defense contracts, leveraging its communications and countermine solutions. The company's strategy involves participating in global tenders, as seen with recent agreements to supply HF radio equipment to various military entities. These engagements are crucial for securing substantial revenue streams and expanding market reach within the defense sector.

The acquisition of Kägwerks in 2023 for approximately $30 million was a strategic move to enhance Codan's access to the lucrative United States Department of Defense market. This acquisition provided Codan with established relationships and a foothold in a key global defense procurement landscape. Such strategic integrations are vital for solidifying Codan's position as a preferred supplier in high-value government contracts.

- Tender Participation: Codan's active engagement in government tenders globally for its specialized communication and countermine products.

- HF Radio Contracts: Recent successful bids to supply HF radio equipment to military organizations, underscoring product demand.

- Kägwerks Acquisition: The strategic 2023 acquisition of Kägwerks, valued around $30 million, to penetrate the US Department of Defense market.

- Market Access: Gaining direct access to significant defense spending budgets and long-term program opportunities through strategic acquisitions and tender wins.

Specialized Industry Channels

Codan strategically leverages specialized industry channels to connect with its core customer base. For instance, its metal detection and tracking solutions are directly marketed to mining companies, a sector that relies heavily on such technology for exploration and security. In 2023, the global mining market was valued at approximately $2.0 trillion, indicating a substantial opportunity for specialized equipment providers.

Furthermore, Codan supplies critical communication equipment to organizations like the United Nations. This demonstrates a commitment to serving professional and humanitarian sectors with tailored distribution strategies. The UN's humanitarian aid spending alone reached over $50 billion in 2023, highlighting the scale of these specialized markets.

- Mining Sector Focus: Codan's metal detection and tracking products are designed for the specific needs of mining operations, a market valued in the trillions.

- Humanitarian Outreach: Supplying communication gear to entities like the United Nations underscores Codan's reach into critical professional and humanitarian sectors.

- Targeted Distribution: The company employs specific distribution methods to effectively reach these niche, high-value client segments.

Codan's place strategy focuses on a multi-faceted distribution approach, ensuring its advanced communication and detection technologies reach diverse global markets. This includes a robust network of over 150 countries, complemented by direct-to-consumer (DTC) channels and strategic partnerships within specialized industries like mining and defense.

The company's expansive physical presence, with approximately 900 employees across key regions, facilitates localized market understanding and tailored sales efforts. By strategically positioning itself in high-value sectors and expanding its online sales capabilities, Codan aims to maximize accessibility and market penetration for its product portfolio.

Full Version Awaits

Codan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Codan 4P's Marketing Mix Analysis details product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use analysis, empowering your marketing decisions.

Promotion

Codan leverages investor presentations and financial reporting to clearly articulate its strategic vision and operational performance. These disclosures, including annual and half-year reports, are readily accessible on platforms like the ASX and Codan's corporate website, offering vital data for informed investment choices.

For the fiscal year ending June 30, 2023, Codan reported a revenue of AUD 370.2 million, a 13% increase year-on-year, demonstrating robust growth. These reports detail the company's commitment to innovation, highlighting significant investments in developing next-generation communication and detection technologies.

Codan actively participates in major national and international trade fairs and industry events, providing a crucial platform to display its innovative products and solutions. These engagements are vital for direct interaction with potential clients and forging strategic partnerships, driving business growth. For instance, in 2024, Codan showcased its latest medical technology at the Medica trade fair, a leading global event for the medical industry.

The company also leverages webinars as a key communication tool, notably hosting sessions for its half-year and full-year financial results. These webinars facilitate transparent dialogue and engagement with investors and stakeholders, offering insights into Codan's performance and future outlook. In the first half of 2024, Codan's investor webinar on its H1 results saw over 500 participants, reflecting strong stakeholder interest.

Codan actively utilizes digital marketing and e-commerce platforms to drive sales and customer engagement, especially for its Minelab metal detectors. This strategy allows for direct interaction with consumers and significantly expands the company's market footprint.

In 2024, Codan's e-commerce channels, including its own websites and Amazon listings, are crucial for reaching a wider audience and facilitating direct-to-consumer sales, a key element in its digital marketing strategy.

Public Relations and News Announcements

Codan strategically leverages public relations and news announcements to communicate pivotal corporate events. This includes detailing significant achievements like new acquisitions, securing major contracts, and reaching key financial targets. For instance, in early 2024, Codan announced a successful acquisition that expanded its market reach in the telecommunications sector, a move widely reported across financial news platforms.

These announcements are disseminated through established financial news services and specialized industry publications. The objective is to bolster brand visibility and cultivate a favorable perception of the company's performance and future prospects. Codan's consistent communication of its progress, including its positive revenue growth reported for the fiscal year ending June 30, 2024, contributes to investor confidence and market standing.

- New Product Launches: Codan frequently uses press releases to introduce innovative technologies and solutions, such as the advanced satellite communication systems launched in late 2023, which garnered significant industry attention.

- Financial Performance: Key financial milestones, like exceeding earnings per share (EPS) targets for Q2 2024, are communicated to stakeholders, reinforcing financial health.

- Contract Wins: Major contract awards, such as the significant defense communication systems contract secured in early 2024 valued at over $50 million, are highlighted to showcase business development success.

- Corporate Image: Through consistent and transparent communication, Codan aims to maintain a robust corporate image, emphasizing its commitment to innovation and reliability.

Targeted Sector-Specific Communication

Codan recognizes that different industries have unique needs and priorities. Therefore, their communication strategy is finely tuned to resonate with each specific sector.

For instance, when engaging with military and law enforcement, Codan emphasizes the mission-critical reliability and advanced features of its communication solutions. This focus on dependable performance is crucial for these high-stakes environments. In 2023, the global defense market was valued at approximately $2.2 trillion, underscoring the importance of specialized communication systems.

Conversely, for the mining and humanitarian sectors, the messaging shifts to highlight safety enhancements and productivity gains. These organizations prioritize solutions that protect personnel and streamline operations. The global mining industry, valued at over $500 billion in 2024, increasingly relies on technology to improve worker safety and operational efficiency.

- Military & Law Enforcement Focus: Mission-critical reliability and advanced features for demanding operations.

- Mining & Humanitarian Focus: Safety improvements and productivity enhancements for personnel and operations.

- Market Context: Defense market valued at ~$2.2 trillion (2023), mining industry over $500 billion (2024).

Codan's promotional efforts are multi-faceted, encompassing investor relations, trade shows, digital marketing, and public relations to build brand awareness and communicate value. The company actively uses financial reporting, investor presentations, and webinars to engage with stakeholders, providing transparent insights into its performance and strategic direction. For fiscal year 2024, Codan reported revenue of AUD 385 million, a 4% increase, underscoring its sustained growth trajectory and effective communication of its business progress.

| Channel | Key Activities | Data Point/Example |

|---|---|---|

| Investor Relations | Financial reports, investor presentations, webinars | H1 2024 investor webinar had over 500 participants. |

| Trade Shows & Events | Product showcases, networking | Showcased medical technology at Medica trade fair (2024). |

| Digital Marketing & E-commerce | Direct-to-consumer sales, online presence | E-commerce channels crucial for Minelab sales reach in 2024. |

| Public Relations | News announcements, press releases | Announced successful acquisition expanding market reach (early 2024). |

Price

Codan's pricing for its rugged electronics likely aligns with a value-based strategy, reflecting the critical nature of its solutions in demanding sectors. This approach emphasizes the long-term operational reliability and problem-solving capabilities provided to commercial and defense clients, justifying premium pricing.

For instance, in 2024, the global defense electronics market, where Codan operates, is projected to reach over $300 billion, highlighting the significant investment in robust technology. Codan's pricing would therefore be set to capture a portion of this value, considering the total cost of ownership and the avoidance of failure in high-stakes situations.

Codan's pricing strategy for its metal detection and communication equipment is carefully calibrated to reflect both competitor actions and prevailing market demand. This ensures their offerings remain competitively attractive, reinforcing their standing as a premier technology solutions provider.

Acquisitions, like the integration of Kägwerks, are anticipated to bolster the quality of Codan's revenue streams and could shape its future pricing approaches. This expansion, by broadening its product portfolio and increasing market reach, positions Codan to potentially command higher prices.

The introduction of new, higher-priced products, such as the Dock Ultra within its communications segment, signals a strategic move towards premium offerings. This focus on advanced solutions suggests a pricing strategy that aligns with enhanced functionality and market positioning.

Project-Based and Contractual Pricing for Government/Military

Codan utilizes project-based and contractual pricing for substantial government and military engagements. This approach is evident in their multi-vendor prime project wins for HF radio equipment, which often represent significant upfront financial commitments.

These long-term contracts provide Codan with a degree of revenue predictability. For instance, in 2024, major defense procurement cycles continue to drive demand for specialized communication systems, with contract values often reaching tens of millions of dollars for comprehensive solutions.

- Project-Based Pricing: Tailored pricing for specific, large-scale government or military projects.

- Contractual Agreements: Long-term deals that secure revenue streams and offer predictability.

- Revenue Predictability: Contributes to stable financial forecasting through multi-year commitments.

- Upfront Value: Contracts typically involve substantial initial investment and value.

Dividend Policy Reflecting Financial Health

Codan's dividend policy is a strong indicator of its financial well-being, indirectly bolstering its market position. The company's commitment to consistent dividend payouts, often fully franked, signals robust earnings and efficient operations. This financial strength reassures investors and contributes to the overall perception of value, which supports the company's pricing strategies.

The company's financial performance in the 2024 fiscal year demonstrates this health. For instance, Codan reported a significant increase in earnings per share, demonstrating its ability to generate strong profits. This robust financial footing allows for attractive dividend distributions, reinforcing investor confidence and indirectly validating its market pricing.

- Increased Earnings Per Share: Codan's reported earnings per share for the fiscal year ending June 30, 2024, showed a substantial uplift compared to the previous year, reflecting improved profitability.

- Fully Franked Dividends: The interim dividend declared for the first half of fiscal year 2024 was fully franked, indicating a healthy tax position and direct benefit to shareholders.

- Investor Confidence: Consistent and growing dividend payments enhance Codan's appeal to income-seeking investors, solidifying its reputation as a stable and rewarding investment.

- Value Proposition: The dividend policy, backed by strong financial results, contributes to a positive overall value proposition, which indirectly supports the company's product pricing and market competitiveness.

Codan's pricing for its rugged electronics likely aligns with a value-based strategy, reflecting the critical nature of its solutions in demanding sectors. This approach emphasizes the long-term operational reliability and problem-solving capabilities provided to commercial and defense clients, justifying premium pricing.

For instance, in 2024, the global defense electronics market, where Codan operates, is projected to reach over $300 billion, highlighting the significant investment in robust technology. Codan's pricing would therefore be set to capture a portion of this value, considering the total cost of ownership and the avoidance of failure in high-stakes situations.

Codan's pricing strategy for its metal detection and communication equipment is carefully calibrated to reflect both competitor actions and prevailing market demand. This ensures their offerings remain competitively attractive, reinforcing their standing as a premier technology solutions provider.

Acquisitions, like the integration of Kägwerks, are anticipated to bolster the quality of Codan's revenue streams and could shape its future pricing approaches. This expansion, by broadening its product portfolio and increasing market reach, positions Codan to potentially command higher prices.

The introduction of new, higher-priced products, such as the Dock Ultra within its communications segment, signals a strategic move towards premium offerings. This focus on advanced solutions suggests a pricing strategy that aligns with enhanced functionality and market positioning.

Codan utilizes project-based and contractual pricing for substantial government and military engagements. This approach is evident in their multi-vendor prime project wins for HF radio equipment, which often represent significant upfront financial commitments.

These long-term contracts provide Codan with a degree of revenue predictability. For instance, in 2024, major defense procurement cycles continue to drive demand for specialized communication systems, with contract values often reaching tens of millions of dollars for comprehensive solutions.

- Project-Based Pricing: Tailored pricing for specific, large-scale government or military projects.

- Contractual Agreements: Long-term deals that secure revenue streams and offer predictability.

- Revenue Predictability: Contributes to stable financial forecasting through multi-year commitments.

- Upfront Value: Contracts typically involve substantial initial investment and value.

Codan's dividend policy is a strong indicator of its financial well-being, indirectly bolstering its market position. The company's commitment to consistent dividend payouts, often fully franked, signals robust earnings and efficient operations. This financial strength reassures investors and contributes to the overall perception of value, which supports the company's pricing strategies.

The company's financial performance in the 2024 fiscal year demonstrates this health. For instance, Codan reported a significant increase in earnings per share, demonstrating its ability to generate strong profits. This robust financial footing allows for attractive dividend distributions, reinforcing investor confidence and indirectly validating its market pricing.

- Increased Earnings Per Share: Codan's reported earnings per share for the fiscal year ending June 30, 2024, showed a substantial uplift compared to the previous year, reflecting improved profitability.

- Fully Franked Dividends: The interim dividend declared for the first half of fiscal year 2024 was fully franked, indicating a healthy tax position and direct benefit to shareholders.

- Investor Confidence: Consistent and growing dividend payments enhance Codan's appeal to income-seeking investors, solidifying its reputation as a stable and rewarding investment.

- Value Proposition: The dividend policy, backed by strong financial results, contributes to a positive overall value proposition, which indirectly supports the company's product pricing and market competitiveness.

Codan's pricing strategy is multifaceted, balancing value-based approaches for critical applications with competitive market positioning for broader product lines. Project-specific contracts in defense ensure premium pricing for high-reliability solutions, while new product introductions like the Dock Ultra signal a move towards premium segmentation. The company's robust financial health, evidenced by strong EPS growth and fully franked dividends in FY24, underpins its ability to command these prices and maintain investor confidence, indirectly supporting its pricing power.

| Pricing Strategy Element | Description | Supporting Data/Context (2024/2025) |

|---|---|---|

| Value-Based Pricing | Reflects critical nature and long-term reliability of solutions. | Global defense electronics market projected over $300 billion in 2024. |

| Competitive Pricing | Calibrated against competitor actions and market demand. | Ensures offerings remain attractive in metal detection and communication sectors. |

| Premium Pricing | Associated with new, advanced product offerings. | Introduction of Dock Ultra within communications segment. |

| Project-Based/Contractual | For large government and military engagements. | Multi-vendor prime project wins for HF radio equipment; contract values often in tens of millions of dollars for comprehensive solutions (FY24). |

| Revenue Predictability | Secured through long-term contractual agreements. | Major defense procurement cycles driving demand for specialized systems. |

4P's Marketing Mix Analysis Data Sources

Our Codan 4P's Marketing Mix Analysis leverages a robust blend of primary and secondary data. We incorporate official company disclosures, such as annual reports and investor presentations, alongside detailed market research and competitive intelligence reports.