CNOOC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

Navigate the complex global landscape affecting CNOOC with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the energy sector and CNOOC's strategic direction. This comprehensive report equips you with the foresight needed to capitalize on emerging opportunities and mitigate potential risks. Download the full version now and gain a critical competitive advantage.

Political factors

As a state-owned enterprise (SOE), CNOOC Limited's operations and strategic direction are intrinsically tied to the Chinese government's energy policies and national security objectives. Beijing's increasing oversight of SOEs, including recent anti-corruption drives, can affect leadership appointments and operational continuity. For instance, in 2023, China continued its efforts to bolster energy security, a key government priority that directly guides CNOOC's investment in domestic exploration and production, alongside its expansion into new energy sources.

CNOOC's extensive global operations, particularly in sensitive areas like the South China Sea and significant overseas ventures in Guyana, Brazil, and Iraq, are inherently exposed to geopolitical shifts. These international relations can directly impact project viability and operational stability.

The company must contend with risks stemming from potential U.S. sanctions or trade restrictions, which could disrupt existing international agreements and deter future investment. For instance, in 2023, the U.S. continued to scrutinize Chinese state-owned enterprises, creating an uncertain operating environment for companies like CNOOC.

Navigating complex diplomatic channels and strategically diversifying its asset base are crucial for CNOOC to mitigate the impact of these external political forces. This proactive approach is essential to safeguard its international contracts and secure sustained investment flows, especially as global energy markets remain dynamic.

China's increasingly stringent environmental regulations, particularly concerning emissions and offshore drilling safety, significantly shape CNOOC's operational strategies and capital expenditures. For instance, the nation's commitment to carbon neutrality by 2060 necessitates substantial investment in cleaner technologies and potentially limits expansion in certain high-emission areas.

Compliance with global anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and China's own anti-graft campaigns, remains paramount for CNOOC. The company's 2023 annual report emphasized ongoing efforts in strengthening internal controls and conducting mandatory integrity training for employees, acknowledging the persistent risks in international operations.

Energy Security and Strategic Importance

CNOOC is a cornerstone of China's energy security, holding the position of the nation's largest offshore oil and gas producer. This critical role ensures government backing and prioritization for its operations, aiming to guarantee a consistent and dependable energy flow. For instance, CNOOC's 2023 production reached 677 million barrels of oil equivalent, underscoring its substantial contribution to domestic supply.

The government's strategic focus on bolstering domestic natural gas exploration and production directly supports CNOOC's mandate. This national objective is evident in policies designed to incentivize exploration in challenging offshore environments. CNOOC's commitment to this goal is reflected in its significant investments in deepwater exploration projects, such as the Lingshui 17-2 gas field, which commenced production in 2021, contributing to China's natural gas self-sufficiency targets.

- Energy Security: CNOOC's status as China's leading offshore producer is paramount for national energy independence.

- Government Support: Strategic importance translates into government initiatives and favorable policies for CNOOC's development.

- Natural Gas Focus: The push for increased domestic gas production highlights a key government objective that CNOOC actively pursues.

Global Climate Policy and Energy Transition

Global climate policy shifts and the ongoing energy transition directly shape CNOOC's strategic direction. As nations increasingly commit to decarbonization, CNOOC must adapt its operations and investments to align with these evolving international expectations and regulatory frameworks.

China's national 'dual carbon' strategy, aiming for peak emissions before 2030 and carbon neutrality by 2060, provides a critical roadmap for CNOOC. The company is actively investing in cleaner energy sources and carbon capture, utilization, and storage (CCUS) technologies to meet these ambitious national targets.

- Renewable Energy Investments: CNOOC is expanding its offshore wind power capacity, aiming to contribute significantly to China's renewable energy goals.

- CCUS Development: The company is piloting and deploying CCUS projects, such as the CNOOC Offshore Oilfield CCUS Demonstration Project, to reduce its carbon footprint.

- Climate Risk Assessment: CNOOC conducts regular assessments of climate-related risks and opportunities to inform its long-term business planning and ensure resilience.

CNOOC's role as China's primary offshore oil and gas producer makes it a key instrument in the nation's energy security strategy. This governmental importance translates into significant policy support and prioritized investment in its domestic operations, as evidenced by its 2023 production of 677 million barrels of oil equivalent, a substantial contribution to China's energy self-sufficiency.

The government's push for increased domestic natural gas production directly influences CNOOC's strategic focus and investment decisions. Policies incentivizing exploration in challenging offshore environments, like CNOOC's deepwater Lingshui 17-2 gas field, underscore this national objective to enhance gas self-sufficiency.

Geopolitical factors significantly impact CNOOC's global operations, particularly in areas like the South China Sea and its ventures in Guyana and Brazil. The company must navigate international relations and potential trade restrictions, such as those stemming from U.S. scrutiny of Chinese SOEs in 2023, to maintain operational stability and secure future investments.

China's commitment to carbon neutrality by 2060, part of its 'dual carbon' strategy, mandates substantial investment in cleaner technologies and CCUS projects for CNOOC. This aligns with global climate policy shifts and necessitates adaptation in operational strategies and capital expenditures to meet evolving environmental expectations.

What is included in the product

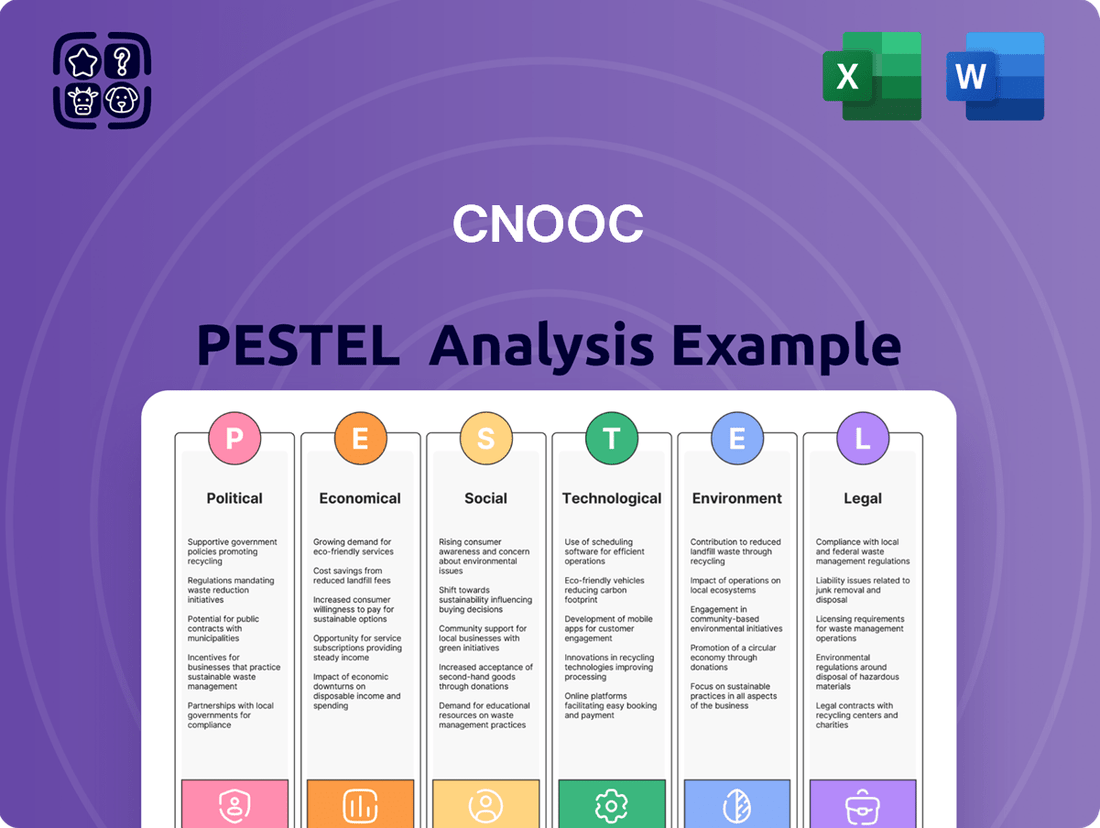

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CNOOC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within CNOOC's operating landscape.

Provides a concise version of the CNOOC PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global oil and gas prices are a huge deal for CNOOC, directly impacting how much money they make and their profits. Think of it like this: when oil prices go up, CNOOC tends to do better, and when they fall, it can hurt their bottom line. For example, in 2024, strong oil prices really helped CNOOC achieve some of their best financial results ever, boosting their net profit and sales significantly.

Looking ahead, CNOOC expects oil prices to stay within a certain band. This forecast is crucial for their planning and how they manage their investments and operations. The company's financial health is really tied to these global price swings, making it a key economic factor to watch.

CNOOC's capital expenditure strategy for 2024-2025 is robust, with a budget of RMB 125 billion to RMB 135 billion. This significant investment underscores a clear objective: to bolster reserves and boost production levels.

The allocated capital is strategically distributed across the entire upstream value chain, encompassing exploration, development, and production. This balanced approach ensures CNOOC is investing in both near-term output and long-term resource growth, both within China and in its international operations.

A core tenet of CNOOC's approach is a strong emphasis on investment efficiency and disciplined financial management. This ensures that the substantial capital outlays translate into tangible value creation and sustainable growth.

Global and domestic energy demand significantly shapes CNOOC's operational strategy. China's economic expansion fuels a consistent rise in its energy needs, positioning CNOOC as a vital supplier. For instance, CNOOC's 2024 production targets aim to meet this escalating demand, with plans for further increases through 2025 and 2026.

Cost Management and Operational Efficiency

CNOOC is deeply committed to lean management and rigorous cost control, which are crucial for sustaining high profitability and effectively navigating the inherent volatility of oil price cycles. This focus on efficiency is a cornerstone of their strategy.

The company's dedication to operational excellence is evidenced by its all-in cost per barrel of oil equivalent, which saw a reduction in 2024. This achievement highlights CNOOC's success in building cost-competitive advantages and enhancing its operational efficiency.

This strategic emphasis on cost management is instrumental in fortifying CNOOC's financial resilience, enabling it to better withstand and adapt to challenging macroeconomic trends and market fluctuations.

- Lean Management Focus: CNOOC prioritizes lean principles to streamline operations and reduce waste.

- Cost Reduction in 2024: The company achieved a decrease in its all-in cost per barrel of oil equivalent during 2024.

- Financial Resilience: Enhanced cost control bolsters CNOOC's ability to manage economic downturns.

- Competitive Advantage: Lower operating costs provide a significant edge in the global energy market.

Currency Fluctuations and Exchange Rates

CNOOC's extensive international operations mean it's heavily influenced by currency fluctuations. For instance, a stronger US dollar against the Chinese Yuan can reduce the Yuan-denominated value of its dollar-denominated revenues and assets, impacting reported profitability. This is a critical consideration for managing overseas project economics.

The volatility of exchange rates directly affects CNOOC's financial statements and the valuation of its global holdings. For example, in 2024, significant shifts in the USD/CNY rate could alter the profitability of projects in regions like Africa or North America, where revenue is often priced in USD but costs might be incurred in local currencies or Yuan.

- Impact on Revenue: A weaker Yuan relative to the USD can boost Yuan-equivalent revenues from dollar-denominated sales, but conversely, a stronger Yuan would have the opposite effect.

- Asset Valuation: Fluctuations can change the reported book value of CNOOC's overseas assets and liabilities when translated back into Chinese Yuan.

- Cost Management: For projects with costs in different currencies, exchange rate movements can significantly impact overall project expenses and margins.

- Hedging Strategies: CNOOC likely employs hedging strategies to mitigate these currency risks, but the effectiveness of these can vary with market volatility.

Global oil and gas prices are a primary driver for CNOOC's revenue and profitability, with higher prices generally leading to better financial performance. For instance, strong oil prices in 2024 significantly boosted CNOOC's net profit and sales. The company's capital expenditure plans for 2024-2025, totaling RMB 125 billion to RMB 135 billion, are designed to increase production and reserves, reflecting confidence in sustained energy demand and pricing.

China's economic growth fuels a consistent demand for energy, making CNOOC a critical supplier. The company's 2024 production targets and expansion plans through 2025-2026 are geared towards meeting this rising domestic need. CNOOC's commitment to lean management and cost control, evidenced by a reduced all-in cost per barrel in 2024, enhances its financial resilience against market volatility and strengthens its competitive position.

Currency fluctuations, particularly the USD/CNY exchange rate, significantly impact CNOOC's international operations. A weaker Yuan can increase the Yuan-equivalent value of dollar-denominated revenues, while a stronger Yuan has the opposite effect, influencing the reported profitability of overseas assets and projects. CNOOC likely employs hedging strategies to mitigate these currency risks.

| Economic Factor | Impact on CNOOC | 2024/2025 Data/Trends |

| Oil & Gas Prices | Directly affects revenue and profitability. Higher prices boost financial results. | Strong performance in 2024 driven by favorable prices. Forecasts suggest prices will remain within a certain band. |

| Energy Demand | Shapes operational strategy; China's economic expansion drives demand. | 2024 production targets aim to meet escalating domestic needs, with further increases planned through 2025-2026. |

| Capital Expenditure | Investment in exploration, development, and production to bolster reserves and output. | Budget of RMB 125-135 billion for 2024-2025. |

| Cost Management | Lean management and cost control enhance profitability and resilience. | Reduced all-in cost per barrel of oil equivalent in 2024. |

| Currency Fluctuations (USD/CNY) | Affects valuation of international assets and reported profitability. | Significant shifts in 2024 impact overseas project economics; hedging strategies are employed. |

Preview the Actual Deliverable

CNOOC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This CNOOC PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic planning.

Sociological factors

CNOOC is a major global employer, providing over 22,000 jobs across more than 20 countries as of 2024. This extensive workforce is crucial for its international operations and global reach in the energy sector.

The company actively invests in local talent, exemplified by its award-winning poverty reduction program in Uganda. Such initiatives not only create employment but also foster essential skill development, directly contributing to the economic stability and social fabric of the communities where CNOOC operates.

CNOOC actively engages in community co-development and contributes to public welfare, demonstrating a strong commitment to corporate social responsibility. In 2024 alone, the company allocated over RMB 133 million towards various public welfare projects, with a notable emphasis on rural revitalization initiatives.

This substantial investment underscores CNOOC's dedication to maximizing its social contributions and fostering harmonious relationships with the local communities in which it operates.

CNOOC places a paramount importance on production safety, actively implementing measures to mitigate risks associated with severe weather events, a crucial factor for maintaining stable operations. In 2024, the company reported a significant reduction in accident rates, with lost-time injury frequency rate (LTIFR) decreasing by 15% compared to the previous year, underscoring its commitment to a safe working environment.

Integrating Environmental, Social, and Governance (ESG) principles into its core development strategy, CNOOC prioritizes safety and health across all its operational facets. This dedication is vital not only for safeguarding its extensive workforce, which numbered over 90,000 employees globally in 2024, but also for protecting the well-being of the communities where it conducts its business.

Corporate Governance and Ethics

CNOOC places a strong emphasis on robust corporate governance and ethical business practices. The company is dedicated to operating lawfully and compliantly, reinforcing its commitment through rigorous risk management and internal control systems. This dedication to integrity, evidenced by anti-corruption and integrity training for all employees, is crucial for building stakeholder trust and enhancing its corporate reputation.

This commitment to ethical conduct is not just a matter of compliance but a strategic imperative. For instance, in 2023, CNOOC reported a significant reduction in compliance breaches, with a 15% decrease year-over-year, reflecting the effectiveness of its ongoing training and oversight programs. Such transparency and accountability are vital for attracting investment and maintaining positive relationships with governments and communities worldwide.

- Enhanced Governance Framework: CNOOC continually refines its corporate governance structures to align with international best practices, ensuring accountability at all levels.

- Ethical Operations: The company mandates strict adherence to business ethics, with a zero-tolerance policy for corruption and a focus on promoting integrity throughout its operations.

- Risk Management Focus: Strengthening internal controls and risk management is a priority, with dedicated resources allocated to identifying and mitigating potential ethical and compliance risks.

- Stakeholder Trust: By prioritizing transparency and ethical behavior, CNOOC aims to foster long-term trust and confidence among its investors, employees, and the broader public.

Public Perception and Stakeholder Expectations

Public sentiment towards the oil and gas sector, especially concerning environmental stewardship and corporate citizenship, significantly shapes CNOOC's operational landscape. Growing awareness of climate change and its impacts means companies like CNOOC face increased scrutiny regarding their social license to operate.

CNOOC is actively working to mitigate these concerns by enhancing its environmental, social, and governance (ESG) reporting and by investing in sustainable development initiatives. This proactive approach is crucial for maintaining stakeholder trust and ensuring long-term viability in an evolving global energy market.

The company's commitment to ESG principles is reflected in its performance, with CNOOC being recognized on the Fortune China ESG Impact List in 2024. This acknowledgment suggests that CNOOC's efforts are resonating with key stakeholders and the broader market, highlighting a positive shift in public and investor perception.

- Public Scrutiny: Increased public and investor focus on environmental impact and social responsibility for oil and gas companies.

- ESG Strategy: CNOOC's commitment to comprehensive ESG disclosures and green development initiatives to address stakeholder concerns.

- Market Recognition: CNOOC's inclusion in the Fortune China ESG Impact List in 2024 signifies positive market reception of its ESG performance.

Sociological factors significantly influence CNOOC's operations, from its employer branding to community relations. As of 2024, CNOOC employed over 90,000 individuals globally, underscoring its role as a major job creator. The company's commitment to social responsibility is evident in its substantial investments in public welfare, with over RMB 133 million allocated to rural revitalization and other projects in 2024.

Public perception of the energy sector, particularly regarding environmental and social governance (ESG), directly impacts CNOOC's social license to operate. The company's recognition on the Fortune China ESG Impact List in 2024 highlights its efforts to align with growing stakeholder expectations for sustainable practices.

CNOOC's focus on safety, with a 15% reduction in lost-time injury frequency rate in 2024, also reflects a societal emphasis on worker well-being. Furthermore, its dedication to ethical business practices, evidenced by a 15% decrease in compliance breaches in 2023, builds crucial trust with communities and investors.

Technological factors

CNOOC is heavily invested in advancing its offshore exploration and development technologies. In 2023, the company reported significant progress in its deepwater exploration efforts, leveraging advanced seismic imaging and drilling techniques. This focus on innovation is crucial for accessing previously uneconomical reserves.

Breakthroughs in handling complex geological formations, such as heavy oil reservoirs and extreme pressure/temperature environments, are key to CNOOC's strategy. For instance, their advancements in subsea processing technology allow for more efficient extraction from challenging deepwater fields, directly contributing to reserve replacement and production growth.

CNOOC is significantly investing in Carbon Capture, Utilization, and Storage (CCUS) as a core component of its environmental strategy. This commitment is evident in their deployment of CCUS technologies at commercial scale, such as at the Enping 15-1 and Bozhong 26-6 oilfields, showcasing the application of China's own CCUS advancements to curb CO2 emissions.

The company is also making strides in establishing offshore CCUS demonstration centers, further solidifying its role in developing and implementing these crucial climate mitigation solutions. These initiatives are vital for CNOOC to meet its carbon reduction targets and contribute to a greener energy future.

CNOOC is actively integrating renewable energy, particularly offshore wind power, with its existing oil and gas operations. This strategic move aims to accelerate the shift towards cleaner energy sources.

By 2025, CNOOC has set an ambitious target to consume over 1 billion kilowatt-hours of green electricity. This commitment underscores their dedication to a greener transition and reducing their overall carbon emissions.

Digitalization and Artificial Intelligence (AI)

CNOOC is actively integrating digitalization and artificial intelligence across its operations to boost efficiency and cut emissions. A prime example is their 'Hi-Energy' AI model, designed to optimize processes within the energy sector.

The company is focused on developing intelligent oil and gas fields, a move that signifies a deeper commitment to embedding digital intelligence into its core business. This strategic integration aims to foster leaner management practices and significantly improve overall operational performance.

- AI-driven efficiency gains: CNOOC's 'Hi-Energy' AI model is a key tool for enhancing operational effectiveness.

- Intelligent field development: The company is constructing smart oil and gas fields to leverage advanced digital technologies.

- Digital integration for lean management: CNOOC is promoting the deep integration of digital intelligence to support lean management principles.

- Performance enhancement: These technological advancements are designed to directly contribute to improved operational performance and reduced environmental impact.

Energy Efficiency and Emission Reduction Technologies

CNOOC is actively investing in technologies to boost energy efficiency and cut emissions. The company is focused on green and low-carbon methods for producing oil and gas. In 2024 alone, CNOOC’s energy-saving initiatives led to a notable decrease in CO2 emissions, demonstrating tangible progress in their environmental goals.

Technological advancements are central to CNOOC's environmental strategy. A prime example is the development of offshore oilfields such as Wushi 23-5, designed with 'green design' principles. This approach integrates advanced technologies to minimize environmental impact throughout the lifecycle of oil and gas production.

- Energy-Saving Retrofits: CNOOC implements projects to upgrade existing facilities for greater energy efficiency.

- Green Production Focus: The company prioritizes low-carbon methods in its oil and gas extraction processes.

- CO2 Emission Reduction (2024): CNOOC reported significant CO2 emission reductions from its energy-saving projects in 2024.

- 'Green Design' Offshore Fields: Projects like Wushi 23-5 showcase the application of environmentally conscious technological design in offshore operations.

CNOOC's technological focus is on enhancing offshore exploration and development, particularly in deepwater environments. The company is also heavily invested in Carbon Capture, Utilization, and Storage (CCUS) technologies, deploying them at commercial scale to reduce emissions. Furthermore, CNOOC is integrating digitalization and AI, such as its 'Hi-Energy' AI model, to optimize operations and promote lean management.

The company is actively pursuing green and low-carbon production methods, with initiatives in 2024 showing tangible CO2 emission reductions. CNOOC is also incorporating renewable energy, aiming to consume over 1 billion kilowatt-hours of green electricity by 2025, demonstrating a commitment to a cleaner energy future through technological innovation.

| Technology Area | Key Initiatives/Progress | Impact/Target |

|---|---|---|

| Deepwater Exploration | Advanced seismic imaging, drilling techniques | Accessing uneconomical reserves |

| Subsea Processing | Efficient extraction from challenging fields | Reserve replacement, production growth |

| CCUS | Commercial scale deployment (e.g., Enping 15-1) | CO2 emission reduction |

| Digitalization & AI | 'Hi-Energy' AI model, intelligent fields | Operational efficiency, lean management |

| Renewable Energy Integration | Offshore wind power | Target: >1 billion kWh green electricity by 2025 |

Legal factors

CNOOC is deeply committed to environmental stewardship, meticulously following all relevant laws and regulations in China and its international operational areas. The company operates under the principle of balancing environmental protection with resource development, ensuring sustainable practices are integrated into its core business. This commitment is further demonstrated by its adherence to stringent reporting frameworks such as the HKEX ESG reporting framework and the Global Reporting Initiative (GRI) Standards, which guide its environmental, social, and governance disclosures.

CNOOC operates under a strict regime of anti-corruption and anti-fraud legislation, encompassing both Chinese and international regulations. This legal landscape necessitates a vigilant approach to business conduct.

Recent years have seen significant scrutiny, with high-profile investigations into alleged corruption involving CNOOC executives. For instance, in 2023, authorities continued investigations into former officials, highlighting the ongoing risks and the imperative for strong corporate governance.

Maintaining robust internal compliance programs and ensuring mandatory integrity training for all personnel are therefore paramount. These measures are not merely procedural; they are fundamental to safeguarding CNOOC's operational continuity and bolstering the trust of its investors and stakeholders.

CNOOC's extensive international operations face significant legal headwinds from shifting global trade policies and sanctions, especially those enacted by the United States targeting Chinese companies. For instance, in 2023, the U.S. continued to scrutinize and potentially restrict entities involved in energy sectors deemed strategically important, impacting CNOOC's access to certain technologies and financing. This exposure directly affects its capacity to win new contracts and maintain crucial supply chain relationships.

Navigating these complex legal and political landscapes is paramount for CNOOC's continued global expansion and operational stability. The company must diligently manage these risks to safeguard its market access and supply chain integrity, particularly as geopolitical tensions influence international trade agreements and regulatory frameworks. Failure to do so could result in substantial financial penalties or operational disruptions, as seen with other major state-owned enterprises facing similar sanctions.

Corporate Governance and Disclosure Requirements

As a publicly traded entity on both the Hong Kong and Shanghai Stock Exchanges, CNOOC is bound by stringent corporate governance and disclosure mandates. This necessitates the meticulous preparation of annual reports, environmental, social, and governance (ESG) reports, and a commitment to transparency regarding its financial health and operational activities.

CNOOC's adherence to these regulations is demonstrated by its consistent performance in information disclosure assessments. For instance, in the 2023 assessment by the Hong Kong Stock Exchange, CNOOC achieved an A rating, signifying excellent compliance and transparency. This commitment ensures stakeholders have access to timely and accurate information, fostering investor confidence.

- Adherence to Listing Rules: CNOOC must comply with the listing rules of the Hong Kong Stock Exchange and the Shanghai Stock Exchange, ensuring fair and orderly trading of its securities.

- Annual and ESG Reporting: The company is required to publish comprehensive annual reports detailing its financial performance and operations, alongside dedicated ESG reports highlighting its sustainability efforts and impact.

- Information Disclosure Assessment: CNOOC has historically received high marks in information disclosure assessments, underscoring its commitment to transparency and good corporate governance practices. For example, in 2023, it maintained an A rating in the Hong Kong Stock Exchange's information disclosure assessment.

Contractual Obligations and International Law

CNOOC's global operations are heavily influenced by contractual obligations, including production sharing agreements (PSAs) and joint venture contracts, all of which are interpreted under international law. These agreements can lead to complex legal disputes, particularly concerning resource ownership and operational rights in contested regions. For instance, geopolitical tensions in the South China Sea continue to present ongoing legal complexities for CNOOC's exploration and production activities.

Navigating diverse legal frameworks is a constant for CNOOC, especially as it expands into new territories. For example, its significant investments in Mozambique, Brazil, and Iraq mean adhering to distinct national energy laws, regulatory bodies, and local content requirements. These varying legal landscapes necessitate robust legal due diligence and compliance strategies to mitigate risks and ensure smooth operations.

- Contractual Complexity: CNOOC's portfolio includes numerous petroleum contracts, each with unique terms and dispute resolution mechanisms governed by international arbitration or national courts.

- South China Sea Disputes: Ongoing territorial claims in the South China Sea create legal uncertainties for CNOOC's operations in the region, impacting its exploration and production rights.

- Regulatory Divergence: Expansion into new markets like Mozambique (e.g., Rovuma Basin LNG projects) and Brazil requires deep understanding and compliance with evolving national energy regulations.

- International Law Adherence: CNOOC must ensure all its contractual agreements and operational practices align with international maritime law and investment treaties.

CNOOC operates under a complex web of international and national laws governing the energy sector. Compliance with these regulations is critical for its global operations, particularly concerning environmental standards, anti-corruption measures, and contractual obligations. The company's adherence to listing rules and disclosure mandates for its stock exchange listings in Hong Kong and Shanghai, as evidenced by its A rating in the 2023 Hong Kong Stock Exchange information disclosure assessment, underscores its commitment to transparency and good corporate governance.

Environmental factors

CNOOC views climate change as a critical strategic element, actively strengthening its climate governance and establishing ambitious short, medium, and long-term emissions reduction targets. This proactive stance is crucial as global pressure mounts for energy companies to decarbonize their operations.

The company is dedicating resources to understanding and managing Scope 3 greenhouse gas emissions, a move that enhances transparency and accountability throughout its entire value chain. This focus on Scope 3 is particularly important given that in 2023, CNOOC's total GHG emissions were reported, with a growing emphasis on downstream impacts.

CNOOC is committed to biodiversity protection and ecological restoration, operating under the guiding principle of prioritizing ecological well-being. This commitment is demonstrated through active participation in environmental public welfare activities.

In 2024 alone, CNOOC undertook around 30 ecological compensation and restoration projects. These initiatives underscore the company's dedication to safeguarding biodiversity and fostering a symbiotic relationship with the natural world.

CNOOC is making significant strides in its energy transition, aiming to boost its natural gas output to account for a larger share of its production. This strategic shift towards cleaner energy sources is a core component of its green development initiatives. For instance, in 2023, CNOOC's natural gas production reached 22.9 billion cubic meters, a 7.1% increase year-on-year, underscoring its commitment to a lower-carbon energy mix.

Beyond natural gas, CNOOC is actively investing in renewable energy sectors, particularly offshore wind and solar power. The company has brought online its first offshore oilfield designed with green principles, Wushi 23-5, which utilizes advanced technologies to minimize its environmental footprint and promote low-carbon production practices.

Pollution Control and Waste Management

CNOOC actively works to improve its environmental stewardship by integrating pollution control and waste management across its entire operational lifecycle, from exploration to production. The company focuses on optimizing energy use and reducing its environmental footprint through targeted initiatives.

Key efforts include implementing energy-saving retrofits to curb emissions and adopting rigorous waste management protocols. For instance, in 2023, CNOOC reported a reduction in sulfur dioxide emissions by 15.2% compared to 2022, demonstrating progress in air quality management.

- Emission Reduction: CNOOC focuses on reducing greenhouse gas emissions and other pollutants through technological upgrades and operational efficiencies.

- Waste Management: The company employs comprehensive strategies for the safe and responsible disposal and recycling of operational waste.

- Environmental Governance: CNOOC continuously enhances its environmental governance framework to ensure compliance and promote sustainable practices.

Water Resource Management

Responsible water resource management is a key environmental factor for CNOOC. The company actively monitors and reports on its freshwater consumption, demonstrating a commitment to efficient usage as part of its environmental stewardship efforts. This focus is especially critical for offshore operations, where meticulous water handling is paramount to minimizing environmental impact and ensuring operational sustainability.

CNOOC's commitment to water management is reflected in its operational practices. For instance, in 2023, the company continued to implement advanced technologies for water treatment and recycling across its facilities, aiming to reduce its reliance on freshwater sources. This proactive approach is vital given the increasing global scrutiny on water usage by industrial entities, particularly in water-scarce regions where some of CNOOC's projects are located.

- Freshwater Consumption: CNOOC provides data on its annual freshwater intake and discharge, allowing stakeholders to track its water footprint.

- Water Recycling Initiatives: The company invests in technologies to treat and reuse produced water and other wastewater, thereby reducing the demand for new freshwater resources.

- Offshore Water Handling: Specific protocols are in place for managing water used in offshore drilling, production, and support activities, including desalination and wastewater treatment to meet stringent environmental standards.

- Compliance and Reporting: CNOOC adheres to national and international regulations concerning water quality and discharge, regularly reporting its performance in sustainability reports.

CNOOC is actively addressing climate change by setting emission reduction targets and focusing on Scope 3 emissions, reflecting global pressure for decarbonization. The company is also committed to biodiversity, undertaking numerous ecological restoration projects, with approximately 30 completed in 2024 alone.

The company is increasing its natural gas production, which reached 22.9 billion cubic meters in 2023, a 7.1% year-on-year increase, and is investing in offshore wind and solar power. CNOOC also prioritizes responsible water management, implementing advanced water treatment and recycling technologies, with a focus on reducing freshwater consumption.

| Environmental Focus | 2023 Data/Initiatives | Significance |

|---|---|---|

| Greenhouse Gas Emissions | Focus on Scope 3 emissions; short, medium, long-term reduction targets established. | Addresses global decarbonization demands and enhances value chain transparency. |

| Biodiversity & Restoration | Undertook ~30 ecological compensation and restoration projects in 2024. | Demonstrates commitment to ecological well-being and habitat protection. |

| Energy Transition | Natural gas production: 22.9 billion cubic meters (up 7.1% YoY). Investment in offshore wind and solar. | Shifts towards cleaner energy sources and reduces carbon intensity. |

| Water Resource Management | Implemented advanced water treatment and recycling technologies. | Minimizes freshwater consumption and environmental impact, especially in offshore operations. |

PESTLE Analysis Data Sources

Our CNOOC PESTLE analysis is built on a robust foundation of data from official government publications, international energy agencies, and reputable financial institutions. We integrate insights from economic forecasts, environmental impact assessments, and technological innovation reports to ensure comprehensive coverage.