CNOOC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

CNOOC navigates a complex energy landscape, facing significant pressures from powerful buyers and a constant threat of substitutes. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis delves into the intricate web of competition, revealing the true forces shaping CNOOC's strategic advantage.

Ready to move beyond the basics? Get a full strategic breakdown of CNOOC’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The offshore exploration and production sector, crucial for CNOOC, depends heavily on specialized equipment and services. A concentrated market with few highly capable suppliers for advanced drilling gear, seismic tech, and offshore platforms gives these suppliers considerable leverage. This is a key factor in the bargaining power of suppliers for CNOOC.

The global oilfield equipment market, valued at approximately $192 billion in 2023, is characterized by a few dominant players. Companies like Schlumberger, Halliburton, and Baker Hughes often control significant portions of the market for critical technologies, potentially driving up costs for CNOOC through higher prices or less favorable contract terms.

High switching costs significantly bolster the bargaining power of suppliers to CNOOC. The offshore oil and gas industry demands highly specialized equipment and services, often involving intricate integration with existing platforms and proprietary technologies. For instance, the development of a deepwater field involves substantial upfront investment in unique subsea systems and specialized drilling rigs, making it prohibitively expensive and time-consuming to switch providers mid-project.

CNOOC could incur massive financial outlays and face considerable operational delays if it were to change key suppliers for essential components like subsea production systems or specialized drilling fluids. These high switching costs, often running into tens or hundreds of millions of dollars, effectively lock CNOOC into existing supplier relationships, granting those suppliers considerable leverage in price negotiations and contract terms.

Suppliers of unique and highly specialized technologies, like advanced drilling equipment or sophisticated geological imaging software, wield significant bargaining power. Their offerings are often indispensable for efficient exploration and production, making companies like CNOOC reliant on their expertise.

CNOOC's strategic emphasis on technological advancement, particularly in deepwater exploration and intelligent field development, underscores its dependence on these specialized suppliers. For instance, CNOOC invested approximately $10.5 billion in research and development in 2023, much of which is directed towards acquiring and integrating cutting-edge technologies critical for its operations.

Forward Integration Threat

The threat of forward integration by suppliers, while not a dominant force for CNOOC, presents a nuanced consideration. Large, integrated oilfield service providers possess the capacity to move into upstream exploration and production (E&P) activities, potentially diminishing their dependence on clients like CNOOC and altering the supplier dynamic. This theoretical shift could impact CNOOC's bargaining leverage in securing specialized services.

For instance, in 2024, major oilfield service firms continued to consolidate and expand their technological capabilities, offering end-to-end solutions. This trend could, in principle, allow them to absorb some E&P functions, thereby increasing their own bargaining power. While CNOOC's scale as a significant producer mitigates this risk, it remains a factor in strategic supplier relationship management.

- Forward Integration Threat: While less common, large, integrated oilfield service companies could potentially move into certain aspects of E&P themselves, reducing their reliance on E&P companies like CNOOC.

- Impact on Negotiations: This theoretical threat, though not a primary concern for CNOOC as a major producer, could influence supplier negotiations by potentially shifting the power balance.

- Industry Trends (2024): Major oilfield service firms in 2024 focused on technological advancements and integrated service offerings, which could enable them to perform more E&P functions.

Importance of Supplier's Input to CNOOC's Cost Structure

The cost of specialized equipment, essential services, and crucial raw materials from suppliers represents a substantial segment of CNOOC's operational and capital spending. For instance, in 2023, CNOOC's capital expenditures reached approximately RMB 100.2 billion, with a significant portion directed towards development and exploration activities, underscoring the reliance on external suppliers for these critical components.

Given CNOOC's extensive capital expenditure plans, particularly in areas like deep-water exploration and advanced drilling technologies, the pricing leverage held by these specialized suppliers directly influences the company's overall profitability and project viability.

- Specialized Equipment: High-demand, technologically advanced offshore drilling rigs and subsea equipment often come with limited suppliers, granting them significant pricing power.

- Essential Services: Geophysical survey providers and specialized engineering firms critical for complex projects can command higher prices due to their unique expertise and capacity.

- Raw Materials: While oil and gas itself is a commodity, the specialized chemicals and materials used in extraction and processing can be subject to supplier concentration.

The bargaining power of suppliers for CNOOC is significant due to the specialized nature of the offshore oil and gas industry. A limited number of highly capable providers for advanced drilling equipment, seismic technology, and offshore platforms give these suppliers considerable leverage, impacting CNOOC's costs and contract terms.

High switching costs further strengthen supplier power, as the intricate integration of specialized equipment and proprietary technologies makes it prohibitively expensive and time-consuming to change providers mid-project. This reliance on specific suppliers for essential components, like subsea production systems, locks CNOOC into existing relationships, granting suppliers considerable negotiation power.

Suppliers of unique technologies, such as advanced drilling gear or sophisticated geological imaging software, are indispensable for CNOOC's efficient exploration and production, particularly in deepwater projects. CNOOC's substantial R&D investments in 2023, around $10.5 billion, highlight its dependence on acquiring and integrating these critical, supplier-provided technologies.

| Factor | Impact on CNOOC | Supporting Data/Trend |

| Supplier Concentration | High leverage for specialized equipment providers. | Global oilfield equipment market dominated by a few key players (e.g., Schlumberger, Halliburton). |

| Switching Costs | Significant barrier to changing suppliers; strengthens supplier negotiation. | Deepwater field development involves millions in specialized subsea systems and drilling rigs. |

| Technological Dependence | CNOOC relies on suppliers for cutting-edge tech, especially for deepwater. | CNOOC's 2023 R&D spend of ~$10.5 billion targets advanced exploration technologies. |

What is included in the product

Tailored exclusively for CNOOC, analyzing its position within its competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Visualize CNOOC's competitive landscape with an intuitive spider chart, instantly highlighting key pressure points and strategic vulnerabilities.

Customers Bargaining Power

CNOOC's primary customers are often large, state-owned enterprises within China, including power generators and industrial users. These entities wield significant purchasing power due to their sheer scale and their critical role in the national economy.

While China's natural gas consumption is expected to keep rising, these major domestic buyers are in a strong position to negotiate favorable terms. Their substantial purchase volumes and the government's influence in the energy sector further bolster their bargaining clout.

The commoditized nature of crude oil and natural gas significantly amplifies the bargaining power of CNOOC's customers. Because these resources are largely undifferentiated, buyers can easily switch between suppliers based on price alone, limiting CNOOC's pricing flexibility.

This lack of differentiation means that in 2024, customers can leverage competitive offerings from numerous global producers, putting pressure on CNOOC to match or beat market prices. For instance, the Brent crude oil benchmark averaged around $82.50 per barrel in early 2024, reflecting a highly competitive global market where price is a primary driver for customer choice.

Customer price sensitivity is a major factor for CNOOC. Given that energy costs are a significant portion of expenses for many industries and impact the broader economy, customers are keenly aware of price changes. This sensitivity is amplified during times of economic slowdown or when other energy options become more attractive.

Potential for Backward Integration by Customers

The potential for backward integration by customers, while theoretically possible, presents a minor threat to CNOOC. Large industrial consumers or state-owned entities could explore investing in their own energy production capabilities or establishing long-term supply contracts that circumvent direct market purchases from producers like CNOOC. This would reduce their reliance on individual suppliers.

However, the sheer scale and capital intensity of offshore oil and gas exploration and production make this a significant barrier for most customers. For instance, the capital expenditure for a single offshore platform can run into billions of dollars. CNOOC's extensive global infrastructure and established supply chains are also difficult and costly for most customers to replicate.

- Limited Practicality: The immense capital investment required for backward integration into offshore oil and gas production is a substantial deterrent for most customers.

- Scale of Operations: Replicating CNOOC's vast operational scale and complex logistical networks is economically unfeasible for the majority of its customer base.

- Cost-Benefit Analysis: For most consumers, securing energy through CNOOC's existing infrastructure remains more cost-effective than undertaking the massive undertaking of developing their own production facilities.

Availability of Alternative Energy Sources for Customers

Customers, especially in power generation and heavy industry, are increasingly turning to alternative energy sources. This shift is fueled by global energy transition initiatives and a desire for cost savings and environmental compliance.

The growing availability of substitutes, such as solar and wind power, directly enhances customer bargaining power. For instance, in 2024, renewable energy capacity additions continued their robust growth, with global solar PV capacity alone expected to surpass 1,000 GW by the end of the year, offering a tangible alternative to traditional energy providers.

- Growing Renewable Adoption: Global renewable energy capacity is expanding rapidly, providing viable alternatives.

- Policy Support for Alternatives: Government incentives and mandates encourage the adoption of cleaner energy sources.

- Increased Customer Options: A wider array of energy sources gives customers more leverage in negotiations.

- Impact on Energy Pricing: The availability of cheaper alternatives can pressure traditional energy suppliers to offer more competitive pricing.

CNOOC's customers, particularly large state-owned enterprises in China, wield substantial bargaining power due to their immense purchasing volume and critical role in the national economy.

The commoditized nature of oil and gas means buyers can easily switch suppliers based on price, limiting CNOOC's pricing flexibility, especially as global benchmarks like Brent crude averaged around $82.50 per barrel in early 2024, reflecting intense market competition.

While backward integration is a theoretical threat, the prohibitive capital costs and operational complexity of offshore production make it impractical for most customers, reinforcing CNOOC's advantageous position.

The increasing availability of alternative energy sources, with global solar PV capacity expected to exceed 1,000 GW by the end of 2024, further empowers customers by providing viable substitutes and pressuring CNOOC for competitive pricing.

| Customer Type | Bargaining Power Factors | Impact on CNOOC | 2024 Context |

|---|---|---|---|

| Large State-Owned Enterprises (Power, Industry) | High Volume Purchases, Critical Role | Strong Negotiation Leverage | Dominant buyers in China's energy market |

| Industrial Users | Price Sensitivity, Energy Cost Component | Limits CNOOC's Pricing Flexibility | Energy costs are a significant operational expense |

| All Customers | Commoditized Product, Availability of Substitutes | Pressure to Offer Competitive Pricing | Global oil prices and renewable energy growth provide alternatives |

Preview Before You Purchase

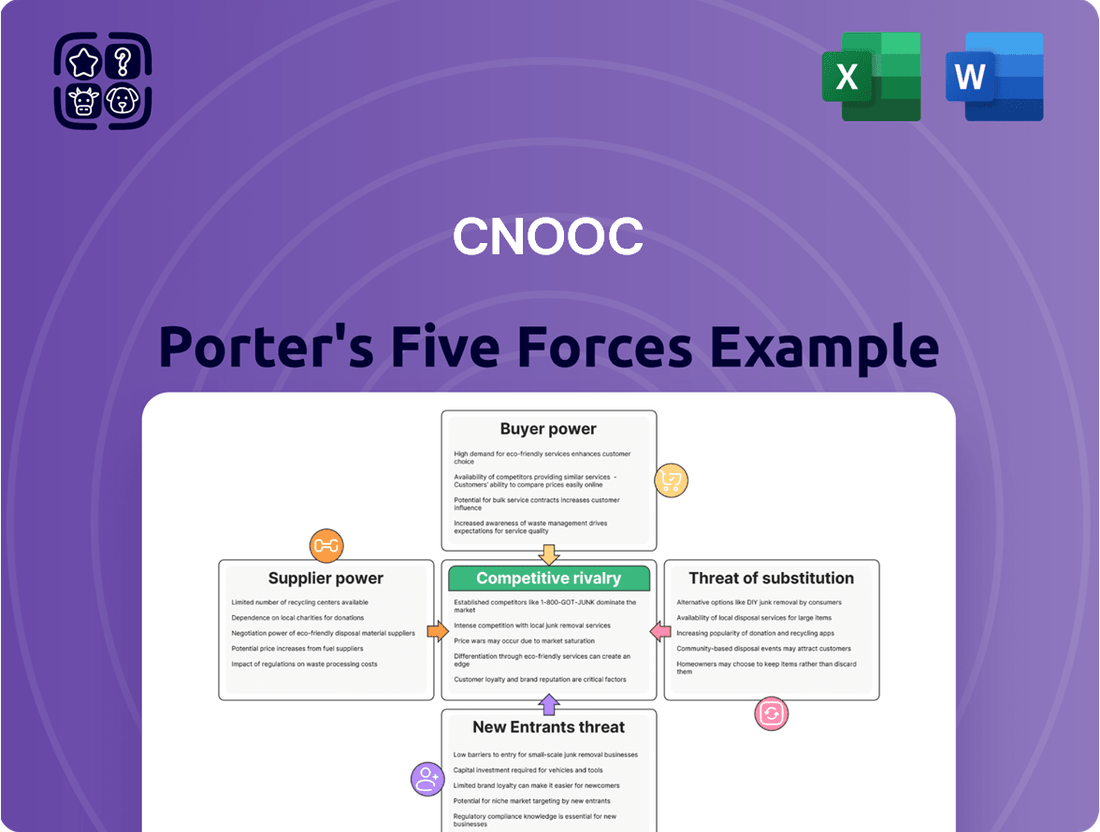

CNOOC Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis of CNOOC you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This professionally formatted document is ready for your immediate use, offering a thorough examination of CNOOC's industry position.

Rivalry Among Competitors

CNOOC operates in a fiercely competitive landscape, contending with both domestic giants and international powerhouses. State-owned rivals like PetroChina and Sinopec are major players within China, while global oil majors such as ExxonMobil, Shell, and BP also vie for market share. This intense rivalry is especially evident in the crucial exploration and production segments of the oil and gas industry.

In 2024, the global oil and gas sector continued to see significant competition, with companies like Shell reporting a net profit of $16.59 billion for the first half of 2024, demonstrating their robust operational capabilities. Similarly, ExxonMobil posted earnings of $19.89 billion for the same period, underscoring the scale of investment and competition CNOOC faces from these international entities.

Oil and natural gas are essentially interchangeable commodities, meaning that CNOOC's competitive battles are often won or lost on price. This commodity nature forces a relentless focus on operational efficiency and keeping production costs as low as possible to remain competitive.

In 2024, CNOOC's commitment to cost control was evident. The company reported an average production cost of approximately $25 per barrel of oil equivalent, a figure that consistently ranks among the lowest in the industry. This efficiency is paramount when competing against global giants and smaller players alike, where even minor cost advantages can significantly impact market share and profitability.

The oil and gas sector, including giants like CNOOC, operates with substantial fixed costs for exploration, drilling, and refining. These immense upfront investments necessitate high production levels to achieve economies of scale and recover capital, fueling intense competition as companies vie for market share to optimize their cost structures. For instance, in 2024, global upstream capital expenditures were projected to exceed $600 billion, underscoring the capital-intensive nature of the industry.

Furthermore, consolidation trends, particularly within the oilfield services segment, can amplify competitive pressures. As fewer, larger service providers emerge, they may gain greater pricing power, potentially increasing costs for exploration and production companies. This dynamic can force remaining operators to compete more fiercely on operational efficiency and resource acquisition to maintain profitability amidst rising service expenses.

Global Production Targets and Investment

Global oil and gas giants are aggressively pursuing production growth and channeling significant capital into new ventures, intensifying competitive pressures. CNOOC, for instance, has outlined ambitious production goals, aiming for record output levels in 2025 and subsequent years, signaling a commitment to expanding its operational footprint.

This drive for increased output fuels a dynamic competitive landscape where companies vie for market share and resource access.

- CNOOC's 2025 production target: CNOOC aims for 650-670 million barrels of oil equivalent (boe) in 2025, a notable increase from its 2023 output of 633.4 million boe.

- Global investment trends: Major oil producers are expected to increase capital expenditure in 2024, with significant investments directed towards exploration and production to meet rising global energy demand.

- Rivalry drivers: Ambitious production targets and substantial investment in new projects by competitors create a challenging environment for all players, including CNOOC, to maintain and grow their market positions.

Geopolitical Factors and Government Influence

Geopolitical tensions and the influence of national governments significantly shape the competitive landscape for companies like CNOOC. As a state-owned enterprise, CNOOC benefits from government backing, which can translate into preferential access to resources and favorable regulatory treatment.

However, this government affiliation also means CNOOC's strategic decisions and market positioning are intrinsically linked to national energy policies and evolving international relations. For instance, China's Belt and Road Initiative, a key government policy, can open new avenues for CNOOC's overseas investments and operations, yet also expose it to the political risks associated with participating nations.

- Government Support: CNOOC receives substantial support from the Chinese government, including access to capital and favorable policies, which strengthens its competitive position domestically and internationally.

- Policy Dependence: CNOOC's operations are heavily influenced by China's national energy security strategies and its stance on international energy markets, impacting its investment choices and production levels.

- International Relations: Geopolitical shifts and trade disputes can directly affect CNOOC's access to foreign markets, technology, and capital, as seen in the scrutiny some Chinese state-owned enterprises face in Western markets.

- Resource Allocation: Government directives can influence how CNOOC allocates its resources, prioritizing national strategic goals over purely commercial returns in certain instances.

CNOOC faces intense competition from both domestic state-owned enterprises like PetroChina and Sinopec, as well as global oil majors such as Shell and ExxonMobil. The commodity nature of oil and gas means competition often centers on price, necessitating a strong focus on operational efficiency. In the first half of 2024, Shell reported $16.59 billion in net profit and ExxonMobil $19.89 billion, highlighting the financial scale of CNOOC's rivals.

The industry's high fixed costs for exploration and production drive a need for economies of scale, intensifying the battle for market share. CNOOC's reported production cost of approximately $25 per barrel of oil equivalent in 2024 demonstrates its focus on efficiency in this challenging environment. Global upstream capital expenditures were projected to exceed $600 billion in 2024, underscoring the capital-intensive nature of this rivalry.

| Competitor | 2024 H1 Net Profit (approx.) | Key Operational Focus |

|---|---|---|

| Shell | $16.59 billion | Exploration & Production, Refining |

| ExxonMobil | $19.89 billion | Upstream Investment, Cost Efficiency |

| PetroChina/Sinopec | (Not explicitly stated for H1 2024 in this context) | Domestic Market Dominance, Integrated Operations |

SSubstitutes Threaten

The most significant threat of substitution for companies like CNOOC stems from the accelerating adoption of renewable energy. Solar, wind, and hydropower are rapidly becoming more competitive and accessible.

China's commitment to clean energy is a key driver here. By April 2025, the nation's installed renewable power capacity exceeded 2,000 gigawatts. This substantial growth directly challenges the long-term demand for traditional fossil fuels, impacting CNOOC's market position.

The threat of substitutes for CNOOC is significantly amplified by global and national energy transition policies. These policies, driven by climate change concerns and decarbonization goals, actively promote the shift away from fossil fuels towards cleaner alternatives. For instance, China's Energy Law, updated to reflect these priorities, aims to enhance energy security while steering the economy towards lower carbon emissions, with a strong emphasis on renewable energy development.

This policy push directly impacts CNOOC by making renewable energy sources like solar and wind more competitive and attractive to consumers and governments alike. In 2023, China's non-fossil fuel energy consumption reached approximately 17.5% of total energy consumption, a figure expected to continue rising, directly substituting demand for oil and gas. This creates a substantial threat as these alternatives gain market share and technological advancements further reduce their costs.

Advancements in energy storage and efficiency represent a significant threat of substitutes for CNOOC. Improved battery technologies, for instance, are making renewable energy sources like solar and wind more competitive and reliable, directly reducing the demand for fossil fuels. In 2024, global investment in clean energy technologies continued to surge, with estimates suggesting over $2 trillion in annual spending by 2030, underscoring this shift.

Enhanced energy efficiency measures also diminish the need for CNOOC's oil and gas products. As industries and consumers adopt more efficient technologies and practices, the overall energy consumption per unit of output decreases. This trend is supported by data showing continued improvements in energy intensity across major economies, meaning less energy is required to produce each dollar of GDP.

Emergence of Alternative Fuels in Transportation and Industry

While oil is still king in transportation, the landscape is shifting. Electric vehicles (EVs) are gaining serious traction, and the development of alternative fuels like hydrogen and biofuels is accelerating. This presents a growing, long-term substitution threat to traditional fossil fuels, impacting demand for products like those CNOOC produces.

For instance, global EV sales in 2023 surpassed 13.6 million units, a significant jump from previous years. This trend is expected to continue, driven by government incentives and improving battery technology. Similarly, investments in hydrogen infrastructure and biofuel production are on the rise, aiming to decarbonize sectors that are harder to electrify.

In industrial settings, the pressure to move away from natural gas is also mounting. Many industries are exploring electrification or adopting cleaner alternatives to reduce their carbon footprint and comply with stricter environmental regulations. This diversification of energy sources means less reliance on conventional fuels.

- Electric Vehicle Adoption: Global EV sales reached approximately 13.6 million in 2023, indicating a strong shift away from internal combustion engines.

- Alternative Fuel Development: Significant investment is flowing into hydrogen and biofuel technologies, positioning them as viable substitutes in transportation and industry.

- Industrial Electrification Trends: Industries are increasingly adopting electrification and cleaner energy alternatives to natural gas, driven by environmental and regulatory pressures.

- Long-Term Substitution Risk: The combined growth of EVs and alternative fuels poses a substantial long-term threat to the market share of fossil fuels.

Price Competitiveness of Substitutes

The increasing price competitiveness of renewable energy sources poses a significant threat to CNOOC. As solar and wind technologies mature, their levelized cost of energy (LCOE) continues to fall. For instance, in 2024, the global average LCOE for new utility-scale solar PV projects was around $39 per megawatt-hour, a substantial decrease from previous years, making it competitive with, and in many cases cheaper than, new fossil fuel power generation.

This trend directly impacts CNOOC's customer base, particularly in the power generation sector. As renewable energy becomes more economically viable, utilities and industrial consumers are more likely to switch from natural gas and oil, which CNOOC supplies, to cleaner and increasingly cheaper alternatives. This shift can lead to reduced demand for CNOOC's core products.

The declining cost of battery storage also amplifies the threat from renewables. By 2024, grid-scale battery storage costs have fallen by over 70% in the last decade, enabling a more reliable and consistent supply of renewable energy. This further erodes the perceived necessity of traditional fossil fuel baseload power, a market CNOOC serves.

- Falling Renewable Costs: Global LCOE for solar PV averaged approximately $39/MWh in 2024, making it a strong price competitor.

- Battery Storage Advancements: A 70% cost reduction in grid-scale battery storage over the past decade enhances renewable reliability and attractiveness.

- Customer Migration: Utilities and industrial clients are increasingly opting for renewables due to improved cost-effectiveness, impacting CNOOC's demand.

- Market Shift: The growing price parity between fossil fuels and renewables threatens CNOOC's market share in energy generation.

The increasing competitiveness of renewable energy sources, driven by falling costs and technological advancements, presents a significant substitution threat to CNOOC. This is further exacerbated by supportive government policies and growing consumer demand for cleaner alternatives.

The shift towards electrification in transportation, particularly with the surge in electric vehicle (EV) sales, directly impacts the demand for gasoline and diesel, core products for oil and gas companies like CNOOC. By 2023, global EV sales surpassed 13.6 million units, a clear indicator of this trend.

Moreover, advancements in energy efficiency and the development of alternative fuels such as hydrogen and biofuels are also chipping away at the market share traditionally held by fossil fuels. These substitutes are becoming more viable across various sectors, from power generation to heavy industry.

The global energy landscape is undergoing a profound transformation, with renewables and efficiency measures directly challenging the dominance of fossil fuels. For CNOOC, this translates to a growing need to adapt to a market where substitutes are not only available but increasingly cost-effective and policy-supported.

| Substitution Area | Key Drivers | Impact on CNOOC | Relevant Data (2023-2024) |

|---|---|---|---|

| Renewable Energy (Solar, Wind) | Falling LCOE, improved storage | Reduced demand in power generation | Solar PV LCOE ~$39/MWh (2024); Battery storage costs down 70% (decade) |

| Electric Vehicles (EVs) | Government incentives, battery tech | Decreased demand for gasoline/diesel | Global EV sales > 13.6 million units (2023) |

| Alternative Fuels (Hydrogen, Biofuels) | Decarbonization goals, industrial adoption | Substitution in transportation and industry | Rising investment in hydrogen infrastructure and biofuel production |

| Energy Efficiency | Technological advancements, regulatory push | Lower overall energy consumption | Continued improvements in energy intensity across economies |

Entrants Threaten

The offshore oil and natural gas sector, where CNOOC operates, demands staggering capital investments for exploration, drilling, and production infrastructure. This inherently high cost of entry acts as a formidable barrier, deterring many potential new competitors from entering the market. For instance, CNOOC's capital expenditure in 2023 was approximately RMB 100 billion (around $14 billion USD), underscoring the immense financial resources needed to establish a foothold.

The oil and gas industry, particularly in China, faces significant barriers to entry due to stringent government regulations. These include rigorous environmental protection laws, demanding safety standards, and complex licensing procedures that new companies must navigate. For instance, China's environmental regulations have become increasingly strict, with penalties for non-compliance, adding substantial costs for potential entrants.

As a state-owned enterprise, CNOOC benefits from direct government oversight and influence, which translates into preferential treatment regarding resource allocation and operational approvals. This government control acts as a formidable deterrent for new, non-state-backed entities seeking to enter the market, effectively limiting competition and solidifying the position of established players like CNOOC.

The offshore exploration and production (E&P) sector, where CNOOC operates, demands highly specialized technology, advanced drilling capabilities, and a significant pool of technical expertise. These are substantial hurdles for any new entrant looking to break in, as acquiring them is both difficult and expensive. For instance, developing capabilities for ultra-deepwater exploration, a key area for CNOOC, requires billions in investment and years of accumulated knowledge.

Control over Existing Infrastructure and Distribution Channels

Established players like CNOOC possess significant advantages due to their existing, vast infrastructure for oil and gas extraction, processing, and transportation. This includes extensive pipeline networks, offshore platforms, and storage terminals, which are incredibly costly and time-consuming for newcomers to replicate. For instance, CNOOC's integrated upstream and downstream operations, built over decades, represent a substantial barrier to entry.

The sheer scale of investment required to build comparable infrastructure makes it economically challenging for new entrants to compete effectively. New companies would need to secure massive capital for exploration, production facilities, and distribution logistics, facing immediate cost disadvantages compared to incumbents with amortized infrastructure assets.

This control over existing infrastructure and distribution channels significantly deters new entrants by raising the capital expenditure and operational complexity required to enter the market.

- Existing Infrastructure: CNOOC's extensive network of pipelines, offshore platforms, and processing facilities provides a significant cost advantage and operational efficiency.

- High Capital Requirements: New entrants face immense capital expenditure needs to build parallel infrastructure, making market entry prohibitively expensive.

- Distribution Control: Established players often control key distribution channels, limiting access for new companies to reach end markets.

- Economies of Scale: Incumbents benefit from economies of scale in infrastructure utilization, further reducing per-unit costs and increasing the barrier for smaller competitors.

Brand Loyalty and Established Relationships

While oil and gas are often seen as commodities, CNOOC benefits significantly from established relationships with major industrial buyers and state-owned enterprises. These long-standing connections, coupled with a history of dependable supply, foster a degree of loyalty that new market entrants would find challenging to replicate. This is particularly true given CNOOC's status as China's largest offshore oil and gas producer, a position built over decades.

The threat of new entrants for CNOOC, specifically concerning brand loyalty and established relationships, is therefore moderated. New companies entering the Chinese market would face an uphill battle to displace CNOOC's entrenched position. For instance, in 2024, CNOOC's extensive network of supply agreements with key domestic industries, including power generation and petrochemicals, underscores the difficulty new players would have in securing comparable off-take agreements. These relationships are not easily replicated and often involve long-term contracts and integrated supply chains.

- Established Buyer Relationships: CNOOC's deep ties with major Chinese industrial consumers create a significant barrier for new entrants seeking to secure large-scale contracts.

- State Entity Preferences: State-owned enterprises often favor established domestic suppliers like CNOOC, providing a consistent demand base.

- Reliability Track Record: CNOOC's history of consistent and reliable supply delivery builds trust and preference among its customer base.

- Market Dominance Advantage: As China's largest offshore producer, CNOOC leverages its scale and experience to maintain strong customer loyalty.

The threat of new entrants for CNOOC is generally low due to substantial capital requirements and regulatory hurdles in the offshore oil and gas sector. These barriers, coupled with CNOOC's integrated infrastructure and strong government backing, make it exceptionally difficult for new players to establish a competitive presence. For example, in 2024, the ongoing development of deep-sea oil fields continues to demand billions in investment, a cost prohibitive for most potential new companies.

| Barrier Type | Description | Impact on New Entrants | CNOOC's Advantage |

|---|---|---|---|

| Capital Requirements | Extremely high investment needed for exploration, drilling, and infrastructure. | Prohibitive for most potential entrants. | Established financial capacity and access to capital. |

| Government Regulation & Policy | Stringent environmental, safety, and licensing requirements. | Complex and costly to navigate. | Favorable treatment as a state-owned enterprise. |

| Technological Expertise | Need for specialized technology and skilled personnel. | Difficult and expensive to acquire. | Decades of accumulated knowledge and advanced capabilities. |

| Existing Infrastructure | Vast networks of platforms, pipelines, and processing facilities. | Costly and time-consuming to replicate. | Economies of scale and integrated operations. |

Porter's Five Forces Analysis Data Sources

Our CNOOC Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including CNOOC's annual reports, investor presentations, and regulatory filings with the SEC and other relevant bodies. We also incorporate industry-specific data from reputable sources like IHS Markit and Wood Mackenzie, alongside macroeconomic indicators from international organizations.