CNOOC Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

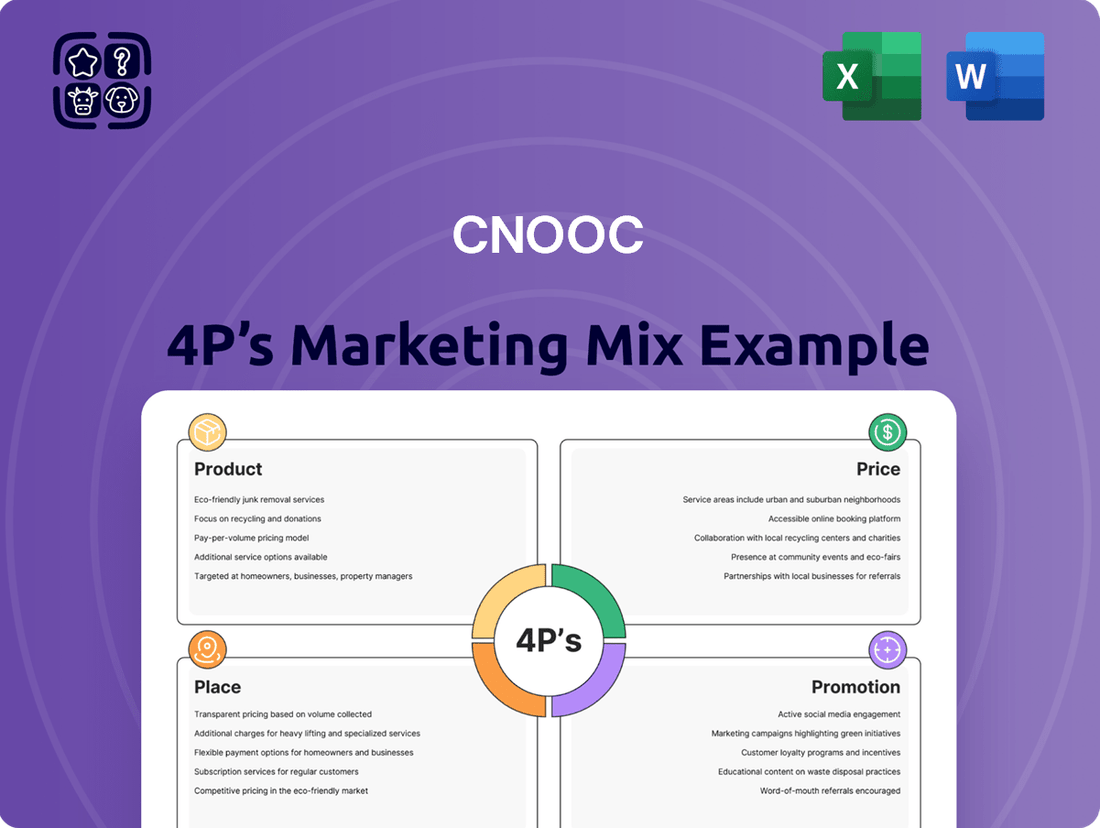

Discover how CNOOC leverages its extensive product portfolio, competitive pricing, strategic global reach, and impactful promotional campaigns to dominate the energy market. This analysis dives deep into each element of their 4Ps strategy.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering CNOOC's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

CNOOC's foundational products are crude oil and natural gas, serving as critical global energy sources. The company's expertise lies in exploring, developing, and producing these hydrocarbons, with a significant emphasis on offshore operations.

In 2023, CNOOC reported a net production of 677 million barrels of oil equivalent (boe), with offshore fields contributing the majority. This output directly fuels power generation, industrial manufacturing, and the transportation sector across the globe.

The average realized price for crude oil in 2023 was $83.99 per barrel, and for natural gas, it was $6.31 per thousand cubic feet, reflecting the market dynamics for these essential commodities.

CNOOC's product strength lies in its specialized offshore exploration and production (E&P) expertise and technology. This includes mastery in deepwater drilling and subsea engineering, crucial for accessing difficult-to-reach reserves.

Their advanced reservoir management techniques ensure efficient extraction, a key differentiator. For instance, CNOOC's Liwan 3-1 field, a deepwater gas project, showcases their capability in developing complex offshore assets, contributing significantly to China's energy security.

CNOOC's Refined Products and Chemicals portfolio extends its reach beyond upstream exploration, transforming crude oil into essential refined petroleum products like gasoline and diesel, alongside valuable petrochemicals such as plastics. This strategic downstream integration allows CNOOC to capture more value from its resources and serve a wider array of industrial and consumer needs.

In 2024, CNOOC's refining segment processed approximately 25 million tons of crude oil, yielding a diverse range of refined products. The company's chemical segment, meanwhile, produced over 3 million tons of ethylene and its derivatives, crucial building blocks for various industries, including packaging and automotive manufacturing.

Strategic Energy Security Contribution

CNOOC's commitment to energy security is a cornerstone of its marketing strategy, directly impacting China's national interests and global energy markets. The company’s extensive exploration and production activities, both domestically and internationally, are crucial for maintaining a stable and varied energy supply. This strategic contribution significantly bolsters the intrinsic value and market demand for CNOOC's oil and gas products.

In 2024, CNOOC continued to emphasize its role in bolstering China's energy independence. For instance, its offshore production platforms are vital, with the company consistently reporting substantial output figures. In the first half of 2024, CNOOC reported a net production of 321.4 million barrels of oil equivalent (BOE), a 5.7% increase year-on-year, underscoring its capacity to meet domestic demand.

- Domestic Production Growth: CNOOC's ongoing development of offshore oil and gas fields, such as the Lufeng 15-1 oilfield which commenced production in 2024, directly contributes to China's energy self-sufficiency.

- Global Supply Chain Stability: Through its international ventures, CNOOC helps diversify global energy sources, mitigating risks associated with geopolitical instability and ensuring a more predictable energy flow for importing nations.

- Enhanced Product Perception: The company's strategic importance in securing energy supplies elevates the perceived reliability and necessity of its products, creating a competitive advantage beyond mere commodity pricing.

- Investment in Future Security: CNOOC's continued investment in exploration and new technologies, including offshore wind power projects initiated in 2024, signals a long-term dedication to securing China's energy future.

Low-Carbon and Sustainable Energy Initiatives

CNOOC is actively pursuing low-carbon and sustainable energy initiatives, aligning with the global energy transition. This strategy focuses on reducing its operational carbon footprint and exploring new energy avenues. For instance, CNOOC has committed to investing significantly in offshore wind power projects, aiming to harness renewable resources. Their 2023 annual report highlighted continued progress in carbon capture, utilization, and storage (CCUS) technologies, with several projects advancing. These efforts are crucial for ensuring the long-term competitiveness and sustainability of CNOOC's product portfolio.

The company's commitment to sustainability is reflected in its strategic investments and operational adjustments. CNOOC's development plans include expanding its presence in new energy sectors, such as offshore wind farms, which are becoming increasingly vital for decarbonization efforts. By 2025, CNOOC aims to substantially increase its renewable energy capacity. Furthermore, their focus on CCUS technologies is designed to mitigate emissions from existing operations, with pilot projects demonstrating promising results in capturing CO2. This proactive approach is key to CNOOC's vision of becoming a leading clean energy provider.

- Offshore Wind Investments: CNOOC is expanding its offshore wind power generation capacity, a key component of its renewable energy strategy.

- Carbon Capture Technology: The company is investing in and developing carbon capture, utilization, and storage (CCUS) projects to reduce emissions from its operations.

- Operational Footprint Reduction: CNOOC has set targets to lower the carbon intensity of its oil and gas production activities.

- New Energy Ventures: Exploration and potential investment in other low-carbon energy solutions are part of CNOOC's diversification strategy for long-term viability.

CNOOC's product offering centers on crude oil and natural gas, essential for global energy needs and CNOOC's core business. The company also produces refined petroleum products like gasoline and diesel, alongside petrochemicals such as plastics, adding value downstream. This diversified product slate supports various industrial and consumer sectors.

CNOOC's commitment to energy security is a significant product attribute, directly bolstering China's energy independence and influencing global supply. Their offshore production, exemplified by new fields coming online in 2024, ensures a stable domestic supply. This strategic role enhances the perceived reliability and value of their oil and gas.

The company is also expanding into low-carbon energy, notably offshore wind power, with significant investments planned through 2025. This diversification, coupled with advancements in carbon capture technologies, positions CNOOC for long-term sustainability and a broader product appeal in the evolving energy landscape.

| Product Category | Key Products | 2023/2024 Data Points | Strategic Importance |

|---|---|---|---|

| Upstream Hydrocarbons | Crude Oil, Natural Gas | 2023 Net Production: 677 million boe H1 2024 Net Production: 321.4 million boe (up 5.7% YoY) |

Core business, energy security, domestic supply |

| Downstream Refined Products | Gasoline, Diesel, Jet Fuel | 2024 Refining Throughput: Approx. 25 million tons | Value addition, serving transportation and industrial sectors |

| Petrochemicals | Ethylene, Polyethylene, Polypropylene | 2024 Ethylene Production: Over 3 million tons | Building blocks for manufacturing (plastics, automotive) |

| New Energy | Offshore Wind Power | Expansion planned through 2025; Lufeng 15-1 oilfield commenced production in 2024 | Low-carbon transition, diversification, future growth |

What is included in the product

This analysis delves into CNOOC's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning within the energy sector.

It provides a professionally written, company-specific deep dive into CNOOC's marketing mix, grounded in actual brand practices and competitive context.

Provides a clear, actionable framework for CNOOC to address market challenges by strategically aligning Product, Price, Place, and Promotion to meet customer needs and competitive pressures.

Simplifies complex marketing strategies into a digestible 4P analysis, enabling CNOOC to pinpoint and alleviate pain points in their go-to-market approach.

Place

CNOOC's global offshore operational presence is a cornerstone of its 'Place' strategy, spanning critical hydrocarbon basins in Asia, Africa, North America, and South America. This expansive footprint ensures strategic access to diverse reserves and proximity to major energy demand centers. For instance, as of the first half of 2024, CNOOC reported significant production from its offshore fields in China, with continued investment in expanding its international portfolio.

CNOOC's energy distribution hinges on an integrated logistics and supply chain network. This includes extensive pipelines, significant storage capacity, and a substantial fleet of tankers and LNG carriers. For instance, in 2023, CNOOC managed over 20,000 kilometers of offshore and onshore pipelines, facilitating the movement of millions of tons of oil and gas.

This robust infrastructure is crucial for the efficient and timely delivery of crude oil and natural gas. The network connects production sites to processing facilities and then to global markets, ensuring product availability for end-users. CNOOC's investment in LNG terminals, such as the one in Zhuhai, highlights its commitment to expanding its global reach and diversifying supply routes.

CNOOC's direct sales strategy targets major industrial clients and national oil companies, distributing crude oil and natural gas globally. This B2B model relies on long-term supply contracts and spot sales, showcasing a commitment to large-scale energy consumers. In 2023, CNOOC's upstream production reached 670 million barrels of oil equivalent, with a significant portion allocated to these direct industrial sales channels, reflecting their importance in the company's revenue stream.

Strategic Storage and Export Terminals

CNOOC's strategically positioned storage and export terminals are vital for its global reach, ensuring efficient product flow. These facilities, situated along critical coastlines and shipping lanes, allow for robust inventory control and agile responses to market shifts. In 2023, CNOOC reported significant investments in upgrading its terminal infrastructure to enhance throughput capacity and operational efficiency, supporting its expanding international operations.

These terminals are not just storage hubs but critical links in CNOOC's supply chain, facilitating the seamless loading and unloading of massive cargo volumes. This capability is paramount for maintaining a competitive edge in the international energy market. For instance, their terminals played a key role in CNOOC's 2024 export volumes, which saw a notable increase in LNG shipments to Asian markets, demonstrating the terminals' direct impact on market access and product availability.

- Strategic Location: Terminals are situated at key global coastal points and major shipping routes, optimizing CNOOC's distribution network.

- Inventory Management: Facilitates effective control over product stock, allowing for better response to demand fluctuations.

- Market Access: Crucial for efficient loading and unloading of large vessels, ensuring consistent product availability to global markets.

- Operational Efficiency: Investments in terminal upgrades in 2023 aimed to boost throughput and support CNOOC's growing international trade, particularly in LNG exports in 2024.

International Trading and Market Access

CNOOC actively participates in international trading hubs, optimizing the placement and sale of its energy products. This global reach is crucial for navigating complex commodity pricing and responding to dynamic market signals. For instance, in 2023, CNOOC's overseas oil and gas production reached approximately 500,000 barrels of oil equivalent per day, highlighting its significant international footprint and the importance of market access for these operations.

The company engages in sophisticated trading activities to maximize revenue and maintain a competitive edge in the global energy trade. This includes managing price risks and capitalizing on arbitrage opportunities across different markets. CNOOC's commitment to international market access allows it to effectively monetize its diverse portfolio of oil and gas assets.

- Global Market Presence: CNOOC leverages key international trading centers to facilitate the sale of its energy output.

- Sophisticated Trading: The company employs advanced trading strategies to manage price volatility and optimize sales.

- Revenue Maximization: Broad market access enables CNOOC to achieve better pricing and wider distribution for its products.

- Competitive Positioning: Active engagement in global energy markets is vital for CNOOC's sustained competitiveness.

CNOOC's 'Place' strategy is defined by its extensive global operational footprint and integrated logistics. This network facilitates efficient delivery of crude oil and natural gas to major industrial clients and national oil companies through direct sales and long-term contracts. Strategic storage and export terminals are key to managing inventory and ensuring market access, particularly for growing LNG exports.

| Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Global Operations | Presence in key hydrocarbon basins worldwide. | First half 2024: Production from China offshore fields and international portfolio expansion. |

| Logistics Network | Pipelines, storage, tankers, LNG carriers. | 2023: Over 20,000 km of pipelines; significant investments in LNG terminals (e.g., Zhuhai). |

| Distribution Channels | Direct sales to industrial clients and NOCs. | 2023: Upstream production of 670 million barrels of oil equivalent, with substantial direct sales. |

| Terminal Infrastructure | Strategic coastal locations for storage and export. | 2023: Investments in terminal upgrades for enhanced throughput; key role in 2024 LNG exports. |

What You Preview Is What You Download

CNOOC 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of CNOOC's marketing mix, covering Product, Price, Place, and Promotion, is fully complete and ready for your immediate use.

Promotion

CNOOC's promotion strategy is anchored in building strong investor relations and maintaining exceptional financial transparency. This commitment is crucial for attracting and retaining capital from a global investor base. For instance, in the first half of 2024, CNOOC reported a net profit attributable to equity holders of RMB 62.5 billion, a significant figure demonstrating operational success and providing a solid foundation for investor confidence.

The company regularly provides detailed financial disclosures, timely earnings reports, and comprehensive investor presentations. These communications clearly outline operational performance, strategic advancements, and the company's future trajectory. This consistent and open dialogue is designed to cultivate trust and assurance among its varied financial stakeholders, including institutional investors and individual shareholders.

CNOOC is increasingly highlighting its commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles. This focus is evident in their detailed sustainability reports, which showcase environmental protection efforts, stringent safety protocols, and active community involvement.

These reports are crucial for building CNOOC's reputation and attracting investors and regulators who prioritize sustainability. For instance, CNOOC's 2023 ESG report detailed a 10.2% reduction in greenhouse gas emissions intensity compared to 2022, demonstrating tangible progress in environmental stewardship.

By transparently communicating these initiatives, CNOOC aims to align with global sustainability trends and meet the growing demand for responsible corporate practices. Their investment in renewable energy projects, such as offshore wind farms, further underscores this dedication, with CNOOC planning to invest over $10 billion in clean energy by 2025.

CNOOC's promotion strategy heavily relies on its role as a state-owned enterprise, emphasizing its contributions to China's energy security and national development. This involves proactive engagement with government bodies to align operations with national strategies and secure favorable regulatory environments.

The company actively cultivates relationships with a wide array of stakeholders, including industry partners, local communities, and international organizations. This broad engagement fosters trust and collaboration, crucial for maintaining operational stability and unlocking new growth avenues, particularly in overseas markets.

In 2023, CNOOC's commitment to national development was evident in its significant investments in domestic oil and gas production, contributing to a stable energy supply. Furthermore, its participation in international forums and partnerships underscores its global outreach and its role in shaping energy dialogues.

Participation in Global Industry Forums and Partnerships

CNOOC leverages global industry forums and strategic partnerships to amplify its market presence. By actively engaging in major international oil and gas conferences and exhibitions, CNOOC highlights its technological innovations and operational prowess. For instance, its participation in events like the International Petroleum Week in London or the Offshore Technology Conference (OTC) in Houston provides a platform to demonstrate advancements in areas such as deep-water exploration and production. These engagements are crucial for building its reputation and fostering collaborations.

These forums are instrumental in showcasing CNOOC's commitment to operational excellence and sharing valuable industry insights. Such active participation not only elevates its standing within the global energy sector but also directly supports its business development objectives. For example, in 2023, CNOOC announced several new joint venture discussions stemming from networking at key industry events, underscoring the tangible benefits of these engagements.

- Showcasing Technological Advancements: CNOOC presents its latest innovations in offshore drilling and renewable energy integration at global forums.

- Forging Strategic Alliances: Participation facilitates partnerships with international energy firms and technology providers, enhancing collaborative opportunities.

- Enhancing Industry Reputation: Active engagement in forums like the World Energy Congress bolsters CNOOC's image as a leader in the energy transition.

- Facilitating Business Development: Networking at these events leads to new project opportunities and strengthens existing business relationships.

Cultivating Corporate Brand and Public Perception

CNOOC actively cultivates its corporate brand, aiming to be seen as a dependable, responsible, and technologically forward-thinking energy provider. This ongoing promotional effort relies on strategic corporate communications, including official announcements and targeted media engagement.

The company’s commitment to operational excellence, safety, and creating lasting value is central to shaping positive public perception. In 2024, CNOOC continued to highlight its investments in green energy initiatives, aiming to balance traditional energy production with sustainable development goals.

- Brand Reputation: CNOOC focuses on being perceived as a reliable and technologically advanced energy producer.

- Communication Strategy: Utilizes official announcements, press releases, and media outreach to convey its message.

- Public Perception Goals: Aims to positively influence public opinion regarding operational excellence and safety.

- Value Creation: Emphasizes its commitment to long-term value creation for stakeholders.

CNOOC's promotion strategy centers on robust investor relations and transparent financial reporting, exemplified by its H1 2024 net profit of RMB 62.5 billion, reinforcing investor confidence.

The company actively promotes its ESG commitments, detailing a 10.2% reduction in greenhouse gas emission intensity in its 2023 report and planning over $10 billion in clean energy investments by 2025.

Leveraging its role in national energy security, CNOOC engages with government and industry partners, showcasing technological advancements at international forums like OTC Houston to foster collaborations and business development.

| Promotion Aspect | Key Initiatives/Data | Impact/Objective |

|---|---|---|

| Investor Relations & Financial Transparency | H1 2024 Net Profit: RMB 62.5 billion | Builds investor confidence and attracts capital |

| ESG & Sustainability | 2023 ESG Report: 10.2% GHG intensity reduction | Enhances reputation and attracts ESG-focused investors |

| Brand Building & Industry Presence | Planned Clean Energy Investment: >$10 billion by 2025 | Positions CNOOC as a responsible, forward-thinking energy provider |

| Strategic Engagement | Participation in OTC Houston, International Petroleum Week | Showcases innovation, fosters partnerships, and drives business development |

Price

CNOOC's revenue is directly tied to the volatile global commodity markets. The prices of its main products, crude oil and natural gas, are benchmarked against international standards like Brent and WTI crude oil, and regional gas hub prices. For instance, Brent crude oil prices fluctuated significantly in early 2024, trading in a range of approximately $75 to $90 per barrel, while natural gas prices in key hubs like Henry Hub saw considerable volatility, impacting CNOOC's top line.

CNOOC balances revenue by using both long-term contracts and spot sales. This dual strategy helps ensure stable income while also allowing flexibility to profit from market fluctuations.

Long-term contracts provide predictable revenue streams, often with pricing tied to established benchmarks and adjusted periodically. For instance, in 2024, many of CNOOC's LNG contracts were indexed to global benchmarks like the Japan Korea Marker (JKM), which saw significant volatility but offered a degree of price certainty for both buyer and seller.

Spot market sales enable CNOOC to react quickly to favorable market conditions, selling excess production or capitalizing on sudden price increases. This approach was particularly beneficial in late 2024 when unexpected demand surges in Asia led to higher spot prices for crude oil and natural gas.

CNOOC's pricing strategy is deeply rooted in its production economics, where exploration, development, and operational expenses are key cost drivers. The company actively pursues cost optimization and efficiency gains to secure healthy profit margins.

In 2023, CNOOC reported a cost of sales of RMB 232.9 billion, reflecting the significant investment in its upstream operations. This figure underscores the importance of managing these costs to remain competitive, particularly when oil and gas prices fluctuate.

Effective cost management is paramount for CNOOC’s sustained profitability, especially in the face of potential price downturns. For instance, a 1% improvement in operational efficiency could translate to substantial savings, directly impacting the bottom line.

Impact of Governmental Policies and Regulations

As a significant Chinese state-owned enterprise, CNOOC's pricing is heavily influenced by domestic government policies, energy regulations, and national strategic goals. These external forces can set domestic price caps, dictate export volumes, and shape investment incentives, all of which directly affect CNOOC's revenue and market positioning. Navigating these regulatory landscapes is a fundamental aspect of their pricing approach.

For instance, China's energy security objectives, often prioritized in policy directives, can lead to regulations that favor domestic production and potentially influence CNOOC's pricing to ensure affordability for consumers. In 2024, the government's focus on stable energy prices, particularly for natural gas, would likely translate into direct or indirect guidance on CNOOC's domestic pricing strategies, aiming to balance market forces with social stability. The company must also consider national carbon reduction targets, which may introduce pricing mechanisms or incentives for cleaner energy sources, impacting the competitiveness of its traditional oil and gas products.

- Governmental Influence: CNOOC's pricing is directly shaped by Chinese state policies, affecting domestic price ceilings and export quotas.

- Energy Security: National strategic objectives, such as ensuring stable energy supply, can lead to regulations that influence CNOOC's domestic pricing to maintain affordability.

- Regulatory Compliance: Adherence to energy regulations and national carbon reduction goals is a critical factor in CNOOC's pricing strategy, impacting product competitiveness.

Capital Investment and Project Valuation

CNOOC's pricing strategies are deeply intertwined with the significant capital required for new exploration and development. The company evaluates potential projects based on projected future revenues, which are directly influenced by anticipated oil and gas prices. This ensures that investments are not only economically sound but also enhance shareholder value.

For instance, CNOOC's capital expenditure for 2024 is projected to be between 90 billion and 100 billion RMB, reflecting substantial investment in future production. The anticipated Brent crude oil price, a key benchmark, averaged around $83 per barrel in early 2024, providing a basis for these long-term financial assessments and asset valuations. This forward-looking approach is crucial for maintaining a competitive pricing framework.

- Capital Intensity: New exploration and development projects require massive upfront investment.

- Revenue Forecasting: Expected future oil and gas prices are critical for project valuation.

- Investment Planning: Anticipated commodity prices guide long-term strategic capital allocation.

- Shareholder Value: Viable projects contribute positively to the company's overall financial health.

CNOOC's pricing is fundamentally driven by global commodity markets, with benchmarks like Brent and WTI crude oil, and regional gas prices directly influencing its revenue. For example, Brent crude averaged around $83 per barrel in early 2024, a key factor in CNOOC's revenue projections.

The company employs a strategy of balancing long-term contracts, often indexed to benchmarks like JKM for LNG, with opportunistic spot sales. This dual approach ensures revenue stability while allowing CNOOC to capitalize on market volatility, as seen with higher spot prices in Asia during late 2024 due to demand surges.

Production economics, including exploration and operational costs, are critical to CNOOC's pricing and profit margins. With 2023 costs of sales at RMB 232.9 billion, efficient cost management is essential, especially when commodity prices are low.

Government policies in China significantly influence domestic pricing, with national energy security and affordability goals potentially setting price caps. In 2024, the emphasis on stable natural gas prices likely guided CNOOC's domestic pricing, alongside considerations for carbon reduction targets.

| Pricing Factor | 2024 Benchmark Example | Impact on CNOOC |

|---|---|---|

| Crude Oil Prices | Brent Crude: ~$83/barrel (early 2024) | Directly impacts revenue from oil sales. |

| Natural Gas Prices | Henry Hub: Volatile (early 2024) | Affects revenue from gas sales and LNG contracts. |

| Contract Types | Long-term indexed (e.g., JKM) vs. Spot | Provides revenue stability and flexibility for profit. |

| Production Costs | 2023 Cost of Sales: RMB 232.9 billion | Crucial for maintaining profit margins. |

| Government Policy | Energy security, price stability | Influences domestic pricing and market access. |

4P's Marketing Mix Analysis Data Sources

Our CNOOC 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence.