CNOOC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

Curious about CNOOC's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in the energy market, highlighting potential Stars, Cash Cows, and areas needing attention. To truly understand their competitive edge and unlock actionable growth strategies, dive into the full analysis.

Don't just wonder, know. The complete CNOOC BCG Matrix provides a detailed quadrant-by-quadrant breakdown, offering the clarity needed to make informed investment decisions and optimize resource allocation. Secure your copy today for a strategic advantage.

Stars

CNOOC's deepwater and ultra-deepwater exploration has yielded substantial results, exemplified by the Lingshui 36-1 gas field and the Kaiping South oil field. These discoveries boast proven reserves exceeding one hundred million tons of oil equivalent, significantly bolstering CNOOC's long-term resource foundation and ensuring future production capacity.

The successful exploration of the Liwan 4-1 structure, a significant achievement in ultra-deepwater carbonate formations, has unlocked promising new avenues for future exploration efforts. These advancements are critical for maintaining CNOOC's competitive edge in the global energy market.

CNOOC's major new production projects are poised to be significant growth drivers. Key developments such as Bozhong 26-6 Oilfield Phase I and Kenli 10-2 Oilfield Phase I in China, alongside international ventures like Yellowtail in Guyana and Buzios7 in Brazil, are slated to come online in 2025. These projects are crucial for CNOOC to meet its ambitious production targets, with the company aiming for a record output in the coming years.

The strategic integration of exploration and development activities is central to CNOOC's approach, accelerating the process of converting discovered reserves into actual production. This focus is expected to bolster the company's production capacity and contribute to its overall financial performance, supporting its position in the global energy market.

CNOOC is strategically expanding its international exploration into the Atlantic Ocean rim and Belt and Road countries. This geographic diversification is key to broadening its global reach and identifying new resource prospects. For instance, CNOOC's total overseas oil and gas production reached 29.84 million tons in the first half of 2024, with significant contributions from regions like Guyana.

Strengthening Natural Gas Reserves

CNOOC is actively bolstering its natural gas reserves, a strategic move that aligns with the global shift towards cleaner energy sources. The company is investing heavily in developing significant gas regions, aiming to establish three trillion-cubic-meter-level gas areas across the South China Sea, Bohai Sea, and onshore China. This expansion is crucial for diversifying CNOOC's energy portfolio beyond traditional oil production.

These initiatives are already yielding results, with projects like the Dongfang 1-1 gas field, a complex high-pressure, high-temperature development, contributing to enhanced gas output. This focus on natural gas is not just about meeting current demand but also positioning CNOOC for long-term growth in a transitioning energy landscape.

- Natural Gas Exploration Focus: CNOOC is prioritizing the exploration and development of natural gas resources.

- Trillion-Cubic-Meter Gas Regions: The company is establishing three major gas regions, each projected to hold trillions of cubic meters of natural gas.

- Strategic Diversification: This emphasis on natural gas helps diversify CNOOC's hydrocarbon assets and aligns with global energy transition trends.

- Key Development Projects: Projects like the Dongfang 1-1 gas field are instrumental in boosting natural gas production.

Technological Innovation and AI Integration

CNOOC is a significant player in technological innovation, particularly in its integration of artificial intelligence into its operations. The company is actively developing intelligent oil and gas fields, a move that underscores its commitment to digital transformation. This strategic focus aims to streamline operations and boost productivity.

The 'Hi-Energy' artificial intelligence model is central to CNOOC's strategy. By merging digital intelligence with traditional oil and gas activities, CNOOC is pushing for leaner management practices and improved operational efficiency. This technological push is vital for effectively managing complex extraction processes and staying ahead in the dynamic energy sector.

- Investment in Intelligent Fields: CNOOC is channeling resources into creating smart oil and gas fields, enhancing data-driven decision-making.

- 'Hi-Energy' AI Model: The company's proprietary AI model is being deployed to optimize exploration, production, and management.

- Efficiency Gains: Integration of digital technology is projected to yield significant improvements in operational lean management and overall efficiency.

- Competitive Edge: These technological advancements are crucial for CNOOC to maintain its competitive position in the global energy market.

CNOOC's deepwater and ultra-deepwater exploration, exemplified by fields like Lingshui 36-1 and Kaiping South, represents its 'Star' performers. These ventures boast reserves exceeding one hundred million tons of oil equivalent, securing substantial future production capacity and demonstrating CNOOC's prowess in challenging environments. The successful Liwan 4-1 structure further highlights this capability, opening new exploration frontiers.

Major new production projects, including Bozhong 26-6 Phase I and Kenli 10-2 Phase I in China, along with international projects like Yellowtail in Guyana and Buzios 7 in Brazil, are set to drive significant growth. These are CNOOC's current and future stars, aiming to boost production to record levels. The company's strategic integration of exploration and development accelerates the conversion of reserves into output, bolstering financial performance.

CNOOC's international expansion into the Atlantic Ocean rim and Belt and Road countries is a key strategy for identifying new resource prospects, with overseas production reaching 29.84 million tons in the first half of 2024, driven by regions like Guyana. This geographic diversification is crucial for its 'Star' assets and future growth. The company's focus on natural gas, aiming for three trillion-cubic-meter gas regions, also positions it for long-term success.

| Project/Area | Type | Status/Outlook | Significance | Key Data Point |

| Lingshui 36-1 Gas Field | Deepwater Gas | Producing | Major gas discovery, significant reserves | Reserves > 100 million tons of oil equivalent |

| Kaiping South Oil Field | Deepwater Oil | Producing | Key oil discovery, contributes to production | Reserves > 100 million tons of oil equivalent |

| Yellowtail (Guyana) | Offshore Oil | Development/Production | International growth driver | Significant contribution to overseas production (H1 2024: 29.84 million tons) |

| Buzios 7 (Brazil) | Offshore Oil | Development/Production | International growth driver | Key international venture |

What is included in the product

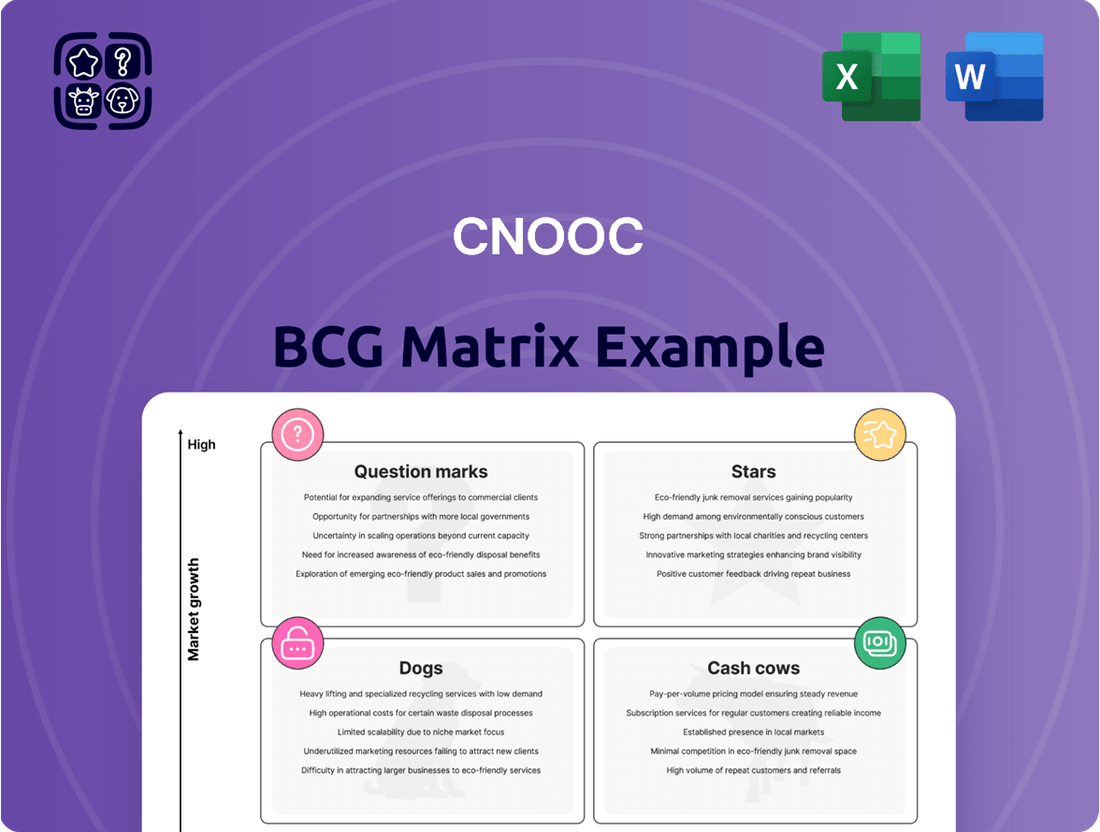

The CNOOC BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides CNOOC's investment decisions, indicating which units to grow, maintain, or divest.

The CNOOC BCG Matrix provides a clear, one-page overview of each business unit's strategic position, simplifying complex portfolio analysis.

Cash Cows

CNOOC's established offshore China oil and gas fields, primarily in Bohai Bay and the South China Sea, are its undisputed Cash Cows. These mature assets are the bedrock of the company's operations, consistently delivering the bulk of its production.

In 2023, these fields were instrumental in CNOOC's performance, contributing approximately 69% of its total net production. This stable and significant output generates substantial, reliable cash flow for the company.

The established infrastructure and proven reserves mean these fields require comparatively less capital expenditure for new exploration or development, allowing CNOOC to reinvest profits elsewhere or return value to shareholders.

CNOOC has demonstrated remarkable operational strength, achieving record-high net oil and gas production for six consecutive years, extending through 2024. This sustained performance, with a 2024 output of 726.8 million BOE, underscores the company's robust market position and consistent revenue streams.

The company's production targets suggest this growth trajectory will continue through 2027, reinforcing its status as a reliable and maturing asset base. This consistent high volume is a key indicator of CNOOC's operational efficiency and its ability to leverage its mature assets effectively.

CNOOC's cost-competitive production advantage is a significant factor in its Cash Cow status. The company achieved an all-in production cost of US$27.03 per barrel of oil equivalent (BOE) in Q1 2025, a testament to its operational efficiency. This follows a strong performance in 2024, where the cost was US$28.52 per BOE.

This sustained low-cost structure, particularly in offshore production, enables CNOOC to maintain healthy profit margins regardless of oil price volatility. It ensures robust cash flow generation, a hallmark of a Cash Cow in the BCG matrix.

Stable Capital Expenditure and High Payout Ratio

CNOOC's position as a Cash Cow is reinforced by its stable capital expenditure and a commitment to shareholder returns. For 2025, the company anticipates capital expenditures to remain flat, within the RMB 125-135 billion range, mirroring the 2024 projections. This financial discipline allows for substantial cash generation.

This consistent cash flow is further demonstrated by CNOOC's policy to maintain a dividend payout ratio of at least 45% annually for the next three years. This strategy highlights a mature business model that effectively returns surplus capital to investors while ensuring the continuity of its stable operations.

- Stable Capital Expenditure: CNOOC's 2025 capex forecast of RMB 125-135 billion is flat compared to 2024, indicating predictable investment needs.

- High Payout Ratio: A commitment to a minimum 45% dividend payout ratio over the next three years signals strong shareholder value distribution.

- Mature Business: These financial characteristics point to a well-established entity generating significant surplus cash.

- Shareholder Returns: The surplus cash is strategically allocated to reward shareholders and maintain operational stability.

China's Largest Shallow Water Oil Field

The commencement of heavy crude production at China's largest shallow water oil field, operated by CNOOC, marks a significant milestone for the company. This asset is a stable production cornerstone, bolstering CNOOC's domestic market presence and contributing critically to China's energy independence. The successful development underscores CNOOC's advanced technical expertise in managing mature and complex oil reserves, ensuring sustained output for years to come.

- Asset Status: Cash Cow

- Production Type: Heavy Crude

- Operator: CNOOC

- Significance: China's largest shallow water oil field, enhancing energy security and domestic market share.

CNOOC's established offshore oil and gas fields, particularly those in Bohai Bay and the South China Sea, represent its core Cash Cows. These mature assets consistently contribute the majority of the company's production, with 2023 output from these regions forming approximately 69% of its net production. This stable output generates substantial and reliable cash flow, a hallmark of a Cash Cow. The company's commitment to a minimum 45% dividend payout ratio for the next three years further solidifies this status, demonstrating a mature business model effectively returning surplus capital to shareholders.

| Metric | 2023 | 2024 (Est.) | Q1 2025 |

|---|---|---|---|

| Net Production (Million BOE) | 719.5 | 726.8 | N/A |

| All-in Production Cost (USD/BOE) | N/A | 28.52 | 27.03 |

| Capital Expenditure (RMB Billion) | 125.0 - 135.0 | 125.0 - 135.0 | N/A |

Delivered as Shown

CNOOC BCG Matrix

The CNOOC BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis, detailing CNOOC's business units within the BCG framework, is ready for immediate application in your strategic planning. You are seeing the final, professionally formatted report, ensuring no surprises and full usability for your business insights.

Dogs

CNOOC's divestment of its Gulf of Mexico assets in December 2024 clearly places these operations within the Dogs quadrant of the BCG Matrix. This strategic move signals a deliberate exit from these specific regions or operations, often due to declining profitability or limited future growth potential.

Assets categorized as Dogs are typically characterized by low market share and low market growth. CNOOC's decision to sell these assets suggests they were no longer a strategic fit or were underperforming compared to other business units, aligning with the core definition of a Dog in the BCG framework.

Older, marginal fields nearing the end of their productive life, characterized by high operational costs and declining output, would fall into the 'dog' category within CNOOC's portfolio. These assets often demand significant ongoing investment for maintenance with minimal prospects for future growth, making them prime candidates for decommissioning or strategic divestment to streamline operations. CNOOC's stated commitment to prioritizing high-efficiency investments underscores a strategic shift away from such mature, low-return assets.

CNOOC's refining and chemical operations, while part of its portfolio, are often overshadowed by its dominant Exploration and Production (E&P) segment. If these downstream activities are small in scale, grapple with fierce market competition, or consistently lag behind the profitability of E&P, they would fit the description of underperforming non-core operations within a BCG matrix framework.

Public disclosures from CNOOC tend to emphasize advancements and investments in E&P and new energy initiatives. This strategic focus suggests that the refining and chemical segments are not currently positioned as significant engines for future growth, further solidifying their potential classification as underperforming non-core assets.

Exploration Areas with Repeated Failures

Exploration areas with repeated failures, often categorized as Dogs in a BCG matrix context, represent ventures where CNOOC has invested significant capital expenditure but has not seen a return in terms of new reserves or production. These are areas where initial optimism has been met with consistent disappointment, such as drilling dry wells or finding commercially unviable quantities of oil and gas.

A prime example of this is CNOOC's strategic shift in exploration focus. After encountering repeated failures in the northern slope of Kaiping, the company redirected its efforts to the southern slope. This move signifies a recognition that certain geological areas, despite initial promise and investment, may not deliver the expected commercial outcomes, thus becoming a drain on resources.

- Resource Drain: Continued investment in unpromising exploration blocks consumes capital that could be allocated to more productive ventures, impacting overall financial performance.

- Strategic Reallocation: The company's decision to move exploration focus from the northern to the southern slope of Kaiping after initial failures highlights a necessary strategic adjustment to mitigate losses.

- Opportunity Cost: Resources tied up in Dog exploration areas represent an opportunity cost, preventing investment in potentially higher-return projects elsewhere in CNOOC's portfolio.

Assets Impacted by Geopolitical Tensions

CNOOC's assets are significantly influenced by geopolitical tensions, particularly with the United States. The company's inclusion on the Pentagon's blacklist in 2020, for instance, highlights these external pressures. This designation can restrict market access and operational capabilities for specific CNOOC assets.

These geopolitical headwinds can lead to decreased profitability and operational flexibility. For example, assets previously considered strong performers might become less viable due to sanctions or trade restrictions, effectively becoming 'problematic' due to external factors rather than internal operational flaws. In 2024, the ongoing scrutiny of Chinese energy companies by the US government continues to pose a risk to CNOOC's international operations and asset valuations.

- Pentagon Blacklist: CNOOC was identified on the Pentagon's list of Chinese military companies, impacting its perceived risk profile.

- Market Access: Geopolitical tensions can limit CNOOC's ability to access key international markets for its oil and gas products.

- Operational Constraints: External pressures may force CNOOC to scale back or alter operations in certain regions, affecting asset performance.

- Valuation Impact: The risk of sanctions or trade disputes can negatively affect the valuation of CNOOC's international assets.

CNOOC's divestment of its Gulf of Mexico assets in December 2024 firmly places them in the Dogs quadrant of the BCG Matrix. This strategic exit highlights operations with low market share and limited growth potential, aligning with the definition of Dogs. These assets, often mature and costly to maintain, are being strategically divested to focus on more profitable ventures.

Exploration ventures that consistently yield dry wells or commercially unviable reserves, such as CNOOC's initial focus on the northern slope of Kaiping, also fall into the Dog category. These represent capital drains with poor returns, prompting strategic reallocation of resources to more promising areas, like the southern slope of Kaiping.

Geopolitical factors, including US scrutiny and potential market access restrictions, can also relegate even previously strong assets to Dog status. The Pentagon's 2020 blacklist designation for CNOOC exemplifies how external pressures can diminish an asset's viability and valuation, impacting its performance within the BCG framework.

CNOOC's refining and chemical operations, if small-scale and facing intense competition, may also be classified as Dogs. Their performance often lags behind the core Exploration and Production segment, indicating they are not significant growth drivers, further supporting their classification as underperforming non-core assets.

Question Marks

CNOOC is making significant strides in offshore wind, exemplified by its development of the world's first 16-megawatt tension-leg floating wind power platform. This initiative positions CNOOC in a high-growth renewable energy sector, though its current market share in offshore wind is modest relative to its established oil and gas business.

The company is channeling substantial investment into scaling its renewable energy operations, a sector where profitability is still in its formative stages. For instance, by the end of 2023, CNOOC's installed capacity for offshore wind power reached 10.75 gigawatts, a notable increase that underscores its commitment to this burgeoning market.

CNOOC is actively pursuing onshore photovoltaic (solar) projects as a key component of its green development strategy. This move targets a high-growth renewable energy sector, though CNOOC's current market share in this specific area is modest, placing it in the question mark category of the BCG matrix.

These solar ventures demand significant upfront capital and successful integration with CNOOC's existing energy infrastructure to realize their full potential. For context, global solar power capacity reached over 1,300 GW by the end of 2023, highlighting the substantial market opportunity but also the competitive landscape CNOOC is entering.

CNOOC is actively investigating the industrialization of Carbon Capture, Utilization, and Storage (CCUS) technologies, with a specific focus on establishing offshore CCUS demonstration centers in northern China. This strategic move positions CCUS as a key component in CNOOC's decarbonization efforts within the energy sector.

CCUS is recognized as a high-growth, emerging technology essential for achieving climate goals. However, its path to commercial viability and broad adoption remains uncertain, placing it firmly in the 'Question Mark' category of the BCG Matrix. This means it requires substantial investment in research and development, with the immediate return on investment not yet guaranteed.

New, Unproven Exploration Blocks (e.g., Mozambique, Iraq)

CNOOC is actively pursuing new, unproven exploration blocks like those in Mozambique and Iraq, aligning with its 'Belt and Road' initiative. These ventures represent significant investments in seismic surveys and potential drilling, embodying the high-risk, high-reward nature of 'Question Marks' in the BCG Matrix.

These regions offer substantial growth potential but come with inherent uncertainties regarding commercial viability. CNOOC's strategy here involves substantial upfront capital expenditure without guaranteed returns, a hallmark of undeveloped assets with uncertain futures.

- Mozambique: CNOOC has participated in offshore exploration, including blocks in the Rovuma Basin, known for its significant natural gas discoveries, though further development and market realization remain ongoing.

- Iraq: The company holds interests in exploration blocks in Iraq, a region with vast untapped oil reserves but also geopolitical complexities that influence operational risk and investment timelines.

- Capital Intensive: Exploration in these frontier areas requires significant financial commitment for geological surveys, seismic data acquisition, and initial drilling phases, often running into hundreds of millions of dollars per block.

- Uncertainty: The success rate for new exploration blocks globally is typically low, meaning a substantial portion of these investments may not result in commercially viable discoveries, placing them firmly in the 'Question Mark' category.

Deep Coalbed Methane and Tight Gas Resources (Onshore Exploration)

CNOOC's onshore exploration efforts are targeting unconventional gas, specifically deep coalbed methane and tight gas, to broaden its energy supply. This strategic move aims to tap into resources that, while promising for future growth, currently represent a minor portion of CNOOC's total output.

These unconventional plays are characterized by significant technical hurdles and substantial upfront investment requirements for extraction. For instance, advancements in hydraulic fracturing and horizontal drilling are crucial for unlocking these reserves, mirroring global trends in unconventional resource development. In 2024, CNOOC continued to invest in these technologies, recognizing their importance for future production.

- Growth Potential: Deep coalbed methane and tight gas offer substantial untapped reserves, presenting a high-growth avenue for CNOOC's gas production.

- Technical & Capital Intensity: Extraction requires advanced technologies like hydraulic fracturing and horizontal drilling, demanding significant capital outlay.

- Current Market Share: These unconventional resources currently constitute a small fraction of CNOOC's overall gas production portfolio.

- Success Factors: Efficient extraction techniques and supportive market prices are critical for the economic viability and expansion of these operations.

CNOOC's investments in onshore solar power and emerging technologies like CCUS represent areas with high growth potential but also significant uncertainty regarding profitability and widespread adoption. These ventures require substantial capital and face considerable risks, characteristic of 'Question Marks' in the BCG matrix. The company's exploration in frontier regions such as Mozambique and Iraq also falls into this category, demanding large upfront investments with no guarantee of successful commercial extraction.

BCG Matrix Data Sources

Our CNOOC BCG Matrix is constructed using a blend of official company filings, extensive market research, and reputable industry analyses to provide a comprehensive view of their business units.