CNH Industrial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

CNH Industrial navigates a dynamic global market, leveraging its strong brand recognition in agriculture and construction while facing challenges in supply chain disruptions and evolving emissions regulations. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind CNH Industrial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CNH Industrial's diverse global product portfolio is a significant strength, covering agricultural machinery, construction equipment, and commercial vehicles. Brands like Case IH and New Holland Agriculture cater to farming needs, while CASE and New Holland Construction Equipment serve the building sector. This breadth extends to trucks, buses, and powertrain solutions, offering a comprehensive offering across multiple industries.

CNH Industrial benefits from a rich heritage and a portfolio of globally recognized brands, including Case IH and New Holland. These established names are synonymous with quality and performance in the agricultural and construction sectors, bolstering the company's market standing and customer loyalty.

The company's extensive global footprint, with operations and dealerships spanning five continents, ensures significant market access. This widespread presence facilitates efficient distribution, localized customer support, and a robust supply chain, crucial for serving diverse international markets effectively.

CNH Industrial's commitment to innovation is a significant strength, particularly in areas like precision agriculture, automation, and sustainable powertrains. This focus directly translates into enhanced productivity and efficiency for their customers, a key selling point in the competitive agricultural and construction equipment markets.

The company's recent product introductions, such as automated spraying systems and electric vehicle models, underscore its strategic push towards higher-margin, technology-driven solutions. This integration of 'Iron + Tech' positions CNH Industrial to capture evolving market demands for smarter, more sustainable equipment.

Focus on Cost Management and Operational Efficiency

CNH Industrial demonstrates a robust focus on cost management and operational efficiency. The company actively pursues cost-saving initiatives and strives for operational excellence, which includes strategic efforts to optimize dealer inventories and fine-tune production levels. These actions are vital for successfully navigating volatile market conditions and protecting profit margins.

These disciplined approaches have yielded tangible results. For instance, CNH Industrial reported substantial cost savings in 2023, with further efficiencies targeted and realized through the first half of 2024. This commitment to streamlining operations helps the company maintain competitiveness even when market demand fluctuates.

- Cost Reduction Initiatives: CNH Industrial has implemented various programs aimed at reducing operational expenses across its global manufacturing and supply chain networks.

- Inventory Management: The company has made significant strides in reducing dealer inventory levels, a key factor in improving working capital and operational flexibility.

- Production Optimization: CNH Industrial is actively managing production volumes to better align with market demand, thereby minimizing waste and enhancing efficiency.

- Efficiency Gains: These efforts contributed to a notable improvement in operational efficiency, as reflected in the company's financial performance throughout 2023 and early 2024.

Sustainability Initiatives and ESG Performance

CNH Industrial's dedication to sustainability is a significant strength, clearly outlined in its 2024 Sustainability Report. The company is actively pursuing energy efficiency and increasing its reliance on renewable electricity sources.

This commitment is reflected in tangible achievements:

- Increased Renewable Electricity Usage: CNH Industrial achieved 70.4% of its total electricity consumption from renewable sources.

- CO2 Emission Reduction Efforts: The company is implementing projects aimed at reducing its overall carbon footprint.

- Positive ESG Profile: These initiatives contribute to a strong and favorable Environmental, Social, and Governance (ESG) standing, which is increasingly important for investors and stakeholders.

CNH Industrial's robust financial health is a key strength, evidenced by its consistent revenue growth and profitability. The company reported net sales of $8.56 billion for the first quarter of 2024, an increase of 11% compared to the same period in 2023. This financial stability provides a solid foundation for future investments and strategic initiatives.

The company's strategic focus on integrating technology with its machinery, often referred to as 'Iron + Tech', is a significant differentiator. This approach enhances product value by offering advanced features like precision farming and automation, directly addressing customer needs for increased efficiency and productivity. For example, their precision agriculture solutions aim to optimize resource usage, leading to better yields for farmers.

CNH Industrial's commitment to sustainability is a growing strength, aligning with global trends and investor preferences. The company aims to increase its use of renewable energy and reduce its environmental impact across operations. This dedication is reflected in their 2024 Sustainability Report, which details progress in areas like CO2 emission reduction and increased reliance on renewable electricity sources.

CNH Industrial's operational efficiency and cost management strategies are crucial strengths, particularly in navigating market volatility. The company actively works to optimize production and manage inventory levels, contributing to improved working capital and profitability. These disciplined approaches have resulted in tangible cost savings, enhancing their competitive position.

| Metric | 2023 (Full Year) | Q1 2024 | Year-over-Year Change (Q1 2024 vs Q1 2023) |

|---|---|---|---|

| Net Sales (USD billions) | 32.57 | 8.56 | +11% |

| Adjusted EBIT (USD billions) | 3.77 | 1.05 | +16% |

| Renewable Electricity Usage | N/A (Targeting higher % in 2024) | 70.4% (of total electricity consumption) | N/A |

What is included in the product

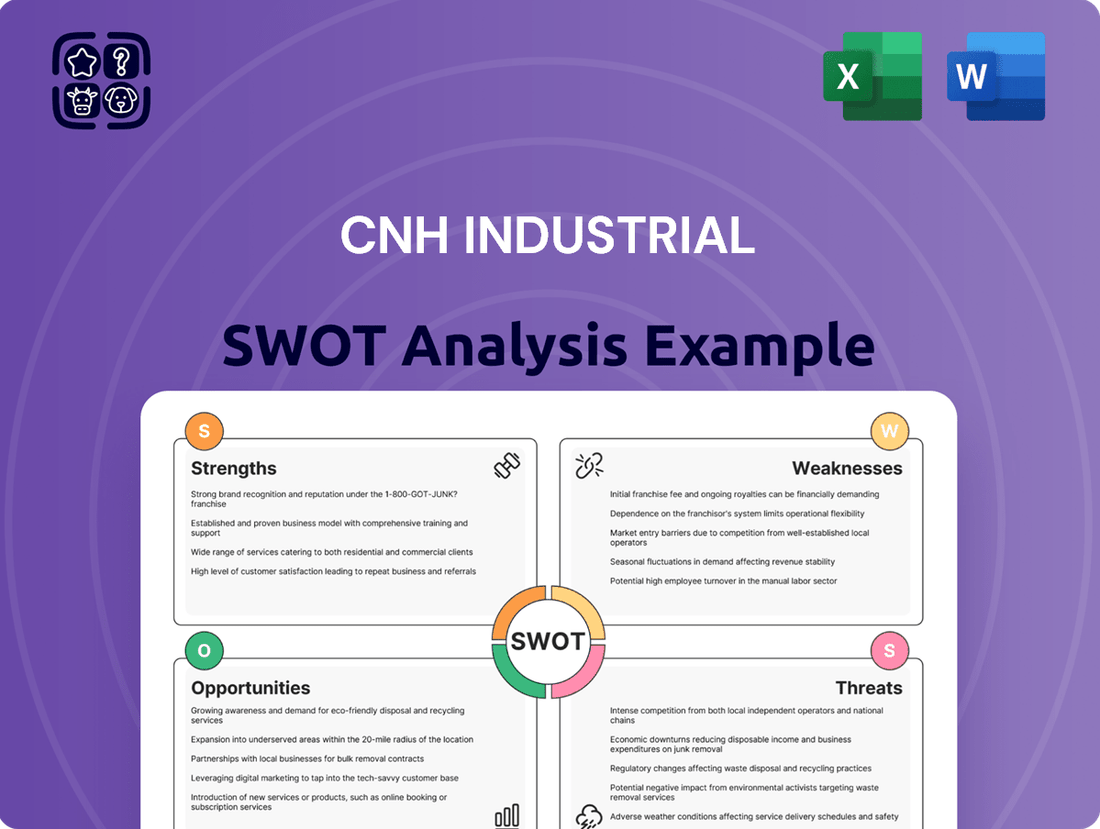

Offers a full breakdown of CNH Industrial’s strategic business environment by examining its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear visual representation of CNH Industrial's market position, helping to identify and address competitive threats and capitalize on emerging opportunities.

Weaknesses

CNH Industrial's reliance on the agriculture and construction sectors makes it inherently vulnerable to economic downturns. These industries are known for their cyclical nature, meaning they can experience significant swings in demand based on broader economic conditions.

For instance, in the first quarter of 2024, CNH Industrial reported a 13% decrease in consolidated revenues compared to the prior year, largely attributed to reduced industry volumes and efforts by dealers to manage inventory levels. This sensitivity to market cycles was further highlighted by a 15% drop in net sales for its Agriculture segment, underscoring the impact of lower demand.

CNH Industrial has faced significant headwinds, with substantial year-over-year decreases in net sales reported across both its agriculture and construction segments in late 2024 and early 2025. This downturn is largely due to lower shipment volumes and a general softening of industry demand in key geographic markets.

The impact on profitability is also evident, as adjusted EBIT margins have seen a notable decline in these same periods. This contraction reflects the challenges in maintaining profitability amidst reduced sales and ongoing market pressures.

CNH Industrial has been strategically reducing its production to clear out high dealer inventory levels. This necessary step, while aimed at rebalancing the supply chain, has led to lower segment margin results in the short term, indicating a significant challenge in managing excess stock.

Exposure to Currency and Geopolitical Risks

CNH Industrial faces significant headwinds due to its global operations, making it susceptible to fluctuations in currency exchange rates. For instance, in the first quarter of 2024, the company reported that unfavorable currency movements impacted its net sales by approximately $100 million. This exposure can erode profitability when revenues generated in weaker currencies are converted back to the company's reporting currency.

Furthermore, the company's extensive international footprint places it directly in the path of geopolitical uncertainties and evolving trade policies. Potential trade barriers, such as tariffs imposed on imported components or finished goods, can disrupt CNH Industrial's intricate supply chains and necessitate costly adjustments to its pricing strategies. This adds a layer of financial volatility that is difficult to predict and manage, particularly in an increasingly protectionist global trade environment.

- Currency Volatility: Unfavorable exchange rate movements, like those impacting CNH Industrial in Q1 2024, can reduce reported revenues and profits.

- Geopolitical Instability: Tensions between major global economies can lead to unpredictable policy changes that affect international business operations.

- Trade Barriers: Tariffs and import/export restrictions can increase costs, disrupt supply chains, and necessitate strategic shifts in production and sales.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of materials and finished products, impacting production schedules and delivery times.

Intense Competitive Pressures

CNH Industrial operates in a fiercely competitive environment, facing significant challenges from major players such as John Deere and Caterpillar. These rivals are also making substantial investments in cutting-edge technologies, including precision agriculture and the development of electric-powered machinery. This intense rivalry puts pressure on CNH Industrial’s market position and can make it difficult to achieve its desired profit margins.

For instance, in the agricultural equipment sector, John Deere's continued innovation in autonomous farming solutions and advanced data analytics presents a direct challenge to CNH Industrial's offerings. Similarly, Caterpillar's strong presence in the construction machinery market, coupled with its focus on electrification and digital services, intensifies the competitive landscape for CNH's construction equipment divisions.

The need to constantly innovate and invest in new technologies to keep pace with competitors can strain financial resources. This dynamic means CNH Industrial must carefully balance its R&D spending and capital expenditures to maintain a competitive edge without compromising its financial health.

- Intense Rivalry: CNH Industrial contends with established giants like John Deere and Caterpillar, who are aggressively pursuing technological advancements.

- Technology Investment Race: Competitors are heavily investing in precision agriculture and electric equipment, forcing CNH to match these efforts.

- Market Share Erosion Risk: The competitive pressure can lead to a decline in CNH Industrial's market share if it fails to innovate effectively.

- Margin Pressure: Achieving ambitious profit margin targets becomes more challenging due to the need to compete on price and technological features.

CNH Industrial's reliance on the agriculture and construction sectors makes it inherently vulnerable to economic downturns. These industries are known for their cyclical nature, meaning they can experience significant swings in demand based on broader economic conditions.

For instance, in the first quarter of 2024, CNH Industrial reported a 13% decrease in consolidated revenues compared to the prior year, largely attributed to reduced industry volumes and efforts by dealers to manage inventory levels. This sensitivity to market cycles was further highlighted by a 15% drop in net sales for its Agriculture segment, underscoring the impact of lower demand.

CNH Industrial faces significant headwinds due to its global operations, making it susceptible to fluctuations in currency exchange rates. For example, in Q1 2024, unfavorable currency movements impacted net sales by approximately $100 million, eroding reported profitability.

The company also operates in a fiercely competitive environment, contending with giants like John Deere and Caterpillar who are heavily investing in precision agriculture and electrification, putting pressure on CNH's market position and profit margins.

Same Document Delivered

CNH Industrial SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, detailing CNH Industrial's Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering a comprehensive understanding of the company's strategic position.

Opportunities

CNH Industrial is well-positioned to capitalize on the burgeoning precision agriculture market. The company is making substantial investments in cutting-edge technologies, including autonomous systems and sophisticated data-driven solutions, aiming to enhance efficiency and yield for farmers.

A core strategic objective for CNH Industrial involves doubling the sales contribution of precision technology as a percentage of its total agriculture net sales. This ambitious goal highlights the significant growth opportunities anticipated in this sector, driven by increasing farmer adoption of advanced agricultural tools.

CNH Industrial is actively pursuing growth in emerging markets, recognizing their potential to offer significant new revenue streams and crucial diversification away from more mature economies. This strategic push is designed to balance out slower growth rates observed in developed regions.

By expanding its presence in developing economies, CNH Industrial aims to mitigate the impact of regional demand fluctuations and tap into the substantial growth potential inherent in these expanding markets. For instance, in 2024, the company reported strong performance in Latin America, with net sales in the Agriculture segment increasing by 19% year-over-year, highlighting the positive impact of emerging market engagement.

CNH Industrial's robust dedication to sustainability, exemplified by its progress in renewable electricity and eco-friendly product development, serves as a powerful differentiator in the market. This commitment resonates with an increasing segment of consumers and investors who prioritize environmental responsibility, thereby bolstering the company's brand image and potentially expanding its market footprint.

Strategic Partnerships and Acquisitions for Technology Advancement

CNH Industrial is actively pursuing strategic partnerships with emerging digital and technology start-ups. This approach is designed to inject fresh innovation and accelerate the company's technological advancement. By collaborating with these agile companies, CNH Industrial can gain access to cutting-edge solutions more rapidly than through internal development alone.

Furthermore, CNH Industrial intends to engage in disciplined, margin-accretive mergers and acquisitions (M&A). These strategic moves will bolster the company's capabilities and competitive edge in critical technological domains. For instance, acquiring a company with advanced AI-driven analytics for precision agriculture could significantly enhance CNH Industrial's offerings.

- Partnerships with digital start-ups: CNH Industrial aims to integrate novel technologies into its product lines and operational processes.

- Margin-accretive M&A: Acquisitions will focus on targets that demonstrably improve profitability and market position.

- Accelerated innovation: Inorganic growth strategies are key to rapidly enhancing capabilities in areas like automation and connectivity.

Optimizing Dealer Network with Dual-Brand Strategy

CNH Industrial is optimizing its dealer network by implementing a dual-brand strategy, a move designed to significantly enhance customer satisfaction and expand its market presence. This approach allows for a more comprehensive product offering within a single dealership, potentially boosting sales efficiency and customer loyalty.

This strategic realignment is expected to streamline CNH Industrial's go-to-market operations. By offering a broader portfolio under a unified network, the company aims to capture a larger share of the market and improve its overall sales effectiveness.

- Enhanced Customer Experience: A single point of contact for multiple brands simplifies the purchasing and service process for customers.

- Broader Market Reach: Dual-brand dealerships can attract a wider customer base, catering to diverse needs with an expanded product line.

- Operational Efficiencies: Streamlined inventory management and shared resources across brands can lead to cost savings and improved profitability for dealerships.

- Sales Growth Potential: Offering a more complete solution can increase average transaction values and drive incremental sales.

CNH Industrial's strategic focus on precision agriculture presents a significant growth avenue, with the company aiming to double the sales contribution of these technologies in its agriculture segment. This aligns with a market trend showing increasing farmer adoption of advanced tools, as evidenced by the 19% year-over-year increase in CNH Industrial's Agriculture net sales in Latin America during 2024, a key emerging market.

The company is also leveraging strategic partnerships with technology start-ups and pursuing margin-accretive mergers and acquisitions to accelerate innovation in areas like automation and connectivity. This inorganic growth strategy is designed to rapidly enhance capabilities and gain a competitive edge in critical technological domains.

Furthermore, CNH Industrial's dual-brand dealer strategy is poised to boost customer satisfaction and market presence by offering a more comprehensive product portfolio, potentially leading to increased sales efficiency and loyalty.

Threats

CNH Industrial faces a significant threat from a prolonged downturn in its core agricultural and construction markets. The company anticipates that 2025 global industry retail sales for both agriculture and construction equipment will decline compared to 2024 figures. This projected slump in demand, fueled by persistently low commodity prices and elevated input costs for farmers, directly impacts CNH's revenue streams and overall profitability.

CNH Industrial faces a fierce competitive environment, with giants like John Deere and Caterpillar heavily investing in cutting-edge technology. This aggressive innovation by rivals poses a significant threat, potentially leading to a decline in CNH's market share.

The ongoing technological race, particularly in areas like precision agriculture and autonomous machinery, means CNH must continuously innovate to keep pace. Failure to do so could result in losing ground to competitors who are already capturing a larger portion of the market. For instance, John Deere's reported significant R&D spending in 2024 for advanced farming solutions directly challenges CNH's market position.

This intense rivalry inevitably puts downward pressure on pricing and profit margins. As competitors introduce more advanced and potentially cost-effective solutions, CNH may be forced to lower its prices to remain competitive, impacting its overall profitability and financial performance.

Global trade barriers, such as escalating tariffs and sanctions, directly threaten CNH Industrial's operational efficiency and financial performance. For instance, the ongoing trade disputes and geopolitical tensions in various regions can disrupt the flow of components and finished goods, increasing logistics costs and delivery times. In 2024, the International Monetary Fund (IMF) projected a slowdown in global trade growth due to these persistent uncertainties.

Supply Chain Disruptions and Production Challenges

CNH Industrial, like many in the manufacturing sector, faces ongoing risks from supply chain disruptions and production bottlenecks. These challenges, exacerbated by global events, can hinder the company's capacity to fulfill customer orders promptly and efficiently. For instance, in Q1 2024, CNH Industrial reported that supply chain issues, particularly related to component availability, continued to present headwinds, impacting production schedules for certain product lines.

These disruptions can directly translate into higher operational costs due to expedited shipping, premium pricing for scarce components, and the potential for idle production lines. Furthermore, delays in product delivery can damage customer relationships and lead to lost sales opportunities. The company's reliance on a global network of suppliers means that localized issues, such as port congestion or geopolitical instability in key manufacturing regions, can have a ripple effect across its entire production process.

The industry capacity constraints also play a significant role. As demand for agricultural and construction equipment remains robust, the ability of CNH Industrial and its suppliers to scale production quickly enough to meet this demand is a constant challenge. This can lead to longer lead times for customers and put pressure on CNH Industrial to manage inventory and production planning effectively.

- Supply Chain Vulnerabilities: CNH Industrial's global supply chain is susceptible to disruptions from geopolitical events, natural disasters, and trade policy changes, impacting component availability and logistics.

- Production Capacity: Meeting the growing demand for agricultural and construction machinery is constrained by existing production capacities and the ability to secure necessary raw materials and components.

- Increased Costs and Delays: Disruptions lead to higher input costs, increased transportation expenses, and extended delivery times, affecting profitability and customer satisfaction.

Rising Operating Costs and Margin Pressure

CNH Industrial faces persistent pressure from rising operating costs. Even with ongoing cost-saving measures, the company anticipates that reduced production and sales volumes will likely dampen segment margin performance. This is a significant concern as it directly impacts profitability.

Adding to this challenge, CNH Industrial is also contending with increased risk costs within its financial services division. Furthermore, unfavorable net price realization, meaning the prices they can achieve for their products are not as strong as hoped, can further squeeze the company's overall profit margins.

- Margin Erosion: Lower production and sales volumes are projected to negatively affect segment margins, despite cost-saving efforts.

- Financial Services Risk: An uptick in risk costs within the financial services segment adds another layer of profitability pressure.

- Pricing Challenges: Unfavorable net price realization directly impacts revenue and contributes to overall margin compression.

CNH Industrial is vulnerable to escalating raw material and component costs, which can significantly erode profit margins. For instance, the company has noted that persistent inflation in these areas, coupled with supply chain inefficiencies, continues to pose a challenge to its cost structure throughout 2024 and into 2025.

The company also faces the threat of regulatory changes and evolving emissions standards across different global markets. Adapting to these new regulations often requires substantial investment in research and development, which can strain financial resources and potentially impact product competitiveness if not managed effectively.

Furthermore, CNH Industrial operates in an industry sensitive to interest rate fluctuations. Higher interest rates can dampen demand for heavy equipment, as financing costs increase for customers, impacting sales volumes and the performance of its financial services segment.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from CNH Industrial's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's competitive landscape and operational performance.