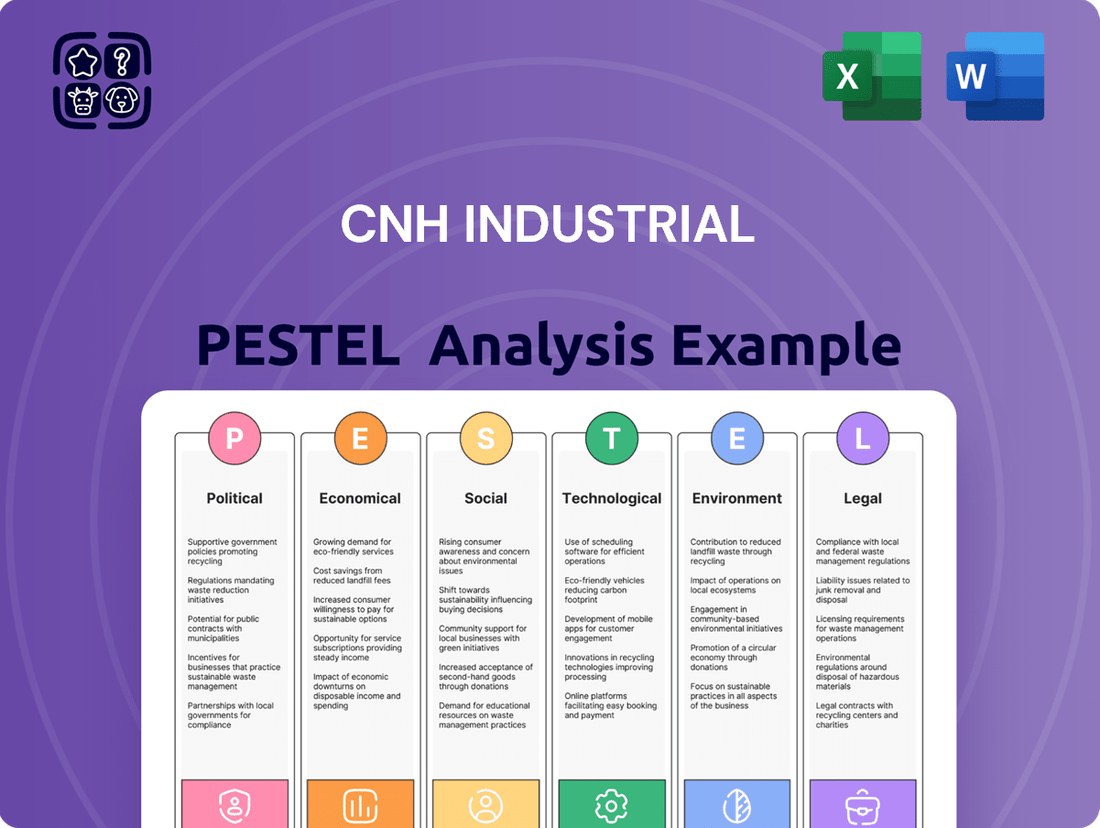

CNH Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

Uncover the intricate web of political, economic, social, technological, environmental, and legal forces shaping CNH Industrial's trajectory. Our expertly crafted PESTLE analysis provides the critical intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and equip yourself with actionable insights to navigate the complex global landscape.

Political factors

Government infrastructure spending is a significant tailwind for CNH Industrial. Major global initiatives, such as the U.S. Bipartisan Infrastructure Law, are injecting billions into projects like roads and bridges. Similarly, European nations are leveraging recovery plans, like Italy's PNRR, to fund extensive public works.

These substantial investments directly translate into increased demand for the heavy machinery CNH Industrial manufactures. For example, the U.S. infrastructure package alone is expected to support trillions in projects over the coming decade, creating a sustained need for construction equipment.

Global trade uncertainties and ongoing tariff discussions remain a significant concern for CNH Industrial. For instance, the lingering effects of past tariff actions, like those implemented by the Trump administration, continue to influence supply chain costs and product pricing. These policies directly impact CNH Industrial's ability to manage the cost of imported components and the competitiveness of its exported agricultural and construction equipment.

Government subsidies play a crucial role in bolstering the global agricultural sector, directly impacting CNH Industrial's agricultural machinery sales. These subsidies, covering everything from seeds and fertilizers to loans and equipment upgrades, create a more favorable environment for farmers. For instance, the USDA's various grant programs in the United States and India's extensive subsidy initiatives for agricultural inputs and machinery adoption significantly encourage farmers to invest in modern technologies. This increased purchasing power and demand for advanced equipment directly benefits companies like CNH Industrial.

Geopolitical Stability and Conflicts

Geopolitical instability, including ongoing conflicts like the war in Ukraine, presents significant headwinds for CNH Industrial. These events can cloud the economic forecast, potentially dampening production and short-term growth in crucial markets for the company. For example, the ongoing conflict has contributed to volatility in energy and raw material prices, impacting manufacturing costs for CNH Industrial and its customers.

Such instabilities directly disrupt global supply chains, a critical concern for an equipment manufacturer like CNH Industrial. These disruptions can lead to production delays and increased logistics costs. Furthermore, geopolitical tensions can erode business confidence, making companies hesitant to invest in new machinery, which directly affects CNH Industrial's sales pipeline.

- Supply Chain Disruptions: The war in Ukraine has exacerbated existing supply chain vulnerabilities, impacting the availability of key components and raw materials for agricultural and construction equipment manufacturers.

- Economic Uncertainty: Geopolitical conflicts contribute to broader economic uncertainty, potentially leading to reduced capital expenditure by CNH Industrial's customer base in affected regions.

- Shifting Demand: Global commodity demand can shift due to geopolitical events, influencing the need for agricultural machinery in different parts of the world.

Regulatory Environment for Vehicles

Political decisions concerning vehicle standards and emissions directly shape CNH Industrial's operations, especially for its commercial vehicles and powertrain divisions. Governments worldwide are increasingly focused on environmental protection and safety, leading to stricter mandates that CNH must navigate. For instance, the Euro 7 emissions standards, expected to be fully implemented in Europe by 2027, will require significant investment in new powertrain technologies for heavy-duty vehicles.

CNH Industrial's ability to adapt to these evolving regulatory frameworks is paramount for maintaining market access and product competitiveness. Failure to comply can result in penalties and lost market share. The company's 2024 financial reports indicate ongoing R&D expenditure aimed at meeting these stringent global emission targets, with a notable portion allocated to developing cleaner engine technologies.

- Stricter Emissions Standards: Regulations like Euro 7 in Europe necessitate advanced emission control systems, impacting powertrain development costs.

- Safety Mandates: Evolving safety regulations for commercial vehicles require integrated safety features, influencing vehicle design and electronic architecture.

- Government Incentives: Political support through subsidies for low-emission vehicles or alternative fuels can create market opportunities for CNH's sustainable solutions.

Government infrastructure spending remains a significant driver for CNH Industrial, with substantial global initiatives like the U.S. Bipartisan Infrastructure Law and Europe's recovery plans fueling demand for construction equipment. These public works projects, totaling trillions over the next decade, directly translate into increased orders for CNH's machinery.

Subsidies in the agricultural sector, such as those provided by the USDA and India, enhance farmer purchasing power for advanced machinery, directly benefiting CNH's agricultural equipment sales. However, geopolitical instability, like the war in Ukraine, creates economic uncertainty and disrupts supply chains, impacting manufacturing costs and customer investment decisions.

Evolving vehicle standards and emissions regulations, such as Europe's Euro 7, necessitate significant R&D investment for CNH Industrial to ensure compliance and maintain market access. While these regulations present challenges, political support through incentives for low-emission vehicles can also create new market opportunities.

| Political Factor | Impact on CNH Industrial | Supporting Data/Example |

| Infrastructure Spending | Increased demand for construction equipment | U.S. Bipartisan Infrastructure Law supporting trillions in projects over the next decade. |

| Agricultural Subsidies | Boosted sales of agricultural machinery | USDA grant programs and India's machinery adoption initiatives. |

| Geopolitical Instability | Supply chain disruptions, increased costs, reduced customer investment | War in Ukraine impacting energy and raw material prices; affecting manufacturing costs. |

| Emissions Regulations | Necessity for R&D investment in new powertrain technologies | Euro 7 standards in Europe requiring significant investment in cleaner engine technologies by 2027. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CNH Industrial, detailing their influence across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Offers a clear, actionable understanding of the external forces impacting CNH Industrial, simplifying complex market dynamics for strategic decision-making.

Economic factors

CNH Industrial experienced a challenging market in early 2024, with consolidated revenues declining. This downturn is largely attributed to decreased industry demand and a strategic effort by dealers to reduce inventory, impacting both agricultural and construction equipment sectors.

Despite these headwinds, the global agricultural machinery market is anticipated to see growth. However, the construction equipment market is projected to reach its lowest point in 2025. Analysts expect a recovery to begin in 2026, indicating a near-term contraction before an upturn.

Rising interest rates, particularly in the 2024-2025 period, are directly impacting CNH Industrial by increasing financing costs for both its dealers and end-customers. This makes purchasing new agricultural and construction machinery less affordable, potentially leading to a slowdown in sales volumes.

The company's financial services arm, crucial for offering competitive financing solutions, is consequently exposed to greater risk. Higher rates and a potential market slowdown necessitate increased provisioning for bad debts, which can negatively affect CNH Industrial's overall profitability and net income in the coming fiscal years.

Fluctuations in the cost of raw materials and energy significantly influence CNH Industrial's production expenses and overall profitability. For instance, while some commodity prices showed year-over-year improvement, the persistent rise in material costs has directly contributed to higher new equipment prices, reshaping market dynamics.

In 2024, the agricultural machinery sector, a key market for CNH Industrial, has seen continued pressure from these rising input costs. For example, steel prices, a critical component for manufacturing, experienced volatility throughout late 2023 and into early 2024, impacting the cost base for tractors and construction equipment.

Currency Exchange Rate Risks

CNH Industrial, operating globally, faces significant currency exchange rate risks. Fluctuations in foreign exchange markets can directly impact the company's reported earnings and overall equity value. For instance, a stronger US dollar against other currencies could reduce the reported value of sales made in those weaker currencies.

To manage this volatility, CNH Industrial actively employs derivative financial instruments. These hedging strategies are designed to protect a portion of the company's anticipated trading transaction exchange risk. This proactive approach aims to stabilize financial results and mitigate potential losses stemming from adverse currency movements.

- CNH Industrial's hedging strategy aims to protect against currency fluctuations impacting its global earnings.

- The company uses derivative financial instruments to mitigate exchange rate risks on forecasted transactions.

- Recent financial reports indicate ongoing efforts to manage the impact of currency volatility on reported results.

Dealer Inventory and Retail Demand

CNH Industrial has been strategically managing dealer inventory, aiming for a substantial reduction by the end of 2025 after experiencing elevated stock levels. This proactive approach is crucial for optimizing operational efficiency and responding to market dynamics.

The first quarter of 2025 saw a noticeable slowdown in retail demand across both the agriculture and construction sectors. This softer demand directly impacted CNH Industrial's production schedules, leading to adjustments in operating hours. For instance, the company reported a reduction in production hours in key manufacturing facilities to better align output with current market absorption rates.

- Inventory Reduction Goal: CNH Industrial is targeting a significant decrease in dealer inventory by the end of 2025.

- Q1 2025 Demand: Retail demand was subdued in early 2025.

- Production Adjustments: Production hours were reduced in agriculture and construction segments due to slower retail demand.

Economic headwinds are significantly shaping CNH Industrial's performance. Rising interest rates in 2024-2025 are increasing financing costs for dealers and customers, potentially dampening sales of agricultural and construction equipment. Furthermore, fluctuations in raw material and energy costs directly impact production expenses, as seen with volatile steel prices affecting tractor manufacturing in early 2024.

The global economic outlook presents a mixed picture for CNH Industrial. While the agricultural machinery market is expected to grow, the construction equipment sector is projected to hit a low in 2025 before a recovery begins in 2026. This anticipated contraction in construction demand will likely influence CNH Industrial's sales volumes and production planning.

Currency exchange rate volatility poses a notable risk to CNH Industrial's global earnings. A stronger US dollar, for example, could diminish the reported value of sales made in other currencies. To counter this, the company actively uses derivative financial instruments to hedge against these exchange rate risks on anticipated transactions.

| Economic Factor | Impact on CNH Industrial | Data/Trend (2024-2025) |

| Interest Rates | Increased financing costs, reduced affordability | Rising rates throughout 2024-2025 |

| Raw Material Costs | Higher production expenses, increased equipment prices | Volatile steel prices in late 2023-early 2024 |

| Currency Exchange Rates | Impact on reported earnings and equity value | Active use of hedging instruments to mitigate risk |

| Market Demand (Agri) | Anticipated growth | Continued pressure from input costs in 2024 |

| Market Demand (Construction) | Projected contraction, low in 2025 | Slowdown in retail demand in Q1 2025 |

Preview the Actual Deliverable

CNH Industrial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CNH Industrial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping CNH Industrial's industry landscape, enabling informed decision-making.

Sociological factors

A significant challenge facing the heavy equipment sector, including CNH Industrial, is the shortage of skilled operators. This global issue necessitates proactive measures, pushing companies to develop innovative training programs. For instance, CNH Industrial is actively addressing this by investing in advanced training technologies.

CNH Industrial is employing cutting-edge solutions like simulators and virtual reality to enhance the skills of its own workforce, as well as its customers and partners. This strategic approach ensures that individuals can effectively operate increasingly sophisticated machinery, bridging the skills gap and improving operational efficiency across the board.

Farmers and construction professionals are actively seeking advanced technologies to boost their productivity and operational efficiency. This trend is evident in the growing demand for precision agriculture and smart construction equipment, reflecting a clear shift towards data-driven operations.

CNH Industrial's strategy aligns perfectly with this, prioritizing customer-driven innovation and technological leadership. They are focusing on developing solutions that not only streamline complex tasks but also offer crucial data insights for better decision-making, while also aiming to minimize environmental impact.

For example, in 2024, CNH Industrial reported a significant increase in sales of its connected services and precision farming solutions, indicating strong customer adoption of these advanced technologies. This adoption is driven by the tangible benefits of improved yields, reduced input costs, and enhanced sustainability, all key concerns for modern agricultural and construction businesses.

Societies worldwide are increasingly prioritizing sustainability, directly impacting customer preferences for eco-friendly and energy-efficient machinery in sectors like agriculture and construction. This shift creates a significant demand for greener equipment.

CNH Industrial is responding by investing in the development of electric vehicles and alternative fuel technologies. For instance, in 2023, CNH Industrial's investments in sustainable solutions were a key part of their strategy to meet evolving market demands and environmental regulations, aiming to reduce the carbon footprint of their machinery.

Demographic Shifts in Agriculture

Demographic shifts are significantly reshaping agriculture. An aging farmer population, with the average age of farmers in the US reaching around 58 years old as of recent agricultural censuses, means there's a growing need for equipment that is not only efficient but also user-friendly and less physically demanding. This trend is compounded by increasing urbanization, drawing younger generations away from farming and further accentuating the labor shortage and the demand for advanced solutions.

CNH Industrial is responding to these demographic pressures by investing heavily in technologies designed to streamline agricultural operations. Their focus on automation, precision farming, and intuitive interfaces directly addresses the need for equipment that can be operated with less specialized training and reduced physical strain. For instance, advancements in autonomous tractors and robotic harvesting systems are being developed to mitigate labor challenges and make farming more accessible.

Key demographic trends impacting CNH Industrial's market include:

- Aging Workforce: The average age of farmers continues to rise, necessitating simpler and more ergonomic equipment designs.

- Urbanization: Rural-to-urban migration reduces the available agricultural labor pool, increasing the demand for labor-saving technologies.

- Demand for Automation: As the workforce shrinks and ages, there's a greater reliance on automated systems to maintain productivity and efficiency in farming operations.

Workplace Health and Safety Focus

CNH Industrial places a significant emphasis on workplace health and safety, recognizing its impact on employee well-being and operational efficiency. The company actively engages in programs designed to prevent diseases and disorders, fostering a healthier workforce. This commitment is underscored by their adoption of advanced technologies, such as AI-powered ergonomic work-analysis tools.

These AI tools are instrumental in capturing human movement patterns at workstations. By analyzing this data, CNH Industrial aims to proactively identify and mitigate risks associated with repetitive strain and other physical stressors. The ultimate goal is to reduce staff absences due to injury and improve overall safety performance across their operations.

- Disease and Disorder Prevention Programs: CNH Industrial invests in initiatives to safeguard employee health.

- AI-Powered Ergonomic Analysis: Utilizes artificial intelligence to study workstation movements and identify potential hazards.

- Reduced Staff Absences: Aims to decrease lost workdays by improving safety and preventing injuries.

- Enhanced Safety Culture: Fosters an environment where employee well-being is a top priority.

Societal shifts towards sustainability are driving demand for eco-friendly machinery, prompting CNH Industrial to invest in electric and alternative fuel technologies, as seen in their 2023 strategic focus on sustainable solutions to meet evolving market needs and environmental regulations.

Demographic trends, such as an aging farmer population averaging around 58 years old in the US, necessitate user-friendly and less physically demanding equipment, pushing CNH Industrial to prioritize automation and precision farming technologies to address labor shortages and enhance operational efficiency.

The global shortage of skilled operators is a critical challenge, with CNH Industrial actively investing in advanced training solutions like simulators and virtual reality to upskill its workforce and customers, ensuring proficiency with increasingly sophisticated machinery.

Societal emphasis on health and safety is evident in CNH Industrial's adoption of AI-powered ergonomic analysis tools to proactively identify and mitigate workplace physical risks, aiming to reduce staff absences and foster a safer operational environment.

Technological factors

CNH Industrial is doubling down on its investment in cutting-edge technologies, particularly in automation and precision agriculture. This strategic focus is driven by a commitment to achieve technology leadership in these key areas. By 2025, CNH Industrial aims to have nearly all its factory-fit and aftermarket precision technology solutions developed and produced in-house, underscoring a dedication to customer-inspired innovation.

CNH Industrial is actively integrating AI into its agricultural machinery, notably through its innovative AI-powered sprayer technology. This advanced system, deployed across brands like Case IH and New Holland, utilizes machine learning and sophisticated camera sensing to conduct real-time crop analysis.

The AI sprayer can accurately identify weeds and apply treatments with remarkable precision. This targeted approach not only optimizes the use of fertilizers and herbicides but also significantly reduces overall chemical consumption for farmers, contributing to more sustainable agricultural practices. For instance, by minimizing overspray, the technology can lead to substantial savings on input costs, a crucial factor for profitability in the 2024-2025 agricultural season.

CNH Industrial is actively investing in electrification and alternative fuels, introducing models like the electric backhoe loader and methane-powered tractors. This strategic move directly addresses the growing demand for sustainable, lower-emission machinery in both the agriculture and construction sectors, reflecting a significant industry trend toward decarbonization.

Digital Platforms and Connectivity

CNH Industrial is significantly investing in digital platforms to enhance customer connectivity and operational efficiency. Their FieldOps™ platform, for instance, allows farmers to manage their equipment and operations from a single interface, providing crucial data for better decision-making.

These digital solutions are not just about convenience; they deliver tangible benefits. By offering valuable data insights, CNH Industrial's platforms help customers optimize their farming practices, leading to improved performance and a reduced environmental footprint. This focus on digital transformation is a key technological driver for the company.

- Digital Platform Investment: CNH Industrial is increasing its investment in digital solutions like FieldOps™ to improve customer engagement and data utilization.

- Data-Driven Optimization: The digital tools provide actionable insights that help customers enhance operational performance and sustainability in agriculture.

- Connectivity Enhancements: Advancements in connectivity allow for real-time monitoring and management of agricultural machinery, boosting efficiency.

Advanced Manufacturing and Training Technologies

CNH Industrial is actively integrating advanced manufacturing and training technologies to enhance its operations and workforce capabilities. They are utilizing virtual reality (VR), augmented reality (AR), and sophisticated simulators to train employees, customers, and partners. This strategic adoption of immersive technologies is crucial for upskilling their global workforce and ensuring higher product quality.

These technological investments directly contribute to improved product development and testing. For instance, CNH Industrial's technology centers, such as the one in India, leverage these advanced tools to rigorously test and evaluate new products before market release. This focus on simulation and digital twin technology allows for early identification and correction of potential issues, leading to more robust and reliable machinery.

- VR/AR Training: CNH Industrial is implementing VR and AR for hands-on training modules, reducing the need for physical equipment and minimizing training time.

- Simulator Technology: Advanced simulators are used for operator training, allowing for practice in various scenarios and improving user proficiency with CNH Industrial equipment.

- Product Evaluation Centers: Technology hubs are crucial for virtual prototyping and performance testing, ensuring product excellence and innovation.

CNH Industrial's technological advancements are heavily focused on automation and precision agriculture, aiming for technology leadership by 2025 with a significant portion of precision tech developed in-house. The integration of AI, particularly in sprayer technology, allows for real-time crop analysis and precise application of treatments, optimizing resource use and reducing chemical consumption, which is a key benefit for farmers in the 2024-2025 season.

Electrification and alternative fuels are also central to CNH Industrial's strategy, with the introduction of electric and methane-powered machinery addressing the growing demand for sustainable, lower-emission equipment. Furthermore, the company is enhancing digital platforms like FieldOps™ to improve customer connectivity and provide data-driven insights for operational efficiency and sustainability.

CNH Industrial is also leveraging advanced manufacturing and training technologies, including VR and AR, to upskill its workforce and improve product quality. These investments in simulation and digital twin technology are crucial for rigorous product development and testing, ensuring the reliability of their machinery.

| Technology Area | CNH Industrial Focus | Impact |

|---|---|---|

| Automation & Precision Agriculture | In-house development of precision tech by 2025, AI-powered sprayers | Optimized resource use, reduced chemical consumption, enhanced crop yields |

| Electrification & Alternative Fuels | Electric backhoe loaders, methane-powered tractors | Lower emissions, sustainable operations, meeting decarbonization trends |

| Digital Platforms | FieldOps™ for equipment management and data insights | Improved customer connectivity, enhanced operational efficiency, data-driven decision-making |

| Advanced Manufacturing & Training | VR/AR for workforce upskilling, simulation for product testing | Higher product quality, improved operator proficiency, efficient product development |

Legal factors

CNH Industrial is navigating increasingly stringent environmental and emissions regulations globally. For instance, new engine emission standards, like those implemented in the European Union and North America, are compelling manufacturers to invest heavily in cleaner technologies. This directly impacts CNH's research and development, pushing for the creation of machinery that meets these evolving benchmarks.

In response, CNH Industrial is actively developing eco-friendly and energy-efficient equipment. This includes advancements in electric tractors and the integration of biofuel-compatible engines across its product lines. These initiatives are crucial for ensuring compliance and maintaining market access in regions with strict environmental mandates.

CNH Industrial must adhere to stringent product safety and certification standards worldwide, ensuring its agricultural and construction machinery meets critical safety benchmarks. For instance, in 2024, the European Union's Machinery Directive (2006/42/EC) continues to mandate comprehensive safety features for all new machinery placed on the market, directly impacting CNH's design and manufacturing processes.

Compliance with these regulations, such as those set by the Environmental Protection Agency (EPA) for emissions in the United States or specific safety certifications like ISO 13482 for personal care robots, is not just a legal necessity but a core element of product development. These standards protect operators and reduce liability, with failures often resulting in costly recalls and reputational damage, as seen in past industry incidents where non-compliance led to significant financial penalties.

CNH Industrial's global footprint, spanning 164 countries as of early 2024, necessitates meticulous navigation of diverse international trade laws, tariffs, and bilateral/multilateral agreements. For instance, the company must comply with varying import/export regulations and product standards in key markets like the European Union, North America, and South America.

Ensuring compliance with these intricate legal frameworks is paramount for maintaining supply chain integrity and securing market access. Failure to adhere to international trade regulations, such as those related to emissions standards or product safety, can result in significant penalties, customs delays, and reputational damage, directly impacting CNH Industrial's financial performance and operational efficiency.

Labor Laws and Workplace Regulations

CNH Industrial, with its global workforce exceeding 35,000 individuals, must meticulously navigate a complex web of labor laws and workplace regulations across all operating regions. This commitment is evident in their ongoing efforts to maintain high standards for occupational health and safety, ensuring fair working conditions and ethical employment practices. The company's dedication to preventing occupational diseases underscores its proactive approach to employee well-being.

Key legal considerations for CNH Industrial include:

- Compliance with International Labor Standards: Adherence to ILO conventions and national labor laws, covering aspects like minimum wage, working hours, and collective bargaining rights.

- Health and Safety Regulations: Implementing robust safety protocols and investing in training to minimize workplace accidents and prevent occupational illnesses, a critical area for manufacturing firms.

- Employment Practices: Ensuring fair hiring, non-discrimination, and equitable treatment of all employees, in line with evolving global expectations and legal frameworks.

- Data Privacy and Employee Records: Managing employee data in compliance with GDPR and similar data protection laws, safeguarding sensitive personal information.

Data Privacy and Digital Security Laws

CNH Industrial faces a complex legal landscape regarding data privacy and digital security as its operations increasingly rely on connected machinery and digital platforms. Compliance with regulations like the GDPR (General Data Protection Regulation) and similar data protection laws globally is paramount, especially concerning the vast amounts of sensitive information collected by precision agriculture technologies. Failure to secure this data can lead to significant fines and reputational damage.

The evolving nature of these laws requires continuous adaptation. For instance, the number of reported data breaches impacting industrial sectors has seen a steady rise, underscoring the critical need for robust cybersecurity measures. CNH Industrial must ensure its digital ecosystems are secure to protect customer data and maintain trust.

- Data Protection Compliance: Adherence to GDPR, CCPA, and other regional data privacy statutes is essential for CNH Industrial's global operations.

- Cybersecurity Mandates: Increasing regulatory focus on protecting critical infrastructure and sensitive industrial data necessitates strong cybersecurity frameworks.

- Connected Machinery Risks: The legal implications of data breaches or cyber-attacks on connected agricultural and construction equipment require careful management.

CNH Industrial must navigate a complex web of international trade laws, tariffs, and agreements across its 164 operating countries as of early 2024. Compliance with varying import/export regulations and product standards in key markets like the EU, North America, and South America is crucial for supply chain integrity and market access. Failure to adhere to these regulations can result in significant penalties and customs delays.

The company is also subject to stringent product safety and certification standards globally, such as the EU's Machinery Directive (2006/42/EC) in 2024, which mandates comprehensive safety features. Adherence to these standards, like ISO 13482, protects operators, reduces liability, and prevents costly recalls and reputational damage.

Furthermore, CNH Industrial's global workforce of over 35,000 individuals requires strict adherence to diverse labor laws and workplace safety regulations. This includes compliance with ILO conventions, ensuring fair employment practices, and managing employee data according to regulations like GDPR.

CNH Industrial's increasing reliance on connected machinery and digital platforms necessitates compliance with data privacy and cybersecurity mandates, such as GDPR and CCPA. The growing number of reported data breaches in industrial sectors highlights the critical need for robust cybersecurity measures to protect sensitive information and maintain customer trust.

Environmental factors

CNH Industrial is actively pursuing decarbonization, with a notable 25.4% year-over-year reduction in its Scope 1 and Scope 2 CO2 emissions achieved in 2024. This progress is a direct result of the company's commitment to implementing robust energy-saving measures across its worldwide facilities.

CNH Industrial is significantly advancing its renewable electricity adoption, with 70.4% of its total electricity consumption now sourced from green energy. This substantial commitment directly supports its environmental footprint reduction targets and aligns with broader global sustainability objectives. By prioritizing renewables, the company is actively contributing to a cleaner energy future.

CNH Industrial is making strides in waste reduction and embracing circular economy principles, particularly through its CNH Reman division. This focus on remanufacturing and reusing components not only minimizes waste but also conserves valuable resources.

In 2024, these efforts led to a significant reduction in raw material consumption, amounting to roughly 5,200 metric tons. Furthermore, the company saw a positive financial impact, with an 11% increase in spare parts net sales attributed to remanufactured components, demonstrating the economic viability of these sustainable practices.

Water Stewardship and Management

CNH Industrial demonstrates a significant commitment to water stewardship, with all 31 of its manufacturing facilities holding ISO 14001 certification. This certification mandates the implementation of robust water management plans across its operations.

These comprehensive plans are specifically designed to enhance the efficiency of water resource utilization and actively reduce overall water consumption at its global sites. This proactive approach aligns with increasing environmental regulations and stakeholder expectations for responsible water management.

- Global Water Management: All 31 CNH Industrial plants are ISO 14001 certified, indicating adherence to strict environmental management standards, including water stewardship.

- Resource Optimization: Water management plans focus on optimizing the use of water as a critical resource within manufacturing processes.

- Consumption Reduction: A key objective of these plans is to minimize water consumption across CNH Industrial's worldwide production facilities.

Development of Eco-Friendly Products

CNH Industrial is actively pursuing the development of eco-friendly products, a key environmental consideration. This commitment is evident in their introduction of electric vehicles, such as the CASE 580EV electric backhoe loader, which aims to reduce emissions in construction operations. The company is also focusing on precision agriculture technologies.

These agricultural advancements are designed to optimize resource utilization, thereby minimizing the environmental footprint of farming. This includes reducing the need for chemical applications and promoting more sustainable land management practices. CNH Industrial’s investment in these areas reflects a broader industry trend towards greener solutions.

- Electric Vehicle Innovation: CNH Industrial's CASE 580EV electric backhoe loader demonstrates a tangible step towards electrifying heavy equipment, reducing on-site emissions.

- Precision Agriculture Focus: The company is advancing technologies that enable farmers to use inputs like water and fertilizers more efficiently, leading to less waste and reduced environmental impact.

- Resource Optimization: By integrating advanced sensors and data analytics, CNH Industrial's agricultural machinery helps farmers apply resources precisely where and when they are needed, minimizing overuse and runoff.

- Sustainable Power Solutions: Beyond electrification, CNH Industrial is exploring alternative power sources and fuel-efficient designs across its product lines to meet evolving environmental regulations and customer demands.

CNH Industrial is making significant strides in reducing its environmental impact, evidenced by a 25.4% year-over-year decrease in Scope 1 and 2 CO2 emissions in 2024, driven by energy efficiency initiatives. The company is also prioritizing renewable electricity, with 70.4% of its total consumption now sourced from green energy, underscoring its commitment to sustainability.

Circular economy principles are being embraced, particularly through the CNH Reman division, which reduced raw material consumption by approximately 5,200 metric tons in 2024, while simultaneously boosting spare parts net sales by 11% from remanufactured components.

Water stewardship is a key focus, with all 31 manufacturing facilities holding ISO 14001 certification, ensuring robust water management plans are in place to optimize usage and reduce consumption across global operations.

The company is actively developing eco-friendly products, including the CASE 580EV electric backhoe loader, and advancing precision agriculture technologies to enhance resource efficiency and minimize the environmental footprint of farming operations.

| Environmental Metric | 2024 Performance | Key Initiatives |

|---|---|---|

| Scope 1 & 2 CO2 Emissions Reduction | 25.4% year-over-year | Energy-saving measures across facilities |

| Renewable Electricity Usage | 70.4% of total consumption | Prioritizing green energy sources |

| Raw Material Consumption Reduction (Reman) | Approx. 5,200 metric tons | CNH Reman division, circular economy principles |

| Water Management Certification | All 31 plants ISO 14001 certified | Robust water management plans, consumption reduction |

| Eco-Friendly Product Development | Electric vehicles (e.g., CASE 580EV) | Reducing emissions in construction, precision agriculture |

PESTLE Analysis Data Sources

Our PESTLE analysis for CNH Industrial is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.