CNH Industrial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

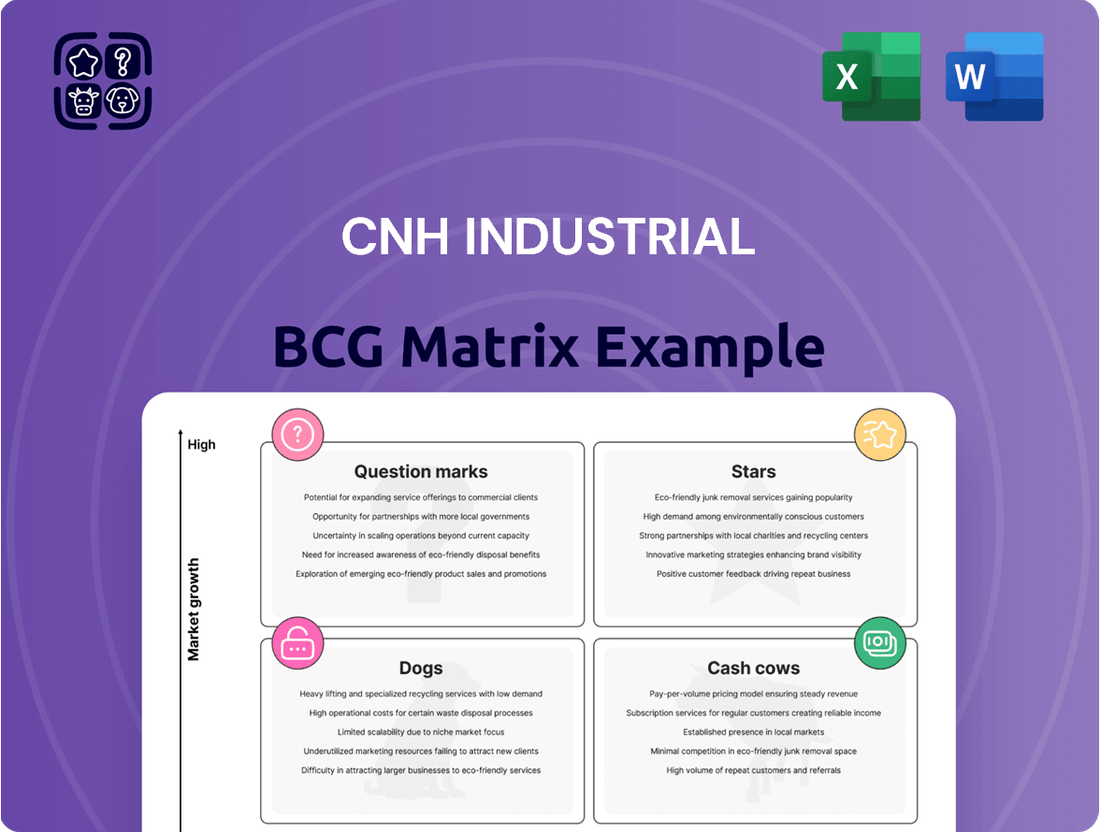

Curious about CNH Industrial's product portfolio performance? Our BCG Matrix analysis highlights which segments are driving growth and which require strategic attention. Understand their current market standing and identify potential opportunities for your investments.

This preview offers a glimpse into CNH Industrial's strategic positioning. Unlock the full BCG Matrix to receive detailed quadrant placements, actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and a clear roadmap for future capital allocation. Purchase the complete report for a comprehensive understanding and to inform your strategic decisions.

Stars

CNH Industrial is making significant strides in precision agriculture, pouring substantial investment into autonomous systems and data analytics. This strategic focus is crucial for their future expansion, aiming to nearly double precision technology sales as a proportion of total agricultural revenue by 2030. Remarkably, 90% of these cutting-edge technologies are being developed internally, underscoring their commitment to innovation and control over their technological roadmap.

CNH Industrial's 2024 launch of its next-generation twin and single rotor combines represents a strategic move to solidify its market leadership in harvesting technology. These innovative machines are engineered to deliver a compelling 15% reduction in total cost of ownership for farmers, a significant advantage in today's agricultural landscape.

CNH Industrial is undertaking a significant overhaul of its tractor lineup, set to roll out from 2026. This refresh spans a wide range of horsepower, from compact 20 HP models to powerful 700+ HP machines, ensuring a comprehensive offering across various agricultural needs.

This strategic move involves substantial investment in their foundational tractor products, integrating advanced technologies to enhance performance and efficiency. CNH Industrial aims to reinforce its standing in the competitive agricultural machinery market and capitalize on emerging growth opportunities through these updates.

Strategic Focus on 'Iron + Tech' Integration

CNH Industrial's strategic vision centers on a powerful fusion of 'Iron + Tech'. This means combining their robust, traditional machinery with advanced digital and technological innovations. The goal is to create superior products that offer enhanced performance and capabilities for customers in both agriculture and construction.

This integration is key to their competitive edge. By embedding cutting-edge technology into their heavy equipment, CNH Industrial aims to deliver world-class solutions. This forward-thinking approach is designed to drive innovation and maintain market leadership.

- Agricultural Advancements: Precision farming technologies, like automated steering and data analytics, are being integrated into tractors and harvesters to boost efficiency and yield for farmers.

- Construction Technology: In construction, CNH is focusing on telematics for fleet management, autonomous equipment operation, and advanced diagnostics to improve productivity and reduce downtime.

- Financial Impact: This 'Iron + Tech' strategy is expected to contribute to revenue growth, with digital services and connected equipment becoming increasingly important revenue streams. For example, in 2023, CNH reported net sales of $24.3 billion, with a significant portion driven by innovation in these areas.

Growth in Asia Pacific Agricultural Market

The Asia Pacific agricultural market presents a significant growth opportunity for CNH Industrial. Tractor demand in this region saw a robust increase, climbing 10% in the fourth quarter of 2024 and a further 12% in the first quarter of 2025, contrasting with declines in other global markets.

CNH Industrial can capitalize on this positive momentum, positioning its agricultural machinery segment in Asia Pacific as a 'Star' within its BCG Matrix. This strategic focus allows for increased investment in market share expansion and the introduction of a wider range of products tailored to regional needs.

- Asia Pacific tractor demand up 10% in Q4 2024.

- Asia Pacific tractor demand up 12% in Q1 2025.

- Regional growth contrasts with declines elsewhere.

- Opportunity to expand market share and product offerings.

CNH Industrial's agricultural segment in the Asia Pacific region is a prime candidate for the 'Star' classification in the BCG Matrix. The region experienced a substantial 10% increase in tractor demand during the fourth quarter of 2024, followed by another impressive 12% rise in the first quarter of 2025. This robust growth, particularly when contrasted with declines in other markets, signals a high-growth area where CNH Industrial can further solidify its position.

Given this strong market performance, CNH Industrial should strategically allocate additional resources to expand its market share and tailor its product portfolio to meet the specific demands of Asia Pacific customers. This proactive approach will leverage the current market dynamics for sustained growth and profitability.

The company's focus on integrating advanced technologies, such as precision agriculture and autonomous systems, aligns perfectly with the evolving needs of this burgeoning market. By doubling down on these innovative offerings, CNH Industrial can capture a larger share of this high-growth opportunity.

| Market Segment | Growth Rate (Q4 2024) | Growth Rate (Q1 2025) | BCG Classification |

|---|---|---|---|

| CNH Industrial - Agriculture (Asia Pacific) | 10% | 12% | Star |

| CNH Industrial - Agriculture (Global Average) | [Data Not Available] | [Data Not Available] | [Varies] |

What is included in the product

This BCG Matrix overview details CNH Industrial's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investment, holding, or divestment for each quadrant.

The CNH Industrial BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

CNH Industrial's Case IH and New Holland brands are the bedrock of its agricultural equipment segment, holding significant market share in a mature industry. These established names are critical cash cows, consistently generating substantial revenue and profits for the company, even amidst broader market fluctuations.

In 2024, CNH Industrial reported that its Agriculture segment, heavily influenced by these brands, continued to be a primary revenue driver. For instance, the company's net sales for the first quarter of 2024 reached $5.1 billion, with the Agriculture segment contributing a substantial portion, underscoring their role as reliable cash generators.

CNH Industrial's Financial Services segment is a classic Cash Cow, consistently delivering robust positive net income. This segment is vital for supporting CNH Industrial's dealer network and end customers by offering essential financing solutions that directly boost equipment sales.

In 2023, CNH Industrial's financial services division reported a net income of $516 million, highlighting its significant contribution to the company's overall profitability. This financial arm acts as a stable cash generator, ensuring that even during market downturns, customers can access the financing needed to purchase CNH Industrial's agricultural and construction equipment, thereby fostering loyalty.

CNH Industrial's aftermarket services and parts likely represent a significant Cash Cow. This segment typically offers high profit margins and generates consistent, stable revenue for heavy equipment manufacturers. The company's investment in customer service and predictive maintenance, as highlighted in their strategic priorities, strongly indicates a focus on nurturing this mature, cash-generating business.

Operational Excellence and Cost Savings Initiatives

CNH Industrial's dedication to operational excellence and cost savings is a key driver of its Cash Cow status. By the close of 2024, the company successfully achieved an impressive $600 million in cost savings through various efficiency programs.

These initiatives directly bolster profit margins and enhance cash flow generated from established business lines. This focus on optimizing existing operations ensures CNH Industrial can continue to fund investments in growth areas and maintain a strong financial position.

- $600 million in cost savings achieved by the end of 2024.

- Improved profit margins resulting from operational efficiency.

- Enhanced cash flow from existing, mature business segments.

- Strengthened financial stability supporting future strategic investments.

Global Dealer Network Strength

CNH Industrial boasts a formidable global dealer network, a critical asset that underpins its market presence and customer service. This extensive network acts as a powerful distribution channel, ensuring CNH's agricultural and construction equipment reaches customers efficiently and receives reliable support.

The company's strategic dual-brand dealer approach further solidifies this strength, allowing for broader market coverage and enhanced customer engagement. This integrated system is designed to generate consistent sales and provide dependable after-sales service, particularly in established, mature markets where brand loyalty and service quality are paramount.

For instance, CNH Industrial's Case IH and New Holland brands, supported by this widespread network, are key contributors to the company's stable cash flow. As of the first quarter of 2024, CNH Industrial reported a net sales increase of 13% year-over-year, reaching $5.1 billion, demonstrating the ongoing effectiveness of its operational strategies, including dealer network performance.

- Global Reach: CNH Industrial operates through approximately 4,000 dealers across more than 170 countries.

- Dual-Brand Strategy: The company leverages both Case IH and New Holland brands through its dealer network to maximize market penetration.

- Revenue Contribution: The agriculture segment, heavily reliant on this network, consistently contributes a significant portion of CNH Industrial's overall revenue. In Q1 2024, agricultural net sales were $3.1 billion, up 11% compared to Q1 2023.

- Service and Support: The dealer network provides essential after-sales service, parts availability, and financing options, fostering customer retention and repeat business.

CNH Industrial's established agricultural brands, like Case IH and New Holland, are prime examples of its cash cows. These brands dominate mature markets, consistently generating substantial and reliable profits for the company. Their strong market position allows them to contribute significantly to CNH Industrial's overall financial health.

The company's Financial Services segment is another key cash cow, providing essential financing that supports equipment sales and generates robust positive net income. This segment's stability is crucial, especially during economic downturns, ensuring continued customer access to CNH Industrial's products.

Aftermarket services and parts also function as a significant cash cow, characterized by high profit margins and predictable revenue streams. CNH Industrial's focus on operational excellence, including achieving $600 million in cost savings by the end of 2024, further enhances the profitability of these mature business lines.

| Business Segment | BCG Category | Key Characteristics | 2024 Data Point |

| Agriculture (Case IH, New Holland) | Cash Cow | High market share in mature industry, consistent revenue generation. | Agriculture net sales of $3.1 billion in Q1 2024, up 11% YoY. |

| Financial Services | Cash Cow | Provides financing, high profit margins, stable net income. | Net income of $516 million in 2023. |

| Aftermarket Services & Parts | Cash Cow | High profit margins, stable and predictable revenue. | Contributes to enhanced cash flow from existing operations. |

Preview = Final Product

CNH Industrial BCG Matrix

The CNH Industrial BCG Matrix preview you're viewing is the exact, unwatermarked report you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, detailing CNH Industrial's product portfolio across stars, cash cows, question marks, and dogs, is meticulously prepared for your business planning needs. You can confidently use this preview as a direct representation of the final, fully editable document that will be delivered to you, ensuring no surprises and full value for your investment.

Dogs

North American combine sales saw a steep drop, with a 33% decrease in the fourth quarter of 2024 and a further 51% decline in the first quarter of 2025. This significant downturn in a crucial agricultural equipment sector, occurring alongside a broader market contraction, strongly indicates that this product line within this region is currently positioned as a 'Dog' in the BCG Matrix. This classification stems from its low market share coupled with negative growth prospects.

CNH Industrial's North American tractor segment, specifically units exceeding 140 horsepower, is currently positioned as a Dog in the BCG Matrix. Sales experienced a significant downturn, dropping 34% in the fourth quarter of 2024 and a further 24% in the first quarter of 2025.

This sharp decline in demand suggests a struggling market for these high-horsepower tractors in North America. If this downward trend persists, CNH Industrial may need to consider strategic options, including potential divestiture or a thorough re-evaluation of its product strategy in this segment.

The overall construction equipment segment is currently facing significant headwinds, impacting CNH Industrial's performance. CNH Industrial's construction net sales saw a substantial decrease of 33% in Q4 2024 and continued to decline by 22% in Q1 2025, reflecting challenging market conditions.

Despite CNH Industrial's strategic initiatives aimed at revitalizing this sector, the current market environment and recent sales figures place the construction equipment segment firmly in the 'Dog' category for the short term. This classification stems from its low market share and low growth prospects in the immediate future.

EMEA Tractor and Combine Demand

Demand for tractors in the EMEA region saw a notable downturn, with a 6% decrease in the fourth quarter of 2024 and a steeper 23% drop in the first quarter of 2025. This persistent decline indicates that the tractor market in EMEA is currently facing significant headwinds.

Similarly, the combine harvester market in EMEA experienced a substantial contraction. Demand fell by 31% in Q4 2024 and continued its downward trajectory with a 34% decrease in Q1 2025. These figures highlight a struggling market for combine harvesters in the region.

- Tractor Demand Decline (EMEA): -6% in Q4 2024, -23% in Q1 2025.

- Combine Demand Decline (EMEA): -31% in Q4 2024, -34% in Q1 2025.

- Market Status: Both product categories in EMEA are currently considered Dogs in the BCG Matrix due to consistent negative demand trends.

South American Combine Demand

South American combine demand experienced a notable downturn, falling by 21% in the fourth quarter of 2024. This decline contrasts with a 10% increase in tractor demand during the same period.

While there was a slight uptick of 1% in combine demand in Q1 2025, the overarching negative trend suggests this product line might be classified as a 'Dog' within CNH Industrial's portfolio. The inconsistency in performance indicates a struggle for sustained market traction in the region.

- South American Combine Demand Q4 2024: -21%

- South American Tractor Demand Q4 2024: +10%

- South American Combine Demand Q1 2025: +1%

- Implication: Potential 'Dog' product line due to inconsistent demand trends.

CNH Industrial's North American combine and high-horsepower tractor segments are currently classified as Dogs. This is due to significant sales declines of 33% and 34% respectively in Q4 2024, followed by further drops of 51% and 24% in Q1 2025. The construction equipment segment also shows 'Dog' characteristics with a 33% sales decrease in Q4 2024 and a 22% drop in Q1 2025.

| Product Segment | Region | Q4 2024 Change | Q1 2025 Change | BCG Classification |

|---|---|---|---|---|

| Combine Harvesters | North America | -33% | -51% | Dog |

| Tractors (>140 HP) | North America | -34% | -24% | Dog |

| Construction Equipment | Global | -33% | -22% | Dog |

| Tractors | EMEA | -6% | -23% | Dog |

| Combine Harvesters | EMEA | -31% | -34% | Dog |

| Combine Harvesters | South America | -21% | +1% | Dog (potential) |

Question Marks

CNH Industrial is actively investing in electric and alternative fuel vehicles, aligning with its broader sustainability goals. However, these represent nascent markets where CNH's market share is yet to be firmly established.

These vehicle segments are considered 'question marks' within the BCG framework. They necessitate substantial capital outlay to achieve widespread market adoption and reach profitability, reflecting the inherent risks and uncertainties of pioneering new technologies.

CNH Industrial's investment in digital platforms like FieldOps™ positions them for future growth, aligning with their strategy to lead in agricultural and construction technology. These platforms are designed to enhance operational efficiency and data-driven decision-making for customers.

While the potential is significant, the market adoption and revenue generation from these new digital services are still in their nascent stages. This places them in a position requiring substantial ongoing investment to demonstrate their value proposition and achieve critical mass in user engagement and monetization.

CNH Industrial's SenseApply and IntelliSense technologies represent a significant advancement in agricultural spraying, leveraging AI and camera sensing for highly precise application. This innovation targets a growing demand for efficiency and sustainability in farming. The company is investing heavily in this area, recognizing its potential to disrupt traditional spraying methods.

As a relatively new offering, CNH Industrial's AI-powered sprayer technology falls into the 'Question Mark' category of the BCG matrix. While the market for precision agriculture is expanding rapidly, with projections suggesting continued strong growth through 2024 and beyond, the actual market penetration and established profitability of these specific AI systems are still developing. CNH Industrial is actively working to scale production and adoption.

Expansion into Emerging Markets (e.g., specific South American and Asia Pacific segments)

CNH Industrial's strategic push into emerging markets like South America and parts of the Asia Pacific presents a classic BCG "question mark" scenario. While these regions offer significant long-term growth prospects, CNH's current market share for its specific product lines in these areas might be relatively low, necessitating substantial investment to gain traction.

For instance, in 2024, CNH Industrial continued to focus on expanding its dealer network and product offerings in key South American agricultural markets, aiming to capitalize on growing demand for advanced farming equipment. Similarly, in the Asia Pacific, the company has been introducing new construction machinery models tailored to local needs, targeting infrastructure development projects. These efforts are crucial for building brand recognition and securing a competitive edge in these dynamic, yet challenging, environments.

- High Growth Potential: Emerging economies in South America and Asia Pacific are experiencing robust GDP growth and increasing demand for agricultural and construction machinery, driven by urbanization and infrastructure development.

- Low Market Share: Despite growth, CNH Industrial's market share for specific, newly introduced product lines in these regions may still be nascent, reflecting the early stages of market penetration.

- Targeted Investment: Capturing market share in these competitive emerging markets requires significant, focused investment in dealer networks, localized product development, marketing, and after-sales support.

- Strategic Importance: Success in these question mark segments is vital for CNH Industrial's long-term global diversification and revenue growth strategy, offsetting potential slowdowns in more mature markets.

Strategic Acquisitions for Capability Building (e.g., Raven Industries, Sampierana)

CNH Industrial's acquisition of Raven Industries for approximately $2.1 billion in 2021 was a significant step to bolster its precision agriculture capabilities. This move aimed to integrate advanced sensing, GPS, and automation technologies directly into CNH's agricultural equipment, enhancing efficiency and yield for farmers.

The Sampierana acquisition, focusing on mini and midi excavators, strengthened CNH's construction equipment portfolio, particularly in the compact machinery segment. This acquisition allows CNH to compete more effectively in a growing market for smaller, versatile construction tools.

- Raven Industries: Enhanced precision farming solutions, including autonomous operations and data management.

- Sampierana: Expanded compact excavator offerings, targeting urban construction and landscaping.

- Integration: Full market impact and new product integration are ongoing processes, requiring continued investment and development.

- Future Growth: These acquisitions position CNH Industrial to capture emerging trends in automation and specialized equipment markets.

CNH Industrial's ventures into electric and alternative fuel vehicles, alongside its AI-driven precision agriculture technologies like SenseApply, represent significant 'question marks'. These areas demand substantial investment to capture market share in rapidly evolving sectors. Similarly, its expansion into burgeoning markets in South America and Asia Pacific requires dedicated capital to build brand presence and dealer networks.

The company's strategic acquisitions, such as Raven Industries for precision agriculture and Sampierana for compact excavators, are also in this category. While these moves bolster CNH's capabilities and market reach, their full integration and market impact are still developing, necessitating ongoing investment and strategic execution to realize their full potential.

These 'question mark' segments are crucial for CNH Industrial's future growth and diversification. Successfully navigating these areas will require sustained financial commitment and astute market strategies to convert potential into established market leadership.

| CNH Industrial Question Marks | Market Growth Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| Electric & Alternative Fuel Vehicles | High (driven by sustainability mandates) | Nascent | High (R&D, production scaling) | Technology development, market penetration |

| AI-Powered Sprayer Technology (SenseApply) | Very High (precision agriculture demand) | Developing | High (scaling, customer adoption) | Product refinement, farmer education |

| Emerging Markets (South America, Asia Pacific) | High (economic development) | Low to Moderate (for specific product lines) | Significant (dealer networks, localization) | Market entry, brand building |

| Raven Industries Integration | High (data-driven farming) | Growing | Ongoing (technology integration) | Leveraging acquired capabilities |

| Sampierana Integration | Moderate to High (compact construction) | Growing | Ongoing (product line expansion) | Strengthening construction segment |

BCG Matrix Data Sources

Our CNH Industrial BCG Matrix is built on robust data, integrating financial disclosures, market growth analyses, and industry expert insights.