China Merchants Shekou Industrial Zone Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Shekou Industrial Zone Holdings Bundle

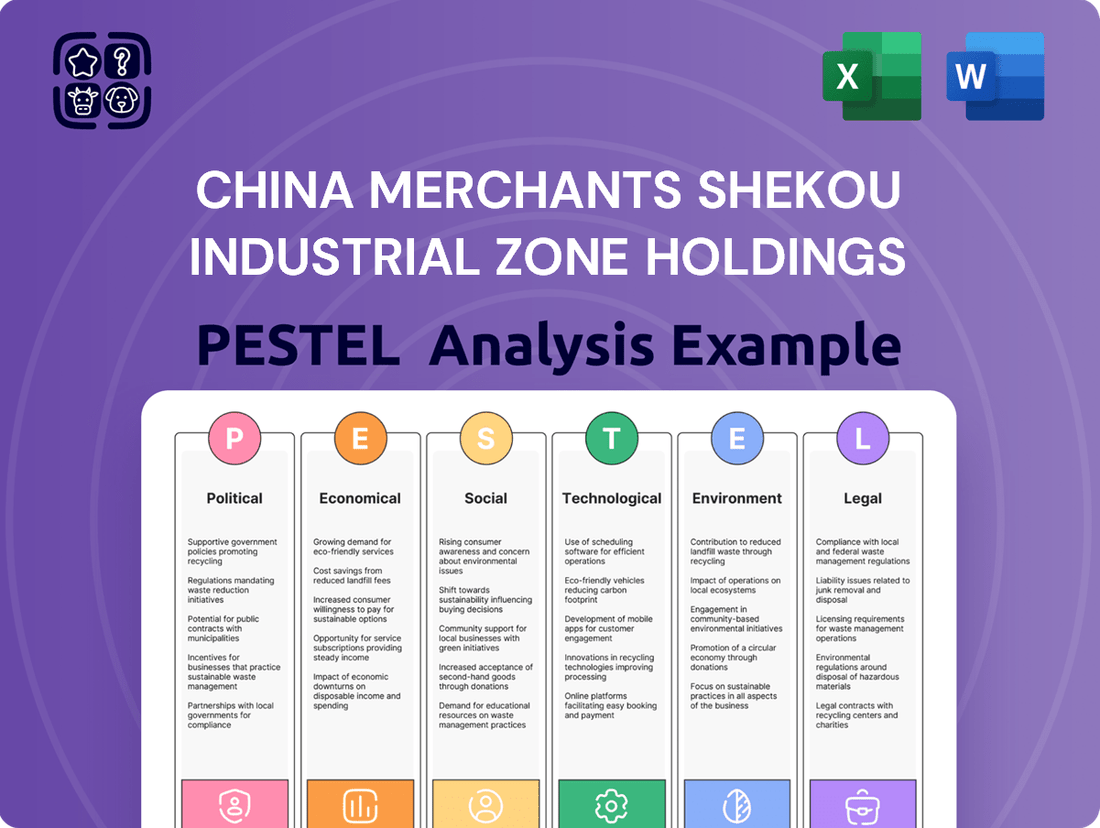

Uncover the critical political, economic, social, technological, legal, and environmental forces impacting China Merchants Shekou Industrial Zone Holdings. Our PESTEL analysis provides a comprehensive overview of these external factors, offering actionable intelligence for strategic planning. Gain a competitive edge by understanding these dynamics. Download the full version now for an in-depth look.

Political factors

The Chinese government is actively supporting the real estate sector, aiming to stabilize the market through policies designed to increase housing demand and manage high inventory. These initiatives are projected to foster a gradual recovery, with a more significant turnaround not fully expected until late 2025.

As a prominent urban developer, China Merchants Shekou Industrial Zone Holdings is well-positioned to capitalize on these government-backed policy tailwinds, which are anticipated to offer a modest uplift to market conditions.

The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) initiative, a cornerstone of China's national strategy, continues to drive significant development, aiming to boost connectivity and establish an international innovation hub. China Merchants Shekou's operations are intrinsically linked to the GBA's ambitious legislative agenda and development blueprints for the 2024-2027 period, influencing its strategic direction.

In 2023, the GBA saw substantial investment, with total retail sales of consumer goods reaching approximately 13.5 trillion yuan, highlighting the region's economic dynamism and potential for companies like China Merchants Shekou.

China's urbanization policy is moving away from simply building more cities and towards making them better places to live, focusing on quality and efficiency. This new approach, often called 'people-centered urbanization,' means cities will increasingly depend on smart technology, data analysis, and effective management to grow. This aligns perfectly with China Merchants Shekou's mission to develop well-rounded urban areas and create communities where people thrive.

Emphasis on Urban Renewal Projects

The Chinese government's strong focus on urban renewal projects, with a target to renovate old urban residential communities by 2025, directly benefits companies like China Merchants Shekou. This policy aims to optimize the utilization of existing urban infrastructure and elevate living standards for citizens. Such initiatives create significant opportunities for China Merchants Shekou to engage in the revitalization of urban areas and improve land use efficiency. By 2023, China had already made substantial progress, with many cities reporting completion rates exceeding 80% for their planned urban renewal projects, indicating a robust pipeline of future development opportunities.

These urban renewal efforts are not just about aesthetics; they are a strategic move to boost domestic consumption and stimulate economic growth. The renovation of older neighborhoods often involves upgrading utilities, improving public spaces, and sometimes incorporating commercial and residential mixed-use developments. This presents a direct avenue for China Merchants Shekou to leverage its expertise in property development and management.

Key aspects of this political emphasis include:

- Government Mandate: The directive to complete urban residential renovations by 2025 underscores a clear political will and commitment to this sector.

- Economic Stimulus: Urban renewal projects are viewed as a key driver for economic activity, creating jobs and boosting related industries.

- Improved Livability: Enhancing the quality of life for residents in older urban areas is a stated objective, aligning with broader social development goals.

- Land Use Optimization: The policy encourages more efficient use of prime urban land, which is a core competency for China Merchants Shekou.

International Trade Relations and Shipping Tariffs

Recent US actions, including proposed fees on Chinese-owned, operated, and built vessels docking at US ports starting October 2025, present a significant political factor for China Merchants Shekou Industrial Zone Holdings. These tariffs, though subject to specific exemptions, are poised to introduce additional operational costs and logistical complexities for the company's extensive port and shipping operations. This development could directly affect the profitability and efficiency of its international maritime trade services.

The imposition of such tariffs underscores the evolving nature of international trade relations and the potential for politically motivated trade barriers. For China Merchants Shekou, this means navigating a landscape where geopolitical tensions can directly translate into financial implications. The company’s reliance on global shipping routes makes it particularly vulnerable to these policy shifts.

- US Port Fees: Potential implementation of fees on Chinese-affiliated vessels arriving at US ports from October 2025.

- Cost Impact: Tariffs could increase operational expenses for China Merchants Shekou's shipping and logistics divisions.

- Trade Complexity: New regulations add layers of administrative and financial challenges to international maritime trade.

- Geopolitical Sensitivity: The company's business model is exposed to fluctuations in US-China trade relations.

The Chinese government's continued support for the real estate sector, with a focus on stabilizing the market and increasing housing demand, presents a favorable political climate. Initiatives like the Guangdong-Hong Kong-Macao Greater Bay Area development plan are strategically designed to foster economic integration and innovation, directly benefiting urban developers like China Merchants Shekou. Furthermore, the national push for urban renewal projects, aiming to upgrade existing residential areas by 2025, creates substantial opportunities for the company to leverage its expertise in revitalizing urban landscapes and improving land use efficiency.

However, potential US tariffs on Chinese-owned vessels docking at US ports from October 2025 introduce a significant political risk. These tariffs could increase operational costs and create logistical hurdles for China Merchants Shekou's extensive port and shipping operations, impacting its international trade services. This highlights the company's exposure to the evolving geopolitical landscape and the potential for trade barriers to directly affect its financial performance.

| Policy/Initiative | Impact on China Merchants Shekou | Timeline/Status |

|---|---|---|

| Real Estate Market Stabilization Policies | Potential for gradual market recovery and increased housing demand | Ongoing, with significant turnaround not fully expected until late 2025 |

| Guangdong-Hong Kong-Macao Greater Bay Area (GBA) Initiative | Strategic alignment with national development plans, driving urban development opportunities | Ongoing, with ambitious legislative agenda and development blueprints for 2024-2027 |

| Urban Renewal Projects | Direct benefit from government focus on renovating old urban residential communities | Target to complete renovations by 2025; over 80% completion in many cities by 2023 |

| US Port Fees on Chinese Vessels | Potential increase in operational costs and logistical complexities for shipping operations | Proposed to start October 2025 |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting China Merchants Shekou Industrial Zone Holdings, providing a comprehensive understanding of its operating landscape.

It offers actionable insights for strategic decision-making by highlighting key external drivers and their implications for the company's future growth and risk management.

A PESTLE analysis of China Merchants Shekou Industrial Zone Holdings provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during strategic planning and decision-making.

Economic factors

China's economic growth is expected to moderate, with projections for 2025 generally falling between 4.5% and 4.9%. This slowdown is largely attributed to weaker domestic consumer demand, a key driver of economic activity.

In an effort to counter this trend, Chinese policymakers are implementing a moderately loose monetary policy. This includes a more proactive fiscal approach, with potential interest rate adjustments and increased government spending aimed at stimulating economic activity and ensuring market stability.

The property market remains a considerable headwind for China's economy, with ongoing contractions in real estate investment. Policy interventions are in place to support housing demand and clear excess inventory, but a substantial recovery isn't expected before the latter half of 2025.

China Merchants Shekou's financial results for 2024 reflected this challenging environment, showing a dip in gross margin and increased asset impairments. However, the company's early 2025 cumulative sales performance indicated resilience, outperforming the general market trend.

Chinese consumers are adopting a more prudent approach to spending, prioritizing tangible value and necessity over discretionary purchases. This shift is largely influenced by concerns over income stability and asset depreciation, rather than a general lack of optimism.

Income growth expectations for 2025 are notably subdued, contributing to this cautious sentiment. For instance, while specific projections vary, many surveys indicate a moderation in anticipated income increases compared to previous years, directly impacting household spending power.

Persistent job insecurity and the ongoing decline in property values are significant headwinds for consumer confidence. This environment encourages a focus on essential goods and services, and a preference for experiences that offer lasting value, marking a departure from earlier trends of conspicuous consumption.

Shifting Investment Landscape

The investment landscape in China is undergoing a significant transformation. While traditional real estate investment has seen a contraction, there's a notable and sustained growth in manufacturing and infrastructure sectors. This shift presents both challenges and new avenues for companies involved in urban development.

Government initiatives are actively shaping this evolving investment environment. The issuance of special-purpose bonds and a renewed focus on asset revitalization are injecting fresh structural opportunities, particularly into commercial real estate. These developments can create indirect benefits for integrated urban development service providers, such as China Merchants Shekou Industrial Zone Holdings, by fostering demand for their expertise in transforming and managing revitalized assets.

- Manufacturing Investment Growth: China's fixed asset investment in manufacturing saw a year-on-year increase of 7.1% in the first four months of 2024, indicating robust expansion in this sector.

- Infrastructure Investment Momentum: Infrastructure investment also demonstrated resilience, growing by 4.2% year-on-year during the same period, underscoring continued state support for development.

- Special-Purpose Bond Issuance: In 2024, China planned to issue 1 trillion yuan in special-purpose bonds to support infrastructure and key projects, a significant fiscal tool for driving investment.

- Asset Revitalization Focus: Government policies encouraging the revitalization of existing assets and industrial parks are creating new opportunities for urban renewal and commercial real estate development.

Regional Economic Disparities and Opportunities

China's economic landscape is marked by significant regional disparities, with lower-tier cities emerging as key growth drivers. These cities are witnessing a burgeoning middle class, fueling new consumption patterns and presenting untapped potential for development.

For China Merchants Shekou, this translates into strategic opportunities. The company can tailor its residential and commercial property offerings to meet the evolving demands of these expanding urban centers, capitalizing on their growth trajectory.

- Lower-tier cities are projected to contribute a substantial portion of China's future consumption growth.

- The expansion of the middle class in these regions is driving demand for upgraded housing and modern commercial spaces.

- China Merchants Shekou can leverage these trends by diversifying its project portfolio beyond major metropolitan areas.

China's economic growth is expected to see a slight moderation in 2025, with forecasts generally landing between 4.5% and 4.9%, driven by a recalibration of domestic consumer demand. Policymakers are employing a moderately loose monetary and proactive fiscal strategy, including potential interest rate adjustments and increased government spending, to bolster economic activity and ensure stability amidst these shifts. The property sector continues to present challenges, with ongoing contractions in real estate investment, though policy interventions aim to support housing demand and clear inventory, with a substantial recovery anticipated later in 2025.

| Economic Indicator | 2024 (Actual/Projected) | 2025 (Projected) | Key Drivers/Implications for China Merchants Shekou |

|---|---|---|---|

| GDP Growth Rate | ~5.0% | 4.5%-4.9% | Moderating growth may impact overall demand for property and urban development services. |

| Consumer Spending | Cautious, prioritizing essentials | Continued prudence, focus on value | Shift in consumer preferences requires adaptation in product offerings and marketing. |

| Manufacturing Investment | +7.1% (Jan-Apr 2024) | Sustained growth expected | Growth in manufacturing can indirectly boost demand for industrial park development and related infrastructure. |

| Infrastructure Investment | +4.2% (Jan-Apr 2024) | Steady growth | Continued infrastructure spending supports urban development projects and connectivity. |

| Property Market Investment | Contraction | Stabilization expected H2 2025 | Challenges in the property market necessitate strategic adjustments and focus on asset revitalization. |

Preview Before You Purchase

China Merchants Shekou Industrial Zone Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Merchants Shekou Industrial Zone Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external influences shaping the company's strategic landscape.

Sociological factors

China's urbanization continues its brisk advance, with the rate hitting 67% in 2024, signaling ongoing migration to urban centers. This trend presents both opportunities for development and challenges in managing growing city populations.

However, significant demographic shifts are simultaneously altering the landscape. A shrinking working-age population and a progressively aging workforce are creating new dynamics in the labor market and influencing the structure of urban areas.

For China Merchants Shekou Industrial Zone Holdings, understanding and adapting to these evolving demographic patterns is crucial for effective urban planning and sustainable community development initiatives.

Chinese consumers are increasingly prioritizing value and personal fulfillment over overt displays of wealth. This shift means developers like China Merchants Shekou need to focus on creating communities that offer more than just a physical space, emphasizing livability and sustainability to meet these evolving lifestyle needs.

For instance, the demand for experiential retail and flexible living arrangements is growing. In 2024, reports indicated a significant rise in spending on travel and leisure activities, suggesting a broader trend where consumers allocate resources towards experiences rather than solely material possessions.

China's government is prioritizing 'people-centered urbanization,' a policy that directly supports China Merchants Shekou's focus on creating livable and sustainable communities. This national directive aims to elevate the quality and efficiency of urban living across the country, encouraging developments that enhance resident well-being.

This focus extends beyond new construction to include the vital renovation of existing residential areas. By investing in the upgrade of older neighborhoods, the government, and by extension companies like China Merchants Shekou, are working to improve the overall quality of life for a broader segment of the population.

Impact of Housing Affordability and Wealth Effects

Falling property prices and sluggish income growth in China have significantly dampened consumer confidence and wealth effects. For instance, China's national average home prices saw a year-on-year decline of 1.4% in the first quarter of 2024, according to the National Bureau of Statistics. This downturn directly impacts household balance sheets, as real estate often represents a substantial portion of Chinese wealth.

Government interventions aimed at stabilizing the property market are crucial for influencing demand. Policies focusing on housing affordability, such as reduced down payment requirements and lower mortgage rates, are designed to boost purchasing power. In early 2024, several major cities lowered mortgage interest rates, with some provincial capitals seeing rates fall below 3% for first-time homebuyers.

- Property Market Downturn: National average home prices declined 1.4% year-on-year in Q1 2024.

- Consumer Confidence Impact: Reduced wealth from falling property values negatively affects spending.

- Government Intervention: Policies like lower mortgage rates aim to stimulate housing demand and affordability.

- Purchasing Power: Affordability measures are key to unlocking potential homeowner demand.

Labor Market Dynamics and Talent Attraction

China's labor market is undergoing significant shifts, with a growing emphasis on specialized skills and a rise in job insecurity for some sectors. This transformation demands that companies like China Merchants Shekou develop agile approaches to talent acquisition and management. For instance, the demand for professionals in areas like smart city development and advanced logistics is projected to climb, requiring continuous upskilling initiatives.

Attracting and retaining top-tier talent is paramount for China Merchants Shekou's continued success in its diverse business segments, including urban development, port operations, and digital parks. The company's ability to secure individuals with expertise in areas such as AI-driven port management or sustainable urban planning will directly impact its innovation capacity and operational efficiency.

Key considerations for China Merchants Shekou in this evolving labor landscape include:

- Talent Demand: Increasing need for professionals in high-tech fields like AI, big data analytics, and green building technologies.

- Skills Gap: Addressing the mismatch between available workforce skills and the evolving requirements of modern industries.

- Retention Strategies: Implementing competitive compensation, career development opportunities, and a positive work environment to retain skilled employees.

- Gig Economy Influence: Adapting to the rise of flexible work arrangements and the gig economy to tap into specialized talent pools.

Chinese society is increasingly prioritizing quality of life and community well-being, with a growing demand for green spaces and sustainable living environments. This aligns with China Merchants Shekou's focus on creating livable, people-centered urban developments.

The aging population, with the proportion of those aged 65 and above reaching 15.4% in 2023, presents both a need for specialized eldercare facilities and a potential shift in consumer spending towards services that support a higher quality of life for seniors.

Furthermore, the evolving consumer preference for experiences over material goods, evident in the 2024 surge in travel and leisure spending, indicates a market ripe for integrated developments that offer diverse amenities and lifestyle opportunities.

China Merchants Shekou must adapt its offerings to cater to these demographic and lifestyle shifts, focusing on creating communities that foster well-being, cater to an aging population, and provide rich experiential offerings.

Technological factors

Technological advancements are fundamentally reshaping urban development, with knowledge, data, and technology becoming paramount. China Merchants Shekou, deeply involved in digital park services, is strategically placed to harness these changes. The company can leverage cutting-edge smart city technologies, artificial intelligence, and sophisticated data analytics to significantly improve how it manages its urban and industrial park offerings.

China's commitment to green development is profoundly impacting its construction sector. The nation is pushing for a significant shift towards renewable materials and more stringent emissions controls, evidenced by the development of national standards like the Zero Carbon Building Standard. This regulatory push directly influences property developers like China Merchants Shekou, encouraging the integration of advanced, eco-friendly construction materials and practices into their projects.

This green transformation translates into tangible opportunities and requirements for China Merchants Shekou. For instance, the push for energy efficiency in new buildings, a key component of green building standards, can lead to lower operational costs for properties over their lifecycle. By 2023, China's green building market was already valued at hundreds of billions of yuan, with projections for continued robust growth driven by these policy initiatives.

The maritime industry is rapidly embracing digitalization, a trend that will significantly impact port operations. By 2025, enhanced maritime safety regulations will mandate more streamlined declaration processes and stricter ship entry protocols. China Merchants Shekou Industrial Zone Holdings is well-positioned to leverage these digital advancements within its port logistics and industrial park management sectors, aiming for greater operational efficiency and improved safety compliance.

Innovation in Construction and Urban Planning

Technological advancements are reshaping China's urban development, with a growing emphasis on quality and sustainability. This shift necessitates exploring new productive forces and technologies within urban planning and construction.

China Merchants Shekou can leverage innovations like biomanufacturing and the burgeoning low-altitude economy to enhance its development practices. For instance, the biomanufacturing sector, projected to reach 3 trillion yuan by 2025, offers sustainable building material solutions. The low-altitude economy, with government support aiming for significant growth by 2030, could revolutionize logistics and infrastructure within development zones.

- Biomanufacturing: Potential for sustainable and efficient construction materials.

- Low-Altitude Economy: Opportunities for innovative urban logistics and infrastructure.

- Urbanization Focus: Shift towards quality enhancement driving technological adoption.

- Efficiency and Sustainability: Key drivers for new technologies in construction.

Cross-boundary Data Flow Facilitation

Initiatives within the Greater Bay Area (GBA), like the facilitation measure for the Standard Contract for the Cross-boundary Flow of Personal Information, are significantly smoothing data exchange. This is a crucial technological factor for China Merchants Shekou Industrial Zone Holdings, especially for their digital park services and integrated solutions, allowing for more efficient, data-driven operations across the GBA. For instance, the GBA aims to become a global hub for data innovation, with policies actively encouraging cross-border data flows to foster economic growth and technological advancement.

This enhanced cross-boundary data flow directly benefits China Merchants Shekou's business model by enabling:

- Improved operational efficiency: Seamless data exchange allows for better resource allocation and real-time monitoring within their industrial parks.

- Development of new digital services: Access to broader datasets can fuel the creation of innovative, data-intensive services for park tenants.

- Enhanced regional integration: Facilitating data flow supports the broader GBA initiative, aligning China Merchants Shekou with regional development strategies.

Technological advancements are driving a significant shift towards smart city solutions and digital park management for China Merchants Shekou. The company's focus on leveraging AI and data analytics for operational efficiency is aligned with China's broader push for technological innovation in urban development. This includes exploring emerging sectors like biomanufacturing, which is projected to reach 3 trillion yuan by 2025, for sustainable construction materials, and the low-altitude economy to revolutionize logistics within its zones.

| Technology Area | Impact on China Merchants Shekou | Relevant Data/Projections |

| Smart City Tech & AI | Enhanced park management, operational efficiency | China's smart city market expected to exceed $100 billion by 2025 |

| Biomanufacturing | Sustainable building materials, eco-friendly construction | Projected market value of 3 trillion yuan by 2025 |

| Low-Altitude Economy | Innovative logistics, improved infrastructure within zones | Government support aiming for significant growth by 2030 |

| Digitalization in Maritime | Streamlined port operations, enhanced safety | Stricter ship entry protocols mandated by 2025 |

Legal factors

China's real estate landscape is shaped by foundational laws like the Civil Code and the Urban Real Estate Administration Law, which dictate land use rights and the often complex renewal procedures. While residential land tenure is generally assured of renewal, the process for non-residential properties can be less predictable, with local government interpretations of national guidelines creating a patchwork of approaches. This variability presents a challenge for major developers such as China Merchants Shekou Industrial Zone Holdings, impacting long-term project planning and investment security.

The construction sector in China operates under the Construction Law of the PRC, with recent regulatory shifts placing a heightened emphasis on sustainable building practices and enhanced labor welfare. These evolving standards necessitate greater adherence to environmental protocols and worker safety regulations.

The nationwide implementation of the Regulation on Wage Payment for Migrant Workers, effective from 2024, mandates real-time salary monitoring. This directly affects developers like China Merchants Shekou, increasing their compliance burden and potential financial exposure related to timely and accurate wage disbursement.

New maritime safety regulations, effective March 1, 2025, from China's Ministry of Transport will increase compliance burdens for companies like China Merchants Shekou Industrial Zone Holdings. These rules, specifically Regulation 2024, mandate more rigorous shipper declarations and port entry checks for vessels transporting hazardous materials. This heightened scrutiny is expected to impact operational efficiency and potentially increase logistical expenses for the company's port and shipping divisions.

Environmental Impact Assessment and Carbon Emission Regulations

China's environmental regulatory landscape is tightening significantly. The revised Environmental Protection Law now enforces much harsher penalties for emissions violations, pushing companies towards greater compliance. This is particularly relevant for China Merchants Shekou's extensive urban development projects, which often involve construction materials and significant energy consumption.

The national Emissions Trading System (ETS) is also set to expand. By late 2025, it is projected to include major industries such as cement and steel. This expansion will directly impact the cost and availability of construction materials, a critical component of China Merchants Shekou's supply chain and project execution. Consequently, the company must meticulously adhere to evolving environmental impact assessment requirements and carbon emission regulations to mitigate risks and ensure sustainable operations.

- Stricter Penalties: The revised Environmental Protection Law introduces more severe financial penalties for non-compliance with emissions standards.

- ETS Expansion: By late 2025, China's ETS is expected to cover cement and steel industries, increasing operational costs for these sectors.

- Project Compliance: China Merchants Shekou's urban development projects must navigate these enhanced environmental regulations and impact assessments.

- Supply Chain Impact: The carbon pricing mechanisms within the ETS will likely affect the cost of key construction materials.

Greater Bay Area Legislative Harmonization

The Greater Bay Area (GBA) is actively working on legislative harmonization, with the Special Legislative Plan for the GBA (2024-2027) specifically targeting the simplification of regulations and the enhancement of the legal framework for investment and cross-boundary services. This initiative is crucial for companies like China Merchants Shekou, which operate across multiple jurisdictions within the GBA. The plan includes measures to align mediation regulatory frameworks, a move that could significantly reduce friction in dispute resolution for complex cross-border transactions. Furthermore, efforts to facilitate data flow are paramount, as this directly impacts the operational efficiency and innovation potential for businesses engaged in diverse sectors within the GBA.

This legislative push aims to create a more predictable and efficient legal environment, which is essential for China Merchants Shekou's diversified business portfolio, spanning property development, logistics, and port operations. For instance, the GBA's commitment to cross-boundary data flow could streamline the management of supply chains and logistics services, areas where China Merchants Shekou has substantial interests. The successful implementation of these plans is expected to foster greater economic integration and provide a more stable foundation for foreign and domestic investment.

- GBA Legislative Plan Focus: Streamlining regulations and improving legal conditions for investment and cross-boundary services from 2024-2027.

- Key Initiatives: Promoting interface of mediation regulatory frameworks and facilitating data flow.

- Impact on Business: Creates a more predictable and efficient legal environment for companies like China Merchants Shekou.

- Economic Integration: Aims to foster greater economic integration within the Greater Bay Area.

New maritime safety regulations effective March 1, 2025, from China's Ministry of Transport will increase compliance burdens for companies like China Merchants Shekou Industrial Zone Holdings. These rules mandate more rigorous shipper declarations and port entry checks for vessels transporting hazardous materials, impacting operational efficiency and potentially increasing logistical expenses for the company's port and shipping divisions.

The nationwide implementation of the Regulation on Wage Payment for Migrant Workers, effective from 2024, mandates real-time salary monitoring, directly affecting developers like China Merchants Shekou by increasing their compliance burden and potential financial exposure related to timely and accurate wage disbursement.

China's environmental regulatory landscape is tightening significantly, with the revised Environmental Protection Law enforcing much harsher penalties for emissions violations, pushing companies towards greater compliance. By late 2025, the national Emissions Trading System (ETS) is projected to include major industries such as cement and steel, directly impacting the cost and availability of construction materials critical to China Merchants Shekou's supply chain.

The Greater Bay Area's Special Legislative Plan for 2024-2027 targets regulatory simplification and enhancement of the legal framework for investment and cross-boundary services, crucial for companies like China Merchants Shekou operating across multiple GBA jurisdictions, potentially reducing dispute resolution friction and streamlining data flow.

Environmental factors

China's ambitious 'dual carbon' strategy, aiming for emissions to peak before 2030 and achieve carbon neutrality by 2060, is a pivotal environmental factor. This national directive creates a strong market pull for sustainable urban development and green building practices.

This commitment directly translates into increased demand for eco-friendly construction materials, energy-efficient designs, and smart city technologies, areas where China Merchants Shekou can leverage its expertise. For instance, in 2023, China's investment in renewable energy reached a record high, signaling a broader economic shift that favors companies aligning with carbon reduction goals.

China Merchants Shekou's 2024-2025 Energy Saving and Carbon Reduction Action Plan targets a significant reduction in energy consumption and CO2 intensity, aiming to boost non-fossil energy use in areas like building materials, architecture, and transportation. For instance, the plan might stipulate a 5% year-on-year decrease in energy consumption per unit of output for their building materials segment.

This necessitates that all China Merchants Shekou projects actively incorporate energy efficiency measures and sustainable methodologies throughout their lifecycle, from initial design and construction to ongoing operations. This could translate to a requirement for new developments to achieve a certain green building certification, such as LEED Platinum, which mandates stringent energy performance standards.

China is actively pushing for greener building practices, evidenced by its draft Zero Carbon Building Standard aimed at slashing carbon emissions. This aligns with a broader national strategy to integrate circular economy principles into industrial processes, emphasizing resource efficiency and waste minimization within the construction sector.

This governmental push directly supports China Merchants Shekou's sustainability objectives. For instance, by 2025, China aims to have 30% of new buildings in major cities meet green building standards, a significant increase from previous years, creating a favorable market for eco-conscious development and material sourcing.

Increased Environmental Scrutiny in Urban Development

China's commitment to high-quality urban development, as emphasized in its 14th Five-Year Plan (2021-2025), directly impacts China Merchants Shekou. This focus necessitates greater ecological protection and sustainable land use, meaning the company faces increasingly stringent environmental regulations for its new projects and urban renewal initiatives. For instance, the Ministry of Ecology and Environment has been progressively tightening standards for construction projects, pushing for reduced emissions and waste. This requires China Merchants Shekou to proactively integrate robust environmental management systems and invest in green infrastructure solutions to ensure compliance and maintain its development pipeline.

The push for sustainability means that environmental impact assessments are more rigorous, and companies are expected to demonstrate a clear commitment to green building practices. This can include:

- Mandatory use of eco-friendly building materials: With a growing emphasis on reducing embodied carbon in construction.

- Implementation of advanced wastewater treatment and recycling systems: To minimize water pollution and conserve resources.

- Development of green spaces and biodiversity corridors within urban projects: Aligning with national biodiversity goals.

- Adoption of energy-efficient technologies and renewable energy sources: To lower the carbon footprint of developments.

Regional Environmental Protection Initiatives

Key regions where China Merchants Shekou operates, such as the Greater Bay Area (GBA), are increasingly focused on green and low-carbon development. National strategies like the Beautiful China Initiative are driving significant investment in ecological governance. For instance, by the end of 2023, Guangdong Province, a core part of the GBA, had seen substantial progress in its ecological civilization construction, with a reported 30% increase in green building certifications for new urban developments.

These regional environmental protection initiatives directly impact China Merchants Shekou's urban and industrial park projects. The company must align its planning and execution with evolving regulations and targets for emissions reduction, waste management, and biodiversity conservation. This includes incorporating sustainable materials and energy-efficient designs, which can affect project costs and timelines.

Specific regional directives might include:

- Mandatory green building standards for all new developments exceeding a certain size.

- Stricter emissions controls for industrial zones, potentially requiring new pollution abatement technologies.

- Incentives for renewable energy adoption within commercial and residential complexes.

- Enhanced requirements for water resource management and wastewater treatment.

China Merchants Shekou's ability to adapt to and integrate these environmental protection efforts is crucial for its long-term operational success and compliance within these dynamic regions.

China's ambitious 'dual carbon' strategy, aiming for emissions to peak before 2030 and achieve carbon neutrality by 2060, is a pivotal environmental factor. This national directive creates a strong market pull for sustainable urban development and green building practices, directly translating into increased demand for eco-friendly construction materials and energy-efficient designs. China Merchants Shekou's 2024-2025 Energy Saving and Carbon Reduction Action Plan targets a significant reduction in energy consumption and CO2 intensity, aiming to boost non-fossil energy use across its operations. By 2025, China aims for 30% of new buildings in major cities to meet green building standards, a significant increase that favors eco-conscious development.

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Merchants Shekou Industrial Zone Holdings is built on a robust foundation of data from official Chinese government publications, reports from international financial institutions, and reputable industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.