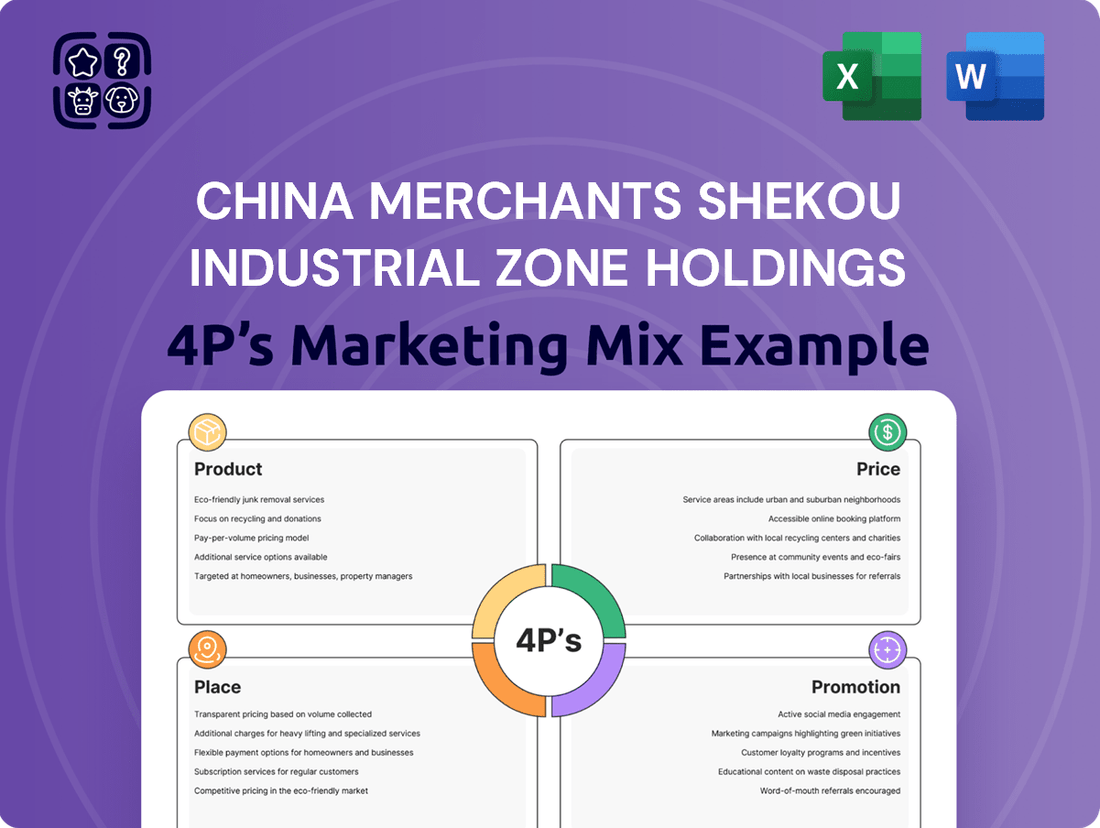

China Merchants Shekou Industrial Zone Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Shekou Industrial Zone Holdings Bundle

China Merchants Shekou Industrial Zone Holdings masterfully crafts its product offerings, from integrated urban development to logistics solutions, and employs strategic pricing to capture value. Their expansive place strategy leverages prime locations and robust infrastructure, while their promotion effectively communicates their comprehensive capabilities.

Unlock a deeper understanding of how these elements synergize for market leadership.

Get the full, editable 4Ps Marketing Mix Analysis for China Merchants Shekou Industrial Zone Holdings today and gain actionable insights for your own strategic planning.

Product

China Merchants Shekou Industrial Zone Holdings delivers comprehensive urban development solutions, integrating residential and commercial property creation. This involves the meticulous planning, design, and construction of entire communities, prioritizing livability and sustainability. Their expertise spans from developing entirely new urban districts to breathing new life into existing areas, showcasing a complete approach to city building.

China Merchants Shekou Industrial Zone Holdings offers comprehensive port and shipping services, a cornerstone of global trade. Their operations span container terminals, bulk cargo handling, and sophisticated port logistics, ensuring seamless movement of goods. In 2023, the company managed a significant volume of cargo throughput, contributing to China's robust export economy.

China Merchants Shekou's industrial park management leverages digital services to optimize operations and drive innovation. This includes sophisticated spatial planning and fostering targeted industrial clusters, creating a supportive ecosystem for resident businesses.

The company actively integrates digital technologies to build smart, efficient, and interconnected industrial environments. For instance, by the end of 2023, China Merchants Shekou managed over 100 industrial parks, with a significant portion incorporating these advanced digital solutions to enhance productivity and collaboration.

Residential and Commercial Properties

China Merchants Shekou Industrial Zone Holdings offers a broad spectrum of residential and commercial properties. This encompasses family housing under its established China Merchants brand, alongside commercial spaces designed for offices, retail, and integrated mixed-use developments. The company prioritizes high standards in quality, innovative design, and catering to the diverse requirements of both city dwellers and businesses.

In 2024, the company continued its strategic property development, with a significant portion of its revenue derived from these core offerings. For instance, their residential projects aim to address the growing demand for quality urban living, while their commercial ventures support economic activity and provide essential services. The focus remains on creating value through well-planned and desirable properties.

- Residential Offerings: Development of diverse housing options, including apartments and villas, catering to various income levels and family needs.

- Commercial Spaces: Provision of modern office buildings, retail centers, and integrated mixed-use developments designed to foster business growth and community engagement.

- Quality and Design Focus: Emphasis on superior construction, aesthetic appeal, and functional layouts that enhance user experience and property value.

- Market Responsiveness: Strategic development of properties in prime urban locations to meet the evolving demands of residents and businesses in key Chinese cities.

Cruise Industry Construction and Operation

China Merchants Shekou's involvement in the cruise industry construction and operation, particularly through its cruise homeport development and management, represents a strategic diversification. This segment offers end-to-end services for cruise operators and travelers, bolstering coastal tourism. For instance, by 2024, China's cruise market was showing signs of robust recovery, with projections indicating a significant rebound in passenger numbers and port calls, aligning with Shekou's strategic positioning.

This expansion into cruise infrastructure complements their established real estate and logistics operations. The company aims to capture value across the entire cruise tourism value chain. By 2025, several major coastal cities in China are expected to have enhanced cruise terminal facilities, creating a favorable environment for Shekou's investments in this sector.

- Cruise Homeport Development: Shekou is actively involved in building and managing key cruise terminals, acting as vital hubs for passenger embarkation and disembarkation.

- Comprehensive Service Provision: The company offers a full suite of services catering to cruise lines, including port operations, logistics, and passenger amenities.

- Tourism and Leisure Growth: This initiative directly supports the growth of tourism and leisure industries in coastal regions, enhancing their economic appeal.

- Market Alignment: Shekou's strategic focus on cruise infrastructure development is well-timed with the anticipated resurgence and expansion of the cruise market in Asia, particularly in China.

China Merchants Shekou's product strategy centers on integrated urban development, encompassing both residential and commercial real estate. They also offer specialized port and logistics services, crucial for international trade. A key growth area is their investment in cruise homeport development and operations, aligning with the recovering Asian cruise market.

| Product Segment | Key Offerings | 2023/2024 Data Point |

|---|---|---|

| Urban Development | Residential & Commercial Properties | Significant revenue contribution in 2024 |

| Port & Logistics | Container & Bulk Cargo Handling | Managed substantial cargo throughput in 2023 |

| Industrial Parks | Smart & Digitalized Environments | Operated over 100 parks by end of 2023 |

| Cruise Infrastructure | Homeport Development & Operations | Positioned for projected 2025 market growth |

What is included in the product

This analysis delves into China Merchants Shekou Industrial Zone Holdings's marketing mix, examining its diverse product offerings, strategic pricing models, extensive distribution networks, and integrated promotional activities.

This 4Ps analysis for China Merchants Shekou Industrial Zone Holdings acts as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies directly address market needs and competitive challenges.

It simplifies complex marketing decisions into actionable insights, easing the burden on management by providing a clear, concise overview of their market positioning and competitive advantages.

Place

China Merchants Shekou strategically targets key urban development zones, often massive areas ripe for their integrated 'Port – Park – City' approach. This model, exemplified by projects like the Shenzhen Bay Headquarters Base, which saw significant growth in high-tech and finance sectors by 2024, allows for holistic planning and resource deployment.

China Merchants Shekou Industrial Zone Holdings strategically concentrates its port and shipping services within vital Western Shenzhen hubs, specifically Shekou Port, Chiwan Port, and Mawan Port. These facilities are crucial gateways, handling significant volumes of international and domestic trade, underscoring their importance in global supply chains. For instance, in 2023, the Shenzhen port complex, which includes these hubs, saw container throughput exceeding 30 million TEUs, a testament to their operational scale.

China Merchants Shekou boasts a significant nationwide presence, with residential and commercial developments strategically located across numerous Chinese cities. This extensive footprint targets areas exhibiting robust demand and promising growth prospects, enabling the company to serve a wide array of customers and adapt to varied regional market conditions. For instance, in 2023, the company actively pursued land acquisitions in prime locations such as Beijing and Hangzhou, underscoring its commitment to expanding its portfolio in key economic hubs.

Integrated Industrial Park Networks

China Merchants Shekou Industrial Park Networks are designed to cultivate specific industries, creating synergistic clusters for businesses. These parks are strategically located to ensure optimal access to logistics, infrastructure, and a supportive business environment. For instance, their parks in the Greater Bay Area, a key economic hub, benefit from extensive transportation networks and a concentration of advanced manufacturing and technology firms. As of early 2025, the company manages over 20 such parks across China, contributing significantly to regional economic development and industrial upgrading.

The company's organizational restructuring, completed in 2025, specifically targeted the streamlining of management for these integrated industrial park networks. This move is intended to enhance operational efficiency and better support the diverse needs of the businesses within these clusters. This strategic alignment is crucial as China Merchants Shekou aims to expand its footprint and deepen its role in fostering innovation and industrial growth.

- Strategic Location: Parks are situated in key economic zones with robust logistics and infrastructure.

- Industry Clustering: Focus on creating synergistic environments for specific industries.

- Operational Efficiency: 2025 restructuring aims to improve management of park operations.

- Economic Contribution: Over 20 parks managed as of early 2025, supporting regional development.

Online and Direct Sales Channels

China Merchants Shekou Industrial Zone Holdings employs a dual strategy for property sales, leveraging both direct sales and online channels to connect with potential buyers. This approach is particularly relevant for their residential offerings, aiming to capture a broad market segment and align with evolving consumer preferences for digital engagement.

While specific online platforms are not publicly detailed, the company confirms that a substantial portion of their sales are finalized through direct contracts. This indicates a continued reliance on traditional, personal sales interactions, likely complemented by digital outreach to broaden reach.

- Direct Sales Dominance: A significant majority of property transactions are concluded via direct sales channels, underscoring the importance of personalized customer engagement.

- Online Channel Integration: The company is exploring and utilizing online platforms to expand its market reach, especially for residential properties, reflecting a modern sales approach.

- Adaptability to Market Trends: This multi-channel strategy allows them to cater to diverse buyer behaviors, from traditional in-person negotiations to digital browsing and purchasing.

China Merchants Shekou's place strategy is deeply rooted in its integrated development model, focusing on prime urban locations and port-centric zones. Their expansion into key economic regions, like the Greater Bay Area, leverages existing infrastructure and high-demand markets. By 2024, their presence in Western Shenzhen, encompassing Shekou, Chiwan, and Mawan ports, facilitated over 30 million TEUs in container throughput, highlighting the strategic importance of these locations.

| Location Focus | Key Hubs | 2023 Throughput (TEUs) | 2024 Development Focus | Strategic Advantage |

|---|---|---|---|---|

| Western Shenzhen | Shekou Port, Chiwan Port, Mawan Port | 30+ Million | Continued integration of port, park, and city development | Major trade gateway, supply chain hub |

| Nationwide | Beijing, Hangzhou, Greater Bay Area | N/A (Portfolio expansion) | Acquisition of prime land in growth cities | Diversified market access, regional economic contribution |

Preview the Actual Deliverable

China Merchants Shekou Industrial Zone Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of China Merchants Shekou Industrial Zone Holdings' 4P's Marketing Mix provides a deep dive into their product strategy, pricing models, distribution channels, and promotional activities. You'll gain actionable insights into how these elements contribute to their market success.

Promotion

China Merchants Shekou Industrial Zone Holdings (CMSK) heavily relies on its robust corporate branding and its association with the esteemed China Merchants Group to cultivate trust and credibility among stakeholders. This affiliation significantly amplifies their promotional efforts, making their offerings more appealing in the competitive market.

With a distinguished history as a premier urban development and operation service provider in China, CMSK has meticulously built a strong reputation. This established goodwill acts as a powerful promotional tool, reassuring investors and customers of their capabilities and commitment to quality.

Furthermore, CMSK's status as a state-owned conglomerate underpins its image of stability and reliability. This governmental backing provides a distinct advantage, particularly in large-scale infrastructure and urban development projects, solidifying its promotional appeal as a dependable partner.

China Merchants Shekou Industrial Zone Holdings executes highly focused marketing initiatives for each distinct property and industrial park venture. These campaigns zero in on what makes each development special, whether it's a particular lifestyle benefit or a unique business advantage.

For example, the company actively promotes projects like the PAVILIA COLLECTION, emphasizing its comprehensive community amenities and integrated living experience. This targeted approach ensures that potential buyers and tenants understand the specific value proposition of each development, a strategy that contributed to the company's robust sales performance in 2024, with reported sales reaching RMB 125.8 billion.

China Merchants Shekou actively manages its public image through robust public relations and media engagement. The company consistently communicates its successes, strategic initiatives, and role in urban development to financial and industry media outlets.

Recent reports highlight China Merchants Shekou's strong performance, with news of significant sales surges and strategic land acquisitions frequently appearing in reputable financial publications. For instance, in the first half of 2024, the company reported a substantial increase in contracted sales, underscoring its market strength and effective communication strategies.

Digital Marketing and Online Presence

China Merchants Shekou Industrial Zone Holdings likely leverages digital marketing to connect with its diverse audience, including investors, businesses, and potential residents. This would encompass a robust corporate website serving as a primary information hub. For instance, in 2023, their online presence would have been crucial in disseminating information about their extensive portfolio, which includes industrial parks, urban renewal projects, and residential developments.

Their digital strategy would likely involve showcasing their projects through high-quality visuals and detailed descriptions on their website and potentially on popular Chinese social media platforms. Online property portals would also be key for reaching homebuyers. The company’s 2024-2025 digital marketing efforts would aim to highlight their commitment to sustainable development and smart city initiatives, further attracting discerning investors and tenants.

Key components of their digital marketing and online presence would include:

- Corporate Website: A comprehensive platform detailing projects, financial reports, and corporate news.

- Social Media Engagement: Utilizing platforms like WeChat and Weibo to share updates and interact with stakeholders.

- Online Property Listings: Showcasing residential and commercial properties to a wider audience.

- Digital Advertising: Targeted online campaigns to reach specific investor and buyer demographics.

Industry Events and Partnerships

China Merchants Shekou actively engages in industry events and cultivates strategic partnerships to bolster its promotional efforts. This includes participation in major real estate expos and maritime industry conferences, showcasing their development projects and operational expertise. For instance, their involvement in the 2024 China International Import Expo likely provided a platform to highlight their integrated urban development and cruise terminal services.

Strategic collaborations are a key component of their market expansion strategy. These partnerships can take various forms, such as joint ventures for large-scale property developments, which leverage shared resources and expertise. Additionally, agreements for cruise retail operations within their terminals aim to enhance the passenger experience and create new revenue streams, demonstrating their comprehensive capabilities to a wider market.

Key promotional activities and partnerships for China Merchants Shekou include:

- Participation in Industry Conferences: Engaging in events like the China International Import Expo to showcase integrated urban development and cruise terminal services.

- Joint Ventures for Property Development: Collaborating with other entities to undertake significant real estate projects, expanding their development footprint.

- Cruise Retail Agreements: Forging partnerships to manage retail operations within their cruise terminals, enhancing service offerings and revenue.

- Strategic Alliances: Building relationships that broaden market reach and validate their operational strengths to potential clients and investors.

China Merchants Shekou Industrial Zone Holdings (CMSK) employs a multi-faceted promotional strategy that leverages its strong brand, historical reputation, and state-owned backing. Targeted marketing campaigns for specific projects, like the PAVILIA COLLECTION, highlight unique value propositions, contributing to strong sales performance, with RMB 125.8 billion in reported sales for 2024. Their digital presence, including a comprehensive corporate website and social media engagement, is crucial for disseminating information about their diverse portfolio and commitment to smart city initiatives, aiming to attract discerning investors and tenants in 2024-2025.

CMSK actively participates in industry events and forms strategic partnerships, such as joint ventures for property development and cruise retail agreements, to expand market reach and showcase their capabilities. Their presence at events like the 2024 China International Import Expo serves to highlight their integrated urban development and cruise terminal services, reinforcing their image as a reliable partner.

The company's promotional efforts are supported by consistent media engagement, ensuring that successes and strategic initiatives are communicated to financial and industry outlets. This proactive communication strategy, evident in the frequent reporting of strong sales figures and strategic land acquisitions throughout 2024, solidifies their market position.

CMSK's promotional mix effectively utilizes its affiliation with the China Merchants Group, its long-standing reputation as a premier urban development provider, and its status as a state-owned enterprise to build trust and appeal to a broad spectrum of stakeholders.

Price

China Merchants Shekou Industrial Zone Holdings likely employs value-based pricing for its urban developments, assessing the worth of integrated solutions like advanced infrastructure, diverse amenities, and the promise of sustainable, livable communities. This approach moves beyond the cost of individual elements to capture the overall benefit and desirability of their projects.

For instance, the company's significant investments in projects like the Shenzhen Bay Headquarters Base, which aims to create a world-class business hub, are priced to reflect the premium associated with its strategic location, high-quality design, and the economic vibrancy it fosters. This reflects a strategy where the perceived value of the entire ecosystem, not just the real estate, drives pricing decisions.

China Merchants Shekou Industrial Zone Holdings (CMSK) adopts a competitive pricing strategy for both its residential and commercial properties. This approach meticulously considers prevailing market demand, the pricing of rival developments, and the unique attributes and location of each project.

This strategy has proven effective, as evidenced by CMSK's robust sales performance, even amidst market volatility. For instance, in the first half of 2024, the company achieved contracted sales of RMB 88.6 billion, indicating a resilient and adaptive pricing model that resonates with buyers.

The cost of land acquisitions is a critical factor in determining the final sale prices for China Merchants Shekou's property developments. For instance, in 2023, the company reported significant investments in land banking across major Chinese cities, with acquisition costs directly translating into the pricing of their residential and commercial projects. This strategic expansion, while building a robust development pipeline, inherently raises the cost base, necessitating careful pricing to ensure profitability.

Financing Options and Investment Appeal

China Merchants Shekou Industrial Zone Holdings' robust financial standing, characterized by low financing costs and strong debt repayment metrics, directly bolsters its pricing flexibility and investment appeal. For instance, as of the first half of 2024, the company reported a net gearing ratio of approximately 35%, demonstrating a healthy balance sheet and a capacity for further strategic investments or acquisitions. This financial prudence is crucial for maintaining stable operations, which in turn underpins investor confidence and can support competitive pricing in its real estate and industrial park developments.

The company's commitment to a conservative debt-to-equity ratio, which stood at around 0.45 in early 2024, is a key factor in its investment attractiveness. This conservative approach signals financial stability and reduces risk for potential investors, making the company a more appealing proposition. Such financial health can translate into favorable borrowing terms, further reducing operational costs and enhancing profitability, which are vital for long-term value creation and investor returns.

- Financial Health: Low financing costs and strong debt repayment indicators enhance pricing flexibility.

- Investor Appeal: A conservative debt-to-equity ratio of approximately 0.45 (early 2024) signals stability and reduces risk.

- Operational Stability: Prudent financial management supports consistent operations, boosting investor confidence.

- Cost Advantage: Favorable borrowing terms contribute to reduced operational costs and improved profitability.

Dividend Policy and Shareholder Value

China Merchants Shekou Industrial Zone Holdings' dividend policy signals its financial health and dedication to rewarding shareholders, which can indirectly bolster its pricing power. A stable dividend history, such as their commitment to consistent payouts, builds investor trust and can positively influence the market's perception of their property values and development projects.

The company's approach to shareholder returns is a key element in its overall value proposition. For instance, in 2023, China Merchants Shekou declared a final dividend of RMB 0.40 per share, demonstrating a continued focus on returning capital to investors. This commitment can foster a sense of security among stakeholders, potentially supporting higher valuations for their real estate offerings.

- Dividend Payout: Reflects financial stability and commitment to shareholder returns.

- Investor Confidence: Consistent dividends can enhance market perception and asset value.

- 2023 Dividend: RMB 0.40 per share declared, reinforcing shareholder value focus.

- Pricing Influence: Indirectly supports pricing strategy by signaling profitability and reliability.

China Merchants Shekou Industrial Zone Holdings (CMSK) employs a multi-faceted pricing strategy, balancing value-based and competitive approaches. The company prices its premium developments like the Shenzhen Bay Headquarters Base to reflect the comprehensive benefits of integrated infrastructure and a vibrant economic ecosystem, not just raw land costs. This strategy is supported by robust sales, with RMB 88.6 billion in contracted sales achieved in H1 2024, indicating effective market resonance.

Land acquisition costs are a direct input into their pricing, as seen in significant 2023 land banking investments. CMSK’s strong financial health, evidenced by a net gearing ratio of approximately 35% in H1 2024 and a conservative debt-to-equity ratio around 0.45 in early 2024, provides pricing flexibility and cost advantages through favorable borrowing terms.

| Pricing Strategy Aspect | Description | Supporting Data/Example |

|---|---|---|

| Value-Based Pricing | Captures perceived benefits of integrated developments. | Shenzhen Bay Headquarters Base pricing reflects ecosystem value. |

| Competitive Pricing | Considers market demand and rival pricing. | Robust sales of RMB 88.6 billion in H1 2024. |

| Cost-Plus Influence | Land acquisition costs directly impact final prices. | Significant 2023 land banking investments. |

| Financial Health Impact | Low financing costs and strong balance sheet support flexibility. | Net gearing ~35% (H1 2024); Debt-to-equity ~0.45 (early 2024). |

4P's Marketing Mix Analysis Data Sources

Our analysis of China Merchants Shekou Industrial Zone Holdings' 4Ps is grounded in official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and market trend data.