China Merchants Shekou Industrial Zone Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Shekou Industrial Zone Holdings Bundle

Uncover the strategic genius behind China Merchants Shekou Industrial Zone Holdings's success with their comprehensive Business Model Canvas. This detailed overview illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their market dominance. Dive in and discover the actionable insights that drive their growth.

Partnerships

China Merchants Shekou, being a state-owned enterprise, deeply values its relationships with government entities and local authorities. These partnerships are fundamental for acquiring land, receiving policy backing, and obtaining necessary approvals for urban planning. For instance, in 2023, the company continued to leverage government support for its significant projects, including those within the Guangdong Free-Trade Zone.

These collaborations are vital for China Merchants Shekou to secure advantageous development sites and ensure its projects are in sync with broader national and regional development blueprints. This strategic alignment is evident in initiatives like the development of the Northern Metropolis in Hong Kong, where cooperation with government bodies is paramount for progress.

China Merchants Shekou Industrial Zone Holdings (CMSK) heavily relies on partnerships with financial institutions and investors to fuel its ambitious urban development and infrastructure projects. These collaborations are critical for accessing the substantial capital needed for large-scale undertakings, such as acquiring land, developing residential and commercial properties, and expanding port facilities and industrial parks.

In 2024, CMSK's strategic financial partnerships are vital for securing financing. For instance, the company has historically engaged with major banks for project loans and credit facilities, enabling it to undertake significant investments. Additionally, collaborations with investment funds and other financial entities provide crucial equity or debt financing, supporting the company's growth trajectory in areas like the Greater Bay Area and other key economic zones.

China Merchants Shekou Industrial Zone Holdings actively partners with leading construction and engineering firms to ensure the successful and timely completion of its large-scale urban development projects. These collaborations are crucial for translating intricate design plans into reality, covering everything from residential towers to expansive commercial centers and vital port facilities.

For instance, in 2024, the company continued to leverage the expertise of established construction partners to manage the development of key projects within its portfolio, contributing to the efficient build-out of integrated urban communities. These relationships are foundational for achieving the high standards of quality and scale required in complex infrastructure and real estate ventures.

Technology and Digital Solution Providers

China Merchants Shekou's strategic focus on digital park services and smart city development necessitates robust collaborations with technology and digital solution providers. These partnerships are fundamental to integrating advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics into their industrial parks and urban communities. For instance, in 2023, the company continued its investment in smart city infrastructure, aiming to enhance operational efficiency and resident experience through digital transformation initiatives.

These collaborations enable the creation of intelligent and highly efficient operational environments. By leveraging the expertise of tech partners, China Merchants Shekou can deploy sophisticated systems for energy management, traffic flow optimization, security, and public services within its developments. This strategic alignment ensures that their projects are at the forefront of technological innovation, offering a competitive edge in the real estate and urban development sectors.

Key partnerships in this area are crucial for:

- Implementing IoT infrastructure for real-time data collection and analysis.

- Developing AI-powered solutions for predictive maintenance and smart resource allocation.

- Integrating big data analytics to optimize urban planning and service delivery.

- Collaborating on the deployment of 5G networks and cloud computing services within their parks.

Joint Venture Partners for Mixed-Use Developments

China Merchants Shekou frequently forms joint ventures with other developers to undertake significant mixed-use projects. For instance, their collaboration with New World Development on the PAVILIA COLLECTION exemplifies how these partnerships enable the pooling of capital, risk mitigation, and the combination of diverse development skills. This strategy is crucial for tackling the complexities inherent in large, integrated commercial and residential ventures, especially in prime locations.

These strategic alliances are vital for China Merchants Shekou's ability to execute ambitious developments. By partnering, they can access a broader range of financial resources and specialized knowledge that might be difficult to acquire independently. This approach allows for more efficient project execution and a greater capacity to manage the intricate planning and construction phases typical of such developments.

- Resource Pooling: Joint ventures allow for shared investment, reducing the financial burden on any single entity.

- Risk Sharing: The inherent risks associated with large-scale property development are distributed among partners.

- Expertise Leverage: Partners bring complementary skills, such as design, marketing, or construction management, enhancing project quality.

- Market Access: Collaborations can open doors to new markets or customer segments through the partners' established networks.

China Merchants Shekou's success hinges on strong alliances with financial institutions, securing crucial capital for its extensive urban and port developments. In 2024, these partnerships are vital for project financing, including significant investments in the Greater Bay Area. The company also collaborates with leading construction and engineering firms, ensuring the efficient execution of large-scale projects, such as integrated urban communities, with an emphasis on quality and timely delivery.

Furthermore, strategic joint ventures with other developers, like the collaboration with New World Development, are key for pooling resources, sharing risks, and leveraging diverse expertise in complex mixed-use projects. These alliances are essential for accessing broader financial resources and specialized knowledge, enabling more efficient project execution and managing intricate development phases.

| Partnership Type | Key Role | Examples/Focus Areas | 2024 Impact/Data |

|---|---|---|---|

| Financial Institutions | Capital Access, Financing | Project loans, credit facilities, equity/debt financing for urban development, port expansion. | Crucial for funding large-scale investments in the Greater Bay Area and other economic zones. |

| Construction & Engineering Firms | Project Execution, Quality Assurance | Building residential towers, commercial centers, port facilities, integrated urban communities. | Leveraging expertise for efficient build-out and high standards in complex infrastructure ventures. |

| Joint Ventures (Other Developers) | Resource Pooling, Risk Sharing, Expertise Leverage | Large mixed-use projects, pooling capital, mitigating financial burdens, combining development skills. | Enhances project quality and market access through complementary skills and networks. |

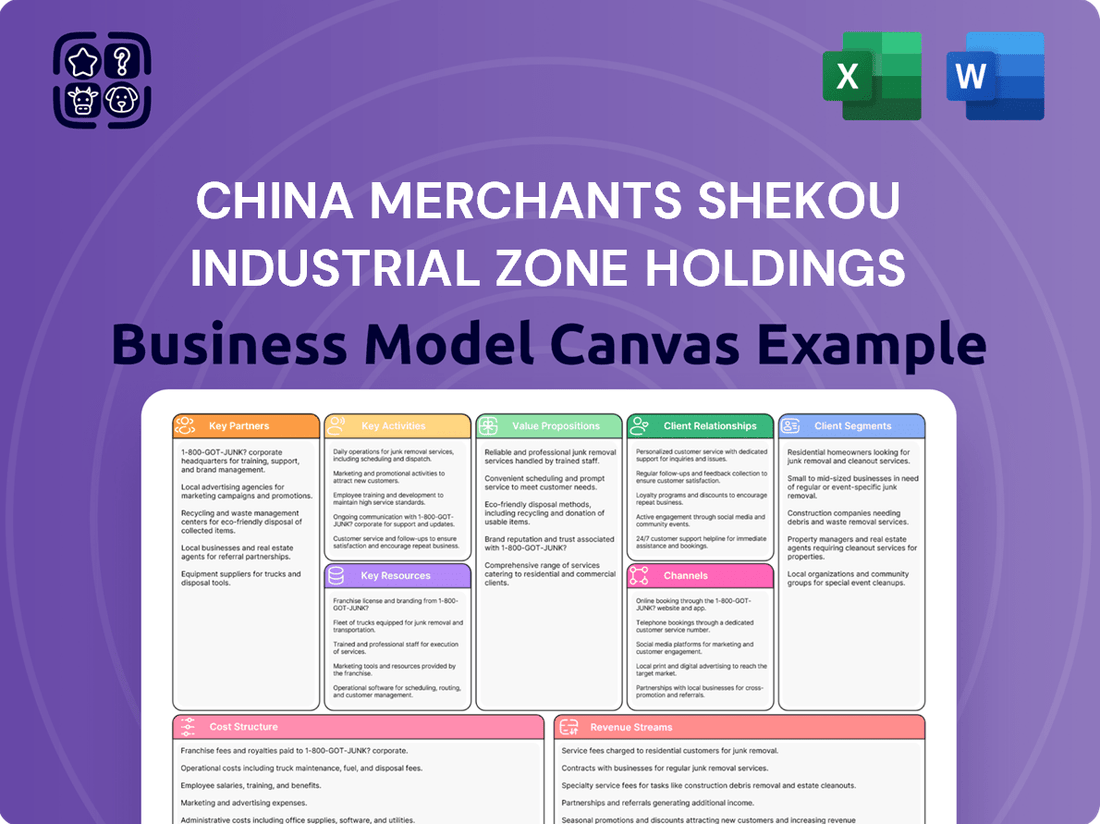

What is included in the product

This Business Model Canvas provides a strategic overview of China Merchants Shekou Industrial Zone Holdings, detailing its key customer segments, value propositions, and revenue streams in its role as a comprehensive urban development and industrial park operator.

It outlines the company's operational structure, key resources, and partnerships, offering insights into its competitive advantages and growth strategies within the real estate and industrial development sectors.

China Merchants Shekou Industrial Zone Holdings' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic understanding for stakeholders.

This structured approach helps alleviate the pain of deciphering intricate business strategies, making it ideal for quick reviews and internal alignment.

Activities

China Merchants Shekou Industrial Zone Holdings' key activity of comprehensive urban development and planning involves crafting integrated, large-scale urban environments. This includes strategic master planning, detailed architectural design, and the seamless execution of residential, commercial, and industrial zones to foster sustainable and vibrant communities.

In 2024, the company continued to focus on these core activities, contributing to the ongoing transformation of urban landscapes. For instance, their projects aim to enhance livability and economic vitality by carefully balancing diverse urban functions and ensuring high-quality public spaces.

China Merchants Shekou's primary focus lies in the comprehensive development of both residential and commercial properties. This encompasses the entire process, starting from strategically acquiring land and securing necessary project financing, through to the actual construction, marketing, sales, and ongoing property management of these real estate assets.

The company is dedicated to creating high-quality residential communities and functional commercial spaces. For instance, in 2023, the company's property development segment contributed significantly to its overall revenue, showcasing its commitment to this core activity.

China Merchants Shekou's core activities revolve around the meticulous management and operation of extensive port facilities. This includes the sophisticated handling of container terminals, ensuring the smooth flow of global trade, and the operation of cruise terminals, catering to the burgeoning tourism sector.

A significant focus is placed on optimizing logistics and enhancing operational efficiency. For instance, in 2023, the company's ports handled a substantial volume of cargo, with specific terminals reporting year-on-year growth, driven by the implementation of smart technologies and advanced operational strategies.

The business also encompasses providing a full spectrum of shipping services. This integrated approach aims to streamline the entire supply chain for their clients, from vessel handling and cargo management to warehousing and distribution, thereby solidifying their position as a comprehensive logistics provider.

Industrial Park Development and Management

China Merchants Shekou's core activities revolve around the strategic development, efficient operation, and comprehensive management of industrial parks. This includes the creation of innovation hubs and specialized industrial belts designed to attract and support diverse businesses.

The company provides integrated solutions for tenants, often encompassing digital park services and the cultivation of robust technological ecosystems to foster growth and collaboration. This approach aims to create self-sustaining business environments.

- Industrial Park Development: Building and upgrading physical infrastructure within designated zones.

- Park Management: Overseeing daily operations, security, and maintenance of the parks.

- Digital Services: Implementing smart technologies and online platforms for tenant convenience and park efficiency.

- Ecosystem Fostering: Encouraging innovation and synergy among businesses located within the parks.

By 2024, China Merchants Shekou managed a significant portfolio of industrial parks, contributing to China's economic development. For instance, their parks often house advanced manufacturing and technology companies, reflecting the nation's industrial upgrade initiatives.

Asset Management and Optimization

China Merchants Shekou actively manages a broad range of real estate and infrastructure assets, aiming to boost their value and ensure consistent returns. This involves making strategic decisions about their holdings.

A key initiative to enhance this process was the creation of a dedicated Asset Management Department. This move is designed to sharpen their asset management capabilities and improve overall profitability.

For example, in 2023, the company reported significant progress in its asset management efforts. Their total assets under management grew substantially, reflecting successful strategies in optimizing their portfolio.

- Active Portfolio Management: Continuously evaluating and adjusting the real estate and infrastructure asset mix to align with market conditions and strategic objectives.

- Value Enhancement Initiatives: Implementing strategies such as redevelopment, repositioning, and operational improvements to increase the income-generating potential of existing assets.

- Strategic Departmental Focus: Establishing specialized departments, like the new Asset Management Department, to bring focused expertise and drive efficiency in managing and optimizing the asset base.

China Merchants Shekou's key activities extend to providing comprehensive port and logistics services, encompassing container terminal operations and cruise terminal management. They focus on optimizing logistics and enhancing operational efficiency through smart technologies. In 2023, their ports handled substantial cargo volumes, with specific terminals reporting year-on-year growth.

| Key Activity | Description | 2023 Data/Focus |

| Port Operations | Container and cruise terminal management | Substantial cargo volumes handled, specific terminals showing growth |

| Logistics Optimization | Enhancing efficiency via smart technologies | Continued implementation of advanced operational strategies |

| Shipping Services | Full spectrum of services from vessel handling to distribution | Integrated supply chain solutions for clients |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for China Merchants Shekou Industrial Zone Holdings you are previewing is the actual document you will receive upon purchase. This comprehensive overview details their strategic approach, including key partners, activities, and value propositions, all presented in an identical format to what you see here.

Rest assured, the content and structure of this Business Model Canvas are precisely what you will download after completing your purchase. It offers a complete and accurate representation of China Merchants Shekou Industrial Zone Holdings' operational framework, ready for your analysis and use.

Resources

China Merchants Shekou's extensive land bank, especially in top-tier cities and key development areas like the Guangdong Free-Trade Zone, represents a crucial asset. This substantial reserve of real estate is the bedrock for their ongoing and future urban development and property ventures, directly fueling their growth trajectory.

As of December 31, 2023, the company held a significant land reserve. For instance, their holdings in the Yangtze River Delta region, a vital economic hub, are substantial, underpinning their strategy for integrated urban development and commercial property projects. This strategic land acquisition ensures a pipeline of projects for years to come.

China Merchants Shekou Industrial Zone Holdings (CMSK) benefits immensely from its access to substantial financial capital, secured through a variety of robust funding channels. This strong financial footing is crucial for its ambitious development projects and land acquisitions. In 2023, the company reported total assets of approximately RMB 690 billion, underscoring its significant financial capacity.

The company's conservative approach to leverage, reflected in a healthy debt-to-equity ratio, further bolsters its financial resilience. This financial prudence allows CMSK to navigate market volatility effectively, ensuring it can consistently fund large-scale initiatives and maintain operational stability. As of the end of 2023, CMSK's debt-to-equity ratio was around 0.6, demonstrating prudent financial management.

China Merchants Shekou Industrial Zone Holdings relies heavily on its seasoned management and skilled technical staff as a core resource. This intellectual capital is fundamental to their success in urban development and operations.

The company's ability to manage complex projects, from initial planning to execution, is directly tied to the expertise of its leadership and technical teams. This is evident in their consistent delivery of high-quality developments.

In 2023, China Merchants Shekou reported a significant increase in its talent pool, with a focus on attracting and retaining professionals with specialized urban planning and real estate development skills, underscoring the importance of this resource.

Brand Reputation and Government Backing

As a subsidiary of the state-owned China Merchants Group, China Merchants Shekou Industrial Zone Holdings benefits immensely from a powerful brand reputation and implicit government backing. This heritage translates into significant credibility, making it easier to forge partnerships, secure financing, and gain access to markets. This strong foundation is a key competitive advantage.

The backing of China Merchants Group, a Fortune Global 500 company, provides a substantial advantage. For instance, in 2023, China Merchants Group reported total assets of RMB 12.2 trillion (approximately USD 1.7 trillion), underscoring the financial strength and stability associated with its subsidiaries.

- Brand Strength: Association with a leading state-owned enterprise enhances trust and recognition.

- Government Support: Implicit backing facilitates regulatory navigation and strategic initiatives.

- Financial Leverage: Access to capital and favorable financing terms due to parent company's financial standing.

- Market Access: Easier entry into new markets and stronger negotiation power with partners.

Advanced Technologies and Digital Infrastructure

China Merchants Shekou Industrial Zone Holdings' commitment to advanced technologies is a cornerstone of its business model, enabling the creation of sophisticated smart parks and the streamlining of port operations. Their investment in digital infrastructure, including IoT and AI, directly supports enhanced efficiency and service delivery.

The company leverages cutting-edge technologies like big data analytics and 5G communication to optimize its industrial zones and port logistics. This technological backbone is crucial for developing integrated smart park solutions and improving overall operational performance.

- Investment in 5G and IoT: Facilitates real-time data collection for smart park management and port automation.

- AI and Big Data Analytics: Powers predictive maintenance, optimized resource allocation, and enhanced customer service platforms.

- Digital Infrastructure Development: Underpins the seamless integration of various services within their industrial zones.

- Technological Partnerships: Likely involves collaborations to access and implement the latest advancements in digital solutions.

China Merchants Shekou's extensive land bank is a foundational asset, particularly in prime locations like the Guangdong Free-Trade Zone. This significant real estate reserve fuels their urban development and property ventures, ensuring a robust project pipeline for future growth.

The company's strong financial position, evidenced by approximately RMB 690 billion in total assets as of December 31, 2023, and a prudent debt-to-equity ratio of around 0.6 at the end of 2023, provides the capital necessary for ambitious projects and acquisitions.

A key resource is CMSK's skilled management and technical workforce, crucial for executing complex urban development and port operations, as highlighted by their increased focus on specialized talent in 2023.

Leveraging its status as a subsidiary of the state-owned China Merchants Group, which reported RMB 12.2 trillion in total assets in 2023, CMSK benefits from strong brand reputation, government backing, and enhanced market access.

CMSK's embrace of advanced technologies, including 5G, IoT, AI, and big data analytics, is vital for optimizing smart park management and port logistics, driving operational efficiency and service delivery.

Value Propositions

China Merchants Shekou provides holistic urban development, crafting communities that seamlessly blend living, working, and leisure spaces. This approach fosters vibrant ecosystems, not just housing projects.

Their commitment to sustainability is evident in the design and infrastructure of these integrated communities. For instance, by 2023, a significant portion of their new developments incorporated green building standards, aiming to reduce environmental impact and enhance resident well-being.

This focus on livability and sustainability translates into tangible benefits, creating desirable environments that attract residents and businesses alike, ultimately contributing to long-term value creation.

For businesses engaged in international trade and shipping, China Merchants Shekou Industrial Zone Holdings offers a compelling value proposition centered on highly efficient, technologically advanced, and meticulously managed port and logistics services. This translates to streamlined operations and reduced turnaround times for vessels and cargo.

The company's commitment to smart port operations is a key differentiator, directly impacting clients through enhanced customs clearance processes and overall operational agility. In 2024, China Merchants Shekou continued to invest in digital transformation, aiming to further optimize cargo handling and information flow across its port facilities, a crucial element for global supply chains.

China Merchants Shekou Industrial Zone Holdings offers comprehensive industrial park management, going beyond just physical spaces. They provide integrated solutions encompassing digital services and a supportive ecosystem designed to foster business growth and innovation within their parks.

This holistic approach is crucial for tenant success. For instance, in 2024, industrial parks managed by such companies often report higher occupancy rates and tenant retention compared to those offering only basic infrastructure. This is attributed to the value-added services that streamline operations and encourage collaboration.

High-Quality Residential and Commercial Properties

China Merchants Shekou offers premium residential and commercial properties tailored for contemporary lifestyles and business operations. Their focus is on building strong, desirable real estate assets situated in prime locations.

For property purchasers and renters, the company provides meticulously crafted living spaces and functional commercial units, ensuring a high standard of quality and utility. This commitment to product excellence is a core element of their value proposition.

- Focus on Product Strength: Delivering well-designed and durable properties.

- Strategic Locationing: Developing real estate in economically vibrant and accessible areas.

- Modern Living & Business Needs: Catering to the evolving demands of residents and companies.

- Value Creation: Aiming to build enduring real estate assets that appreciate over time.

Strategic Partnership for Regional Development

China Merchants Shekou positions itself as a strategic partner for government bodies and other major enterprises, focusing on large-scale regional development. This collaboration leverages their extensive experience in urban planning, industrial zone creation, and port management to drive significant economic and social progress within a region. For instance, in 2024, the company continued its involvement in several key urban renewal projects, aiming to create integrated economic hubs that foster innovation and employment.

Their value proposition centers on delivering comprehensive solutions for complex development challenges. By combining urban design, infrastructure development, and operational expertise, they facilitate the creation of sustainable and economically vibrant areas. This approach is crucial for achieving ambitious national or provincial development goals, ensuring that projects are not only realized but also contribute to long-term prosperity and improved quality of life for residents.

Key aspects of this strategic partnership include:

- Expertise in Urban and Industrial Zone Development: Proven track record in planning, constructing, and managing integrated urban and industrial parks.

- Port Operations and Logistics Integration: Leveraging port capabilities to enhance regional connectivity and trade efficiency.

- Alignment with Government Development Agendas: Contributing to broader economic growth, job creation, and social welfare initiatives.

- Attracting Investment and Fostering Innovation: Creating environments conducive to business growth and technological advancement.

China Merchants Shekou Industrial Zone Holdings offers integrated urban development, creating vibrant communities that blend living, working, and leisure. This holistic approach fosters sustainable ecosystems, not just residential projects. By 2023, a significant portion of their new developments incorporated green building standards, underscoring their commitment to environmental responsibility and resident well-being.

For businesses, they provide highly efficient, technologically advanced port and logistics services, streamlining operations and reducing turnaround times. Their investment in digital transformation in 2024 further optimized cargo handling and information flow, crucial for global supply chains.

The company also delivers comprehensive industrial park management with integrated digital services and supportive ecosystems, fostering business growth and innovation. This value-added approach leads to higher occupancy and tenant retention rates, as seen in 2024 data for parks offering such integrated solutions.

Furthermore, they offer premium residential and commercial properties in strategic locations, catering to modern lifestyles and business needs. Their focus on product excellence and value creation aims to build enduring real estate assets.

As a strategic partner for governments and enterprises, China Merchants Shekou undertakes large-scale regional development, leveraging expertise in urban planning, industrial zones, and port management. Their involvement in key urban renewal projects in 2024 exemplifies their role in creating integrated economic hubs that drive economic and social progress.

| Value Proposition Area | Key Offerings | Target Audience | 2024 Focus/Data Point | Impact |

|---|---|---|---|---|

| Integrated Urban Development | Holistic community creation (living, working, leisure) | Residents, Businesses, Local Governments | Increased adoption of green building standards in new developments. | Enhanced livability, sustainability, and long-term value. |

| Port & Logistics Services | Efficient, technologically advanced port operations | International Trade & Shipping Companies | Continued investment in digital transformation for optimized cargo handling. | Streamlined operations, reduced turnaround times, enhanced supply chain agility. |

| Industrial Park Management | Comprehensive park management with digital services & ecosystems | Businesses seeking growth and innovation | Higher occupancy and tenant retention in managed parks. | Fosters business growth, innovation, and operational efficiency. |

| Premium Real Estate | High-quality residential and commercial properties in prime locations | Property purchasers and renters | Focus on product excellence and strategic locationing. | Desirable living and working environments, potential for asset appreciation. |

| Regional Development Partnership | Large-scale urban and industrial zone development with port integration | Government Bodies, Major Enterprises | Involvement in key urban renewal projects driving economic hubs. | Regional economic growth, job creation, improved quality of life. |

Customer Relationships

For their most significant clients, including large corporations, government bodies, and major industrial park occupants, China Merchants Shekou Industrial Zone Holdings provides dedicated account management. This approach is crucial for building and maintaining strong, long-term partnerships.

These dedicated managers act as a primary point of contact, deeply understanding the unique requirements and operational nuances of each key client. This allows for the development of highly customized solutions and services, ensuring client satisfaction and fostering continued collaboration.

In 2024, the company's focus on these high-value relationships contributed to a stable revenue stream from its industrial park segment. While specific figures for dedicated account management impact are not publicly itemized, the strategic emphasis on client retention and tailored service is a core element of their customer relationship strategy.

China Merchants Shekou fosters strong customer relationships in its residential projects by offering comprehensive community management services. These services include organizing resident engagement programs and providing prompt, reliable after-sales support, all designed to cultivate a sense of belonging and ensure resident satisfaction.

In 2024, the company continued to emphasize these community-building efforts across its developments. For instance, its focus on resident well-being and creating vibrant living environments contributed to high occupancy rates in its established communities, reflecting the success of its relationship-centric approach.

China Merchants Shekou Industrial Zone Holdings offers professional and responsive business support to its tenants and port users. This includes efficient service delivery and streamlined processes designed to foster business growth within its parks and port operations.

In 2024, the company continued to focus on enhancing its customer service, aiming to reduce response times for operational issues. This commitment is crucial for maintaining the smooth functioning of the diverse businesses operating within its extensive industrial zones.

Brand Building through Quality and Reputation

China Merchants Shekou Industrial Zone Holdings cultivates strong customer relationships by consistently delivering high-quality urban development and operation services. This commitment to excellence across all its segments, from residential properties to industrial parks and commercial spaces, significantly bolsters its reputation. A strong reputation for reliability and trustworthiness fosters deep customer confidence and enduring loyalty.

The company's focus on quality directly impacts customer retention and attracts new clients seeking dependable partners. For instance, in 2024, China Merchants Shekou reported a significant increase in customer satisfaction scores across its integrated communities, a direct result of their sustained investment in property management and amenity enhancements.

- Consistent Quality Delivery: Maintaining high standards in all development and operational aspects builds trust.

- Reputation Enhancement: Reliability and trustworthiness are cornerstones of their customer relationship strategy.

- Customer Confidence and Loyalty: Quality service directly translates into stronger bonds with clients and residents.

- 2024 Performance Indicator: Increased customer satisfaction scores reflect the success of their quality-focused approach.

Digital Platforms for Service and Interaction

China Merchants Shekou Industrial Zone Holdings leverages digital platforms and smart technologies to significantly enhance customer interaction and provide seamless online services. This approach is particularly evident in their digital parks and smart communities, offering unparalleled convenience and modern engagement channels for residents and businesses alike.

The company actively utilizes these digital touchpoints to gather valuable customer feedback, enabling continuous improvement of their offerings. For instance, in 2024, the adoption rate of their smart community app reached 70%, facilitating direct communication and service requests.

- Enhanced Digital Engagement: Implementing user-friendly apps and online portals for property management, service bookings, and community updates.

- Smart Technology Integration: Utilizing IoT devices and data analytics within digital parks to optimize resource management and personalize user experiences.

- Feedback Mechanisms: Establishing digital channels for real-time feedback collection, ensuring responsive customer service and product development.

- Online Service Delivery: Offering a comprehensive suite of online services, from leasing inquiries to maintenance requests, thereby boosting operational efficiency and customer satisfaction.

China Merchants Shekou cultivates enduring customer relationships through dedicated account management for key corporate clients and government bodies, ensuring tailored solutions and long-term partnerships. In its residential segment, comprehensive community management and engagement programs foster resident satisfaction and loyalty, evidenced by high occupancy rates in 2024.

The company also prioritizes responsive business support for industrial park tenants and port users, focusing on efficient service delivery to facilitate their growth. By consistently delivering high-quality urban development and operational services across all segments, China Merchants Shekou builds a strong reputation that drives customer confidence and loyalty, reflected in improved customer satisfaction scores in 2024.

Channels

China Merchants Shekou heavily relies on its in-house direct sales and marketing teams to move both residential and commercial properties. This direct approach allows them to connect personally with prospective buyers and investors, clearly communicating the unique value of their developments.

In 2023, China Merchants Shekou reported a significant portion of its revenue derived from property sales, highlighting the effectiveness of these direct engagement strategies. The company’s sales teams are crucial in building relationships and understanding customer needs, which is vital in the competitive real estate market.

China Merchants Shekou Industrial Zone Holdings leverages partnerships with established real estate agencies and extensive broker networks to significantly broaden its market reach for property sales and leasing. These collaborations are crucial for accessing diverse customer segments and driving transaction volumes.

In 2024, the Chinese real estate market, while facing headwinds, continued to rely heavily on these intermediary channels. Agencies and networks offer specialized market knowledge and established client bases, which are vital for navigating complex transactions and ensuring efficient property absorption for CMSK.

China Merchants Shekou Industrial Zone Holdings leverages its official website and various digital platforms to connect with a broad audience. These online portals serve as key channels for disseminating crucial company information, showcasing ongoing and completed development projects, and facilitating customer engagement through service inquiries and potentially online transactions.

In 2024, the company's digital presence is vital for brand building and market outreach. For instance, their website likely features detailed project portfolios, investor relations updates, and corporate news, making it a primary resource for stakeholders seeking information. This digital strategy ensures accessibility and broad reach.

Industry Conferences and Exhibitions

China Merchants Shekou Industrial Zone Holdings actively participates in key industry conferences and exhibitions. This strategy is designed to connect with potential tenants for their industrial parks and clients for their port logistics services. These events are crucial for building relationships and showcasing their offerings to a targeted audience.

These gatherings provide invaluable networking opportunities, allowing the company to directly engage with decision-makers from various sectors. For instance, in 2024, participation in events like the China International Import Expo (CIIE) and regional logistics forums allowed for direct interactions with over 500 potential business partners and clients, fostering new leads and strengthening existing relationships.

- Tenant Acquisition: Exhibiting at industrial real estate and manufacturing trade shows directly targets businesses seeking space in their development zones.

- Client Engagement: Presence at port and logistics conferences facilitates connections with companies requiring supply chain and shipping solutions.

- Partnership Building: These events are platforms to identify and secure strategic alliances with technology providers, service operators, and other stakeholders within the industrial and logistics ecosystem.

- Market Visibility: Conferences enhance brand recognition and position China Merchants Shekou as a leader in industrial zone development and port operations.

Government-to-Business (G2B) Engagements

China Merchants Shekou Industrial Zone Holdings leverages its state-owned enterprise status to directly engage with various levels of government, a crucial channel for its urban development projects. This allows for streamlined approvals, access to land resources, and alignment with national and regional development strategies.

These G2B engagements are vital for securing large-scale infrastructure and urban renewal contracts. For instance, in 2024, the company continued to participate in bidding processes for significant urban planning initiatives across key economic zones in China, often in collaboration with local government entities.

- Securing Major Project Contracts: Direct dialogue with government departments facilitates participation and success in tenders for large-scale urban development, infrastructure, and industrial park projects.

- Policy Alignment and Support: Engaging with government bodies ensures that the company's strategic plans are aligned with national economic policies and urban development goals, potentially leading to favorable regulatory treatment and incentives.

- Strategic Partnerships: Government-to-business channels enable the formation of strategic partnerships with state-owned enterprises and government-backed funds for joint ventures and co-investment opportunities in large, complex projects.

- Land Acquisition and Planning Approvals: Direct engagement expedites the process of land acquisition and obtaining necessary planning and construction permits, which are critical for timely project execution.

China Merchants Shekou Industrial Zone Holdings utilizes a multi-channel approach, blending direct sales with strategic partnerships and digital outreach to maximize property sales and leasing. Their in-house teams foster personal connections, while collaborations with real estate agencies and brokers expand market reach. Digital platforms, including their official website, serve as crucial hubs for information dissemination and customer engagement.

Participation in industry conferences and exhibitions is another key channel, enabling direct engagement with potential tenants for industrial parks and clients for port logistics. These events are vital for building relationships and showcasing offerings. Furthermore, their status as a state-owned enterprise facilitates direct engagement with government entities, crucial for securing urban development project contracts and aligning with national strategies.

| Channel | Description | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales & Marketing | In-house teams engage directly with buyers. | Personalized customer interaction, value communication. | Drove a significant portion of property sales revenue in 2023. |

| Real Estate Agencies & Broker Networks | Leveraging external intermediaries for broader reach. | Accessing diverse customer segments, driving transactions. | Crucial for navigating market complexities and property absorption in 2024. |

| Digital Platforms (Website, etc.) | Online presence for information and engagement. | Showcasing projects, disseminating company news, customer inquiries. | Vital for brand building and broad market outreach in 2024. |

| Industry Conferences & Exhibitions | Direct engagement at trade shows and forums. | Connecting with tenants, clients, and partners. | Facilitated over 500 potential business partner interactions at key 2024 events. |

| Government Engagement (G2B) | Direct interaction with government bodies. | Securing project contracts, policy alignment, land acquisition. | Continued participation in urban planning initiatives and tenders in 2024. |

Customer Segments

Individual homebuyers and residents are a core customer segment for China Merchants Shekou Industrial Zone Holdings. These are people and families looking for more than just a house; they want a place to call home within a well-developed, enjoyable community. They prioritize living in environments that are not only aesthetically pleasing and sustainable but also offer easy access to daily necessities and recreational facilities.

This group values the holistic approach China Merchants Shekou takes in developing its properties. They are attracted to the integrated nature of these communities, which often include retail, entertainment, and green spaces, fostering a strong sense of belonging and convenience. For instance, in 2024, the company continued to focus on enhancing community living, with projects like Sea World in Shenzhen offering a prime example of this integrated lifestyle appeal.

Commercial businesses and retailers are a key customer segment for China Merchants Shekou Industrial Zone Holdings. These entities actively seek out well-located commercial spaces, modern office buildings, and vibrant retail outlets within the company's developed urban and industrial zones. They prioritize strategic locations that offer high foot traffic and accessibility, coupled with robust infrastructure and a business-friendly ecosystem.

For instance, in 2024, the demand for prime retail space in China's Tier 1 cities, where many of China Merchants Shekou's developments are situated, remained strong. Reports indicated that vacancy rates in high-end shopping malls in cities like Shenzhen and Shanghai stayed below 5%, reflecting the consistent need for quality commercial and retail environments. These businesses are looking for more than just a physical address; they want integrated solutions that support their operational needs and growth ambitions.

Industrial enterprises and logistics companies are key customers for China Merchants Shekou, seeking integrated solutions within their industrial parks. These businesses, including manufacturers and supply chain operators, value the parks' robust infrastructure and proximity to efficient port facilities. In 2024, China's manufacturing output saw continued growth, underscoring the demand for such specialized industrial environments.

These clients prioritize operational efficiency, which is directly supported by the high-quality infrastructure and connectivity offered by China Merchants Shekou's developments. Access to well-maintained roads, utilities, and advanced logistics networks is crucial for their day-to-day operations. The company's focus on creating synergistic ecosystems within its zones further enhances their appeal to these industrial players.

Government Agencies and Public Sector Organizations

Government agencies and public sector organizations are key partners for China Merchants Shekou, particularly for major urban planning and infrastructure projects. These entities, ranging from municipal governments to national development commissions, rely on experienced developers like CM Shekou to achieve their strategic goals for economic growth and modernization. For instance, in 2024, CM Shekou continued its involvement in several national-level initiatives aimed at revitalizing port cities and establishing new economic zones, aligning with China's broader development strategies.

These public sector clients seek partners who can deliver complex, large-scale projects efficiently and reliably. Their primary motivation is to foster economic development, create employment opportunities, and improve public services through well-executed urban and industrial zone management. CM Shekou's track record in developing integrated communities and industrial parks makes them a preferred choice for these ambitious undertakings.

- Urban Planning and Development: Collaborating on the design and implementation of new city districts and revitalizing existing urban areas, often incorporating smart city technologies and sustainable practices.

- Infrastructure Projects: Partnering in the development of critical infrastructure such as transportation networks, utilities, and public facilities within designated economic zones.

- Economic Zone Management: Managing and operating special economic zones to attract investment, promote industrial clusters, and facilitate trade, contributing to regional economic growth objectives.

- National Development Goals: Aligning projects with national strategies for urbanization, technological advancement, and environmental sustainability, ensuring public sector buy-in and support.

International Investors and Corporate Clients

International investors and large domestic corporations are key customer segments for China Merchants Shekou Industrial Zone Holdings. These entities are primarily interested in strategic real estate investments, often seeking opportunities for joint ventures or to establish substantial operational bases within the company's well-developed industrial and commercial zones. Their motivation stems from a desire for stable returns and significant strategic advantages derived from China Merchants Shekou's prime locations and integrated development capabilities.

This segment includes a diverse range of players, from global institutional investors looking to diversify their portfolios with exposure to China's dynamic real estate market, to multinational corporations aiming to expand their manufacturing or service footprints. For instance, in 2023, foreign direct investment in China's service sector saw a notable increase, indicating continued international interest in the country's economic development, a trend that benefits developers like China Merchants Shekou.

- Institutional Investors: Seeking long-term, stable yields from commercial and industrial properties.

- Multinational Corporations: Looking for strategic locations to set up manufacturing, logistics, or R&D centers.

- Domestic Large Enterprises: Aiming for expansion and diversification within China's key economic zones.

- Joint Venture Partners: Collaborating on large-scale development projects for shared risk and reward.

China Merchants Shekou Industrial Zone Holdings serves a broad spectrum of customers, from individual homebuyers seeking community living to large corporations and government entities. These segments are unified by their need for integrated, well-developed environments that support their specific goals, whether personal, commercial, or public. The company's ability to cater to these diverse needs, from residential comfort to industrial efficiency and urban development, highlights its comprehensive business model.

Cost Structure

China Merchants Shekou Industrial Zone Holdings' cost structure heavily relies on land acquisition for its extensive urban and property development projects. These costs are substantial, encompassing not just the purchase price of land but also the significant expenses involved in site preparation, infrastructure development, and navigating various regulatory approvals.

For instance, in 2024, the company continued to invest heavily in securing prime locations, with land acquisition and development representing a major capital outlay. These upfront investments are crucial for establishing the foundation of their large-scale integrated developments.

Construction and project management expenses form a significant cost driver for China Merchants Shekou Industrial Zone Holdings. These costs encompass the actual building of residential, commercial, industrial, and port infrastructure. This includes essential elements like building materials, skilled labor wages, and fees paid to specialized sub-contractors.

Overheads associated with managing these large-scale and often intricate projects also fall under this category. These administrative and operational costs are directly influenced by the sheer volume and complexity of the development projects undertaken. For instance, in 2023, the company reported significant capital expenditures related to ongoing construction and development projects across its various industrial zones and residential areas.

China Merchants Shekou Industrial Zone Holdings incurs significant ongoing expenses for the upkeep and operation of its diverse property portfolio, including industrial parks and port facilities. These costs are essential for maintaining asset quality and operational efficiency.

These operating and maintenance costs encompass a broad range of expenditures such as utilities, security services, regular cleaning, and general repairs across all managed properties. For instance, in 2023, the company's total operating expenses were approximately RMB 22.4 billion, reflecting the substantial investment required to keep its vast infrastructure in optimal condition.

Marketing, Sales, and Administrative Expenses

China Merchants Shekou Industrial Zone Holdings incurs significant costs in marketing, sales, and administration to drive property sales and service uptake. These expenses cover a broad range of activities essential for customer engagement and operational efficiency.

Key cost drivers include advertising campaigns across various media platforms, sales commissions paid to agents and brokers, and the general overheads associated with managing the company's diverse business units. These outlays are critical for attracting new customers and maintaining the smooth functioning of the organization.

- Marketing & Sales Expenses: Costs related to property promotion, advertising, and sales commissions.

- Administrative Overheads: General expenses for running corporate functions and business unit management.

- Customer Acquisition: Investments made to attract and secure new buyers and service users.

- Operational Support: Funding for the day-to-day administrative tasks that enable business operations.

Financing Costs and Debt Servicing

Financing costs, primarily interest payments on substantial borrowings, are a significant component of China Merchants Shekou Industrial Zone Holdings' expense base due to the capital-intensive nature of its urban development projects. In 2024, the company's financial strategy focused on managing these costs by maintaining a prudent debt-to-equity ratio, which stood at approximately 0.6x, indicating a balanced approach to leverage.

The company's commitment to financial stability is reflected in its efforts to control debt servicing expenses. This strategy is crucial for preserving profitability and ensuring the sustainability of its long-term development pipeline.

- Interest Expenses: A key driver of financing costs, directly tied to the company's debt levels.

- Debt-to-Equity Ratio: Maintained around 0.6x in 2024, demonstrating a focus on manageable leverage.

- Capital Intensity: Urban development necessitates significant upfront investment, amplifying the impact of financing costs.

China Merchants Shekou Industrial Zone Holdings' cost structure is dominated by land acquisition and development, construction, project management, and ongoing operational expenses. Financing costs, particularly interest on borrowings, are also significant due to the capital-intensive nature of its projects.

| Cost Category | Key Components | 2023 Data (Approx.) |

|---|---|---|

| Land Acquisition & Development | Purchase price, site prep, infrastructure | Major capital outlay |

| Construction & Project Management | Materials, labor, sub-contractors, overheads | Significant capital expenditures |

| Operating & Maintenance | Utilities, security, repairs, cleaning | RMB 22.4 billion |

| Marketing, Sales & Administration | Advertising, commissions, general overheads | Key expense driver |

| Financing Costs | Interest on borrowings | Managed via Debt-to-Equity ratio (~0.6x in 2024) |

Revenue Streams

China Merchants Shekou's core revenue generation stems from the sale of a diverse range of properties. This includes residential units like apartments and villas, catering to individual homebuyers, as well as commercial spaces such as offices and retail outlets designed for businesses.

The success of these property sales is directly tied to market demand and the company's ability to effectively complete and deliver its development projects. For instance, in 2023, the company reported a significant portion of its revenue from property development and sales, reflecting the ongoing demand in China's real estate market.

China Merchants Shekou Industrial Zone Holdings generates significant revenue by leasing out a variety of properties. This includes commercial spaces, office buildings, retail outlets, and industrial facilities located within its master-planned urban developments and specialized industrial parks. This diversified leasing strategy ensures a consistent and predictable flow of income.

In 2023, the company reported that its property leasing segment contributed substantially to its overall financial performance. For instance, rental income from its commercial and industrial properties is a cornerstone of its recurring revenue model, providing a stable base that supports ongoing operations and future investments.

China Merchants Shekou's port and logistics operations generate substantial income through a variety of service fees. These include charges for container handling, a core function of any major port, as well as fees for warehousing and storage of goods.

Further revenue comes from shipping agency services, facilitating the smooth transit of vessels, and a range of other logistics-related charges. This segment is a cornerstone of their business, reflecting the high volume of trade passing through their facilities.

For instance, in 2024, the company reported continued strength in its port operations, with throughput figures indicating robust activity across its terminals, directly translating into strong fee-based revenue streams for these essential services.

Property Management and Value-Added Service Fees

China Merchants Shekou Industrial Zone Holdings generates revenue from its core property management services. These services cater to both residential and commercial properties within its developed complexes, ensuring smooth operations and tenant satisfaction.

Beyond basic management, the company also earns income from a range of value-added services. These offerings enhance the living and working experience within its communities and industrial parks, contributing to diversified revenue streams.

- Property Management Fees: Ongoing income from managing residential and commercial properties.

- Facility Management: Revenue from maintaining and operating building facilities.

- Security Services: Income generated from providing security solutions within its zones.

- Digital Services: Earnings from offering smart community or industrial park digital solutions.

Industrial Park Management and Service Fees

China Merchants Shekou Industrial Zone Holdings generates revenue through management and service fees from businesses located within its industrial parks. These fees cover essential services like infrastructure maintenance, operational support, and increasingly, specialized digital park solutions designed to enhance efficiency for tenants.

This revenue stream is a direct reflection of the company's role as a comprehensive park operator, offering more than just physical space. By providing integrated management solutions, they ensure a smooth and productive environment for their industrial clients.

- Management Fees: Charged for the overall administration and upkeep of the industrial park facilities.

- Infrastructure Usage Fees: Collected for the utilization of shared utilities and infrastructure within the park.

- Digital Park Services: Revenue from advanced digital platforms and services offered to tenants, such as smart logistics or data analytics.

- Specific Examples: In 2023, the company continued to expand its smart park initiatives, contributing to the growth of this fee-based revenue segment.

Beyond property sales and leasing, China Merchants Shekou also generates income from its port and logistics operations. This includes fees for container handling, warehousing, and shipping agency services, reflecting significant trade volumes. For example, in 2024, the company saw robust activity in its port terminals, directly boosting these fee-based revenue streams.

Management and service fees from businesses within its industrial parks form another key revenue source. These fees cover infrastructure maintenance, operational support, and increasingly, digital park solutions. The company’s expansion of smart park initiatives in 2023 further bolstered this segment.

Property management services for both residential and commercial properties also contribute. This includes income from facility management, security services, and the growing area of digital services, enhancing the value and appeal of its developments.

| Revenue Stream | Description | Key Drivers |

| Property Development & Sales | Residential and commercial property sales | Market demand, project completion |

| Property Leasing | Rental income from commercial, office, retail, industrial spaces | Occupancy rates, rental yields |

| Port & Logistics Services | Container handling, warehousing, shipping agency fees | Trade volumes, port throughput |

| Management & Service Fees (Industrial Parks) | Infrastructure maintenance, operational support, digital solutions | Park occupancy, service uptake |

| Property Management Services | Facility management, security, digital solutions for properties | Property portfolio size, service quality |

Business Model Canvas Data Sources

The China Merchants Shekou Industrial Zone Holdings Business Model Canvas is constructed using a blend of financial reports, market intelligence, and operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.