China Merchants Shekou Industrial Zone Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Shekou Industrial Zone Holdings Bundle

China Merchants Shekou Industrial Zone Holdings navigates a landscape shaped by moderate buyer power and intense rivalry within the industrial zone development sector. While the threat of new entrants is somewhat mitigated by high capital requirements and established infrastructure, the bargaining power of suppliers, particularly for specialized construction materials and labor, presents a notable challenge. Substitutes, such as alternative industrial park locations or different business models, also exert pressure on its market position.

The complete report reveals the real forces shaping China Merchants Shekou Industrial Zone Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Land suppliers, primarily local governments in China, wield significant bargaining power over developers like China Merchants Shekou Industrial Zone Holdings. This power stems from their control over land availability and pricing, directly impacting development costs. For instance, in 2023, land sales revenue for China's local governments exceeded 10 trillion yuan, showcasing their crucial role in the real estate ecosystem.

Government policies regarding land supply and development are key determinants of project feasibility. Recent interventions aimed at stabilizing the property market, such as adjustments to land auction regulations and pricing mechanisms, can influence both the cost and accessibility of land for companies. This dynamic means developers must closely monitor government directives to navigate the market effectively.

The bargaining power of construction material suppliers for China Merchants Shekou Industrial Zone Holdings is influenced by several factors. The availability of raw materials, the number of competing suppliers, and the distinctiveness of their offerings all play a role. In 2024, China's vast construction sector means a large pool of potential suppliers, but for specialized or premium materials, certain suppliers might hold more sway.

Global supply chain disruptions, such as those experienced in 2022 and continuing into 2023 and 2024, can significantly bolster supplier power. If domestic production is also constrained, for instance, due to environmental regulations or energy shortages impacting manufacturing, suppliers of essential building components could command higher prices or dictate terms more forcefully.

Financiers and lenders hold significant bargaining power over China Merchants Shekou Industrial Zone Holdings, as the company, like many real estate developers, is heavily dependent on their capital. The cost and availability of loans directly impact the company's ability to fund its projects and operations.

Recent years have seen increased scrutiny and tighter regulations on real estate financing in China, a trend that intensified in 2023 and continued into 2024. This deleveraging campaign, aimed at curbing systemic financial risks, has made lenders more selective and demanding, thereby strengthening their position when negotiating terms with developers like China Merchants Shekou.

Technology and Digital Solutions Providers

China Merchants Shekou Industrial Zone Holdings' increasing involvement in digital park services and smart city initiatives means a growing dependence on technology and digital solution providers. These specialized companies, offering expertise in areas like AI, IoT, cloud computing, and smart infrastructure, can wield considerable bargaining power due to their unique and proprietary offerings. For instance, the widespread adoption of Building Information Modeling (BIM) further solidifies this reliance on specific software and service vendors.

This reliance translates into potential cost pressures and strategic dependencies for China Merchants Shekou. The market for advanced digital solutions is often characterized by a limited number of highly specialized providers, particularly in niche areas critical for smart city development.

- High Switching Costs: Migrating complex digital infrastructure and data management systems can be costly and time-consuming, locking companies into existing provider relationships.

- Concentration of Expertise: Certain advanced technologies, like sophisticated AI algorithms for urban management or specialized IoT platforms, are controlled by a few key players.

- Intellectual Property: Proprietary software and patented technologies held by these providers create barriers to entry and enhance their negotiation leverage.

Labor and Skilled Workforce

The availability of a skilled workforce, encompassing architects, engineers, construction professionals, and urban planners, is crucial for China Merchants Shekou Industrial Zone Holdings' varied projects. A scarcity of specialized talent or rising wage expectations, especially for expertise in urban development and advanced digital park services, can significantly amplify the bargaining power of these employees.

Consider these aspects regarding the skilled workforce:

- Talent Scarcity Impact: In 2024, China continued to face a demand-supply gap in certain high-skilled sectors, potentially driving up labor costs for companies like China Merchants Shekou.

- Wage Growth Trends: Reports from early 2025 indicated continued upward pressure on wages for specialized technical roles within China's rapidly developing urban and technology sectors.

- Unionization and Collective Bargaining: While not as prevalent as in some Western economies, the potential for collective bargaining by skilled labor groups in specific regions could further enhance their negotiation leverage.

- Geographic Concentration: The concentration of skilled labor in specific economic zones might give workers in those areas increased bargaining power due to limited alternative employment options for employers.

Land suppliers, primarily local governments in China, hold substantial bargaining power over developers like China Merchants Shekou Industrial Zone Holdings due to their control over land availability and pricing. This is underscored by the fact that in 2023, local governments in China generated over 10 trillion yuan from land sales, highlighting their critical position in the real estate market.

Government policies, such as adjustments to land auction regulations and pricing, directly influence land costs and accessibility for developers, as seen in efforts to stabilize the property market in 2023 and 2024. This necessitates that companies like China Merchants Shekou closely monitor these directives to navigate market dynamics effectively.

The bargaining power of construction material suppliers for China Merchants Shekou Industrial Zone Holdings is influenced by factors like raw material availability and the number of competing suppliers. While China's large construction sector in 2024 offers a broad supplier base, specialized materials may grant certain suppliers more leverage.

Global supply chain disruptions, which persisted from 2022 through 2023 and into 2024, have amplified supplier power. Constraints on domestic production, potentially due to environmental regulations or energy shortages impacting manufacturing, can lead suppliers of essential building components to demand higher prices or dictate more stringent terms.

What is included in the product

This analysis of China Merchants Shekou Industrial Zone Holdings reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within its unique industrial zone development context.

Gain immediate clarity on competitive pressures within the Shekou Industrial Zone, allowing for proactive strategic adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Residential property buyers in China are currently wielding significant bargaining power. This is largely due to a protracted downturn in the real estate market, characterized by falling prices and an oversupply in numerous urban centers. For instance, in 2024, property sales volume in many Tier 1 and Tier 2 cities saw a noticeable decline compared to previous years, creating a more favorable environment for buyers.

Government policies implemented to stabilize the market further underscore this shift. Measures such as relaxed purchase restrictions and more accommodating mortgage terms are designed to reignite buyer confidence, effectively signaling a market where buyers have greater leverage. This buyer-driven dynamic means that developers like China Merchants Shekou Industrial Zone Holdings must be more responsive to buyer demands regarding pricing and project features.

The bargaining power of commercial property tenants and buyers is significantly influenced by vacancy rates and the overall supply of available space. When there's a lot of empty property, tenants gain more sway.

In 2024, a notable trend emerged across many Chinese cities, particularly in first and second-tier urban centers, where commercial real estate vacancy rates climbed. This oversupply naturally put downward pressure on rental prices, effectively increasing the leverage held by prospective tenants.

China Merchants Shekou's port and shipping services are utilized by a wide array of businesses, primarily those engaged in international trade and logistics. The strength of these customers' bargaining power hinges on several factors, notably the availability of competing port facilities and alternative logistics providers. For instance, the sheer volume of trade handled by major Chinese ports, such as Shanghai and Ningbo-Zhoushan, which collectively handled over 2.7 billion tons of cargo in 2023, underscores the potential for customers to seek better terms if alternatives exist.

The competitive landscape for port services in China is dynamic. While China's continued investment in port infrastructure, aiming to enhance efficiency and capacity, benefits the overall logistics ecosystem, it also provides customers with more choices. This increased competition among ports and logistics firms can lead to price pressures and demands for improved service levels from port operators like China Merchants Shekou.

Digital Park Service Clients

The bargaining power of digital park service clients, such as businesses and government entities, varies. China Merchants Shekou's ability to offer unique, integrated smart city solutions is a key factor. If competitors offer similar services, clients gain leverage. In 2024, the smart city market saw significant growth, with investments reaching billions globally, indicating a competitive landscape where clients can exert more pressure.

- Client Scale: Larger clients, like major corporations or significant government bodies, often possess greater bargaining power due to their volume of business and potential to switch providers.

- Service Differentiation: If China Merchants Shekou's digital park services are highly specialized and difficult to replicate, client bargaining power is reduced.

- Availability of Alternatives: The presence of numerous competing digital park service providers directly increases the bargaining power of potential clients.

Government and Public Sector Entities

Government and public sector entities wield considerable bargaining power over China Merchants Shekou Industrial Zone Holdings. As key players in urban planning and policy, they can significantly influence the terms of large-scale development projects, including zoning regulations and approvals. For instance, in 2024, many municipal governments in China were actively seeking developers for ambitious smart city and urban renewal projects, often stipulating favorable terms for public benefit and infrastructure integration.

Their influence stems from their ability to grant or withhold permits, set development standards, and their role as major clients for infrastructure and public amenity construction. This power is amplified when these entities are the primary purchasers of services or land for significant urban transformation initiatives. China Merchants Shekou's participation in such projects means they must often negotiate terms that align with governmental objectives, potentially impacting profit margins.

- Government as a Major Client: Public sector entities often commission extensive infrastructure and urban development projects, making them crucial customers for companies like China Merchants Shekou.

- Policy and Regulatory Influence: Governments set the rules for urban planning, land use, and development, giving them leverage over project scope, timelines, and financial terms.

- Negotiating Power in Urban Renewal: In 2024, many Chinese cities prioritized smart city and sustainable development, empowering local governments to negotiate advantageous terms for developers involved in these initiatives.

- Impact on Project Viability: The ability of government entities to shape project requirements and approval processes directly affects the cost and profitability of China Merchants Shekou's developments.

The bargaining power of residential property buyers for China Merchants Shekou is substantial, driven by a market oversupply and declining prices in many 2024 urban centers. This leverage is amplified by government measures easing purchase restrictions, signaling a buyer-centric market. Consequently, developers must be highly responsive to buyer demands concerning pricing and property features to secure sales.

Commercial property tenants and buyers hold considerable sway, especially when vacancy rates are high, as observed in many Chinese cities during 2024. This oversupply pressured rental prices, increasing tenant negotiation power. China Merchants Shekou must therefore adapt its commercial offerings and pricing strategies to attract and retain these influential clients.

Customers in port and shipping services, such as international traders, possess significant bargaining power due to the availability of competing port facilities and logistics providers. The sheer volume of cargo handled by major Chinese ports, exceeding 2.7 billion tons in 2023, illustrates the potential for customers to seek better terms. China Merchants Shekou faces pressure to offer competitive pricing and enhanced service levels in this dynamic environment.

Clients of digital park services, including businesses and government entities, have varying levels of bargaining power. The growing smart city market, with global investments in the billions in 2024, indicates a competitive landscape where clients can exert more pressure if similar services are readily available. China Merchants Shekou’s ability to differentiate its unique, integrated smart city solutions is crucial in mitigating this client leverage.

| Customer Segment | Key Bargaining Power Factors | 2024 Market Context/Data |

|---|---|---|

| Residential Property Buyers | Market oversupply, falling prices, government easing policies | Property sales volume declined in many Tier 1/2 cities in 2024. |

| Commercial Property Tenants/Buyers | High vacancy rates, availability of alternative spaces | Increased vacancy rates in major urban centers in 2024 led to downward pressure on rents. |

| Port & Shipping Services Customers | Availability of competing ports/logistics providers, trade volume | China's ports handled over 2.7 billion tons of cargo in 2023, offering customers choice. |

| Digital Park Service Clients | Availability of alternative providers, service differentiation | Smart city market saw billions in global investment in 2024, indicating competitive pressure. |

Preview Before You Purchase

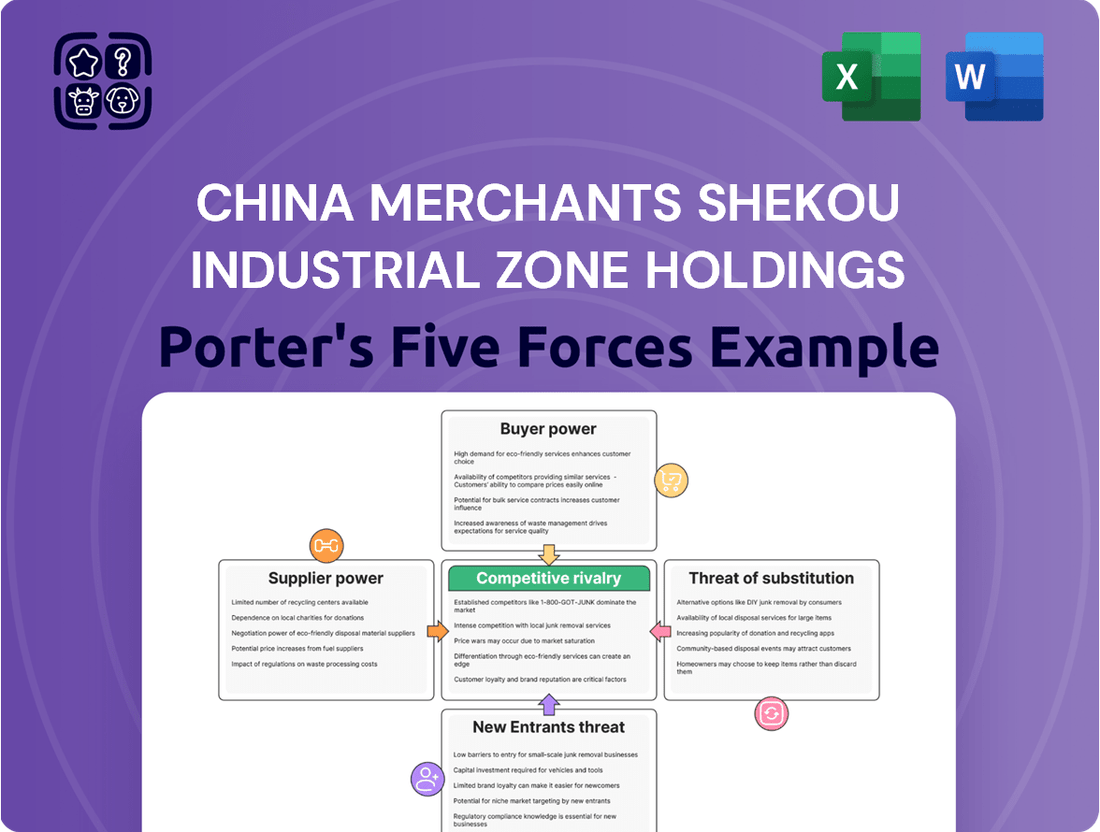

China Merchants Shekou Industrial Zone Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Merchants Shekou Industrial Zone Holdings, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. You can be confident that the analysis you see is precisely the document you will receive, offering a complete and professionally formatted strategic assessment.

Rivalry Among Competitors

The Chinese real estate sector is a battlefield, with many large developers fiercely competing for dominance. China Merchants Shekou, despite being a top five player by sales, faces formidable rivals. State-backed behemoths like Poly Developments and China Vanke, along with other significant entities such as Longfor Group and Seazen Holdings, are constantly vying for market share.

This intense rivalry is amplified by a recent significant downturn in the market. Developers are now engaged in a fierce struggle to secure sales and successfully complete their projects, making the competitive landscape even more challenging for all participants.

While China Merchants Shekou holds a significant presence in port and shipping, the Chinese logistics landscape is intensely competitive. Other state-owned enterprises and numerous private logistics firms are actively expanding their infrastructure and adopting advanced technologies, intensifying rivalry.

The ongoing trend of vertical integration within China's shipping and logistics sectors introduces competition from companies aiming to provide comprehensive, end-to-end supply chain solutions. This means China Merchants Shekou faces rivals offering a more holistic service package, not just port operations.

The digital park and smart city service sectors in China are experiencing robust growth, drawing in numerous new players and spurring significant innovation. This dynamic environment presents a growing competitive challenge for established companies like China Merchants Shekou Industrial Zone Holdings.

While China Merchants Shekou has carved out a market position, the landscape is becoming increasingly crowded. Technology giants and other urban development companies are actively entering this space, particularly as the Chinese government champions smart city initiatives. For instance, by the end of 2023, China had approved over 290 national smart city pilot projects, indicating a strong governmental push that fuels this burgeoning competition.

Geographic and Regional Competition

Competitive rivalry within China Merchants Shekou Industrial Zone Holdings is heavily influenced by geographic and regional dynamics. Competition can vary significantly by region and city across China. While first-tier cities like Shenzhen and Shanghai remain crucial markets, second-tier cities are also experiencing substantial development and increasing competition.

China Merchants Shekou's strategic land acquisitions in high-growth areas, such as its significant investments in the Greater Bay Area, demonstrate its proactive approach to maintaining a competitive edge in specific geographies. For instance, in 2023, the company continued to focus on acquiring prime land parcels in key economic zones, anticipating future demand and competitive pressures.

- Regional Market Concentration: China Merchants Shekou's competitive landscape is shaped by its presence in key economic hubs, where local developers and state-owned enterprises are also active.

- Second-Tier City Growth: The company's expansion into developing second-tier cities highlights the evolving competitive environment, with local players often having strong regional ties and market knowledge.

- Land Acquisition Strategy: Strategic land acquisitions in areas like the Greater Bay Area, which saw significant infrastructure investment announcements in 2024, are critical for China Merchants Shekou to secure future market share against rivals.

Impact of Market Downturn on Rivalry

The current downturn in China's real estate market has significantly heightened competitive rivalry among developers like China Merchants Shekou Industrial Zone Holdings. With sales volumes falling and profit margins tightening, companies are under immense pressure to conserve cash and maintain liquidity.

This pressure translates into more aggressive sales tactics and a sharpened focus on operational efficiency across the industry. Competitors are actively seeking ways to reduce costs and boost sales, leading to a more intense battle for market share.

- Intensified Competition: Developers are employing more aggressive pricing and promotional strategies to attract buyers in a shrinking market.

- Focus on Cash Flow: Maintaining adequate cash reserves has become paramount, driving cost-cutting measures and a cautious approach to new investments.

- Consolidation Pressure: Weaker players may struggle to survive, potentially leading to industry consolidation as stronger companies acquire distressed assets.

China Merchants Shekou Industrial Zone Holdings faces intense competition from major state-backed developers and other significant players in the Chinese real estate sector. This rivalry is exacerbated by a significant market downturn, forcing companies to compete aggressively for sales and project completion.

The company's expansion into digital parks and smart city services also introduces competition from technology giants and new urban development firms, driven by government initiatives like the approval of over 290 national smart city pilot projects by the end of 2023.

| Competitor | Market Position | Key Strengths |

|---|---|---|

| Poly Developments | Top 5 Developer | State backing, extensive land bank |

| China Vanke | Top 5 Developer | Strong brand recognition, diversified business |

| Longfor Group | Major Developer | Residential and commercial property, strong urban renewal focus |

| Seazen Holdings | Major Developer | Residential development, property management services |

SSubstitutes Threaten

For residential property, alternatives like renting or opting for pre-owned homes pose a significant threat to new developments. In 2024, China's rental market experienced a notable downturn, with average rents in major cities like Beijing and Shanghai seeing a decrease of 3-5% year-on-year. This shift empowers renters, giving them greater leverage and making renting a more attractive substitute to purchasing new units.

The abundance and competitive pricing of existing homes further bolster the threat of substitutes. Data from the China Real Estate Information Corporation indicated that the inventory of existing homes available for resale increased by approximately 7% in the first half of 2024, often at prices below comparable new constructions. This availability and potential cost savings make second-hand properties a strong competitor to new residential projects.

Businesses looking for commercial space have several alternatives to traditional office buildings, including the growing popularity of co-working spaces. These flexible arrangements offer cost savings and adaptability, making them attractive substitutes. For instance, the global co-working market was valued at approximately $10.2 billion in 2023 and is projected to grow significantly.

Furthermore, the widespread adoption of remote and hybrid work models has diminished the demand for large, centralized office spaces. This trend allows companies to reduce their physical footprint or even operate without a traditional office altogether. In 2024, it's estimated that over 30% of the global workforce will be working remotely at least part-time.

Companies also have the option to relocate to different cities or industrial zones that offer more favorable lease terms, lower operating costs, or better access to talent. The presence of high vacancy rates in many commercial property markets in 2024, with some urban centers experiencing office vacancy rates exceeding 15%, further empowers businesses to negotiate better deals or choose existing, move-in ready spaces over new developments.

The threat of substitutes for China Merchants Shekou Industrial Zone Holdings' port and shipping services is moderate. While sea lanes remain the backbone of global trade, alternative transportation modes like rail freight, air freight, and integrated multimodal logistics solutions pose a competitive challenge. For instance, the burgeoning China-Europe freight rail network offers a compelling alternative, particularly for time-sensitive shipments and specific cargo types, impacting the demand for traditional sea routes.

Non-Integrated Urban Development Solutions

The threat of substitutes for China Merchants Shekou's integrated urban development model arises from clients choosing fragmented, unbundled services. Instead of a single provider handling property development, infrastructure, and management, clients could engage separate specialists for each component. This unbundling allows for greater customization and potentially lower costs for specific service elements, directly challenging the value proposition of a comprehensive, one-stop solution.

For instance, a developer might opt for a specialized infrastructure firm to handle utilities and transportation, a separate property developer for residential and commercial spaces, and a third-party company for ongoing property management. This approach allows clients to cherry-pick best-in-class providers for each segment, potentially bypassing the need for an all-encompassing integrated urban development company like China Merchants Shekou.

- Fragmented Service Providers: Clients can source individual services like construction, infrastructure, and management from different specialized firms.

- Cost Optimization: Unbundling may allow clients to negotiate better rates for specific services compared to an integrated package.

- Flexibility and Customization: Choosing separate providers offers greater flexibility to tailor solutions to unique project requirements.

Generic Property Management and Community Services

The threat of substitutes for generic property management and community services is significant. Numerous smaller, local providers and even in-house management by property owners offer comparable services, often at a lower cost. For China Merchants Shekou Industrial Zone Holdings, the key is to highlight the distinctiveness and perceived value of its offerings to mitigate this threat.

In 2024, the property management sector continued to see a proliferation of smaller, agile companies capable of offering tailored services. These often compete by focusing on niche markets or leveraging lower overheads. For instance, many residential communities are exploring self-management models, particularly in areas where service quality from larger providers has been inconsistent.

- High Availability of Local Providers: Numerous smaller, regional property management firms exist, often with established local relationships and lower cost structures.

- Rise of In-House Management: Property owners, especially those with multiple assets, are increasingly considering or implementing in-house management to control costs and service quality directly.

- Price Sensitivity: For basic property maintenance and community services, price is a major factor, making generic alternatives attractive to cost-conscious property owners.

- Differentiating Value: China Merchants Shekou must emphasize unique service packages, technology integration, or brand reputation to justify any premium over substitute offerings.

The threat of substitutes for China Merchants Shekou's offerings is multifaceted, impacting its residential, commercial, and industrial segments. For residential property, renting or purchasing pre-owned homes presents a strong alternative, especially with declining rental prices in major Chinese cities in 2024, which fell by 3-5% year-on-year. Similarly, commercial clients can opt for flexible co-working spaces, a market valued at $10.2 billion in 2023, or even remote work models, with over 30% of the global workforce working remotely part-time in 2024, reducing the need for traditional office spaces.

The port and shipping sector faces moderate substitution threats from alternatives like China-Europe freight rail, which offers a competitive option for time-sensitive cargo. Furthermore, the integrated urban development model is challenged by clients choosing fragmented, unbundled services from specialized providers, allowing for greater customization and potential cost savings. Generic property management services also face significant competition from numerous smaller, local providers and the increasing trend of in-house management by property owners, particularly in 2024, where many residential communities explored self-management.

| Segment | Key Substitutes | Impact/Trend (2024 Data) |

|---|---|---|

| Residential Property | Renting, Pre-owned Homes | Rents in major cities down 3-5% YoY; increased inventory of resale homes. |

| Commercial Property | Co-working Spaces, Remote Work | Global co-working market ~$10.2B (2023); >30% global workforce remote part-time. |

| Port & Shipping | Rail Freight (e.g., China-Europe) | Growing competitiveness for time-sensitive and specific cargo. |

| Urban Development | Unbundled Service Providers | Clients can cherry-pick specialized firms for construction, infrastructure, management. |

| Property Management | Local Providers, In-house Management | Proliferation of smaller firms; increasing adoption of self-management models. |

Entrants Threaten

Entering China's urban development and large-scale property sector demands immense capital for land acquisition, construction, and infrastructure. This high barrier significantly deters new players, especially given recent financial market deleveraging efforts and ongoing economic adjustments within China.

The real estate, port, and industrial park sectors in China are heavily regulated, with new entrants facing a labyrinth of government permits and policies. For instance, in 2024, the Chinese government continued its focus on stabilizing the property market, introducing measures that often require substantial capital and compliance expertise, making it difficult for smaller or foreign companies to enter.

China Merchants Shekou Industrial Zone Holdings benefits significantly from its established brand reputation and substantial market share. This strong market position makes it difficult for new entrants to gain a foothold, as they must contend with the company's long-standing relationships with local governments and a proven history of successfully executing large-scale development projects.

Overcoming China Merchants Shekou's entrenched leadership requires new competitors to invest heavily in building trust and recognition. For instance, in 2023, China Merchants Shekou reported total assets of RMB 775.5 billion, showcasing the scale of operations that new entrants must match or surpass to compete effectively.

Access to Land and Strategic Locations

Securing prime land parcels and strategic locations is a significant barrier for new entrants in China's real estate and industrial development sectors. Established players like China Merchants Shekou often possess extensive existing land banks and established relationships with government entities that control land supply. This makes it exceptionally difficult for newcomers to acquire desirable sites for urban development, ports, or industrial parks.

The Chinese government's role in land allocation further solidifies this advantage for incumbents. For instance, in 2023, urban land supply auctions saw intense competition, with successful bids often reflecting existing developer advantages. New entrants face not only the challenge of capital but also the hurdle of navigating complex land acquisition processes where preferential access is a key determinant of success.

- Government Control: Land supply in China is largely state-controlled, favoring established developers with strong government ties.

- Existing Land Banks: Companies like China Merchants Shekou benefit from pre-existing land reserves, giving them a head start.

- High Acquisition Costs: New entrants face prohibitive costs and complex procedures to acquire competitive land parcels.

- Strategic Location Scarcity: Desirable locations for development are limited and highly sought after, exacerbating entry barriers.

Expertise in Integrated Urban Development and Digital Services

The threat of new entrants for China Merchants Shekou Industrial Zone Holdings, particularly concerning its expertise in integrated urban development and digital services, is moderate. Their business model is complex, encompassing urban planning, construction, port operations, and advanced digital park services. This requires a broad spectrum of specialized knowledge and significant capital investment.

New companies entering this space would need to either develop or acquire a similarly diverse skill set. For instance, a new entrant would have to master not only traditional real estate development but also the intricacies of port logistics and the implementation of cutting-edge digital infrastructure within these zones. This multifaceted expertise barrier is substantial.

- High Capital Requirements: Establishing integrated urban development projects necessitates enormous upfront capital for land acquisition, infrastructure development, and technology integration, deterring many potential new entrants.

- Regulatory Hurdles: Navigating the complex web of urban planning, environmental, and digital service regulations in China requires significant experience and established relationships, which new players may lack.

- Brand Reputation and Track Record: China Merchants Shekou benefits from a strong brand reputation built over years of successful project delivery, a factor that new entrants would struggle to replicate quickly.

- Technological Integration Complexity: Successfully integrating digital services into urban development requires specialized knowledge in areas like IoT, smart city technologies, and data management, a steep learning curve for new competitors.

The threat of new entrants for China Merchants Shekou Industrial Zone Holdings is generally considered moderate. Significant capital investment is required for land acquisition and development, a substantial hurdle for newcomers. Furthermore, navigating China's complex regulatory landscape and securing necessary permits demands considerable expertise and established relationships, which new players often lack.

China Merchants Shekou's established brand and extensive land banks provide a considerable competitive advantage, making it difficult for new entrants to gain traction. The scarcity of prime locations further intensifies this barrier, as new companies must compete with incumbents for limited, desirable development sites.

The company's integrated business model, spanning urban planning, port operations, and digital services, presents a steep learning curve and high expertise requirements for any potential competitor. Successfully replicating this multifaceted approach is a significant challenge for new market participants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, construction, and infrastructure. | Deters smaller or less-capitalized firms. |

| Regulatory Environment | Complex permits, policies, and government oversight. | Requires deep understanding and established connections. |

| Brand & Market Share | Established reputation and significant market presence. | Difficult for new entrants to build trust and gain market share. |

| Land Acquisition | Access to prime locations and existing land banks. | New entrants face high costs and competition for sites. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Merchants Shekou Industrial Zone Holdings is built upon a foundation of comprehensive data, including company annual reports, official government statistics, and reputable industry research databases. This approach ensures a robust understanding of the competitive landscape.