CMB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMB Bundle

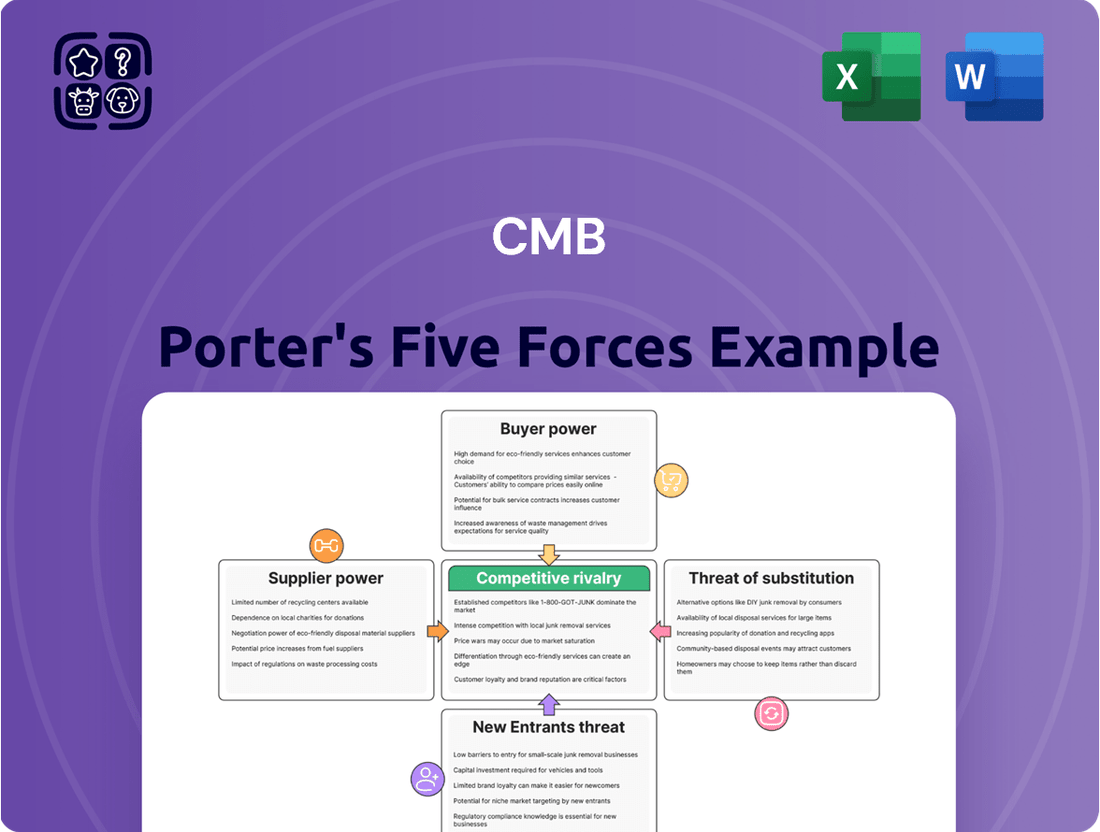

CMB's competitive landscape is shaped by five key forces, revealing the intensity of rivalry, the power of buyers and suppliers, and the ever-present threats of new entrants and substitutes. Understanding these dynamics is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CMB’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers in the maritime sector, particularly for companies like CMB focusing on new technologies such as hydrogen solutions, is a crucial consideration. A concentrated supplier base, where only a few companies can provide essential components like advanced marine engines or specialized hydrogen fuel cell systems, significantly amplifies supplier power. For instance, if only two or three global shipyards possess the certified expertise to build advanced gas carriers or if a limited number of engine manufacturers dominate the market for dual-fuel engines, these suppliers can dictate terms and pricing.

In 2024, the maritime industry continues to see consolidation among key equipment manufacturers. For example, the market for large marine diesel engines is largely dominated by a handful of players, and the emerging market for hydrogen propulsion systems is still developing, with a limited number of certified suppliers. This concentration means these specialized suppliers, particularly those providing cutting-edge green technology, can command higher prices and favorable payment terms due to high demand and limited alternatives, impacting CMB's cost structure and project timelines.

The bargaining power of suppliers for CMB is significantly influenced by switching costs. For critical components like advanced marine engines or specialized fuel systems, the expense and complexity involved in changing suppliers can be substantial. These costs might include financial penalties for early contract termination, the need for extensive re-tooling of manufacturing or maintenance facilities, and potential compatibility issues with existing CMB vessels or new designs.

In 2024, the maritime industry has seen a growing demand for eco-friendly propulsion systems, such as those powered by green methanol or hydrogen. Suppliers of these cutting-edge technologies often possess strong bargaining power due to limited alternative providers and the specialized nature of their offerings. For instance, if a key supplier of a unique dual-fuel engine system has a dominant market share and few competitors, CMB would face considerable leverage from that supplier, potentially leading to higher component prices or less favorable contract terms.

The bargaining power of suppliers for CMB hinges on the uniqueness of its inputs, especially concerning advanced hydrogen technologies and dual-fuel engines. If suppliers provide proprietary components or highly specialized materials with limited substitutes, their leverage increases considerably. For instance, a 2024 report indicated that the global market for hydrogen fuel cell components was projected to reach $4.5 billion, with a significant portion driven by specialized, patented technologies.

When CMB relies on a few key suppliers for critical, differentiated technologies, such as advanced fuel injection systems for dual-fuel engines or specialized catalysts for hydrogen production, these suppliers gain substantial bargaining power. This power is amplified if switching costs for CMB are high due to integration complexities or the need for extensive retooling. In 2023, the average lead time for specialized marine engine components saw an increase of 15%, reflecting tighter supply chains and supplier concentration for high-tech parts.

Supplier Power 4

The bargaining power of suppliers for CMB is a crucial factor to assess. A key consideration is the threat of forward integration by these suppliers. This means evaluating whether CMB's key suppliers have the capability and inclination to enter the shipping or logistics market themselves, directly competing with CMB.

If suppliers can credibly threaten to become direct competitors, their leverage in negotiations significantly increases. This could lead to more stringent terms, higher prices, or even preferential treatment for the suppliers' own operations, impacting CMB's profitability and operational flexibility.

For instance, consider a scenario where a major engine manufacturer for CMB's fleet also possesses the expertise and capital to operate its own shipping vessels. In such a case, CMB would be more susceptible to price hikes or supply disruptions if the supplier decided to prioritize its own fleet.

- Forward Integration Threat: Assess if key suppliers possess the resources and strategic intent to enter CMB's core logistics operations.

- Competitive Credibility: Evaluate the likelihood of suppliers successfully competing with CMB if they pursued forward integration.

- Negotiating Leverage: Understand how the potential for supplier competition directly impacts CMB's ability to negotiate favorable terms and pricing.

- Industry Examples: Analyze historical instances in the shipping or related industries where supplier forward integration altered competitive dynamics.

Supplier Power 5

The bargaining power of suppliers is a crucial element in understanding the competitive landscape for CMB. If CMB represents a substantial portion of a particular supplier's total sales, that supplier's leverage is inherently reduced. For instance, if a key component supplier derives 30% of its revenue from CMB, they are less likely to push for unfavorable terms compared to a supplier where CMB is a minor client.

Conversely, when CMB is a small customer for its suppliers, those suppliers gain significant power. This is because they can more easily absorb the loss of CMB's business and are not overly reliant on it for their own financial stability. This dynamic allows them to dictate terms, potentially increasing prices or limiting supply to CMB.

Consider the automotive industry in 2024. Major automakers, who are significant customers, often negotiate favorable pricing with tire manufacturers, as these manufacturers depend on the volume. However, for specialized electronic component suppliers, if the automaker only buys a fraction of their output, the supplier holds more sway.

- Supplier Dependence: The percentage of a supplier's revenue generated from CMB directly impacts their bargaining power. Lower dependence means higher supplier power.

- Concentration of Suppliers: If there are few suppliers for a critical input, their collective power increases, even if CMB is a large customer for each individual supplier.

- Switching Costs: High costs for CMB to switch suppliers for essential goods or services empower those existing suppliers.

- Availability of Substitutes: The presence of readily available substitute inputs weakens supplier power.

The bargaining power of suppliers is a critical factor for CMB, particularly concerning specialized components for new technologies like hydrogen propulsion. When suppliers offer unique, proprietary, or highly specialized inputs, their leverage grows significantly. For instance, in 2024, the market for advanced marine hydrogen fuel cell systems is still developing, with a limited number of certified providers, allowing these suppliers to command premium pricing and favorable terms.

High switching costs further empower suppliers. If changing a supplier for essential parts like advanced engines involves substantial expenses for retooling, contractual penalties, or compatibility issues, CMB's ability to negotiate is diminished. The maritime industry in 2023 saw increased lead times for specialized engine parts, up by 15%, highlighting supplier concentration and the costliness of switching.

Suppliers who can credibly threaten forward integration, meaning entering CMB's own logistics business, gain considerable negotiating power. This potential competition can lead to more stringent contract terms and higher prices for CMB. Conversely, if CMB represents a large portion of a supplier's revenue, the supplier's power is reduced, as they are more dependent on CMB's business.

| Factor | Impact on Supplier Bargaining Power | 2024/2023 Data/Example |

|---|---|---|

| Supplier Concentration | High | Limited global players in advanced marine diesel engines and emerging hydrogen propulsion systems. |

| Switching Costs | High | Increased lead times (15% in 2023) for specialized marine engine components indicate difficulty in switching. |

| Uniqueness of Input | High | Patented technologies in hydrogen fuel cell components (market projected $4.5B in 2024) give suppliers leverage. |

| Forward Integration Threat | High | Potential for engine manufacturers to operate their own shipping fleets can increase supplier leverage. |

| Customer Dependence (CMB's reliance on supplier) | Low | If CMB is a small client for a specialized supplier, that supplier has more power. |

What is included in the product

Assesses the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing a comprehensive view of CMB's competitive environment.

Instantly identify and quantify competitive pressures, allowing for targeted strategies to alleviate threats and capitalize on opportunities.

Customers Bargaining Power

The bargaining power of customers within the commercial mortgage-backed securities (CMBS) market is moderate. This is largely due to the fragmented nature of the buyer base for individual CMBS tranches; typically, no single investor holds a dominant market share for a given security.

However, large institutional investors, such as pension funds and insurance companies, do wield some influence. These entities often invest in significant volumes and can negotiate terms or demand specific features on the CMBS they purchase, especially for larger, more liquid deals.

For instance, in 2023, the average CMBS deal size remained substantial, offering opportunities for large buyers to exert influence. Investor demand dictates pricing and structure, and a shift in preference by major players can significantly impact the market.

Buyer power is a critical factor in the shipping industry, and for CMB, understanding customer leverage is key. If customers face low switching costs, meaning it's easy and inexpensive to move their business to another carrier, they gain significant power to negotiate better rates and terms. This can put pressure on CMB's profitability.

In 2024, the global shipping market saw intense competition, with many carriers vying for market share. This environment generally translates to lower switching costs for shippers, as alternative providers are readily available. For instance, the availability of numerous freight forwarders and integrated logistics solutions means a customer can shift their cargo with relatively little operational disruption.

When customers can easily find comparable services elsewhere, they are less tied to a single provider like CMB. This allows them to shop around for the best prices and service levels, effectively driving down the margins for shipping companies. The ease with which a business can change its logistics partner directly amplifies customer bargaining power.

The bargaining power of customers in the commercial maritime sector, particularly for container shipping (CMB), is significantly shaped by their price sensitivity. Customers for whom shipping represents a substantial portion of their operational costs, and who operate in highly competitive markets, exhibit greater price sensitivity. For instance, a 2024 industry report indicated that for many small to medium-sized e-commerce businesses, freight costs can account for up to 20% of their product's landed cost, making them acutely aware of any price fluctuations.

This sensitivity directly translates into increased bargaining power. When customers can easily switch to alternative carriers or have the ability to absorb or pass on increased shipping costs to end consumers, their leverage grows. For example, large retailers often negotiate bulk shipping rates, and if CMB's pricing becomes uncompetitive, these major clients can readily divert significant volumes to rivals, thereby diminishing CMB's pricing discretion.

Buyer Power 4

The bargaining power of customers is a critical factor for CMB, impacting its pricing and service agreements. Large customers possess significant leverage, especially if they have the potential for backward integration, meaning they could develop their own logistics or fleet capabilities. This threat alone can empower buyers to negotiate more favorable terms from CMB.

For instance, a substantial portion of CMB's revenue might come from a few key clients. If these clients represent a significant percentage of CMB's business, their ability to switch providers or invest in their own infrastructure increases their negotiation strength. In 2024, the global logistics sector saw continued consolidation and investment in technology, making it more feasible for large shippers to explore in-house solutions if perceived value from third-party providers diminishes.

Consider the following scenarios that amplify customer bargaining power:

- High Volume Customers: Clients who regularly ship large volumes of goods have more weight in negotiations.

- Availability of Substitutes: If alternative logistics providers or methods are readily available and cost-effective, customers have less incentive to accept CMB's terms.

- Low Switching Costs: If it is easy and inexpensive for customers to switch to another provider, their bargaining power increases.

- Price Sensitivity: Customers highly focused on cost reduction will exert more pressure on CMB to lower prices.

Buyer Power 5

The bargaining power of customers for CMB, a maritime shipping company, is significantly influenced by the availability of alternatives. If customers, such as businesses needing to transport goods, have numerous other shipping or transport services they can easily switch to, their leverage increases. This includes other maritime carriers offering similar routes and capabilities, or even different modes of transport like rail or air freight for certain types of cargo.

For instance, in the global container shipping market, major players like Maersk, MSC, and CMA CGM offer services that can be seen as direct substitutes for CMB's offerings on many trade lanes. This competitive landscape means that if CMB’s pricing or service quality is not attractive, customers can readily shift their business. The global container shipping market saw freight rates fluctuate significantly in 2024, with the Shanghai Containerized Freight Index (SCFI) indicating periods of both sharp increases and decreases, directly impacting customer sensitivity to pricing and thus their bargaining power.

- Availability of Substitutes: The presence of numerous other maritime carriers and alternative transport modes (e.g., air, rail) provides customers with choices, enhancing their bargaining power.

- Customer Concentration: If CMB serves a few very large customers, those customers will likely have more power than many small ones.

- Switching Costs: Low costs for customers to switch from CMB to a competitor further empower buyers.

- Price Sensitivity: Customers who are highly sensitive to shipping costs will exert more pressure on CMB to offer competitive rates.

The bargaining power of customers for CMB is elevated by the availability of numerous alternative shipping providers and transport modes. This access to substitutes means customers can easily shift their business if CMB's pricing or service quality falters, especially given the competitive landscape and fluctuating freight rates observed in 2024.

High-volume clients and those with low switching costs possess significant leverage, enabling them to negotiate favorable terms. Customers highly sensitive to shipping costs also exert considerable pressure, as demonstrated by e-commerce businesses where freight can represent a substantial portion of landed costs.

The potential for large customers to pursue backward integration, developing their own logistics capabilities, acts as a further deterrent against unfavorable terms from CMB. This threat alone empowers buyers to demand better pricing and service agreements.

CMB's pricing discretion is further limited by the concentration of its revenue among a few major clients. These key customers, if dissatisfied, can divert significant volumes to rivals or invest in in-house solutions, as the logistics sector's technological advancements in 2024 made such options more viable.

| Factor Amplifying Customer Power | Impact on CMB | Example Scenario (2024 Market) |

|---|---|---|

| Availability of Substitutes | Reduces CMB's pricing flexibility | Shippers switching between major carriers like MSC and CMA CGM due to minor price differences. |

| Low Switching Costs | Increases customer negotiation strength | A small business easily moving its cargo from CMB to a competitor with a more streamlined onboarding process. |

| Price Sensitivity | Pressures CMB for lower rates | An e-commerce company renegotiating terms with CMB as freight costs exceed 20% of product cost. |

| Customer Concentration | Empowers large clients | A major retailer threatening to shift 15% of its volume away from CMB if rates are not competitive. |

Preview the Actual Deliverable

CMB Porter's Five Forces Analysis

This preview displays the exact CMB Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You're looking at the actual document, meticulously prepared to provide actionable insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

CMB operates in highly competitive segments, including dry bulk, container shipping, and specialized maritime technology. The dry bulk sector, for instance, sees numerous players, with major companies like Oldendorff Carriers and Berge Bulk frequently vying for contracts. Container shipping is dominated by large alliances such as the Ocean Alliance and 2M, intensifying competition among carriers like Maersk and MSC, who together controlled over 30% of global container capacity in early 2024.

The maritime shipping industry, particularly for traditional vessels, has experienced a moderate growth rate. In 2023, the global maritime trade volume saw an estimated increase of around 2.4%, a slight uptick from the previous year. This relatively stable growth means companies often vie for existing market share, which can heighten competitive rivalry.

Conversely, the emerging hydrogen-based maritime technology sector is in its nascent stages, characterized by rapid, albeit small-scale, growth. While still a niche market, investments and pilot projects are expanding quickly. This rapid expansion offers opportunities for new entrants and established players to grow without necessarily engaging in intense direct competition for market share, though collaboration and early-mover advantage are key.

The interplay between these two segments is crucial. As traditional shipping faces pressure to decarbonize, the growth of hydrogen solutions, though currently small, represents a significant future competitive battleground. Companies investing heavily in these green technologies are positioning themselves to capture future market share, potentially intensifying rivalry as the technology matures and becomes more widely adopted.

In the shipping and maritime technology sectors, product and service differentiation is generally low, particularly in the core freight shipping segment. This lack of unique offerings means that competition often boils down to price, intensifying rivalry among established players and new entrants alike.

For instance, the global container shipping market, dominated by a few major alliances, frequently sees price wars erupt, especially during periods of overcapacity. In 2023, freight rates on major routes saw significant fluctuations, with some indices dipping below operating costs, highlighting the pressure of price-based competition. While technological advancements in areas like autonomous shipping and green propulsion are emerging, their widespread adoption is still developing, and the majority of the market remains focused on cost efficiency.

Competitive Rivalry 4

The shipping industry is characterized by substantial exit barriers, making it difficult for companies to leave the market. These barriers include the high asset specificity of vessels, which are expensive and difficult to repurpose, and significant sunk costs associated with fleet acquisition and maintenance. Furthermore, long-term contracts with customers often bind shipping companies to existing operations, even during downturns.

These high exit barriers contribute to persistent overcapacity and intensified competitive rivalry. When firms find it challenging to exit, they may continue operating at reduced profitability rather than incurring substantial losses from divesting assets. This reluctance to leave the market can prolong periods of intense price competition as companies fight for market share.

For instance, in early 2024, the global container shipping market continued to grapple with the aftermath of post-pandemic demand shifts. While freight rates had moderated from their peaks, the underlying issue of vessel oversupply, fueled by new builds ordered during boom times, remained a key factor. Major carriers, despite reporting lower profits compared to 2022, maintained large fleets, demonstrating the commitment to their existing infrastructure.

- High Asset Specificity: Ships represent a significant, specialized investment with limited alternative uses, creating a strong disincentive to exit.

- Long-Term Contracts: Existing commitments to clients can lock companies into operations, even when market conditions are unfavorable.

- Sunk Costs: The substantial capital invested in acquiring and maintaining fleets represents costs that cannot be recovered upon exit.

- Industry Overcapacity: High exit barriers can exacerbate overcapacity, leading to price wars and reduced profitability for all players.

Competitive Rivalry 5

Competitive rivalry within the market is intense, with major players demonstrating a strong commitment to market leadership. For instance, in 2024, established companies are heavily investing in research and development, with some dedicating over 15% of their revenue to technological innovation to secure a competitive edge. This aggressive posture stems from high strategic stakes, as firms vie for market share and strive to maintain their dominant positions through continuous product improvement and expansion into new territories. The pursuit of global presence is a key battleground, with companies actively acquiring smaller players or establishing new operations in emerging economies.

The strategic objectives of these competitors are multifaceted, encompassing not only market share but also the establishment of technological moats and the expansion of their global footprints. This creates a dynamic environment where mergers and acquisitions are common. For example, in the first half of 2024, there were over 50 significant M&A deals in this sector, signaling a fierce competition for talent, intellectual property, and market access. Firms are willing to absorb substantial costs and risks to achieve these ambitious goals, leading to heightened competitive behavior across the board.

- Market Leadership: Competitors are fiercely vying for the top spot, evidenced by aggressive pricing strategies and extensive marketing campaigns throughout 2024.

- Technological Innovation: Significant R&D spending, with some firms allocating over 15% of revenue in 2024, highlights the importance of staying ahead technologically.

- Global Presence: Companies are actively pursuing international expansion, with numerous strategic partnerships and market entries occurring in 2024.

- Aggressive Behavior: High strategic stakes fuel intense competition, leading to price wars and rapid product development cycles as firms protect or advance their market positions.

Competitive rivalry is a significant factor in the maritime industry, driven by low product differentiation in core shipping services and high exit barriers. Companies often compete on price, especially during periods of overcapacity, as seen in the container shipping market where freight rates can fluctuate dramatically. For example, in 2023, some major shipping routes experienced rates dipping below operational costs, illustrating intense price-based competition.

The industry's high exit barriers, including specialized assets and sunk costs, mean firms struggle to leave, perpetuating overcapacity and rivalry. This was evident in early 2024 with the continued presence of large fleets despite post-pandemic demand shifts, as companies remained committed to their existing infrastructure.

Furthermore, major players actively invest in innovation, with some dedicating over 15% of their 2024 revenue to R&D, and pursue aggressive strategies like acquisitions to gain market share and technological advantages. This intense competition for market leadership and global presence fuels a dynamic environment of strategic maneuvering.

| Metric | 2023 Data | Early 2024 Trend | Impact on Rivalry |

|---|---|---|---|

| Global Maritime Trade Volume Growth | ~2.4% | Slightly improved | Moderate growth supports existing competition for market share. |

| Container Shipping Market Share (Top 2 Alliances) | >30% (early 2024) | Stable | Dominance by alliances intensifies competition among members and smaller carriers. |

| R&D Investment (Top Competitors) | >15% of revenue | Continued investment | Drives innovation and creates technological battlegrounds. |

| M&A Deals in Sector | >50 (H1 2024) | Active | Indicates fierce competition for talent, IP, and market access. |

SSubstitutes Threaten

The threat of substitutes for CMB's maritime shipping services is a significant consideration. Alternative transportation modes like air freight, rail, and road transport can offer quicker transit times for certain high-value or time-sensitive cargo, or for shorter, inland routes. For instance, while maritime shipping remains cost-effective for bulk goods, the speed advantage of air cargo is undeniable for urgent shipments. In 2024, the global air freight market is projected to continue its growth, demonstrating the viability of these substitutes for specific market segments.

The threat of substitutes for CMB (China Merchants Bank) is moderate, particularly from digital payment platforms and fintech companies offering similar financial services, often at lower costs or with greater convenience. For instance, services like Alipay and WeChat Pay have significantly penetrated the Chinese market, providing seamless payment, wealth management, and even lending options that directly compete with traditional banking services offered by CMB. In 2024, the digital payment transaction volume in China continued its upward trajectory, indicating a strong customer preference for these alternatives.

The threat of substitutes in maritime transport is influenced by how easily customers can shift to alternative methods. While switching from bulk shipping to air cargo for time-sensitive goods might involve higher costs and logistical challenges, the availability of intermodal options like rail and road for shorter hauls presents a more immediate substitute threat. For instance, the increasing efficiency and reach of rail networks in major trade corridors can divert cargo that might otherwise travel by short-sea shipping or inland waterways.

Threat of Substitution 4

The threat of substitutes for CMB.TECH's decarbonization solutions is a critical consideration. As the world pushes for greener alternatives, entirely new technologies could emerge that achieve similar environmental goals through fundamentally different means. For instance, advancements in direct air capture or novel energy storage methods might offer pathways to carbon neutrality that bypass the need for CMB.TECH's specific hydrogen or ammonia-based technologies.

Breakthroughs in alternative energy and transport sectors represent a significant substitute threat. Imagine a scenario where battery-electric vehicles achieve unprecedented range and charging speeds, making hydrogen fuel cell technology less appealing for certain applications. Similarly, the development of highly efficient synthetic fuels derived from renewable sources could directly compete with green hydrogen and ammonia as clean energy carriers.

The evolving technological landscape means that what is cutting-edge today could be rendered obsolete tomorrow. For example, if a highly efficient and scalable carbon capture and utilization (CCU) technology becomes widespread, it could reduce the demand for upstream decarbonization efforts that CMB.TECH focuses on. The International Energy Agency reported in 2024 that global investment in clean energy technologies reached a new record, highlighting the rapid pace of innovation and the potential for disruptive substitutes.

- Technological Advancements: Breakthroughs in areas like advanced battery technology or synthetic fuels could offer alternative decarbonization pathways.

- Shifting Energy Paradigms: The rise of new energy carriers or storage solutions might present more cost-effective or efficient substitutes for hydrogen and ammonia.

- Policy and Market Adoption: Government incentives and market demand could accelerate the adoption of competing decarbonization technologies, increasing the substitute threat.

- Economic Viability: If substitute solutions become significantly cheaper or more accessible, they could erode CMB.TECH's market share.

Threat of Substitution 5

Customers are increasingly open to substitute solutions, driven by a confluence of factors. For instance, heightened environmental consciousness in 2024 has seen a significant uptick in demand for sustainable alternatives across various sectors. Regulatory shifts also play a crucial role; stricter emissions standards, for example, can compel industries to explore less polluting substitutes, even if initially more expensive.

Supply chain resilience strategies adopted in recent years, particularly post-pandemic, have also broadened the appeal of substitutes. Companies are diversifying their material inputs and production methods to mitigate risks, making them more receptive to alternative offerings. This proactive approach means that even if the core product remains competitive, the evolving landscape of customer priorities and operational strategies can amplify the threat of substitution.

Consider the automotive industry in 2024: while internal combustion engine (ICE) vehicles remain prevalent, the rapid advancement and increasing affordability of electric vehicles (EVs) present a potent substitute. Factors like government incentives for EV adoption, expanding charging infrastructure, and growing consumer awareness of climate change are accelerating this shift. Reports from early 2024 indicated a surge in EV sales, demonstrating a clear willingness to adopt newer, albeit sometimes costlier, alternatives driven by these macro trends.

The threat of substitution is not solely cost-driven; it's increasingly influenced by performance, convenience, and ethical considerations. A faster delivery option or a product with a lower environmental footprint can sway customer loyalty, even if the price point is higher. This dynamic highlights the need for businesses to continuously innovate and adapt to meet evolving customer expectations.

- Environmental Consciousness: A 2024 survey revealed that 65% of consumers consider sustainability a key factor in purchasing decisions, up from 40% in 2020.

- Regulatory Impact: New carbon pricing mechanisms introduced in several major economies by 2024 are making carbon-intensive substitutes less attractive.

- Supply Chain Diversification: Global supply chain disruptions in 2023-2024 led many businesses to explore alternative material sourcing, increasing familiarity with substitute options.

- Technological Advancements: The accelerating pace of innovation in areas like renewable energy and biodegradable materials offers more viable and appealing substitutes than ever before.

The threat of substitutes for CMB's services is moderate, with digital platforms and fintech companies offering competitive alternatives. For instance, the convenience and cost-effectiveness of mobile payment solutions like Alipay and WeChat Pay, which saw continued growth in transaction volume in 2024, present a direct challenge to traditional banking services. This indicates a clear customer preference for more agile digital financial tools.

| Substitute Type | Key Features | 2024 Market Trend/Impact | Example |

|---|---|---|---|

| Digital Payment Platforms | Convenience, Speed, Lower Transaction Fees | Continued high transaction volume growth | Alipay, WeChat Pay |

| Fintech Lenders | Faster Loan Approval, Online Accessibility | Increasing market share in consumer and SME lending | Ant Group (Alibaba) |

| Robo-Advisors | Automated Investment Management, Lower Fees | Growing adoption among retail investors seeking cost-effective wealth management | Wealthfront, Betterment |

Entrants Threaten

The threat of new entrants into the shipping industry is generally considered low due to exceptionally high capital requirements. Acquiring or constructing even a single large container vessel can cost tens of millions of dollars, with a fleet requiring hundreds of millions. For example, a new 15,000 TEU (twenty-foot equivalent unit) containership delivered in 2024 could cost upwards of $150 million. Beyond vessels, establishing the necessary global logistics networks, port relationships, and operational infrastructure demands significant upfront investment, acting as a formidable barrier.

Existing players in dry bulk and container shipping, like CMB, benefit from significant economies of scale. This means they can spread their fixed costs over a larger volume of cargo, leading to lower per-unit costs. For example, large container shipping lines operate massive vessels, allowing them to carry thousands of TEUs (twenty-foot equivalent units) at once, drastically reducing the cost per container moved compared to smaller vessels.

New entrants often find it challenging to match these cost efficiencies. Without the established infrastructure, large fleet size, and optimized routes that incumbents possess, newcomers struggle to achieve the same economies of scale. This makes it difficult for them to compete effectively on price, a critical factor in the highly competitive shipping industry.

In 2024, the capital expenditure required to build or acquire a modern, large container ship can easily exceed $150 million, and building a fleet capable of achieving economies of scale would require billions. This high barrier to entry, coupled with the need for extensive global networks and port relationships, deters many potential new competitors.

Furthermore, established players often have long-term contracts with major clients and preferential access to port facilities, creating additional hurdles for new companies trying to secure business and operational capabilities. These entrenched advantages make it difficult for new entrants to gain a foothold and compete on a level playing field.

The global maritime transport sector faces significant hurdles for new entrants, primarily due to stringent regulatory landscapes. Navigating complex international shipping laws, such as those enforced by the International Maritime Organization (IMO), requires substantial expertise and capital. For instance, compliance with the IMO's Ballast Water Management Convention, effective since September 2017, necessitates costly equipment upgrades for vessels, presenting a barrier to smaller or less capitalized new players.

Environmental regulations, like the International Maritime Organization's 2020 sulfur cap, which mandated a reduction in fuel oil sulfur content to 0.5%, added another layer of complexity and cost. Companies had to invest in low-sulfur fuels or exhaust gas cleaning systems, known as scrubbers. This regulatory shift, impacting all shipping operations, means any new entrant must factor in these significant compliance costs from the outset, potentially limiting the influx of smaller, agile competitors.

Licensing requirements and safety standards further erect walls for potential newcomers. Obtaining the necessary certifications and adhering to international safety management codes, such as the ISM Code, demands rigorous documentation and operational procedures. As of 2024, the ongoing development and implementation of new environmental targets, like those aimed at decarbonization by 2050, will continue to raise the bar for entry, requiring substantial investment in greener technologies and operational practices.

Threat of New Entrants 4

The threat of new entrants for CMB, a major player in the maritime industry, is significantly mitigated by the substantial barriers to entry. Gaining access to established distribution channels, which are crucial for efficient cargo movement, is a formidable challenge. For instance, securing berths in congested ports or obtaining favorable agreements with key logistics providers often requires years of relationship building and significant capital investment. CMB's long-standing presence has allowed it to cultivate these essential networks, making it difficult for newcomers to replicate their reach and operational efficiency.

Furthermore, the capital-intensive nature of the shipping industry presents another substantial hurdle.

- High Capital Requirements: Acquiring a modern fleet of vessels, including container ships, bulk carriers, and specialized tankers, demands billions of dollars. For example, a new, large container vessel can cost upwards of $150 million in 2024.

- Established Customer Relationships: CMB benefits from deep-rooted relationships with major global shippers and freight forwarders, built on reliability and service over decades. These loyalties are hard-won and difficult for new entrants to displace.

- Regulatory and Compliance Hurdles: Navigating complex international maritime regulations, environmental standards (like IMO 2023 sulfur cap compliance), and safety certifications requires specialized knowledge and significant resources, creating a steep learning curve for new competitors.

- Economies of Scale: CMB's large operational scale allows for cost efficiencies in purchasing, maintenance, and crew management that smaller, newer entrants cannot immediately match.

Threat of New Entrants 5

The threat of new entrants in the hydrogen-based mobility sector, particularly concerning CMB.TECH's operations, is influenced by significant barriers to entry. These include the substantial capital investment required for developing and scaling hydrogen production, storage, and refueling infrastructure. Furthermore, stringent safety regulations and the need for specialized expertise in handling hydrogen present additional hurdles for potential newcomers.

Proprietary technology and intellectual property play a crucial role in deterring new competition. CMB.TECH, for instance, has invested heavily in developing unique hydrogen-based solutions and related technologies. These innovations, often protected by patents, create a competitive advantage by making it difficult for new entrants to replicate their offerings or achieve comparable performance and efficiency.

The established infrastructure and supply chains already in place by existing players like CMB.TECH also act as a deterrent. Building a comparable network of hydrogen production facilities, distribution channels, and refueling stations from scratch is a time-consuming and capital-intensive endeavor. For example, as of early 2024, the development of hydrogen refueling stations remains a significant bottleneck globally, with fewer than 100 operational stations in many key markets.

- Capital Intensity: High upfront costs for hydrogen production, storage, and distribution infrastructure.

- Technological Expertise: Need for specialized knowledge in hydrogen handling and fuel cell technology.

- Regulatory Environment: Compliance with complex and evolving safety and environmental standards.

- Intellectual Property: Patented technologies create a barrier to replication and market entry.

- Infrastructure Development: The slow build-out of refueling networks limits market accessibility for new entrants.

The threat of new entrants into the shipping sector is significantly low, primarily due to the immense capital investment required to establish operations. Acquiring a modern container vessel alone can cost over $150 million in 2024, and building a competitive fleet necessitates billions. This financial barrier, combined with the need for extensive global logistics networks and port access, effectively deters most potential newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including proprietary market research, financial statements, and expert interviews. This ensures a comprehensive understanding of industry structure.