CMB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMB Bundle

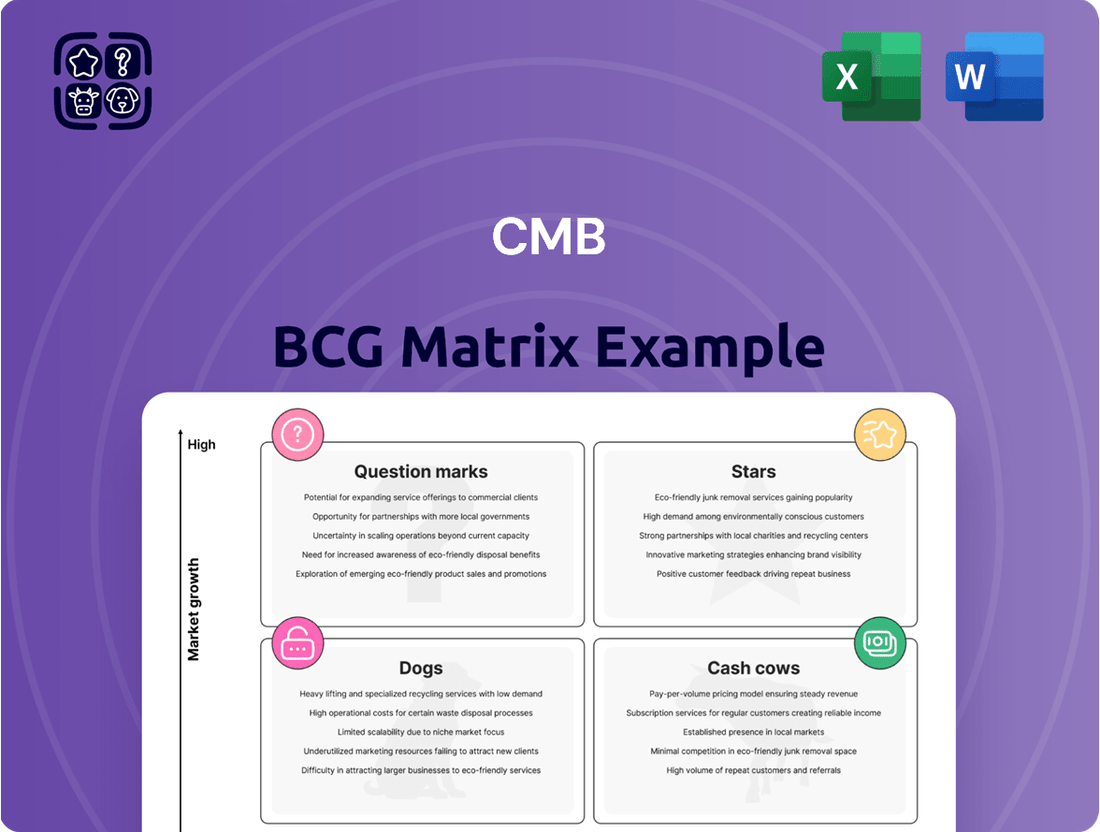

Unlocking the secrets to a thriving product portfolio begins with understanding the BCG Matrix. This powerful framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for strategic allocation of resources and investment. Knowing where your products sit is crucial for making informed business decisions and driving growth.

Ready to move beyond basic understanding and into actionable strategy? Purchase the full BCG Matrix report to gain a comprehensive breakdown of each product's position, complete with data-backed insights and tailored recommendations. This is your key to optimizing your product mix and maximizing profitability.

Stars

CMB.TECH is actively investing in hydrogen-powered vessels and dual-fuel engines, a move that places them at the forefront of the expanding shipping decarbonization sector.

Their commitment is underscored by a substantial contract backlog of USD 2.94 billion as of Q1 2025, demonstrating robust market demand for their sustainable maritime solutions.

This backlog includes innovative ammonia-fueled vessels and hydrogen-powered tugboats and Crew Transfer Vessels (CTVs), crucial components for a greener shipping industry.

CMB.TECH's focus on these advanced technologies positions them to capitalize on the growing need for environmentally friendly marine transportation.

The global shipping industry is undergoing a significant transformation, driven by a strong commitment to decarbonization. This shift, fueled by increasingly strict environmental regulations and a growing market appetite for sustainable practices, positions the sector as a high-growth opportunity for companies like CMB.TECH. By 2024, we see a clear trend where major shipping lines are actively seeking and investing in greener alternatives to traditional fossil fuels.

The market for hydrogen-fueled ships is experiencing an impressive growth trajectory. Projections indicate a compound annual growth rate (CAGR) that is substantial, with significant capital being channeled into both the necessary infrastructure and the underlying technologies required to support this transition. This investment surge is a direct response to the urgent need to reduce the sector's carbon footprint.

CMB.TECH's strategic roadmap is centered on expanding its hydrogen-based solutions. The company is actively contributing to global sustainability goals by pioneering and scaling these cleaner technologies. This focus aligns perfectly with the broader industry movement towards a low-carbon future, aiming to set new benchmarks in environmental performance.

Strategic partnerships and joint ventures are key drivers for CMB.TECH's growth in the clean energy maritime sector. For instance, their collaboration with MOL for nine ammonia-fueled vessels, expected to begin deliveries in 2024, significantly expands their market presence. The JPNH₂YDRO joint venture in Japan further solidifies their commitment to hydrogen engine research and development, a critical area for future marine propulsion.

Fleet Rejuvenation with Newbuilds

CMB.TECH's strategic focus on fleet rejuvenation is a key driver for maintaining its market position. The company had 21 newbuild deliveries scheduled for 2024, with additional orders placed in Q1 2025, underscoring a significant investment in modern, low-carbon vessels. This proactive fleet modernization is essential for staying competitive in an industry increasingly prioritizing sustainability.

These new additions, including Newcastlemax bulk carriers and advanced product tankers, are designed to enhance CMB.TECH's capabilities in high-growth shipping segments. This commitment to acquiring state-of-the-art vessels ensures the company can meet evolving market demands and capture opportunities in environmentally conscious shipping routes. The fleet upgrade directly supports CMB.TECH's growth objectives.

- Fleet Modernization: 21 newbuild deliveries in 2024 and further orders in Q1 2025.

- Focus on Low-Carbon: New vessels are designed for future-proof, low-carbon operations.

- Market Expansion: Newcastlemaxes and product tankers are critical for growth in key segments.

- Competitive Edge: Proactive fleet renewal ensures a strong position in a greener shipping market.

Hydrogen Production and Infrastructure

The company's strategic investment in hydrogen production, exemplified by its facility in Walvis Bay, Namibia, signals a deep commitment to controlling the entire green fuel value chain. This vertical integration is crucial for securing a consistent supply for its expanding fleet and for capturing opportunities within the rapidly growing green fuel market. The Namibian project, which includes initial hydrogen output and future plans for an ammonia plant, demonstrates a clear long-term vision for sustainable energy solutions.

This approach positions the company to capitalize on the projected growth in the hydrogen market, which is anticipated to reach hundreds of billions of dollars globally in the coming decades. For instance, by 2030, the global green hydrogen market alone is forecast to exceed $50 billion, according to various industry analyses. By establishing production and bunkering infrastructure, the company is building a foundation for significant future revenue streams.

- Investment in Production: The Walvis Bay facility represents a tangible commitment to green fuel generation.

- Bunkering Infrastructure: Developing bunkering capabilities is key to serving both internal fleet needs and external demand.

- Value Chain Control: Vertical integration ensures supply reliability and cost management in a nascent but critical industry.

- Ammonia Plant Plans: The expansion into ammonia production highlights a strategy to diversify and meet broader market needs for hydrogen derivatives.

Stars in the BCG matrix represent ventures with high market share in high-growth industries. CMB.TECH's significant investments in hydrogen-powered vessels and dual-fuel engines, coupled with a substantial contract backlog of USD 2.94 billion as of Q1 2025, firmly place it in this category. The company's proactive fleet modernization, including 21 newbuild deliveries in 2024, further solidifies its position as a leader in a rapidly expanding and evolving market.

| Category | Market Growth | Market Share | CMB.TECH's Position |

|---|---|---|---|

| Stars | High | High | Pioneering hydrogen and ammonia-fueled vessels, significant backlog, and proactive fleet expansion. |

What is included in the product

The CMB BCG Matrix provides a strategic framework for analyzing a company's product portfolio, categorizing them based on market growth and relative market share.

It guides decisions on investment, divestment, and resource allocation for different business units or products.

Quickly visualize portfolio health and make strategic decisions without overwhelming data.

Cash Cows

CMB's established dry bulk and container shipping operations are classic cash cows. These segments, representing the company's traditional strengths, likely benefit from significant market share and operational efficiencies. Even though the growth rates in these mature markets are typically modest, they are crucial for generating stable and substantial cash flow, underpinning the company's financial health.

For instance, CMB's 2024 financial performance underscored the strength of these core shipping activities. The company reported robust turnover and a healthy net profit, directly reflecting the consistent cash generation from its dry bulk and container shipping businesses. This reliable income stream is vital for funding other strategic initiatives and investments within the group.

The CMB Group's cash-flow management is a prime example of optimal strategy, evidenced by its continuously improving net financial position. In 2024, the company achieved a historic low with financial debt nearly at zero, showcasing exceptional financial discipline.

This robust financial health, stemming from stable operations, provides CMB with the capacity to self-fund new growth initiatives and comfortably manage administrative expenses. This is a hallmark of a successful cash cow, generating more cash than it consumes.

Furthermore, CMB's substantial contract backlog, reported at over €5 billion as of the end of 2023, acts as a powerful predictor of sustained future revenue streams, reinforcing its position as a reliable cash generator for the foreseeable future.

CMB's diversified and modern fleet, boasting over 150 seagoing vessels across crude oil tankers, dry bulk carriers, and container ships, acts as a significant Cash Cow.

This extensive and continually rejuvenated fleet generates consistent revenue streams from various shipping routes and cargo types. For instance, in 2024, CMB's fleet modernization included the delivery of several newbuild vessels, enhancing operational efficiency and ensuring sustained productivity in a mature, high-margin industry.

Strong Financial Performance in 2024

CMB.TECH, a significant player in the shipping industry following the Euronav merger, demonstrated robust financial health in 2024. The company achieved a substantial profit of USD 870.8 million for the entire year. This impressive performance underscores the efficiency and market leadership of its established shipping segments within mature markets, highlighting strong cash generation capabilities.

The company’s strategic focus on specialized markets, clients, and products contributes to this success. This targeted approach allows CMB.TECH to excel in areas demanding high expertise and specific solutions.

- 2024 Profit: USD 870.8 million for CMB.TECH.

- Key Strengths: Excellent cash generation and high efficiency in established shipping segments.

- Market Position: Leaders in respective mature markets.

- Strategic Focus: Specialization in select markets, clients, and products.

Long-Term Charter Agreements

Long-term charter agreements are a key component of a company's Cash Cows, particularly in industries like shipping. By securing these contracts, especially for vessels equipped with low-carbon fuels, the company significantly bolsters its contract backlog. This strategic move ensures a steady flow of predictable revenue, insulating the business from the unpredictable swings of the spot market.

These extended agreements are a clear signal of the company's robust market standing and the deep trust clients place in its services. For instance, in 2024, many shipping companies reported substantial increases in their order books due to securing multi-year charters. This stability is crucial for consistent cash generation from core assets.

- Stable Revenue: Long-term contracts provide predictable income, unlike volatile spot market rates.

- Reduced Risk: Minimizes exposure to fluctuating market conditions and enhances financial forecasting.

- Market Strength: Indicates a strong competitive position and high customer confidence.

- Asset Utilization: Ensures efficient use of core shipping assets over extended periods.

Cash cows, like CMB's established dry bulk and container shipping operations, are foundational to the company's financial stability. These segments leverage significant market share and operational efficiencies to generate substantial, consistent cash flow, even in mature markets with modest growth rates. This reliable income stream is critical for funding ongoing investments and strategic development across the group.

CMB's 2024 financial results highlight the strength of these core businesses, with robust turnover and healthy net profits directly attributable to their consistent cash generation. This financial bedrock allows CMB to maintain a strong financial position, evidenced by its near-zero financial debt achieved in 2024, enabling self-funding of growth and efficient management of operational expenses.

The company's diversified fleet of over 150 vessels across various shipping sectors, including crude oil tankers, dry bulk carriers, and container ships, serves as a significant cash cow. Fleet modernization, such as the delivery of newbuild vessels in 2024, enhances operational efficiency and ensures sustained productivity in these established, high-margin industries, contributing directly to reliable revenue streams.

CMB.TECH's strong performance in 2024, with a profit of USD 870.8 million, further exemplifies the cash-generating power of its established shipping segments. This success is driven by strategic specialization in select markets, clients, and products, allowing for market leadership and high efficiency within mature segments.

| Business Segment | 2024 Performance Indicator | Cash Flow Contribution |

| Dry Bulk Shipping | Robust Turnover & Healthy Net Profit | High & Stable |

| Container Shipping | Robust Turnover & Healthy Net Profit | High & Stable |

| CMB.TECH (General Shipping) | USD 870.8 Million Profit | Significant |

Preview = Final Product

CMB BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This preview showcases the complete strategic analysis, free from any watermarks or demo content, ensuring you get a professional and ready-to-use tool for your business planning. You can confidently assess the value of this comprehensive matrix, knowing that the purchased version will be identical and instantly available for your strategic decision-making.

Dogs

CMB has been actively selling off its older ships, including Suezmaxes and VLCCs, as part of a plan to modernize its fleet. These older vessels, often less fuel-efficient and less competitive, would typically fall into the Dogs category of the BCG Matrix. For instance, in 2023, CMB continued its strategy of divesting older tonnage, contributing to a more streamlined and modern fleet. This approach aims to boost overall fleet efficiency and free up capital.

While CMB holds real estate assets, the performance of specific niche interests remains undisclosed. Should these ventures operate within sluggish markets, possess a small market share, and yield minimal profits, they would likely fall into the Dogs category of the BCG Matrix.

These underperforming niche real estate holdings could represent a drain on CMB's capital, tying up resources that could be better allocated to more lucrative ventures. For instance, if a particular CMB real estate investment in a declining industrial area saw occupancy rates drop to 40% in 2024, it would exemplify a Dog.

Marginal financial services ventures within CMB's portfolio, similar to other businesses with limited scale or operating in intensely competitive spaces without a clear edge, often fall into the 'Marginal' category on the BCG matrix. These segments may hover around break-even or even consume cash, presenting meager growth opportunities. For instance, while specific 2024 performance data for CMB's financial services ventures isn't publicly detailed, the broader trend in the financial sector in 2024 indicated heightened competition, particularly in areas like retail banking and investment services.

These ventures might be candidates for strategic review, potentially leading to divestiture or a significant scaling back of operations to reallocate resources to more promising areas. The challenge for these marginal segments lies in differentiating themselves or finding niche markets where they can thrive. Without a strong value proposition or a unique selling point, they risk becoming drains on capital and management attention.

Legacy Crude Oil Tanker Segments Post-Merger

Following the merger that integrated Euronav into CMB.TECH, the company's operational focus has shifted significantly. This transition has moved CMB.TECH away from being solely a crude oil tanker operator towards a broader, diversified maritime group. The strategic emphasis is now on developing and expanding in areas like clean shipping technologies.

Legacy crude oil tanker segments within the post-merger entity might be re-evaluated. While some of these operations could still generate profits, those that are no longer considered core to the company's future strategy, or those struggling in a competitive and consolidating market, could be categorized as Dogs in the BCG matrix. This classification reflects the company's commitment to decarbonization and future growth areas.

For instance, as of mid-2024, the global tanker market has seen fluctuating freight rates. While VLCC (Very Large Crude Carrier) rates experienced periods of strength, the long-term investment trend is leaning towards alternative fuels and vessel types. CMB.TECH's strategic pivot indicates a divestment or reduced focus on traditional crude oil transport to prioritize its investments in green shipping solutions.

- Market Shift: The maritime industry is increasingly prioritizing decarbonization, impacting the long-term viability of traditional fuel-dependent segments.

- Strategic Realignment: CMB.TECH's merger with Euronav signifies a move towards diversification beyond pure crude oil carriage.

- Underperforming Assets: Legacy tanker operations not aligned with the new green strategy may be classified as Dogs.

- Investment Focus: Capital allocation is likely directed towards cleaner technologies and future-proof maritime assets.

Outdated Technology Applications

Outdated technology applications represent a significant drag on efficiency within CMB. These might include legacy software systems or manual operational processes that are no longer cost-effective or aligned with modern business needs. For instance, if a substantial portion of CMB's administrative tasks still relies on paper-based filing or outdated databases, it consumes valuable employee time and incurs printing and storage costs without contributing to innovation or strategic growth.

These internal "products" can divert resources away from more impactful initiatives, such as CMB's stated focus on new research and development. In 2024, many companies have reported significant cost savings by migrating from on-premises legacy systems to cloud-based solutions, with some achieving efficiency gains of up to 30%. Such outdated applications offer little to no competitive advantage and may even hinder progress towards decarbonization goals if they are energy-intensive.

- Legacy Software: Systems that are no longer supported by vendors and lack integration capabilities.

- Manual Processes: Repetitive, paper-based workflows that are prone to errors and delays.

- Inefficient Data Management: Siloed or outdated databases that impede data analysis and decision-making.

- Resource Drain: Applications consuming IT support, energy, and staff time without delivering commensurate value.

Dogs in the BCG matrix represent business units or products with low market share in a slow-growing industry. For CMB, this often translates to older, less efficient assets or ventures in declining markets. Divesting these segments allows for capital reallocation to more promising, high-growth areas. For instance, CMB's sale of older vessels aligns with shedding these 'Dog' assets.

These underperforming segments consume resources without generating significant returns or future growth potential. Identifying and managing these 'Dogs' is crucial for optimizing a company's portfolio. CMB's strategic focus on clean shipping technologies implies a deliberate move away from traditional, potentially 'Dog' category assets.

The challenge lies in recognizing these units before they become substantial drains. A proactive approach to portfolio management, which includes divesting or restructuring 'Dogs', is key to maintaining a healthy and growth-oriented business. For example, a legacy real estate holding with low occupancy in 2024 would fit this description.

Question Marks

Early-stage hydrogen and ammonia production facilities, like CMB's projects under development, are classic examples of "Question Marks" in the BCG matrix. These ventures require substantial capital infusion to move from initial small-scale operations towards full commercial viability and market penetration within the nascent green hydrogen and ammonia sector. As of recent reports, such early-stage projects often face uncertainties regarding technology maturation and market adoption rates, necessitating careful strategic planning and significant financial backing to navigate the path to becoming established players.

CMB.TECH's exploration into new, untested dual-fuel engine applications places these initiatives squarely in the Question Marks category of the BCG Matrix. These ventures target the burgeoning decarbonization market, a sector ripe for growth but where CMB.TECH's market share for these specific novel applications is currently minimal. For instance, their development of ammonia-fueled marine engines, a key area for shipping decarbonization, represents a significant technological leap with substantial R&D investment.

The high-risk, high-reward nature of these nascent applications necessitates considerable financial backing to overcome technical hurdles and establish market acceptance. Consider the significant capital expenditure required to certify and scale up these engines for, say, heavy-duty trucking or specialized industrial processes. These efforts are crucial for proving their viability and capturing future market share in a competitive landscape aiming for reduced emissions.

CMB.TECH's engagement in pilot projects within emerging green shipping niches, like the pioneering ammonia-powered container ship Yara Eyde, firmly places these initiatives in the 'Question Marks' category of the BCG Matrix. These ventures represent high-potential growth areas, evidenced by the increasing global focus on decarbonization in maritime transport, a sector responsible for approximately 3% of global greenhouse gas emissions. However, their current market share is negligible, and they demand significant capital investment for technology development and infrastructure, aiming to validate new solutions and market acceptance.

Expansion into New Geographical Markets for H2 Solutions

For CMB.TECH's hydrogen solutions, expanding into nascent geographical markets would position them as a potential question mark in the BCG matrix. This strategy involves significant upfront investment in market development and infrastructure, aiming to capture future growth in regions with low current adoption but high potential. For instance, entering markets in Southeast Asia or parts of Africa, where hydrogen infrastructure is still in its early stages, would require substantial capital expenditure for plant construction, distribution networks, and customer education. This aligns with the question mark quadrant, where investments are made with the hope of future market leadership.

The global green hydrogen market is projected to reach USD 134.86 billion by 2030, growing at a CAGR of 49.2%, according to Precedence Research. However, regional adoption rates vary significantly, presenting both opportunities and challenges for new market entries. CMB.TECH's expansion into these less-developed hydrogen economies could be seen as a high-risk, high-reward endeavor, demanding patient capital and a long-term vision.

- Capital Intensive Entry: New market expansion requires substantial investment in building hydrogen production facilities, establishing distribution networks, and securing early customers, mirroring the capital needs of question mark products.

- Nascent Market Adoption: Targeting regions with low current hydrogen adoption rates means significant effort is needed for market education and infrastructure development, typical of question mark strategies.

- Future Growth Potential: These markets are chosen for their anticipated future demand, representing an investment in potential market share before widespread competition emerges, a hallmark of question mark positioning.

- Regional Disparities: The global hydrogen market's uneven development means that entering markets with less mature infrastructure presents a classic question mark scenario for growth.

Unproven Real Estate or Financial Tech Startups

Unproven real estate or financial tech startups within CMB's portfolio would likely be classified as Stars, assuming they possess high growth potential in emerging markets. These ventures, characterized by innovation and disruptive technology, require significant investment to capture market share and achieve scale. For instance, a fintech startup focusing on AI-driven mortgage origination could represent a Star if it demonstrates rapid user adoption and a clear path to profitability in a rapidly expanding digital lending sector.

These Star ventures, while promising, carry inherent risks. Their success hinges on their ability to outmaneuver established competitors and adapt to evolving market demands. Without substantial capital infusion and strategic guidance, they could falter, potentially transitioning into Question Marks or even Dogs if their growth falters and market share remains negligible. The venture capital landscape in 2024 saw significant investment in proptech and fintech, with areas like AI in property valuation and blockchain in real estate transactions attracting considerable attention.

- High Growth Potential: These startups operate in nascent or rapidly expanding markets, offering the possibility of substantial future returns.

- Low Market Share: Despite potential, they currently hold a small portion of the overall market, indicating an opportunity for expansion.

- Significant Investment Needs: Scaling these ventures requires considerable capital for research, development, marketing, and operational expansion.

- Strategic Importance: They can position CMB at the forefront of technological innovation in the real estate and financial services sectors.

Question Marks in the BCG matrix represent business units or products with low relative market share in high-growth industries. These ventures require significant investment to grow their market share and move towards becoming Stars. Without adequate funding or a clear strategy, they risk becoming Dogs.

CMB.TECH's early-stage green ammonia projects and novel dual-fuel engine applications fit this category due to their operation in the rapidly expanding but still developing green maritime sector. For example, the global maritime industry is under pressure to decarbonize, with regulations pushing for lower emissions. The development of ammonia-fueled engines, while promising, is capital-intensive and faces market acceptance hurdles, characteristic of Question Marks.

The significant capital required for research, development, and infrastructure build-out, coupled with the uncertainty of future market adoption, places these initiatives firmly in the Question Mark quadrant. For instance, the capital expenditure for certifying and scaling new engine technologies can run into tens of millions of dollars, with the potential for substantial returns if successful.

The success of these ventures hinges on strategic investment and execution. For example, pilot projects for ammonia-powered vessels, while innovative, are still in their infancy. The global market for green ammonia is projected to grow substantially, but current adoption rates for ammonia as a marine fuel are low, highlighting the Question Mark characteristics of these investments.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust foundation of data, incorporating financial statements, market research reports, and industry trend analyses to provide a comprehensive view.