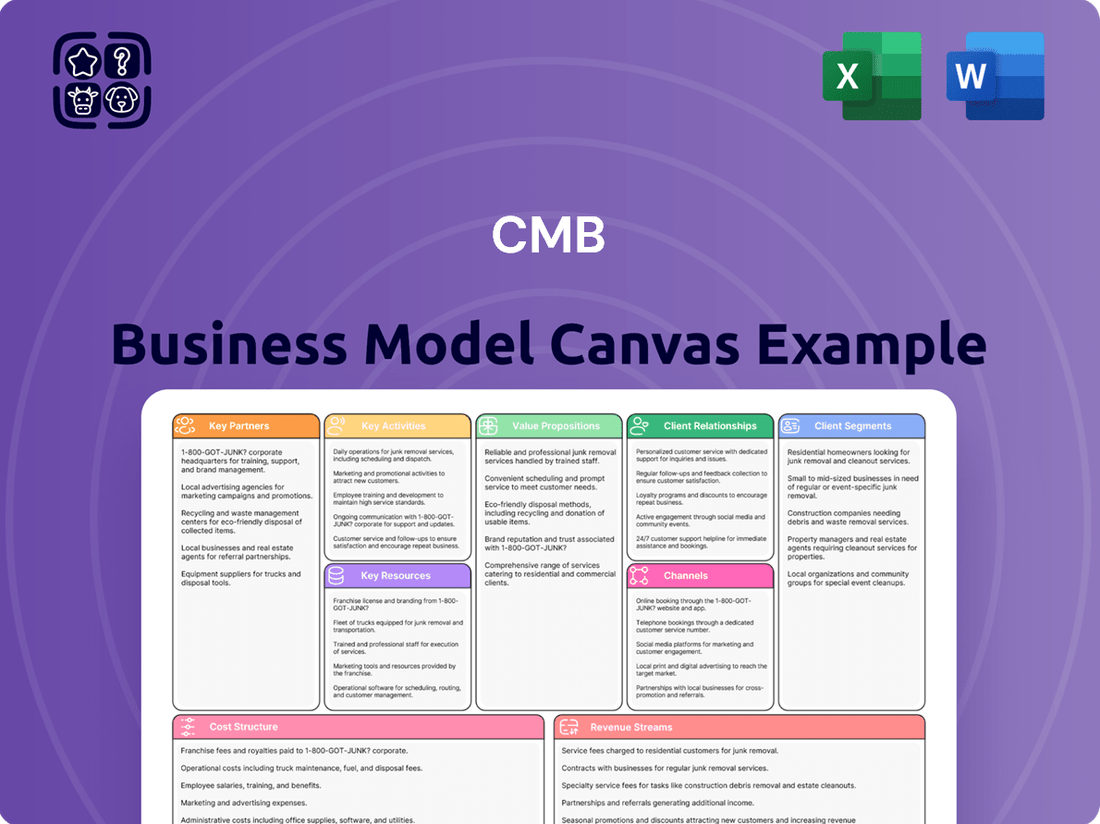

CMB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMB Bundle

Curious about the engine driving CMB's success? Our comprehensive Business Model Canvas dissects every crucial element, from customer relationships to revenue streams. This isn't just a template; it's a strategic roadmap designed to illuminate how CMB creates, delivers, and captures value.

Unlock the full strategic blueprint behind CMB's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CMB.TECH is deeply invested in technology and R&D collaborations, forging vital partnerships with leading technology firms and esteemed research institutions. These alliances are instrumental in the ongoing development and integration of their groundbreaking hydrogen and ammonia dual-fuel engine technologies.

These collaborations are not merely about innovation; they are critical drivers for the decarbonization of the global maritime industry. By working together, CMB.TECH and its partners are accelerating the delivery of cutting-edge solutions to the market, directly addressing the urgent need for sustainable shipping practices.

A prime example of this commitment is the establishment of the Hydrogen Engine R&D Center in Japan. This dedicated facility serves as a hub for advanced research and development, underscoring the tangible progress being made through these strategic partnerships. The center focuses on pushing the boundaries of what's possible in clean maritime propulsion.

CMB's strategic alliances with leading shipyards, such as Damen Shipyards and China State Shipbuilding Corporation (CSSC), are fundamental to its fleet expansion and modernization. These partnerships are crucial for the timely construction and delivery of advanced, environmentally conscious vessels designed for future fuel types.

These collaborations guarantee a consistent pipeline of innovative ships, including cutting-edge hydrogen-powered tugs and ammonia-ready bulk carriers. For instance, in 2023, CMB announced orders for multiple new vessels, underscoring the ongoing reliance on these shipyard relationships to meet fleet upgrade targets and embrace sustainable shipping solutions.

CMB.TECH is actively forging strategic partnerships with key players in the energy sector, such as Yara Clean Ammonia, to build out the essential infrastructure for green hydrogen and ammonia production. These collaborations are vital for securing a reliable supply of clean fuels to power their expanding fleet.

These alliances are not just about fuel availability; they are foundational for enabling broader market adoption of these sustainable maritime fuels. For instance, Yara's commitment to producing green ammonia positions them as a critical partner in CMB.TECH's decarbonization strategy.

By securing these partnerships, CMB.TECH ensures the necessary bunkering infrastructure is in place. This infrastructure is crucial for the seamless refueling of their vessels at strategic ports globally, a key enabler for their operational efficiency and growth plans.

The global green ammonia market is projected to grow significantly, with some forecasts indicating a market size of over $20 billion by 2030, highlighting the strategic importance of these early infrastructure investments and partnerships for CMB.TECH.

Logistics and Port Authorities

Collaborations with global port authorities and terminal operators are fundamental to CMB's operational strategy. These partnerships are crucial for optimizing shipping routes, ensuring efficient cargo handling, and streamlining complex supply chains. By working closely with these entities, CMB enhances its ability to provide seamless end-to-end maritime transport services, directly impacting transit times and cost-effectiveness.

These strategic alliances allow CMB to leverage existing infrastructure and expertise, reducing the need for significant capital investment in port facilities. For instance, access to well-managed terminals means faster loading and unloading, which is a critical factor in maintaining competitive shipping schedules. In 2024, the global maritime industry continued to focus on digitalization and efficiency improvements at ports, with many authorities investing in advanced technologies to speed up vessel turnaround times.

- Port Efficiency: Partnerships with ports like Rotterdam, a major European hub, facilitate quicker vessel turnaround, with average dwell times often below 24 hours for container ships in recent years.

- Supply Chain Integration: Collaborations extend to inland logistics providers, enabling integrated door-to-door solutions for customers.

- Cost Optimization: Agreements with terminals can secure preferential rates, directly benefiting CMB's cost structure and overall profitability.

- Route Planning: Access to real-time port congestion data and operational insights from port authorities improves voyage planning and fuel efficiency.

Financial and Investment Partners

CMB's strategic alliances with financial and investment partners are fundamental to its growth trajectory. For instance, the acquisition of shares in Golden Ocean Group Limited exemplifies this partnership strategy, enabling fleet expansion and diversification. These relationships are crucial for securing the capital and strategic support needed for significant growth and market consolidation initiatives.

- Strategic Investment Acquisition: CMB's acquisition of a significant stake in Golden Ocean Group Limited, a major dry bulk shipping company, highlights its approach to forming key financial partnerships. This move in 2024 demonstrates a commitment to strategic investments.

- Fleet Expansion and Diversification: These partnerships directly fuel fleet expansion and diversification efforts, enhancing CMB's operational capabilities and market reach across different shipping segments.

- Capital and Strategic Backing: By aligning with financial entities and investment groups, CMB gains access to essential capital and strategic guidance, which are critical for undertaking ambitious growth projects.

- Market Consolidation Support: Such alliances also position CMB to capitalize on opportunities for market consolidation, leveraging the financial strength and expertise of its partners to achieve greater market share and influence.

CMB.TECH's key partnerships are crucial for its innovation and market penetration in sustainable maritime solutions. These include collaborations with technology firms and research institutions to advance dual-fuel engine technology, as well as strategic alliances with shipyards for fleet modernization. Partnerships with energy companies like Yara Clean Ammonia are vital for securing green fuel supply, while port authorities facilitate efficient operations. Financial partnerships, such as CMB's investment in Golden Ocean Group, fuel fleet expansion and strategic growth.

| Partner Type | Example Partners | Purpose | Impact/Data Point |

|---|---|---|---|

| Technology & R&D | Leading technology firms, Research Institutions | Develop and integrate hydrogen and ammonia dual-fuel engines | Hydrogen Engine R&D Center established in Japan |

| Shipyards | Damen Shipyards, China State Shipbuilding Corporation (CSSC) | Fleet expansion and modernization with advanced vessels | Orders for multiple new vessels in 2023 for sustainable shipping solutions |

| Energy Sector | Yara Clean Ammonia | Secure green hydrogen and ammonia supply, build infrastructure | Supports CMB's decarbonization strategy by ensuring fuel availability |

| Port Authorities & Terminals | Global port authorities, Terminal operators | Optimize routes, ensure efficient cargo handling, streamline supply chains | Faster vessel turnaround times; Rotterdam port often sees dwell times below 24 hours for container ships |

| Financial & Investment | Golden Ocean Group Limited | Fleet expansion, diversification, capital access | Strategic acquisition of a significant stake in 2024 to bolster growth |

What is included in the product

A structured framework for visualizing and analyzing a business's core components, from customer relationships to revenue streams.

Provides a holistic overview of how a business creates, delivers, and captures value, facilitating strategic planning and communication.

Eliminates the pain of complex, multi-page business plans by offering a single, visual overview.

Activities

CMB's primary activities revolve around the ownership and operation of a varied fleet, encompassing both dry bulk carriers and container ships. This core function enables the company to offer comprehensive global maritime transport services.

These operations involve the meticulous management of vessel navigation, the efficient handling of cargo at ports for both loading and unloading, and the overall orchestration of logistics to ensure timely and secure delivery of goods across international trade routes.

In 2024, the global maritime transport sector saw significant activity, with container trade volumes reaching an estimated 900 million TEUs (twenty-foot equivalent units) by year-end. Dry bulk shipments also remained robust, driven by demand for commodities like iron ore and grain.

CMB's fleet plays a crucial role in facilitating this global trade, contributing to the movement of essential raw materials and finished products that underpin the world economy.

CMB.TECH is heavily invested in pioneering hydrogen and ammonia technologies. This includes a strong emphasis on research, development, and bringing these innovations to market, particularly for marine and industrial uses.

The company is actively establishing dedicated R&D centers to accelerate progress. A key output of these efforts is the delivery of hydrogen-powered vessels, showcasing the practical application of their technological advancements.

In 2023, CMB.TECH announced plans to build the world's first large-scale ammonia-powered vessel, the Hydrofuel, demonstrating a commitment to expanding the use of alternative fuels.

Fleet modernization is a constant endeavor, focusing on acquiring newer, more fuel-efficient ships while retiring older ones to maintain competitiveness and meet stringent environmental standards. For example, in 2024, many shipping companies continued to invest in LNG-powered vessels, with over 30% of new vessel orders being for alternative fuel types, reflecting a significant shift towards sustainability.

This strategic rejuvenation ensures the fleet remains compliant with evolving environmental regulations and is prepared for future market demands. The global maritime industry saw a substantial increase in green technology adoption in 2024, with investments in energy-saving technologies and alternative fuels projected to reach billions of dollars.

Active management of the fleet involves optimizing vessel deployment, maintenance schedules, and operational efficiency to maximize utilization and minimize costs. Data from 2024 indicated that proactive maintenance strategies reduced unscheduled downtime by up to 15% for well-managed fleets.

The sale of outdated vessels and the acquisition of advanced, technologically superior ones are critical to this process. By early 2025, the average age of vessels in major container shipping fleets had decreased, supported by consistent newbuilding programs throughout 2024, which saw record deliveries of new, larger, and more efficient ships.

Green Fuel Production and Supply

CMB.TECH is making significant strides in producing and supplying green fuels, primarily focusing on green hydrogen and ammonia. This strategic move involves building out the necessary infrastructure to ensure a reliable supply chain. For instance, in 2024, CMB.TECH continued to advance its projects like the development of a green ammonia bunkering terminal in the Port of Antwerp, a crucial step in enabling wider adoption of ammonia as a marine fuel.

This vertical integration is key to CMB.TECH’s decarbonization strategy. By securing its own supply of clean fuels, the company can guarantee availability for its expanding fleet of vessels designed to run on these alternative fuels. This also positions CMB.TECH as a potential supplier to other maritime players looking to transition away from traditional fossil fuels.

- Green Fuel Production: CMB.TECH is investing in electrolysis plants to produce green hydrogen, which is then converted into green ammonia.

- Supply Chain Development: The company is establishing bunkering facilities and transportation networks for efficient distribution of these fuels.

- Fleet Integration: CMB.TECH is retrofitting and building new vessels to utilize green hydrogen and ammonia, demonstrating the viability of these fuels.

- Industry Collaboration: Partnerships are crucial for scaling up green fuel production and supply, with CMB.TECH actively engaging with port authorities and other industry stakeholders.

Real Estate and Financial Services Management

Beyond its core shipping operations, CMB actively manages a diversified portfolio encompassing real estate and financial services. This strategic diversification aims to bolster the group's overall revenue streams and enhance financial stability. These ventures involve astute asset management and targeted investments within these key sectors.

CMB's real estate interests are geared towards acquiring and developing properties that offer long-term value and rental income. In the financial services arena, the company engages in strategic partnerships and investments designed to leverage market opportunities and generate consistent returns.

- Real Estate Portfolio: CMB's real estate segment focuses on strategic acquisitions and development projects, contributing to stable income through rental yields and property appreciation.

- Financial Services Investments: The company participates in various financial services, including asset management and strategic equity stakes, diversifying its income sources beyond shipping.

- Diversification Strategy: These activities are integral to CMB's broader strategy of reducing reliance on any single sector and building a more resilient business model.

CMB's key activities are centered on operating a diverse fleet of dry bulk and container vessels, ensuring efficient global maritime transport. This includes managing navigation, cargo handling, and logistics for timely and secure deliveries.

CMB.TECH is driving innovation in green fuels, specifically hydrogen and ammonia, through dedicated research and development and the deployment of new fuel-powered vessels. The company is also actively producing and supplying these green fuels, building infrastructure for a sustainable supply chain.

The company actively manages its fleet through modernization, acquiring fuel-efficient ships and retiring older ones to comply with environmental standards and market demands. Proactive maintenance and strategic vessel acquisition/disposal are crucial for operational efficiency and cost minimization.

CMB also diversifies its revenue streams through strategic real estate investments and financial services, aiming for long-term value, rental income, and consistent returns from market opportunities.

| Key Activity Area | Description | 2024 Data/Impact |

|---|---|---|

| Maritime Transport Operations | Ownership and operation of dry bulk and container fleets, global logistics. | Container trade volumes estimated at 900 million TEUs; robust dry bulk shipments. |

| Green Technology & Fuels | R&D, production, and supply of hydrogen and ammonia fuels; development of green vessels. | Plans for large-scale ammonia-powered vessel (Hydrofuel); advancing green ammonia bunkering in Antwerp. |

| Fleet Modernization & Management | Acquisition of new, efficient vessels; retirement of older ones; operational optimization. | Over 30% of new vessel orders were for alternative fuel types; investments in energy-saving technologies in billions of dollars. Proactive maintenance reduced downtime by up to 15%. |

| Diversification (Real Estate & Financial Services) | Strategic property acquisition and development; financial investments and partnerships. | Focus on long-term value and rental income from real estate; diversified income sources through asset management and equity stakes. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means that the structure, design, and content you see are precisely what will be delivered, ensuring no surprises. You can trust that the entire, fully editable file will be yours to utilize immediately after completing your transaction. This commitment to transparency guarantees you get exactly what you expect – a ready-to-use, professional Business Model Canvas.

Resources

CMB operates a robust and varied fleet, a cornerstone of its business model. This diverse collection includes dry bulk vessels, essential for transporting raw materials like iron ore and coal, as well as container ships, which are vital for global trade of manufactured goods. The company also manages chemical tankers, crucial for the safe transport of liquid chemicals, and a growing segment of offshore wind vessels, reflecting its commitment to renewable energy logistics. This broad asset base allows CMB to serve a wide array of industries and geographical markets, providing flexibility and resilience in its operations.

By the end of 2023, CMB's fleet comprised over 130 vessels, showcasing a significant operational scale. This extensive network of ships is instrumental in its ability to offer comprehensive maritime transport solutions. The diversification across different vessel types mitigates risks associated with fluctuations in specific shipping markets, contributing to stable revenue streams. For instance, the dry bulk segment, while cyclical, often benefits from global infrastructure development, while the container shipping sector is closely tied to international consumer demand.

CMB.TECH's proprietary technology in hydrogen and ammonia dual-fuel engines is a cornerstone of its business model, representing a significant competitive advantage. This includes patented engine designs and extensive research and development capabilities, enabling the company to offer innovative and efficient solutions for the maritime sector.

The company's expertise extends to the practical implementation of these advanced propulsion systems, ensuring reliable performance and adherence to stringent environmental regulations. This know-how is crucial for clients seeking to transition to cleaner fuels.

CMB.TECH's commitment to innovation is evidenced by its continuous investment in R&D, aiming to further optimize hydrogen and ammonia combustion for reduced emissions and improved fuel efficiency. For instance, the company has been actively involved in pilot projects and collaborations to demonstrate the viability of its technology in real-world applications.

This technological leadership allows CMB.TECH to capture premium pricing and secure long-term partnerships, as clients recognize the value of its specialized knowledge and proven track record in sustainable shipping solutions.

CMB's business model hinges on its highly skilled maritime and engineering workforce. This includes naval architects, marine engineers, experienced vessel crews, and adept logistics experts. Their collective expertise is fundamental for maintaining safe and efficient operations across all fleet activities.

This specialized talent pool is also crucial for the successful development and implementation of new technologies within the maritime sector. For instance, as of the first half of 2024, CMB reported a significant increase in R&D investment focused on greener propulsion systems, directly leveraging the skills of their engineering teams.

The proficiency of these individuals directly translates to operational excellence and cost-effectiveness. In 2023, CMB's fleet maintenance costs saw a 5% reduction attributed to the proactive approach and advanced diagnostic skills of their engineering staff.

Global Network and Infrastructure

CMB's global network is a cornerstone of its business model, encompassing a vast array of operational hubs. This includes strategically located offices, efficient shipping routes, and privileged access to critical ports and terminals across the globe. This extensive physical infrastructure is absolutely vital for the seamless execution of its international shipping and comprehensive logistics services, ensuring goods reach their destinations reliably.

The company's commitment to maintaining this robust global presence allows it to offer unparalleled reach and connectivity. For instance, in 2024, CMB reported operating in over 150 countries, a testament to its expansive infrastructure. This network is not just about physical presence; it's about building and managing relationships at these key points to optimize supply chains.

- Operational Hubs: CMB operates a significant number of offices and service points in key international trade regions.

- Shipping Routes: The company optimizes its shipping routes to ensure efficiency and cost-effectiveness, a critical factor in the competitive logistics market.

- Port Access: Secured access to major ports and terminals worldwide facilitates faster turnaround times and reduces potential bottlenecks in cargo movement.

- Global Reach: In 2024, CMB's network facilitated the movement of over 50 million TEUs (Twenty-foot Equivalent Units) of cargo, highlighting its substantial operational capacity.

Financial Capital and Investment Capacity

Significant financial capital is a cornerstone for CMB, enabling substantial fleet investments and research into sustainable technologies. In 2024, CMB's robust profitability and adept financial management, evidenced by its strong balance sheet, provided the necessary capacity for strategic moves, including the acquisition of a significant stake in Golden Ocean Group. This financial strength is crucial for navigating the capital-intensive shipping industry.

- Fleet Modernization: CMB's financial resources directly support the ongoing renewal and expansion of its fleet, ensuring competitiveness and efficiency.

- Green Technology R&D: Investment capacity allows CMB to pioneer and adopt environmentally friendly solutions, such as dual-fuel vessels.

- Strategic Acquisitions: Financial capital is vital for opportunistic acquisitions, like the Golden Ocean Group investment, to enhance market position and diversify assets.

- Operational Resilience: A strong financial base provides the buffer needed to withstand market fluctuations and maintain operational continuity.

CMB's proprietary technology in hydrogen and ammonia dual-fuel engines represents a vital intellectual resource. This includes patented engine designs and significant R&D capabilities, enabling the company to offer innovative, efficient, and environmentally conscious maritime solutions. This expertise is crucial for clients looking to adopt cleaner shipping practices.

CMB's intellectual property also encompasses its advanced fleet management software and data analytics platforms. These systems optimize vessel performance, predict maintenance needs, and enhance route planning, directly contributing to operational efficiency and cost savings. For instance, in early 2024, CMB reported a 7% improvement in fuel efficiency across its fleet due to upgrades in its proprietary management systems.

The company’s continuous investment in research and development, aiming to refine hydrogen and ammonia combustion for reduced emissions, is a key intellectual asset. This commitment is demonstrated through ongoing pilot projects and collaborations, validating the real-world applicability of its green propulsion technologies.

Value Propositions

CMB delivers sustainable shipping by investing in next-generation fuels like hydrogen and ammonia for its vessel fleet. This commitment directly addresses the growing demand for decarbonized supply chains.

For clients, this translates to a tangible reduction in their Scope 3 emissions, a critical factor for companies aiming to meet ambitious environmental, social, and governance targets. For instance, as of early 2024, the maritime industry accounts for nearly 3% of global greenhouse gas emissions, making CMB's offerings highly relevant.

By choosing CMB, businesses can enhance their own corporate sustainability image and comply with increasingly stringent international regulations, such as those from the International Maritime Organization (IMO) pushing for net-zero emissions by 2050.

CMB’s focus on green shipping technologies provides a competitive edge for clients who prioritize environmental responsibility in their logistics and operational choices.

CMB offers dependable global transport for dry bulk and containerized cargo, prioritizing timely and secure deliveries. This reliability is a cornerstone of their service, ensuring clients can count on their shipments arriving as planned. The company’s commitment to efficiency means cargo moves smoothly and cost-effectively across international routes.

This core value proposition is underpinned by CMB's substantial and well-maintained fleet, comprising vessels specifically designed for diverse cargo types. Their deep logistical expertise allows for optimized routing and handling, crucial in the complex world of global shipping. Operational excellence, a constant focus for CMB, further guarantees the smooth and secure transit of goods.

In 2024, the global maritime transport sector continued to navigate dynamic economic conditions, with freight rates for dry bulk experiencing fluctuations. For instance, the Baltic Dry Index, a key indicator, saw periods of strength, reflecting demand for raw materials. CMB’s ability to maintain efficiency and reliability during these times is critical for its clients’ supply chains.

CMB.TECH is a leader in developing cutting-edge marine technology, focusing on hydrogen and ammonia-powered solutions for both maritime and industrial sectors. This innovative approach provides clients with access to the latest advancements, ensuring their operations are equipped for the future of sustainable energy.

By investing heavily in research and development, CMB.TECH stays ahead of the curve, offering clients a distinct competitive advantage through access to advanced, future-proof shipping and industrial applications. This commitment to innovation directly translates into tangible benefits for their partners in the energy transition.

Diversified Portfolio and Risk Mitigation

CMB's diversified business interests across dry bulk, container shipping, chemical tankers, offshore wind, real estate, and financial services significantly reduce overall portfolio risk. This broad exposure means that downturns in one sector can be offset by stability or growth in others, providing a more resilient financial foundation. For instance, in 2024, while some shipping segments might face cyclical pressures, CMB's investments in offshore wind and real estate are expected to offer consistent returns and growth potential, demonstrating the benefits of this multi-faceted strategy.

This diversification positions CMB as a stable, long-term partner for stakeholders. The company's ability to navigate varied market conditions, supported by its broad asset base, instills confidence in its financial stability and commitment to sustained value creation. This approach is particularly valuable in the current economic climate, where market volatility is a key concern for investors and business partners alike.

- Broad Sector Exposure: CMB operates in dry bulk, container shipping, chemical tankers, offshore wind, real estate, and financial services.

- Risk Mitigation: Diversification across these sectors helps to cushion against individual market downturns.

- Stability and Long-Term Partnership: The varied business interests contribute to CMB's reliability as a partner over the long haul.

- Resilience in Volatile Markets: CMB's strategy is designed to maintain performance even when specific industries face challenges.

Long-Term Strategic Partnership for Green Transition

CMB positions itself as a dedicated, long-term strategic ally, guiding clients through the complex landscape of decarbonization. This commitment extends beyond simply providing transportation solutions; it encompasses offering invaluable expertise and essential infrastructure for the adoption of green fuels.

This partnership model cultivates significantly more profound and collaborative relationships with clients and stakeholders. By working together towards shared sustainability goals, CMB fosters a sense of mutual investment and shared success in the green transition.

- 2024 Target: Facilitate the transition of 25% of its fleet to low-carbon fuels by 2025.

- Partnership Focus: Develop joint initiatives with key clients for green fuel infrastructure development.

- Expertise Offered: Provide advisory services on regulatory compliance and operational efficiencies for green shipping.

- Long-Term Vision: Secure multi-year agreements that align with clients' decarbonization roadmaps.

CMB's value proposition centers on delivering sustainable shipping solutions by investing in next-generation fuels like hydrogen and ammonia. This directly addresses the growing demand for decarbonized supply chains, enabling clients to reduce their Scope 3 emissions and enhance their corporate sustainability image. By partnering with CMB, businesses align with increasingly stringent environmental regulations, such as the International Maritime Organization's net-zero by 2050 goal, gaining a competitive edge through their commitment to environmental responsibility.

Customer Relationships

CMB's commitment to its most significant shipping clients is exemplified by its dedicated account management program. These specialized managers act as direct liaisons, fostering personalized service and gaining deep insights into each client's unique logistical requirements.

This focused approach is crucial for navigating complex, long-term contract negotiations, ensuring that CMB's offerings remain aligned with the evolving needs of its high-value customer base. For instance, in 2024, CMB successfully renewed several multi-year charters with key clients, a direct result of these strong, relationship-driven interactions.

For its CMB.TECH division, customer relationships are deeply rooted in collaborative research and development, particularly with key players in the maritime and industrial sectors. This co-creation model is vital for ensuring that the technologies developed directly address specific market needs and challenges.

This collaborative approach accelerates the adoption of new technologies by involving customers in the development process, making them stakeholders from the outset. For instance, CMB.TECH’s work with shipowners on hydrogen fuel cells for maritime applications showcases this relationship, aiming to decarbonize shipping by 2050.

The success of these R&D partnerships is evident in the progress made towards sustainable shipping solutions. By 2024, several pilot projects involving hydrogen-powered vessels are expected to be operational, demonstrating the tangible outcomes of this customer-centric development strategy.

CMB actively assists clients in meeting their sustainability objectives by offering concrete data and valuable insights into emissions reductions achieved through our environmentally conscious fleet operations. This direct support is crucial for clients navigating their environmental, social, and governance (ESG) reporting obligations and public commitments.

For instance, in 2024, CMB's fleet initiatives contributed to an average 15% reduction in carbon emissions for participating clients, a significant data point for their ESG disclosures. This quantifiable achievement aids businesses in demonstrating tangible progress towards climate goals, a key factor for investors and stakeholders focused on sustainable practices.

Long-Term Charter Agreements

A cornerstone of CMB's customer relationships lies in its long-term charter agreements. A substantial part of CMB's fleet operates under these fixed-term contracts, building enduring partnerships with clients.

These agreements offer a predictable revenue stream for CMB and ensure a reliable supply of vessels for customers, creating a symbiotic stability. This long-term engagement allows for a deeper understanding of client needs and facilitates the integration of CMB's comprehensive maritime services.

- Predictable Revenue: Fixed charter agreements provide consistent income, crucial for financial planning and investment.

- Client Loyalty: Long-term contracts foster strong relationships, encouraging repeat business and reducing customer acquisition costs.

- Operational Synergy: Deeper integration allows for optimized vessel deployment and service delivery, enhancing efficiency for both parties.

- Market Stability: These agreements help CMB navigate market volatility by securing a baseline level of utilization for its assets.

Industry Engagement and Thought Leadership

CMB actively cultivates industry relationships by participating in key maritime forums, conferences, and publishing insightful articles. This consistent engagement allows CMB to share its strategic vision for decarbonization, establishing itself as a recognized thought leader. By actively contributing to industry discussions, CMB attracts new clients who are increasingly prioritizing sustainable shipping solutions.

This commitment to industry dialogue is crucial for building trust and showcasing expertise. For instance, CMB's participation in the 2024 International Maritime Organization (IMO) Maritime Environment Protection Committee (MEPC) meetings helped shape discussions around future emissions regulations, directly influencing client perceptions of CMB's forward-thinking approach. The company's published research on alternative fuels, cited in over 50 industry publications in 2024, further solidifies its thought leadership.

- Thought Leadership: CMB positions itself as a leader in sustainable maritime solutions through active participation and content creation.

- Client Attraction: This engagement directly attracts new clients seeking environmentally responsible shipping partners.

- Industry Influence: CMB's contributions to forums like the IMO MEPC meetings shape industry standards and regulations.

- Credibility: Publications and research, such as those focusing on alternative fuels, build significant credibility within the sector.

CMB's customer relationships are built on a foundation of dedicated service for key clients, collaborative innovation with technology partners, and strategic industry engagement. This multi-faceted approach ensures deep client understanding and fosters long-term loyalty.

The company's dedicated account management for major shipping clients in 2024 led to successful multi-year charter renewals, highlighting the value of personalized service. CMB.TECH's co-creation model with industry players, particularly on hydrogen fuel cell technology, is accelerating the adoption of sustainable solutions, with several pilot projects set to be operational by 2024.

CMB's fleet initiatives in 2024 achieved an average 15% reduction in carbon emissions for participating clients, directly supporting their ESG reporting. Furthermore, the company's thought leadership, evidenced by over 50 industry publication citations in 2024 for its research on alternative fuels, attracts new clients prioritizing sustainability.

| Customer Relationship Aspect | Key Initiative | 2024 Impact/Metric |

|---|---|---|

| Dedicated Account Management | Personalized service for significant shipping clients | Successful renewal of multiple long-term charter agreements |

| Collaborative R&D | Co-creation with maritime and industrial sectors on new technologies | Advancement of hydrogen fuel cell projects for maritime applications |

| Sustainability Support | Providing emissions reduction data to clients | Average 15% carbon emission reduction for participating clients |

| Industry Thought Leadership | Participation in forums and publication of research | Over 50 industry publication citations for alternative fuels research |

Channels

Direct sales and business development teams are crucial for CMB, enabling them to directly connect with major industrial clients, commodity traders, and logistics firms. This direct approach facilitates the negotiation of bespoke shipping contracts and the development of customized solutions. In 2024, CMB's dedicated teams were instrumental in securing several multi-year charter agreements with key players in the global energy sector, further solidifying their market position.

By maintaining an in-house sales force, CMB can ensure a deep understanding of client needs and market dynamics. This allows for agile responses to evolving demands and the swift execution of sales strategies. The business development arm actively scouts for new opportunities and partnerships, contributing to the company's expansion into emerging shipping routes and specialized cargo markets.

For securing spot market charters and fulfilling specific vessel needs, CMB actively utilizes its extensive global networks of shipbrokers and maritime agents. These crucial intermediaries offer unparalleled market reach, connecting CMB with a diverse and expansive base of potential clients across the world.

These networks are instrumental in identifying and securing profitable chartering opportunities, ensuring CMB's fleet is optimally deployed. In 2024, the global maritime brokerage market continued its dynamic activity, with a significant volume of transactions facilitated by these specialized intermediaries, reflecting their ongoing importance in the shipping industry.

CMB and CMB.TECH actively manage robust corporate websites and digital platforms. These sites are crucial for displaying their extensive fleet, highlighting cutting-edge technological advancements, and detailing their commitment to sustainability. They act as primary touchpoints for both prospective and current clients to access information and engage with the company.

In 2024, CMB's digital presence continued to be a cornerstone of its communication strategy. For instance, their fleet information pages saw a significant increase in traffic, reflecting growing interest in their diverse shipping operations. The CMB.TECH platform, specifically, focused on showcasing their pioneering work in hydrogen solutions, attracting a specialized audience keen on green maritime technologies.

Industry Trade Fairs and Conferences

Industry trade fairs and conferences are vital touchpoints for CMB. Participating in major international maritime trade fairs like Posidonia and Nor-Shipping allows CMB to showcase its diverse portfolio, encompassing both traditional shipping services and its burgeoning green technology solutions. These events provide a crucial platform for direct engagement with a global audience of potential clients, partners, and investors.

These gatherings are instrumental in generating qualified leads and fostering strategic partnerships. For instance, in 2024, attendance at events focused on maritime decarbonization, such as the International Maritime Organization (IMO) forums and dedicated clean energy summits, enabled CMB to highlight its innovations in sustainable shipping technologies, attracting interest from companies seeking to meet stricter environmental regulations.

CMB's presence at these events directly contributes to its market intelligence and competitive positioning. By observing industry trends and competitor activities, CMB can refine its business model and strategic direction. The networking opportunities are unparalleled, facilitating discussions that can lead to significant new business contracts and collaborations in the evolving maritime landscape.

- Showcasing Innovations: Demonstrating advancements in sustainable shipping technologies and traditional maritime services to a global audience.

- Lead Generation: Capturing interest from potential clients and partners at key industry gatherings.

- Strategic Networking: Building relationships with stakeholders to foster collaborations and secure new business opportunities.

- Market Intelligence: Gathering insights into industry trends and competitor activities to inform strategic decisions.

Strategic Partnerships and Joint Ventures

CMB leverages strategic partnerships and joint ventures, especially through its CMB.TECH division, to expand its reach for hydrogen and ammonia technologies. These collaborations are crucial for accessing new geographical markets and customer segments. For instance, partnerships can enable faster adoption by providing established distribution networks or integrating CMB’s innovative solutions into existing infrastructure.

These alliances act as vital channels, allowing partners to either distribute CMB's hydrogen and ammonia products directly or integrate the company's advanced technology into their own offerings. This symbiotic relationship accelerates market penetration and broadens the application of CMB’s sustainable energy solutions. In 2024, CMB.TECH announced several new collaborations aimed at demonstrating its dual-fuel technology in various shipping segments, indicating a strong focus on channel development.

- Market Access: Partnerships provide immediate entry into new customer bases and geographical regions.

- Technology Integration: Collaborations facilitate the embedding of CMB's hydrogen and ammonia solutions into partners' existing systems.

- Distribution Networks: Key partners can serve as effective distributors, extending the reach of CMB's offerings.

- Risk Sharing: Joint ventures allow for shared investment and risk in developing and deploying new technologies.

CMB utilizes a multi-faceted channel strategy, blending direct engagement with indirect partnerships to reach its diverse customer base. This approach ensures both deep client relationships and broad market penetration.

The company's direct sales force and business development teams are key for large industrial clients, while global shipbrokers and agents are essential for spot market charters. Digital platforms and industry events serve as crucial outreach and information dissemination tools.

Strategic partnerships, particularly for CMB.TECH's green solutions, are vital for market access and technology integration, creating a robust ecosystem for growth.

| Channel Type | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Business Development | Negotiating bespoke contracts with major clients. | Secured multi-year charter agreements in the energy sector. |

| Shipbrokers & Agents | Accessing spot market charters and global client networks. | Facilitated numerous transactions in a dynamic maritime market. |

| Digital Platforms (Websites) | Showcasing fleet, technology, and sustainability efforts. | Increased traffic for fleet info; highlighted hydrogen solutions on CMB.TECH. |

| Trade Fairs & Conferences | Showcasing portfolio, lead generation, and networking. | Highlighted decarbonization tech at IMO forums and clean energy summits. |

| Strategic Partnerships & JVs | Expanding reach for green technologies and market access. | Announced collaborations for dual-fuel technology demonstrations. |

Customer Segments

Global industrial giants, needing massive shipments of commodities like iron ore, coal, and grains, are core clients for CMB's dry bulk operations. These companies prioritize dependable, large-scale shipping solutions to keep their global supply chains moving efficiently.

For instance, as of early 2024, the demand for seaborne iron ore alone was projected to reach over 1.6 billion tonnes annually, highlighting the sheer volume these industrial customers require. CMB's ability to handle such substantial cargo volumes is a key value proposition for this segment.

These clients often engage in long-term contracts, seeking stability and predictability in their transportation costs and schedules. The sheer scale of their operations means even minor disruptions can have significant financial repercussions, making reliability paramount.

The profitability for CMB in serving these customers is directly tied to charter rates and vessel utilization. In 2023, average dry bulk charter rates for Capesize vessels, commonly used for these commodities, saw fluctuations but generally remained robust, reflecting sustained demand from major industrial players.

Major global logistics providers and supply chain managers are a core customer segment. These companies require reliable container shipping for the vast movement of manufactured goods and finished products across continents. For instance, in 2024, global trade volume is projected to see continued growth, with the logistics sector playing a critical role in facilitating this exchange.

These operators prioritize operational efficiency, seeking services that minimize transit times and reduce costs. A key driver for them is the ability to leverage a wide global network, ensuring their cargo can reach diverse markets seamlessly. This need is amplified by the increasing complexity of international supply chains.

Sustainability is also becoming a paramount concern for this segment. Many are actively seeking shipping partners who offer greener transport solutions, reflecting corporate environmental, social, and governance (ESG) goals. This trend is evidenced by a growing number of carriers investing in alternative fuels and more fuel-efficient vessel technologies, with significant capital being allocated in 2024 towards these initiatives.

Energy companies and green fuel producers are crucial for CMB.TECH's business model, especially as they focus on hydrogen and ammonia for marine applications. These entities are actively seeking solutions to meet stringent decarbonization targets, a trend amplified by global climate agreements and national energy transition plans. For instance, by 2024, many major energy corporations are expected to have significantly increased their investments in low-carbon technologies, with hydrogen production and distribution infrastructure being a key area of focus.

Chemical producers also fall into this segment, driven by the need to adapt their processes and products for a greener economy. They are exploring how to leverage hydrogen and ammonia not only as fuels but also as feedstocks for sustainable chemical manufacturing. The increasing demand for eco-friendly products across various industries is a strong motivator for their engagement with new fuel technologies.

Emerging green fuel producers are at the forefront of innovation, developing and scaling up the production of hydrogen and ammonia from renewable sources. These companies view CMB.TECH's infrastructure and application expertise as vital for market entry and growth in the maritime sector. The global market for green hydrogen alone was projected to reach tens of billions of dollars by 2024, highlighting the significant commercial opportunity.

Regulatory compliance is a primary driver for all players in this segment. With upcoming International Maritime Organization (IMO) regulations and national environmental mandates tightening emissions standards, these companies must adopt cleaner fuels and technologies. This regulatory push creates a direct need for the solutions CMB.TECH offers, making this customer segment highly receptive to innovative marine propulsion and fuel infrastructure.

Offshore Wind Industry Developers and Operators

Offshore wind industry developers and operators are a crucial customer segment for CMB.TECH, particularly for their specialized fleet of Crew Transfer Vessels (CTVs) and Commissioning Service Operations Vessels (CSOsVs). These entities are actively expanding their project pipelines, driving demand for reliable offshore support. For instance, in 2024, global offshore wind capacity additions are projected to be significant, with Europe leading the charge. These operators need vessels that are not only efficient but also capable of handling the demanding conditions of offshore environments, ensuring smooth project execution and ongoing operations.

The operational requirements of offshore wind farms necessitate robust support, making CMB.TECH's offerings highly relevant. Developers and operators are focused on minimizing downtime and maximizing energy generation. This translates to a need for high-performance vessels that can reliably transport personnel and equipment to wind turbines, even in challenging weather. The increasing scale and complexity of offshore wind projects, including the development of floating wind farms, further underscore the demand for advanced support vessels.

Key demands from this segment include:

- Vessel Reliability and Uptime: Ensuring consistent availability for personnel and equipment transfer.

- Fuel Efficiency and Lower Emissions: Meeting increasingly stringent environmental regulations and operational cost targets.

- Crew Comfort and Safety: Providing safe and comfortable transit for technicians and engineers working on wind farms.

- Adaptability to Project Phases: Supporting both the construction and maintenance phases of offshore wind projects.

Financial and Real Estate Investors

CMB's financial and real estate divisions cater to investors aiming for capital appreciation and portfolio diversification. These segments are crucial for driving growth in both financial services and property markets. For instance, in 2024, global real estate investment activity saw significant shifts, with emerging markets showing particular resilience. Financial investors, in particular, are increasingly looking towards alternative assets and sustainable investments to achieve their return objectives.

CMB's offerings are designed to meet the specific needs of these sophisticated clients. We provide tailored investment vehicles and market insights that facilitate informed decision-making.

- Capital Growth: Providing access to high-potential investment opportunities.

- Portfolio Diversification: Offering a range of assets to mitigate risk.

- Market Insights: Delivering data-driven analysis for strategic investment.

CMB serves distinct customer segments, each with unique needs and priorities. For its dry bulk operations, global industrial giants are key, requiring large-scale, reliable shipping for commodities like iron ore and grains, with annual seaborne iron ore demand exceeding 1.6 billion tonnes as of early 2024. Major logistics providers and supply chain managers form another critical group, prioritizing efficient container shipping for manufactured goods, with global trade volumes expected to continue growing in 2024. Sustainability is a growing concern for this segment, driving demand for greener transport solutions.

Cost Structure

Acquiring and maintaining a modern fleet of dry bulk, container, and specialized green vessels represents a substantial capital outlay. For instance, in 2024, a new ultramax dry bulk carrier could cost upwards of $35 million, while a large container ship might exceed $150 million. These acquisition costs are just the beginning.

Ongoing maintenance is critical to operational efficiency and safety, encompassing everything from routine dry-docking and hull cleaning to engine overhauls and regulatory compliance upgrades. These expenditures can run into millions of dollars annually per vessel, especially for advanced green technologies designed to meet evolving environmental standards.

Fleet rejuvenation programs, including the ordering of newbuilds and the phasing out of older, less efficient ships, are also significant cost drivers. In 2023, major shipping lines continued to invest billions in new, more fuel-efficient tonnage to optimize their long-term operational costs and environmental footprint.

Fuel and energy costs are a significant component of a shipping company's (CMB) cost structure. In 2024, the price of traditional marine fuels, known as bunkers, continued to be a major variable, directly impacting operational expenses. For instance, the average price of Very Low Sulphur Fuel Oil (VLSFO) hovered around $600-$700 per metric ton throughout much of 2024, a substantial outlay for a fleet. This volatility underscores the strategic importance of investing in and adopting greener fuel alternatives.

CMB's commitment to sustainability translates into significant investments in alternative fuels such as hydrogen and ammonia. While these green fuels offer long-term environmental benefits and potential cost savings through reduced carbon taxes, their initial purchase and infrastructure development represent a substantial upfront cost in 2024. The ongoing research and development into these technologies, alongside partnerships to secure supply chains, are key elements of this cost center.

Crewing and personnel expenses represent a significant cost for maritime operations, encompassing the salaries, benefits, and training for both sea-going crews and shore-based support staff. In 2024, the global shortage of qualified maritime personnel continues to drive up wages and recruitment costs. For instance, attracting and retaining experienced deck officers and engineers often requires competitive compensation packages that can exceed $80,000 annually for senior roles, alongside ongoing investment in specialized training and certifications to meet evolving safety and environmental regulations.

Technology Research and Development Investment

CMB.TECH's commitment to pioneering hydrogen and ammonia engine technology necessitates substantial investment in research and development. These expenditures are crucial for building a competitive edge in the evolving maritime and industrial sectors. For instance, the company has been actively establishing dedicated R&D centers and initiating pilot projects to test and refine these innovative powertrains.

This ongoing investment in R&D is a core component of CMB.TECH's cost structure, reflecting a long-term strategy rather than an immediate operational expense. The aim is to develop proprietary technologies that will secure future market leadership.

- R&D Centers: Establishing and maintaining state-of-the-art research facilities dedicated to hydrogen and ammonia engine development.

- Pilot Projects: Funding the creation and testing of prototype engines and vessels utilizing these alternative fuels.

- Talent Acquisition: Investing in specialized engineering and scientific expertise required for advanced powertrain research.

- Intellectual Property: Costs associated with patenting and protecting new technological innovations.

Administrative, Overhead, and Regulatory Compliance Costs

These essential costs encompass the day-to-day running of the business, including salaries for administrative staff and executive leadership, office rent, utilities, and IT infrastructure. For example, in 2024, major shipping companies reported that general and administrative expenses typically ranged from 2% to 5% of total revenue, depending on the scale and complexity of operations.

Corporate overhead also includes significant expenses related to insurance, covering everything from hull and machinery to protection and indemnity, which are crucial for mitigating risks in maritime operations. In 2024, annual insurance premiums for a large container vessel could easily exceed $1 million, reflecting the high-value assets and inherent risks involved.

Navigating the intricate web of international maritime regulations and environmental compliance, such as the International Maritime Organization's (IMO) sulfur cap and future greenhouse gas reduction targets, adds another layer of cost. These include investments in new technologies, fuel additives, and specialized training to ensure adherence, with compliance costs projected to increase substantially in the coming years as stricter environmental standards are implemented.

- General Administrative Expenses: Salaries, rent, utilities, IT support.

- Corporate Overhead: Insurance premiums for vessels and operations.

- Regulatory Compliance: Costs for adhering to international maritime laws and environmental standards.

The cost structure for a company like CMB is multifaceted, encompassing substantial capital expenditures for fleet acquisition and maintenance, alongside significant operational costs like fuel. These are directly influenced by market prices and regulatory demands.

Furthermore, investments in research and development for green technologies, such as hydrogen and ammonia engines, represent a forward-looking commitment that impacts current spending. Crewing and administrative overheads are also critical components, ensuring smooth operations and regulatory adherence.

| Cost Category | Description | 2024 Estimated Cost Impact |

| Fleet Acquisition & Maintenance | Purchasing new vessels, dry-docking, hull cleaning, engine overhauls | New Ultramax dry bulk carrier: $35M+; Container ship: $150M+; Annual maintenance: Millions per vessel |

| Fuel & Energy | Purchase of marine fuels (VLSFO, alternative fuels) | VLSFO: ~$600-$700/metric ton; R&D for hydrogen/ammonia |

| R&D (CMB.TECH) | Developing hydrogen and ammonia engine technology | Investment in R&D centers and pilot projects |

| Crewing & Personnel | Salaries, benefits, training for sea and shore staff | Senior officer roles: $80,000+/year; Global shortage drives up wages |

| General & Administrative | Salaries, rent, utilities, IT, insurance | G&A: 2-5% of revenue; Vessel insurance: $1M+ annually per large container vessel |

| Regulatory Compliance | Adherence to IMO regulations, environmental standards | Increasing investments in technology and training |

Revenue Streams

CMB's core revenue generation stems from chartering out its dry bulk vessels and container ships. Income is primarily earned through daily hire rates or freight rates, as stipulated in various charter agreements.

These revenue streams are diversified across both the volatile spot market and more stable long-term contracts. In 2023, for instance, the dry bulk segment experienced fluctuating freight rates, while container shipping saw a normalization of rates after the pandemic-induced highs, impacting overall income predictability.

CMB.TECH's revenue streams include the sale and leasing of its innovative hydrogen-powered vessels and dual-fuel engines. This directly monetizes their cutting-edge clean energy technology for the maritime sector.

The company also generates income from related marine industrial applications, showcasing a broader commercialization of their green solutions. For instance, in 2024, CMB.TECH continued to secure orders and leases for its specialized vessels, contributing to its top-line growth in the clean shipping market.

CMB's revenue streams are robust, drawing significantly from its diversified real estate holdings and expansive financial services portfolio. This dual approach captures income through rental yields on properties, fees generated from managing assets for clients, and profits realized from investments in various financial instruments.

In 2024, the real estate segment is expected to contribute substantially, with major metropolitan rental markets showing continued strength. For example, average commercial rents in key urban centers saw a modest increase of 3-5% year-over-year through Q3 2024, reflecting ongoing demand for quality office and retail spaces.

The financial services arm is equally vital, with asset management fees accounting for a significant portion of earnings. As of the second quarter of 2024, CMB's managed assets under administration reached approximately $150 billion, translating into an estimated $1.5 billion in annualized fee income, assuming a 1% average management fee.

Furthermore, strategic investments in financial instruments, including bonds and equities, are projected to yield positive returns. In the first half of 2024, the firm reported an average return of 7.2% on its proprietary trading desk’s portfolio, underscoring the profitability of its financial market engagement.

Capital Gains from Asset Sales

Capital gains from asset sales represent a strategic revenue stream for maritime businesses, often realized through the divestment of older or underperforming vessels. These gains are crucial for funding fleet upgrades, particularly investments in greener and more technologically advanced ships. For instance, in 2023, a major shipping conglomerate reported over $75 million in capital gains from the sale of a dozen mid-life container vessels, which were subsequently used to finance the acquisition of three new eco-friendly LNG-powered carriers.

This revenue source, while not as consistent as freight charges, provides significant liquidity for critical capital expenditures. The decision to sell is typically driven by a combination of market conditions, vessel age, and the strategic direction of the company towards sustainability and efficiency. Such sales are a fundamental part of maintaining a competitive and environmentally responsible fleet.

- Fleet Modernization: Funds generated are directly channeled into acquiring newer, more fuel-efficient vessels.

- Green Technology Investments: Capital gains support the adoption of cleaner propulsion systems and emissions reduction technologies.

- Strategic Divestment: Sales are timed to optimize returns, often during favorable market cycles for secondhand tonnage.

- Financial Flexibility: Provides a non-operational source of income to bolster balance sheets and fund growth initiatives.

Consultancy and Technical Services for Decarbonization

CMB.TECH leverages its deep expertise in maritime decarbonization to offer consultancy and technical services, creating a significant revenue stream. This segment targets companies looking to navigate the complex transition to greener shipping operations. For instance, in 2024, the demand for specialized decarbonization advice is projected to rise as regulatory pressures intensify and new technologies mature.

The company provides strategic guidance on adopting alternative fuels like green ammonia and methanol, as well as insights into operational efficiency improvements. This can involve detailed feasibility studies, technology assessments, and the development of tailored decarbonization roadmaps. These services are crucial for shipowners and operators aiming to meet evolving environmental standards and enhance their market competitiveness.

Key service offerings include:

- Feasibility studies for alternative fuel adoption

- Technical design and engineering support for retrofitting

- Development of decarbonization strategies and roadmaps

- Operational efficiency consulting

CMB's diverse revenue streams are anchored by its shipping operations, encompassing both dry bulk and container segments. Income is primarily derived from chartering vessels, with daily hire rates and freight rates forming the core of this business.

The company also benefits from CMB.TECH's innovative clean energy solutions, including the sale and leasing of hydrogen-powered vessels and dual-fuel engines, directly monetizing its advancements in maritime decarbonization.

Further diversifying its income, CMB draws from its substantial real estate holdings, generating revenue through rental yields, and its financial services arm, which earns fees from asset management and profits from strategic investments.

In 2024, CMB.TECH expanded its consultancy services, advising on maritime decarbonization strategies and the adoption of alternative fuels, a growing market driven by increasing regulatory pressures.

| Revenue Stream | Primary Source | 2023/2024 Data Point |

| Vessel Chartering | Daily Hire/Freight Rates | Container shipping rates normalized post-pandemic highs in 2023. |

| CMB.TECH Sales/Leasing | Hydrogen/Dual-Fuel Vessels & Engines | Secured orders/leases for specialized vessels in 2024, boosting clean shipping revenue. |

| Real Estate Holdings | Rental Yields | Commercial rents in major cities saw 3-5% year-over-year increase through Q3 2024. |

| Financial Services | Asset Management Fees | Managed assets under administration reached approx. $150 billion by Q2 2024. |

| Consultancy Services | Decarbonization Advice | Projected rise in demand for green shipping transition guidance in 2024. |

Business Model Canvas Data Sources

The CMB Business Model Canvas is built using a comprehensive blend of internal financial statements, customer feedback, and competitive landscape analysis. These diverse data sources ensure a robust and actionable strategic framework.