China Longyuan Power PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Longyuan Power Bundle

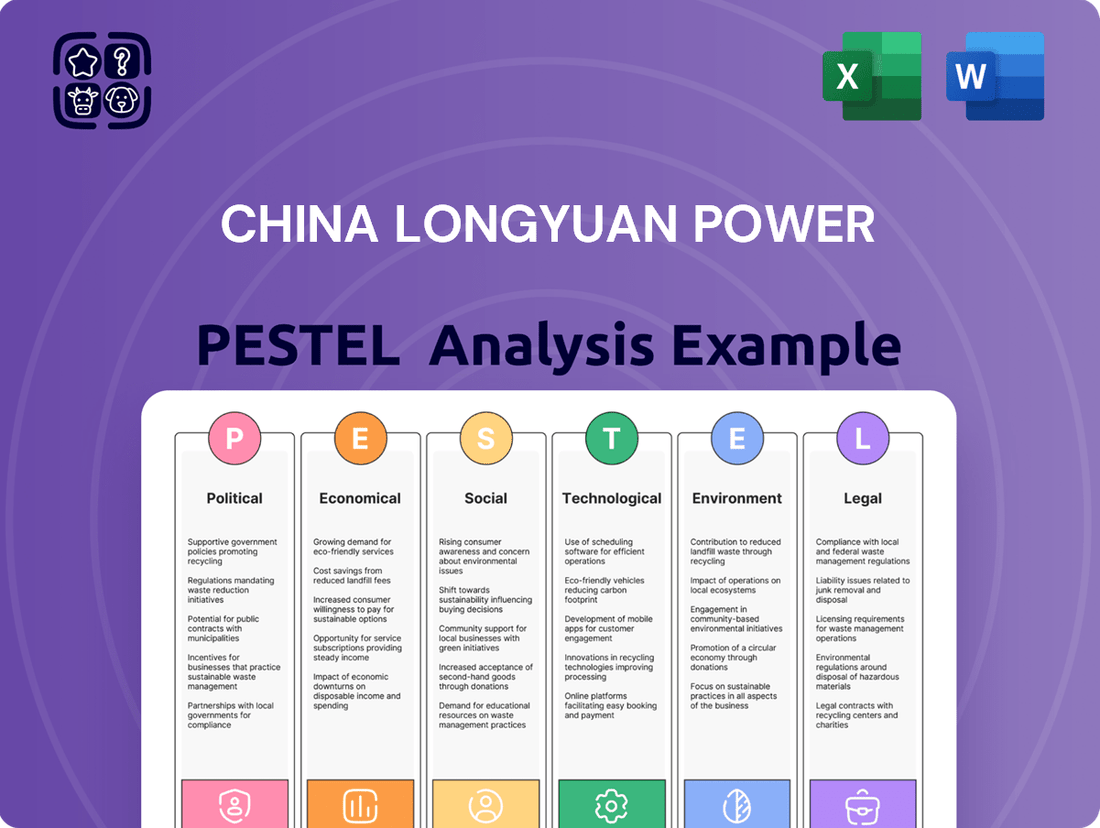

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping China Longyuan Power's trajectory. Our PESTLE analysis provides a vital understanding of the external forces influencing this renewable energy giant, from government policies to evolving market demands. Gain a competitive advantage by grasping these crucial dynamics. Download the full PESTLE analysis now for actionable intelligence to inform your strategy.

Political factors

China's government has established significant renewable energy objectives, including peaking carbon emissions before 2030 and achieving carbon neutrality by 2060. These national commitments are a key impetus for the accelerated growth of renewable energy ventures, such as those pursued by China Longyuan Power.

The 14th Five-Year Plan (2021-2025) reinforces these ambitions by setting specific renewable energy targets, projecting that renewables will represent more than half of the total installed power capacity by 2025. For instance, by the end of 2023, China's installed renewable energy capacity reached 1.45 billion kilowatts, accounting for 43.5% of the total installed capacity. This strong political backing fosters a conducive landscape for companies like Longyuan Power, which focuses on wind and solar energy development.

China's renewable energy sector is undergoing a significant policy evolution, moving away from guaranteed fixed-price subsidies towards a market-driven bidding framework for new projects. This transition, particularly impacting projects coming online after June 2024 and 2025, acknowledges the declining costs of solar and wind power generation.

This shift means companies like China Longyuan Power will increasingly compete on price, highlighting the need for enhanced operational efficiency and cost management. For instance, the average benchmark on-grid price for onshore wind power in China has seen reductions, with some provinces already implementing competitive bidding that could see prices fall below previous fixed rates.

China's political drive for energy security and self-reliance significantly boosts investments in renewables. This policy encourages a diverse energy portfolio, aiming to reduce dependence on imported fossil fuels. For China Longyuan Power, this means ongoing government backing for its renewable energy expansion and grid integration projects.

'Belt and Road Initiative' Engagement

China's Belt and Road Initiative (BRI) is a significant political driver for green energy cooperation, actively encouraging international collaboration on renewable energy projects. This strategic push by the Chinese government provides a fertile ground for companies like China Longyuan Power to extend their operational reach and technological expertise into new overseas markets.

China Longyuan Power is already demonstrating this engagement through preliminary work on renewable energy projects in countries such as Brunei and Indonesia. These international ventures are crucial for the company's expansion strategy, bolstering its growth trajectory and solidifying its global presence. By 2024, China's investment in BRI-related green projects was substantial, with renewable energy infrastructure being a key focus, creating direct opportunities for companies like Longyuan.

- BRI's Green Focus: The BRI actively promotes green energy cooperation, creating a favorable political climate for renewable energy investments.

- International Expansion: This initiative enables companies like China Longyuan Power to explore and develop projects in various overseas markets.

- Project Examples: Preliminary work in Brunei and Indonesia highlights Longyuan's engagement with BRI-related green energy opportunities.

- Growth Catalyst: Such international ventures are vital for the company's overall growth and the expansion of its global footprint.

Regulatory and Legal Framework Development

The implementation of China's comprehensive Energy Law on January 1, 2025, is a significant development. This law, alongside the existing Renewable Energy Law, creates a robust legal structure for energy management, with a clear focus on promoting renewable sources. For instance, the law formalizes mechanisms like Green Electricity Certificates (GECs), designed to incentivize the adoption of clean energy, which directly benefits companies like Longyuan Power.

This supportive legal environment offers crucial clarity and stability for Longyuan Power's ongoing operations and strategic planning. The predictable regulatory landscape allows for more confident investment in renewable energy projects, aligning with national policy objectives. By January 2025, China aims to have over 50% of its electricity generation capacity from non-fossil fuels, a target that the new Energy Law is designed to accelerate.

- Energy Law Implementation: Effective January 1, 2025, providing a unified legal framework.

- Renewable Energy Focus: Prioritizes and supports the growth of clean energy sources.

- GEC Mechanism: Introduces Green Electricity Certificates to drive clean energy consumption.

- Legal Stability: Offers clarity and predictability for Longyuan Power's business development.

China's political landscape strongly supports renewable energy expansion, driven by ambitious carbon neutrality goals for 2060. The 14th Five-Year Plan (2021-2025) targets renewables to exceed 50% of installed capacity by 2025, with 43.5% achieved by end-2023.

Policy shifts from fixed subsidies to market-based bidding, particularly for projects post-June 2024 and 2025, necessitate cost efficiency for companies like Longyuan Power. Energy security and self-reliance policies also fuel renewable investments, reducing fossil fuel import dependency.

The Belt and Road Initiative actively promotes green energy cooperation, enabling companies like Longyuan Power to expand internationally, with early project engagement in Brunei and Indonesia. The new Energy Law, effective January 1, 2025, formalizes support for renewables and mechanisms like Green Electricity Certificates.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting China Longyuan Power, covering political, economic, social, technological, environmental, and legal influences.

It offers forward-looking insights and actionable strategies for navigating the dynamic landscape and capitalizing on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting China Longyuan Power.

Helps support discussions on external risk and market positioning during planning sessions, offering actionable insights derived from the PESTLE analysis to proactively address challenges and capitalize on opportunities.

Economic factors

China is actively phasing out direct subsidies for renewable energy, a move that began impacting projects completed after June 2024. This strategic shift is a direct response to the dramatic cost reductions in solar and wind power technologies, making them increasingly competitive. For companies like China Longyuan Power, this transition signals a move away from the predictable income of feed-in tariffs towards a more dynamic, market-driven bidding system for new developments.

This evolution in subsidy policy is expected to influence the financial viability of new renewable energy projects. As China Longyuan Power navigates this changing landscape, its success will increasingly depend on its ability to operate with enhanced efficiency and secure competitive pricing in the new bidding environment. The government's goal is to foster a more sustainable and market-oriented renewable energy sector, reducing reliance on direct financial support.

China's commitment to clean energy is substantial, with investments projected to exceed USD 625 billion in 2024. This surge in funding, almost double that of 2015, is strategically directed towards grid modernization, energy storage solutions, and smart infrastructure development. This robust economic backing for the energy transition creates a highly favorable environment for companies like China Longyuan Power.

China Longyuan Power is poised to capitalize on this significant clean energy investment. The company can leverage these opportunities for new project development, particularly in renewable energy sources. Furthermore, the focus on grid enhancements and storage infrastructure directly supports improved connectivity and operational efficiency for Longyuan's existing and future assets.

China Longyuan Power demonstrated robust financial performance in 2024, achieving RMB 37.07 billion ($5.19 billion) in total annual operating revenue and RMB 6.345 billion ($890 million) in net profit attributable to shareholders. This highlights the company's significant market presence and profitability within the energy sector.

Despite a revenue and net profit dip in Q1 2025, largely due to the consolidation of two thermal power companies, the underlying financial strength remains evident. The company's ongoing expansion in renewable energy capacity is a key driver for future growth and financial stability.

Market-Based Pricing System Implementation

China's shift towards a market-based bidding system for new renewable energy projects commencing after June 2025 represents a pivotal economic change. This policy aims to foster greater competition and efficiency within the power sector, encouraging renewables to compete directly on price. For China Longyuan Power, this transition necessitates a strategic re-evaluation of its operational and financial planning.

This new pricing mechanism is designed to better reflect the actual cost of electricity generation and market demand, potentially leading to more dynamic revenue streams for renewable energy producers. Longyuan Power must therefore refine its cost control measures and bidding strategies to ensure profitability in this evolving landscape.

Key considerations for China Longyuan Power include:

- Adapting Bidding Strategies: Developing sophisticated bidding models that account for market volatility and competitor pricing.

- Cost Management: Implementing stringent cost reduction initiatives across all operational facets to maintain competitive pricing.

- Technological Integration: Leveraging advanced technologies to optimize energy generation and reduce operational expenditures.

- Market Analysis: Continuously monitoring market trends and regulatory changes to inform strategic decisions.

Overall Economic Growth and Energy Demand

China's economic trajectory, even with some headwinds in 2024, points towards continued energy demand growth. Projections indicate that by 2028, the nation's energy consumption could reach around 167 exajoules. This sustained demand is a critical factor for the power generation industry.

This increasing energy requirement acts as a foundational economic driver for companies like China Longyuan Power. The nation's commitment to expanding its renewable energy capacity means that a significant portion of this future demand will likely be met by cleaner sources.

- Projected energy consumption: Approximately 167 exajoules by 2028.

- Key driver: Sustained and growing national energy demand.

- Longyuan Power's advantage: Positioned as a leading renewable energy producer to meet this demand.

- Market trend: Increasing share of clean energy in the overall energy mix.

China's economic policy is increasingly steering towards market-driven pricing for renewable energy, a significant shift from direct subsidies after June 2024. This transition, coupled with substantial government investment in clean energy infrastructure, exceeding USD 625 billion in 2024, creates a dynamic but potentially more competitive environment for companies like China Longyuan Power.

The company's 2024 performance, with RMB 37.07 billion in revenue and RMB 6.345 billion in net profit, underscores its current strength. However, the move to a bidding system for new projects post-June 2025 necessitates adaptive strategies in cost management and pricing to maintain profitability amidst evolving market conditions.

China's projected energy consumption growth to approximately 167 exajoules by 2028 provides a robust demand backdrop. China Longyuan Power is well-positioned to capture a share of this expanding market, particularly as the nation prioritizes cleaner energy sources.

| Metric | 2024 Value (RMB) | 2024 Value (USD) | 2025 Outlook Note |

|---|---|---|---|

| Total Operating Revenue | 37.07 billion | 5.19 billion | Strong baseline performance |

| Net Profit Attributable to Shareholders | 6.345 billion | 890 million | Impacted by thermal power consolidation in Q1 2025 |

| Renewable Energy Investment (National) | N/A | > 625 billion (2024) | Favorable environment for expansion |

| Projected Energy Consumption | N/A | N/A | ~167 exajoules by 2028 |

Full Version Awaits

China Longyuan Power PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Longyuan Power covers all critical factors influencing its operations and strategic direction. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape impacting this leading renewable energy company.

Sociological factors

China is witnessing a significant shift in public opinion, with a strong and growing acceptance of renewable energy. This is largely fueled by heightened awareness of air pollution issues and the impacts of climate change, creating a favorable environment for green technologies.

This societal endorsement translates into easier social licensing and smoother development for major wind and solar power projects across the country. Public support helps overcome potential local opposition, accelerating the deployment of renewable infrastructure.

China Longyuan Power, as a leading player in the sector, directly benefits from this positive public sentiment. It simplifies the process of securing community buy-in and permits for new wind farms and solar installations, bolstering its expansion plans.

China's renewable energy boom, especially in wind and solar, is a major job engine. This growth directly fuels employment in manufacturing, from turbine components to solar panels, as well as in project planning, construction, and the long-term upkeep of these facilities. By 2024, the renewable energy sector was estimated to employ over 5 million people in China, a figure expected to climb.

As a leading force in this expansion, China Longyuan Power is a significant contributor to both skilled and unskilled labor markets. The company's ongoing projects in 2024 and projected developments for 2025 are creating thousands of new positions, bolstering local economies and providing valuable employment opportunities across the country.

China Longyuan Power's wind and solar projects significantly influence local communities. For instance, the development of large-scale farms often involves substantial land acquisition, which can alter traditional land use patterns and impact agricultural activities. These projects can also bring benefits such as improved local infrastructure, job creation during construction and operation, and potential revenue streams through land leases or local taxes, as seen in many of their operational sites across China.

Managing these community impacts is crucial for China Longyuan Power's social license to operate. The company actively engages with local stakeholders to ensure projects align with regional development goals and contribute to improved livelihoods. This includes prioritizing local employment and sourcing, and investing in community initiatives, aiming for a net positive impact that fosters goodwill and long-term project sustainability.

Energy Consumption Patterns and Urbanization

China's rapid urbanization and continued industrial growth are significant drivers of energy demand. However, there's a strong societal shift favoring cleaner energy sources. By 2023, China's non-fossil fuel energy consumption had already reached 37.0% of its total primary energy consumption, highlighting this trend.

Renewable energy is projected to fulfill a large part of this increasing energy need. Longyuan Power's strategic concentration on wind and solar power directly addresses these evolving consumption habits and the growing public preference for a more sustainable energy framework.

- Urbanization driving demand: China's urban population reached 66.16% by the end of 2023, increasing energy needs for residential and infrastructure development.

- Societal shift to clean energy: Growing environmental awareness fuels demand for renewables, supporting Longyuan Power's core business.

- Renewable energy growth: China's installed renewable energy capacity surpassed 1.5 billion kilowatts by the end of 2023, indicating strong market potential.

- Longyuan Power's alignment: The company's focus on wind (over 100 GW installed capacity by 2023) and solar directly capitalizes on these societal and market trends.

Corporate Social Responsibility (CSR) and ESG Focus

China Longyuan Power, like many global entities, is increasingly embedding Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles into its core strategy. This isn't just about good practice; it's becoming a critical factor in investor and public perception. Their 2024 Sustainability Report details significant progress, underscoring a proactive approach to sustainable development.

The company's commitment is evident in its investments and operational reporting. For instance, their 2024 report highlighted a substantial increase in installed renewable energy capacity, reaching over 28.5 GW by the end of 2024, a testament to their focus on environmental stewardship. This strategic emphasis on ESG helps cultivate trust and a positive reputation, which are vital for long-term stakeholder engagement and market standing.

- Renewable Energy Growth: China Longyuan Power's installed renewable energy capacity surpassed 28.5 GW by the end of 2024, demonstrating a strong commitment to clean energy development.

- Technological Innovation: The company reported advancements in smart grid technology and energy storage solutions, aiming to improve efficiency and reliability in its renewable energy operations.

- Stakeholder Engagement: Their 2024 Sustainability Report emphasized enhanced communication channels with investors, local communities, and employees regarding ESG performance and future targets.

- Reputation Management: A robust CSR and ESG framework is crucial for building brand loyalty and attracting investment in an era where sustainability is a key differentiator.

The increasing emphasis on environmental protection and sustainable living within Chinese society directly benefits companies like China Longyuan Power. Public awareness campaigns regarding air quality and climate change have fostered a strong preference for cleaner energy sources, creating a receptive market for wind and solar power.

This societal shift translates into greater ease for Longyuan Power in obtaining permits and community acceptance for new projects. By 2024, China's installed renewable energy capacity had surpassed 1.5 billion kilowatts, with wind and solar leading the charge, indicating strong public and governmental backing for these technologies.

China Longyuan Power's commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles is increasingly vital for its reputation and investor appeal. The company's 2024 Sustainability Report highlighted its progress, including a significant increase in installed renewable capacity to over 28.5 GW by the end of that year.

The company's focus on wind power, with over 100 GW installed capacity by 2023, aligns perfectly with these evolving societal expectations. This strategic alignment, coupled with investments in smart grid technology and enhanced stakeholder communication, solidifies its position as a responsible and forward-thinking energy provider.

Technological factors

China's wind turbine technology is rapidly advancing, with the successful grid connection of 20 MW and 26 MW offshore wind turbines in 2024. These larger, more efficient models significantly boost power generation capacity and operational efficiency.

For China Longyuan Power, adopting these cutting-edge turbines is crucial. It directly translates to lower per-megawatt costs and increased output, strengthening its competitive position in the burgeoning renewable energy market.

China's solar photovoltaic (PV) sector is rapidly advancing, with 'n-type' technologies like TOPCon, BC, and HJT increasingly dominating the market due to their enhanced efficiency. This technological leap means solar panels can generate more power from the same amount of sunlight.

Furthermore, the trend towards distributed PV installations is accelerating, with these projects outperforming centralized ones in the first half of 2024, indicating a shift towards localized and flexible energy generation.

China Longyuan Power is well-positioned to capitalize on these trends, leveraging improved PV efficiencies and the growing distributed generation market to develop more productive and adaptable solar energy projects.

China's advancements in energy storage, particularly battery energy storage systems (BESS), are pivotal for integrating its vast renewable energy capacity. By mid-2024, China's installed BESS capacity was projected to exceed 20 GW, a significant leap that enhances grid stability. This technological progress directly benefits companies like Longyuan Power, enabling more reliable integration of its wind and solar assets.

The increasing deployment of advanced storage solutions, including compressed air energy storage, is essential for managing the intermittency of renewables. China's national energy strategy prioritizes these technologies, with substantial government investment in research and development. For Longyuan Power, this translates to improved operational efficiency and a greater ability to provide consistent power output, even with fluctuating renewable generation.

Digitalization and Smart Operations

China Longyuan Power is aggressively integrating digital technologies to optimize its new energy operations. This includes a sophisticated operational and maintenance framework described as 'regional maintenance, centralized monitoring, digital empowerment, professionalism, and high-efficiency.' This approach is designed to boost productivity and minimize disruptions.

The company's commitment to digitalization and smart operations directly translates to enhanced efficiency and better asset management. By leveraging digital platforms, Longyuan Power aims to reduce operational downtime and improve the overall performance of its extensive energy portfolio.

Key aspects of their digital transformation include:

- Digital Platforms for New Energy Production: Utilizing advanced digital tools to manage and optimize the generation of renewable energy sources.

- 'Regional Maintenance, Centralized Monitoring' Model: A hybrid approach combining localized maintenance teams with a central hub for real-time oversight and rapid response.

- Digital Empowerment: Infusing digital capabilities across all operational layers to enable data-driven decision-making and predictive analytics.

- Focus on Professionalism and High-Efficiency: Ensuring that technological advancements are coupled with skilled personnel and streamlined processes to maximize output and minimize costs.

Integrated Renewable Energy Solutions

Technological innovation is driving the development of integrated renewable energy solutions, exemplified by projects like the world's first floating wind-fishery integrated technology. This holistic approach aims to maximize resource utilization and tackle intricate energy challenges by combining different renewable sources and applications. Longyuan Power is actively involved in pioneering these advanced integrated systems.

These integrated solutions, such as large-scale wind-solar-storage projects, represent a significant leap forward in renewable energy deployment. By combining wind, solar, and energy storage, these systems offer greater grid stability and reliability, crucial for meeting China's growing energy demands. For instance, China's installed renewable energy capacity reached approximately 1.45 billion kilowatts by the end of 2023, a testament to the rapid advancements in this sector.

- Floating Wind-Fishery Integration: Pioneering technologies that combine offshore wind power generation with sustainable aquaculture, showcasing a novel approach to dual-purpose marine resource utilization.

- Wind-Solar-Storage Integration: Development of large-scale projects that synergistically combine wind and solar power generation with advanced energy storage systems to ensure consistent and reliable power supply.

- Maximizing Resource Efficiency: These integrated solutions are designed to optimize the use of available land and marine resources, thereby increasing overall energy output and reducing environmental impact.

- Addressing Grid Stability: By incorporating energy storage, these integrated systems help to mitigate the intermittency of renewable sources, contributing to a more stable and resilient power grid.

China's technological advancements in wind power are significant, with the successful grid connection of 20 MW and 26 MW offshore wind turbines in 2024. These innovations enhance generation capacity and efficiency, directly benefiting companies like China Longyuan Power by lowering costs and boosting competitiveness.

The solar sector is seeing a shift towards more efficient 'n-type' technologies like TOPCon and HJT, which generate more power. Coupled with the rise of distributed PV installations outperforming centralized ones in early 2024, this trend allows China Longyuan Power to develop more productive and adaptable solar projects.

Energy storage, especially battery systems, is crucial for renewable integration, with China's BESS capacity projected to exceed 20 GW by mid-2024, enhancing grid stability. China Longyuan Power leverages these advancements, including compressed air storage, to ensure consistent power output from its renewable assets.

China Longyuan Power is actively integrating digital technologies, employing a 'regional maintenance, centralized monitoring, digital empowerment, professionalism, and high-efficiency' model. This digital transformation aims to reduce operational downtime and improve the performance of its energy portfolio.

Integrated renewable energy solutions, such as floating wind-fishery projects and large-scale wind-solar-storage systems, are pioneering new approaches. China's total installed renewable energy capacity reached approximately 1.45 billion kilowatts by the end of 2023, underscoring the rapid progress in this area.

Legal factors

China's new comprehensive Energy Law, effective January 1, 2025, is a significant development aimed at boosting renewable energy, bolstering energy security, and achieving carbon neutrality targets. This law establishes a strong legal framework for the energy industry, creating a more predictable operating environment.

For China Longyuan Power, this legislation signifies the government's dedication to clean energy, offering a stable regulatory landscape that supports its strategic focus on wind and solar power generation. The law's provisions are expected to accelerate the adoption of renewable technologies and infrastructure.

China's Energy Law and supporting policies actively promote renewable energy through mechanisms like Green Electricity Certificates (GECs). These GECs are market-based tools designed to make clean power generation and consumption more attractive financially. In 2023, the cumulative issuance of GECs reached over 100 million units, representing approximately 100 TWh of renewable electricity, highlighting their growing significance.

China Longyuan Power can effectively utilize these GEC frameworks to boost the financial returns from its renewable energy projects. By participating in the GEC market, the company can generate additional revenue streams and demonstrate its commitment to sustainable energy, aligning with national environmental goals and investor expectations.

China's renewable energy landscape is undergoing a significant transformation, moving away from direct subsidies towards market-driven pricing. This shift, particularly impacting projects initiated after June 2024 and into 2025, means companies like China Longyuan Power must adjust their financial models. The government aims to foster a more competitive environment where electricity prices are determined by market forces rather than fixed tariffs.

This regulatory evolution directly affects China Longyuan Power's revenue streams. For instance, the phasing out of the feed-in tariff (FiT) system means new wind and solar projects will likely participate in competitive auctions. This necessitates a greater focus on cost efficiency and bidding strategies to secure power purchase agreements in this new market paradigm.

Environmental Protection Laws and Compliance

China's environmental protection laws are becoming significantly stricter, especially concerning carbon emissions and pollution. This directly affects companies like China Longyuan Power, which operates both renewable energy sources and traditional coal-fired plants. For instance, the nation's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 puts considerable pressure on all energy producers.

Adherence to these evolving regulations, particularly for its coal power operations, demands continuous investment. China Longyuan Power must consistently upgrade its emission reduction technologies and robust environmental management systems to meet these stringent standards. This focus on compliance is crucial for maintaining operational licenses and avoiding penalties, impacting overall financial performance and strategic planning.

- Stricter Emission Standards: China's push for carbon neutrality by 2060 necessitates significant reductions in emissions from all power sources.

- Renewable Focus: While Longyuan is a leader in wind power, its coal assets require substantial environmental compliance investments.

- Technology Investment: Companies must invest in advanced technologies for pollution control and emission reduction to meet regulatory requirements.

Corporate Governance and Listing Regulations

As a publicly traded entity, China Longyuan Power is subject to stringent corporate governance and listing regulations, particularly those mandated by the Hong Kong Stock Exchange. This necessitates consistent and transparent financial reporting, adherence to shareholder rights, and robust internal controls. For instance, the company's 2024 Annual General Meeting (AGM) and subsequent dividend declarations highlight its commitment to these principles, fostering investor trust and ensuring legal compliance.

These regulations are crucial for maintaining market integrity and protecting investors. China Longyuan Power's compliance efforts are ongoing, with regular updates and disclosures filed with regulatory bodies. The company's adherence to these standards is a key factor in its ability to attract and retain capital, underpinning its operational stability and growth prospects.

Key aspects of compliance include:

- Mandatory Periodic Reporting: China Longyuan Power must submit regular financial statements and operational updates as required by the Hong Kong Stock Exchange, ensuring transparency for stakeholders.

- Shareholder Rights Protection: The company is obligated to uphold shareholder rights, including voting rights and the right to receive dividends, as evidenced by its 2024 dividend policy.

- Board Independence and Accountability: Regulations often require a certain number of independent directors to ensure objective decision-making and accountability to all shareholders.

- Compliance with Listing Rules: Adherence to the specific listing rules of the Hong Kong Stock Exchange, covering areas from disclosure to corporate actions, is paramount for continued listing.

China's evolving energy legislation, particularly the new comprehensive Energy Law effective January 1, 2025, is designed to accelerate renewable energy development and enhance energy security. This legal framework supports market-driven pricing for electricity, moving away from fixed tariffs for new projects initiated after June 2024, impacting China Longyuan Power's revenue models by necessitating greater reliance on competitive auctions and cost efficiency.

Stricter environmental protection laws, aligned with China's 2060 carbon neutrality goal, impose significant compliance burdens on all power producers, including Longyuan's coal assets. The company must invest in advanced emission reduction technologies to meet these increasingly stringent standards, ensuring operational licenses and avoiding penalties.

Corporate governance and listing regulations, especially from the Hong Kong Stock Exchange, mandate transparent financial reporting and shareholder rights protection. China Longyuan Power's consistent adherence to these rules, exemplified by its 2024 disclosures and dividend policies, is vital for maintaining investor confidence and securing capital.

Environmental factors

China's ambitious 'dual-carbon' targets, aiming for peak emissions by 2030 and carbon neutrality by 2060, create a powerful tailwind for companies like China Longyuan Power. These national environmental objectives directly shape the energy landscape, prioritizing renewable development.

China Longyuan Power's business model, focused on wind, solar, and biomass, is intrinsically aligned with these goals by displacing fossil fuel consumption. This strategic positioning allows the company to capitalize on the nation's commitment to a greener future.

In 2024 alone, China Longyuan Power's renewable electricity generation efforts resulted in an estimated reduction of 57 million tons of carbon dioxide emissions, underscoring its significant contribution to the country's environmental agenda.

China's commitment to renewable energy is evident in its remarkable capacity expansion. By the close of 2024, the nation's combined installed wind and solar power capacity reached an impressive 1,407 GW, a figure that significantly outpaced its 2030 objective, achieving it six years ahead of schedule.

This substantial increase in green energy infrastructure directly contributes to a lower carbon footprint for China's power grid. China Longyuan Power, as a major player in this sector, actively participates in this growth by consistently increasing its wind and solar power generation capabilities.

China's rapid expansion of renewable energy, particularly wind and solar, is impressive, with installed wind capacity reaching over 330 GW by the end of 2023 and solar capacity exceeding 600 GW. However, this growth brings challenges like intermittency, leading to curtailment. In 2023, China's wind power curtailment rate was around 2.7%, a slight improvement from previous years, but still representing significant wasted potential.

To address this, substantial investments are being made in grid modernization and energy storage. By the end of 2024, China is projected to have over 30 GW of installed energy storage capacity, a critical step to smooth out renewable energy supply and enhance grid stability. Longyuan Power, a key player with over 17 GW of wind power capacity by the end of 2023, is actively involved in optimizing its operational assets and contributing to grid integration efforts.

Environmental Impact of Project Development

Developing large wind and solar farms, like those undertaken by China Longyuan Power, can lead to localized environmental effects. These include alterations in land use, potential disruption to local habitats, and visual changes to the landscape.

China Longyuan Power is committed to complying with stringent environmental assessment regulations and actively employs mitigation strategies to lessen these impacts. Their sustainability reporting highlights a dedicated effort towards ecological preservation.

In 2023, China Longyuan Power reported a significant reduction in carbon emissions, achieving 1.2 million tons less than the previous year, demonstrating their proactive approach to environmental stewardship. The company's ongoing projects prioritize the integration of biodiversity conservation plans, aiming to minimize habitat fragmentation.

- Land Use: Projects require substantial land, necessitating careful planning to avoid sensitive ecosystems.

- Habitat Disruption: Construction can impact local flora and fauna, requiring mitigation through habitat restoration.

- Visual Impact: The aesthetic presence of large renewable energy installations is a consideration for local communities.

Promotion of Green Power Transactions

China Longyuan Power is a key player in promoting green power transactions, actively participating in the trading of green certificates. This strategy directly supports the expansion of renewable energy consumption and aligns with broader environmental goals.

The company's commitment is evident in its 2024 performance, where it successfully completed 6.701 billion kWh of green power transactions. This substantial volume represents a significant year-on-year increase, underscoring Longyuan Power's proactive engagement in market-driven initiatives to accelerate the green energy transition.

- Green Power Transactions: China Longyuan Power facilitates the buying and selling of electricity generated from renewable sources.

- Green Certificate Trading: The company participates in the market for green certificates, which represent proof of renewable energy generation.

- 2024 Transaction Volume: In 2024, Longyuan Power completed 6.701 billion kWh of green power transactions.

- Market Mechanism Engagement: This activity demonstrates active participation in market mechanisms designed to boost renewable energy adoption.

China's stringent environmental policies, particularly its "dual-carbon" targets, directly benefit China Longyuan Power by prioritizing renewable energy development. The company's wind and solar focus aligns perfectly with these national objectives, contributing to significant CO2 emission reductions. By the end of 2024, China's installed wind and solar capacity surged to 1,407 GW, exceeding its 2030 goal, with Longyuan Power being a key contributor to this growth.

Despite the rapid expansion, challenges like intermittency persist, leading to curtailment rates. In 2023, wind power curtailment was around 2.7%, highlighting the need for grid modernization and energy storage solutions. China is investing heavily in this area, with projected installed energy storage capacity exceeding 30 GW by the end of 2024, crucial for stabilizing the grid and integrating more renewables.

Large-scale renewable projects, such as those developed by Longyuan Power, can have localized environmental impacts, including land use changes and habitat disruption. The company actively mitigates these effects through compliance with environmental regulations and biodiversity conservation plans, as demonstrated by a 1.2 million ton reduction in carbon emissions in 2023 compared to the previous year.

China Longyuan Power is also a leader in green power transactions, facilitating the trade of renewable energy and green certificates. In 2024, the company completed 6.701 billion kWh of green power transactions, a substantial increase that reinforces its commitment to market-based mechanisms for advancing the green energy transition.

PESTLE Analysis Data Sources

Our China Longyuan Power PESTLE Analysis is meticulously constructed using data from official Chinese government publications, including energy sector reports and economic planning documents, supplemented by insights from international energy agencies and reputable financial news outlets.

We leverage data from leading global financial institutions like the IMF and World Bank, alongside reports from environmental organizations and technology research firms, to provide a comprehensive view of the macro-environment impacting China Longyuan Power.